Crypto super PACs have hundreds of millions ready to spend on the midterms

With Trump faltering and their policy agenda incomplete, the crypto industry has moved at least $288 million toward the midterms in a desperate bid to keep Republicans in control of Congress

We’re still eight months out from Election Day, but the cryptocurrency industry has already dumped at least $288 million into the 2026 midterms — more than double what they spent in the entire 2024 cycle, when their $130 million in spending was itself a historic sum that reshaped Congress. That earlier investment bought them Trump, a deregulatory Congress, and the systematic dismantling of financial oversight that they'd spent years demanding. With Republican anxiety mounting as midterms approach, and the crypto industry’s wishlist only partially fulfilled, it seems they’re preparing to spend whatever it takes to finish the job.

The pro-crypto super PACs that were the focus of my 2024 campaign finance reporting are sitting on $221 million in unspent cash, waiting to deploy it against candidates who might otherwise be tempted to stand up to the crypto industry’s deregulatory demands and self-drafted legislation. And these PACs claim to have $100 million more in committed funds that haven’t shown up in official filings yet.

I’ve been hard at work updating FollowTheCrypto.org, a website I built and maintain to track cryptocurrency industry political spending. I have more work to do, but the numbers that have emerged already reveal the staggering amount the crypto industry is preparing to spend to cement their grip on Congress as they work to rewrite the rules for their companies.

This year, I’m also more closely tracking direct contributions from cryptocurrency companies and their executives to candidates and other campaign committees. The industry’s political operation has matured beyond simply funneling money through pro-crypto super PACs — individual companies and executives have developed their own funding strategies, backing candidates and causes that serve their interests. A significant portion of this direct spending has gone toward buying favor with President Trump through contributions to Trump-aligned PACs — and that’s not counting funding for his pet projects like the East Wing ballroom renovation or military parade, or the money the industry has funneled to his family’s crypto ventures.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

By the numbers

Here’s where the cryptocurrency industry stands, early into the 2026 election cycle:

- $288 million: Total cryptocurrency industry spending toward the 2026 election cycle to date. This includes funds sent to pro-crypto PACs, direct contributions to candidates, and contributions to non-crypto PACs.a

- $221 million: Cash on hand with pro-crypto super PACs, ready to deploy in the midterms

- $100 million: Additional committed funds that pro-crypto PACs say they have secured but haven’t yet appeared in FEC filings

- $3 million: Already spent by pro-crypto super PACs in the 2026 cycle, primarily on special elections in Florida and Virginia

- $74 million: Contributions to Trump PACs in the 2026 cycle by crypto companies and executives

