Anatomy of a crypto meltdown

October 2025 brought the most dramatic crypto flash crash of all time, but it was only a dress rehearsal for the systemic crisis the industry is building toward.

At 4:50 pm on October 10, when traditional markets were closed, Donald Trump launched a new salvo in the simmering US–China trade war. Likely referring to China’s dramatically expanded restrictions on the rare earth minerals it almost singlehandedly controls, Trump posted that he would retaliate with an imminent 100% tariff increase on the country and new export controls on software. The timing muted the announcement’s impact on US equities markets and left Asian markets largely untouched,1 but crypto absorbed the full shock of the Trump-induced panic. The episode compressed a global liquidity crisis into less than an hour — a sign that the market most eager to be taken seriously may also be the one least equipped to handle real-world shocks.

Bitcoin shed more than $10,000 in a matter of minutes, with the flash crash wiping out at least 10%a of its value instantly and pushing prices 15% below their morning levels. Traders holding $19 billion in leveraged positions were liquidated in a blink, and complaints erupted on social media as crypto platform glitches exacerbated losses.

The worst of the chaos was over quickly, and Trump’s Sunday retreat from his bold threats made only days prior helped to further stabilize jumpy markets — though bitcoin continues to trade down about 13% below its price from that morning, and 16% below its all-time high set only the prior Monday. But the October 10 panic gave a valuable reminder of the frightening speed at which crypto markets can unravel, and a dire warning for a future scenario in which crypto is further integrated into traditional finance.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription.

The initial sell-off

The markets were already rattled by China’s October 9 announcement that it would tighten its grip on rare-earth mineral exports — crucial materials for high-tech manufacturing that China controls through its near-monopoly on processing. This was viewed as an escalation in the ongoing economic conflict between the two superpowers, which has already left some analysts fearing market crashes or even a global recession.

Trump’s choice to retaliate with threats of an enormous tariff hike renewed fears of severe economic turmoil and disrupted supply chains. Traders panic-sold high-risk assets like cryptocurrency, with some fleeing to the safety of Treasury bonds and gold. (Bitcoin advocates’ claim that bitcoin functions as “digital gold” has, once again, not held up under pressure.)

In the span of minutes, Bitcoin plummeted around 10%. Altcoins plunged even more steeply, with the popular Solana token diving 40% and Trump’s own memecoin falling more than 60%. The trading firm Wintermute reported that the median crypto token price drop was around 54%, and more than 90% of tokens lost more than 10% of their value.2

Crypto’s generally illiquid markets contributed to the price volatility. CoinDesk reported that “market depth collapsed by more than 80% across major exchanges within minutes.”3 Market makers — institutions that normally provide liquidity and price stability by taking the opposite side of trades — came under fire as some accused them of amplifying the crash by withdrawing liquidity during this crucial period. The Coinwatch crypto tracking platform accused market makers of “desert[ing] their responsibility”,4 and blockchain analyst YQ alleged “they executed a coordinated withdrawal at the optimal moment to minimize their losses while maximizing subsequent opportunities.”5 Others characterized these institutions’ pullback as a normal risk management response to elevated volatility, and the predictable actions of firms with no mandate to maintain market stability at the expense of their trading books. Regardless of the reason, the severe lack of market depth resulted in extreme price dislocations across exchanges. On Binance, the Cosmos token momentarily appeared to plummet in value from $3.90 to a tenth of a cent.

Unlike traditional equities markets, where circuit breakers or other mechanisms to halt trading force cool-down periods when assets encounter extreme volatility, crypto markets are all gas, no brakes. When prices start falling rapidly, there’s no systemwide pause to allow liquidity to rebuild or for traders to take a breather and reconsider the risk.

