Issue 33 – Can I cross border with crypto?

... and other questions you should probably answer before you decide to steal $9 million.

The big news this week was the slew of lawsuits and criminal charges against Celsius and its CEO Alex Mashinsky, plus a ruling in the long-running SEC v. Ripple case that set off a wave of speculation as to potential implications for other securities-related litigation.

That's not all, though — it was a very busy week, with developments in various court cases, lawmakers making demands for crypto-related investigations (though I doubt you'll guess the target), and more than $100 million lost to various SNAFUs.

In the courts

Crypto Twitter has been abuzz this week as Judge Analisa Torres issued a ruling on motions for summary judgment in the SEC v. Ripple case that has some claiming victory for Ripple. This is probably premature, as I wrote in my most recent special edition:

Elsewhere in SEC cases, the Commission argued that Coinbase made a knowing and "calculated decision to take on [securities law risks] in the name of growing its business".1 Later, in a pre-motion hearing on July 13, Judge Katherine Polk Failla tried to understand Coinbase's argument that the SEC implicitly signed off on Coinbase's business model when they approved its S-1:2

I am not saying that the commission should be omniscient at the time it's evaluating a registration statement and that it should know all things. But I would have thought the commission was doing diligence into what Coinbase was doing, and somehow I thought that it would say, you know, you really shouldn't do this. This is violative of the securities laws, or we are kind of in some interesting unchartered territory here with respect to whether the assets on your platform are securities, so be forewarned that maybe some day there could be a problem.

Meanwhile, Coinbase has suspended its staking services in California, New Jersey, South Carolina, and Wisconsin as a result of state lawsuits which were filed simultaneously with the lawsuit from the SEC. Ten states in total filed lawsuits related to Coinbase's staking services, but these four stipulated that Coinbase must stop offering staking services to their residents as the cases are litigated.3

The SEC wants to subpoena communications pertaining to the "Let's Go Brandon" cryptocurrency token (also called LGBcoin) between hedge fund manager James Koutoulas and high-profile conservatives including Candace Owens and former Representative Madison Cawthorn. Koutoulas filed a motion to quash, arguing that the SEC has no jurisdiction because LGBcoin is not a security.4 The SEC has helpfully pointed out to him that that is not actually his decision to make, and that it's a wildly premature argument.a

LBRY, the company behind the blockchain-based "free speech" file-sharing network of the same name, has been fined a bit over $111,000 for their "egregious" unregistered securities offering and will now shut down. The SEC originally wanted a $22 million fine, but massively reduced the request because of the company's "lack of funds and near-defunct status". The judge didn't rule on the specific question of whether LBRY's token (LBC) was a security, which some in the industry are quite irritated about (and not unreasonably, in my view).5

Terraform Labs co-founder Shin Hyun-Seong (aka Daniel Shin) is preparing for trial in South Korea after he was charged with deceiving investors and manipulating token prices in connection with the failed Terra/Luna projects.6

Sam Bankman-Fried wants a list of close friends to be able to visit without signing the visitor log or being accompanied by a security guard.7 They will pinky swear not to let him use their laptops or cell phones. SBF also wants to be able to provide the list of names under seal. The government doesn't object to the list being kept out of the public record, but lawyer-journalist Matthew Lee and his organization Inner City Press intends to do so if the request is granted.8

Federal prosecutors have reportedly been investigating former FTX executive Ryan Salame and his girlfriend Michelle Bond for possibly falling afoul of campaign finance laws in connection to Bond's 2022 campaign for the Republican nomination for a New York seat in Congress. This has nothing to do with FTX or the lawsuits relating to it, but does seem to explain the FBI's search of Salame's home in late April that I mentioned in Issue 26.9

The DOJ announced its "first criminal case involving [an] attack on a smart contract operated by [a] decentralized exchange", accusing computer security engineer Shakeeb Ahmed of wire fraud and money laundering. They didn't name the exchange, but the details in the indictment make it trivial to identify the target as Crema Finance, which was exploited for around $9 million in July 2022 [W3IGG]. Ahmed eventually returned all but around $1.5 million of the funds in exchange for an agreement that Crema not refer the incident to law enforcement. I guess he learned the hard way that those agreements don't necessarily mean you won't get charged. Amusingly, after committing the attack, Ahmed allegedly made the following search queries:

- embezzled

- defi hacks fbi

- defi hacks prosecution

- wire fraud

- how to prove malicious intent

- evidence laundering

- can I cross border with crypto

- how to stop federal government from seizing assets

- buying citizenship

Criminal mastermind.