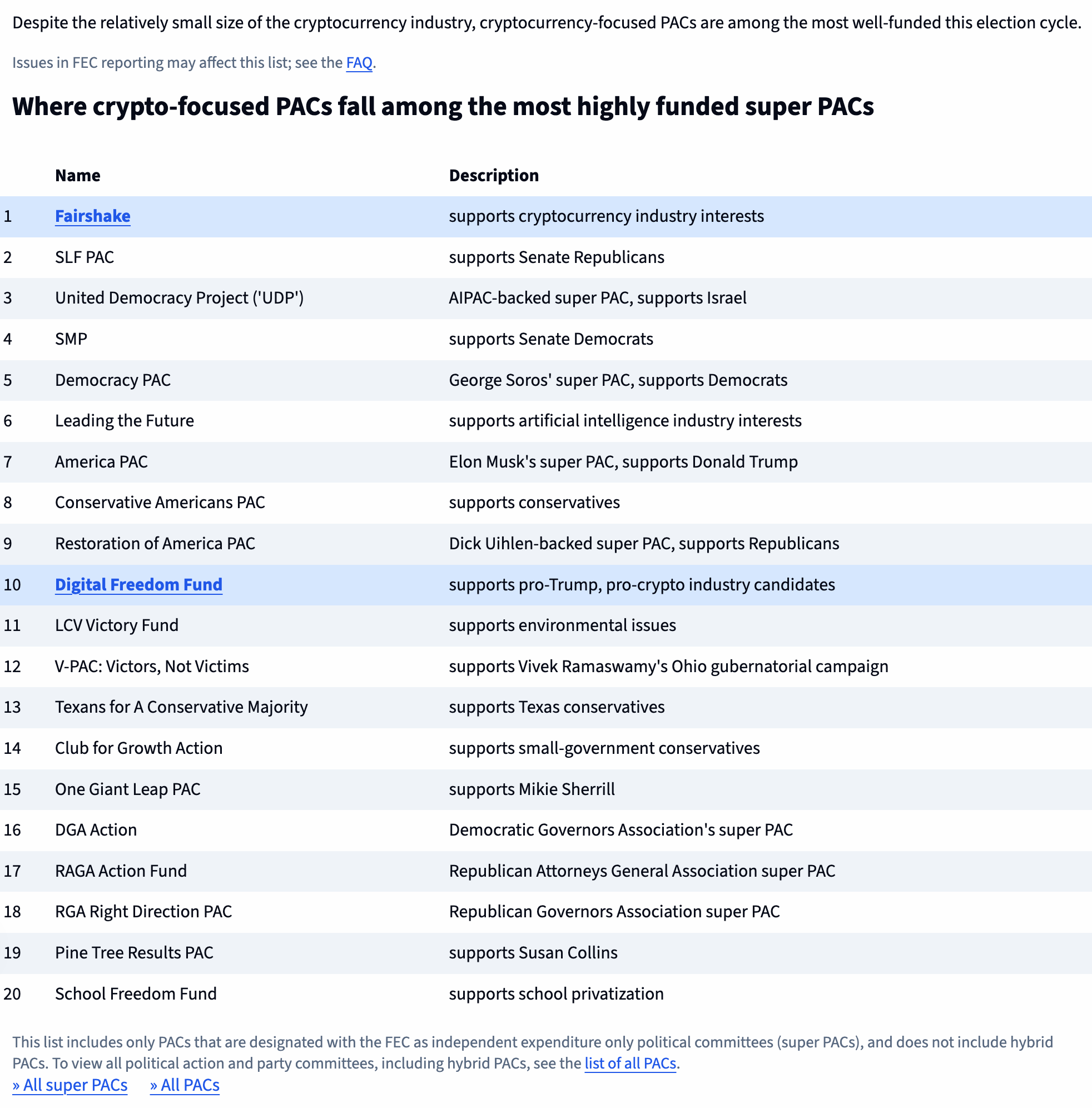

To put this in perspective: the industry’s flagship super PAC, Fairshake, is now the #5 most-funded PAC in the country.b It trails only Trump’s inaugural committee, MAGA Inc, and the RNC and DNC. Another pro-crypto super PAC that specifically supports pro-Trump candidates, the Digital Freedom Fund, ranks #10 among super PACs.

Looking only at super PACs, Fairshake is #1. The Digital Freedom Fund lands in #10, behind only a handful of behemoth PACs like the AIPAC affiliate UDP, Republican and Democrat Senate Committees, and super PACs backed by megadonors George Soros, Elon Musk, and Dick Uihlen.

The war chest

Most of that $221 million sits with Fairshake, the industry’s flagship super PAC. It had $64 million left over from 2024’s fundraising, and has raised $193 million in new funds. Their top donors are, as in 2024, Coinbase, Ripple, and Andreessen Horowitz. This time around, Coinbase has contributed $56 million; Ripple $48 million, and Andreessen Horowitz $24 million.

The $221 million figure doesn’t include $100 million more that a new PAC, the Fellowship PAC, claimed in September to have committed “to back pro-innovation, pro-crypto candidates who will safeguard America’s role as the global leader in digital assets and entrepreneurship” and to “carry ... forward” momentum from the Trump administration’s crypto strategy [I93].1 But the committee’s January filing, covering the period from its creation through the end of 2025, disclosed no receipts and no cash on hand.2 It’s not clear where that $100 million is, or whether it will ever materialize, but given the industry’s history of huge political expenditures, it would be foolish to dismiss it outright. Inquiries sent to the PAC and its public relations contact on February 1 about the committee’s funding and plans for the midterms did not receive a reply.

The Fellowship PAC is one of several new crypto political vehicles that have emerged ahead of the midterms, apparently out of frustration with Fairshake’s 2024 strategy. While Fairshake maintained a veneer of nonpartisanship — backing both Democrats and Republicans who supported their deregulatory agenda — these new PACs have abandoned that pretense entirely.

Some of Fairshake’s biggest 2024 backers have defected. Gemini’s Cameron and Tyler Winklevoss, who gave $5 million to Fairshake in 2024, have made no contributions this cycle — instead funneling more than $21 million to a new Digital Freedom Fund PAC, which explicitly promises to “help realize President Trump’s vision of making America the crypto capital of the world” [I91]. Kraken, which contributed $1 million to Fairshake in 2024, followed suit with $1 million to DFF and nothing to Fairshake.