Crypto exchange glitches

As trading activity spiked on exchanges and prices whipsawed, multiple centralized platforms suffered glitches. Binance’s site went completely down at one point, and customers reported unexplained account freezes, unsuccessful trades, and automated protections like stop-lossesb failing to trigger. Several tokens intended to be maintain pegs to other assets, such as USDe, de-pegged on Binance’s Earn program. Coinbase’s status page claimed there was “latency or degraded performance when transacting”, although customers widely reported not being able to trade at all. The Kraken app showed customers a vague “something went wrong” screen, and customers reported similar issues with trades not completing and stop-losses not triggering. Robinhood users also reported the app freezing, and attempted trades not going through. Other exchanges including OKX, Bitget, and MEXC had intermittent outages, delayed trades, or inaccurate price information.

Though arbitrage traders and bots typically help to keep the price of any given asset consistent across exchanges by capitalizing on small discrepancies, the cascade of technical failures — stuck trades, failed or delayed withdrawals, and inaccurate or nonfunctional pricing data feeds — allowed prices to wildly diverge from one exchange to another.

Some have accused centralized exchanges of minimizing their own losses at their customers’ expense by intentionally halting trading or withdrawals under the guise of “technical difficulties”. Indeed, it is suspiciously common for supposedly highly sophisticated centralized exchanges to suddenly experience glitches or announce urgent “maintenance” under far less volatile circumstances. Kris Marszalek, founder of the Crypto.com centralized exchange, was among the most prominent to repeat this allegation, tweeting that regulators should investigate rival exchanges to determine if any “slow[ed] down to a halt, effectively not allowing people to trade”.6

Leverage

The biggest factor in the Friday crash was leverage. As I described in my most recent recap, crypto leverage — whether through borrowing programs, margin trading, or perpetual futures — creates a cycle of risk that can rapidly snowball.

Borrowers often borrow against, say, bitcoin in order to buy more bitcoin. This creates a feedback loop of risk: when bitcoin prices fall, borrowers simultaneously lose value on their original collateral and on their newly acquired bitcoin, rapidly pushing them toward overleveraged positions. When numerous borrowers are forced to liquidate at once, the resulting sell pressure can create a snowball effect that drives prices down further and becomes very difficult to stop.

This is precisely what happened. Price dips from the first wave of crypto sell-offs caused some leveraged positions and crypto loans to be automatically liquidated as platforms determined there wasn’t sufficient margin to keep them open.c As exchanges forcibly liquidated these positions, they contributed to the sell pressure, causing prices to drop further, triggering more margin calls — the classic crypto “death spiral”.

And some traders don’t just borrow crypto against dollars or stablecoins, but borrow volatile cryptoassets against other volatile cryptoassets. In crashes like this, where the prices of many cryptocurrencies were all simultaneously dropping, these positions were even more volatile because traders’ debt burden was growing as their collateral value was diminishing — causing positions to be liquidated much more rapidly than if the collateral was fixed. And in these types of positions, if a trader is forcibly liquidated, exchanges sometimes need to sell off the loan collateral as well as the borrowed asset, causing sell pressure for both assets.

As prices fall, those trading on leverage are often given an opportunity to restore their positions to a “healthy” state by adding more collateral, thus increasing their margin level. But with the often slow process of converting fiat currency into cryptocurrency, often the only option for traders to obtain more crypto to use as collateral in an emergency is to sell off other crypto assets. This contributes to overall sell pressure as traders panic-sell assets to shore up their leveraged positions. And in rapidly falling markets, traders can be wiped out before they have any chance to add collateral.

These issues were amplified by crypto exchange glitches, where malfunctioning price feeds and de-pegged assets caused erroneous liquidations based on inaccurate prices. (Binance later paid out $283 million to compensate users who had been erroneously liquidated due to apparent de-pegs on their platform,7 plus another $400 million to traders and institutions that were wiped out due to legitimate liquidations.8) On platforms where trades failed or faced significant delays, some customers watched their leveraged positions get forcibly liquidated in front of their eyes as they were unable to top up collateral.

By the end of the flash crash, more than $19 billion had been liquidated.

