Caroline Ellison: A woman with agency or a helpless pawn?

Why did the former Alameda Research CEO receive only two years imprisonment for her role in the FTX collapse?

Former Alameda Research CEO Caroline Ellison has been sentenced to two years in prison for her role in the massive fraud at FTX. She will also serve three years supervised release, and she was ordered to forfeit $11 billion. I think it’s worth unpacking this sentencing decision a bit, because it came as a surprise to many. Some were surprised that she would receive such a short sentence for her central role in such a massive crime, while others were surprised to see her receive any prison time after prosecutors seemed to support a non-custodial sentence.

I’ve also seen some confusion around the $11 billion restitution order, namely surprise that Ellison had $11 billion to forfeit. That’s an easy one to clear up, so I’ll tackle it first. She does not have $11 billion. This order was merely communicating that Ellison and the other co-conspirators must forfeit all proceeds of the crime, and $11 billion was the total amount deemed to be “proceeds traceable to the offenses” committed by Bankman-Fried, Ellison, and the other defendants.

The sentencing recommendation

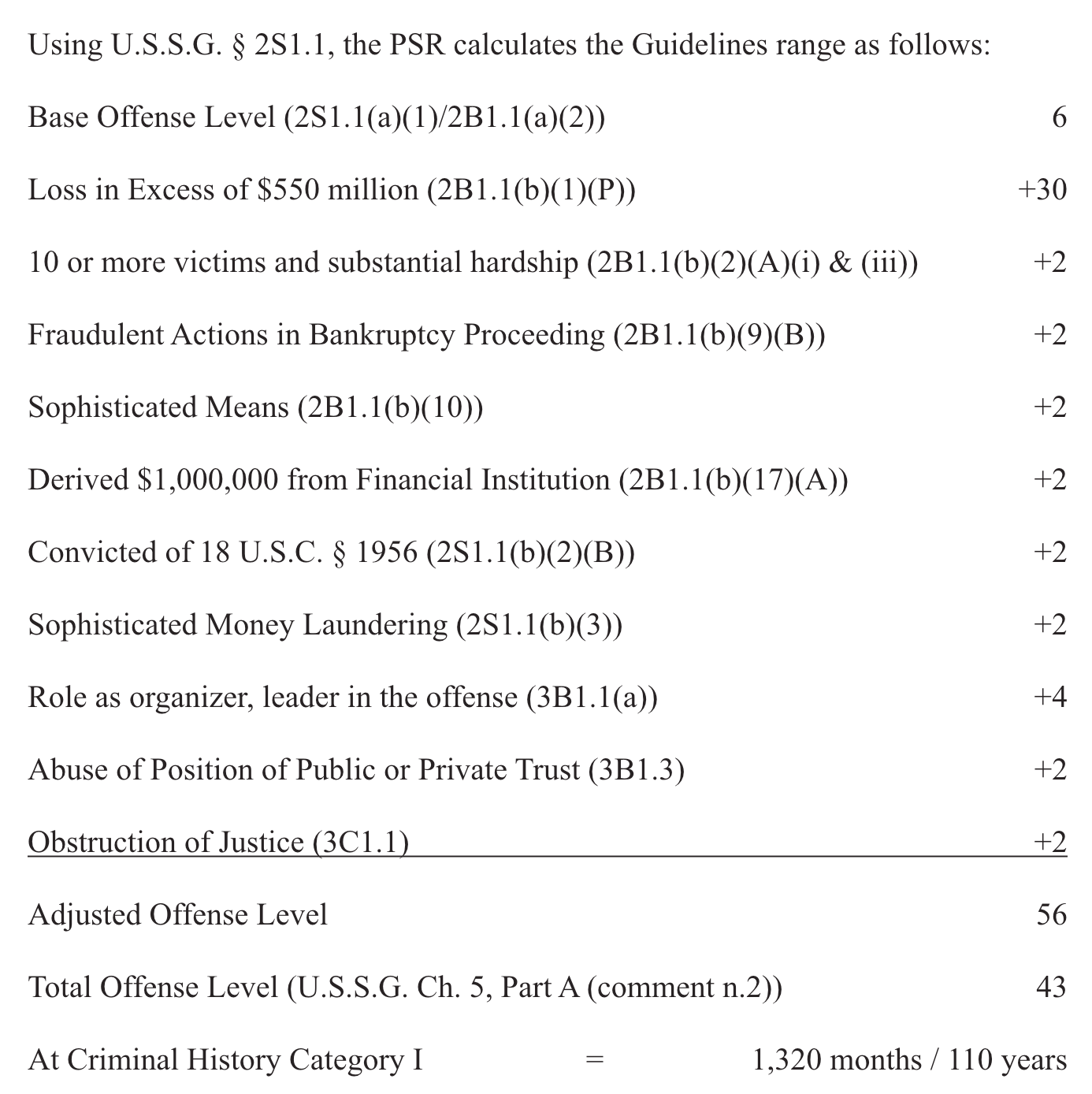

As I mentioned in a recent issue, the probation department had recommended Ellison be sentenced to no jail time at all [I67]. When determining a sentencing recommendation, the probation department considers what the sentencing guidelines dictate: a rather complex bit of analysis to determine a numerical offense level, which is then combined with the criminal history of the offender to suggest a duration of imprisonment. These guidelines are intended to provide some degree of consistency, so that people receive roughly similar sentences for similar crimes, regardless of the judge they wind up in front of.