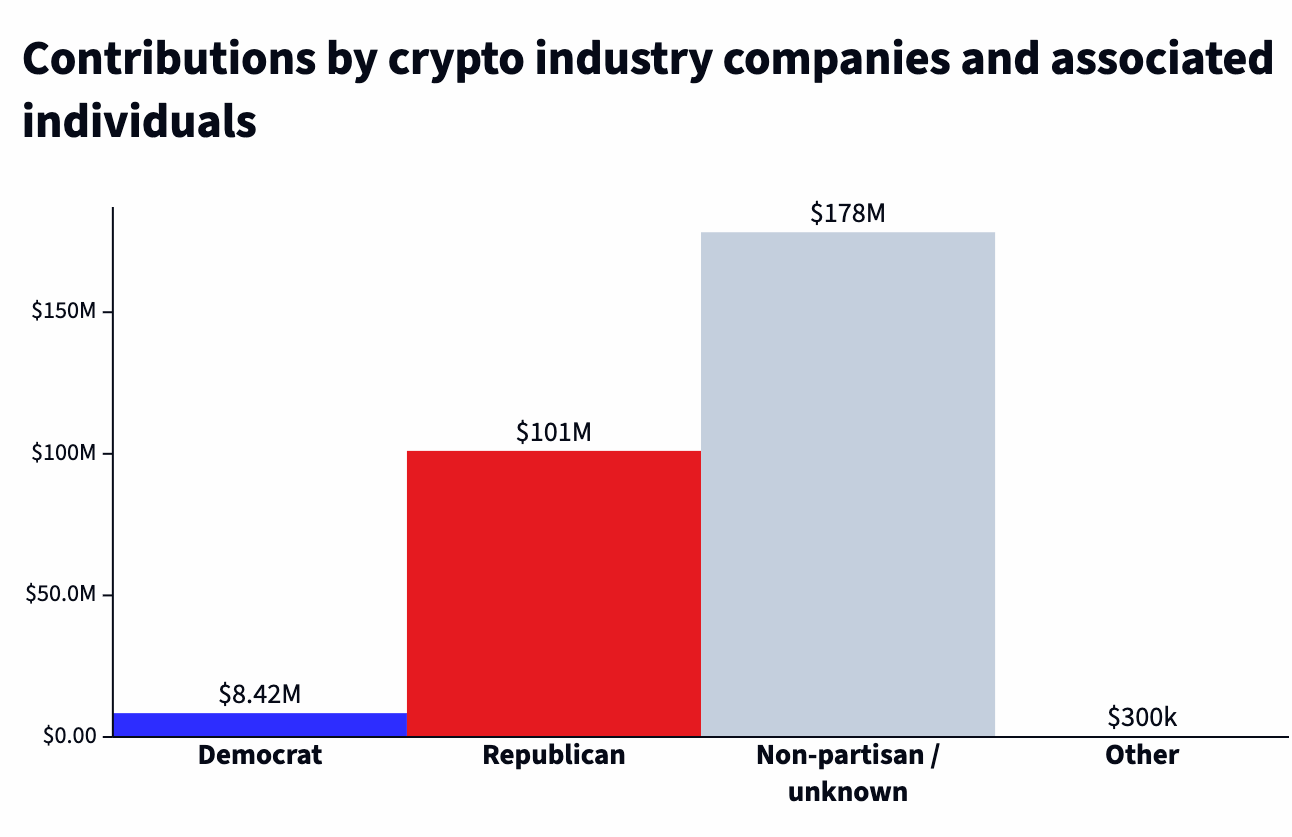

The partisanship is also stark when looking at direct contributions to candidates and campaign committees from crypto companies and their executives: of contributions to candidates or partisan committees, 92% has gone to Republicans.

This shift from thinly veiled to overt Trump alignment reflects how completely the industry has bet on Republican control. In 2024, Fairshake’s stated nonpartisan posture gave the industry plausible deniability — they could claim to want “sensible regulation” and “clear rules of the road”, framing any Republican tilt as merely a byproduct of Democrats’ reluctance to embrace crypto. The bipartisan veneer also provided cover if the election went the other way. But that strategy always had its skeptics: some crypto executives had balked at supporting even pro-crypto Democrats, arguing that the priority must be installing Republicans [I64]. Now, with Trump in office, the industry writing its own laws, and many crypto executives going full MAGA, that skepticism is gaining ground. While Fairshake remains the dominant force, a cohort of explicitly partisan PACs has emerged alongside it. The industry is now openly working to consolidate one-party control over crypto regulation, and they’re willing to spend whatever it takes to keep it that way.

In fact, the industry has gone so all-in on Trump that they can no longer afford for him to fail. Trump’s brazen crypto corruption has soured public opinion on both Trump and crypto, making the industry’s political position more precarious even as Trump works to fulfill their deregulatory checklist. But that wishlist has been slower to materialize than the industry might like — the crypto market structure bill they’ve spent years lobbying for remains stalled in the Senate [I99] — and they can’t afford to lose control of Congress before they get it across the finish line. If Democrats retake Congress, or if the corruption becomes too toxic for even Republicans to ignore, the industry faces the real possibility of a regulatory backlash far worse than anything under Biden. There’s been palpable anxiety in the industry and among the regulators they’ve installed about making their policy changes permanent enough that a future administration can’t simply undo them [I100]. I think they know they’ve overplayed their hand. It’s why they’re spending whatever it takes to secure their grip on the reins: because the alternative is existential.

Following the crypto (so far)

