Issue 55 – Halving a bad time

The bitcoin "halving" looms, and that may not be as good news as coiners hope. Also, Terra committed fraud and Uniswap got a Wells notice.

Bitcoiners are all aflutter as the halving date approaches in about a week. This is very exciting for them, because the past three halvings look like they've precipitated major price increases (particularly if you use a log scale, which bitcoiners love).

The "halving" is the moment when bitcoin block rewards — that is, the amount of bitcoin issued as a reward to the miner for successfully mining a block — are reduced by half. This is a strategy to ensure the total supply of bitcoin gradually tapers off before reaching its final 21,000,000 coins. While the very first bitcoiners received 50 bitcoins for each block they mined, now only 6.25 BTC are issued per block, and that's scheduled to reduce to 3.125 BTC per block around April 19.

Although responsible investment advisers will often warn that "past performance is no guarantee of future results", that's largely the kind of thought process that goes into predictions for the halving. "Number went up last time, so number go up again". More sophisticated explainers might delve into supply and demand, suggesting that the gradual closing of the bitcoin faucet amid roughly steady demand is what drives prices higher. Either way, some people are piling into bitcoin in belief of guaranteed double-your-money returns, if not better.

These folks might do well to be a bit more cautious. For one, it's not clear to what degree the past price movements were caused by the halving, versus simply correlated with it. Notably, the previous halving in May 2020 coincided with massive macroeconomic changes in the early months of the COVID-19 pandemic, which brought money flowing into riskier asset classes across the board, and also brought a wave of bored pandemic-driven day traders into crypto.

Furthermore, the number of bitcoins being minted each day (around 900 now, soon to be around 450) pales in comparison to the total number of bitcoins already minted (almost 19.7 million). While it's true that there will be a reduction in the speed at which the supply of bitcoins is increasing, it doesn't change much when you look at the total supply overall, and the scale of the reduction gets less and less dramatic each time the halving happens.

