Issue 27 – Buzzword bingo

We may never get to play a $45 million AI-powered NFT mecha-cockfighting game. Thanks a lot, Gary Gensler.

Things continue to slowly shift in the crypto industry. This week has been eventful, as the EU moves forward on a broad regulatory framework for crypto and the US sees continued skirmishes between the industry and various regulatory and enforcement bodies.

In government

In Issue 25, I mentioned that the Markets in Crypto Assets (MiCA) bill had passed in European Parliament. Today, the finance ministers of the EU's Council unanimously approved the bill, marking the last step in its bureaucratic journey. The bill will formally become law sometime this summer, but won't come into effect for 12 to 18 months as firms and regulators are given a grace period to catch up with the new requirements.1

In the US, the House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion will be holding another hearing later this week on the stablecoin draft bill that was published in mid-April. This will be the second hearing about it, following one last month. The draft bill has been described as bipartisan, but Waters and some other Democrats seem to think it's a non-starter.

Meanwhile, Eun Young Choi, Director of the US Justice Department's National Cryptocurrency Enforcement Team (NCET) said in an interview with the Financial Times that she aims to crack down on the "significantly" increased crypto crime that she's observed over the past four years. She specifically plans to focus on exchanges and crypto mixers, hoping "that by focusing on those types of platforms, we're going to have a multiplier effect." We shall see, I suppose.

In the courts

Coinbase

Coinbase's mandamus petition mentioned last week has received a strong response from the SEC, who wrote in reply that it is absurd that Coinbase is seeking mandamus in relation to a petition they filed fewer than ten months ago, and have supplemented repeatedly since.

"Coinbase's preference for faster or different regulatory action by the Commission does not entitle it to extraordinary relief from this Court", they wrote, going on to describe as "baseless" Coinbase's claim that the SEC had already made a decision on Coinbase's petition but was refusing to release it.

Terra

New filings in the SEC lawsuit against Terraform Labs have formally named Chicago-based Jump Crypto as the firm that secretly propped up the Terra stablecoin when it faltered in May 2021, a year before its ultimate collapse.2 The clandestine deal allowed Terraform Labs CEO Do Kwon to claim that the algorithmic stablecoin had recovered via a "self-heal[ing]" mechanism, which in turn increased traders' confidence in the stablecoin's ability to maintain its peg. In reality, Jump had infused millions of dollars into Terra to bring it back to its $1 peg, ultimately profiting more than $1 billion from the move. This deal was referenced in the original February 2023 lawsuit from the SEC against Terraform Labs, but the counterparty was at the time only identified as a "U.S. Trading Firm". CoinDesk quickly identified the firm as Jump, citing unnamed people familiar with the matter, but now the SEC has officially confirmed. As of yet, Jump has not been targeted by any governmental complaint in connection to the Terra collapse.

Meanwhile, Do Kwon has been granted €400,000 ($435,000) bail as he awaits trial on charges of document forgery in Montenegro, in a case that apparently needs to be handled before he is likely extradited either to the US or South Korea to face more serious charges related to the Terra collapse. Evidently the fact that he's on trial for using said forged documents to evade other prosecutions for months was not sufficient to convince a Montenegrin judge that he's a flight risk. Kwon and his traveling companion will be confined to an apartment in Podgorica. They won't be required to wear location monitoring devices because, according to their Montenegrin lawyer, "we don't have that kind of security".3 What could possibly go wrong.

Alex Mashinsky (Celsius)

Alex Mashinsky thinks it's ridiculous that everyone's blaming him, and pins his company's collapse instead on factors outside of his control, like the collapse of Terra.

In a motion to dismiss the lawsuit brought by New York Attorney General Letitia James, Mashinsky complained that "Instead of acknowledging that Celsius's eventual downfall was caused by a series of calamitous, external events, the NYAG pins all resulting losses on the alleged misstatements of Mashinsky".4 While the nearly 500-page independent examiner's report on the Celsius collapse was produced as a part of the bankruptcy proceedings and not this lawsuit, I imagine it won't help Mashinsky's argument that his hands are totally clean.

Sam Bankman-Fried (FTX)

SBF has filed motions to dismiss ten of the thirteen criminal charges he's facing based on several arguments: failure to identify a property interest that can form the basis of the offense, failure to allege that fraud was conducted "in connection with" commodities transactions, that the Commodities Exchange Act doesn't apply extraterritorially, that an allegation is "premised on an invalid 'right to control' theory of property fraud", that FTX was not required to register as a money transmitting business, and so on.

