Issue 20 – These things happen

The SEC enters a feeding frenzy and someone spends a quarter million dollars on a fart.

It's been a fairly busy week, with several bits of news out of the SEC, a couple of crypto project hacks, various developments in ongoing legal cases, and a Senate hearing on crypto. I also spent last Friday (the 10th) at a workshop at Harvard titled "Web3: What don't we know about it yet?". There I participated in a conversation with the more crypto-optimistic Shlomit Wagman, who led Israel's anti-money laundering authority for several years, and who is now a research fellow at Harvard. I also listened to a series of interesting conversations and presentations from various Harvard blockchain clubs (there are four), regulators from the US, EU, and Singapore, and a group of people researching and working in the realms of cryptocurrency, digital identity, and privacy. It was an enjoyable day, and certainly a good opportunity to engage with some opposing viewpoints.

This week's Senate hearing, titled "Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets", featured as witnesses crypto skeptic Lee Reiners, proponent of "crypto self-regulation" Yesha Yadav, and crypto lobbyist Linda Jeng. I livetweeted and livetooted it, and there is a video recording and copies of witnesses' written testimonies on the Senate website. It was, as these hearings typically are, mostly an exercise for Senators to grandstand, but I thought Lee Reiners was well prepared and quite effective in his points.

There is no evidence whatsoever to suggest that crypto promotes financial inclusion. In fact, there is overwhelming evidence to suggest the exact opposite is happening. Most people who've invested in cryptocurrency have lost money. Of those people, a plurality are minorities and low-income Americans. This is an example of predatory inclusion. We saw the same thing with subprime loans leading up to the 2008 financial crisis, where low-income and minority communities are being explicitly targeted with very, very risky products. And unfortunately they have lost, in many cases, everything.

– Lee Reiners, Policy Director at Duke Financial Economics Center

It was also the week of Valentine's Day, which always seems to bring out some weirdness from the crypto world:

In FTX

Over in bankruptcy court, the question of an independent examiner has finally been settled, with Judge Dorsey ultimately deciding not to appoint one. It's not the outcome I'd personally hoped for, but I do understand the cost concerns that were being considered.

The more interesting news this week was over in criminal court, where Sam Bankman-Fried never followed through on appealing the judge's decision to release the names of his two non-family bond sureties. As a result, we now know the sureties for the bonds of $500,000 and $200,000 are Larry Kramer and Andreas Paepcke, respectively. Kramer is the former dean of the Stanford law school, current president of the Hewlett Foundation, and a close friend of the Bankman-Fried family. Paepcke is a current Stanford research scientist, whose website describes his research interests as "user interfaces and systems for teaching and learning" — or at least it did, until either he or Stanford took it down shortly after he was publicly linked to this high-profile case. Both Mr. Bankman and Mrs. Fried are (or were) Stanford law profs, so it seems they tapped their friends and colleagues to put up a spare couple hundred thou to get their son out of a tight spot.