In bankruptcies

FTX wants the bankruptcy court to award more than $323 million in recovery from the leadership of FTX Europe. The bankruptcy team claims that FTX's acquisition of the Swiss Digital Assets DA AG ("DAAG") company, which later became FTX Europe, was little more than a "dubious investment designed to enrich [FTX insiders] or further their criminal scheme". DAAG "had limited business and no intellectual property beyond a 'business plan'", but "FTX insiders… believed DAAG's founders could provide access to European regulators that would allow FTX to obtain the necessary licenses for activities in the European Economic Area". According to the bankruptcy team, one of the beneficiaries of the deal was a "close associate" of Bankman-Fried's, and the deal was partially motivated by FTX insiders wanting to enrich him and another party.10

BlockFi's Committee of Unsecured Creditors continues to not pull any punches. A 92-page preliminary report aimed at answering "Why did BlockFi fail?" alleges that BlockFi management — particularly CEO Zac Prince — were irresponsible in their due diligence (or lack thereof) when choosing to overexpose the company to FTX. In particular, the Committee claims that in August 2021 the management saw the very same type of balance sheet that was ultimately published by CoinDesk in November 2022, kicking off the series of events ending with FTX's demise. However, Prince allegedly overruled the alarm bells that BlockFi's risk management team was ringing about it, telling them in August 2021 to "get comfortable [with Alameda] being a three arrows size borrower".11 BlockFi maintains that there's no evidence that management "knew, should have known, or reasonably could have known, about FTX's and Alameda's true nature", and that it would be too pricey to pursue legal remedies against them.12

In government

In the U.S.

Prometheum is a crypto trading firm that recently emerged as the poster child for compliance in the crypto industry, having successfully registered with the SEC as a "special purpose broker-dealer" for digital assets and as an "alternative trading system". Prometheum's SEC-praising co-CEO Aaron Kaplan then turned up as a witness in a June House of Representatives hearing, painting a target on the firm's back among crypto advocates and SEC critics who viewed Prometheum as falling somewhere in the spectrum from "startup likely to fail" to "corrupt SEC plant that illegitimately earned its registration". Now some Republican lawmakers have picked up this baton, and added a twist of China panic. They're insisting that the Attorney General and/or SEC investigate the firm, zeroing in on what they allege are conflicting statements between Prometheum's public financial statements and Kaplan's testimony to Congress about investments in the company from "China-based entities… with ties to the Chinese Communist Party". The Congresspeople who signed the letter are Sen. Tommy Tuberville (R-AL), Rep. Blaine Luetkemeyer (R-MT), Rep. Barry Loudermilk (R-GA), Rep. Ralph Norman (R-SC), Rep. Byron Donalds (R-FL), and Rep. Mark Alford (R-MO).13

Elsewhere, Rep. Ritchie Torres (D-NY) has asked for two separate investigations into the SEC over its registration of "deceptive" Prometheum, and over what he describes as a "haphazard and heavy-handed approach to digital assets". He sent his requests to the Inspector General of the SEC and to the Comptroller General.1415

These letters strike me as a handy way for these Congressmembers to play to their crypto base without actually having to do anything.

Speaking of Congresspeople having to actually do things, the markup of Republican-proposed comprehensive crypto regulation has been pushed back to July 26.16

You might remember New York Mayor Eric Adams for nailing the very top of the crypto markets when he announced in November 2021 that he would accept several of his first paychecks in Bitcoin. Ouch. Despite that, he's remained a dedicated Bitcoin shill, which made it a bit surprising when his annual financial disclosure stated he held no "security, including stocks, bonds, ETFs, mutual funds, or cryptocurrencies with a market value of $1,000 or more". Now, he claims that this was all a misunderstanding over whether the form required him to disclose non-security cryptocurrencies, and he has since promised to amend the form. Oopsie poopsie. This definitely wasn't a publicity stunt to make a statement around the status of cryptocurrencies as securities, I'm sure.17

In the EU

The European and Securities Markets Authority (ESMA) released a set of proposals related to conflict-of-interest rules and customer complaints under the EU's new MiCA regulations. In doing so, chairwoman Verena Ross stated, "We also want to remind consumers that, even with the implementation of MiCA, there will be no such thing as a safe crypto-asset".18

In international institutions

The Financial Stability Board, a G20 financial watchdog, published a global regulatory framework, which cites the massive failures since 2022 as a strong factor in their decisionmaking. According to the FSB, global baseline rules would help address the problem of crypto firms skirting regulations by going to friendlier jurisdictions, while still allowing countries to be stricter if they desire.19

The Bank for International Settlements, which sometimes goes a little starry-eyed over the so-called promise of blockchains but has generally seemed fairly unimpressed by cryptocurrencies, wrote in a recent report that "crypto has so far failed to harness innovation to the benefit of society" and that "crypto's inherent structural flaws make it unsuitable to play a significant role in the monetary system".

