Issue 24 – We sometimes find $50m of assets lying around that we lost track of; such is life.

Chart crimes, math crimes, and crime crimes.

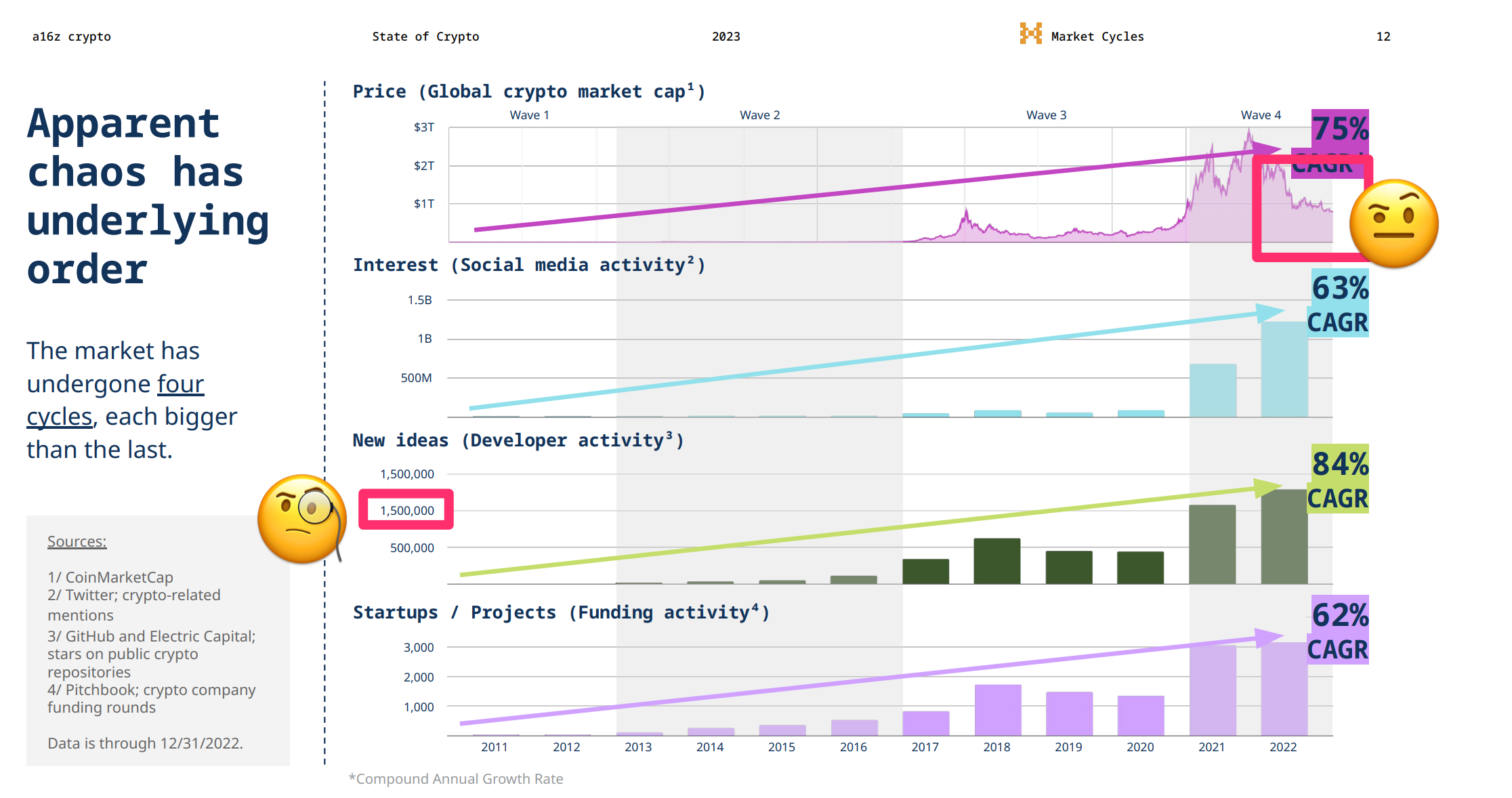

Happy spring, at least to those of you who also live in areas where it's just beginning to feel that way. If you heard the sputtering of tired, sticky engines it might have been your neighbor trying to resuscitate a stalling lawnmower for another season, but it might also have been the distant sounds of Andreessen Horowitz trying to force another cycle out of the crypto hype machine as they insisted that no, really, web3 is an evolution of the Internet.

I picked apart their latest and apparently annual "State of Crypto" report in a thread on Twitter and Mastodon (identical content, so just pick your platform of choice), which I can neither embed in this newsletter nor unroll using one of those thread-unroller bots because Twitter is going just great.

To try to present a rosy image of the crypto industry, the report is full of chart crimes, math crimes, sourcing crimes, and… well, there are probably crime crimes at least being mentioned in there too, let's be real.