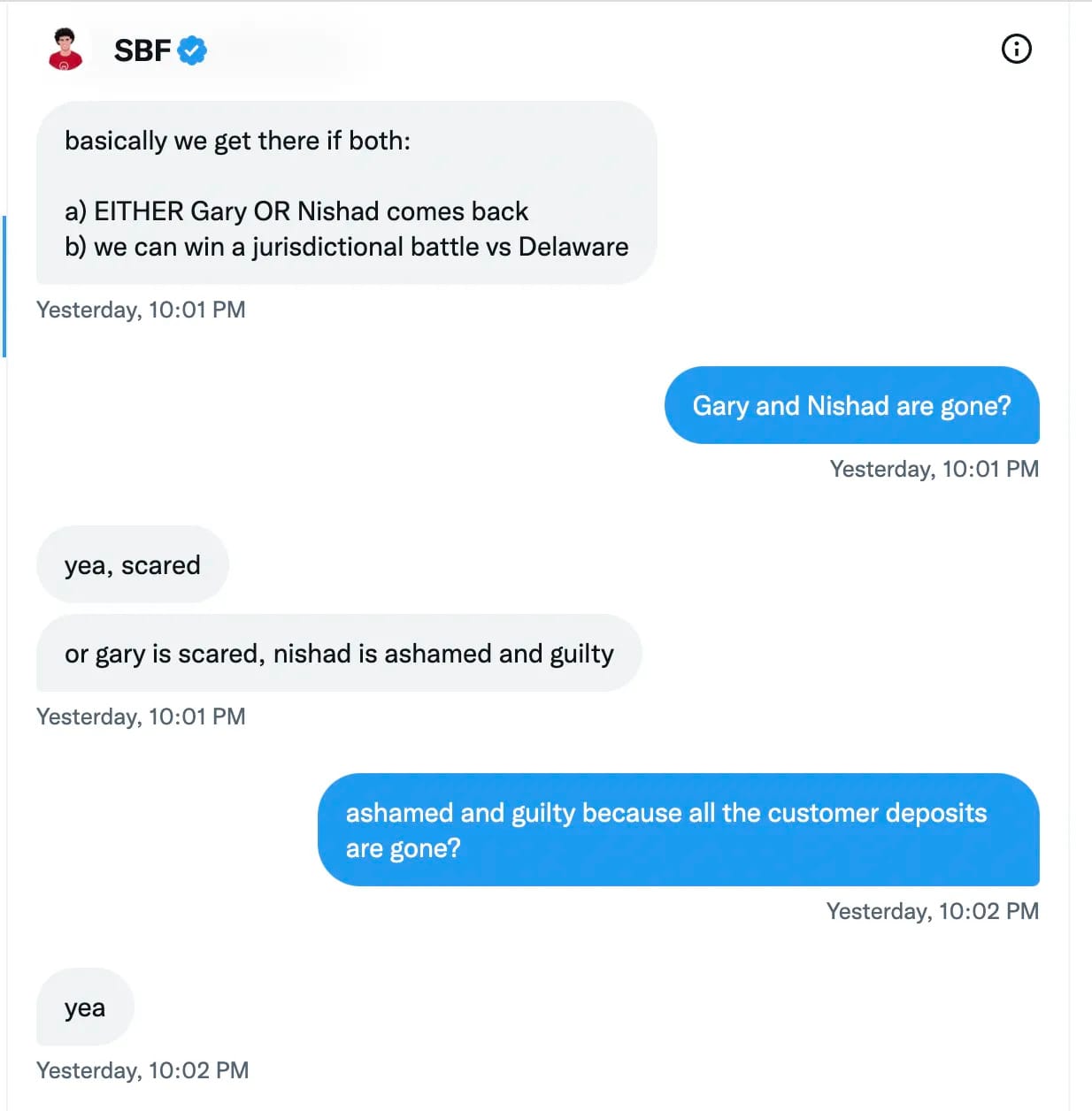

Meanwhile, before SBF's attorneys and the government's attorneys managed to suss out new bond conditions to deal with SBF having messaged a former FTX exec to ask if they could "have a constructive relationship, use each other as resources when possible, or at least vet things with each other", SBF got himself into even more hot water. Government attorneys discovered from their surveillance of his Gmail account that he'd appeared to log in several times from Singaporean IP addresses, which tipped them off to the fact that SBF had been using a virtual private network service (VPN). SBF claimed he simply wanted to watch NFL playoff games and the Super Bowl on the international NFL Game Pass subscription he'd bought while he was in the Bahamas, though the government pointed out that the Super Bowl was available to watch for free in a whole host of places for American viewers. Who knew SBF was so into sports.

The government has requested that SBF's Internet access be tightly curtailed after his latest gambit, proposing terms that would only allow SBF to use the Internet for reviewing discovery, communicating with counsel, or sending emails through his monitored account. SBF's attorneys not only don't think that's necessary, they've actually introduced more messaging services they think SBF should be allowed to use, because apparently it's crucial he be able to Twitter DM.

There was a brief hearing on this subject on Thursday, during which Judge Kaplan seemed to question why the government wasn't asking for SBF to be detained pending trial. "We have a person who allegedly committed a federal felony on pre-trial release: witness tampering," he said to Assistant US Attorney Nicolas Roos. Roos replied that the government believed that because SBF lived with his parents, he wasn't being left unsupervised. Once again, we're seeing SBF treated like a naughty child who simply needs to be parented properly into being the good boy everyone — including the attorneys in charge of prosecuting him — seem to believe he truly is. Someone should really write an essay about that.

