Issue 26 – Fully prepared to litigate

French celebrities rug pull, Binance backs out, and Hamas gives up on Bitcoin.

Hello!

In Web3 is Going Just Great news, I've finally built the auto-crossposter I've been wanting to build for a full year now. This means I can just write posts and run a script that will automatically syndicate the posts to all of W3IGG's social feeds, whereas previously I was manually screenshotting each entry and writing a post on both Twitter and Mastodon. This took a few minutes per entry but was really tedious and error-prone.

I finally prioritized this because W3IGG now has a third social feed! Bluesky is a new, still invite-only, Twitter-like social media platform that I've been trying out. It's still very early in its development, but I think it has some promise as far as Twitter replacements go. Or not, we'll see. Either way, it's now pretty easy to syndicate my Twitter style of posts (with the screenshot, title, and link) to just about any new social media site that may crop up to fill the weird growing void that is Twitter.

If you're on Bluesky, you can now follow Web3 is Going Just Great at @web3isgoinggreat.com.

And if you're not, you're not missing anything — they're the same posts that currently go to the Twitter and Mastodon feeds, and of course the posts that can be accessed on web3isgoinggreat.com or via its RSS feed. #POSSE

In FTX

Perhaps the most interesting FTX news this week was the search of the home of Ryan Salame [W3IGG], the FTX executive and member of Sam Bankman-Fried's inner circle who previously co-ran the Bahamian subsidiary of FTX. He was also known for his massive political contributions to Republican candidates and causes, donating around $24 million during the 2022 midterms. Now it's been alleged that those $24 million were likely misappropriated FTX customer funds.

Though Salame was in close with SBF, he was also apparently the first to turn on him when the FTX ship began to sink. Bahamian court records revealed that on November 9 — shortly before FTX's bankruptcy declaration and SBF's resignation, and the day that Binance walked away from the short-lived acquisition deal — Salame participated in a teleconference with the Executive Director of the Securities Commission of The Bahamas in which he disclosed that customer funds at FTX had been transferred to Alameda to cover Alameda's losses.

Salame is not among the FTX executives who have been charged by the Department of Justice, but on April 27 the FBI searched his Potomoc, Maryland home. It's not yet clear what the FBI was looking for.

Over in bankruptcy court, monthly fee statements have continued to trickle in for the month of March. This is always an eye-popping exercise, particularly for creditors who see the fees as chipping away at the assets that belong to them. Lawyers Sullivan & Cromwell and financial advisors Alvarez & Marsal each charged a bit over $10 million for the month.

A hearing scheduled for May 4 will discuss the possible sale of the LedgerX business.

In other bankruptcies

After months of back-and-forth among the bankruptcy judge, state and federal regulators, the Office of the US Trustee, and various other bodies over whether or not Binance.US would be allowed to buy the assets of the bankrupt Voyager Digital crypto lender, the deal is off — thanks to Binance. [W3IGG].

This shouldn't be terribly surprising to anyone who's been paying attention to the increased scrutiny on Binance from various US regulators and law enforcement, including a recent CFTC complaint against the company and its CEO Changpeng Zhao [W3IGG, newsletter] which seemed to outline some pretty criminal behavior (though it is only a civil complaint). The US is sending a pretty strong "you're not welcome here" signal to the company, and it stands to reason that Binance might choose not to further invest in businesses based in the US and serving US customers.

This is bad news for Voyager creditors, who were overwhelmingly in support of the Binance acquisition, which would have seen them recovering around 73% of their assets on the platform. Without the buyout, Voyager's looking at liquidation, and attorneys for Voyager have estimated that recovery will now be somewhere between 40% and 65%.

Amy Castor and David Gerard have pointed out that if Voyager had aimed straight for liquidation at the time it declared bankruptcy (July 2022), recoveries would have been around 70%.

In the courts

Coinbase

Coinbase seems to have decided it's willing to fight to the death with the SEC, and death seems like a very possible outcome to me. First, Coinbase responded to the Wells notice it had received from the agency [W3IGG], both in written and video format, and published their responses — which seemed at least as much for PR as they were substantive reply to the SEC. They boldly claimed "Coinbase does not list, clear, or effect trading in securities" — a statement clearly at odds with SEC Chairman Gary Gensler's view that nearly all cryptocurrencies are securities. The rest of the statement reads rather more like a series of threats than any serious response to the Wells notice.

Then, Coinbase sued the SEC, asking a judge to force the regulator to reply to a petition they filed in 2022 in which they asked the agency to create new rules to govern the crypto industry.

