The FTX trial, days 2–3: "FTX defrauded its customers", says former employee

Meanwhile, the defense tries to argue that if Sam Bankman-Fried was a criminal, he would've bought a fancier car.

According to Sam Bankman-Fried's defense attorneys, he was just following the move fast and break things mantra that has led the technology industry for decades. "Sam and his colleagues were building the plane as they were flying it," explained lead defense lawyer Mark Cohen. He was "a math nerd who didn't drink or party", Cohen went on,1 apparently hoping the jurors believe teetotalers to be inherently incapable of crime.a Sure, maybe Bankman-Fried hadn't hired a Chief Risk Officer — a piece of information Cohen bafflingly decided to offer up himself — but hey, it was a new company! Well okay, maybe not that new (Alameda Research was five years old when the companies collapsed). Oh, and Caroline Ellison had refused to hedge trades over at Alameda Research, he said, previewing the argument that everything was her fault, not Bankman-Fried's. "Sam didn't steal from anyone," said Cohen. "There was no theft."

I'm not sure if "well, sure, they built their empire out of gasoline-drenched toothpicks and duct tape and then were shocked when $8 billion went up in flames, but he didn't really mean to light fire to everyone's money", is a case-winning strategy to put in front of a jury, but hey, I'm not the superstar defense attorney here.

The government's story goes a little differently. "All of it was built on lies," declared Assistant U.S. Attorney Thane Rehn.2 FTX told customers their money was safe, even paying American celebrities to repeat the claim in multi-billion dollar television advertisements.

Instead, customer money went into one big piggybank, shared between FTX and all the other companies under his control, from which Bankman-Fried pulled fistfuls to spend on venture investments to political and charitable donations to sports sponsorship deals to luxury Bahamian real estate.

Four witnesses have testified so far. First was London-based cocoa brokerb Marc-Antoine Julliard, a retail customer who used FTX to store his crypto, ultimately losing around $100,000. The prosecution likely carefully selected him as someone who only used FTX's spot trading features and intentionally sidestepped its products that allow users to trade on margin or borrow money, anticipating an eventual argument from the defense that FTX's collapse could be blamed on risk inherent to margin trading that customers knew they were taking on when they opted to use the platform. He also spoke of being influenced to choose FTX in part by the company's ad campaigns and photos in the news of Bankman-Fried cozying up to politicians. The defense team asked him whether he understood that cryptocurrencies were volatile and risky, which he said he did; however, prosecutors later gave him the opportunity to clarify that he believed crypto to be risky because of his tokens' volatility, not because FTX might disappear with the tokens entirely.3

Second to testify was former employee and Bahamian penthouse roommate Adam Yedidia, who worked for FTX as a software developer. Yedidia has not been charged with any crimes, and is testifying with an immunity guarantee, which he explained was in case he had "unwittingly written code that contributed to a crime." At one point, prosecutors displayed photographs of the Bahamian paradise that the defense team would later try to describe as a "housing development" and "like a dorm room".

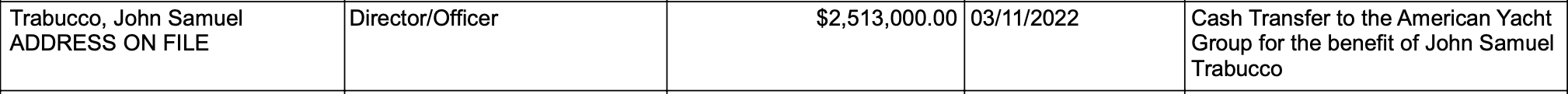

"[Bankman-Fried] didn't buy a yacht, did he?" "Do you know what kind of car he drove?" "He bought a Toyota Corolla, correct?", grilled Cohen, insinuating to the jury that if Bankman-Fried was a thief, he would've bought a fancier car. The prosecution hasn't pointed out yet that Bankman-Fried actually did use customer funds to buy a yacht, which went to co-worker and former Alameda co-CEO Sam Trabucco [I39].4

Yedidia outlined to the prosecution an incident in 2022 in which, while tasked with fixing a bug that overstated the amount of Alameda's debt to FTX customers, he realized that Alameda owed $8 billion that the company had taken from FTX's customer funds. He said that he'd confronted Bankman-Fried about the debt, and Bankman-Fried "looked nervous", explaining he believed they could repay the debt in six months to three years. At that point, Yedidia trusted him to "handle the situation". Yedidia would go on to quit FTX shortly after its collapse, as soon as he learned of the allegations that the company had intentionally misappropriated customer funds.