In Celsius

The other big news this week was the filing of lawsuits against the bankrupt Celsius crypto lender and its CEO Alex Mashinsky [W3IGG]. The company suspended withdrawals on June 12, 2022, and filed for bankruptcy on July 13, 2022. Finally, a year later to the day, Alex Mashinsky was arrested and the DOJ indictment was unsealed.20 The SEC,21 CFTC,22 and Federal Trade Commission (FTC)23 also simultaneously filed lawsuits. Mashinsky is charged with seven counts including securities and commodities fraud, wire fraud, and conspiracy to manipulate the price of Celsius' CEL token. Roni Cohen-Pavon, Celsius' former Chief Revenue Officer, was also named in the indictment.

Mashinsky was already battling a lawsuit from the New York Attorney General that was filed in January [W3IGG], but after the damning examiner's report was published in February as a part of the bankruptcy proceedings, people were growing impatient for more substantial legal action.

Mashinsky pleaded not guilty and is now out on $40 million bail. His attorney gave the expected canned reply to press about how he "vehemently denies the allegations".24

The portion of the FTC complaint targeted at the Celsius corporate entity has already been settled, in an agreement that — if Celsius was operational — would prevent Celsius from operating the type of service they once offered. The FTC also imposed a fine of $4.72 billion. This fine is only going to be imposed after Celsius returns its remaining assets to consumers, and they don't have sufficient assets to do that, so what's another couple billion in debt that'll never be repaid, I guess. The portions of the FTC complaint that target Mashinsky personally, as well as co-founders Shlomi Daniel Leon and Nuke Goldstein, were not settled and will proceed in court.25 The FTC hasn't been as prominent in crypto litigation compared to the SEC or CFTC, but given Celsius's egregiously false advertising to consumers, it's not terribly surprising they decided they had to step in.

In Binance

The Wall Street Journal said Binance had fired more than 1,000 of its formerly 8,000 global employees.26 The same day, CNBC reported that the 1,000 firings were only the beginning of the 1,500 to 3,000 Binance had planned.27 Both outlets characterized the layoffs as belt-tightening in preparation for the outcome of an ongoing U.S. Department of Justice investigation.

Binance CEO Changpeng "CZ" Zhao refuted the allegations in what may just be his knee-jerk response to any media reports about the company at this point. He and a Binance spokesperson said that the layoffs were substantially different in number from what was reported in the media, and he maintained that it was all part of attempts to "increase talent density" in the company and not related to any issues at Binance. "This happens in every company," he wrote.

Things took an awkward turn for CZ when Adam Cochran tweeted a screenshot of an internal message, writing, "Hey [CZ] if your layoffs weren't about cost cutting, why on June 19th did you announce on WEA that you suddenly cut extended benefits for all employees, & *tell them* it was because of 'a decline in profit'? Not exactly trust building to lie about this…"

The announcement informed employees that Binance would be slashing employee benefits, including COVID-19 care reimbursement, mobile phone reimbursement, fitness reimbursement, and work-from-home expenses. The message attributed the change to a "decline in profit" that was requiring them to "be more prudent with our spending".28 The following day, the Wall Street Journal published a report apparently based on the same message.29

CZ reacted by claiming on Twitter that Cochran was "constantly spreading FUD about Binance … just because he pitched his project to Binance Labs and we didn't invest."30 CZ didn't attempt to refute the actual claims, or deny the authenticity of the screenshot.

Meanwhile, in the SEC lawsuit against Binance, a strange entity called Eeon has filed a motion to intervene on behalf of Binance customers, arguing that there needs to be a participant who will argue for customer interests. They also want both the SEC and Binance to have to make daily payouts to compensate customers for loss of access to their funds.31

In other amusing crypto news

The crypto miner Hive Blockchain has rebranded as Hive Digital Technologies as they "evolve [their] focus" to AI.32 Pivot!

