The Sam Bankman-Fried empire crumbled. What does it mean? (part two)

Hold on to your butts.

If you're not familiar with what just happened with the collapse of FTX (a major cryptocurrency exchange), the sudden offer by Binance (an even more major cryptocurrency exchange) to acquire them, and then the rescindment of that offer, you'll want to check out part one.

If you want to know what I think about it, read on… and consider hitting that subscribe button on your way past.

The deal was doomed from the start

Shortly after SBF and CZ announced the Binance/FTX acquisition deal yesterday, people started to ask me my thoughts. I dashed off a few of them an hour or two after I learned of the news. One of them, verbatim, was:

It was hard not to notice how CZ really seemed to be hedging things in his tweets. "we signed a non-binding LOI, intending to fully acquire FTX". "we will be conducting a full DD in the coming days." "This is a highly dynamic situation, and we are assessing the situation in real time. Binance has the discretion to pull out from the deal at any time." I'm giving it decent odds that the deal doesn't go through, or that Binance threatens to pull out if they're not given very friendly terms in the deal.

(For the curious, the rest of my thoughts were reprinted, unedited, by CoinDesk in their collection of takes under the heading "Discount what SBF has said".)

Sure enough, today we heard that Binance had walked away from the table.

By the time CZ got around to writing those tweets, he was already doubting the decision. In fact, I think he knew the deal wouldn't go through even as he was signing it.

Even ignoring CZ's less-than-enthusiastic wording, just think about it: FTX found itself in a "liquidity crunch" so severe that they chose, out of all options, to go with a Binance buyout. They made no attempt at all the things you might expect, like an extended pause on withdrawals to buy time while they liquidated funds, trying to raise emergency funding, or filing for bankruptcy. They didn't shop around to see if there were other interested buyers besides Binance, the ones who had kicked off the whole bank run in the first place!

This suggests to me that a) they are in a really bad spot, and b) they want as few people sniffing around in their books as possible.

Why make the deal at all?

Now, this raises the question: why would CZ go to the trouble of making a deal when he had no intentions of following through?

Publicity.

The biggest publications—the Wall Steet Journal, Reuters, the New York Times—have already run multiple stories on this. It's on their front pages, even as those same publications are trying to report on the midterm elections.

To the average person, particularly the people who have not realized (or don't believe) that it was Binance who fired the largest torpedo into the bow of the inevitably-sinking FTX, Binance comes out of this all looking pretty good, and for very little effort on their part.

After all, they are the ones who entered into this deal "to protect [FTX] users". How noble!

The takeaway to readers is likely to be that Binance is so flush with cash that they could sign a bail-out like this in under a day without even blinking (they must be unsinkable!), and that Binance is the responsible adult in the room who backed out of a deal because of concerns over mishandling of customer funds (surely Binance isn't doing that, then!)

This is no liquidity crunch

This may be stating the obvious, but this was not a mere "liquidity crunch".

A liquidity crunch is something that can happen to a legitimate, solvent financial institution if it unexpectedly finds itself needing to process more withdrawals than it has cash on hand (or easily-liquidated assets).

Liquidity crunches are not good, by any stretch, but they are fairly common in crypto. We saw a lot of them this summer. Exchanges pause withdrawals for a while, or seek quick funding. The company may take a hit in terms of customer trust (and consequently on their token price), and on the loan terms for that emergency funding, but they don't blow up and then sell themselves to their biggest competitor who kicked off the crisis to begin with.

No, FTX is insolvent. They took their customers' money, gave it away (most likely to their sister company, Alameda), and accepted their own token as collateral.

When FTT crashed in price thanks to the CoinDesk report and CZ's announcement that Binance would liquidate their FTT holdings, FTX wound up with a big pile of tokens that were suddenly rapidly approaching 0, and no way to offload them for real cash (okay, or "real crypto") they could use to service withdrawals.

This is what's known as a death spiral. As FTT decreases in price, customers lose faith in FTX. Customers ask FTX to give them back their crypto now, none of those funny-money FTT tokens, please and thank you. And if FTX loaned a bunch of customer funds to Alameda to do their quant magic with, in exchange for FTT, and FTT is now worth considerably less than it was before… well, those customer funds are as good as gone. And as more warning klaxons go off around FTX, with SBF's increasingly desperate-sounding tweets, evidence of a massive bank run requiring FTX to liquidate huge amounts of their non-FTT assets, and ultimately with FTX pausing withdrawals, the price of FTT continues to spiral closer to zero and the hole in FTX's balance sheet starts to look pretty damn big.

Binance was offered an absolute fire sale

Even though the letter of intent was non-binding, Binance and FTX were able to come to an agreement on a deal in less than 24 hours.

That's unbelievably quick.

This suggests to me that Binance was getting a hell of a deal, and that FTX was taking whatever they could get (likely not much).

Yesterday I wondered if Binance might threaten to call off the deal to try to negotiate an even better arrangement, but they seem pretty firm that they will not be moving forward with the acquisition.

The Tinkerbell effect is real

The apparent FTX/Alameda scheme worked for a really long time.

Alameda needed capital for its (quite lucrative) trading strategies. FTX, as one of the largest cryptocurrency exchanges, has nothing if not capital (in the form of customer deposits). So if FTX lends Alameda those customer funds in exchange for some magic beans—let's call them FTT—as long as no one's the wiser, it all works out.

