Issue 62 – Grassroots

Coinbase’s Stand With Crypto Alliance fudges the numbers, a (former) crypto industry CEO has a meltdown, and another exchange suffers a nine-figure hack.

For those in the United States, and surely for many others who are not, I’m sure I don’t have to explain to you what a bananas week it’s been. Politics here have been completely off the rails lately anyway,a but the attempted assassination of former president and current presidential candidate Donald Trump, mixed with the news that president Joe Biden will be ending his re-election campaign and passing the torch to Kamala Harris, has thrown things into high gear.

As you might expect, the wealthy Silicon Valley types who have jumped on the Trump bandwagon with both feet, are being extremely normal about everything. In the wake of the assassination attempt, we were all treated to a rather unpleasant glimpse into the personal fantasies of some of these folks, which seem to follow a similar script in which they each rise up from their keyboards after years of endless tweeting and board meetings, perfectly prepared to step into the role of heroic warrior protagonist in a civil war film. Then, after the Biden announcement, we were treated to a collective meltdown among those who’d decided that a Trump victory was all but assured, and who are now contending with the possibility of an opponent with more energetic support, who is likely to use the Trump campaign’s heavily age-focused rhetoric against the new oldest candidate in the race.

This has very much extended to the crypto world, where we all got to spend a week watching the very public and apparently ongoing meltdown of a crypto company CEO who ended the week stripped of his executive position (more on that in a moment). Some crypto personalities have likewise jumped into feverish conspiracy theorizing, while others are poring through Harris’s history looking for any indication that a Harris presidency could be friendlier to the crypto industry than a Biden one. Some prominent voices — namely Ethereum co-founder Vitalik Buterin — have tried to urge for a more measured approach to politics, but with a decidedly mixed reception.

I don’t think I could have released my Follow the Crypto project at a better time. I suspect political spending from the industry will only accelerate given these developments, and it’s already been incredibly helpful (to me and to other publications) to have the data right there and ready to go.

In the courts

Andrew Chow recently wrote in Time magazine about a town that’s being “terrorized” by noise pollution from a Marathon Digital Holdings Bitcoin mine, which uses cooling fans that emit a hum so loud that it’s regularly measuring at 72 dB within the bedrooms of nearby houses. Imagine having someone running a vacuum in your bedroom at all times. In disappointing news for residents of Granbury, Texas, a jury has acquitted Marathon’s site manager of 12 noise violation charges despite agreeing that the noise was unreasonable.1 As reported by Chow, there are few avenues available to force Marathon to address the noise issue:

Ultimately, Constable John Shirley can’t stop the machines, because there is no state law forcing the operator of a noisy machine to turn it off. When Shirley writes a ticket for disorderly conduct, it merely triggers a $500 fine, as opposed to jail time or another punitive measure. Hood County can’t even pass a relevant noise ordinance law: only Texas cities, not counties, have the ability to do so.

Tornado Cash developer Alexey Pertsev has been denied bail in the Netherlands, where he is preparing to appeal his five-year sentence on money laundering charges [I58]. His request to obtain computer access was also denied.2 Over in the US, fellow Tornado Cash developer Roman Storm is preparing his defense for a trial now scheduled for December.3

The judge who found that Craig Wright is definitely not Satoshi Nakamoto [I51, 52, 53, 54] has formally referred Wright’s case to the Crown Prosecution Service for possible prosecution on forgery and perjury.4 Wright has also been forced to put a statement on his website proclaiming in large text: “Dr. Craig Steven Wright is not Satoshi Nakamoto”, which is very funny.5

Arthur Schaback, the co-founder, former CTO, and board member of the Paxful cryptocurrency exchange, has pleaded guilty to failing to maintain an effective anti-money laundering program. According to the Department of Justice, “Schaback allowed customers to open accounts and trade on Paxful without gathering sufficient know-your-customer (KYC) information; marketed Paxful as a platform that did not require KYC; presented fake [anti-money laundering] policies to third parties that he knew were not, in fact, implemented or enforced at Paxful; and failed to file a single suspicious activity report, despite knowing that Paxful users were perpetrating suspicious and criminal activity.” He will be sentenced in November, and faces up to five years in prison.6

The BitMEX cryptocurrency exchange has pleaded guilty to violations of the Bank Secrecy Act, following in the footsteps of four of its executives who did the same in February 2022. One benefit of waiting so long to do so is they can now brush off the charges as “old news”, as they did in a blog post shortly after the announcement.7

Lithuanian crypto payment service Payeer was fined $10 million, a record-setting amount for a virtual asset service provider in Lithuania. The Lithuanian Financial Crime Investigation Service accused the company of violating anti-money laundering laws, and permitting its customers to transfer funds to sanctioned Russian banks.8

A Singaporean court is forcing the Multichain Foundation to pay over $2.1 million to the Fantom Foundation, which operates the Fantom blockchain. Multichain suffered a $200 million loss in July 2023 [W3IGG], and those losses impacted multiple other projects and blockchain networks. Fantom was successfully able to convince the court that the Multichain Foundation was ultimately responsible for the chain, and obtained a payout, although the $2.1 million was substantially less than the roughly $67 million they claimed.9

A former compliance officer for Crypto.com tried to extort the company for almost $50,000 after they fired him, threatening to release confidential information he’d obtained through his job. Crypto.com has taken him to court in Malta, which is where the exchange is registered.10

