Issue 13 – Don't threaten me with a good time

Sam Bankman-Fried tells me he doesn't think he'll be arrested several hours before he is arrested. Also, Decentraland introduces landlords.

"I don't believe I would be [arrested if I entered the US], but I haven't done a deep dive into that. At some point that's something I have to think harder about," Sam Bankman-Fried told me yesterday morning, hours before he was arrested.

I didn't expect to find myself interviewing SBF, but when a DM landed in my inbox extending an invitation to do so, I figured "why not?" God knows I have questions.

I had the opportunity to ask him:

- Is the incessant clicking sound in the background of all these Twitter interviews you playing video games? (Yes, it is)

- Why aren't you planning to appear in person at the U.S. House Financial Services Committee hearing tomorrow? (It's important for him to be in the Bahamas for some unclear reason, and he's "quite overbooked")

- Are you worried you would be detained if you stepped foot in the U.S.? (see the quote above)

- Are you planning to appear at the Senate Banking Committee hearing on December 14? (No)

- FTX claimed Bahamian regulators told them to re-enable withdrawals for Bahamian customers, but those regulators later said they had made no such instruction. Are you lying, or are they? (Circuitous answer in which he claimed neither group was lying, but that two events were being conflated—I unfortunately did not have time to follow up on this one)

Here is the full interview, timestamped to my portion, which lasts for around five minutes:

If you watch it, I would highly recommend pulling out a copy of my SBF interview bingo card:

My conversation became quite amusing in hindsight when news came out that Sam Bankman-Fried had been arrested by Bahamian Police, after they received notification that United States authorities had filed criminal charges against him, and were likely to request extradition. [W3IGG]

This announcement came on the same day that the Australian Financial Review reported that FTX executives had been a part of a Signal chat room called "Wirefraud". Now, I'm no lawyer, but if you're going to do crimes, maybe don't document them in a group chat helpfully labeled with the name of the crime you are committing.

The charges are courtesy of the Southern District of New York, who subsequently announced they intend to move to unseal the charges this morning. The New York Times reported yesterday that the charges will include wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy and money laundering—the standard buffet of charges in crypto crime cases. The NYT also reported that SBF is the only person named in the indictment.

The SEC followed up by announcing that they also plan to file more charges today, relating to (unsurprisingly) securities law violations.

I will admit I am a little bit disappointed that we won't get to watch SBF testify at today's House Committee meeting, though I also doubt it would have amounted to much. I'm curious about the timing—it seems like prosecutors might wait an extra day for the chance to see what he said under oath in front of Congress—but who knows what information they have that we don't. Or maybe they just thought the risk of him wandering off to some non-extradition country outweighed the likelihood he would say something useful.

New FTX CEO John J. Ray III submitted his testimony, which was published online yesterday in advance the hearing. I did a quick thread to highlight the key parts.

Needless to say, I will be closely following both the House and Senate hearings. If you don't already follow me on Twitter or Mastodon, and would like to catch a live feed of what happens in the hearings (with some shitposting, you know me…), now's a good time to follow me at @molly0xfff and/or @molly0xfff@hachyderm.io. I'll also compile my thoughts into a more coherent format after the fact, and send out a special edition or two of the newsletter to give you all the rundown!

Speaking of hearings, I will be participating as an expert at a hearing on "Web 3.0 and the Metaverse" held on December 14 by the German Bundestag (parliament). I'll be in good company, appearing alongside Jürgen Geuter (perhaps better known as tante), Dr. Malte Engeler, Dr. Elizabeth Renieris, and Lilith Wittmann. Tante's excellent essay on "The Third Web" was among the earlier writings I discovered when beginning my research into web3, and I highly recommend it.

My statement and answers to a prepared list of questions are available for reading ahead of time (as are those of the other experts), and the hearing will be livestreamed. Much of it will be in German, though, and I am not sure how much will be translated to English.