Super PAC spending

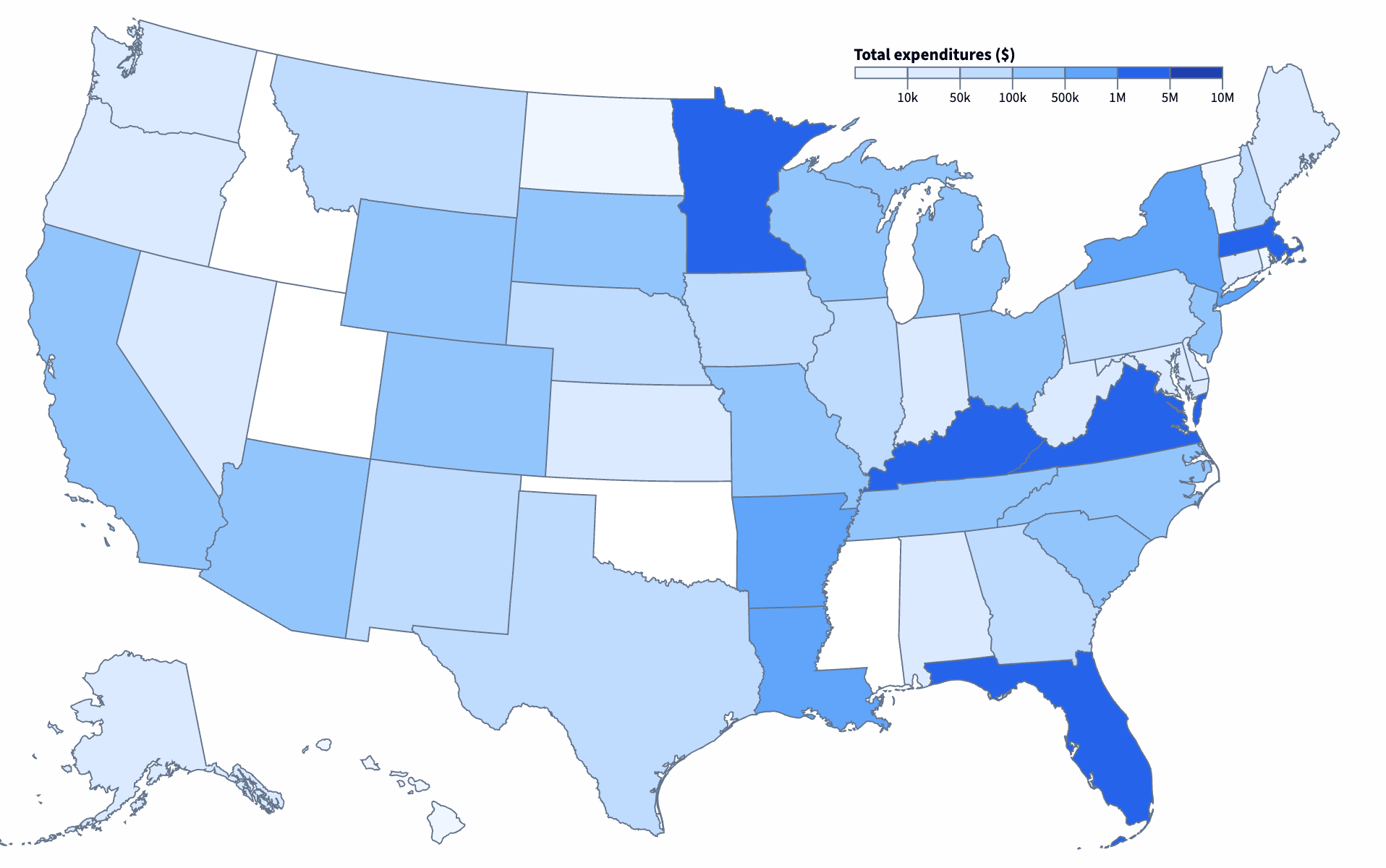

The pro-crypto super PACs have barely touched their accumulated cash so far, but what they have spent has been strategic. In Florida’s 2025 special elections, they intervened in two races that, under other circumstances, should have been easy Republican wins. District 6 and District 1 are deeply red territory, yet both contests became unexpectedly competitive — in part because the Democratic candidates dramatically out-fundraised their Republican opponents.

The super PACs deployed $1.67 million to back Randy Fine in District 6, accounting for nearly half of all independent expenditures in that race. They spent more than half a million for Jimmy Patronis in District 1. Both Republicans won, but by narrower margins than these districts typically deliver. The return on investment was immediate: Fine and Patronis both voted for the GENIUS and CLARITY Acts [I89], the industry’s high-priority legislation for stablecoin regulation and crypto market structure.

Then there was the special election in Virginia, to replace former House Oversight Ranking Member Gerry Connolly. Months before his death, Connolly had marked Trump’s 100th day in office by publishing “a (non-exhaustive) list of one hundred conflicts of interest—from crypto schemes to federal handouts to his billionaire buddy Elon Musk—all just within its first 100 days.”3 When it was time to select his successor, the crypto PACs poured $1 million into the competitive Democratic primary race to back former Connolly aide James Walkinshaw, who had signaled his compliance early by gushing on his website about embracing crypto and AI. One of his opponents, Stella Pekarsky, took the opposite approach, declaring to supporters: “I haven’t taken a penny from crypto PACs because you deserve a voice in Congress that serves you, not the billionaires who funded Trump’s inauguration. They’re scared of me because I can't be bought.”4 She lost, and Walkinshaw cruised to victory in the safely Democratic district, replacing a fierce critic of crypto corruption with a reliable ally.