One other note before diving in to this week's developments: Some of you asked me after my Feedly article which RSS reader I would be choosing to replace them. After trying a few I've settled on Inoreader, a web-based reader which I find most suited to my workflow, which involves many sources in various very distinct folders, which I need to be able to skim through in a fairly visual way in order for my brain to work properly. (This is not an ad.)

In FTX

The first interim report

John J. Ray III's team dropped their first interim report to the independent directors, in which they focus on control failures at the FTX group of companies. Matt Levine questioned in his newsletter why Ray seemed so focused on "trashing the previous management", publishing "gleeful reports about how bad everything at FTX is and how incompetent and criminal its former managers, led by former CEO Sam Bankman-Fried, were". "Gleeful" is probably the right word to use for the tone, and it seems a reasonable thing to wonder. After all, it's not as though it's critically important that everyone know the juicy details of how incompetent SBF and his executive team were because otherwise there's some risk that at the end of this someone will hand the FTX office keys back to SBF and say "alright Sam, we're trusting you, don't fuck it up this time". And with Ray's team still talking about the possibility of restarting the FTX exchange — something that might require them to raise outside capital — you'd think that going on at length about how all of the sophisticated software that supposedly powered FTX was actually totally halfbaked might be counterproductive.

But Ray and his team do have to report on what they're doing, and I think they're also feeling some pressure to justify their fairly exorbitant costs. Ray makes $1,300 an hour, and so explaining what he's doing with those hours is going to be critical. He's already faced accusations from officials in The Bahamas that he might be motivated by "the prospect of multimillion-dollar legal and consultancy fees", and any bankruptcy like this is going to face (often well-founded) gripes from creditors that the new management and lawyers are dragging things out to milk the case for all they can. I think this pressure explains why, in addition to bashing SBF et al, Ray also goes on at fairly great length about how difficult things have been and all the obstacles they've had to traverse.

Anyway, Ray's motivations aside, the whole thing was a pretty great read for those of us who are curious about what was going on behind the scenes at FTX. I did a pretty detailed thread on it too. (Twitter, Mastodon)

Altogether, the report describes a company that "lacked independent or experienced finance, accounting, human resources, information security, or cybersecurity personnel or leadership, and lacked any internal audit function whatsoever" and where "board oversight … was also effectively non-existent." The report goes into even greater detail on the nearly nonexistent accounting that Ray has described in the past, where 56 entities in the FTX group produced no financial statements whatsoever, and where around 80,000 transactions were left as unprocessed entries in "catch-all QuickBooks accounts titled 'Ask My Accountant'".

Sam Bankman-Fried wrote in internal communications:

[Alameda Research is] hilariously beyond any threshold of any auditor being able to even get partially through an audit… Alameda is unauditable. I don't mean this in the sense of "a major accounting firm will have reservations about auditing it"; I mean this in the sense of "we are only able to ballpark what its balances are, let alone something like a comprehensive transaction history." We sometimes find $50m of assets lying around that we lost track of; such is life.

Hilarious. Such is life.

The report also goes on to detail some things that certainly smell a lot like fraud, which might be worrisome to SBF if he wasn't already facing a whole host of fraud charges that probably go far beyond this. But Ray's team outlines how FTX had over a thousand accounts on "external digital asset trading platforms in jurisdictions around the world", many of which were opened using names and email addresses not clearly linked to FTX, using pseudonymous email addresses belonging to specially-created shell companies, or in the name of individuals — including some individuals who didn't have any clear connection to FTX.

Finally, the report induced panic attacks in various more responsible software engineers or crypto traders when it described how FTX managed its crypto wallets. Despite claiming to use cold wallets to safeguard the majority of their crypto, as is generally considered (and acknowledged by FTX) to be best practice for any significant amount of assets, FTX simply lied about doing so and kept most funds in Internet-connected hot wallets. Wallet keys, credentials for third-party exchanges, and application secrets were stored in a completely irresponsible manner: sometimes in unencrypted plaintext on shared servers, sometimes reused, rarely backed up, widely accessible to employees who did not need such access, and poorly labeled. Altogther, Ray and his team paint a picture of a company that was incredibly lucky to even have the chance to blow itself up, when insiders or outsiders could have stolen enormous sums of money from the company in apparently myriad ways.

The latest bankruptcy hearing

There was an omnibus hearing in the FTX bankruptcy, where the debtors' counsel provided an update on their progress. They say that they're up to $6.2 billion in recovered funds, priced based on the date of petition — more like $7.3 billion if you go off today's crypto prices, which have come up somewhat since November 2022, though they acknowledge that that volatility could go in either direction looking forward.

