Issue 18 – Chief Ponzi Officer

If you're in the ponzi business, maybe don't quip to your colleagues in writing that you should be retitled "Ponzi Consultant". Also, a16z-backed rugpulls, Tesla buys high and sells low.

FTX

The bankruptcy

Subpoenas

FTX's new management overseeing the bankruptcy wants permission to subpoena Sam Bankman-Fried, various former executives of FTX or Alameda, and family members of Sam Bankman-Fried. Their questions give us some insight into what leads they're following, so I gave it the special edition treatment yesterday.

Creditor list

FTX also filed a 116-page list of institutional creditors, which is not terribly meaningful, but it's fun to skim through to find bizarre entries like Barstool Sports and Bodybuilding.com. Some saw the multiple entries for "Gensler" and immediately assumed that SEC chairman Gary Gensler is a creditor to FTX for some nefarious reason, without doing a little Googling to find the much more banal information that Gensler is the name of a major office design firm.

However, it's important to remember that the list is a very broad collection of any group to whom FTX might owe money, and not necessarily a list of groups to whom FTX actually does owe money. The groups on the list are also not necessarily customers of FTX that were holding cryptocurrency on the exchange — many of them are just vendors or other service providers.

Independent examiner

The court is tackling the question of whether to appoint an independent examiner. The US Trustee filed a motion on December 1 requesting one be appointed, which was joined by the State of Wisconsin Department of Financial Institutions (joinder) and the Vermont Department of Financial Regulation (joinder). The thrust of the argument is that, while they believe that John J. Ray III and his team are competent and trustworthy, the team's priorities as fiduciaries for the debtors' estates are not necessarily identical to those of a neutral examiner who would be tasked with investigating possible malfeasance leading up to FTX's collapse.

The FTX bankruptcy team and the Committee of Unsecured Creditors both oppose the motion to appoint an independent examiner, arguing that John J. Ray III and team can do a perfectly suitable job, and that an independent examiner would just duplicate their efforts while racking up considerable expenses that would only deplete the remaining resources that could ultimately be distributed to creditors. It's not a bad point — they cite examiner reports for the Enron and Residential Capital bankruptcies, which collectively cost more than $150 million to prepare, although that may be more of an upper bound. The Celsius examiner report, for comparison, is estimated to ultimately cost $6 to $7 million to complete — though Celsius was also a substantially smaller operation than FTX.

There will be a hearing on the subject on February 6, where the decision will presumably be made.

Clawbacks

The FTX debtors are trying to claw back $446 million from the also-bankrupt Voyager, which were loans to Alameda that Voyager recalled when it filed for Chapter 11 in July. [W3IGG] Celsius also tried to claw back $7.7 million from Voyager at one point, but that was denied because they missed a deadline.

As it turns out, there is much less money floating around in the cryptocurrency ecosystem than the huge "market caps" in headlines might make you believe, and now that the house of cards is tumbling down, they're all fighting tooth and nail over it.

The criminal case

Meanwhile, the US Attorney in the criminal case against Sam Bankman-Fried reported that SBF sent emails and Signal messages to FTX US General Counsel Ryne Miller (referenced throughout as "Witness-1"):

Hey [Witness-1], I know it's been a while since we've talked. And I know things have ended up on the wrong foot. I would really love to reconnect and see if there's a way for us to have a constructive relationship, use each other as resources when possible, or at least vet things with each other. I'd love to get on a phone call sometime soon and chat.

SBF's lawyers have tried to argue that SBF was simply being helpful and that this was not, as the US attorney alleges, "an effort to influence Witness-1's potential testimony, and … impl[y] that Witness-1 should align with the defendant". They've added that the Government made "an apparent effort to portray our client in the worst possible light" (gosh!) and accused them of "sandbagging the process" to discuss bond condition modifications.

Judge Kaplan isn't having it, first telling counsel to please cut it out with all of the "pejorative characterizations of the actions and motives of their adversaries". He then wrote that SBF's lawyers' benign characterization of his message to Miller "does not appear, on a preliminary basis, to be a persuasive reading…. it appears to have been an effort to have both the defendant and Witness-1 sing out of the same hymn book." He ordered that SBF may not contact or communicate with any current or former FTX or Alameda employees outside of the presence of counsel, and shall not use any encrypted or ephemeral call or messaging applications like Signal. This is a temporary amendment, pending a hearing next week where it will be argued in more detail.