9,800 Bitcoin (~$295 million) are on the move as the U.S. government likely prepares to sell more Bitcoin confiscated from the perpetrator of the 2012 Silk Road hack. As always, people are worried that this could tank Bitcoin prices, because Bitcoin markets are so illiquid that selling 0.05% of the available supply can actually cause noticeable movement.33

Massive Singaporean state-owned investment company Temasek is backing away from the crypto sector.34

Despite their initial enthusiasm, Sega is hopping off the blockchain train (blocktrain?) due to concerns that it will "devalue" their IP. "The action in play-to-earn games is boring. What's the point if games are no fun?" said co-Chief Operating Officer Shuji Utsumi. While Sega was initially eager about the web3 concept, even planning several blockchain-based projects, now Utsumi says the company is "looking into whether this technology is really going to take off in this industry, after all".35

![Crypto Company Announcement Translation Guide "Today is my last day at [ ]. I am excited to spend more time with family and working on new projects" "We are excited to announce our expansion to [Island Nation]." "We are excited to announce our expansion to the UK" "Decentralizing []" "The path to decentralization and handover to the community for [] is now complete" "We have no exposure to []" "I am quitting [] because of massive fraud and looming legal actions" "We are under investigation by the CFTC" "We are under investigation by the SEC" "Founders and investors are ready to dump their tokens on you" "Devs have finished dumping their tokens and are now ready to stop working" "We have massive undisclosed exposure to [ ]" "Operations continue as normal" "Bankruptcy filing is imminent"](https://www.citationneeded.news/content/images/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https-3a-2f-2fsubstack-post-media.s3.amazonaws.com-2fpublic-2fimages-2fbbee9e05-1b12-4a7f-8158-6030ec0730cd_1000x602.png)

The Web3 is Going Just Great recap

There were 17 entries between July 10 and 17, averaging 2.1 entries per day. $109.42 million was added to the grift counter.

Multichain implodes

[link]

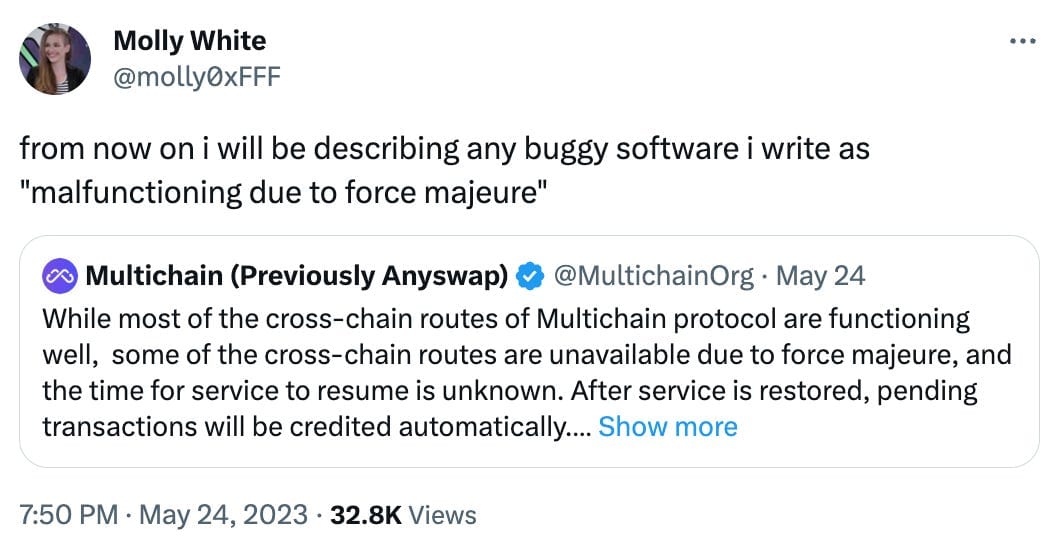

The Multichain saga has been one of the weirdest I've seen since I started closely watching the crypto industry, and that's saying a lot.

On May 24, the blockchain bridge project announced that transactions were "stuck" due to a backend upgrade that was "taking longer than expected". They later stated that some cross-chain routes were unavailable due to force majeure. I made fun of them, because it's hilarious to call a software bug "force majeure".