In the courts

Last week I listed the four separate bankruptcy cases I'm currently following, but I didn't mention the other interesting crypto litigation I've been keeping an eye on. Among those cases are:

- Yuga Labs, Inc. v. Ripps, a trademark infringement lawsuit in which the company behind Bored Apes is suing an artist who copied the Bored Ape NFTs in what he describes as a project to raise awareness around his accusations that Bored Apes have racist origins

- Coin Center v. Yellen, a challenge against the Treasury Department's sanction of the Tornado Cash cryptocurrency tumbler

- Joseph Van Loon v. Department of the Treasury, a different challenge against the Tornado Cash sanction

- Commodity Futures Trading Commission v. Ooki DAO, a first-of-its-kind lawsuit by the CFTC against a DAO

Added to the list this week is Adonis Real v. Yuga Labs, Inc., a class-action lawsuit against the Bored Apes crew and a long list of celebrities (including Jimmy Fallon, Justin Bieber, and Gwyneth Paltrow) alleging undisclosed paid NFT promotions. [W3IGG]

Removed from the list is a class action lawsuit against Kim Kardashian and Floyd Mayweather over their promotion of the EthereumMAX token. The SEC recently levied a fine against Kardashian for that same promotion, but a California judge has just tossed out a class action suit originally filed in January. The judge stated that "while the law certainly places limits on those advertisers, it also expects investors to act reasonably before basing their bets on the zeitgeist of the moment".1

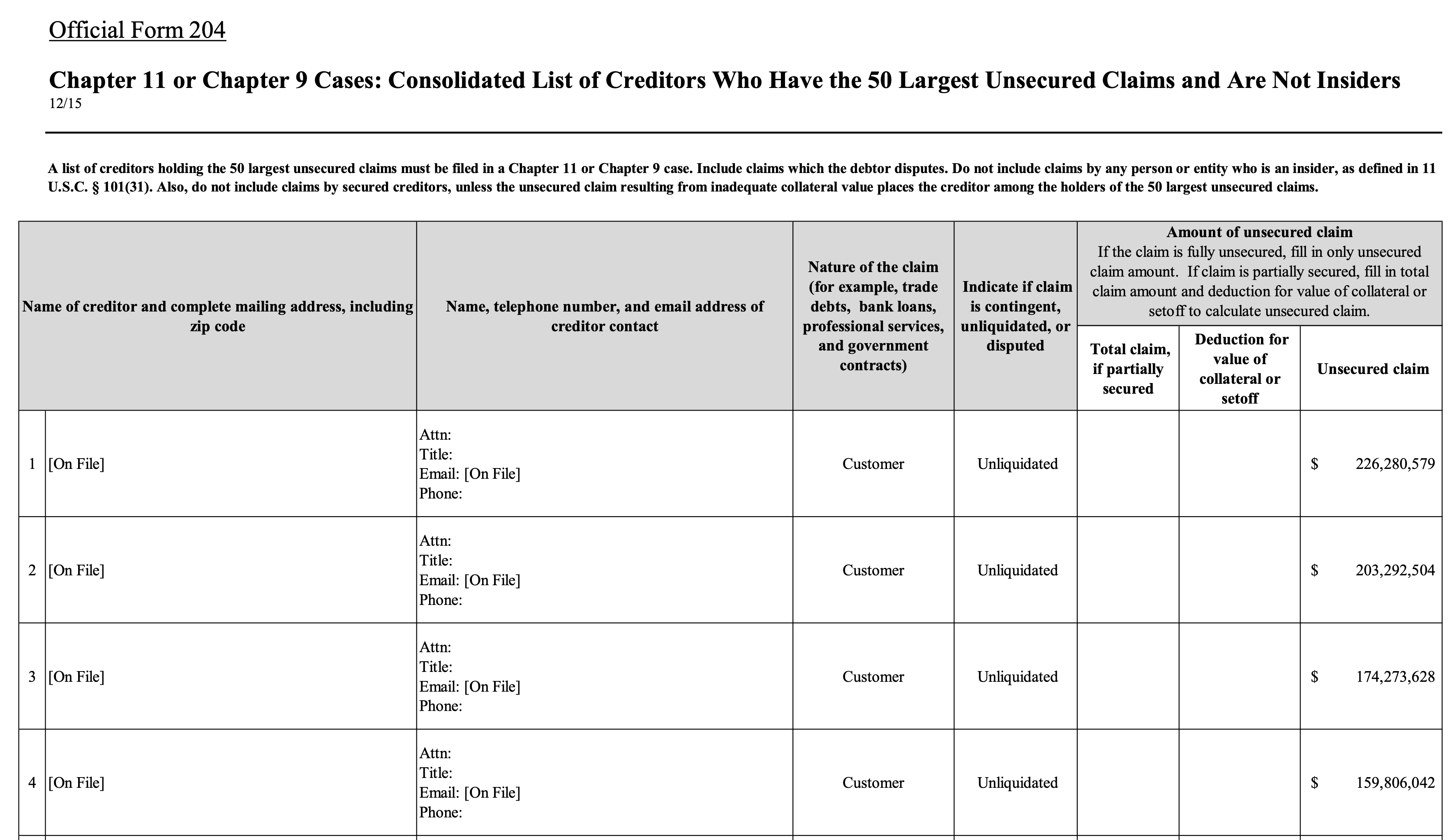

Meanwhile, in FTX bankruptcy-land: Bloomberg, the New York Times, the Financial Times, and Dow Jones & Company (a publisher of media including The Wall Street Journal, Barron's, and various others) filed a group motion to intervene for the purposes of opposing FTX's request to redact customer data in filings. So far, FTX has been allowed on an interim basis to keep private all customer information besides balance amounts, leaving the public with a lot of documents that look like this:

The media outlets' objection means there will now be a discussion of whether FTX is allowed to redact customer data, and if so, what data can be redacted and for which customers.

This same question came up in the Celsius bankruptcy, where customer names were ultimately revealed, including those of individual, small customers. Those filings also revealed transaction details that have allowed sleuths to connect some creditors to their wallet addresses.

I am hopeful that the court finds a suitable middle ground between two extremes: the current status quo where no information has been revealed, even on institutional clients where there really ought to be transparency, and the other extreme where a lot of data (potentially including physical, email, and/or wallet addresses) is revealed on all customers including individual, low-usage and small-figure creditors.

The Web3 is Going Just Great recap

There were 11 new entries between December 6 and December 12, averaging 1.6 posts a day.

Don't threaten me with a good time

[link]

The U.S. Department of Justice is reportedly considering filing criminal charges against Binance executives, including CEO Changpeng "CZ" Zhao. According to Reuters, there is a rift between prosecutors who think the DoJ should charge them now, and those who want to sift through more evidence first. This is all part of a four-year-long investigation into Binance and allegations of money laundering and sanctions evasion, on which Reuters has been doing substantial reporting.

To me, the most interesting part of this report was where Binance defense attorneys have allegedly argued that, among other things, "a criminal prosecution would wreak havoc on a crypto market already in a prolonged downturn".

All my apes 404ed

[link]

Following the collapse of FTX, the entire FTX.us domain has been set up to redirect to a page providing visitors with information about the bankruptcy case. Unfortunately for holders of FTX-hosted NFTs, this means that their NFTs no longer work. [sad trombone]

Assets were being accessed via an API on that domain, and so now NFTs no longer show their associated image assets. Other NFT platforms that build directly on FTX's API (such as the Coachella NFT platform) no longer work, appearing as if there are 0 NFTs in the collection.

Decentraland adds that one feature we've all been waiting for: landlords

[link]

The market for land in the Decentraland metaverse may not be what it used to be, but somehow it still requires people to spend a minimum of $1,500 to acquire even the least coveted plots of "land". Now, though, people have another option: renting from metaverse landlords.

People could make anything in this great web of ours, with its limitless virtual worlds, and yet they decided to recreate… landlords.

In my research, I also discovered that metaverse mortgages are a thing that exists. This leads me to believe that, with enough effort, we could engineer a metaverse subprime mortgage crisis.

Everything else

- Sam Bankman-Fried arrested [link]

- Argo Blockchain faces possible bankruptcy [link]

- Lodestar Finance attacked and drained of nearly $7 million in assets [link]

- CEO of crypto media outlet The Block resigns after it's revealed he took tens of millions in loans from Sam Bankman-Fried [link]

- Class action lawsuit against Jimmy Fallon, Paris Hilton, Justin Bieber, Gwyneth Paltrow, and others accuses them of undisclosed NFT promotions [link]

- Former Love Island Australia contestant Vanessa Sierra rug pulls her NFT project [link]

- Digital Surge enters administration [link]

- Koinly lays off 14% of staff [link]

In the news

CoinDesk had me on their show to talk about crypto skepticism, name some of my favorite fellow skeptics, and sneak in a plea that people not buy in to the story now being peddled by the crypto industry that FTX was an anomaly rather than completely representative.

Jordan Pearson and Edward Ongweso Jr. apparently found this as amusing as I did. They also win "headline of the week" for this one.

Worth a read

When studies published in the past few years showed that Black Americans were adopting crypto even more than their white counterparts, many in the crypto community celebrated this as evidence that crypto was not just a white boys' club, and that it was benefiting communities of color. Now, the Atlantic reports: "[S]urveys show that Black investors got into crypto with gusto, but late…. Because Black investors piled into the crypto market at or near its most recent top, many of those investors are now in the red."

That's all for now, folks. Until next time,

– Molly