Issue 32 – I write to inform you the games are over.

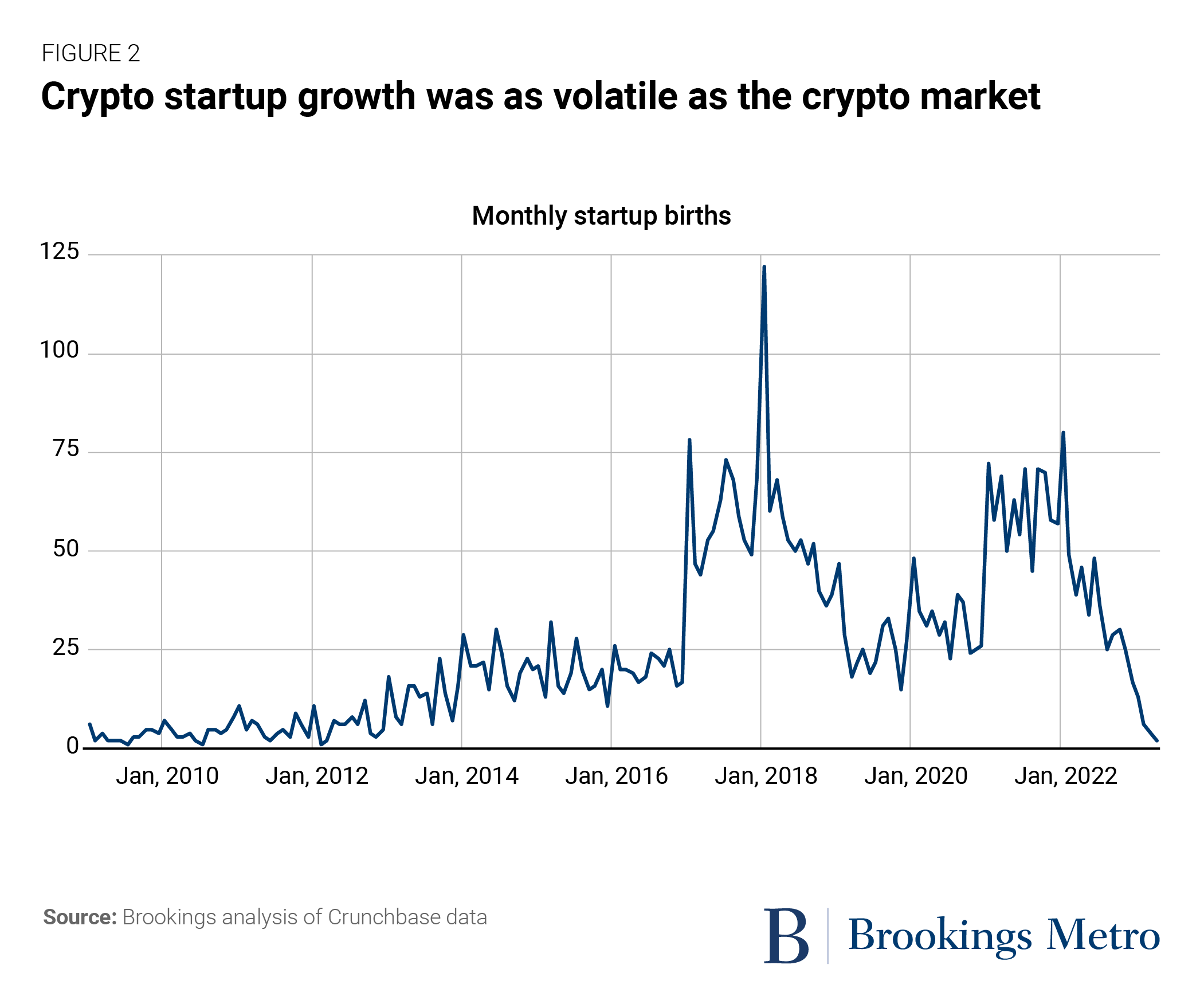

Also, all my apes (once again) liquidated, too many people try to short the NFT market, and NFT protocol developers head for greener pastures.

It's been a particularly bad week for NFTs, as plummeting prices for blue-chip collections like Bored Apes and Azukis have had knock-on effects throughout the crypto world. Those of you who've been with me since the beginning may recall my very first newsletter, in which I wrote about the sub-primate lending crisis that was threatening BendDAO — a project that for some godforsaken reason allows people to take out loans with their NFTs as collateral.

Having apparently learned nothing from last time, those same types of lending protocols — including BendDAO — are once again in crisis, and staring down the barrel of potential cascading liquidations.

It's not all doom and gloom, though, because it produced one of the funnier copypasta candidates that we've seen on crypto Twitter in a while, adding to the classic "all my apes gone" and "taking time to be with my remaining apes":

We should all be extending hands to help right now.