While leverage exists in traditional markets too, the crypto industry takes it to new extremes. Traditional brokers typically limit margin trading to 2–4× leverage, require stable assets like dollars or blue-chip stocks as collateral, and must follow strict regulatory requirements around position monitoring and risk management. But crypto exchanges routinely offer leverage up to 100× or more, accept volatile cryptocurrencies as collateral, and operate with minimal oversight. Traditional markets also have circuit breakers and trading halts that can pause cascading liquidations, and brokers typically follow careful procedures with multiple warning thresholds before forcing positions to close. In crypto, a position can be liquidated before a trader even knows they’re in trouble.

Auto-deleveraging

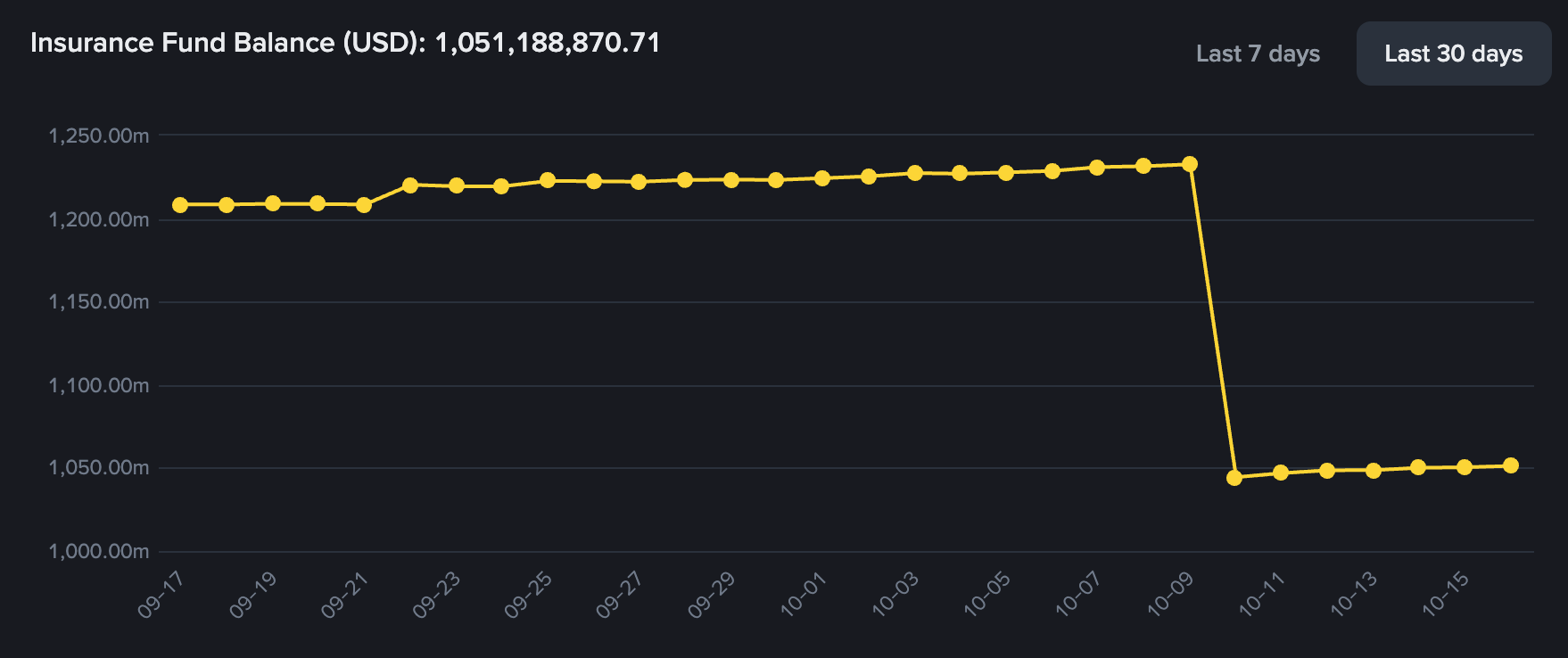

Crypto exchanges that offer leverage trading take on the risk that markets can fall faster than leveraged positions can be liquidated. They typically maintain “insurance funds” to absorb the occasional residual losses in these cases. But what happens if that insurance fund runs dry? In some cases, the exchanges collapse, and losses are spread across all of the platform’s customers. (Sam Bankman-Fried has repeatedly claimed that FTX’s collapse was thanks to oversized margin trades gone bad, though this explanation conflicts with the evidence that FTX had been secretly diverting customer deposits to cover Alameda Research’s losses long before the crash.)

But many platforms have implemented a system called auto-deleveraging, which is sometimes analogized to an emergency brake for when things start to get out of control. In these cases, exchanges may reduce other traders’ profitable leveraged positions to rescue an underwater position.

During this crypto crash, exchanges began to blow through their insurance funds. Binance, for example, dipped into its insurance fund to the tune of around $188 million over just that one day.

