Issue 16 – Bahamian brouhaha

Also featuring stablecoin salaries, Bitcoin burglaries, and rug-pull rationalizations.

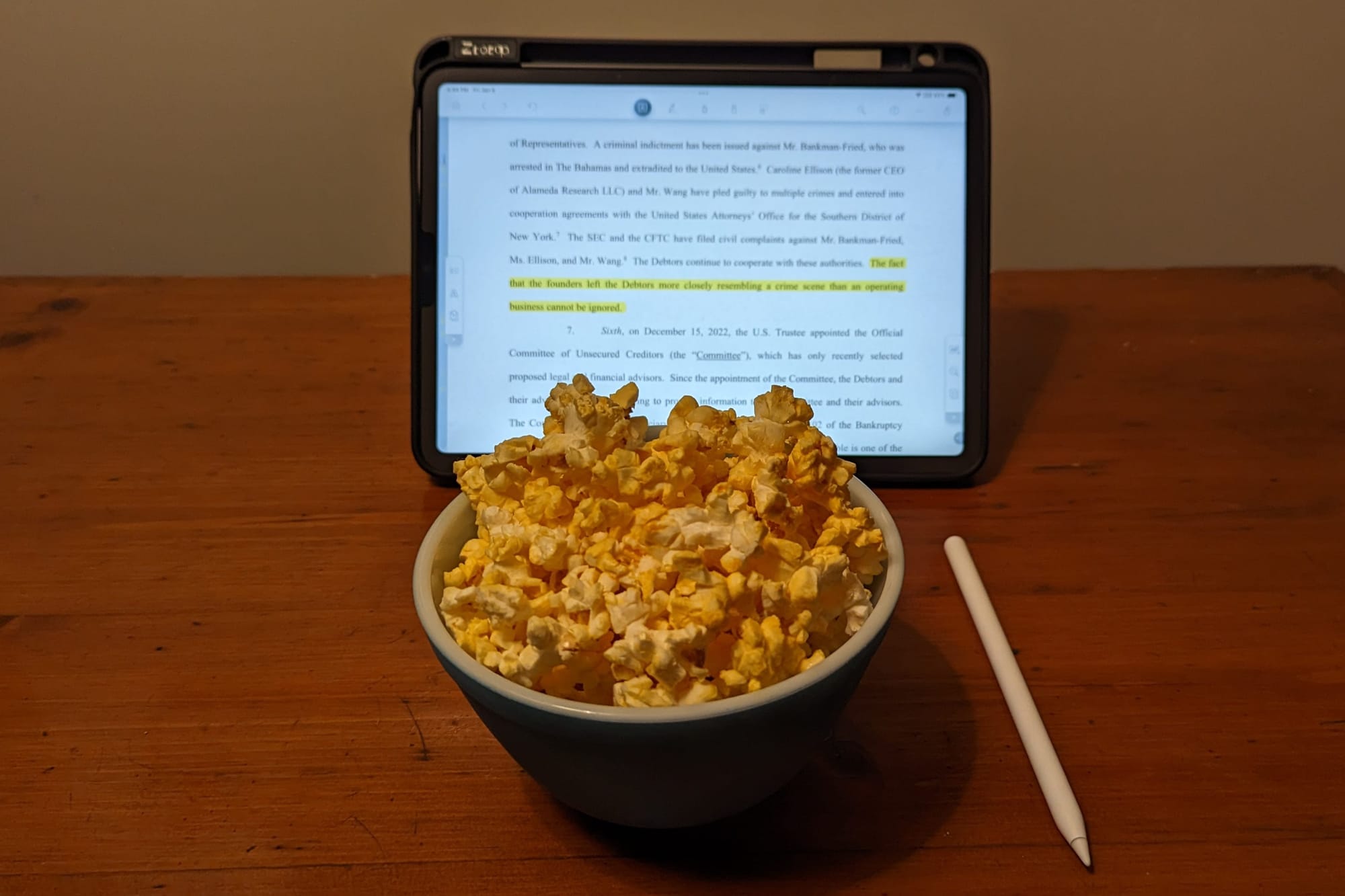

Legal filings have been flying in the various bankruptcy cases, and my stack of novels is going neglected as I turn to CourtListener for my page-turners.