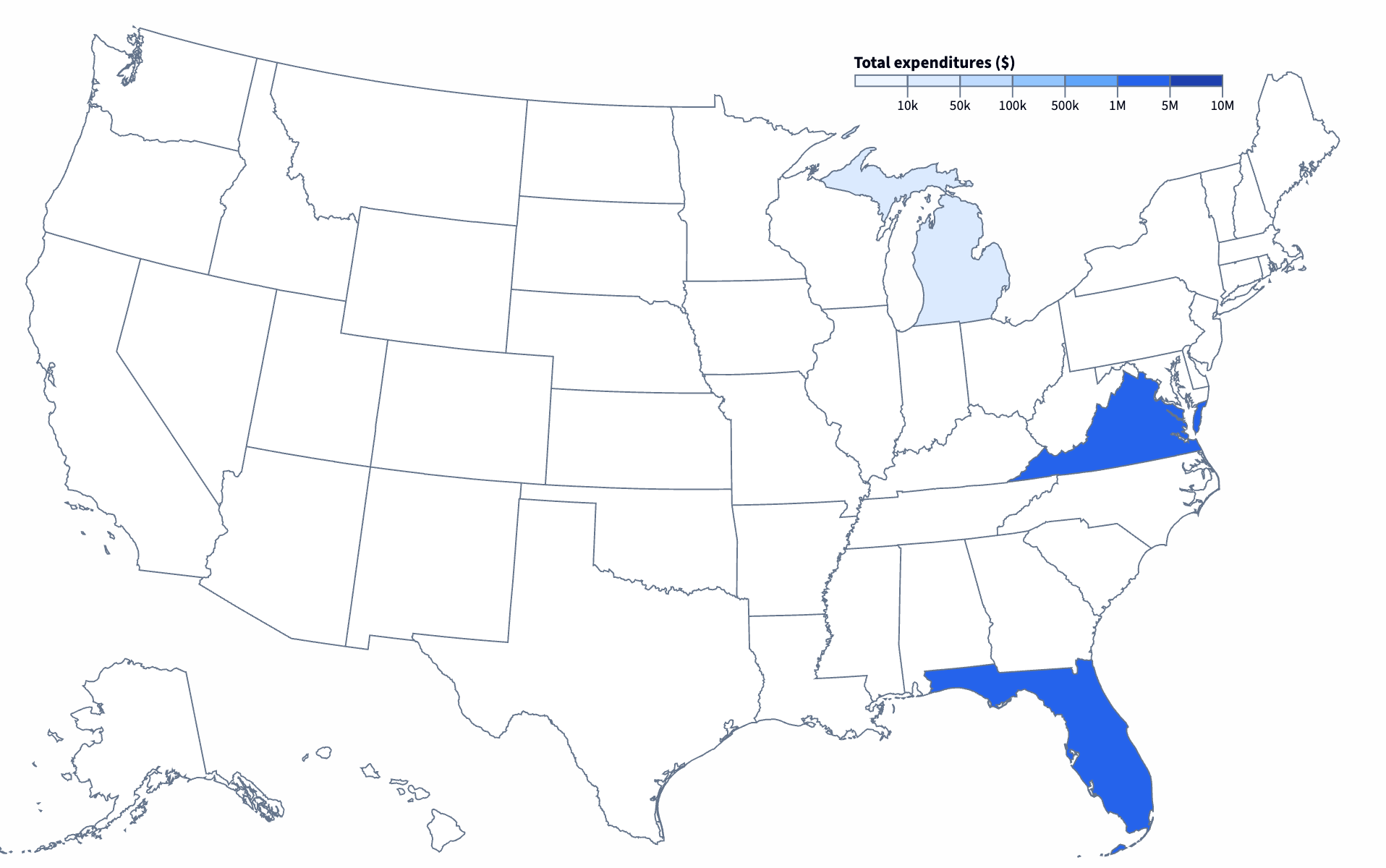

The only crypto super PAC spending towards upcoming races so far is in the Michigan Senate. The relatively modest outlay of cash — less than $50,000 — is supposedly only the beginning of a “multi-million dollar spend campaign” from First Principles Digital, a new super PAC affiliated with crypto’s number one cheerleader on the Hill: retiring Wyoming Senator Cynthia Lummis. (First Principles Digital does not have multiple millions, so this suggests they are expecting significant additional fundraising in the coming months.) The PAC describes itself as a “Republican-led, Republican-focused organization working to elect pro-crypto leaders to Congress” [I91].

In a press release boasting of FPD’s endorsement, Rogers wrote that he “has long been a pro-crypto advocate”.5 This is some revisionist history compared to 2017, when Rogers was unequivocal that he was “not a big fan of Bitcoin”, describing it as used “in human trafficking and every international organized crime event you can think of” and “98% used for illicit activity”.6 But by 2024, Rogers had already shifted his stance, perhaps hoping to attract crypto money for his Senate run. Instead, the Fairshake network spent more than $10 million backing his Democratic opponent Elissa Slotkin — the second-largest crypto PAC expenditure on any race that year. Rogers was baffled by the snub. “I guess the price to go from an ‘F’ to an ‘A’ is $3 million,” he said at the time, referencing the Coinbase-backed advocacy group Stand With Crypto’s politican scorecards.7 Rogers lost.

But First Principles Digital, one of the cohort of explicitly Republican crypto PACs born out of frustration with Fairshake’s stated bipartisanship, has now offered Rogers the millions in support he’d been seeking. If they succeed, Michigan will have two crypto-funded advocates in its Senate.

Company spending

As crypto super PACs wait to deploy their massive stockpiles of cash, crypto companies and their executives have begun targeting support directly towards the Congresspeople who control the fate of their industry.