And so multiple platforms resorted to auto-deleveraging. Among them was Hyperliquid, a buzzy defi trading platform, whose founder stated that “this was Hyperliquid’s first cross-margin ADL in more than 2 years of operation” and that “billions of dollars worth of positions [were] liquidated on Hyperliquid in a matter of minutes.”9 This helped stop the bleeding somewhat, and likely saved some exchanges from collapse. However, the early closures of short positions also removed even more orders from order books, thinning liquidity even further and potentially making it harder for markets to stabilize.

Insider trading allegations

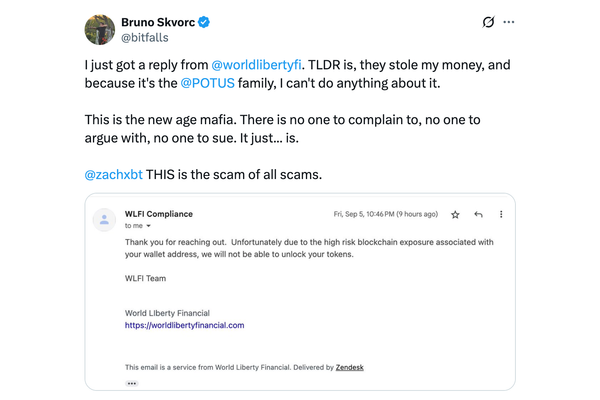

In the aftermath, analysts noticed a wallet that had deposited millions into the Hyperliquid decentralized exchange before the crash, taking a heavily leveraged short position on bitcoin and ether. When the market plummeted, they profited to the tune of more than $150 million. The remarkable timing led some researchers and institutions to question whether the trader had inside information from the White House about upcoming tariff announcements, and the blockchain analytics company Arkham labeled the wallet “Trump insider whale” on their platform.10

Some researchers suggested that the wallet might belong to Garrett Jin, the former CEO of BitForex, a Hong Kong-based exchange that shut down in early 2024 amid exit-scam allegations [W3IGG]. Without initially addressing whether he controlled the wallet, Jin posted to Twitter that “I have no connection with the Trump family or Donald Trump Jr. — this isn’t insider trading”, but then later deleted the tweet. Other crypto sleuths have questioned whether Jin really controlled the wallet or is merely connected to the person who does.11 Jin later tweeted, “The fund isn’t mine — it’s my clients’.”12

In traditional markets, a $150 million profit on well-timed shorts ahead of a presidential announcement might trigger inquiries from the SEC, CFTC, or DOJ. But in crypto, it’s not even clear which agency, if any, would have authority to investigate crypto trades around government announcements. Hyperliquid is based offshore, the possible wallet owner may be as well, and regulatory jurisdiction over cryptocurrency remains hotly contested. It’s not clear which authority has the mandate — or perhaps the appetite — to investigate potential insider trading.