There's still fourteen hours left in the New Year's newsletter special offer, so if you were thinking of picking up a subscription (or gifting one to a friend), you haven't missed your chance to get 20% off for the whole year! Paid subscribers get to join me in the comments section for a chat about each issue.

FTX

There's been a battle between the US and Bahamian FTX bankruptcy proceedings, and tensions between the Joint Provisional Liquidators (JPLs) in the Bahamas and John J. Ray III's legal team handling the US bankruptcy reached an all-time high this week—before abruptly being resolved today.

To give a quick overview: on November 10, Bahamian officials appointed provisional liquidators to oversee the liquidation of FTX Digital Markets when it became clear that FTX was actively in flames. On November 11, newly-appointed FTX CEO John J. Ray III submitted US bankruptcy filings for around 130 companies under the FTX umbrella. FTX Digital Markets was not one of them.

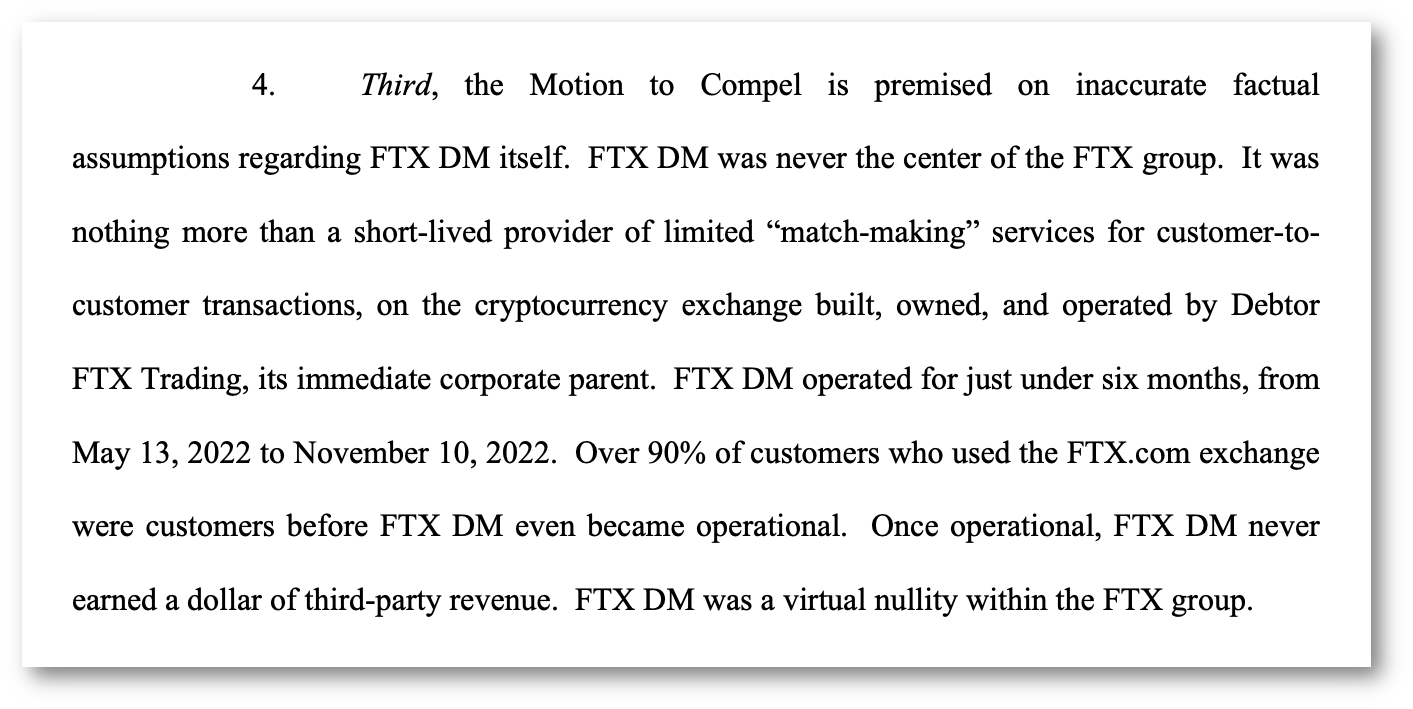

Ray's team maintains that the Bahamas-based FTX Digital Markets entity (FTX DM) is small potatoes, whereas the JPLs argue it is central to FTX's operation.