The offense level calculation begins with a baseline number based on the offense, which for fraud is 6. If that was all that went into consideration, a level 6 offense for a first-time offender has a guidelines sentencing recommendation of 0–6 months imprisonment. However, the base offense level is adjusted upwards by various factors that the sentencing guidelines consider to make the offense more severe: factors like the number of victims involved, the use of “sophisticated means” to commit the crime, the laundering of proceeds of the crime, whether the offender was considered to have been a leader of the criminal enterprise, and the amount of money that was lost in the fraud. For example:

There are also downwards adjustments, for example if the offender was considered to have been a “minimal participant” in the crime, if they assist authorities in investigating or prosecuting the crimes, or if they are believed to have accepted responsibility.

As we observed during Sam Bankman-Fried’s sentencing, the upwards adjustment based on monetary losses is what causes the offense levels to skyrocket for the FTX defendants. Even then, the sentencing guidelines clearly aren’t designed for $11 billion frauds, with adjustments maxing out at losses of $550 million or more. This adjustment alone tacks on 30 points to the offense level, skyrocketing the recommended sentence by about eight years. Eventually, with all adjustments applied, both Ellison and Bankman-Fried were off the charts as far as offense levels go, hitting the maximum of 43. While guidelines suggest that an offense level of 43 should result in a life sentence, regardless of the criminal history of the offender, the maximum length of imprisonment for fraud is set at 110 years.a

However, the guidelines are only guidelines, and both the probation department and the judge may choose to deviate from them. The pre-sentencing reports are not public, so we don’t know specifics, but according to Ellison’s pre-sentencing memo, the decision by the probation department was based on her “extraordinary cooperation with the government, her otherwise unblemished record, and the numerous testimonials of Caroline’s honesty and ethical behavior both before she started working at Alameda and since she left Alameda”.1

Prosecutors also seemed to implicitly endorse the probation department’s recommendation, opting not to recommend any specific sentence in their filings, but going on at great length about how important her cooperation had been to their conviction of Sam Bankman-Fried.

Sentencing

When it came to the judge’s decision, I don’t think anyone was surprised that Judge Kaplan agreed to go with a lower sentence than the 110-year guidelines recommendation. After all, he’d sentenced Bankman-Fried to 25 years — a very long time in prison, to be sure, but still substantially less than the statutory maximum — and it would have been incredibly weird for him to go above this for a co-conspirator who pleaded guilty and cooperated with the investigation and prosecution.

As he explained it during the sentencing hearing, Kaplan opted for a relatively short sentence because he wished to balance Ellison’s acceptance of responsibility, remorse, and cooperation with the feeling that some prison time was still necessary for her role in a fraud of this magnitude. This seems to me to be a reasonable choice, and so the question then becomes: what sentence would be appropriate? Two years does seem very short, particularly given that Ellison was so deeply involved in the fraud, and only began cooperating after the FTX collapse, once authorities were aware a crime had likely been committed. Had she chosen to go the whistleblower route before the FTX collapse, a very short or non-custodial sentence certainly might have felt more appropriate.

Ultimately, I think she and her defense team were extremely successful in telling the story that Ellison was manipulated by her boss and romantic partner, whose approval she desperately sought. “You were vulnerable and you were exploited,” remarked Kaplan during the sentencing hearing, before expressing that he believed she would never “do something like this again”.2