A memorandum of law accompanying the dismissal motions for charges 9, 10, 12, and 13 also argues that SBF agreed to extradition from The Bahamas to the US based on a list of only eight charges, and that he can't be tried on "new, unrelated charges" without consent from The Bahamas.

As of writing, SBF hasn't filed any motions to dismiss counts 5, 6, or 11: conspiracy to commit securities fraud (5) and securities fraud (6) on investors in FTX, or conspiracy to commit money laundering. SBF has pled not guilty to all thirteen charges.

In bankruptcies

BlockFi

BlockFi has also been using the Mashinsky-style argument that "our business didn't collapse because of our own errors, it was [other collapsed business]'s fault!" In BlockFi's case, they're blaming their own collapse on that of FTX.

BlockFi's Official Committee of Unsecured Creditors isn't buying it, though, and tensions between them and the debtors spilled over in a rather explosive court filing accusing the BlockFi team of egregious mismanagement before and after BlockFi's collapse. The Committee argues in the filing that the debtors should relinquish control of BlockFi because they have "learned certain ugly truths undergirding this bankruptcy".

Unfortunately for us curious onlookers, a lot of these ugly truths are obscured by redactions:

Bittrex

The newest entrant on the ever-growing crypto bankruptcy list is Bittrex [W3IGG], an exchange that just announced it was closing operations in the US in late March [W3IGG], and was charged with operating an unregistered exchange several weeks later [W3IGG]. Many in the crypto world were annoyed with the SEC for taking action against the company, apparently believing that the SEC began its investigation only after Bittrex's announcement, rather than the more likely explanation that Bittrex tried to bail from the US when they realized they were in the SEC's crosshairs. It may come as a shock to those people if they ever break a law and discover that simply leaving the country does not wipe the crime from the collective memories of that country's law enforcement agency.

Bittrex has assets and liabilities both within the $500 million–$1 billion range, and has more than 100,000 creditors. Although Bittrex held 20% of US crypto market share in 2018, it has declined markedly in recent years, dropping below 1% by the time they announced their exit.

The Web3 is Going Just Great recap

There were 13 entries between May 2 and May 15, averaging 0.9 entries per day. $17.14 million was added to the grift counter.

Buzzword bingo

[link]