There's also still the question about the identities of the two non-family parties who put up $200,000 and $500,000 toward securing SBF's release. SBF wanted this kept secret for supposed safety reasons, media outlets argued that SBF doesn't really have a leg to stand on there and that the standard right of the public to transparency ought to apply. The judge has agreed with the media outlets and ruled that the sureties' identities can be revealed, but has stayed the actual release until February 7 to allow SBF and his team time to appeal. I assume they will.

Gemini and Genesis

Genesis had its first day bankruptcy hearing on January 23. It was largely uneventful, though it did foreshadow some potential conflicts coming down the road:

For one, Genesis and Gemini can't seem to agree on the amount of money owed to Gemini Earn customers by Genesis. Gemini claims it's $900 million, Genesis says it's $766 million. Part of this discrepancy may come from the fact that Gemini reportedly liquidated collateral — shares of GBTC (which I explained in detail in a deep dive this week) — the value of which Genesis has subtracted from the claim amount. However, Genesis also "disputes that the foreclosure was done in accordance with applicable law". A bankruptcy attorney speaking to Axios said that Genesis may try to use this to void the remaining claim altogether. Ruh roh.

Genesis also reported that they had "substantial claims against DCG entities" — DCG being Genesis' parent company, Digital Currency Group. DCG may be hoping that Genesis can simply jettison its lending business and make that pesky $1.6 billion in debt go away, but I don't know if Genesis will go down without a fight.

Gemini, meanwhile, is having some legal problems. In addition to scrutiny (and charges) from the SEC (January 2023) and the CFTC (June 2022), Gemini is now also facing an inquiry by the New York state Department of Financial Services into whether Gemini misrepresented to customers that their funds were insured under the FDIC regime. [W3IGG]. Axios, once again, has more. Gemini also laid off 10% of its workforce, amounting to around 100 people. This followed a 7% layoff in July 2022, and a 10% layoff only a month before that. [W3IGG]

Celsius

Speaking of independent examiner reports, the examiner in the Celsius bankruptcy just submitted her final report and it. is. a. doozy. At 689 pages, she certainly turned over some stones.

I'm still reading through it, and I may do a special edition to go into more detail, although I know I've filled your inbox more than usual this week and want to avoid spamming you too much. Feel free to weigh in:

As an aside, if you only want to receive some of the newsletters I blast in your direction (weekly recaps, special editions, or deep dives), you can adjust your subscription preferences accordingly. I believe it defaults you to being subscribed to all.

Anyway, the gist of it that I've gathered so far is that Celsius CEO Alex Mashinsky should be feeling pretty worried. He's already facing a civil lawsuit from the New York Attorney General, but some of the stuff detailed in the examiner's report makes me think he might be looking at criminal fraud charges not unlike Sam Bankman-Fried's.

One particular highlight is where a Celsius employee apparently put in writing that Celsius's habit of using customer funds to buy the CEL token was "very ponzi like", and another quipped that he should be given the title "Ponzi Consultant".

Aaaaahhhh! You can't! You can't send messages like that! If you find yourself messaging your boss to say things like "our business is very Ponzi like" and "we have negative equity so we're using customer funds to buy worthless coins so our founder can cash out," no! Stop! If you have written sentences like that, don't send them to your boss! Print them out and get yourself a lawyer and a whistle-blower deal! My lord. This is not legal advice but what are you even doing?

— Matt Levine

The Web3 is Going Just Great recap

There were 11 entries between January 23 and January 31, averaging 1.2 entries per day.

Rally rugpull leaves fans emptyhanded

[link]

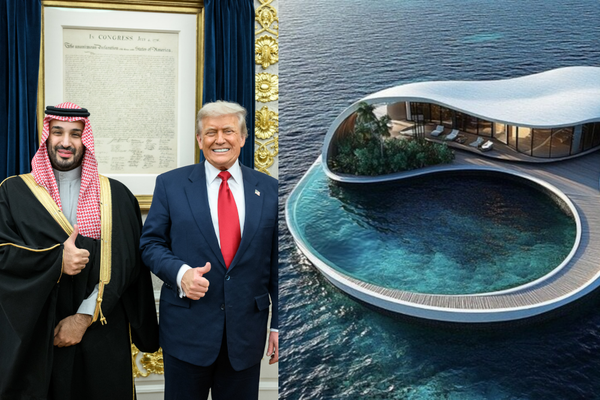

Most rugpulls come from relatively low-profile projects with anonymous founders, but every once in a while we get a big ol' a16z-backed rug.