The most interesting thing to me on the agenda today was the question of whether the judge would grant relief from the automatic stay to permit the insurers with whom FTX had taken out directors & officers insurance policies to advance or reimburse the legal fees that Sam Bankman-Fried is incurring in his various civil, criminal, federal and state regulatory, and insolvency-related proceedings. As of the filing on March 15, the partial list of proceedings included sixteen entries. Oof. The judge denied the motion without prejudice to refile, saying that SBF hadn't submitted evidence that he faces challenges paying for his defense (via his own assets, or possibly other insurance policies), evidence that the motion wouldn't harm the FTX estate, or evidence that he's likely to succeed.

The Web3 is Going Just Great recap

There were 15 entries between April 3 and April 12, averaging 1.5 entries per day. $45.51 million was added to the grift counter.

Paxful shuts down amidst legal and other drama

[link]

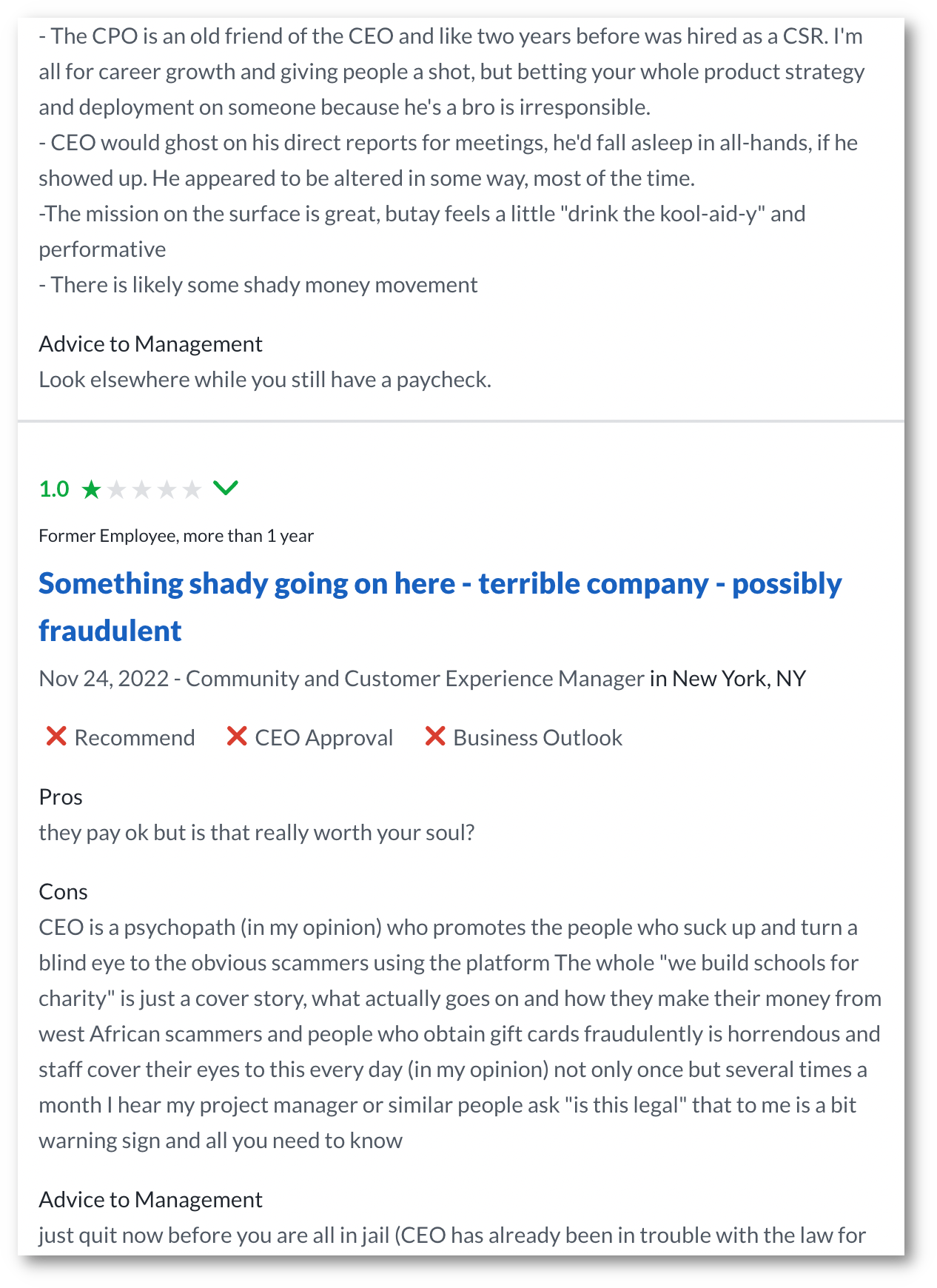

Paxful was a peer-to-peer crypto marketplace that was particularly focused on emerging markets in developing countries and in countries with more volatile fiat currencies or unstable economic systems. On April 4, they abruptly announced they would be suspending the service, and "are not sure if it will come back". The CEO gave several reasons, including "key staff departures", the ever-popular "regulatory challenges", and fears about the safety of funds due to an ongoing lawsuit from his co-founder.