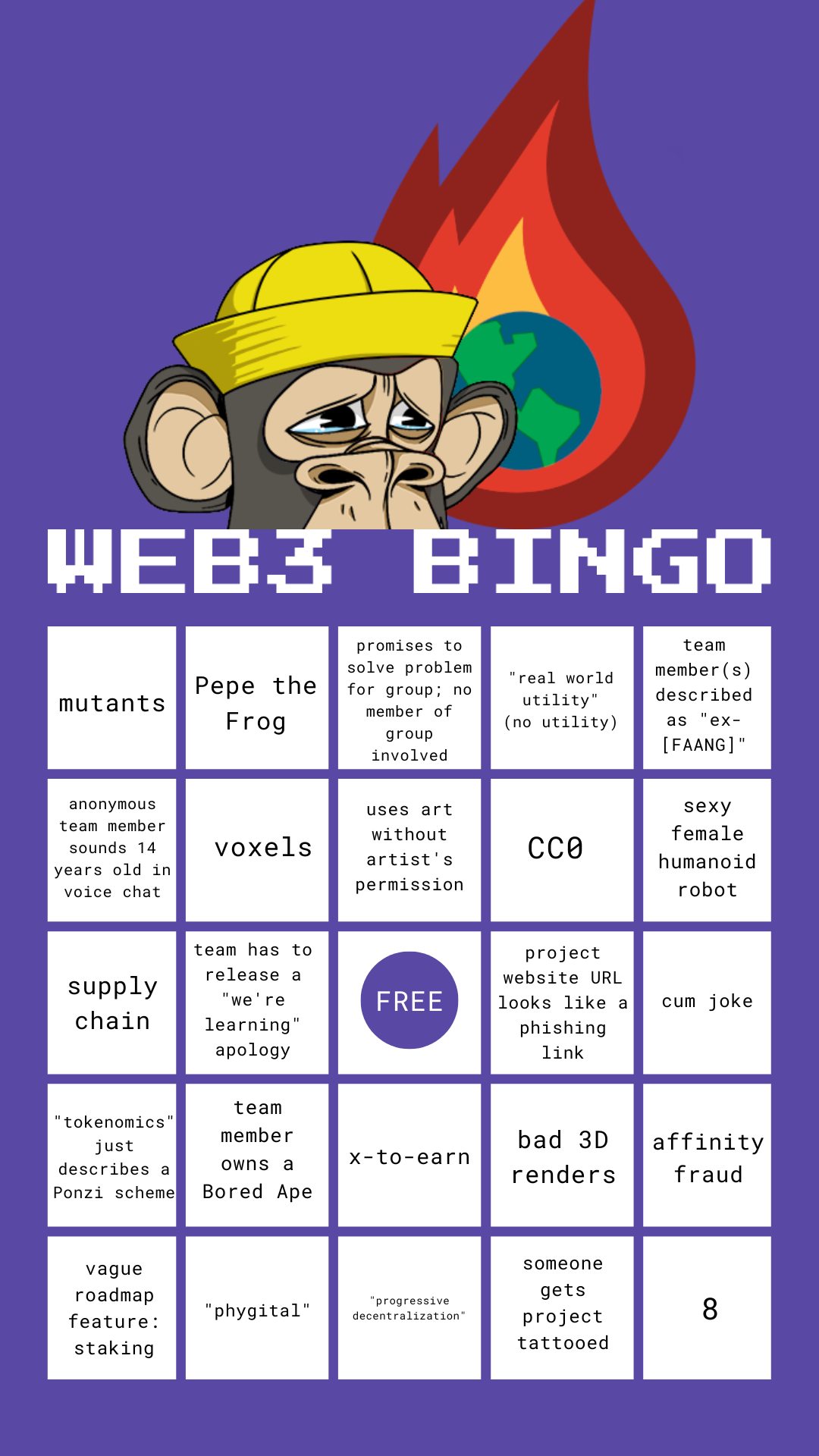

This week in web3: [throws dart] a16z-backed [spins wheel] mecha-cockfighting game [draws card] is paused as [rolls dice] maker pivots to AI.

No, really.

All of us are being deprived of Mecha Fight Club, a fighting game where "AI-powered" NFTs of mecha chickens battle it out. Naturally, creators Irreverent Labs blamed the "lack of clarity" and "regulatory confusion" in the United States, the excuse du jour.

Anyway, I've made some bingo cards so we can be prepared in the future for headlines like this.

![Web3 bingo card, with ape and earth in flames graphic from Web3 is Going Great. Squares read: "you own the IP" / "unruggable" (completely ruggable) / AR/VR / team member previously involved in other scam / vague roadmap feature: breeding / blatant Pokémon ripoff / 420 / Elon Musk reference / "ironically" bad art / outrageously lofty plans for "the brand" / dick joke / incredibly outdated meme / fully anonymous team / how hard can it be to create a video game? / joke about the project being a scam included in website / AI / primate related / woman team member turns out to be a man / "decentralized" (not decentralized) / [adjective] [animal] / funded by Andreessen Horowitz / 69 / FREE / vague roadmap feature: metaverse / shilled by celebrity who was famous >5 years ago](https://www.citationneeded.news/content/images/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https-3a-2f-2fsubstack-post-media.s3.amazonaws.com-2fpublic-2fimages-2f6471502b-d1cd-4021-81e9-89d398574c62_1080x1920.png)

If you want to make your own, here's a plain image template or an editable Canva template. My only request is that you tag me so I can see them.

DINO: Decentralized in name only

[link]

There's been a theme lately of projects trying to undergo "progressive decentralization" — that is, to start out centralized but to gradually transfer control to a DAO as the project gets off the ground — and having a terrible time of it. Early April featured the Arbitrum DAO saga. Now we've got the Aragon DAO.

Aragon is a DAO infrastructure project that has, ironically, been led by a small and centralized non-profit. Throughout 2022, the community of Aragon token holders passed several proposals that would transfer control of Aragon's sizable treasury (~$174 million of various crypto assets) to community control. The control has yet to be transferred, though, and some community members were getting impatient.

Recently, the Aragon Association announced they would be "repurposing the Aragon DAO into a grants program" rather than allowing it meaningful control over the project, an announcement that upset a large portion of the community. The Association simultaneously accused a group of community members of being a part of a group called the "Risk Free Value Raiders", who they say have been coordinating governance attacks on various DAOs, and who they believe are trying to "[extract] value from Aragon for financial profit" rather than pursue the goals of building DAO infrastructure. Various community members were banned from the Aragon Discord; those banned members claim they were only trying to get answers as to why the agreed-upon treasury transfer wasn't happening.