Mind you, I don't think that SBF should be sent back to pre-trial detention — primarily because I don't think anyone should be kept in pre-trial detention, with rare exception. But good god, these guys seem to be prioritizing his ability to play League of Legends, watch football, and write sulking Substack posts above just about anything else, including limiting his abilities to tamper with witnesses or potentially even access stashed cryptocurrency. This grown-ass man can surely find ways to entertain himself without unfettered Internet access — perhaps by reading a book for a change.

Anyway, Judge Kaplan ultimately decided to delay the decision a week so he could get someone to explain VPNs to him. This case is going to go great, I can tell.

Beyond SBF, there are murmurs that former FTX engineering director Nishad Singh is nearing a plea deal with New York prosecutors, potentially making three executives to flip on SBF. Singh is the one that SBF referred to as "ashamed and guilty" in his DMs with Vox journalist Kelsey Piper, so it sure sounds like he'd be a juicy target for prosecutors.

In the other bankruptcies

After reading about all the fraud from the Celsius examiner's report and performing their own six-month-long investigation, the Unsecured Creditors Committee scooped their collective jaws off the floor and filed a motion proposing to sue Alex Mashinsky and other Celsius execs and insiders for breach of fiduciary duty and a few other things. Meanwhile, Celsius has picked a recovery plan involving NovaWulf Digital Management, which would see customers receiving an estimated 70% of funds returned — which is actually pretty good compared to what I was expecting. The actual feasibility of the plan — which seems to involve getting the SEC to agree to some sort of blockchain-based stock offering — is unclear to me.

There's also a report out from Voyager, although it was heavily redacted and also produced by a special committee of the Voyager board — a group that doesn't seem like it would have a strong incentive to turn over rocks that might reveal malfeasance by said board. Needless to say, it wasn't exactly the bombshell of a report like the one out of the Celsius case, and mostly found that Voyager blew up because of that massive $350 million plus 15,250 BTC unsecured loan to Three Arrows Capital, which… yeah. We knew that. As for the conclusions of the report, [redacted]. Also, "While Voyager LLC may have non-frivolous claims against its officers, the costs of litigating these claims (including expert fees) will be significant". The board is recommending that you not sue the board, pleaseandthankyou.

The Web3 is Going Just Great recap

There were 10 entries between February 10 and February 17, averaging 1.4 entries per day.

Do is laying low

[link]

Do was on the go and now he is laying low. Do Kwon has been cagey about his whereabouts ever since September 2022, when South Korea issued a warrant for his arrest related to the Terra/Luna collapse. Now, he's reportedly hiding out in Serbia, where he's definitely not on the run from the red notice that Interpol definitely didn't issue. Earlier this month, Korean prosecutors took a field trip over there to try to find him, apparently to no avail.

Now, the U.S. SEC is getting in on the action, albeit with civil charges (the only kind the agency can bring, at least directly). In a long and revealing complaint, the SEC first made a fairly unsurprising case that Kwon had sold unregistered securities (including both Luna and Terra) and misled investors about the stability of the Terra stablecoin. However, they went further by detailing an event in May 2021, when TerraUSD (aka UST) lost its peg from the dollar. Kwon reportedly called up an unspecified "U.S. Trading Firm" (believed by The Block to be Jump Crypto) who then purchased "massive amounts" of UST to restore the peg, and Kwon went on a social media bragging tour about UST being "automatically self-heal[ing]". Kwon also widely, but falsely, claimed that the Korean company Chai had been using the Terra blockchain to process and settle millions of transactions at various retail stores, and he allegedly even fabricated blockchain transactions to prop up the lie.

As one Terraform employee stated in a chat with another employee on September 1, 2021, "working at terra has reinforced my belief in conspiracy theories ... just the white lies to prop up anchor and mirror and the illusion of decentralization and the true extent of chai adoption … all from the armchair of a single man sipping whisky."

Finally, the SEC alleges that Do Kwon transferred more than 10,000 BTC from wallets belonging to Terraform Labs and the Luna Foundation Guard to wallets under Kwon's control, from which he has already withdrawn over $100 million. Sounds like he's living it pretty large over there in Serbia — unlike the pharmacist in California who borrowed $400,000 against the value of his home to put into UST, or the painter who put $20,000 from his son's college fund into it.