The legal battle is a messy one. Ray Youssef, the CEO and founder who made the closure announcement, has accused his co-founder Artur Schaback of "incompetence and bad behavior", driving away key employees, "adopt[ing] a lavish lifestyle and… showing off". Schaback has accused Youssef of cutting him out of the company while Schaback was on paternity leave, "loot[ing] Paxful coffers", and "an illegal plan to avoid international sanctions on transactions into and out of Russia".

An article in CoinDesk also dug up a 2016 incident in which Youssef, Schaback, another Paxful employee, and a minor scared the daylights out of some people in Miami Beach after deciding to go on a penthouse balcony wearing masks, taking photographs as they aimed an AR-15 rifle at passersby. Police later detained the four, and found cocaine, hashish, and drug paraphernalia.

So, you know, standard company party stuff.

Youssef admitted the drugs were his, which left him with a charge for drug possession with intent to distribute. Several months later, Youssef did jail time in Estonia after being arrested for drug trafficking after repeatedly purchasing controlled substances, including MDMA and steroids, off the dark web. But the Glassdoor reviews from employees who claimed Youssef was on drugs during meetings? Those were just posted by his disgruntled co-founder, he says.

People are still getting destroyed by Terra

[link]

Terra, the blockchain that powered the ill-fated Terra and Luna tokens that collapsed in May 2022, is still limping along. Not only are there projects from that time period or earlier that are still operational, but — surprisingly — people are launching new projects.

One such project was Terraport Finance, which was supposed to "breath[e] continued life into the revived ecosystem" of the mostly defunct chain by providing staking (16% APY!), token buybacks and burns, and a lottery mechanism.

Instead, the unaudited project was hacked for $2 million as an attacker drained all its liquidity pools.

Someone accidentally spends 100 ETH (~$190,000) on a $110 NFT

[link]

I try not to give out financial advice, but I'm pretty comfortable saying that it's probably a good idea to try to structure your finances such that you can't accidentally and irreversibly spend house quantities of money with just a few clicks. Unfortunately, that seems to be what happened to one trader last week, who dropped 100 ETH when they (likely) intended to type in $100. 100 ETH is priced at around $190,000, and the seller who snapped up the offer made a nice 1666x profit over the going floor price.

The buyer hasn't come forward to explain what happened, so it's not entirely clear that this was typo-related, but it certainly looks that way. Though some have speculated that it might have been money laundering, the buyer made an open offer that could be accepted by anyone, which would have made it a very risky way to achieve that goal.

Everything else

- Nicole Behnam pumps and dumps: "There were mistakes made in a wallet that I controlled" [link]

- Ren Protocol transfers all assets to FTX bankruptcy team [link]

- GDAC exchange hacked for assets notionally worth more than $14 million [link]

- Trader loses 14,377 $APE (~$61,000) when they sell their Bored Ape [link]

- 0xSifu loses more than $2.7 million to SushiSwap hack [link]

- Bitcoin mining firm sues business partner after they allegedly lose $500,000 in Bitcoin to fraudster [link]

- dYdX exchange announces it will shut down Canadian operations [link]

- Someone steals the Bored Ape belonging to former NFL star Dez Bryant [link]

- Gemholic raises 921 ETH (~$1.7 million) in a token sale only to realize funds are stuck [link]

- Sentiment protocol hacked for almost $1 million [link]

- Rumor tweet by crypto influencer causes BNB and Bitcoin sell-off [link]

- Over $25 million taken from an MEV bot by malicious validator [link]

Worth a read

Cory Doctorow and the TRASHFUTURE gang talk about the lawsuit against the Internet Archive (Hachette v. Internet Archive), how publishers seem to be taking their justified anger at Amazon out on easier targets, like public libraries, and why this is bad for everyone involved.

Note: towards the beginning, they briefly mention an Interpol red notice that was supposedly filed against Binance CEO Changpeng Zhao. This was ultimately determined to be an unfounded rumor [W3IGG], although the crime-filled CFTC lawsuit they talk about at greater and very entertaining length is quite real and, as I wrote last week, may signal criminal trouble ahead for CZ.

After thoroughly enjoying the recent episode of This Machine Kills with AI researcher Abeba Birhane, I went back and read her recent paper on the values that are being prioritized in machine learning research and — critically — the ones that are not. It's worth a read, and I think it also illustrates the kinds of values that we tend to see elevated (or ignored) in the technology industry far more broadly.

That's all for now, folks. Until next time,

– Molly White