Speaking of which: if you like my work, consider a pay-what-you-want subscription to help me keep doing it.

In the courts

Gemini, Genesis, and DCG

Cameron Winklevoss, one of the co-founder twins behind the Gemini crypto exchange, wrote another overdramatic open letter trying to convince Digital Currency Group CEO Barry Silbert to return the more than a billion dollars they supposedly owe to Gemini. To refresh your memory, DCG is the parent company of Genesis Global Capital, which apparently owes the Winklevosses' Gemini somewhere between $900 million and $1.2 billion, depending on when you ask. Cameron Winklevoss sent his first strongly worded open letter back in January [W3IGG].

Even more than the first, this one's full of flowery language that Winklevoss seems to think makes him sound cool and intimidating, but really just makes him sound like a sort of low-budget supervillain.

Weirdly, he also wrote in the letter that "Sam Bankman-Friend [sic] ... recognized how his actions had hurt others and attempted to make things right". What? When?

As I wrote on Twitter earlier this week, if DCG owed my company over a billion dollars and I had all this evidence that they had engaged in a massive fraud, I would simply... file the lawsuit. It struck me as very weird that they were instead going through this months-long charade with the open letters. However, Gemini has since followed through with their threat, and filed a complaint today that indeed does accuse Barry Silbert and DCG of massive fraud.1 This should be fun to watch.

Celsius

Bloomberg cites "people familiar with the matter" who have said that the CFTC believes Celsius and its former CEO, Alex Mashinsky, broke commodities laws. If a majority of the agency's commissioners decide to proceed, they could file a federal complaint "as soon as this month".2 For whatever all that's worth.

Celsius is busy in bankruptcy court, and Mashinsky is facing a lawsuit from the New York Attorney General, but a CFTC lawsuit would be the first federal complaint against the company or its executives. The SEC and New York federal prosecutors have also been investigating them, unsurprisingly, but have yet to file any formal complaints.

In bankruptcies

FTX

Following FTX's second interim report, which I wrote about last week, FTX has now filed suit against the person they described as "Attorney-1", who they've now confirmed is former FTX chief regulatory officer Daniel Friedberg.3 FTX is hoping to "recover damages caused by breaches of fiduciary duties, legal malpractice, and other wrongdoing, and to recover fraudulent transfers". Friedberg has not yet been charged with any crimes; in January, Reuters reported he was cooperating with prosecutors in the criminal case against Sam Bankman-Fried and "ha[d] not been told he is under criminal investigation".4 That, of course, could have changed in the months since.

Meanwhile, there have been more reports that FTX has been talking with interested parties about restarting the exchange.5 This has come up in the news a handful of times now since the bankruptcy process began, and is always met with varying degrees of shock. If I had to guess, it's more that the FTX debtor team feels they need to be seen to be pursuing all possible avenues to recover as much funds as possible, and is not actually likely to choose this one as the best option.

BlockFi

BlockFi's unsecured creditors committee have filed a motion to liquidate the company, referring to the remaining assets of the estate as "a proverbial 'bundle of sticks'". The creditors are, to put it lightly, displeased with the $16 million per month being spent on the case and to keep the lights on over at BlockFi, where they are still paying "salaries to more than 100 individuals – many of whom, to the best of our knowledge, have had little to do but work on their golf game". The creditor committee alleges that BlockFi's management has been dragging out the bankruptcy proceedings because they want to negotiate releases of personal culpability for loans made to Alameda Research.6

Three Arrows Capital

Liquidators overseeing the Three Arrows Capital fiasco are now trying to recover $1.3 billion from co-founders Su Zhu and Kyle Davies, who have not been cooperating with the liquidators and have instead moved on to bigger and better things new harebrained schemes involving selling claims on crypto bankruptcies.7 The liquidator is also reportedly looking towards reclaiming funds from DCG, Genesis, and BlockFi. According to a report from the liquidator that was leaked to CoinDesk, they are considering more than $1 billion in "prospective claims" against DCG and its Genesis subsidiary, as well as more than $220 million in "preferential payments" that could be clawed back from BlockFi.8

In Binance

Binance continues to have a bad time.

Several high-level employees have fled the company, including the general counsel, chief strategy officer, head of investigations, and a senior VP of compliance. Following reports suggesting that these departures were related to CEO Changpeng Zhao's handling of the rumored ongoing US criminal probe into the company, one departee took to Twitter to argue that "no, it's not because Binance is a sinking ship, I quit because my nag wife says I'm fat and useless."

That's certainly one spin on the classic "quitting to spend more time with my family" that I haven't seen before.