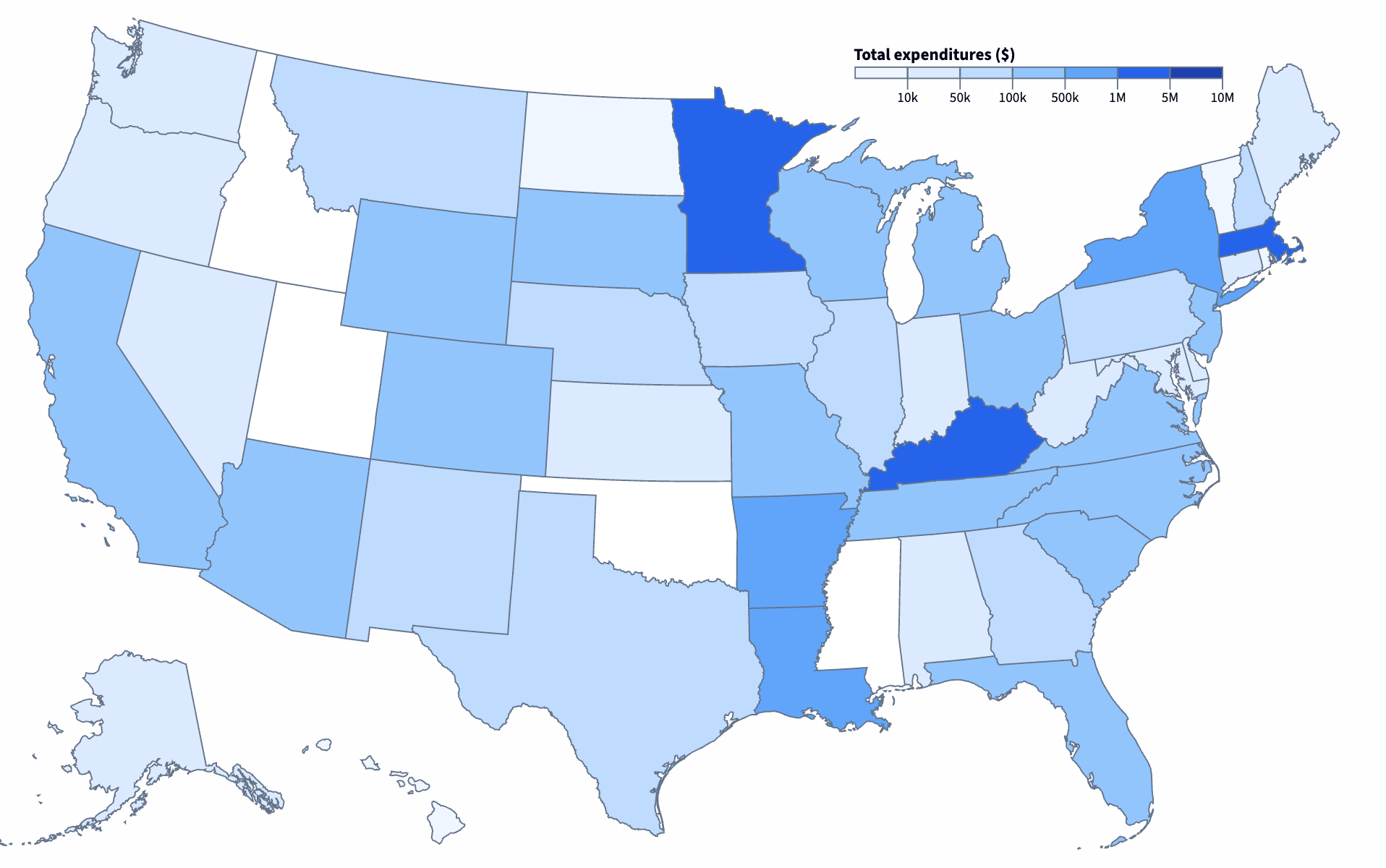

Representative Andy Barr (R-KY), who sits on the House Financial Services Committee and chairs its Subcommittee on Financial Institutions and Monetary Policy, has drawn $1.4 million in support for his Senate bid, mostly from Crypto.com. Representative Tom Emmer (R-MN), the Republican whip and longtime crypto advocate, has pulled in more than $900,000 from the Winklevosses, Andreessen Horowitz, and others to put towards his re-election campaign. French Hill (R-AR), chair of the Committee on Financial Services, has received $543,000 from executives at Coinbase, Andreessen Horowitz, and others. House Speaker Mike Johnson (R-LA) has brought in nearly $500,000, mostly from Andreessen Horowitz and Paxos. The token Democrat in the top five is Senate Banking Committee member Mark Warner (D-VA), who’s brought in $311,600 from various crypto executives. In addition to being useful for bipartisan optics, Warner has also served as a reliable Democratic vote for crypto legislation, and has been a key negotiator on the crypto market structure bill.

The frontrunner in the crypto industry’s more direct funding is instructive. Earlier this month, Barr’s campaign ran an anti-“DEI” ad declaring, “It’s not a sin to be white. It’s not against the law to be male. And it shouldn’t be disqualifying to be a Christian. I’m Andy Barr, and I approve this message to give woke liberals something else to cry about”.

![Andy Barr stands in front of a farmhouse with an American flag on it. There’s text overlaid that says “Andy Barr / End DEI nonsense”, and subtitles read: “I’m Andy [music] Bar. It’s not a sin to be white.”](https://www.citationneeded.news/content/images/2026/02/Screenshot-2026-02-19-at-7.05.08---PM.png)

Judd Legum at Popular Information quickly identified the white supremacist slogan, and the similarities between Barr’s ad and a 2017 4chan campaign that was later promoted by white supremacist David Duke. 4chan’s plan almost a decade ago was to “trigger” leftists and journalists into overreacting to the supposedly innocuous slogan, which they hoped would in turn convince average Americans that leftists and journalists hate white people, and thus push them towards the far right. (This grand plan didn’t exactly work out, given the campaign was immediately adopted by prominent neo-Nazis and Klansmen.)8

The crypto industry has been one of Barr’s biggest sources of campaign funding, with Crypto.com contributing $1.3 million to a pro-Barr super PAC. Executives from Andreessen Horowitz, Robinhood, Coinbase, and other crypto firms have contributed to him directly. A generous reading might be that they’re willing to overlook overt white supremacist messaging in order to install candidates who will support their deregulatory agenda. But as I’ve written recently, I think that many of the worst characteristics of the industry’s favored candidates aren’t “just collateral damage in their pursuit of business-boosting deregulation, but a desirable outcome”.

The only non-incumbent near the top of the crypto-funded list is John Deaton, who ran as a Republican on an explicitly pro-crypto platform in Massachusetts’ 2024 Senate race and was soundly defeated by incumbent Democrat Elizabeth Warren [I70, 97]. Despite losing by nearly 20 points, Deaton is back for another attempt in 2026 — this time targeting the state’s other Senate seat, currently held by Democrat Ed Markey. (He’ll face either Markey or his Democratic primary challenger Seth Moulton, who has himself received modest crypto industry support.) Ripple has already committed $1 million to Deaton’s campaign, but the more significant question is whether the major pro-crypto super PACs will back him this time. In 2024, Fairshake and its affiliates largely stayed out of the race, likely calculating that the race was unwinnable and that backing winners was crucial to their strategy of appearing powerful and effective.