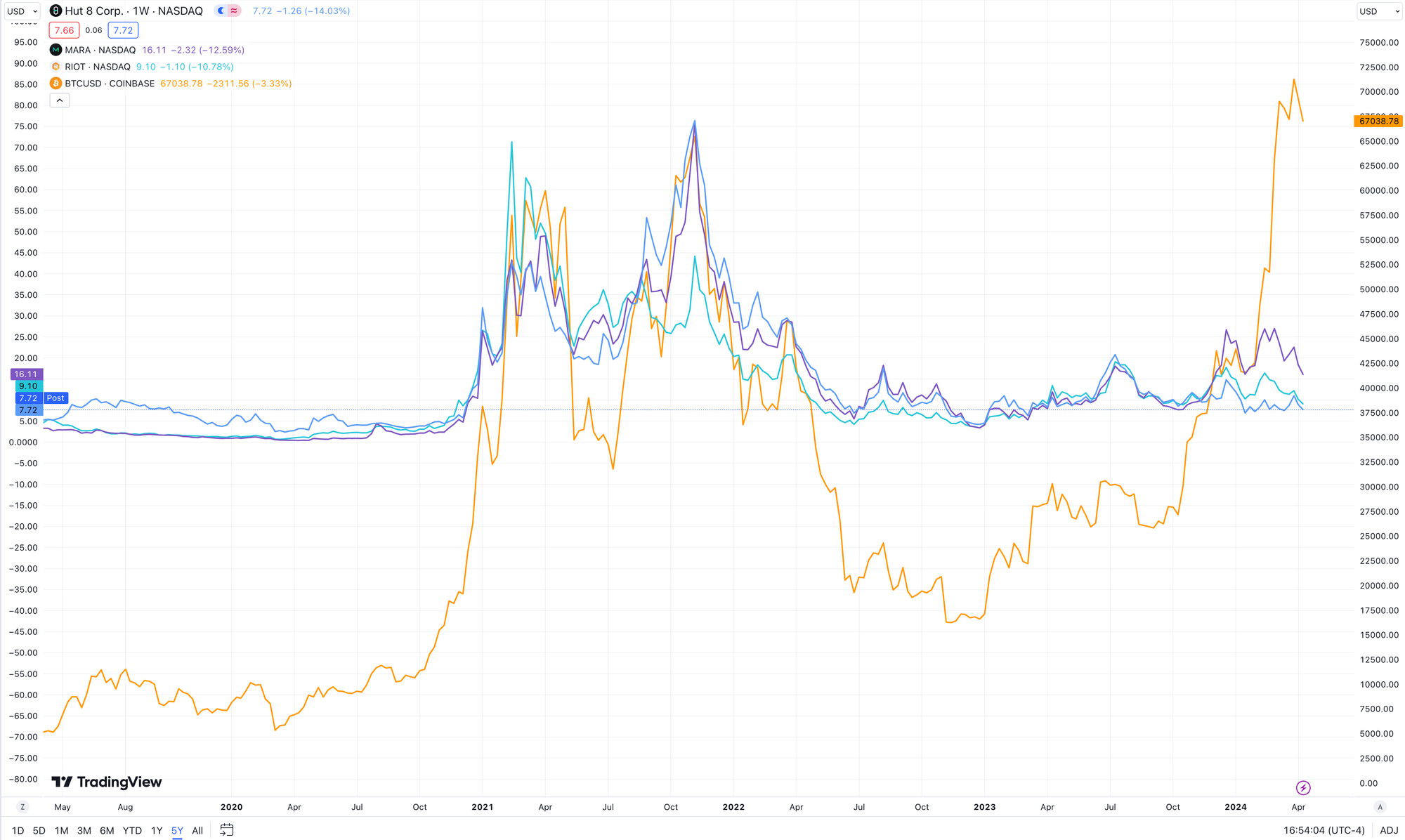

There's also the miner problem. Bitcoin miners have already been operating on incredibly thin margins, and many washed out during the "crypto winter" as the low prices for their bitcoins made mining even less sustainable. Now, with half as many bitcoins issued per block, that's only going to get worse. If bitcoin's price skyrockets as hoped, they might break even and be able to stay in business. If bitcoin's price falters, miners are going to have a really tough time paying off their electricity bills and loan payments, and more companies are likely to collapse.

Don't take my word for it: despite the upwards bitcoin price movement — in the past, fairly well correlated with stock prices for publicly traded bitcoin mining operations — bitcoin mining stocks have been trending down in recent months: likely in anticipation of post-halving chaos in the sector.

Anyway, this should be interesting to watch.

In the courts

Sam Bankman-Fried has filed notice of his appeal, as anticipated.1 He's also asked to stay at MDC Brooklyn while his appeal is being briefed, to allow him easier access to his attorneys.2 Judge Kaplan recommended during sentencing that he go to a federal prison on the west coast so he can be closer to family, but it makes sense that he might want to hit pause on that for a while as the appeal continues on this side of the country.

Do Kwon and Terraform Labs were found liable in the two-week-long civil fraud trial over the collapse of their $40 billion Terra/Luna stablecoin project in May 2022 [W3IGG]. Kwon was found by the jury to have been "intentionally" liable; Terraform Labs was merely "recklessly" liable. This means that the jury believed that Kwon had actively intended to cause harm, whereas the company knew (or should have known) that they might be causing harm and chose to proceed anyway. Penalties for the case haven't been decided yet, but the SEC is pursuing monetary penalties as well as orders that will prevent Kwon or his company from operating in the securities industry.a

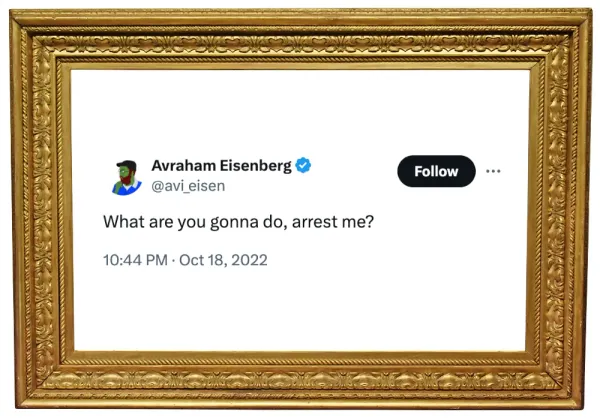

Remember the guy who bragged about his "highly profitable trading strategy", which involved stealing more than $110 million from the Mango Markets defi project [I16, I43], and who subsequently tweeted, "I believe all of our actions were legal open market actions"?

I believe all of our actions were legal open market actions, using the protocol as designed, even if the development team did not fully anticipate all the consequences of setting parameters the way they are.