The fallout

While crypto prices stabilized fairly quickly, though without returning to their earlier highs, many traders suffered huge losses. Retail traders were the most impacted in terms of the raw numbers of liquidations, though institutional traders lost the most in terms of dollar amounts. Social media was flooded with stories (of varying credibilityd) of people losing massive sums — or massive portions of their net worth — in the crash. A Ukrainian crypto influencer named Konstantin Galish was found dead in his Lamborghini in a possible suicide after reportedly losing millions of dollars in investor funds in the crash (though some local news outlets have questioned the circumstances of his death).13

The true extent of damage to institutions may be slow to reveal itself, though that Binance apparently felt the need to hastily implement a $100 million institutional bail-out program is telling. While rumors have swirled that a trading firm blew up, we often don’t learn about such catastrophes until well after the crash. And if such crypto funds were wiped out, contagion can be slow to emerge, as we saw in 2022 when the implosion of the Three Arrows Capital hedge fund led to a steady drumbeat of other firms going bankrupt or announcing major losses over subsequent months.

This flash crash, while violent, was ultimately fairly contained. The cascade of liquidations eventually exhausted itself, easing sell pressure. After the rapid wipeout was over, market makers and arbitrageurs returned to “buy the dip” and profit from price discrepancies across platforms, stabilizing and re-synchronizing prices. And Trump’s quickness to walk back his threats helped ease the nerves across markets. But the meltdown reminded us just how quickly crypto markets can unravel when an abrupt shock pierces the euphoria of traders who’ve been watching prices steadily rise, and seem to forget they can do anything else.

The lack of circuit breakers, massive leverage, technical fragilities, and overwhelming complexity of interwoven crypto assets all combined for a devastating crash. Regulators are unlikely to take any significant action. Exchanges will continue offering extreme leverage while platforms remain without circuit breakers. The industry keeps pushing for greater integration with traditional finance, demanding even fewer restrictions on the high-risk products they market to unsophisticated investors. As crypto grows more interconnected with mainstream finance, future crashes will reach far more widely.

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

This varies somewhat based on which exchange you look at because of the lack of price consistency across exchanges I explain later. ↩

A stop-loss is an instruction to automatically buy or sell an asset when it hits a certain price. In the case of market crashes, stop-losses can potentially limit a trader’s losses by selling a plummeting asset before the price dips too far. ↩

Say someone has $10,000 in a Binance account and opened a long position on bitcoin when it was at $120,000 with 10× leverage — essentially, borrowing $90,000 to buy $100,000 worth of BTC, or about 0.833 BTC. Binance requires that the total value of a trader’s holdings remain at least 10% higher than their liabilities, so as soon as Bitcoin dipped below roughly $118,000 in the flash crash, the position was forcibly liquidated. Binance’s system automatically sold the 0.833 BTC around $118,000, netting about $98,000. The exchange repaid itself the $90,000 loan, deducted interest and fees, and returned the remainder to the trader. If markets crash quickly and Binance has to sell at a greater loss, the trader can lose more. In extreme circumstances, the trader gets completely wiped out and Binance also suffers a loss on the trade. ↩

Some social media users in the crypto world like to engagement farm with highly exaggerated or fabricated “loss porn”. ↩

References

“The Curious Market Timing of Trump’s Tariff Threats”, Bloomberg. ↩

“Market Update: 13 Oct 2025”, Wintermute. ↩

“Crypto’s Black Friday”, CoinDesk. ↩

“Binance Reimburses $283M After Market Crash and Asset Depegging Issues”, Decrypt. ↩

“Binance launches $400 million initiative to refund users, instill market confidence following crypto flash crash”, The Block. ↩

“Alleged 'Trump Insider Whale' Denies Insider Trading, Opens New $340 Million Bitcoin Short”, Decrypt. ↩

“Alleged Hyperliquid whale denies Trump ties, thanks CZ for doxing, and pitches market stabilization fund”, The Block. ↩

“Crypto Kingpin Turns Up Dead in Lamborghini After Market Crash”, Futurism. ↩