In bankruptcies

The FTX estate and the Chicago-based Jump Trading firm are embroiled in a dispute over a loan that never came to pass. A subsidiary of Jump, called Tai Mo Shan, entered into an agreement with FTX’s associated Alameda Research trading firm for 800 million Serum tokens. The tokens would have been delivered in 2023, had FTX not collapsed first, revealing that Serum was largely propped up by FTX. Jump claims they’re owed $264 million in damages for the tokens they never received, using an estimate based on the market price of Serum at the time of bankruptcy, as well as factors including loan interest and the repayment option price.11

Alameda has argued that because the loan never began, they owe nothing to Jump, and they describe the damages amount as “wholly unsupportable”. They also hint at possible litigation towards Jump, noting: “For the reasons stated here and more following discovery, Tai Mo Shan may be liable to the Debtors for fraudulent transfers... The Debtors submit that Tai Mo Shan may have been the recipient of certain constructively fraudulent transfers under section 548(a)(1)(B) of the Bankruptcy Code, including the purported loan at issue here. The Master Loan Agreement and Loan Confirmation provide that Tai Mo Shan would receive 800,000,000 SRM tokens for no fee and no interest. There are no contract provisions specifying any amount of collateral or consideration given by Tai Mo Shan in return for the alleged loan.”12

Meanwhile, in Delaware, a court has ordered Thomas Braziel of the crypto-focused distressed-debt investing firm 117 Partners to repay around $1.95 million he stole from the receivership for Fund.com, a defunct non-crypto finance firm. Braziel rose to prominence through his success in buying claims in crypto bankruptcies including FTX, Celsius, and Voyager, and he started 117 Partners last year to continue his distressed debt investments and provide advisory services to crypto firms. Braziel allegedly took the money from the Fund.com receivership to spend on his own risky investments, as well as on luxury goods and stays at fancy hotels.13

In governments and regulators

Spot Ethereum ETPs began trading in the US today, about a month and a half after they were approved in a rather surprise decision by the SEC [I59]. So far, they have enjoyed around $600 million in volume, though some of this is likely outflows from Grayscale’s Ethereum Trust.14 The volume is considerably less than the $4.6 billion of volume in the Bitcoin ETPs’ first day of trading, as was expected, but is still being described as “relatively high” interest by Bloomberg.15

Back in February 2023, I noted that the SEC had sent a Wells notice to Paxos [I20], a New York-based stablecoin issuer who once issued the Binance-partnered BUSD stablecoin. As I wrote then, a Wells notice “is basically a heads up that the hammer's about to come swinging down unless Paxos can talk the SEC out of the (usually very strong) reasons they're about to swing it”. It seems Paxos managed to do that, because the SEC has informed Paxos that they no longer intend to recommend an enforcement action.16 The decision to send the notice in the first place was a surprise — both to me and to the industry — and perhaps the agency has changed their stance on whether stablecoins like BUSD are broadly securities.

The SEC has also concluded a three-year-long investigation into the Stacks network and the Hiro Systems company that runs it. The investigation began in 2021, not long after the company claimed that its token was “the first SEC-qualified offering in U.S. history”.17 They had originally intended to register their token as a security with the SEC, before informing the agency that they no longer considered their token a security because they had decentralized the project.18 Apparently the SEC, at least for a time, disagreed with this assessment.

Coinbase took an aggressive swing in the ongoing case against them from the SEC, trying to subpoena personal emails and other information from SEC Chairman Gary Gensler as far back as four years before he took the role at the agency. The SEC fought back, saying that directing a subpoena towards Gensler personally rather than towards the agency was an “improper intrusion into a public official's private life.” When Coinbase argued that the personal emails would be “an appropriate source of discovery,” Judge Failla weighed in, commenting, “I was sort of surprised, and not in a good way, by the July 3 response.” Although Coinbase can and will still try to compel a response to the subpoena, they don’t sound likely to succeed, with Failla adding, “I actually reacted to this response by thinking that defense counsel was spending an amount, perhaps not an inconsiderable amount of the reservoir of credibility that they have built up with me throughout this litigation.”19

The crypto industry has long hoped that the CFTC would become the primary industry regulator, mostly because it is smaller and has considerably fewer resources to pursue enforcement actions compared to the SEC. Now, however, the CFTC is trying to make clear to Congress that they would hope to scale up the agency if tasked with overseeing a broader section of the industry. Testifying in front of Congress, CFTC chair Rostin Benham stated that the agency would need almost $100 million in additional funding for the first two years, if installed as the primary regulator. He also stated that, even in its current position regulating only a subset of the industry, a whopping 50% of enforcement actions from the CFTC last fiscal year were against cryptocurrency businesses.20

The US Energy Information Agency is taking another shot at getting cryptocurrency miners to submit reports about their energy consumption, after some hamhanded attempts fell flat earlier this year [I50, 52, 53]. They’re reportedly working on a draft of a survey that will go out to mining firms. The crypto mining industry is very concerned that such surveys might not be sent to all data centers, as is the tendency of many in the industry who seem to feel that no problem may be addressed unless it is the single worst problem on earth.21b While I think it would be worthwhile to survey all data centers, I suspect the crypto miners know that they could drum up a lot more opposition to such a survey if it also threatened to more quantifiably expose the excesses of artificial intelligence companies who have taken after the crypto miners in terms of energy consumption. Instead of blasting carbon into the atmosphere so that people can speculate on internet money, they’re just doing it so they can talk to their chatbot girlfriends.