— Avraham Eisenberg (@avi_eisen) October 15, 2022

Well, he's about to find out if his beliefs were accurate, because his criminal trial kicked off on April 9. In opening statements, his lawyer seemed to try to use the "they had it coming" defense: "Mango Markets and Avi Eisenberg, they weren't operating in the regular financial world. It is speculative, they go in with their eyes open."3 Prosecutors, on the other hand, have pointed to his decision to buy a plane ticket out of the country the very next day, and to his Google searches for terms including "market manipulation criminal elements" and "FBI surveillance", as evidence that he knew quite well his actions were not merely "highly profitable trades".4 It seems that Eisenberg may, like Sam Bankman-Fried, take the stand in his own defense.5

Shakeeb Ahmed, the ex-Amazon bug bounty employee who stole a combined $12 million from Crema Finance and Nirvana Finance in a three-week period in July 2022, has been sentenced to three years in prison, $12.3 million forfeiture, and $5 million in restitution [W3IGG]. The Department of Justice is boasting of its "first ever conviction for the hack of a smart contract".

Several more crypto advocacy groups have filed amicus briefs in support of Tornado Cash developer Roman Storm [I54]. They make similar arguments as he did, namely that those who write software should not be held liable for the actions of those who later use that software, and that the case threatens to dramatically expand the liability of software creators more generally.

To argue [that Tornado Cash operators willfully and knowingly confederated to commit sanctions evasion] would be to suggest that the developers of the Linux open-source operating system confederated with the regime of Iran, merely by freely releasing a valuable computing tool that Iran would later use to operate computers related to its weapons programs. Crafting such a broad standard for sanctions liability would massively chill the publication of software and could be used to villainize countless researchers, scientists, and developers whose selfless release of free and open-source software is largely responsible for the information technology revolution of the last half-century. Amicus brief by Coin Center

Ben Delo has lost his motion to dismiss the class action case against him in connection to his activities at the BitMEX cryptocurrency exchange, and the "God access" that allegedly allowed Delo and co-conspirators to view customer information and plan trades against them. Delo argued the court didn't have personal jurisdiction, as he is a British citizen. Judge Andrew Carter found that Delo had been highly active in the United States, not least by founding a company there, and through actions including "[coming] to New York, posting up next to a Lamborghini to draw the attention of U.S. customers, inducing them to invest in BitMEX".6

Attendees of the Bitcoin CoreDev Atlanta event in October 2022 are angry because the FBI subpoenaed attendee information from the event's leader in the wake of the January 2023 theft of around 205 BTC from bitcoin core developer Luke Dashjr [I16].7 At the time of the theft, those coins were priced at around $3.5 million; today they'd fetch a price of more than $13.7 million. Although Dashjr is a bitcoin ideologue, he seemed to have no issue with calling on the FBI to help him after the theft.

What the heck @FBI @ic3 why can't I reach anyone???

— Luke Dashjr (@LukeDashjr) January 1, 2023

In governments and regulators

The SEC issued a Wells notice to Uniswap, the top decentralized cryptocurrency exchange [W3IGG]. Wells notices are used to inform the recipient of an impending lawsuit, and give them a last-ditch opportunity to convince the SEC that the suit is unwarranted. As has become the norm in the cryptocurrency world, Uniswap responded with outrage via a blog posted titled "Fighting for DeFi", where they wrote: "Taking into account the SEC's ongoing lawsuits against Coinbase and others as well as their complete unwillingness to provide clarity or a path to registration to those operating lawfully within the U.S., we can only conclude that this is the latest political effort to target even the best actors building technology on blockchains."8

Deputy Secretary of the Treasury Wally Adeyemo singled out Tether by name in his prepared statements in front of the Senate Committee on Banking, Housing, and Urban Affairs, where he pleaded for "additional tools to protect the American people" from illicit cryptocurrency operations, particularly those involving stablecoins. He elaborated: "The DPRK, which through numerous complex state-sponsored cyber heists, is able to acquire, launder, and store illicit revenue. It relies on anonymity-enhancing technologies like mixers to hide the sources of its funds. And it leverages over-the-counter digital assets traders to acquire fiat currency. In addition, we’ve seen Russia increasingly turning to alternative payment mechanisms—including the stablecoin tether—to try to circumvent our sanctions and continue to finance its war machine."9

Two days later, leaders from the House and Senate reportedly met to discuss further strategy around a stablecoin bill.10 Efforts to draft a bill acceptable to both sides have languished, particularly after the FTX collapse put a massive damper on some lawmakers' enthusiasm towards the sector.