On May 11, Aragon publicly apologized for how they handled the crisis, unbanned the banned Discord members, and announced that they would "keep following a gradual [treasury] transfer approach, making sure it aligns with the mission of the project", but continued to characterize the members as attackers and reiterated that "we won't stand for hostile and coordinated attacks".

All my NFTs, funged

[link]

One of the interesting characteristics of NFTs is that they are non-fungible: each is unique, meaning that the NFT you own is unlike any other.a This mental model changes a bit when you introduce fractional ownership, which is what the platform Tessera (previously Fractional) aimed to do.

The idea is that if you can't afford a $62k Chromie Squiggle or a $150k CryptoPunk, you could instead buy 1/250th of one for a couple hundred bucks, which I guess appeals to some people for some reason.

Or perhaps it doesn't, because Tessera has just announced that it and its sibling platform Escher will be shutting down. The decision was described as finances-related, with co-founder and CEO Andy Chorlian writing that "we wanted to make this decision while we're still in a financial position to do this responsibly".

However, it may just be that Chorlian has bigger fish to fry at the moment than selling scraps of JPEGs. On April 24, Chorlian was indicted by the Department of Justice for his role in a $2 million crypto asset manipulation scheme in 2018–2019. He's been charged with one count each of conspiracy to commit securities price manipulation and wire fraud, and if convicted faces five years in prison.

Everything else

- Traders lose more than $15 million to phishing website impersonating crypto exchange HitBTC [link]

- South Korean legislator Kim Nam-kuk resigns over allegations of improper crypto dealings [link]

- Citing regulatory concerns, Bakkt delists 25 of 36 crypto tokens on newly acquired Apex Crypto [link]

- Binance exits Canada [link]

- Blockchain-based diamond tracking firm Everledger collapses [link]

- Bittrex files for bankruptcy [link]

- Ethereum user pays 64 ETH ($118,000) transaction fee on 84 ETH ($155,000) swap [link]

- Deus Finance suffers third hack [link]

- WallStreetBets coin tanks 90% after insider dumps holding [link]

- Former OpenSea executive convicted of fraud and money laundering in NFT insider trading case [link]

In the news

I went on Michael Lewis's podcast mini-series "On Background", in which he interviews various experts as a part of his research for his upcoming book on Sam Bankman-Fried. Lewis had been following SBF around for about a year before he was arrested, which should give him a pretty fascinating angle. (See a brief interview in the New York Times, also published today). In the podcast, Lewis and I discuss crypto, fraud, and my predilection for weird hobbies. He also announces the title of the book, which is slated to hit shelves in October.

The Globe stuck me on their list of 50 "tech power players", which was awfully nice of them. Unlike with the Forbes 30 Under 30, I don't think my inclusion obligates me to commit a massive fraud in the next few years.

Christopher Beam wrote a long piece for Bloomberg about the crypto collapse of 2022–2023 and how people both in and outside of the industry are faring. He mentions my opinion that Sam Bankman-Fried and FTX have served as a convenient scapegoat for the crypto industry, who like to pretend widespread failures are just one-off incidents or the fault of a few "bad apples".

Worth a read

's recent newsletter about Andreessen Horowitz's web history revisionism is an excellent complement to my recent Andreessen Horowitz piece. Karpf provides a much more nuanced view into what he believes define the major eras of the web, and — critically — doesn't ignore the huge changes in corporate influence that shaped them.

Malcolm Harris did a great profile of Douglas Rushkoff, a technologist and author whose Survival of the Richest I recommended way back in Issue 4. I'm a fan of Rushkoff's, and really enjoyed this overview of how his signature techno-optimism has evolved over the years. I also loved the quote: "I find, a lot of times, digital technologies are really good at exacerbating the problem while also camouflaging the problem. They make things worse while making it look like something's actually changed."

That's all for now, folks. Until next time,

– Molly White

Footnotes

Though the specifics of this are confusing to some: for example, two completely different NFTs can be visually indistinguishable. ↩

References

"EU Finance Ministers Give Final Go-ahead to MiCA", Decrypt. ↩

"Jump Trading Did Secret Deal to Prop Up TerraUSD Stablecoin, SEC Says", The Wall Street Journal. ↩

"Do Kwon to Be Released Into House Arrest", The Wall Street Journal. ↩

"Alex Mashinsky hints Do Kwon and SBF caused Celsius bankruptcy", Protos. ↩