Grayscale Bitcoin Trust: the free money machine that went into reverse

A lucrative arbitrage opportunity formed the foundation of much of the cryptocurrency industry. When it turned bad, it brought the whole house of cards down with it.

If you're at all familiar with the ongoing DCG/Genesis/Gemini saga, you may have heard yet another "G" company and its related acronym: Grayscale Investments and GBTC.

What is GBTC? How does it work? Why is it so central to the crypto collapse? Read on.

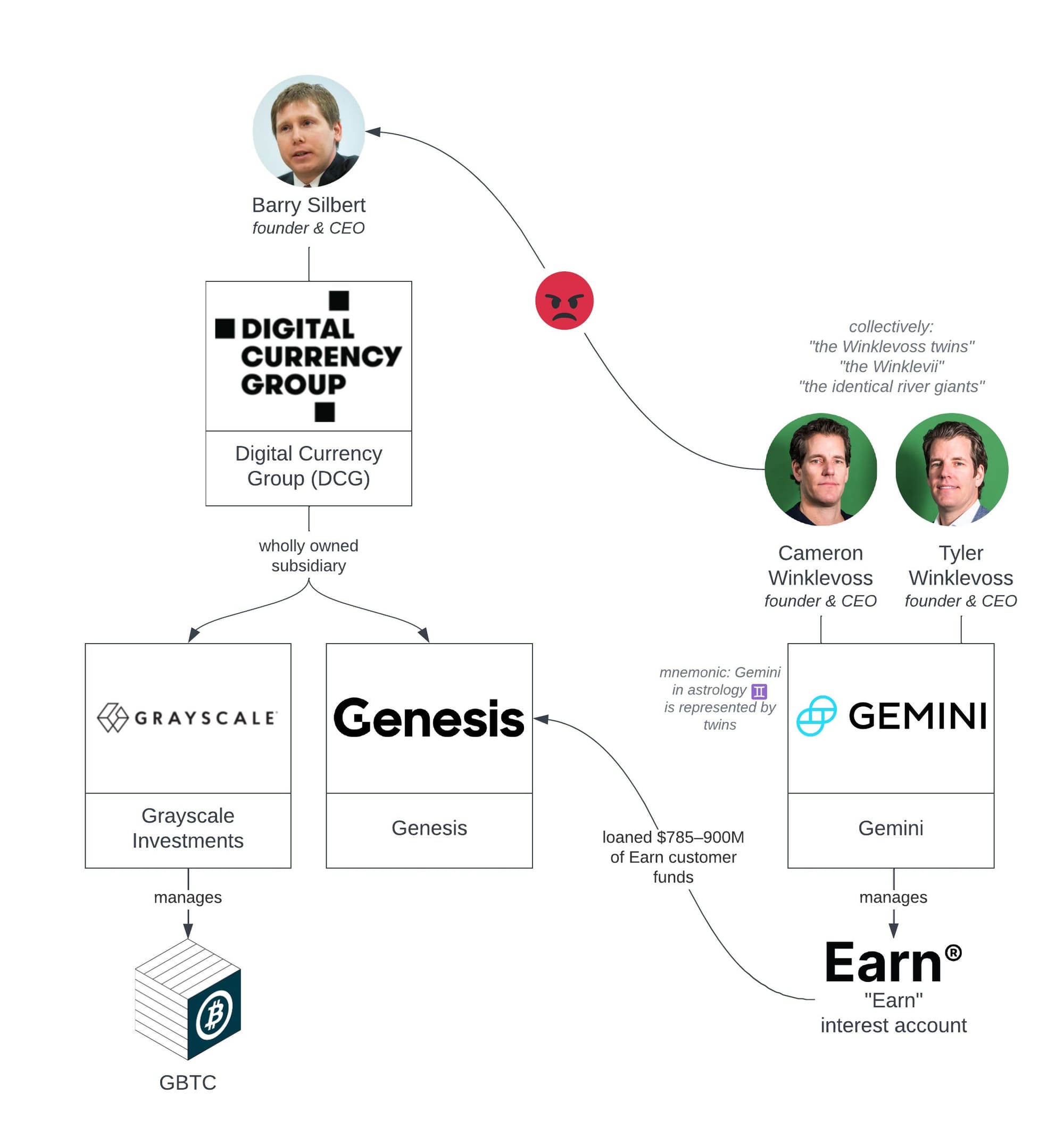

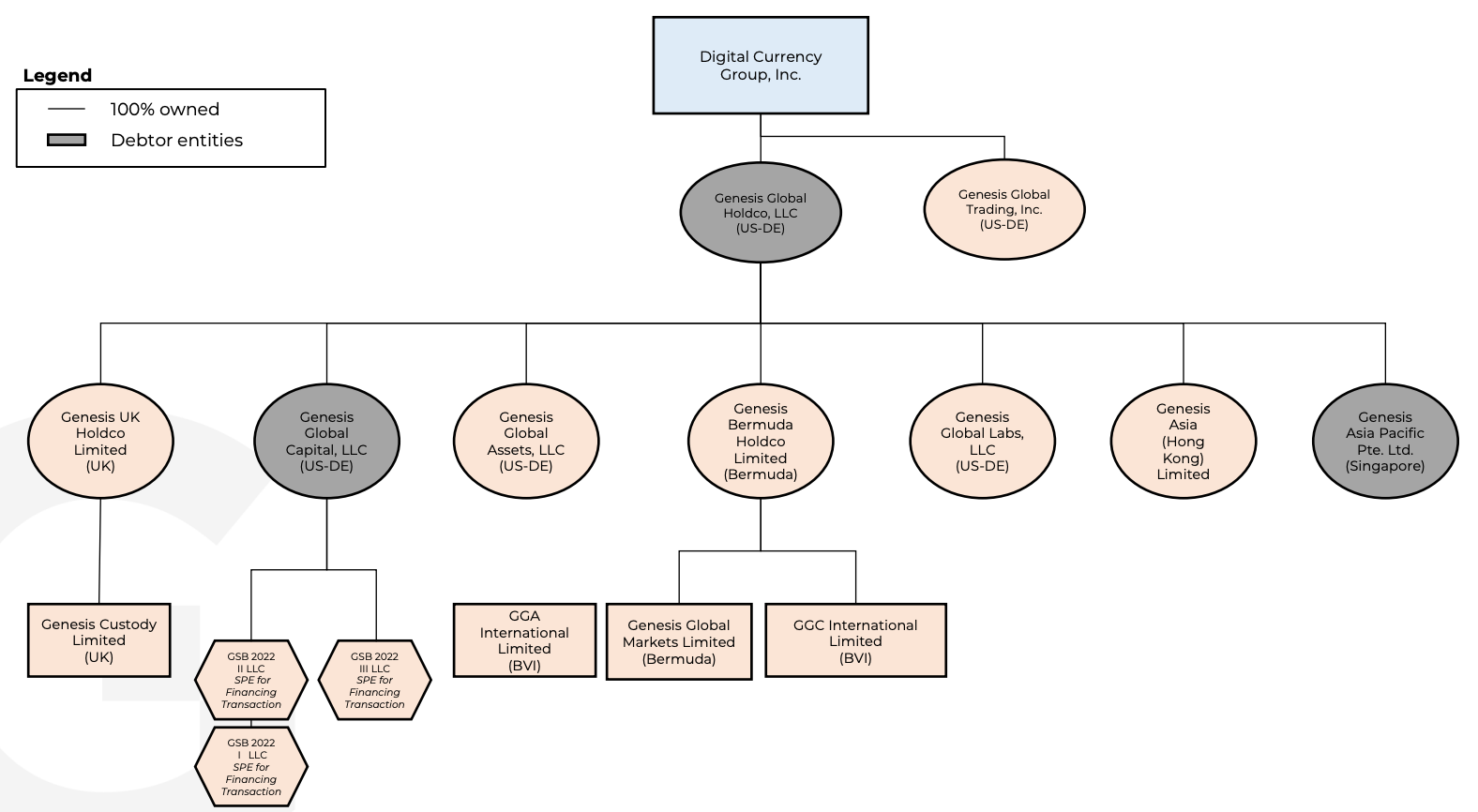

First, let's do a little untangling. Half the crypto industry apparently decided 25 letters of the alphabet were completely uninteresting, or perhaps they just wanted those of us trying to make sense of it all to suffer. Here's a helpful diagram of just a few of the G's involved:

There is a lot more that could go in that chart, such as all the many subsidiary companies of all of these entities, or the various ways that Genesis and DCG are deeply entangled with GBTC, but I figured I would keep it to simple organizational relationships and explain the entanglements later on.

What is GBTC?

GBTC stands for Grayscale Bitcoin Trust. The Grayscale Bitcoin Trust, originally known as the Bitcoin Investment Trust (BIT — no G!), was launched way back in 2013, and it began trading over-the-counter that same year. Grayscale would go on to become a subsidiary of Digital Currency Group (DCG) in 2015.

It's important to remember that it was a lot harder for the average person to buy Bitcoin (BTC) in 2013. Grayscale observed that there was a market there: investors—both institutional and individual—wanted exposure to Bitcoin, but didn't want to or weren't able to mine it themselves, buy it peer-to-peer, or use one of the various (and somewhat shaky) crypto exchanges. So, Grayscale launched GBTC.

GBTC is, as the name would suggest, a trust. Grayscale owns a big pile of Bitcoins, and they issue the $GBTC security. The idea is that Grayscale does all the work of obtaining and custodying the Bitcoins, individual investors can buy GBTC via their usual brokerage accounts (and even put it in tax-advantaged accounts like retirement plans), and investment firms and funds can get exposure to BTC in a compliant way.

Because the number of GBTC shares is proportional to the number of Bitcoins held in the trust, the idea is that the price of GBTC will generally track the price of Bitcoin.

For the more crypto-familiar readers, this is not entirely unlike the mechanism of asset-backed stablecoins. If I take in US$100 and issue 100 MollyUSD, the value of MollyUSD should track the value of the US dollar, assuming people trust me to actually hold on to those dollars responsibly, and trust that they could likely obtain $1 in exchange for their 1 MollyUSD (either by redeeming it with me directly or trading it on the secondary market). We'll come back to this in a moment.