SBF gets to play the role of not only boy genius but knight in shining armor, and crypto enthusiasts and journalists alike muse over whether he's the next Warren Buffett or J.P. Morgan. He also gets to enjoy his spot on the list of the world's wealthiest people.

But as soon as something shakes the faith, and the foundation of FTT that sits below SBF's house of cards begins to falter, everything vanishes into dust.

Regulators and legislators are going to notice

Imagine you're a legislator or a regulator trying to get your head around crypto.

A billionaire leading a top crypto company comes to you, claiming to be the reasonable adult in the room from an inscrutable industry that has often been hostile to the idea of regulation. He promises to work with you, and provides his own suggestions for a regulatory framework. You listen to what he has to say.

Two weeks later, his company blows the fuck up.

It turns out he was inflating his balance sheet with tokens he created out of thin air, through a shady scheme in which two companies which should be operating at arms length were clearly very tightly intertwined.

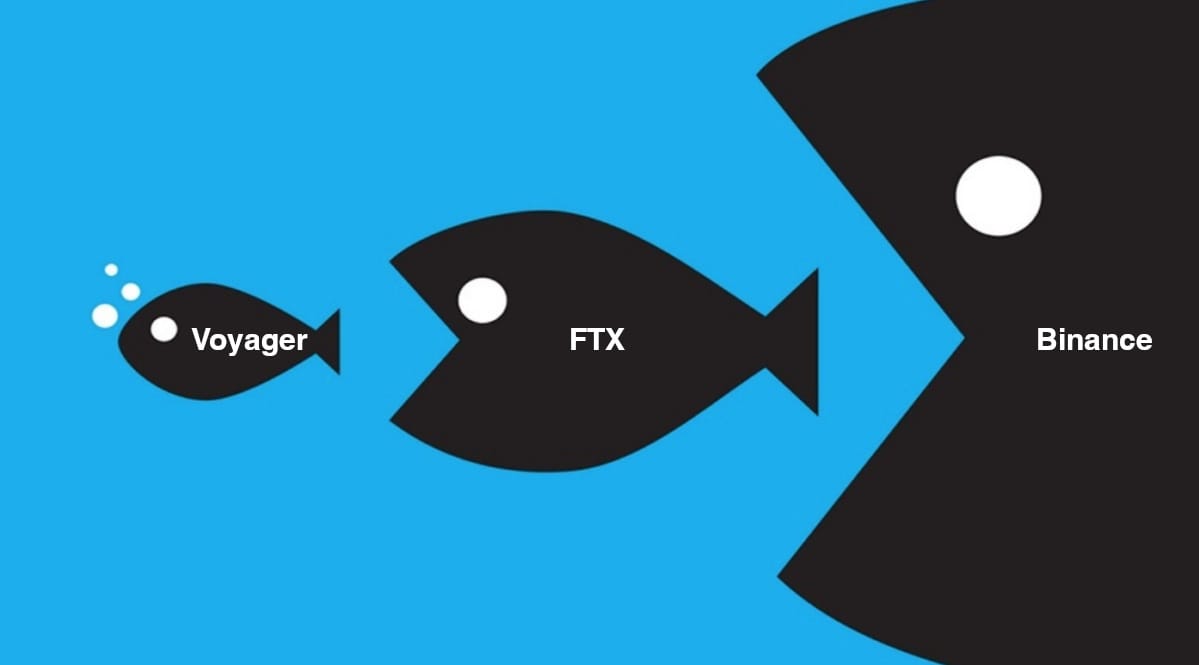

Not only that, the biggest crypto exchange threatens to form a mega-exchange monopoly by subsuming FTX, who themselves had subsumed (or were in the process of subsuming) other platforms.

You're probably going to notice.

Regulators and legislators certainly took notice of the Terra debacle earlier this year, which cranked up the urgency with which they've been considering stablecoin regulation. The Terra collapse will pale in comparison to the fallout from this.

This is really bad

The past year or so has been rough for crypto, as prices tumbled from all-time highs, projects like Terra/Luna collapsed, and major operations like Three Arrows Capital, Celsius, and Voyager were demolished (then going on to demolish other operations in their blast radius, thanks to ever-present crypto contagion).

Those incidents pale in comparison to what is happening here.

If you made a chart of how much FTX was holding in customer funds and compared it to any of those failed companies I mentioned, you'd have to zoom out so far to see FTX that you wouldn't see the other company.

"The important thing is that customers are protected," wrote SBF in his Twitter thread announcing the Binance deal. The deal is off. FTX isn't processing withdrawals. Customers with funds in FTX should be feeling very nervous right now.

There's also been little talk of what will happen to Alameda, who is unquestionably in a very bad situation right now.

The fact that their website is now a Squarespace "private site" notice does not seem to bode well.

We are already seeing effects on the crypto market as traders fear the contagion from FTX/Alameda failure.

Solana plummeted in price, leading to speculation that Alameda may have sold off large portions of their substantial SOL holdings to bolster liquidity.

But it was not just Solana that took a beating. Bitcoin reached a two-year low, plummeting 20% over the last week in response to the news.

The market is nervous.

And it has every reason to be. The fallout from this is going to be substantial, and like the fallout from Terra/Luna, Three Arrows Capital, and Celsius, it will likely be protracted. Furthermore, if firms with exposure to FTX or Alameda fail, they are likely to create a snowball effect where other firms exposed to those firms fail, and so on.

And without Binance there to save the day, who's it going to be? FTX was the rescuer of choice, but now they're in need of rescue, and there's no one left to step up to the plate.