The JPLs also argue that The Bahamas beat the US to the punch in terms of legal proceedings, and so should be treated as the primary bankruptcy proceeding. They've alleged that some actions by the US restructuring team have violated stays put in place by Bahamian courts and made it difficult for the JPLs to do their jobs.

One major point of dispute are FTX assets that were seized on November 11 and 12 by the Securities Commission of the Bahamas (SCB), with the help of Sam Bankman-Fried and Gary Wang. The US team estimates these assets to be valued at under $167 million "if sold at today's spot price, and there may be no buyer for large amounts of FTT at anything near spot price". The SCB, however, issued a press release on December 29 boasting that they had seized assets "valued at more than US$3.5 billion" (emphasis added). The US team is concerned either that the SCB has vastly overestimated the value of the assets they hold (which they believe are primarily FTT tokens), or that there's an "even more troubling" possibility that the SCB took more of FTX's crypto assets than they've disclosed. They also don't believe the assets belong specifically to FTX DM, and that they should be a part of the US bankruptcy estate.

The US team cut off the JPLs' access to FTX systems as the Bahamian seizures were ongoing in November, and have not restored it. The JPLs demanded they immediately be restored access to the system, and all of it — not just the bits pertaining to FTX DM. They also wanted dynamic access to the system, which deeply concerned the US team, although the JPLs later said they would be satisfied with cloned copies of the data (which the US team still didn't want to provide).

Filings and statements by both parties devolved into the… well, catty. The SCB issued several press releases saying things like "[statements by Ray's team] do not appear to be concerned with facts but rather, appear intended only to make headlines and advance questionable agendas".1 The Bahamian Attorney General claimed in a national address that "it is possible that the prospect of multi-million dollar legal and consultancy fees is driving both their legal strategy and their intemperate statements".2 Meanwhile, the US team said the SCB "feels insulted because it has been questioned while sitting imperiously in the Bahamas", and "whether the JPLs are complicit or just complaisant" with the SCB's "raid on the estate" is "unimportant".3

All of this was coming together to form what I expected to be quite the hearing next week, until a joint press release was sent on January 6 to say that the US team and the Bahamian JPLs had come to an agreement on how to cooperate and share information, as well as on a few matters involving untangling some real estate holdings and such.4 This is almost certainly good news for FTX customers who need the lawyers to put away their egos and try to come to the quickest and best resolution possible, but perhaps is less good for whoever's working on the Netflix adaptation and was gearing up to write the courtroom showdown scene. I, at least, have my novels to fall back on.

The Robinhood shares

Another recent focus has been the issue of around 55.2 million shares of Robinhood stock in a brokerage account that was at least nominally owned by "Emergent Fidelity Technologies", one of the 100+ companies under the broad FTX umbrella. The shares, which amount to a ~7.5% share in Robinhood, are valued at around $450 million at recent prices. They were worth even more—something like $663 million—prior to November's events, but took a tumble during and after the collapse.

All kinds of people think they own these shares. John J. Ray III has argued that the shares were "held only nominally by Emergent" and actually belong to the debtors' estate.5 BlockFi (also undergoing bankruptcy proceedings) has argued that they own the shares, because SBF & co. signed them over to BlockFi during the FTX collapse in some sort of last-ditch effort to keep BlockFi from recalling more than $600 million in loans.6 Meanwhile, an FTX customer named Yonatan Ben Shimon is arguing in Antiguan court that he's entitled to almost $11 million worth of these assets because he deposited 3,000 ETH in FTX. Shimon is conveniently using the ETH price at the time of his deposit in October 2021 to calculate what he's owed, rather than today's prices, likely because today's prices put the value of his 3,000 ETH closer to $3.8 million. Sam Bankman-Fried joined that legal proceeding, arguing that he should be given control over Emergent and its assets.7 Sam Bankman-Fried also filed an objection in the US bankruptcy case, arguing against Ray and the debtors' claim to the shares, but also arguing that even though the shares were signed over to BlockFi, he needs them to pay for his criminal defense lawyers.8 Let's just say that that particular portion of the argument has not gone over well on Twitter:

All of this is probably moot, though, because the Department of Justice revealed in a January 4 hearing that they had seized the Robinhood shares, along with $20.75 million USD held in the brokerage account. Elaborating in a January 6 BlockFi filing, they wrote that they had acted "because the Seized Assets constitute property involved in violations of [money laundering and wire fraud laws], or property traceable thereto".9 That's that, I guess—the decision is no longer in the hands of Judge Dorsey and the Delaware bankruptcy court (or Antiguan courts, for that matter).