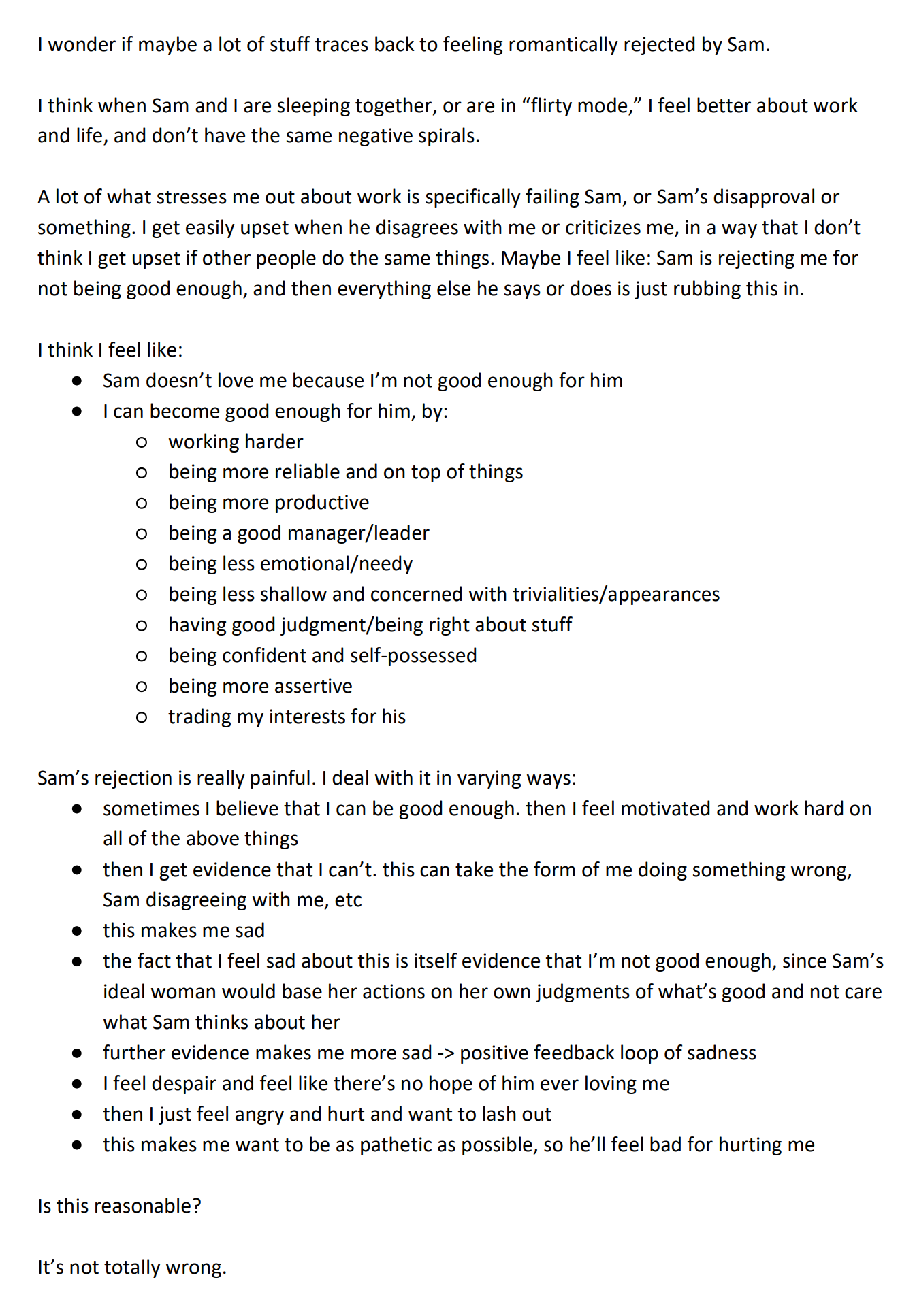

To be clear, I don’t think Ellison fabricated that story: it’s painfully clear from her writings that her relationship with Bankman-Fried was lopsided and unhealthy. Even the diary entries Bankman-Fried leaked to the New York Times in an attempt to portray Ellison as responsible for FTX’s collapse [I34] revealed that she believed that Bankman-Fried’s love for her was highly dependent on her success at work.

At times, Ms. Ellison worried that Mr. Bankman-Fried thought she wasn’t good enough. When he was around, she wrote in the February 2022 Google document, she had “an instinct to shrink and become smaller and quieter and defer to others.” – The New York Times

Diary entries submitted along with her sentencing memo reflect this even more starkly:

However, low self-esteem and the desperation for a boyfriend’s approval hardly excuse stealing billions of dollars from people, and it is surprising to me to see this level of leniency. Certainly some of it was also thanks to her cooperation and assistance with the investigation, prosecution, and bankruptcy proceedings, but it seems that a lot of the decision came down to the story that she was merely a helpless pawn in Bankman-Fried’s machinations, rather than a human being with agency and a moral compass.

Few are so lucky to receive this kind of benefit of the doubt, and there are many people in prisons today who have not been afforded the same degree of leniency as Ellison despite manipulation and, in some cases, violent coercion by romantic partners.

While I am not one to celebrate draconian prison sentences, throwing out sentencing guidelines to impose such a light sentence does feel like a failure to ensure similar sentencing among defendants for similar crimes. It’s hard not to wonder if a woman of color or a person without such a pedigreed upbringing would earn a similar outcome.

References

Defendant Caroline Ellison’s sentencing memorandum, filed on September 10, 2024. Document #497 in US v. Bankman-Fried. ↩

“The Spectre of Sam Bankman-Fried Overshadowed Caroline Ellison's Sentencing”, CoinDesk. ↩

Footnotes

I have quipped in the past about the distinction between “life” and 110 years perhaps reflecting the government’s optimism on life extension research. However, there are some distinctions between the two, generally involving the possibility of early release. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.