Perhaps the worst moment of Yedidia's testimony for the defense team was when the prosecutors asked "Why did your view of FTX change?" "FTX defrauded its customers," Yedidia answered simply.5c

The third witness to testify was Matt Huang, a venture capitalist working for the crypto-focused fund, Paradigm. Paradigm invested $278 million into FTX. According to Huang, there were "concerns about value leakage to Alameda", but they decided to invest anyway, believing that the two companies were properly firewalled. Paradigm later marked their investment to zero.6

The last person to testify on Thursday was Gary Wang, the CTO and coding whiz behind much of Alameda and FTX's software. Wang pleaded guilty to four fraud charges in December 2022, and has been cooperating with the prosecution since. The prosecution only got a few questions in before the trial concluded for the day, but they were to the point:7

Prosecutor: Did you commit crimes at FTX?

Gary Wang: Yes. With Nishad Singh, Caroline Ellison, and Sam Bankman-Fried.

Prosecutor: What was the wire fraud?

Wang: We allowed Alameda to withdraw unlimited funds.

Wang has been implicated in coding the "backdoor" that allowed Alameda Research to dip into customer funds allocated to FTX, a topic that will certainly be explored in more depth during tomorrow's questioning. Although Caroline Ellison has been described as the star witness in this case, I think Gary Wang's testimony is likely to be pivotal as well. Bankman-Fried and others have described Wang as the only person who truly understood how Alameda's and FTX's software worked, a level of understanding that I imagine has been critical to the prosecution as they've prepared their case. Although Sam Bankman-Fried notoriously instructed his employees to set their Signal encrypted messaging app to auto-delete messages so they couldn't later be accessed by regulators or other prying eyes, prosecutors were also able to delve into Wang's Slack messages — which we know about thanks to a complaint from the defense team in August that they were struggling to sift through 750,000 pages of them that had just been produced by the prosecution [I37].

Thus far, Bankman-Fried himself has played a minimal role in the trial. Most of the reporting about him has to do with the fact that he's cleaned up his trademark just-out-of-bed appearance, which he once carefully cultivated. "I think it's important for people to think I look crazy", he said to the New York Times several months before the collapse, in a profile titled, "A Crypto Emperor's Vision: No Pants, His Rules". Now, he's cut his hair, and apparently managed to reign in the once-signature rapidfire leg bouncing. Whether this will ultimately help him or not is less clear, given the defense seems to be hoping to make the argument that he was just a disorganized kid and things fell through the cracks, an argument that may not necessarily be bolstered by making him dress and groom like the grown adult businessman he actually is.

The big question on everyone's mind is: will Bankman-Fried testify? I doubt his lawyers want him to, as he is both abrasive and evasive even on his best days. He likes to try to talk circles around interviewers — a tactic that may pay off with friendly tech journos or the crypto crowd, but is less likely to work for sworn testimony in front of an experienced cross-examiner.

Bankman-Fried, on the other hand, has shown nothing but conviction that he can talk his way out of this, if he just gets the chance. He spent weeks after the collapse talking to anyone who would listen, from journalists like Andrew Ross Sorkin to random people on Twitter like me [I13]. That's been muted lately, but more likely due to the gag order [I35] and subsequent return to jail [I36] rather than any change of heart on his part. Meanwhile, the judge has told him that he has the right to testify, even if his lawyers don't want him to. That temptation may ultimately prove too strong for Bankman-Fried.

Video excerpt from FTX advertisements uploaded to YouTube.

Case exhibits via the New York Post.

Footnotes

References

"Bankman-Fried Didn't Steal His Lawyer Tells Jury It was Caroline Ellison Who Didn't Hedge", Inner City Press. ↩

"Sam Bankman-Fried: FTX crypto empire 'built on lies' - prosecutors", BBC. ↩

"In Bankman-Fried Trial Adam Yedidia Testifies of Condo After French DOGE Trading Victim", Inner City Press. ↩

Schedules/statements filed on July 31, 2023. Document #2003 in In re: FTX Trading Ltd. ↩

"In SBF Trial Paradigm Investor Huang Says All $278 Million Lost After Lies About Alameda", Inner City Press. ↩