Elsewhere in the courts

Celsius

Chief Judge Martin Glenn entered an opinion on the hotly-contested issue of assets in Earn accounts belonging to Celsius customers. As a refresher, Earn accounts were the yield-bearing accounts on the Celsius platform that were supposed to have been made unavailable to non-accredited investors in the US in April 2022. [W3IGG].

Celsius also offered "Custody" and "Withhold" accounts, which did not accrue interest. The judge had previously ordered that crypto in non-interest-bearing accounts belonged to the customers.

Judge Glenn has now ruled that the substantially larger amount of assets in the Earn accounts are property of the Celsius bankruptcy estate, rather than property of the creditors. This was upsetting news to many Celsius Earn account holders who hoped that they might see those assets returned to them soon, and who now seem very worried that all of their money will go towards lawyer fees.

Also in Celsius news, the New York Attorney General filed a civil lawsuit against Celsius CEO Alex Mashinsky, alleging he defrauded investors through his Celsius business. She seeks to bar him from working in the securities industry or as an executive in the state, and also requests disgorgement, damages, and restitution. [W3IGG]

Avraham Eisenberg

Avraham Eisenberg, who was charged with fraud in late December [W3IGG] for his "highly profitable trading strategy" (his words) or "scheme to steal approximately $110 million" (FBI Special Agent Brandon Racz's words), will be detained pending trial. His likely access to up to $40 million in stolen funds that have not yet been accounted for, dual citizenship, and large potential sentence were combined with the fact that he left the US for two months following the theft to make the Magistrate Judge decide he's probably a flight risk. Either that, or it's because he doesn't have Stanford lawyer parents and multimillionaire friends available to be suretors. Who's to say.10

The Web3 is Going Just Great recap

There were 17 entries between December 30 and January 5, averaging 2.4 posts per day. In fact, there were no entries on December 30 or 31, bringing the January average to 3.4 posts a day. Busy!

"What the heck, FBI?"

[link]

If one of the original Bitcoin core developers, self-custodying his assets in various wallets (including several he at least believed were cold wallets), can't keep his cryptocurrencies safe, how can anyone be expected to?

Luke Dashjr claimed that essentially all of his Bitcoins — around 205 of them (~$3.5 million) — were taken. The details around the theft were a little vague, with Dashjr originally saying he thought a PGP key had been compromised, but later saying he believed that may have just been a component of a larger attack.

Dashjr appealed to the FBI for help. So much for money outside control of the state, I guess.

But Your Honor, they were mean to me

[link]

Aurelien Michel, the creator and rug-puller behind the "Mutant Ape Planet" NFT project, made off with $2.9 million in funds that he'd originally promised would go towards a long list of roadmap items including community raffles, merchandise, a project crypto token with staking features, and metaverse land acquisition.

Never of this came to be. When confronted, Michel explained that he "never intended to rug but the community went way too toxic".

This apparently didn't convince the Department of Justice to let him go, because he was arrested at JFK airport and charged with fraud.

The Winklevii pass the buck

[link]

Cameron and Tyler Winklevoss, the twin brothers who run the Gemini crypto platform, wrote an incensed letter to DCG CEO Barry Silbert demanding back the $900 million that customers gave Gemini, who gave it to Genesis, which is a subsidiary of DCG.

Genesis and DCG and Barry Silbert certainly have much to answer for, and seem to be deeply in the hole. However, Cameron Winklevoss's letter came off as remarkably tone-deaf, completely dodging any self-reflection on the responsibility that he and his company had for ensuring the safety of user assets or doing due diligence on their partners.