Over in Malaysia, a government official has disclosed that they believe illegal cryptocurrency mining operations stole at least $722 million worth of electricity between 2018 and 2023. He made the comments alongside promises to crack down on electricity theft.22

In elections and political influence

Donald Trump

Bitcoin 2024

Donald Trump is underscoring his recent embrace of the cryptocurrency world by agreeing to speak at Bitcoin 2024, an annual conference coming up in just a few days. Looking at the conference speakers lineup, I’m forced to wonder if the conference organizers are hoping they will be able to make his usual rambling statements look comparatively reasonable by scheduling him among fellow incoherent bloviators Robert F. Kennedy Jr., Michael Saylor, and Russell Brand.

They also have managed to accumulate the highest concentration of known sexual abusers in their conference lineup that I’ve ever seen, with three out of seven of their headliners having been publicly accused of sexual assault.232425

Attendees will spend between $500 and $20,000 just on tickets to the conference, but Trump is naturally hoping to further lighten some attendees’ purses by hosting a fundraiser event there. For $844,600,c people can purchase a seat at a “roundtable” with the presidential hopeful. For the low, low price of $60,000 (or $100,000 for couples, for anyone who dragged their partner along to the conference and hasn’t broken up by Saturday night), people can pay to take a photo with Trump. Those Bored Apes are suddenly starting to look like sober investment decisions in comparison.

Trump’s most recent platform still doesn’t feature cryptocurrency among its top priorities, although the topic earned two sentences below the fold in the longform platform document released by the Republican National Committee on July 8:26

Republicans will end Democrats’ unlawful and unAmerican Crypto crackdown and oppose the creation of a Central Bank Digital Currency. We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.

Support from the crypto community

So far, we’ve seen many within the cryptocurrency community wholeheartedly embracing Donald Trump, with millions in donations flowing from Gemini’s Winklevoss twins [I60] and Kraken’s Jesse Powell [I61]. Much of crypto Twitter is either unabashedly aboard the Trump train, or embarrassedly aboard the Trump train (claiming that their hand has been forced by a Democratic administration that demonized crypto).

However, few have been quite as aggressive in their Trump support than Ryan Selkis, who up until Friday was the CEO of blockchain intelligence firm Messari. In addition to founding Messari, he also held director positions at Digital Currency Group and the CoinDesk crypto media outlet, and he helped to build the political fundraising foundation that would later become the Fairshake super PAC. Though Selkis has also financially supported Trump to the tune of almost $57,000,27 much of his support has come in the form of an endless barrage of tweets to his more than 350,000 followers — averaging around 117 tweets per day.d

While his tweets and behavior have always been pretty unhinged, he really went off the rails shortly after the attempted Trump assassination, tweeting things like “Anyone that votes against Trump at this point can die in a fucking fire. Literal war.” and “Bolshevism cannot be cured with votes. We must excise the metastatic cancer and evil of the left, by force if necessary.”

Some recent tweets from the founder and CEO of a prominent cryptocurrency company. pic.twitter.com/3ZjJvP0isw

— Molly White (@molly0xFFF) July 18, 2024

This, combined with a Twitter conversation in which he told another member of the cryptocurrency community living in the US on a green card “I hope we send you back”, was apparently the last straw for Messari. On July 19, Selkis announced that he had “decided to step aside” as the company’s CEO, though he said he would “remain full-time with the company” as an advisor. I’m sure they will sorely miss whatever contributions as CEO he managed to squeeze in around his 7-tweets-per-hour posting schedule.

Selkis has yet to settle on which version of events he’s going with, alternately claiming to have been (“temporarily”) defeated by leftists (me)28 while also claiming that he had been planning his CEO exit for a month.29 One thing is clear, though, which is that he believes the recent blowback against him is a result of me reposting his tweets, and not of him tweeting them in the first place.30 And he’s really, really, really mad about that.