Some asked me why people would put their savings into UST as an "investment" if it was just supposed to be a stablecoin. The SEC complaint doesn't go into a ton of detail on this, but it's because once people had transformed their dollars into UST, they would then put them into the Anchor protocol, a lending project also run by Terraform Labs that promised massive 19–20% yields. It was heavily subsidized by TFL because it was completely unsustainable on its own, but it was good money… until everything went to zero.

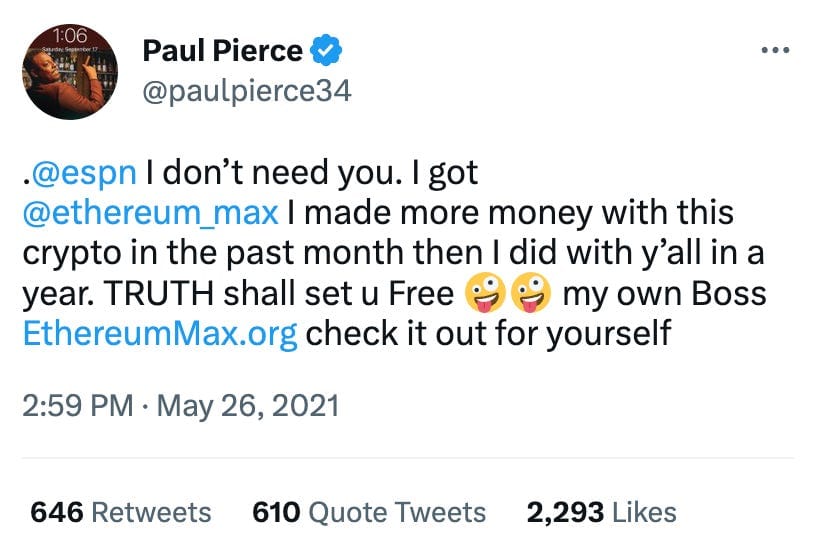

Next in line behind Kim Kardashian to get fined by the SEC: Paul Pierce

[link]

Remember back in October when the SEC levied a $1.26 million fine against Kim Kardashian for undisclosed touting of the EthereumMax crypto token? Well, now the SEC's settled up with former Celtics star Paul Pierce over his promotion of the same token, this time with a $1.4 million fine.

Kim Kardashian at least made a handwave at disclosing that she was compensated by putting "#ad" in small text at the bottom of her Instagram post. Paul Pierce made no such gesture, instead promoting the token in tweets like this one, which he sent shortly after he was abruptly fired from ESPN to show them just how not mad he was about the whole incident:

The SEC pointed out that not only was he violating anti-touting provisions of securities laws, but he was also making materially misleading statements. At the time of the tweet, Pierce had been given around $46,000 of EthereumMax — substantially less than the more than $1 million he'd been paid over his prior year at ESPN. Ouch.

This action leaves me to wonder if Floyd Mayweather is next in line, as he had also allegedly promoted EthereumMax without disclosing that he was compensated. Not only that, but Mayweather has been on the wrong side of the SEC for his cryptocurrency touting activities before: in November 2018, Mayweather paid more than $600,000 and agreed not to promote securities for three years in a settlement over his touting of initial coin offerings (ICOs).

During a highly-publicized fight with fellow boxer and undisclosed crypto shiller Logan Paul in June 2021, Mayweather wore shorts emblazoned with the EthereumMax logo. He reportedly promoted the token the same month at the Bitcoin Miami conference, painfully failing to read the room (which was of course full of Bitcoin maximalists). Both events occurred before he'd passed the three-year mark from his 2018 settlement.

Yet more news from the SEC (and also the NYDFS)

[link]

Those SEC folks must be really burning the midnight oil this week. About time.

On February 13, the New York Department of Financial Services ordered New York-based Paxos to stop minting Binance USD (BUSD), Binance's white-labeled stablecoin (which is not to be confused with Binance-Peg BUSD, how could anyone confuse the two, that's certainly not intentional, etc. etc.).

The same day, the SEC sent a Wells notice to Paxos, which is basically a heads up that the hammer's about to come swinging down unless Paxos can talk the SEC out of the (usually very strong) reasons they're about to swing it. This was somewhat surprising, since the SEC also had to come out and say they believe BUSD to be an unregistered security, and stablecoins were not something they'd clearly been considering under their remit until now. Paxos stopped minting BUSD and cut ties with Binance, at least as far as stablecoins are concerned, but has threatened to "vigorously litigate if necessary" the assertion that BUSD is a security.