He went on to write that "it is time for me to take some time for myself and my family, try and get healthier, lose the weight, start working on the 'honey-do' list, start helping around the house, be more resent [sic] for my kids, take a few naps when I can escape the wife…." Perhaps dishing to the entire Internet about how his wife is such a damn pain for asking him to take out the trash once in a while might provide him the opportunity to "escape" her a little more permanently.

Bloomberg did a profile of the mysterious Yi He, an early and influential part of Binance's history who continues to have considerable (though not clearly acknowledged) influence over the business to date.9 Bloomberg describes her in the headline as "crypto's most powerful woman". In the interview, she provided an awesome quote:

If they really took the time to understand our industry, they would see that if Binance isn't compliant, then practically no other global trading platform or offshore company is.

They sure would.

This week, Binance's application for a custody license in Germany was either denied, or is very likely to be denied, by the Federal Financial Supervisory Authority (BaFin), adding to the ever-growing list of jurisdictions in which they've had licensing trouble.10

Meanwhile, the Australian Securities and Investments Commission searched several Binance locations in connection to an investigation into their local derivatives business,11 which the company shut down in April [W3IGG] thanks to a run-in with the agency. ASIC also reportedly individually tracked down current and former employees this week to try to obtain internal communications and other data from their devices.12

In September, Binance is due to lose support from Paysafe Payment Solutions, their euro banking partner. Binance has suggested they have another partner lined up, but have not said who it will be.13

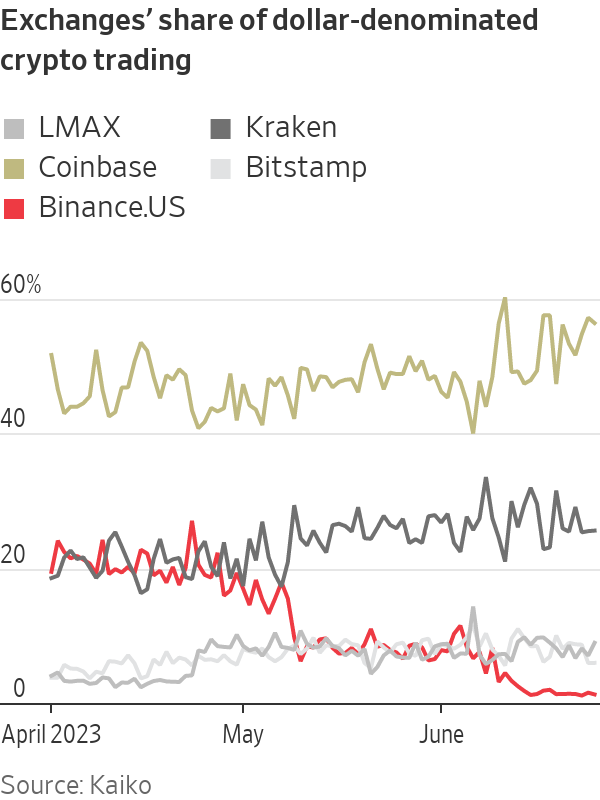

Numbers from CCData say Binance's global spot trading market share is down for the fourth month in a row, to 41.6%. This is their lowest since August 2022.14 Meanwhile, Binance.US has dropped from around 27% of market share of dollar-denominated crypto trading in April, to a little above 1%.15 Oof.

The Web3 is Going Just Great recap

A quick W3IGG changelog: Eagle-eyed watchers may notice that the grift counter on W3IGG has shot up substantially, from around $12.66 billion to more than $67 billion. This is not because of some recent $50 billion+ hack that no one's talking about, but instead because I've updated entries on some of the larger collapses (FTX, Three Arrows Capital, etc.) to be reflected in the counter. There was a lot of confusion coming from the fact that these collapses weren't included, so hopefully this will be clearer for everyone.

The Leaderboard has also been updated to allow for a little more clarity when these numbers are uncertain, and also reflects money that has been recovered after various hacks and scams. You can also now sort the leaderboard in reverse order, or by date.

There were 9 entries between June 28 and July 7, averaging 0.9 entries per day. $142.17 million was added to the grift counter (from just the new entries, not the updates).

Azuki NFT empire has a disastrous new launch

Azukis are a collection of blue-chip NFTs created by Chiru Labs during the peak of NFT hype. They depict various anime-style characters in side profile, sometimes with a weapon slung over one shoulder, and until recently reliably resold for an average of around 16 ETH (almost $30,000) apiece even in these depressed NFT markets.

Chiru Labs recently sold out a new set of NFTs, called Azuki Elementals, which featured artwork that would only be revealed after the sale was complete. However, a glitchy mint process meant that only existing holders of Chiru NFTs were able to get in on the mint. Regardless, Chiru made a whopping 20,000 ETH (~$38 million) from the sale, and people were excited to see what the new additions to the Azuki collection would be.