Dark money

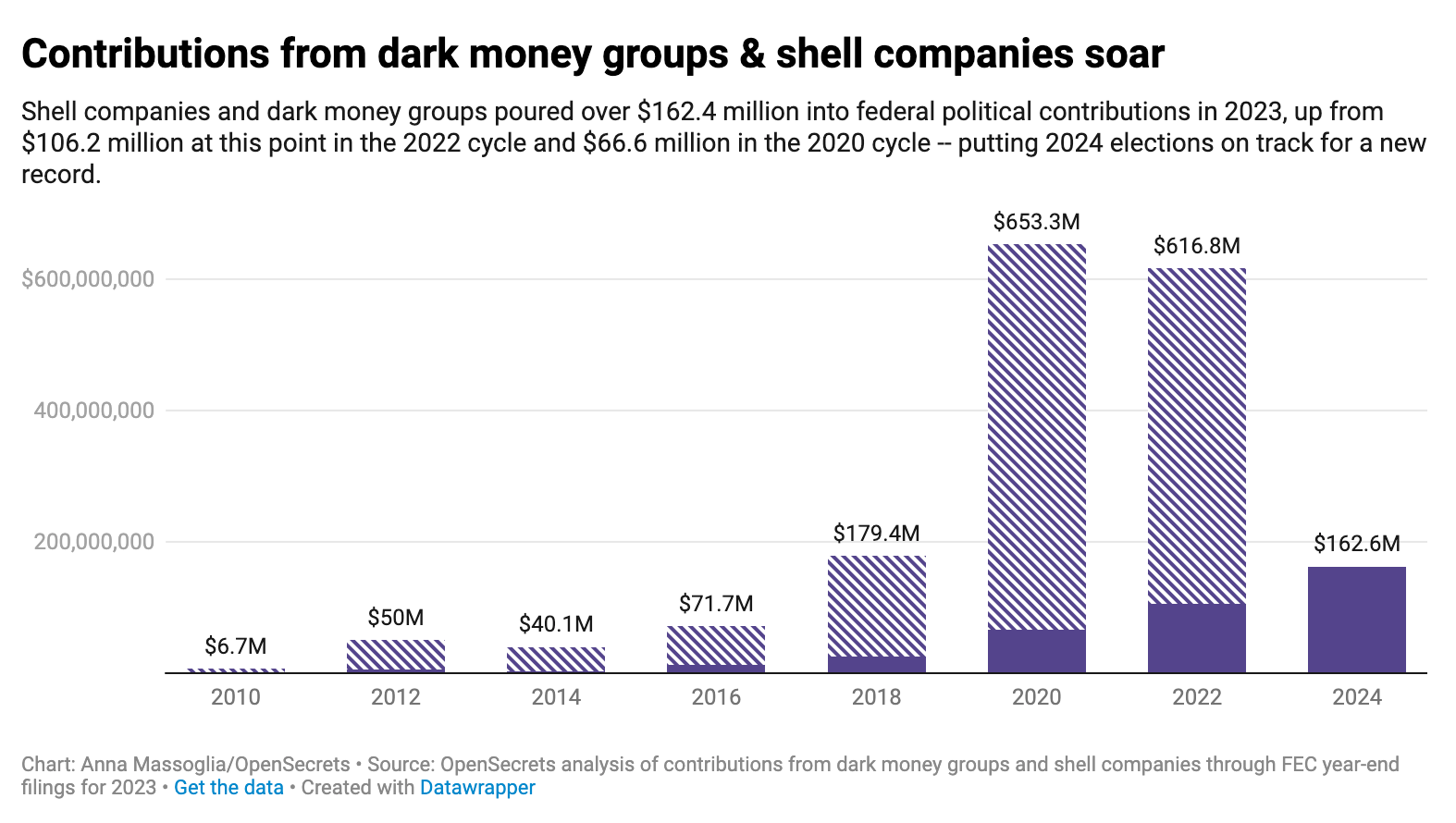

All of the spending I've tracked so far involves entities that have some disclosure requirements. But there is a portion of crypto’s political operation that happens behind the scenes, through structures designed to obscure both their funding and their spending.

Dark money groups — organized as 501(c)(4) “social welfare” organizations — can engage in political spending without disclosing their donors. Unlike super PACs, they can raise and spend millions with minimal filing requirements, and they’re widely used to obscure the true source of campaign contributions. The most prominent such group in the crypto sector is the Cedar Innovation Foundation, founded in early 2023 as crypto prepared its 2024 political blitz. According to CNBC, Coinbase is among its backers.9 Cedar Innovation shares a spokesperson with Fairshake in the omnipresent Josh Vlasto,c so it stands to reason there might be considerable overlap with Fairshake’s backers.

As new pro-crypto super PACs spring up ahead of 2026, so too have new dark money groups. The Solana Policy Institute is, as the name suggests, a 501(c)(4) looking to promote the interests of Solana and other decentralized finance projects. The America First Digital 501(c)(4) shares leadership with First Principles Digital — the Lummis-affiliated super PAC backing Mike Rogers — but operates with far less transparency. The group says it will “help advance pro-crypto policies and regulations, amplify the efforts of industry champions in Washington, and support ongoing education efforts among key decision-makers.” In practice, this likely means funding advocacy campaigns, running ads, and bankrolling “research” that supports the industry’s policy positions. Kraken has announced a $1 million contribution to the group [I93], but short of such self-disclosure, there’s no way to know which other compafnies have contributed, or how much. The Blockchain Innovation Project, a 501(c)(4) established by former Representatives Tim Ryan (D-OH) and David McIntosh (R-IN), says it intends to “advocate for digital assets against the political forces in Washington seeking to destroy the industry”. McIntosh also runs the Bitcoin Freedom PAC, a thus far fairly marginal super PAC that “believe[s] the only way to protect Bitcoin is to beat Democrats”.

This opacity makes it impossible to get a complete picture of crypto’s political maneuvering. The $288 million I’ve tracked so far is only what’s visible through FEC filings and self-disclosures — the real number could be substantially higher.