Meanwhile, the rest of the crypto industry is feeling pretty jumpy. A Fox Business journalist tweeted a bombshell the following day:

SCOOP: The SEC has issued Wells notices to a handful of U.S. stablecoin companies including Circle, ordering them to cease and desist sales of unregistered securities. Companies will have the chance to dispute/litigate the allegations before actions are brought.

This caused a stir for less than an hour, until the journalist deleted the tweet, then deactivated their account, then reactivated their account an hour later to apologize for the mistake and point to a statement from Circle's Chief Strategy Officer denying that Circle received a Wells notice.

Then, a few days later, rumors circulated that Binance planned to delist all "US-based cryptocurrencies". This turned out to be a rumor, but Binance CEO CZ did state that Binance had "pulled back on some potential investments, or bids on bankrupt companies in the US for now" — either because of the increased regulatory action in general, or perhaps because they're taking a hint from US regulators who seem particularly fed up with Binance.

Dexible loses $1.6 million of client funds

[link]

Crypto investment firm BlockTower capital got the short end of the stick in an exploit of the Dexible decentralized exchange aggregator. Seventeen trading accounts were impacted, most severely the account belonging to BlackTower, which was relieved of 18 million TrueFi tokens (amusingly, once called TrustToken) notionally worth $1.5 million. The hacker took a bit of a loss converting the tokens into ETH, which they then laundered through Tornado Cash, but still made off with around $1.57 million all told.

Dexible, for their part, reacted by tweeting: "There's no excuse for an exploit, but these things happen."

Someone pays a quarter million for a fart

[link]

You thought NFTs were dead? Think again. Perhaps longing for the halcyon days when you could mint an NFT on Ethereum and smile in satisfaction at the carbon emissions you just blasted into the atmosphere, some Bitcoiners came up with Ordinals: the latest iteration of NFTs on Bitcoin, and certainly the most popular. If nothing else, I do have to give them credit for pushing some Bitcoin maxis into paroxysms of fury.

Anyway, if you were missing those days during peak NFT mania where people would would do things like spend a million dollars on a cartoon rock, you may be pleased to hear that Bitcoin is having its own little NFT mania.

An Ordinals NFT consisting of a 1-second-long recording of a fart noise reportedly sold for a whopping 12.3 BTC (~$280,000) the other day — although this is just according to a Reddit post because there is no Ordinals marketplace tracking trades, which primarily happen peer-to-peer after being coordinated in various backrooms.

Everything else

- Zachxbt reports phishing scammer "Loyalist" has stolen more than $4 million since early 2022 [link]

- Platypus Finance stablecoin exploited for $8.5 million ten days after launch [link]

- FDIC demands CEX.io stop claiming it's FDIC-insured [link]

- South Korean authorities issue arrest warrant to CEO of Tmon e-commerce platform for shilling Terra [link]

- dForce Network exploited for $3.65 million, funds returned [link]

In the news

Elle Reeve produced a short segment on the Bored Ape Yacht Club NFT project, diving into the allegations that the collection's price was bolstered by a scheme to use celebrity promotions to hype the project, as well as the allegations of racism against the founders. I talked through some of the technical aspects of NFTs and the history of the NFT mania of the past year or two, and then gave my thoughts on the racism allegations: "I doubt that they were a massive alt-right troll campaign. I do think it's likely that the creators of the project basically included some nods to 4chan."

Worth a read

Not enough attention has been given to the centralization factor introduced by the relatively small number of people who typically have commit access to any given blockchain's codebase. Paul Kiernan is helping with that problem, though, and he also shines some light on the relatively unknown incident in 2018 where a Bitcoin-breaking bug was discovered (luckily for them, by a Bitcoin developer) and quietly patched. The bug, and its patch, weren't disclosed until days later when much of the network had downloaded the update, in order to prevent it from being exploited in the meantime. According to Samson Mow, the bug "could have killed bitcoin".

The idea of "proof of reserves" seems to have made it in front of senators, with Senator Thom Tillis (R-NC) briefly promoting it in the hearing this week. Lee Reiners did his best to disabuse him of that notion in the moment, arguing that proof of reserves "aren't worth the paper they're written on", and that it's audits that are needed. Now, finance expert Frances Coppola gives it the longform treatment.

That's all for now folks. Until next time,

– Molly