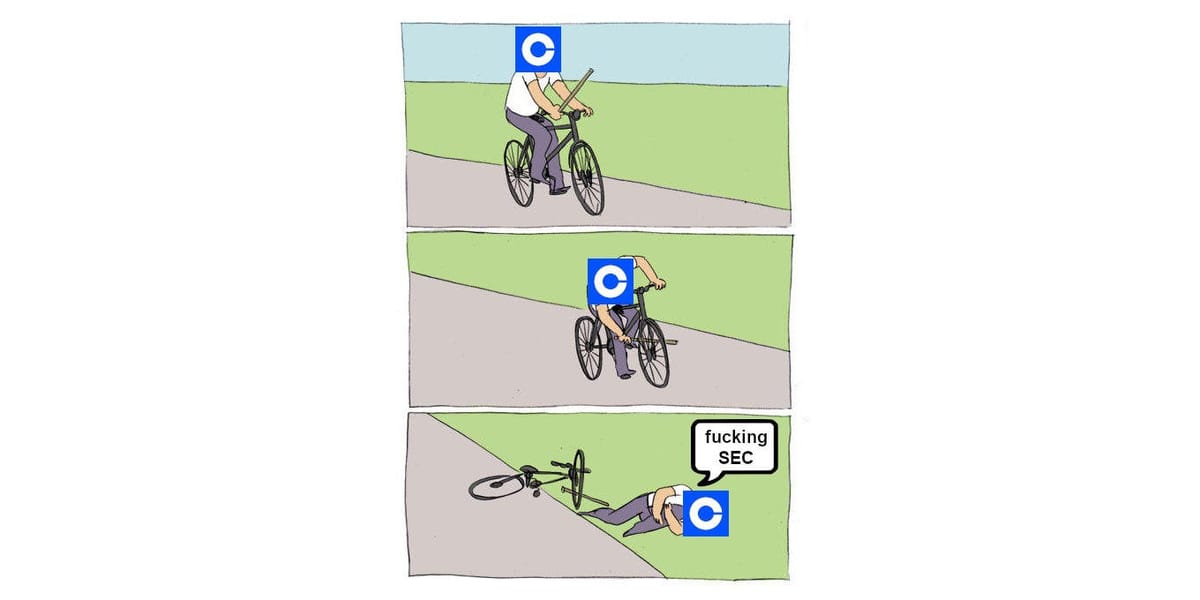

Coinbase is making the classic crypto industry argument that when the SEC makes clear statements that Coinbase doesn't like, it's failing to provide regulatory clarity. If the SEC decides to continue operating as it has been recently, by enforcing existing regulations against crypto companies rather than creating them a bespoke regulatory regime, Coinbase may well get a very clear response. As they say, Coinbase seems to be in the "fuck around" stage of "fuck around, find out".

I have prepared this image just in case that comes to bear:

Coinbase has also announced it will be opening an offshore exchange, based in Bermuda, for non-US customers. It's little more than a publicity stunt to bolster their claims that crypto is being driven offshore: there's a lot of ideological chest-beating, but it doesn't look like a very serious effort. The platform will offer fairly few products, and they're not likely to be terribly interesting compared with other offerings by competing offshore exchanges. Coinbase's big advantage in the US has been its reputation for playing by the rules; with that dwindling, as of its Q4 earnings, its revenue has plunged 75%.a Coinbase is in trouble, and even if it did decide to meaningfully expand offshore, it probably wouldn't help much.

Poloniex

The US entity that used to control the Poloniex crypto exchange will pay a $7.6 million fine to settle allegations of sanctions violations from the Treasury Department's Office of Foreign Assets Control (OFAC). [W3IGG].

The Poloniex crypto exchange now belongs to Justin Sun and is operated out of the Seychelles, where it no longer serves US customers. Circle purchased the exchange in 2018 with the intent of cleaning up its reputation as an anything-goes exchange, but sold it the following year when they discovered that no one wanted to use it anymore if everything was above board.

Terra

Terraform Labs, the company behind the ill-fated Terra and Luna cryptocurrencies, has replied to the February lawsuit from the SEC. The SEC says Terraform Labs and its CEO Do Kwon engaged in transactions involving unregistered securities and committed securities fraud. Terraform Labs wants the case dismissed, arguing that digital assets in general aren't securities. I think that ship may have sailed, my friends.

In other amusing crypto news

Hamas' military has stopped accepting cryptocurrency (or maybe just Bitcoin?)1 donations because they're worried that it isn't even sufficiently good at one of its remaining use cases: crime. "The Al-Qassam Brigades… announces the cessation of receiving financial donations through the digital currency Bitcoin, in order to ensure the safety of the donors in light of the intensification of the prosecution of those who try to support the resistance through this currency," they announced. "Cryptocurrency isn't crime-friendly," crowed Chainalysis.2 This may not actually be such good news for crypto.

Balaji Srinivasan actually paid up on his $1 million bet publicity stunt, in which he bet James Medlock that Bitcoin would hit $1 million by June 15 because the US would enter hyperinflation, thus devaluing the dollar, thus increasing the Bitcoin price. Don't think about it too hard, it'll give you a headache. I suggested he might be doing this because he needed to pump the price of Bitcoin, to which Srinivasan responded by calling me a "woke white". This kicked off a hilarious scramble in his Twitter replies by his fans desperately trying to reassure each other that he was calling me this because of my surname and not because he's "racist against white people". Incredible.

Anyway, now Srinivasan's admitted that it was a stunt, but he's at least paid up (a month and a half ahead of schedule, even). $500,000 will go to Medlock, $500,000 will go to GiveDirectly to be distributed to people in extreme poverty (per Medlock's request), and Srinivasan is chipping in another $500,000 to go towards Bitcoin development. It was a silly stunt, but hey, at least $1 million of Srinivasan's money went to good use for a change.

