Issue 30 – Sturdy Finance isn't, Atlantis Loans sinks

A week of ironically-named failures added to the continuing chaos from the SEC's crypto crackdown.

The SEC lawsuits against Coinbase and Binance have kept me pretty busy this week. I've spoken to a bunch of journalists and gone on a few podcasts (all linked below), and even wrote an article of my own for Rolling Stone: "The Feds Are Coming for Crypto. Can It Survive?"

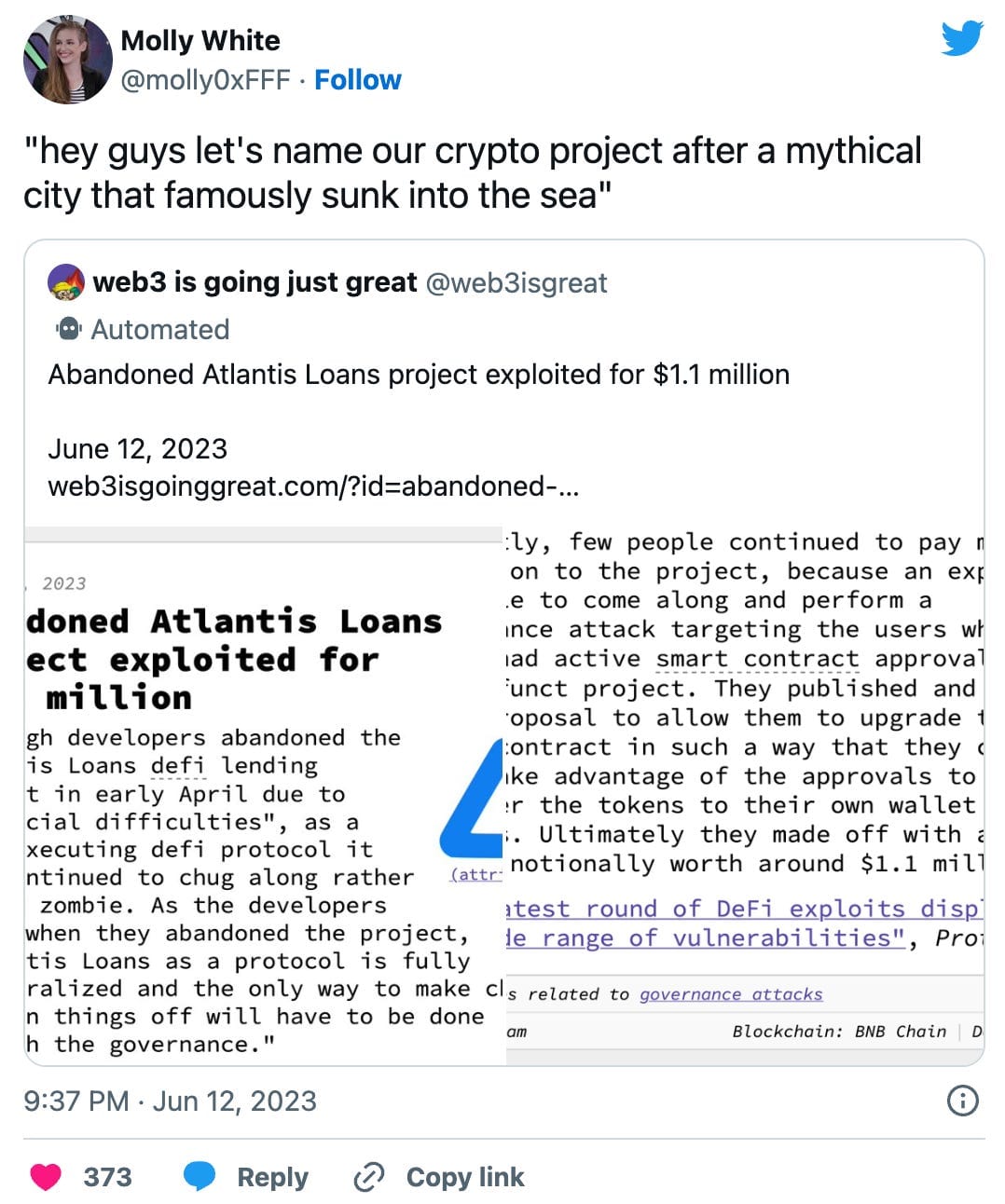

Though that bombshell has captured recent attention, the crypto industry has carried on with its usual hacks and scams. This week had a few particularly ironically named failures: Sturdy Finance wasn't so sturdy [W3IGG], TrueUSD wasn't so true [W3IGG], and the abandoned Atlantis Loans sunk even further [W3IGG].

