Follow the Crypto

FollowTheCrypto.org: A new project to track cryptocurrency industry spending to influence 2024 elections in the United States.

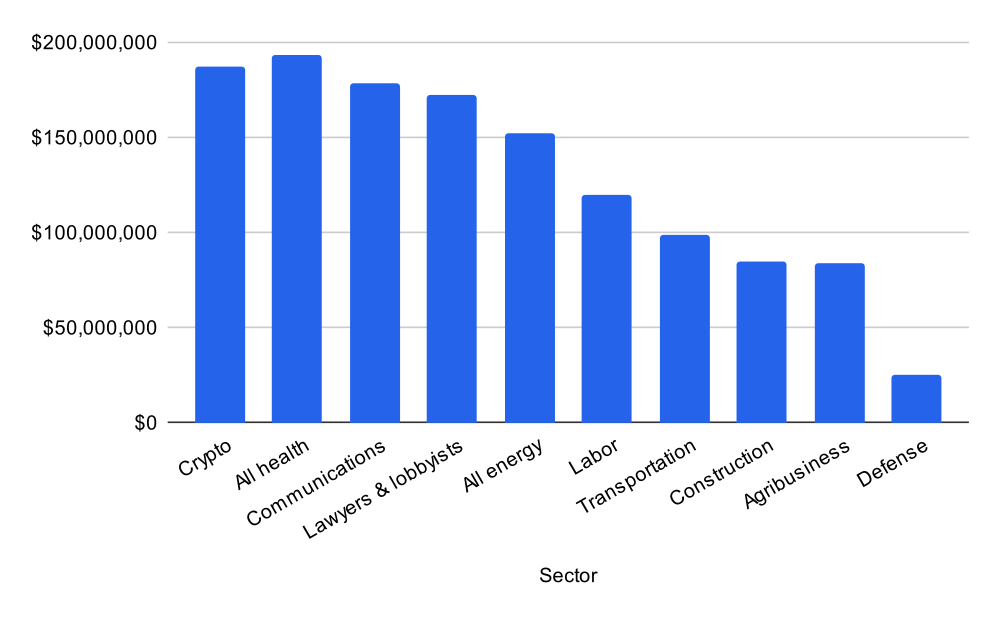

Did you know that the cryptocurrency industry has spent more on 2024 elections in the United States than the oil industry? More than the pharmaceutical industry?

In fact, the cryptocurrency industry has spent more on 2024 elections than the entire energy sector put together. These industries, all worth hundreds of billions or trillions of dollars, are being outspent by an industry that, even by generous estimates, is worth less than $20 billion.a

Most of the cryptocurrency industry’s money is going to massive super PACs like Fairshake — that is, single-issue committees focused only on installing crypto-friendly politicians and ousting those the industry views as a threat.