As it turns out, it was a little more than a bug: the CEO had just gotten whisked away by Chinese police, who also took his devices, hardware wallets, and mnemonic phrases, and the project team was having a hard time accessing the service because he was the sole keeper of these critical access credentials. On July 6, $130 million was suddenly and mysteriously drained from the service. Another $107 million went missing on July 10. On July 14, the team was finally forced to admit that the CEO had been arrested in late May, and that they had only kept the project operational because his sister had granted them physical access to the CEO's home computer, which had saved credentials. The July 6 transfer, according to them, was an unknown party transferring funds out of the project. The July 10 movement of funds, they say, was the CEO's sister aiming to preserve assets by moving them into wallets she controlled. However, on July 13, she too was reportedly arrested.

The project has announced it's shutting down, and the remaining team seems to have little hope of the $237 million being recovered. Meanwhile, people are widely speculating that the whole thing was an inside job.36 Two other projects, Geist Finance [W3IGG] and Hector Network [W3IGG], have announced they'll also be shutting down in the wake of Multichain's collapse, as they were dependent on the project.

Arkham Intelligence announces new dox exchange

[link]

Arkham Intelligence is a blockchain intelligence company with the tagline "deanonymizing the blockchain". On July 10 they announced the launch of their new "on-chain intelligence exchange", where they will invite users to "buy and sell information on the owner of any blockchain wallet address—anonymously, via smart contract."

The project was quickly dubbed "dox-to-earn" by miffed crypto users concerned with the massive privacy and safety concerns likely to be introduced by adding financial incentives to the task of connecting blockchain wallets to real individuals.

"hey isn't the most profitable use of this just to put a bounty on whale wallets and then kidnap people? like ... did that come up in any meetings?" wrote one Twitter user.

Amusingly, the same day as the announcement, it was widely discovered that Arkham had been exposing user email addresses via its referral links, which used easily-reversed base64-encoded email addresses as unique identifiers. [W3IGG]

Arkham's CEO made what I think are pretty strong arguments against public blockchains in general as he tried to defend the project: "Publicly available blockchains are probably the worst possible way of keeping one's private information private. You are literally making transactions which you are broadcasting to a decentralized network of millions of people, all of whom can look on-chain in order to see which transactions are being broadcast."37

Inspector in bankruptcy proceeding charged with kidnapping "Crypto King" alleged scammer

[link]

The 23-year-old self-described "Crypto King" who allegedly stole over $35 million in investor money has made it to the newsletter once before. [W3IGG]

Now he's back, but it's because he's survived allegedly being kidnapped, confined, and beaten by five men, including one who lost $740,000 to the Crypto King's alleged scam. The man, Akil Heywood, was appointed by other investors to be an inspector in the bankruptcy, a role in which he's supposed to represent the interests of the investor group.

He apparently (allegedly) decided to do this by kidnapping the man, beating him, and forcing him to record a video explaining what happened to the funds. He's also been charged with threatening the bankruptcy trustee, trying to get $2 million in crypto out of him.

Everything else

- Hector Network begins shutdown after Multichain collapse [link]

- Scammer "Soup" makes more than $1 million through Discord hacks [link]

- Geist Finance shuts down after Multichain-related losses [link]

- SEC, CFTC, and FTC sue Celsius; CEO Alex Mashinsky arrested [link]

- Digitex Futures CEO to pay $15 million over commodities violations [link]

- OptyFi shuts down, citing regulatory threats and failed fundraising attempt [link]

- Platypus Finance hacked for the second time [link]

- New Rodeo Finance project exploited for the second time in one week [link]

- NFT phisher charged over OpenSea lookalike scam [link]

- AlgoFi announces shutdown [link]

- Multichain drained of another $107 million days after previous theft [link]

- Arkham Intelligence referral program exposes user emails [link]

- Dubai regulator cracks down on BitOasis [link]

- Arcadia Finance exploited [link]

Worth a read

I recommended Matt Levine's writeup of the recent Ripple decision in my special edition, but I'm recommending it again. He explains his view of the ruling (spoiler: he thinks it's "so weird") with a useful analogy to Meta stock.

A nice step in the right direction for open access. As someone who regularly battles uses PACER to follow crypto-related cases, Researcher Seamus Hughes said it well: "For me and PACER it's about the little victories. Does the PDF actually load this time? Is that district court website actually working today? If the answer is yes, it's a win. That's the bar I've set in my head after decades of disappointment. As a general rule in a functioning democracy, public records, in particular, legal ones, should be free. But barring that, if we can clawback 125 million from the U.S. Courts for overcharging for a website that lacks basic user search functions, I'll take it."