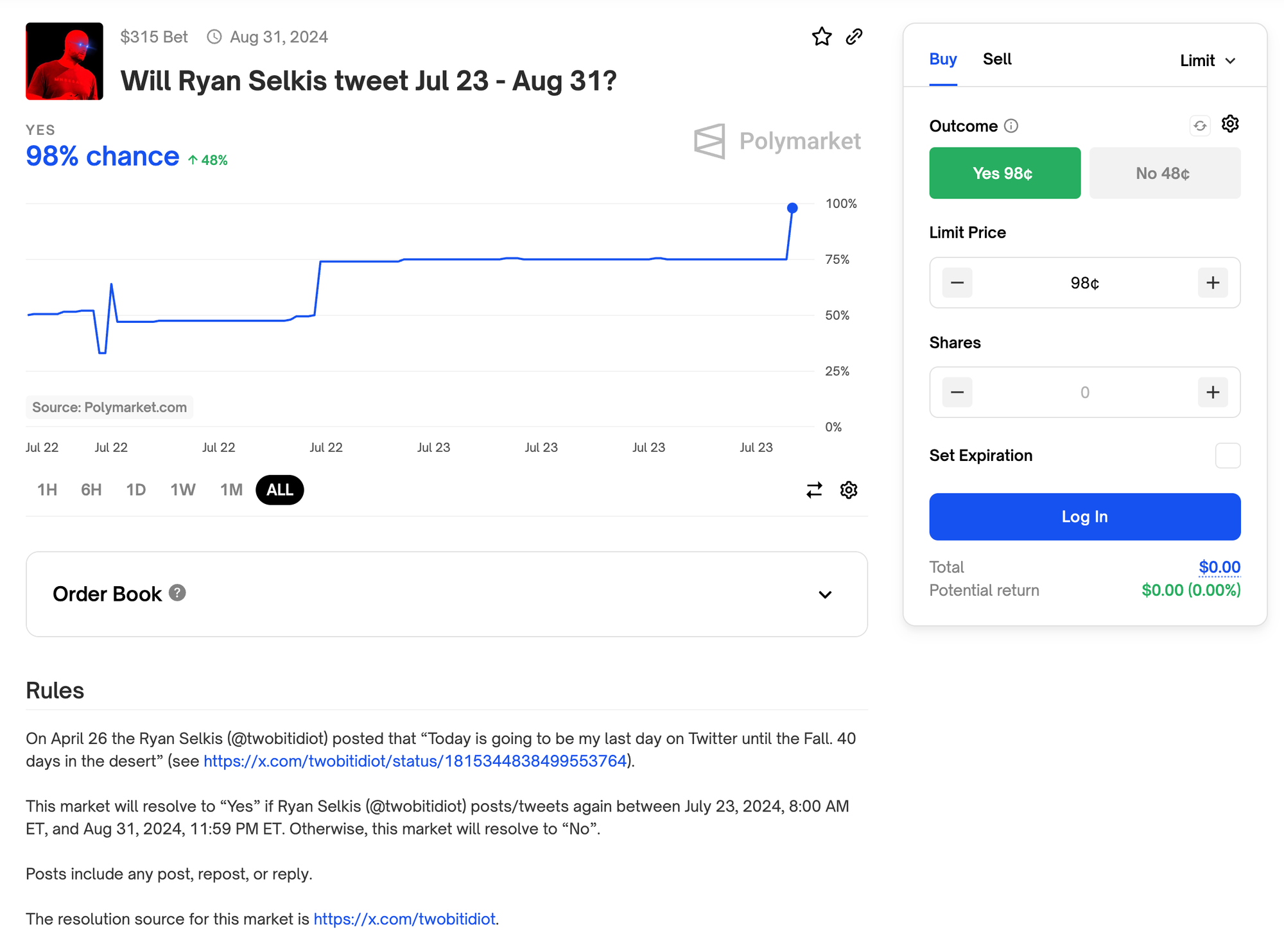

He’s now promised that he’s taking forty days off Twitter, during which time he will be “quietly rage building”.31 This is the first timee I’ve ever been tempted to sign up for Polymarket, though that is tempered somewhat by the fact that betting on the favorite wouldn’t be terribly profitable.

He’s already sent me a DM in lieu of commenting on one of my (unrelated to him) tweets, so his “digital exile” doesn’t seem to be going very well so far. Best of luck to him, though.

Opposition from the crypto community

There are a few swimming against the tide. The most prominent of these is Ethereum co-founder and de facto community leader Vitalik Buterin, who published an essay titled “Against choosing your political allegiances based on who is ‘pro-crypto’”. While neither presidential candidate is mentioned by name, Buterin urges people not to support candidates who are “power-seeking narcissists” or who support crypto for the wrong reasons.

[B]y publicly giving the impression that you support "pro-crypto" candidates just because they are "pro-crypto", you are helping to create an incentive gradient where politicians come to understand that all they need to get your support is to support "crypto". It doesn't matter if they also support banning encrypted messaging, if they are a power-seeking narcissist, or if they push for bills that make it even harder for your Chinese or Indian friend to attend the next crypto conference - all that politicians have to do is make sure it's easy for you to trade coins.

He also criticizes Stand With Crypto’s approach to classifying politicians on their website as pro- or anti-crypto without considering their stances on related policy topics, including freedom to communicate privately via encrypted messaging services, digital identity, privacy, and high-quality access to information.

His message was well-received among some in the crypto community who are frustrated with the increasing reputation of the crypto community as Trump supporters across the board. However, this reputation has certainly been earned by more than just the industry’s wealthy Trump donors, and Buterin’s essay was met with responses from prominent crypto influencers criticizing Buterin for receiving COVID-19 vaccines and for a recent photograph showing him wearing a mask on an airplane. One wrote, “that is one long way of saying you're voting for Biden”, apparently not realizing that Buterin is Canadian.

BitMEX co-founderf and Bitcoin billionaire Arthur Hayes has also written about the upcoming election, commenting:

I am dismayed that many crypto pundits who should know better are now blindly throwing fancy fundraisers for the Trump campaign. They erroneously believe that Trump is sincere and that if they just donate enough money, Operation Chokehold Crypto will vanish. That is poppycock. Trump is an astute politician. He will say whatever to whoever is to be re-elected. Once in office, anything related to crypto will be a distant memory.