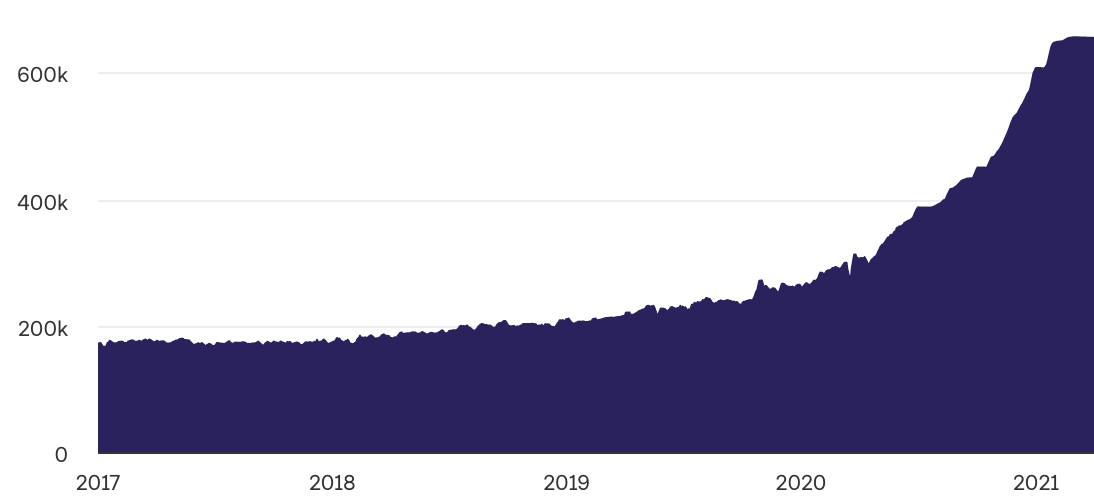

High demand for GBTC, coupled with its limited supply, actually caused GBTC to trade at a significant premium to its net asset value (NAV—that is, the total value of the Bitcoins held in the trust) up until early 2021. From 2019 until the beginning of 2021, GBTC enjoyed a premium that hovered somewhere between 10% and a whopping 50%, meaning that people were willing to pay considerably more for GBTC than the equivalent quantity of BTC.

An arbitrage opportunity

With GBTC trading at a considerable premium for an extended period of time, an attractive arbitrage opportunity emerged.

Institutional investors could buy or borrow Bitcoins and deposit them with Grayscale in exchange for shares of GBTC. After a six month lockup period, they could sell their GBTC shares on the secondary market. Assuming that GBTC continued to trade at a premium and Bitcoin prices remained stable or increased for those six months, this was an incredibly lucrative trade: institutions could pocket the premium, or they could rinse and repeat with the same trade. They also pocketed any increase in the GBTC price, and with Bitcoin (and thus GBTC) generally going up in price over that period, that was lucrative too.

Needless to say, crypto institutions felt like they'd found the free money machine. They kind of had.

And Grayscale certainly had: they charge a 2% annual fee, amounting to hundreds of millions a year in revenue—even in these recent depressed crypto markets.1

The impulse among the crypto crowd was to scrounge up any spare dollar they could find and feed it into this magical machine that was giving them their dollar back, and then some.

The impulse was to find more dollars—say, by taking in customer deposits with the promise of low-risk high returns—to use to perform the GBTC arbitrage. Because the trade was so lucrative, they could promise customers interest rates far beyond what was available in traditional finance, and still keep a big chunk for themselves.

The thing about free money machines…

… the money always runs out.

Perhaps there were some people who performed the GBTC arbitrage during this period, saw the writing on the wall in late 2020, and packed it in. I assume they moved to some beautiful private island, throwing their cell phones into the sea en route so as to not be tempted to check crypto prices and thus be forced to think of all the bagholders they left in their wake. God bless 'em.

However, there were a lot of people who seemed to believe that this trade that had been so lucrative for two years would somehow remain lucrative indefinitely.a Some built businesses around it. Companies leveraged themselves up, borrowing ludicrous sums of money to get Bitcoins to trade for GBTC.

You could say that the free money machine shut off in early 2021, but that's not even really true. It didn't just shut off, it reversed. If the GBTC arbitrage was a money printer up until 2021, there was only a brief period of time where it hovered at the threshold of simply not lucrative before plunging into full on money shredder territory.

In late February 2021, the GBTC premium crossed the 0% threshold and began sinking into discount territory.

The premium turns into a discount

Several factors contributed to cause the GBTC premium to flip to a discount, and to cause that discount to continue to grow ever since.

The arbitrage itself was a big part of it: as more investors discovered the profitable trade, Bitcoins poured into the trust. The supply of GBTC ballooned, but demand couldn't keep up.