They've received recent pushback from longtime crypto opponent Senator Elizabeth Warren, who wrote a letter to McHenry and Waters warning that "efforts to create new regulatory frameworks around the $157 billion stablecoin market, including those that aim to fold stablecoins deeper into the banking sector, could amplify and entrench these risks rather than mitigate them. I urge you to remember the gravity of these risks as your committee consider proposals to regulate stablecoins and avoid introducing stablecoin legislation that holds the potential of unleashing another financial crisis."11 She's right on this one.

Warren's outspokenness against crypto has earned her many enemies in the industry. Now, wealthy cryptocurrency executives including Anthony Scaramucci, Gemini's Winklevoss twins, Cardano's Charles Hoskinson, and executives from Ripple are bankrolling lawyer John Deaton's Senate campaign to unseat her in the 2024 race. Described by Politico as a "political no-name" with "virtually no chance" of winning against Warren, Deaton became known among cryptocurrency advocates when he departed from his usual fare of asbestos injury claims to file an amicus brief in the SEC case against Ripple. In January, he moved to Massachusetts and registered as a Republican to run against Warren.12

Elsewhere in crypto

Following in the footsteps of the eyeball-scanning orbs, TON has come out with palm-scanning software that promises to prove your uniqueness on the blockchain. TON is The Open Network, a project originally created by the Telegram messaging platform. Like Worldcoin's orbs, TON claims that its project doesn't actually store the biometric data, but instead generates a code they say is not reversible even if it were to be compromised. Speaking of the choice to scan palms, the project's founder explained, "For most people, scanning your palm with a smartphone camera just feels less intrusive than eye-scanning." While it may be true that it feels less intrusive, I wouldn't argue that it actually is less intrusive.13

Crypto gaming hardware seems to be having a resurgence after a few hilarious flops during the last hype cycle (namely Polium [W3IGG]). A new Gameboy-looking handheld called BitBoy promises to be both a $500 Bitcoin hardware wallet and a way to play Bitcoin-specific play-to-earn games. Despite the name, it doesn't seem to be related to Ben "BitBoy" Armstrong, the influencer who claims he was "extorted for his lambo" amid a messy meltdown last fall [I40].

Elsewhere, a concept for a handset resembling the Steam Deck is promising a 2025 release. Although the SuiPlay0x1 has been conceptualized to be used for games built on the Sui blockchain, Sui's website only advertises ten such games.14 One is a 2048 clone, another lets you bet on coinflips, and a third allows you to buy packs of words resembling the kind you magnetically attach to fridges, and then write poems with them. Marking my calendar for this one!15

Apparently the Bored Apes project has been sending its royalties to an account at FTX US, which, as you probably recall, is bankrupt. Lol.16

The Web3 is Going Just Great recap

There were 11 entries between April 1 and April 12, averaging 0.9 entries per day. $130.03 million was added to the grift counter.

All my burgers gone

[link]

That Bored Ape-themed restaurant in Long Beach, California that briefly tried to accept cryptocurrency payments [W3IGG] has served its last burger. This was first revealed in a tweet by a local Twitter account, which posted a picture of the vacant building with a sign advertising that a local Mexican food chain will be taking up residence shortly.

Someone mentioned that they had walked past and saw workers hauling old carpet out of the building to be thrown away. Hard to imagine why the new proprietors wouldn't want to keep it!

Evidently the Bored & Hungry brand has been purchased by "HungryDAO", which Bored & Hungry's owner described as "a branding and franchising company".17 It's not clear if the DAO also bought the one Bored Ape and three Mutant Apes that are used in the company's branding, but as of writing they haven't changed hands on the blockchain. They were originally purchased for a combined $455,000, though at current average Ape prices, their resale value is probably somewhere in the ballpark of $75,000.

Australian crypto collapse

Two crypto funds in Australia have toppled, leaving at least 550 creditors with more than US$100 million in claims. One of them, Digital Commodity Assets, was run by a man who drew in wealthy investors to invest a minimum of $33,000 each in his scheme, and who boasted of his past career as a NASA mission specialist.