Stand With Crypto

I’ve written before about the Stand With Crypto Alliance, a Coinbase-backed political action committee, and their attempts to make this “grassroots” group appear to have much broader support than it does — a practice sometimes known as “astroturfing”. In June [I59], I noted that the group appeared to be massively inflating the amount they’ve raised from individual crypto investors by lumping those donations in with the multi-million dollar corporate donations to the completely separate Fairshake super PAC. After my reporting on this, the group added a tooltip to the webpage, which still boasts that a little over $179 million was “donated by crypto advocates” but now admits (if you hover) that almost $178 million of that — over 99% — is actually donations to Fairshake [I61]. And over 90% of the donations to Fairshake, in turn, have come from just four companies.32

Now, the Stand With Crypto PAC has filed its first FEC report and it is... illuminating. While a visitor to the Stand With Crypto website might be impressed that the PAC has managed to raise more than $179 million from almost 1.3 million “crypto advocates”, FEC filings reveal that the committee has actually raised only $13,690 from seven people since its creation in April. Four of those seven people work for either Coinbase or for the Stand With Crypto PAC, and donated $10,750 of the $12,500 in itemized donations (86%).g

This is a pretty disappointing result for a PAC that earned some fanfare on its launch, with the headline in Reuters: “Crypto group with 440,000 members launches PAC to target House, Senate elections”.33

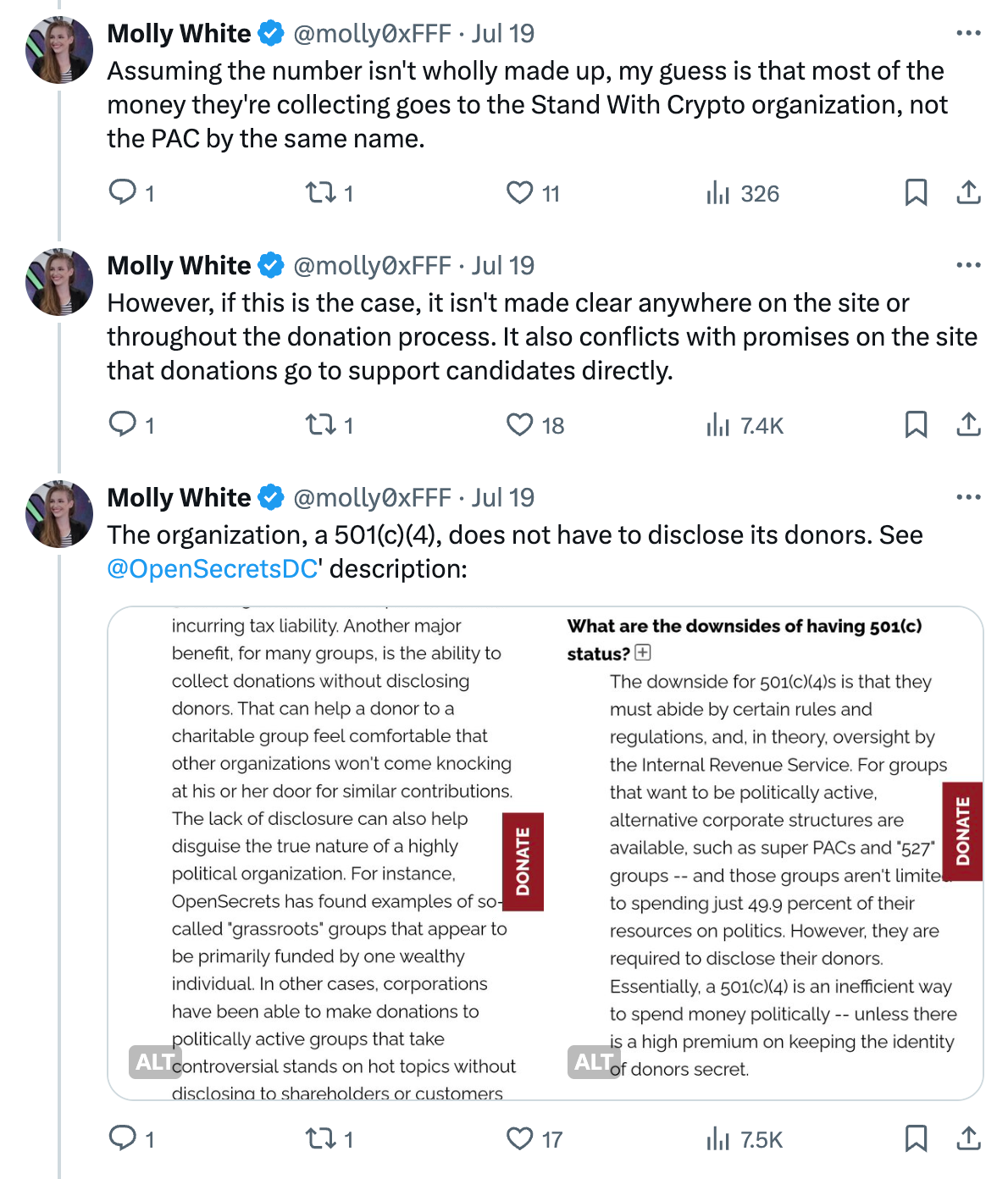

This number is also difficult to reconcile with the Stand With Crypto website, which claims in its new tooltip that $1.49 million was donated to the group. Where’s the rest of the money? Or are they just lying?

The answer is that “Stand With Crypto Alliance” is actually a name used for two separate groups: a 501(c)(4) nonprofit organization and, separately, a political action committee. While donors may think their contributions are going to the political action committee to directly support candidates, particularly after all the press about the PAC this spring, their donations are actually being routed to the 501(c)(4), which is not permitted to make donations that directly support candidates. The true destination of the funds is not mentioned anywhere throughout the donation process, although someone who expands an FAQ box on the website and understands that a 501(c)(4) is a separate entity from a PAC with different limitations on its spending would be able to figure it out.