David Gerard put it more succinctly:

Ed Zitron went ahead and wrote the deep dive that I only got as far as considering writing, and he did a great job:

Everything else

- Huobi performs 20% layoff, reportedly requires employees to take salary in stablecoins [link]

- Genesis lays off another 30% of staff [link]

- Silvergate bank takes $718 million loss liquidating debt during FTX collapse [link]

- New York Attorney General sues Celsius CEO Alex Mashinksy for defrauding investors [link]

- Sports company Fanatics jettisons its majority stake in NFT company Candy Digital [link]

- Logan Paul threatens to sue CoffeeZilla for exposing his (alleged) grift [link]

- NFTs reportedly stolen from influencer CryptoNovo, flipped for at least $525,000 [link]

- Coinbase settles with New York regulators, set to pay $100 million [link]

- Fake NFTs listed under verified collections on Magic Eden marketplace [link]

- Crypto payments platform Wyre to shut down or "scale back" [link]

- Hackers steal $3.2 million from GMX whale [link]

- Users of several NFT marketplaces see porn, Big Bang Theory stills appearing instead of their NFT images [link]

- Streamer and crypto founder DNP3 admits to gambling with investor funds [link]

- Hacker drains the wallet of the RTFKT crypto project's COO [link]

In the news

This week, there has been a lot of talk about "citizen journalists" and the coverage of the FTX collapse. Taylor Lorenz kicked things off with a Washington Post article titled "Influencers outshine traditional media on coverage of FTX implosion" (a funny title to see in traditional media). Jeff John Roberts in Fortune had some bones to pick with her piece, writing that "contra Lorenz, influencers have not 'outshined' more conventional outlets, and, more broadly, it's not a zero-sum game" — which I broadly agree with.a

Slate did an article on the same topic titled "The Only People Having Any Fun in Crypto Right Now", which extensively quotes Crypto Critics Corner's (and Protos's) Cas Piancey. It also extensively quotes editors-in-chief of Cointelegraph and Decrypt, who both seem to think a bit more highly of their own outlets than I think is perhaps deserved.

Both editors in chief … dismissed independent bloggers and critics whom they perceive as having come to prominence simply by villainizing the entire space. "Citizen journalists replacing real, trained outlets is very silly," said Roberts. "People should trust established outlets," by which he means sites like Decrypt.

I agree that "citizen journalists" replacing trained journalists at established outlets is not likely (nor do I think anyone's suggested it is), but disagree that people should a) blindly trust established outlets or b) blindly trust crypto industry outlets that have published some real stinkers.

(Not mentioned in the tweet, but that screenshot is from Decrypt).

To their credit, both publications have published good work too, and I regularly use both when referencing my work—but with a large grain of salt, and usually only after I've corroborated their claims in multiple sources. When it comes to the plain facts, both Cointelegraph and Decrypt are both reasonably accurate, but I spot errors with some frequency. They're also prone to shameless boosterism—Cointelegraph's recent titles include "Bitcoin price would surge past $600K if 'hardest asset' matches gold" and "Ethereum's Shanghai upgrade could supercharge liquid staking derivatives — Here's how".

Worth a read

Levine seems to be detouring into the crypto beat more often lately, and I always enjoy it when he does. He covers a crypto scam that promised people 56,000,000% returns… and a car.

Matt Ford published an enormously crypto-critical piece that also left me wanting to go play some EverQuest.

That's all for now, folks. Until next time,

– Molly White

Footnotes

If you're seeing Fortune's obnoxious text-blurring paywall, stick this in your browser console:

document.querySelector('.paywallActive').classList.remove('paywallActive')↩

References

"Securities Commission of The Bahamas Addresses Misstatements In FTX's U.S. Bankruptcy Case" (press release) ↩

"National Address with respect to the FTX Collapse" - Sen. The Hon. Ryan Pinder KC, Attorney General (event occurs at 15:15) ↩

Debtors' Objection to Emergency Motion (I) for Relief From Automatic Stay and (II) to Compel Turnover of Electronic Records (Document 335, In re FTX Trading Ltd.) ↩

"FTX Debtors and FTX DM (Bahamas) Announce Cooperation Agreement" (press release) ↩

Motion to Enforce the Automatic Stay (Document 291, In re FTX Trading Ltd.) ↩

BlockFi's Objection to the Debtors' Motion to Enforce the Automatic Stay (Document 378, In re FTX Trading Ltd.) ↩

Declaration of Brian D. Glueckstein in Support of Motion to Enforce the Automatic Stay (Document 292, Exhibits N and S, In re FTX Trading Ltd.) ↩

Sam Bankman-Fried's Objection to the Debtors' Motion to Enforce the Automatic Stay (Document 387, In re FTX Trading Ltd.) ↩

United States' Notice of Asset Seizures (Document 203, In re BlockFi Inc.) ↩

Order of Detention Pending Trial (Document 8, United States v. Eisenberg) ↩