The playbook

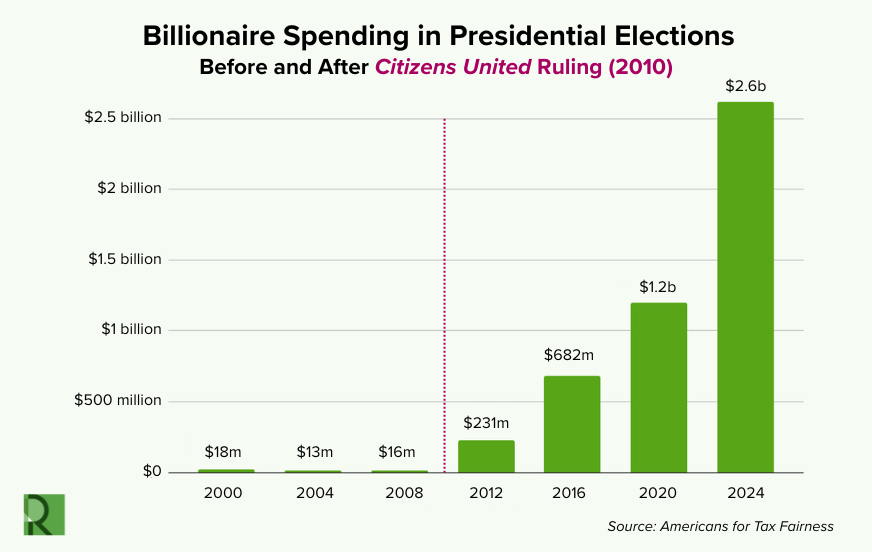

While the crypto industry’s spending from 2024 forward has been staggering, the seed of it was planted way back in 2010, when the Supreme Court’s Citizens United ruling enabled super PACs and largely unlimited political spending.

Note the dark money chart (second chart) was published in March 2024 and has only partial data for that year. (Roosevelt Institute, OpenSecrets)

But what separates crypto’s spending from the many other industries that have taken full advantage of America’s few limits on campaign finance is how systematically they’ve weaponized this framework. They’ve created a playbook: identify the legislators who control their regulatory fate and flood them with cash. Flip those who opposed you with promises of funding and campaign support, and primary anyone who won’t comply. Buy direct access to and influence with the president through his family’s crypto ventures, and use it to dismantle and defang regulators and oversight groups. Wrap it all in a persecution narrative about “debanking”, a “war” on your industry, and Democrats stifling innovation. Publish your own dubious “research” to try to convince political candidates that the industry is simply trying to give Americans what they want. Present it to the public as a noble fight to defend individual freedoms, rather than a push by wealthy executives to enrich themselves even further at the expense of everyday people.

The crypto model has proven so effective that it’s metastasizing into a broader template for how any industry with enough money can purchase favorable policy. Andreessen Horowitz, which has poured roughly $25 million into crypto PACs this cycle (down from about $47 million in 2024), has also contributed $25 million to Leading the Future, a new super PAC led by Fairshake’s spokesperson, aimed at backing candidates who will support the interests of companies developing artificial intelligence tools. The PAC’s goals will elicit déjà vu in those who’ve listened to how the crypto industry justifies its campaign: they just want to advance a clear, unified regulatory framework. They just want to support innovation. They just want to make sure that America doesn’t cede technological dominance to China.

The road ahead

The crypto industry has hundreds of millions of dollars ready to deploy into the midterms, dark money groups operating in the shadows, and a proven playbook. They’re betting that voters won’t know enough or care enough to push back, and that elected officials will either avoid standing up to the crypto industry out of fear of a well-funded primary opponent, or take the money themselves and become a mouthpiece. So far, that bet has paid off.

But the brazenness and corruption that has made this playbook so effective has begun to spark pushback, both among everyday people and in Congress. And it joins the absolute chaos and horror of this regime — threats of a war on Iran, concentration camps, killings of protesters, the pervasive cruelty — in driving backlash against this presidency. Crypto’s, and broader tech sector’s, visible role in installing him through hundreds of millions in political spending won’t be forgotten. When the reckoning comes, the industries that bought this administration will be part of what people remember.

A real step towards solving this problem would be overturning Citizens United. Unfortunately, this would require exactly the kind of political will that unlimited corporate spending is designed to prevent. But that kind of political will often emerges from the wreckage of administrations that went too far.

In order for that will to build, it’s important that people are aware of what is happening. This is why I’m working so hard to expand Follow the Crypto: tracking broader crypto company influence beyond just the super PACs, listing the Trump administration’s apparent quid pro quo deals with crypto firms looking to escape legal consequences, and more to come. Transparency alone won’t solve this problem. But if people don’t know it’s happening, they definitely won’t do anything about it.

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

This figure relies on manual classification and represents a conservative estimate of industry spending. The Federal Election Commission, which gathers and publishes campaign finance data, does not classify firms by industry, so there’s no easy way to look up a list of contributions from crypto firms. Outside projects like OpenSecrets do great work to classify contributions by industry, but they don’t split out the crypto sector out from their “Finance/Insurance/Real Estate” or “Securities & Investment” buckets. They also have not yet updated their data to reflect 2026 spending. ↩

This excludes ActBlue and WinRed, which are fundraising platforms that act as conduits to other committees. Fairshake is #7 if they are included. ↩

Fairshake spokesperson Josh Vlasto may be the busiest person on the planet. In addition to that role, he is the spokesperson for Defend American Jobs (a pro-crypto super PAC with a conservative veneer), Protect Progress (pro-crypto super PAC, progressive veneer), the Cedar Innovation Foundation, Leading the Future PAC (a pro-AI PAC), and the Think Big PAC (a pro-AI PAC with a progressive veneer). ↩

References

FEC Form 3X filed by the Fellowship PAC on January 30, 2026. ↩

“100 Days of Corruption: Oversight Democrats Highlight 100 Conflicts of Interest as President Trump Clears the Path for Corruption”, House Oversight Democrats. ↩

“Crypto Super PACs Return, Spend Big Bucks on Special Elections”, Crypto in America. ↩

“Rogers Secures Crypto Endorsement for U.S. Senate Campaign”, Mike Rogers for US Senate. ↩

“Mike Rogers’ crypto evolution”, Punchbowl News. ↩

“Republican Senate Candidate Blasts Crypto PAC Fairshake Over Snub: ‘They Needed a Democrat’”, Decrypt. ↩

“Major corporations bankroll political ad featuring white supremacist slogan”, Popular Information. ↩

“Mysterious crypto ‘dark money’ group ramps up lobbying efforts ahead of 2024 election”, CNBC. ↩