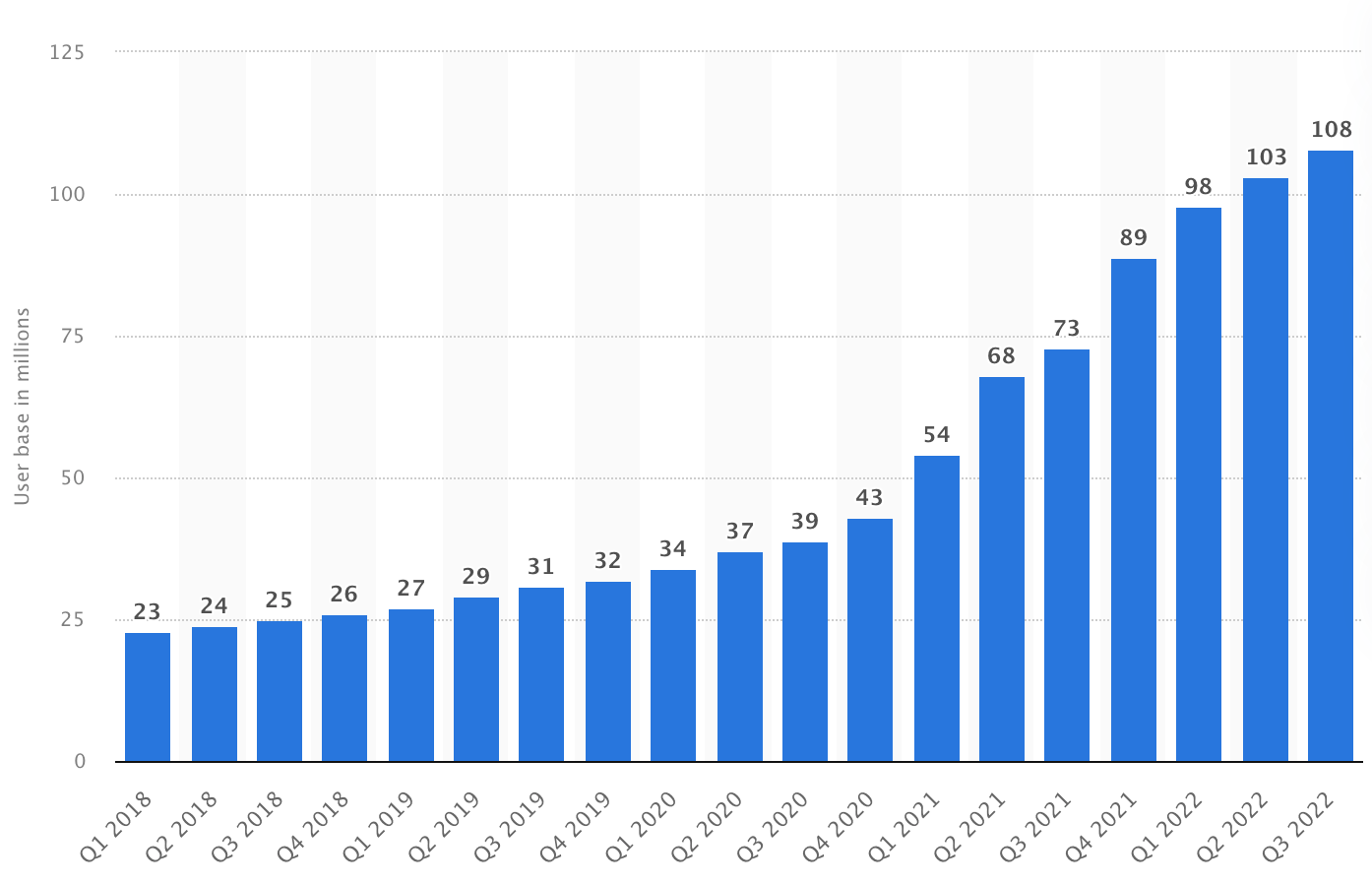

It had also become significantly easier by then for people to buy and hold Bitcoins directly. Coinbase went public in April 2021, and a glance at their user numbers shows that early 2021 was around when the platform really started to take off. Other crypto exchanges and wallet providers had sprung up by then too, offering consumers a selection of more user-friendly options for buying crypto than were available in the earlier days of GBTC.

If we go back to the MollyUSD stablecoin example, we can identify two other major reasons the market might value GBTC below its NAV:

If the market loses trust in Grayscale, they might seek to get out of GBTC, increasing sell pressure. The bear market, the seemingly endless string of crypto company explosions throughout 2022, and emerging evidence of problems at DCG and Grayscale all contributed to weakening trust in GBTC. Grayscale also refused to publish proof-of-reserves in November 2022, following the FTX collapse, leading some to worry that Grayscale might not have all the Bitcoins it claimed to be holding in the trust.b

But critically, people can't redeem their GBTC shares for the equivalent quantity of BTC, nor do they seem to think that it's likely that it will become possible to do so anytime soon.