The other, NGS Crypto, sold "crypto mining packages" where they enticed people to open up self-managed super funds — a type of retirement fund — and use it to earn returns from "blockchain mining". The firm advertised returns of up to 16% annually, and promised that investors would receive 100% of their initial investment back at the term's completion — even "in the unlikely event that crypto mining becomes unprofitable".

Memecoin mania sees almost $29,000 poured into promised rugpull

[link]

A project describing itself as "the world's first memecoin pre-announced as a rugpull" opened up token sales on April 1. Its website said, "Unlike many projects in crypto, which refuse to offer financial advice, we can confidently give this financial advice: do not buy this coin, as it will go to zero."

People quickly put thousands of dollars into the token, as the creator incredulously tweeted things like "Two hours until the presale closes. We are at over 2 ETH. What is wrong with you people?!"

Two hours until the presale closes. We are at over 2 ETH. What is wrong with you people?! pic.twitter.com/de1mwEjGWp

— $THEPLAN (@theplancoin) April 4, 2024

In an amusing twist, after the presale ended, the token's creator claimed that the funds they'd raised were hacked, and put into a liquidity pool that was locked for a year.b Well, most of the funds — some of them went to a farmer in Kenya who was briefly the subject of a frenzy last week as crypto traders started sending him crypto to buy goats and name them after crypto-related topics.18

Everything else

- $26 million liquidated in surprise Pac Finance smart contract change [link]

- MarginFi suffers huge outflows amid CEO ragequit [link]

- $23 million goes missing amid STFIL claims that they're being investigated [link]

- SushiSwap team votes to give themselves control of much of the "decentralized" project's treasury [link]

Worth a read

I was impressed with this reporting out of Mission Local, who wrote about Ripple founder Chris Larsen's political activities. I particularly enjoyed how it went into the "Jedi mind trick" of a person simultaneously bankrolling law enforcement and tough-on-crime policies while vigorously fighting back against attempts by the SEC to enforce laws that apply to him.

Philip Stafford at the FT wrote about how the impact of bitcoin spot ETFs on driving up bitcoin prices is being overstated somewhat.

In the news

I went on Ed Zitron's Better Offline podcast to talk about Wikipedia and how it works. I love nerding out about Wikipedia and I love talking to Ed, so it was a great time!

That's all for now, folks. Until next time,

– Molly White

References

Notice of appeal filed on April 11, 2024. Document #428 in US v. Sam Bankman-Fried. ↩

Letter motion filed on April 8, 2024. Document #425 in US v. Sam Bankman-Fried. ↩

"Avi Eisenberg May Testify in $110M Crypto Fraud Trial, Defense Says", CoinDesk. ↩

Order filed on April 8, 2024. Document #147 in Messieh v. HDR Global Trading Limited. ↩

"FBI probed bitcoin core developer event linked to Luke Dashjr’s BTC hack: Mike Schmidt", The Block. ↩

"Fighting for DeFi", Uniswap Labs blog. ↩

"Testimony of Deputy Secretary of the Treasury Wally Adeyemo Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate", U.S. Department of the Treasury. ↩

"Top U.S. House Lawmakers Meet on Stablecoin Bill Strategy: Punchbowl", CoinDesk. ↩

Letter by Elizabeth Warren to Patrick McHenry and Maxine Waters, sent April 8, 2024. ↩

"Crypto executives put money behind longshot bid to oust Elizabeth Warren", Politico. ↩

"TON’s $5M incentive program aims to drive digital ID verification", Cointelegraph. ↩

"Bitcoin, Sui and Solana Gaming Handhelds: Here's How They Stack Up", Decrypt. ↩

"Crypto Twitter is paying a man to buy goats and name them after crypto things", The Block. ↩

Footnotes

I suspect these kinds of injunctions will become a fraught topic in the near future as more of them are issued. While the SEC has been pretty clear in its belief that the vast majority of those issuing cryptocurrency tokens fall under its remit, the cryptocurrency industry has vociferously disagreed. As more of these bans are issued, I suspect it's only a matter of time until someone barred from the securities industry issues a token, claiming it's okay because that token isn't a security. Indeed, even since its loss, Terraform Labs has continued to argue that the whole case is bogus because their tokens weren't securities. ↩

This is the standard way of releasing new crypto projects, with the locking done to provide confidence that the token's creators won't drain all the funds. ↩