In the courts

The Binance and Coinbase suits are already proceeding in a flurry of filings, with Binance attaching more than 100 exhibits in its opposition to the temporary restraining order (described in the previous recap) in what I assume was a deliberate attempt to make miserable the lives of those of us trying to follow the case. Judge Amy Berman Jackson told Binance and the SEC to try to work out an agreement rather than have her rule on the TRO, and so they did, and Judge Jackson approved the agreement on June 17. Former SEC enforcement attorney John Reed Stark has described the terms of the agreement as "one of the most burdensome, awkward, inconvenient and far-reaching crypto-related orders in SEC history." He's also guessed that their top-tier legal defense may be costing Binance on the order of $1 million per day. Yowza.

Meanwhile, several crypto platforms operating in the US have delisted tokens named by the SEC as securities in the two lawsuits. Robinhood was the first, removing Solana (SOL), Cardano (ADA), and Polygon (MATIC) tokens from their offerings on June 9 [W3IGG]. eToro US followed suit on June 12, delisiting ALGO, MANA, DASH, and MATIC.1 On June 16, Bakkt delisted SOL, ADA, and MATIC.2

As I mentioned in Issue 27, Sam Bankman-Fried's legal team filed motions to dismiss ten of the thirteen criminal charges he's facing, partly on the grounds that they believe the new charges added after he was extradited from The Bahamas violate the terms of his extradition agreement. Judge Lewis Kaplan has consented to splitting the case into two trials, because the legal battle in The Bahamas could delay things substantially. SBF will face the original eight charges in the trial scheduled for October, and the five charges that were added after he was extradited will be handled in a separate trial tentatively scheduled for March 2024.3 Kaplan did not dismiss any of the charges, as SBF's team had hoped, and The Wall Street Journal reported that he "signaled he was unlikely to dismiss any counts before trial, given that defendants face a high legal bar for securing dismissal at the preliminary stages."

The CFTC was awarded a default judgment in their case against Ooki DAO, a DAO created in an attempt by the founders of the bZeroX protocol to make the project "enforcement-proof". No such luck, it seems — they have to close up shop and pay a penalty of around $640,000 [W3IGG].

BitGo tried to convince the Delaware Court of Chancery that Galaxy Digital owes them $100 million in damages for terminating a $1.2 billion deal to acquire the company [W3IGG]. It didn't work.4

Do Kwon of Terra/Luna fame has another six months to spend in Montenegrin jail as judges consider extradition requests from both South Korea and the United States. He's been there for about three months already.5

In bankruptcies

Remember the arguments over whether creditor names would be disclosed in the FTX bankruptcy? Early on in the case, Judge John Dorsey made an interim decision to keep them private. Now he has made that decision permanent for individual creditors, and extended the decision by 90 days for institutional creditors, agreeing with FTX's arguments that the customer lists are trade secrets and that there are reasonable risks that these customers might be targeted for scams if the list is made public. This decision, however, will not apply to customers residing in the EU who are covered under the GDPR — which seems a little bizarre to me.6

Over in the Three Arrows Capital bankruptcy case, the liquidators are proposing that co-founder Kyle Davies be held in contempt of court and fined $10,000 a day as long as he continues to ignore a subpoena. The order would not apply to the other co-founder, Su Zhu, who unlike Davies is not a US citizen. The liquidators are not amused that Davies and Zhu have hidden their whereabouts, ignored subpoenas, and — brazenly — spent much of their time trying to create a new venture based around trading claims in crypto bankruptcies.7

In the government

Some Republicans in Congress who have repeatedly described the need for regulation in the cryptocurrency industry have reacted to the lawsuit from the SEC against Coinbase by… filing legislation to fire the "tyrannical" SEC Chairman Gary Gensler.8

Unsurprisingly this is co-sponsored by Representative Tom Emmer (R-MN), the leader of "The Blockchain Eight", who sent a letter to the SEC in March 2022 (pre-FTX collapse) urging them to back off on crypto investigations. Emmer was also a substantial beneficiary of donations from FTX. Emmer later tried to pin the FTX collapse on Gensler, and made allegations that he was collaborating with SBF.

The Web3 is Going Just Great recap

There were 17 entries between June 7 and June 16, averaging 1.7 entries per day. $16.88 million was added to the grift counter.