GBTC redemptions

One might expect that a system that allows people to put Bitcoins into a pile in exchange for some GBTC might also have a mechanism in which people could go the other direction: redeem GBTC for BTC. Going back to the stablecoin example, asset-backed stablecoins tend to have a mechanism in which at least some holders can go to the issuer and redeem their stablecoins for the underlying asset, which itself helps the coin maintain its peg.c

However, this mechanism does not exist for GBTC, which has been likened to a sort of crypto Hotel California by Amy Castor (and others). Once the Bitcoins go in, they can't leave. The only way to get out of holding GBTC is to sell on the secondary market, at the mercy of the GBTC discount. If someone bought GBTC on the secondary market to begin with, this might be fine with them, as they were likely just trying to get exposure to Bitcoin volatility, and their cost basis was lower. But those investors who obtained GBTC by giving Grayscale Bitcoins anytime after September 2020 or so (six months before GBTC began trading at a discount), or who were still holding GBTC obtained from giving Grayscale Bitcoins before then, were potentially taking a huge loss.

GBTC did briefly allow redemptions very early on, but they had a run-in with the SEC with respect to Regulation M, a rule that disallows them from offering redemptions within the lock-up period. Grayscale decided to stop offering redemptions at all in 2014, ultimately formalizing it as a part of the trust agreement. Some believe this was an overstep by Grayscale, and that the SEC would allow redemptions so long as they happened outside of their six month lock-up period.d Regardless of whether it contributed to their decision to disallow redemptions, it's an undeniable fact that not having a redemption mechanism was very lucrative for Grayscale until 2021 because it allowed the premium to remain in place.

Grayscale has since sought permission from the SEC to convert GBTC into a Bitcoin spot ETF (exchange-traded fund). An ETF differs from the current trust model in a number of ways, including that there would be a mechanism to redeem GBTC shares back to Bitcoin, which would thus introduce market incentives to keep GBTC trading much more closely to its NAV.

In June 2022, the SEC denied Grayscale's request to convert GBTC into an ETF. They have also rejected various other applications by different companies to approve Bitcoin spot ETFs.e The SEC's rejections are based in concerns regarding market manipulation, fraud, and lack of federal oversight. Grayscale immediately sued the SEC, and oral arguments were recently scheduled for March.2

If people were confident that Grayscale would prevail against the SEC sometime soon, we might have seen the GBTC discount reduce, as people would seek to buy the discounted GBTC in hopes of it returning to trade at around NAV once the ETF conversion was complete. That hasn't happened.

GBTC's role in the crypto collapse

As it turns out, this GBTC arbitrage played a huge role in the disaster of a year that the crypto industry just had.

Remember all those firms offering unbelievable (no, literally, unbelievable) interest rates for doing nothing other than holding your crypto?f 7.4% APY from Gemini Earn. 7.5% from BlockFi. You can thank GBTC for a lot of that. Much of the business model of some of these interest-earning accounts involved taking customer funds, funneling them into Grayscale, giving part of the return to customers, and pocketing the rest. As long as the free money machine was operational, it worked pretty well. But Gemini's CEOs are now yelling at Barry Silbert to try to get somewhere between $785 million (according to Genesis) and $900 million (according to Gemini) back from Genesis, which doesn't have the money, and is undergoing bankruptcy proceedings. BlockFi is undergoing bankruptcy proceedings of its own. People who had money in either program can't withdraw, and are looking at lengthy bankruptcy processes before learning what fraction of money they might see again. BlockFi bankruptcy claims are trading at 24 cents on the dollar; Gemini (via Genesis) claims are looking a little better at a whopping 35 cents.