I won't be eligible for the reimbursement due to the time window, but if I was, I'd donate my reimbursement to CourtListener, which has saved me hundreds of dollars in PACER fees and allowed me to easily share court documents directly with all of you.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Opposition to Motion to Quash, and Motion to Compel Compliance with an Administrative Subpoena filed on July 13, 2023. Document #6 in Koutoulas v. United States Securities and Exchange Commission. ↩

References

Response in Opposition to Motion filed on July 7, 2023. Document #26 in Securities and Exchange Commission v. Coinbase, Inc. ↩

Transcript of conference on July 13, 2023. Securities and Exchange Commission v. Coinbase, Inc. Transcript obtained via Decrypt. ↩

"Why we stand by staking", Coinbase. ↩

Motion to Quash an Administrative Subpoena filed on June 23, 2023. Document #1 in Koutoulas v. United States Securities and Exchange Commission. ↩

Memorandum and Order filed on July 11, 2023. Document #109 in US Securities and Exchange Commission v. LBRY, Inc. ↩

"Legal proceedings start for Terraform Labs co-founder in South Korea: Report", CoinTelegraph. ↩

Letter Motion filed on July 13, 2023. Document #174 in United States v. Bankman-Fried. ↩

Notice filed on July 14, 2023. Document #175 in United States v. Bankman-Fried. ↩

"Former FTX Executive Linked to Campaign-Finance Probe of New York GOP Race", Wall Street Journal. ↩

FTX Trading Ltd. - Adversary Proceeding (23-50437) filed on July 13, 2023. ↩

Preliminary report filed on July 14, 2023. Document #1202 in In re: BlockFi, Inc. et al. ↩

"BlockFi Bet Big on FTX and Alameda Even After Seeing Infamous Balance Sheet, Creditors Say", CoinDesk. ↩

"Tuberville Leads Letter Calling for DOJ, SEC Investigation Into China-tied Crypto Firm Prometheum, Inc.", Senator Tommy Tuberville press release. ↩

"Congressman Torres Calls for Investigation Into SEC Over its Approach to Crypto", CoinDesk. ↩

"House Financial Services Committee pushes back crypto markup", Politico. ↩

"NYC mayor Eric Adams to update disclosure form after failing to report crypto holdings, report says", CNBC. ↩

"EU regulator says 'no such thing as a safe crypto-asset'", The Block. ↩

"Global rules leave crypto firms with no place to hide, says G20 watchdog", Reuters. ↩

Indictment filed on July 11, 2023. United States v. Mashinsky. ↩

Complaint filed on July 13, 2023. Securities and Exchange Commission v. Celsius Network Limited. ↩

Complaint filed on July 13, 2023. Commodity Futures Trading Commission v. Celsius Network LLC. ↩

Complaint filed on July 13, 2023. Federal Trade Commission v. Celsius Network Inc. ↩

"Ex-Celsius CEO is charged with fraud", CNN Business. ↩

"FTC Reaches Settlement with Crypto Platform Celsius Network; Charges Former Executives with Duping Consumers into Transferring Cryptocurrency into their Platform and then Squandering Billions in User Deposits", Federal Trade Commission. ↩

"Binance Lays Off Over 1,000 Employees", Wall Street Journal. ↩

"Binance could lay off thousands as company buckles down for DOJ probe, source says", CNBC. ↩

Tweet thread by Adam Cochran ↩

"Binance Cuts Back Employee Benefits, Citing Decline in Profit", Wall Street Journal. ↩

Motion to Intervene filed on July 14, 2023. Document #90 in Securities and Exchange Commission v. Binance Holdings Limited. ↩

"Crypto miner Hive Digital drops 'blockchain' from name amid pivot to AI", CoinTelegraph. ↩

"Silk Road–Linked Bitcoin Worth $300M Moved by U.S. Government: On-Chain Data", CoinDesk. ↩

"Singapore's Temasek says it's not looking to invest in crypto firms amid current regulatory uncertainties", CNBC. ↩

"Sega Pulls Back From Blockchain Gaming as Crypto Winter Persists", Bloomberg. ↩

"Multichain Protocol Experiences Mysterious Withdrawals, Suggesting Multi-Million Dollar Hack or Rug Pull", Chainalysis. ↩

"Arkham CEO Defends 'DOX-to-Earn' Program, Says Public Blockchains 'Worst' for Privacy", CoinDesk. ↩