After mentioning my hunch that the contributions were actually going to the 501(c)(4) and not the PAC, Stand With Crypto’s Twitter account confirmed my suspicion. They did not, however, answer my follow-up question about why the group obfuscates where donations are actually going.

(Twitter)

501(c)(4)s are “social welfare” organizations that, critically, do not have to report the identities of their donors. Under the law, such groups are allowed to involve themselves in political activity so long as politics isn’t the primary purpose of the group — though what makes politics the “primary purpose” of a group is not clearly defined. The OpenSecrets campaign finance research group notes in their explainer on 501(c)(4)s:34

The lack of [donor identity] disclosure can also help disguise the true nature of a highly political organization. For instance, OpenSecrets has found examples of so-called ‘grassroots’ groups that appear to be primarily funded by one wealthy individual.

Ring a bell?

Stand With Crypto features a donations “leaderboard” on their website that reveals the identity of some of the group’s donors,35 and the usual trend appears: $1.36 million of the $1.49 million (91%) comes from only four donors:

- $1 million from the MoonPay cryptocurrency company, known for brokering deals between celebrities and prominent NFT projects like Bored Apes [W3IGG]

- $20,000 from ToshiBase.eth, a wallet belonging to a memecoin project built on Coinbase’s own blockchain and themed after Coinbase CEO Brian Armstrong’s cat

- $15,000 from the Gemini cryptocurrency company, founded and helmed by the Winklevoss twins (both very active political donors)

- $11,774 from Coinbase CEO Brian Armstrong

Very grassroots.

Other political spending

The Fairshake super PAC has once again risen to the top of the list of super PACs by amount donated, although its true position is difficult to nail down.

Raw FEC data, such as what is used to create this table (taken from the identical version on the FEC’s own website), does a poor job of reflecting donations made in cryptocurrency, which are often double- or even triple-counted. With around $40 million in crypto-denominated contributions, Fairshake’s total receipts are being overstated by the FEC by about that amount. The challenge is correcting the data across all PACs — a very labor-intensive process even just for the handful of cryptocurrency-focused committees, that has already required me to call Fairshake directly to decipher some of the FEC data. If we assume that only the cryptocurrency committees are receiving contributions in crypto, and therefore are the only ones suffering from this error (which we know is not the case, although crypto-denominated spending is a very small portion of all election spending),36 this would put Fairshake at around #4 in line. Still, a shocking amount of money, no matter how you slice it.

Recent crypto PAC spending has been entirely focused on Arizona, where PACs have contributed more than $2.3 million to three House primary elections in the past month. Those elections are coming up on July 30.

Conservative-focused PAC Defend American Jobs chipped in more than $580,000 to support far-right Peter Thiel protégé Blake Masters in District 8, shortly after a recent poll showed him trailing in the Republican Primary to Abraham Hamadeh.37 Masters has promised to be “the biggest champion of crypto DC has ever seen”, where he’s vowed to put “woke, miserable regulators ... in their place so great American entrepreneurs can innovate”.38 Hamadeh has not made much in the way of public statements on crypto.

Progressive-focused PAC Protect Progress has contributed more than $1.3 million towards supporting Yassamin Ansari in her Democratic primary against Raquel Terán in District 3. Terán’s campaign was very quick to go on the offensive about it, condemning the spending as a “blatant attempt by MAGA extremists to meddle in a Democratic primary and boost Yassamin Ansari”.39 California Democratic Representative Linda Sánchez and Chair of the Congressional Hispanic Caucus’s BOLD PAC also issued a statement: “This is a blatant effort by an outside group to silence the voices of over half a million Latinos in a majority-Latino district in order to buy a seat in Congress”.40 Both Ansari and Terán have statements on their websites that speak favorably about “blockchain innovation”, but Terán’s voting history in the Arizona Senate against two bills that would have allowed various groups to accept crypto payments seems to have cemented Ansari as the crypto favorite.

Finally, Protect Progress has just dumped $415,300 into the District 1 Democratic primary, where Andrei Cherny is neck and neck with Amish Shah, followed closely by two other candidates in the crowded race. Cherny is a bit of an odd choice, given that his campaign website champions his history of collaboration on consumer protection with notorious crypto opponent Elizabeth Warren. However, his more recent statements softening towards crypto have endeared him to the industry compared to Shah, who voted in the Arizona State House against a bill that would have installed friendlier tax policy for some crypto assets.

Speaking of Warren, donations are beginning to accelerate in her upcoming race to maintain her Senate seat, where she faces two Republican opponents who are running against her pretty much solely on a crypto platform (and a third who wants to ban bitcoin mining). As crypto’s public enemy number one on Capitol Hill, there is a lot of interest in unseating her, but they may have a tough time against a candidate who’s very popular among the many Democrats in Massachusetts. PACs haven’t done a lot of spending against her yet, but one super PAC aligned with her almost solely crypto-focused opponent John Deaton, who moved to Massachusetts to run against her [I55], has raised $2 million from Ripple and the Winklevoss twins.h There’s some disagreement around who the appropriate candidate to go up against Warren might be, and sitting Senator Cynthia Lummis has endorsed Republican Ian Cain, a co-founder of a Massachusetts blockchain firm called Qubit Labs.41

Elsewhere in crypto

Checking back in on Hamster Kombat from last issue [I61], players of the clicker game are now emptying the shelves of electric massage guns, using them to turbo-charge their tapping.42 Now that’s the kind of innovation we’ve been waiting for from this industry.