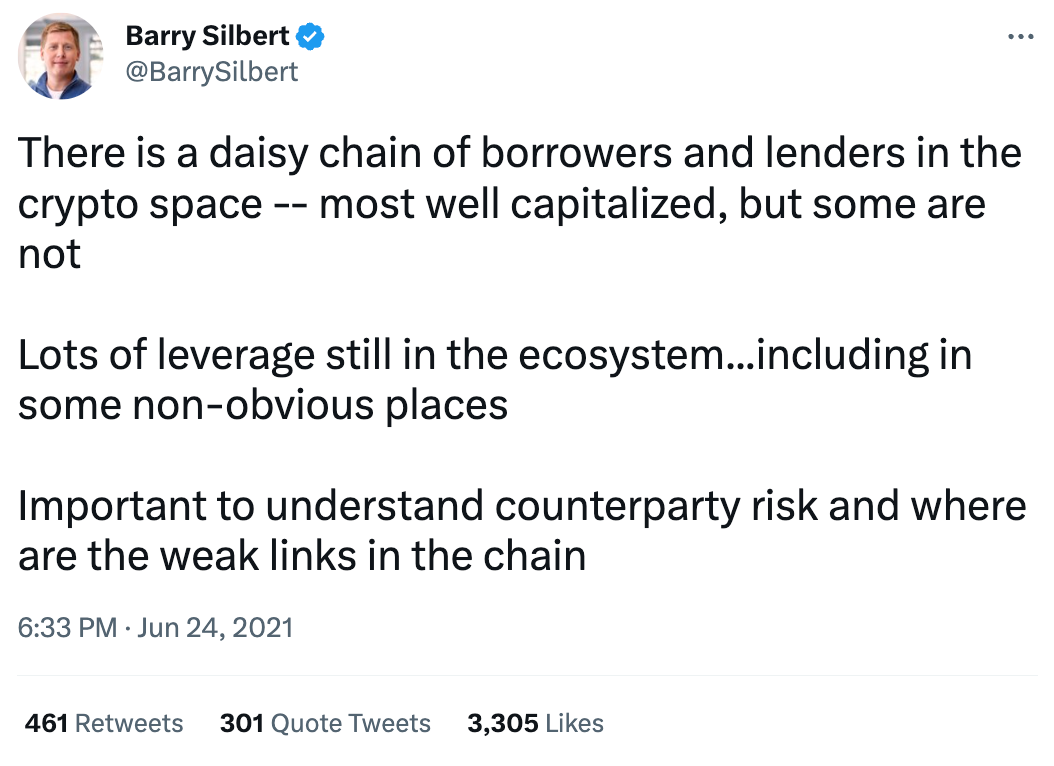

Remember Three Arrows Capital, the crypto hedge fund that blew up in June? We knew from the getgo that they had massive exposure to Terra/Luna, a stablecoin that collapsed in May. But Three Arrows Capital had also taken out loans to shovel billions of dollars3 into GBTC. The six month GBTC lockup period meant they had to bet that the premium would still be there six months after they traded the BTC for GBTC. At the end of 2020, Three Arrows had $1 billion in GBTC, making them GBTC's largest holder.4 By March 2021, GBTC had slipped into trading at a discount. Three Arrows Capital was able to stay afloat for a while longer, taking out yet more loans from just about everyone who offered them and hoping that the market would miraculously rebound. But in June 2022, Terra/Luna dealt them a death blow, and with 3AC's collapse the crypto industry's spiral was well underway.

Stepping back a moment: who loaned money to Three Arrows Capital to perform the GBTC arbitrage? Genesis, also a subsidiary of DCG like Grayscale, just so happened to be the largest crypto lender in the business. Three Arrows Capital borrowed Bitcoins from Genesis, which they then gave to Genesis' sibling company Grayscale in exchange for GBTC.

When the trade was unprofitable, Three Arrows was doubly screwed. And so were all the firms with exposure to Three Arrows Capital (such as Voyager and BlockFi—the latter of which was also performing the GBTC arb, and which came in second to 3AC as the largest GBTC holder as of Q4 2021), and then so were the firms with exposure to them, and now here we are.