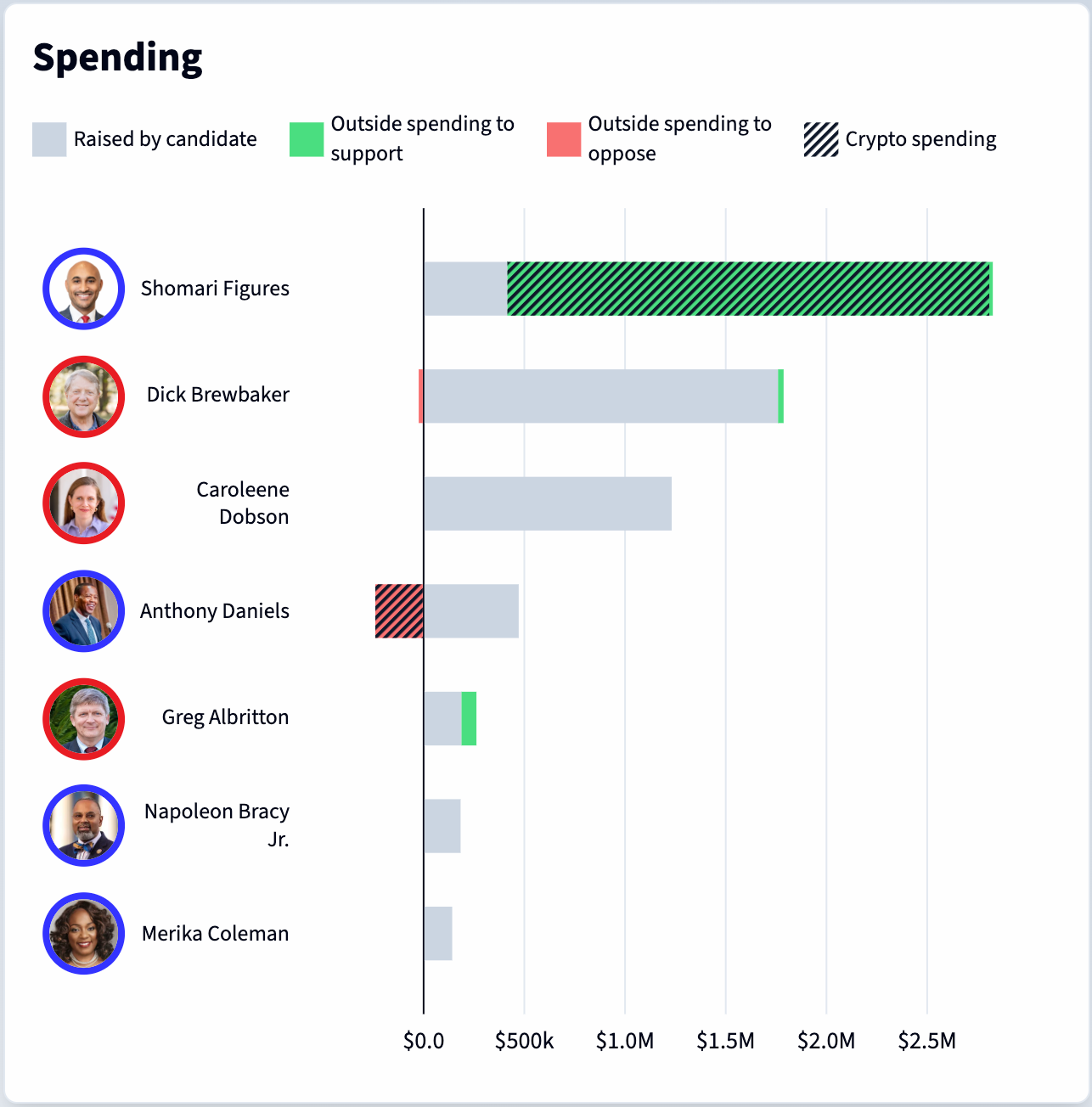

Although these PACs have spent only a fraction of the more than $185 million in their combined war chests, they’re already finding some success. Democratic California Senate candidate Katie Porter lost her primary race after Fairshake spent $10 million on attack ads against her. In New York, Fairshake piled on $2 million to oppose Democratic House Candidate Jamaal Bowman, who ultimately lost his primary race. $1.5 million from the Republican-focused blockchain super PAC, Defend American Jobs, helped Republican Jim Justice win his West Virginia Senate primary. $1.7 million from the Democrat-focused blockchain super PAC, Protect Progress, similarly aided Shomari Figures in winning his Alabama House primary.

Although election spending information is public, it can be incredibly time- and labor-intensive to comb through. The crypto industry isn’t helping to make things clearer, either, with innocuously-named PACs like “Fairshake” that obscure the goals of these committees. Although the industry likes to claim that crypto is a major election issue with grassroots support, advertisements run by these committees rarely mention cryptocurrency or blockchains at all, or even technology or finance more broadly. And some of these PACs funnel money through surrogate committees, obscuring the origins of some of the more heavily partisan spending.

Furthermore, the wealthy executives and venture capitalists associated with the industry are spending heavily as individuals, without going through these PACs or spending through their companies. Cameron and Tyler Winklevoss — founders of the Gemini cryptocurrency exchange — each donated $1 million each to Donald Trump’s presidential campaign. They were followed soon after by Jesse Powell, chairman of the Kraken cryptocurrency exchange, who pitched in another million.b

To help shine a light on this incredible volume of spending, I’ve spent the past two months working on a new website: Follow the Crypto.

In as real time as is possible,c this site tracks contributions to cryptocurrency-focused super PACs like Fairshake, Defend American Jobs, and Protect Progress. It monitors expenditures by those committees: which races they’re influencing, which candidates they’re supporting and opposing, and what ads they’re running. It also provides a view into other election spending by cryptocurrency companies and the wealthy individuals associated with them.

I have more features I’m planning to add to the site, but I felt it was important to release this as quickly as possible. Despite how much these PACs have already raised, the cryptocurrency industry is only ramping up their spending as elections draw nearer, and most of the money held by these PACs is still waiting to be deployed. 50% of the funds in Fairshake’s coffers — $85 million — was raised in May alone,1 and that’s the last month with complete data. These companies show no sign of slowing down. With this site, we will be able to follow how these industries are working to buy influence across the country.

Please share this widely, and send me any feedback, feature requests, questions, or comments you may have! I’m also going to be setting up Twitter, Mastodon, and Bluesky bots to post when there are expenditures or contributions to these committees. You can follow those in advance at on Twitter at @follow__crypto, on Mastodon at @followthecrypto@hachyderm.io, or on Bluesky @followthecrypto.org.

And, if you don’t already, consider supporting my work with a pay-what-you-want subscription to this newsletter, or a one-off contribution. This kind of independent research is what I do full-time, entirely thanks to support from people like you.

Correction: An earlier version of this article estimated that cryptocurrency PACs had raised $203 million, not $187 million. Contributions to Fairshake that were then transferred to Defend American Jobs and Protect Progress were being erroneously double-counted.

Footnotes

Unlike most other industries, people really like to estimate the “size” of the cryptocurrency industry by the total market cap of all cryptocurrencies (a notoriously inaccurate number). Estimates based on traditional metrics vary widely from low single-digit billions to around $20 billion, although the higher numbers are typically projections rather than historical data. ↩

Each was refunded around $150,000, as the maximum individual donation is capped at $844,600. ↩

There are some delays between expenditures and FEC reporting on those expenditures, so the data is not truly real-time, but it’s as close as possible. ↩

References

“Issue 60 – Raging in favor of the machine”, Citation Needed. ↩