Blockchain research firm Elliptic has released a report outlining how Huione Guarantee, a company with links to Cambodia‘s prime minister, has helped to enable the pig butchering industry. The site has processed $11 billion in transactions, some of which connect buyers with those offering money laundering services or web development for the sites used in these romance scams, and selling personal information of potential victims, as well as gear including electric shock shackles and batons reportedly used by the operators of the compounds where human trafficking victims are forced to participate in the scams [I53].43

The Web3 is Going Just Great recap

There were eleven entries between July 6 and July 23, averaging 0.6 entries per day. $248.2 million was added to the grift counter.

WazirX hack

[link]

We made it almost two months without a $100 million+ crypto heist. Almost. However, Indian crypto exchange WazirX is now taking DMM’s place [W3IGG] as the most recent nine-figure crypto theft.

The exchange acknowledged a “suspicious transfer” of around $235 million from one of their multisignature wallets on July 18. This is a significant loss for the company, which stated in a recent “proof of reserves” report that they held around $500 million in total.

In the wake of the attack, WazirX paused withdrawals to try to prevent the attacker from continuing to steal funds, but kept some of the platform operational. The company then halted trading completely three days later, announcing that “The cyber attack theft has impacted our ability to maintain 1:1 collaterals with assets.”

Blockchain sleuth zachxbt has observed that the attack has some of the same hallmarks as previous major thefts perpetrated by the North Korean Lazarus cybercrime group.

Celebrity Twitter accounts hijacked to promote memecoins

[link]

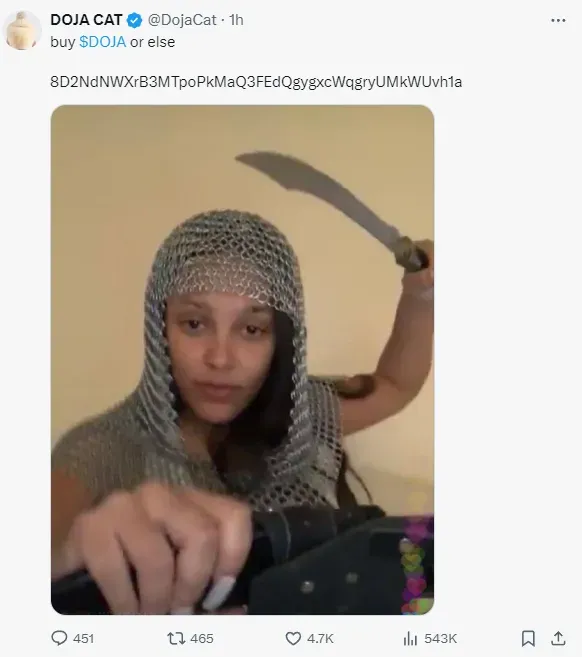

Following a raft of memecoins actually (if surprisingly [I59]) created by celebrities, there have been a series of Twitter compromises in which various accounts have been taken over to promote memecoins not actually endorsed by the real celebrities behind the account.

One prominent such case was Doja Cat, whose Twitter was taken over by an attacker who tweeted things like “buy $DOJA or else” — complete with a photograph of the singer brandishing a toy sword while wearing a chainmail coif.

Others affected have included Sydney Sweeney, 50 Cent, Rich the Kid, and Hulk Hogan [I59].

Everything else

- dYdX v3 exchange website compromised amid sale announcement [link]

- ETHTrustFund rug pulls for $2.2 million [link]

- RHO Markets lending protocol loses $7.6 million to apparent whitehat [link]

- Trip.com accused of "rug pull" as it shuts down its Trekki NFTs [link]

- Users of LI.FI protocol suffer losses of at least $10 million [link]

- Three arrests made in relation to Metamax pyramid scheme [link]

- Minterest hacked for $1.4 million [link]

- Dough Finance hacked for $1.9 million [link]

- Popular defi protocol websites replaced with wallet drainers amid mass Squarespace domain hijacking [link]

Worth a read

If I haven’t completely worn you out by now on the topic of crypto-related election spending, Jake Donoghue did a great guest post on Amy Castor’s blog, digging into the “52 million Americans own crypto” claim that Coinbase and Stand With Crypto are so fond of.

NiemanLab (and some other publications) did fun pieces about the different ways in which people learned the news that Biden had dropped out of the race, which were actually pretty illuminating as far as the state of the news these days. A lot of people seem to have learned via meme. I learned it from a friend who got up to check their phone while we were all reading at the beach, which is not quite as funny as the many people who first learned from the @LizaOutlives Twitter account.

In the news

Follow the Crypto has gotten some nice coverage and shout-outs in various places, including Axios, The Nation, Coda, and Digg. Heise Online did a whole detailed piece about it, which is available in German or auto-translated (pretty well) to English. Most excitingly, some outlets including The Guardian have started to use it for their supporting data in their reporting (which is probably a good idea, if I do say so myself, given the errors in the FEC summary data).

I rejoined the good folks over at TWiG to talk about a lot of mostly unrelated tech topics, including the abandonment of carbon neutrality goals by Google, the recent Authy data breach, Temu, and a font that’s also a large language model.