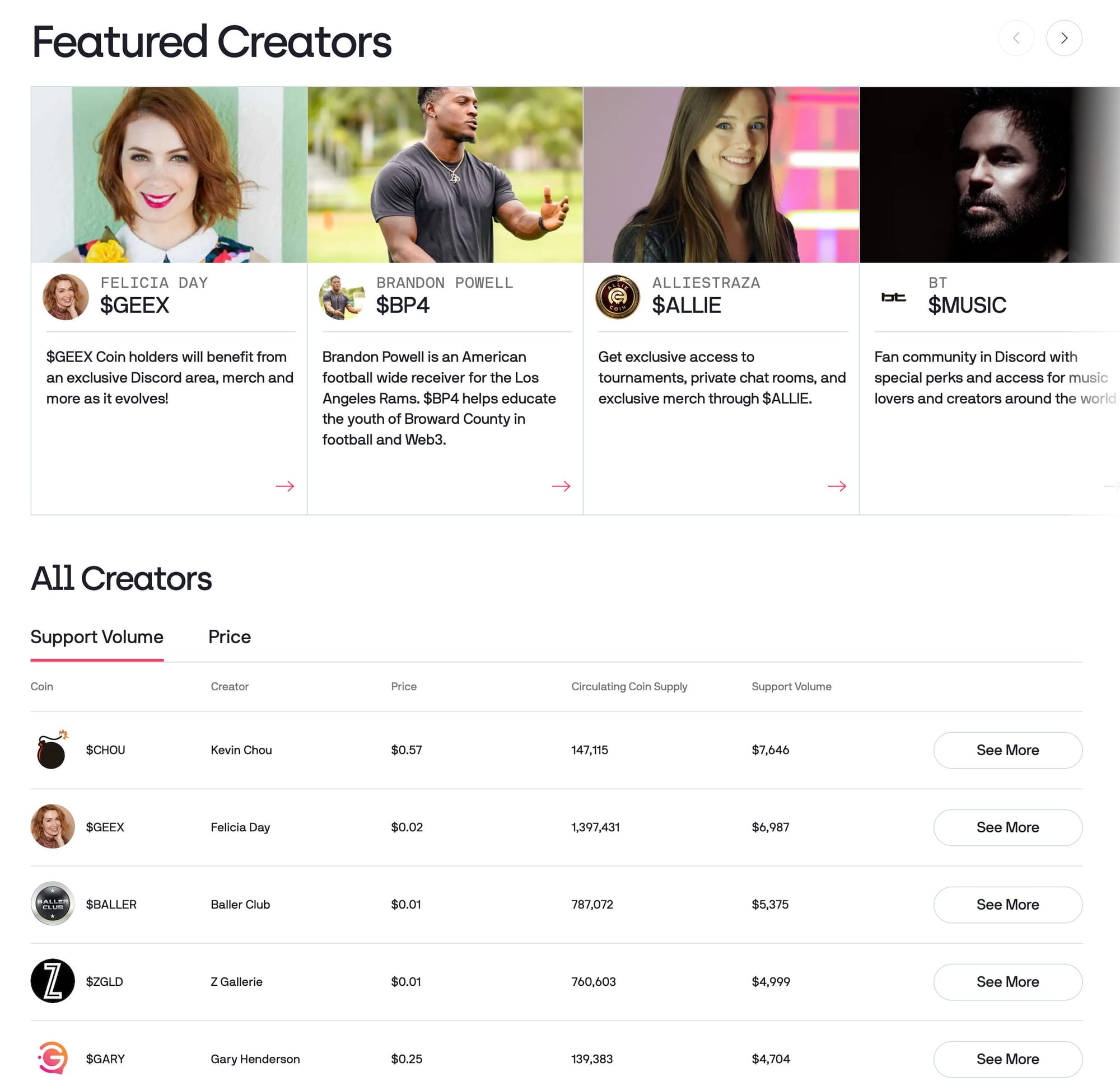

Rally was a project that sought to allow fans to buy "social tokens" from their favorite "creators"—a term they broadly used to describe the various actors, musicians, video game streamers, sports players, and companies who sold tokens on the platform. The idea was that you could buy a token connected to Felicia Day (actor and famous geek) or Brandon Powell (LA Rams wide receiver) or Portugal. The Man (rock band) to support their work or get access to various perks.