The Web3 is Going Just Great recap

There were 17 entries between April 22 and May 2, averaging 1.5 entries per day. $30.65 million was added to the grift counter.

CoinLoan goes kaput, takes Bit4You down with it

Estonian crypto exchange CoinLoan suddenly announced that, effective immediately, all services would be suspended including withdrawals. This followed a declaration from an Estonian court, which declared them insolvent and ordered them to suspend any activities not expressly permitted by court order. CoinLoan had long been showing signs of trouble: in July 2022, on the same day the Vauld cryptocurrency exchange collapsed [W3IGG], CoinLoan instituted a $5,000/day withdrawal limit "to balance the flows of funds and prevent liquidity-related interruptions".

An investigation by Protos suggested that CoinLoan's forced liquidation may have been triggered by Vauld's collapse, citing anonymous sources claiming that Vauld has tens of millions of dollars worth of crypto assets stored with CoinLoan.

The CoinLoan domino took down the Bit4You crypto lender with it. Bit4You is the only Belgian crypto platform, and now it faces uncertainty as it's suspended activities after announcing that CoinLoan was a "major service provider".

Plush NFT film project turns out to be a rug pull

[link]

I can't believe we're all being deprived of an animated film about stuffed bears that look like this, with a script developed based on the votes of a bunch of NFT holders.

Surely the only reason most movie scripts aren't written by collective vote of hundreds of random people is just because the movies this would produce would be too good for the public to handle.

Around 770 people were lured in to spending a total of €1.5 million (~$1.66 million) on procedurally generated NFTs of teddy bears, which sold for around €1,250 each (~$1,380), based on promises that they would become "co-producers" of the Plush animated film. French comedian Kev Adams did much of the promotion for the project, and was among a slate of celebrities supposedly lined up to perform the voices for the film. According to the project, "co-producers'" NFT purchases would earn them a spot in the film credits, voting rights on the script, and a split of 80% of the profits.

However, the project has predictably gone silent since its mint a year ago, with no film to show for it. Its Twitter account hasn't posted since September, and its website no longer sells the NFTs. An investigation from French newspaper Mediapart discovered that the project has been run by a shady operation out of Dubai called Illuminart, which seems to be intentionally playing on confusion with the Universal Studios subsidiary Illumination. An Illuminart marketing campaign even featured Illumination titles, such as The Lorax, Minions, and Despicable Me, along with their respective box office proceeds to suggest Plush NFT holders were in for a 516% profit.

Everything else

- OKX suddenly drastically limits withdrawals for users who haven't completed KYC [link]

- CZ smacks down Justin Sun for trying to game SUI airdrop [link]

- Level Finance exploited for ~$1.1 million [link]

- Individuals lose millions in "permit phishing" scams [link]

- 0VIX Protocol exploited for $2 million [link]

- Hacker steals Bitcoins from Russia, destroys them or donates them to Ukraine [link]

- CFTC imposes record $3.4 billion fine on Bitcoin scammer [link]

- FBI raids home of FTX exec Ryan Salame [link]

- AT&T customers suffer crypto wallet compromises reportedly totaling $15–$20 million [link]

- "Rogue developers" make off with $1.82 million from Merlin [link]

- Binance cancels Voyager acquisition [link]

- Ordinals Finance rug pulls for at least $1 million [link]

- "First BRC-20 wallet" UniSat launches, is immediately exploited [link]

- Kyiv Post alleges misappropriation of funds by Ukraine DAO [link]

In the news

I went on TRASHFUTURE again, this time to discuss the fever dream of a slide deck that was apparently sent across the planar divide from whatever alternate reality Andreessen Horowitz is living in, where crypto's had a banner year.

Michelle Celarier wrote about the Bitcoin price movement over the last handful of months, in which it regained around $10,000 in price. She asked me about the "flight to safety" narrative amid the concerns over the banking industry, as well as about the possibility that it could be price manipulation.

I helped a little bit with the content and fact-checking for John Oliver's latest segment on cryptocurrency, following up on "Cryptocurrencies" from five years ago. I thought they did a pretty good job of it, particularly given how much they crammed into 25 minutes.

Worth a read

A rare fiction recommendation from this newsletter, but this one's worth the read. Cory Doctorow just released his latest novel, and it features a cryptocurrency heist. Learn from my mistakes and don't crack it open at midnight "just for a chapter or two" if you have something to wake up for the next day.

TWSU is always good, but Paris Marx has been on a real winning streak lately with their string of episodes about AI. This one is no exception, with a thoughtful conversation between Marx and guest Aaron Benanav about the perennial headlines that "robots will take all the jobs!", and about some of the risks automation does pose to workers.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Coinbase's Q1 2023 earnings are expected on May 4, so stay tuned if you want more recent numbers. ↩

References

See a conversation on Twitter over this uncertainty. ↩

"Hamas' Al-Qassam Brigades Announces End of Cryptocurrency Donation Efforts", Chainalysis. ↩