That's all for now, folks. Until next time,

– Molly White

Correction: Huoine Guarantee has links to Cambodia’s prime minister, not to the royal family of Cambodia.

Footnotes

And by “lately” I mean for the past decade or so... ↩

If I sound a little exasperated, just imagine the cacophony of crypto enthusiasts over the past weeks, all informing me that I may not provide transparency into cryptocurrency election spending unless I also do the same, massive amount of work across the hundreds of other industries that spend money on politics. ↩

$844,600 is the maximum permitted individual donation amount to the Trump 47 Committee. ↩

For comparison’s sake, I consider myself to be someone who spends far too much time on Twitter, and I apparently average between 6 and 11 tweets per day. ↩

I thought it was the second time, but it turns out the prediction market on “Will Molly White (Web3 is Going Just Great) recant during 2023?” was on the Manifold Markets predictions platform, not Polymarket. ↩

Hayes is one of the BitMEX executives who pled guilty to a Bank Secrecy Act violation, mentioned above. He paid a $10 million fine and spent six months in home confinement. ↩

There are also $1,190 in unitemized contributions. These may be “small-dollar donations” — that is, donations of $200 or less — for which the PAC does not need to report detailed information about the contributor. ↩

The Winklevosses’ July 18 donations have not yet been reported to the FEC, as the Commonwealth Unity Fund PAC reports donations quarterly. I’m working to better incorporate claimed but not yet formally reported contributions into Follow the Crypto. ↩

References

“Texas Jury Sides With Bitcoin Miner Marathon in 'Nightmare' Noise Dispute”, Decrypt. ↩

“Tornado Cash developer Alexey Pertsev denied bail while preparing appeal”, Cointelegraph. ↩

“Conduct Versus Code May Be the Defining Question in Roman Storm Prosecution”, CoinDesk. ↩

“Computer scientist who falsely claimed he was Bitcoin creator 'Satoshi Nakamoto' referred to CPS”, Sky News. ↩

“Paxful Inc. Co-Founder Pleads Guilty to Conspiracy to Fail to Maintain Effective Anti-Money Laundering Program”, Department of Justice. ↩

“Crypto Exchange BitMEX Pleads Guilty to Violating the Bank Secrecy Act From 2015 to 2020”, CoinDesk. ↩

“Crypto payment service Payeer hit with record $10M fine in Lithuania”, Cointelegraph. ↩

“Multichain Foundation to pay $2.1M to Fantom for losses”, Cointelegraph. ↩

“Former Crypto.com compliance officer charged with money laundering, extortion”, Protos. ↩

“Jump Trading Drags FTX Estate to Court Over $264M Serum Token Loan”, CoinDesk. ↩

“Debtors’ objection to proof of claims filed by Tai Mo Shan Limited” filed on July 10, 2024. Document #20030 in In re: FTX. ↩

“FTX-Claims Broker Thomas Braziel Stole $1.9 Million From a Receivership for Personal Gain, Court Says”, The Wall Street Journal. ↩

“Spot Ether ETFs See $600M in Volume In First Half Day of Trading”, CoinDesk. ↩

“Ether ETFs Trade Over $500 Million in Strong Crypto Fund Debut”, Bloomberg. ↩

“SEC drops key stablecoin investigation in win for crypto industry”, Fortune Crypto. ↩

“Bitcoin Scaling Network Stacks Avoids Charges as SEC Closes Investigation”, Decrypt. ↩

“SEC drops probe into Stacks blockchain and developer Hiro Systems”, DL News. ↩

“NY Judge rejects Coinbase's efforts to subpoena SEC Chair Gary Gensler, says she is surprised 'not in a good way'”, The Block. ↩

“The CFTC wants millions more to police crypto as cases make up 50% of workload”, DL News. ↩

“US Government Launches New Attempt to Gather Data on Electricity Usage of Bitcoin Mining”, Inside Climate News. ↩

“Malaysian crypto miners stole $722 million worth of power: energy official”, The Block. ↩

“Judge clarifies: Yes, Trump was found to have raped E. Jean Carroll”, The Washington Post. ↩

“Robert F. Kennedy Jr. Says ‘We’ll See What Happens’ When Asked if More Women Will Accuse Him of Sexual Assault”, People. ↩

“Russell Brand: A timeline of the sexual assault claims as Channel 4 issues apology”, Cosmopolitan. ↩

2024 Republican Party Platform, The American Presidency Project. ↩

Ryan Selkis, Follow the Crypto. ↩

“Crypto group with 440,000 members launches PAC to target House, Senate elections”, Reuters. ↩

“Outside Spending: Frequently Asked Questions About 501(c)(4) Groups”, OpenSecrets. ↩

“Trump Campaign Reaps $3 Million in Crypto, From Bitcoin to Dogecoin”, The Wall Street Journal. ↩

“MAGA donors are pouring money to a Democrat in this Latino congressional district. Why?”, AZ Central. ↩

“CHC BOLD PAC condemns crypto spending in Arizona race”, Punchbowl News. ↩

“BREAKING: Senator Cynthia Lummis Endorses Ian Cain for Senate”, Ian Cain for US Senate. ↩

“Hamster Kombat players are exploiting the game with massage guns”, Protos. ↩

“Huione Guarantee: The multi-billion dollar marketplace used by online scammers”, Elliptic. ↩