Binance and the terrible, horrible, no good, very bad week

This was just a rough week for Binance, and that's saying a lot given that a recent week featured a landmark lawsuit from the SEC. Since then:

- The company ditched its efforts in Cyprus, writing that they wanted to "focus on our efforts on fewer regulated entities in the EU" [link]

- Binance.US cut 50 positions (around 10% of their employees), which they said was in "preparation for a prolonged and very costly legal battle" [link]

- Dutch regulators declined to issue them a license, which is perhaps unsurprising given that Binance requested it only after illegally operating in the country for a while (and then being fined $3.6 million over it [W3IGG]). Now they have to leave the region. [link]

- Wyre, one of Binance.US's payment processors, finally shut down for real [link]

Dominoes fall in South Korea

On June 13, the yield platform Haru Invest abruptly suspended withdrawals and deposits. Initially they only offered a vague explanation that they were experiencing "a certain issue" with a business partner, but later announced that they were pursuing legal action against B&S Holdings, who they accused of filing falsified management reports. [link]

The following day, Korean crypto lending platform Delio also suspended withdrawals, citing a "sharp increase in market volatility and increased confusion among investors" as well as a "surge in withdrawals". [link]

Both Haru Invest and Delio advertised double-digit returns for customers.

Abra exposed as secretly insolvent by Texas State Securities Board

[link]

The Texas securities regulator issued an emergency cease and desist order against Abra, a US-based crypto lender. As alleged by the TSSB, Abra has been "insolvent or nearly insolvent" for months, despite making repeated claims like the one on June 11: "Abra is not bankrupt".

Abra seems to have put money into just about every collapsed crypto project available to them. As alleged by the TSSB, they had $30 million with Babel Finance (restructuring after halting withdrawals in June 2022), $30 million with Genesis (in bankruptcy since January 2023), $10 million with Three Arrows Capital (in liquidation since June 2022), and $8.8 million with Auros (in liquidation, but released in March 2023 after major debt restructuring).

Abra also allegedly transferred the majority of their customer funds to Binance, despite claiming to customers that they kept assets with the Fireblocks crypto custodian.

Everything else

- Machi Big Brother sues zachxbt [link]

- CoinEx settles with New York for $1.7 million [link]

- FPG halts withdrawals after $15–20 million hack [link]

- BNB Chain team prepares to step in to prevent massive Venus Protocol liquidation [link]

- Abandoned Atlantis Loans project exploited for $1.1 million [link]

- Sturdy Finance exploited for $775,000 [link]

- Minting of TrueUSD stablecoin through Prime Trust halted; TUSD deviates from peg [link]

- Crypto.com to shut down institutional trading in the US [link]

- CFTC awarded default judgment in case against Ooki DAO [link]

- Robinhood to delist Solana, Cardano, Polygon tokens after SEC describes them as securities [link]

In the news

I've been pretty busy talking about the lawsuits against Coinbase and Binance:

I had the privilege of rejoining two of my favorite podcasts to chat about the lawsuits from the SEC against Coinbase and Binance.

Whizy Kim gives her thoughts about what the SEC's actions against Coinbase and Binance mean for the industry. "That the agency is going after such behemoths… sends a clear message. It's no longer calling out a few rotten apples; it's saying the whole enterprise needs to be scrutinized under a regulatory lens." She quotes me a couple times, primarily about why the SEC is doing this now and on the potential risk to customers of those exchanges.

Elizabeth Lopatto also writes about the SEC cases, focusing more on the turf war between regulators. She describes me as the "unavoidable sportscaster of crypto". I'm not entirely sure how to feel about being described as "unavoidable".

Worth a read

After a multi-year legal battle over their disclosure, CoinDesk got hold of various documents provided by the Tether stablecoin operator to the New York Attorney General. This clearly made Tether really nervous, because the company released several statements before CoinDesk even published to preemptively condemn whatever it was they were going to say.

That's all for now, folks. Until next time,

– Molly White

References

"Bakkt delists Solana, Polygon, and Cardano, citing lack of regulatory clarity", Fortune. ↩

"Judge Splits Charges Against Sam Bankman-Fried, Sets Two Criminal Trials", The Wall Street Journal. ↩

"US court dismisses BitGo's claims in $100M lawsuit against Galaxy Digital", CoinTelegraph. ↩

"Do Kwon to Remain in Custody While Montenegro Courts Consider Extradition Request: Report", CoinDesk. ↩

"Judge in FTX bankruptcy rejects media challenge, says customer names can remain secret", AP News. ↩

"3AC liquidators file motion to hold Kyle Davies in contempt", CoinTelegraph. ↩

"Emmer, Davidson Introduce 'SEC Stabilization Act' to Remove Chair Gary Gensler", Tom Emmer press release. ↩