They were enormously disappointed when the artwork was revealed to be little more than recycled versions of the original Azuki artwork, and in some cases nearly indistinguishable. Buyers complained that the art was "dilutive" to the previous NFT collection, and the floor price of the new NFTs quickly plummeted from the 2 ETH (~$3,750) mint price to as low as 0.7 ETH (~$1,350). The original Azuki collection floor price suffered as well, dropping from around 17 ETH (~$34,000) to around 5.8 ETH (~$11,600).

The Azuki community decided to fight back, and formed a new "Azuki DAO". The DAO undertook its first vote, with overwhelming support for hiring a lawyer to sue the person behind the Azuki project for "blatantly scamming" them. They also voted to "retrieve a refund of 20,000E[TH] from the team", to be allocated to the DAO, but there was no indication that the Azuki team had agreed to abide by the outcome of the vote. Meanwhile, the creation of the DAO did not exactly go off without a hitch: two exploiters were able to steal 35 ETH (almost $70,000) thanks to a bug in the governance token distribution.

Meanwhile, the team behind the project has apologized, and teased possible updates to the artwork to try to rectify the disaster.

Poly Network is exploited once again

[link]

In August 2021, Poly Network took a not-so-coveted first place when they suffered what was at the time the largest defi hack in history: $611 million. Bizarrely, the attacker returned the funds, the project offered them a position as a chief security advisor, and Poly Network lived to see another day. [W3IGG]

Now, Poly Network's been hacked again. Although even more staggering numbers like $42 billion have been thrown around, that's because the exploit involved minting massive quantities of new tokens, and those "billions" are the result of a naive calculation of token quantity × pre-hack price, with no consideration of actual liquidity. Still, the attacker was able to cash out around 5,196 ETH (~$10.1 million) in liquid assets.

Poly Network wrote on July 2 that "We hope that the attacker will cooperate and return the user assets to avoid any potential legal consequences," but as of yet, it does not appear they have been as lucky as they were two years ago in having the funds miraculously returned to them.

Cardinal Labs succumbs to its team's "itch to explore other pursuits"

[link]

Despite raising $4.4 million in seed funding just under a year ago, Cardinal Labs is closing its doors. The Solana-based NFT protocol promised to enable (among other things) NFT rentals, a feature that apparently someone somewhere wanted at some point.

Cardinal wrote candidly on Twitter that "Product market fit continues to be difficult to find" (gee you think?), and that "the reality is that members of our team are feeling the itch to explore other pursuits."

"We'd hoped that by now the rest of the world's industries would have begun adopting blockchain tech at a larger scale, but that still feels a ways away," they wrote.

Everything else

- Encryption AI rug pulls for $2 million, developer allegedly blames gambling addiction [link]

- Kraken ordered to turn over user information to U.S. tax investigators [link]

- Huobi patches massive vulnerability after researcher allegedly tries for a year to disclose it [link]

Worth a read

That's all for now, folks. Until next time,

– Molly White

References

Complaint, Gemini Trust Company, LLC v. Digital Currency Group, Inc. and Barry Silbert. Supreme Court of the State of New York, County of New York. ↩

"CFTC Investigators Conclude Crypto Lender Celsius, Ex-CEO Broke Rules", Bloomberg. ↩

Alameda Research LLC v. Friedberg. United States Bankruptcy Court, D. Delaware. ↩

"Exclusive: FTX's former top lawyer aided U.S. authorities in Bankman-Fried case", Reuters. ↩

"FTX Begins Talks on Reboot Amid Regulatory Crackdown on Crypto Exchanges", Wall Street Journal. ↩

Cross-motion, In re: BlockFi Inc. United States Bankruptcy Court, D. New Jersey. ↩

"Three Arrows Liquidators Seek $1.3 Billion From Fund's Founders", Bloomberg. ↩

"Three Arrows Capital Liquidator May Try to Claw Back About $1.2B From DCG, BlockFi", CoinDesk. ↩

"Crypto's Most Powerful Woman Speaks Out as Crisis Rocks Binance", Bloomberg. ↩

"Binance Crypto Custody License Application Denied by German Regulator BaFin: Report", CoinDesk. ↩

"Binance Australia Offices Searched by Regulator as Part of Derivatives Probe", Bloomberg. ↩

"Binance Feels Strain of World's Regulators Leaping Into Action", CoinDesk. ↩

"Binance's Euro Banking Partner to Halt Support of the Crypto Exchange in September", CoinDesk. ↩

June 2023 Exchange Review, CCData. ↩

"Binance.US Crypto Market Share Dives", Wall Street Journal. ↩