However, Rally announced with under one day of notice that they were pulling the plug on the project, and sorry, but if you hold any NFTs on the platform they're going to be vanishing in a puff of smoke. So much for "if you own something on ~~the blockchain~~ it's yours forever." Shortly after the announcement, images failed to load on the NFT portion of the site, and payments for creator tokens had been shut off.

Rally had apparently burned through $57 million that it had raised in April of 2021, from groups including Andreessen Horowitz.

Hacked Twitter accounts continue to plague web3

[link]

I've largely stopped posting every time a major Twitter account is compromised and used to shill NFT projects, because between that, Discord hacks, and hacks of other social media platforms it would barely leave room for anything else. Hackers have in the past compromised the accounts of major NFT artists, newspapers with five million followers, Super Smash Bros. Ultimate champions, and others to try to dupe followers into various NFT scams.

The latest incident, however, was particularly lucrative. Hackers were able to compromise the Twitter account belonging to the Azuki blue-chip NFT project, which they then used to promote a fake project in which fans could mint metaverse land. Users rushed to participate in what they thought was a surprise announcement by a top NFT project — potentially a lucrative opportunity if they could get in early. Instead, they had their wallets drained.

One person lost $750,000 in USDC stablecoins. Others lost pricey NFTs, including various Yuga Labs NFTs (Mutant Apes, Otherdeeds), Doodles, and Pudgy Penguins. Altogether, if the hacker was able to flip all the NFTs for their floor price, they were looking at a $1 million windfall, plus the $750k in USDC.

Tesla buys high, sells low

[link]

Elon Musk caught the Bitcoin bug in January 2021, pouring $1.5 billion of company funds into the token. That was also when he announced that Tesla would begin accepting Bitcoin as payment — an announcement that was quickly reversed when someone apparently pointed out to Musk that Bitcoin is an environmental nightmare.

Tesla sold most of its Bitcoin holdings in July, although they still hold around 11,000 BTC. Now, thanks to their SEC filings, we know they lost a total of $140 million last year on the gambit.

The silver lining for crypto here is that this amount is eclipsed by the billions of dollars that Elon Musk lost the company via his various other embarrassing gambits.

Everything else

- Bankrupt FTX tries to claw back $446 million from bankrupt Voyager [link]

- New York regulator investigates Gemini over FDIC claims [link]

- Coinbase fined $3.6 million by Dutch central bank [link]

- Bithumb executives charged with embezzlement [link]

- Kevin Rose loses pricey NFTs to wallet hack [link]

- FBI pins the Harmony Bridge hack on North Korea [link]

- Porsche bungles NFT roll-out [link]

- Gemini lays off 10% of staff amid troubles [link]

In the news

CNN did a very puffy piece about cryptocurrency, interviewing mostly crypto miners and Bitcoin millionaires. They brought me in for a minute or so to be the one token skeptic. Pretty disappointing, honestly, to see major television news still pushing crypto even now.

Rusty Foster liked my annotation of SBF's Substack drivel. At least I assume that when someone says I've caused them to "wake at 3am drenched in cold sweat" that means they like my work.

Personally I think there should be more notes on notes on notes. Maybe someone should publish notes on the Tabs piece. We have to go deeper.

Worth a read

Bennett Tomlin has been doing some digging into Binance's bizarre treatment of customer funds (at Protos), and the implications of that revelation on Binance's proof of reserves, their very questionable handling of corporate and customer funds, and their claims of solvency (during this rant in CCC).

Two mainstream media outlets doing some good digging into some of the beneficiaries of SBF's larger investments. SBF really likes to give money to his various ex-paramours, according to the NYT.

That's all for now, folks. Until next time,

– Molly White