Though in the good times DCG made out handsomely from servicing all sides of the trade, with its subsidiary Genesis taking fees on the loan side and Grayscale on the GBTC side, the decision ultimately came back to bite them. When Three Arrows Capital was ordered to liquidate, Genesis revealed what they first characterized as "hundreds of millions" of dollars in losses, but which was later revealed to be more like $1.2 billion.5 I guess 1200 million is technically "hundreds of millions"…

Not only that, but DCG was the third-largest holder of GBTC as of Q4 2021, after a March 2021–June 2022 buying spree in which they purchased $800 million worth of GBTC in hopes of narrowing the discount. They are heavily exposed to GBTC, owning roughly 10% of its supply.

My palms are sweating, and I don't even like Barry Silbert.

Now what?

The big question now is: what happens next?

Genesis has filed for Chapter 11 bankruptcy protection. It seems that they're hoping to simply jettison the entities that are deeply in debt (to the tune of at least $3.5 billion), while the rest of the business continues merrily on, something that seems deeply unjust but I assume is somehow permissible in bankruptcy.g I hope to be proven wrong.

It remains to be seen what impact a Genesis bankruptcy will have on its parent company DCG, particularly given the substantial promissory note from DCG to Genesis, and the apparent requirement that DCG pay back a $350 million loan in the event of a Genesis bankruptcy.6 DCG seems to be hoping to firewall themselves from the sinking Genesis ship, but Genesis may not go down without a fight. Gemini certainly won't, and the river twins have made several threats to sue Barry Silbert and DCG to try to recoup Gemini Earn customer funds.

As for the likelihood that something like this could happen again, well, I don't think the industry has a strong record of learning from its mistakes.

Further reading

If you want to learn more about the saga of the Grayscale Bitcoin Trust, I would recommend:

- "The 'Widowmaker' Crypto Trade That Helped Blow Up an Industry". Odd Lots. Bloomberg. (Podcast)

- "Welcome to Grayscale's Hotel California". Amy Castor.

Footnotes

This sounds silly, but we are talking about an industry in which a substantial number of projects were built around the idea that prices would continue to go up forever, and which had no plan for if that turned out not to be the case. ↩

Personally, I would guess they do actually have the Bitcoins, but there is an element of "just trust me bro" here that understandably makes people hesitant to give them money. ↩

This mechanism is far from perfect with some stablecoins, such as Tether, but that is a subject for some other post. ↩

Fir Tree Capital alleged in a lawsuit filed in December 2022 that Grayscale's choice to disallow redemptions is "self-imposed" and not based on any legal concern. "Hedge Fund Sues Grayscale for Data on Battered Bitcoin Trust". Bloomberg. ↩

There are several Bitcoin futures ETFs out there, which are a different beast (at least according to the SEC). These futures ETFs, the first of which was launched in October 2021, have likely contributed to the widening GBTC discount as they became some of the first instruments to compete with GBTC as a regulated path to gaining Bitcoin exposure via traditional finance. ↩

The average interest rate for a traditional savings account as of January 2023 was 0.33%. FDIC. ↩

I am not a bankruptcy lawyer, but I have watched a lot of them on

TVZoom. I don't know much about law and I really don't know much about bankruptcy law, so, grain of salt. I'm doing my best. ↩

References

"Grayscale's Bitcoin Investors Have Trust Issues". Bloomberg. ↩

"Court sets date for oral arguments in Grayscale's challenge of SEC's bitcoin ETF decision". CNBC. ↩

"Three Arrows Capital Founders Say Terra, GBTC Trades Led to Fund Blowup: Report". CoinDesk. ↩

"How Three Arrows Capital Blew Up and Set Off a Crypto Contagion". Bloomberg. ↩

"Genesis Files $1.2B Claim Against Three Arrows Capital". CoinDesk. ↩

"Genesis failure would land owner with $350mn payout to financier Todd Boehly". Financial Times. ↩