Issue 42 – To the moon

Reddit MOONs aren't mooning, and people can't tell if TrueUSD is telling the truth. Also, a crypto project feels the industry's initial ambition to create "the new internet" is hopeless.

This break in the Sam Bankman-Fried trial is a good opportunity to take a step back and look at the rest of the cryptocurrency world. It's been a light week or two as far as hacks and scams, but a busy one in the regulatory and legislative world.

The Sam Bankman-Fried trial (and thus my coverage of it) will resume on Thursday.

In the courts

Coinbase and the SEC are wrapping up a bout of legal sparring in the court case from the latter against the former, which was originally filed in June. Coinbase wants the case dismissed, based on the claim that 1) Coinbase doesn't trade securities, and 2) the SEC is violating what's known as the Major Questions Doctrine: the idea that agencies may not decide issues of major significance without clear direction from Congress.1 It would be surprising to see the case thrown out at this stage, but you can't blame them for trying.

Gemini, Genesis, and DCG

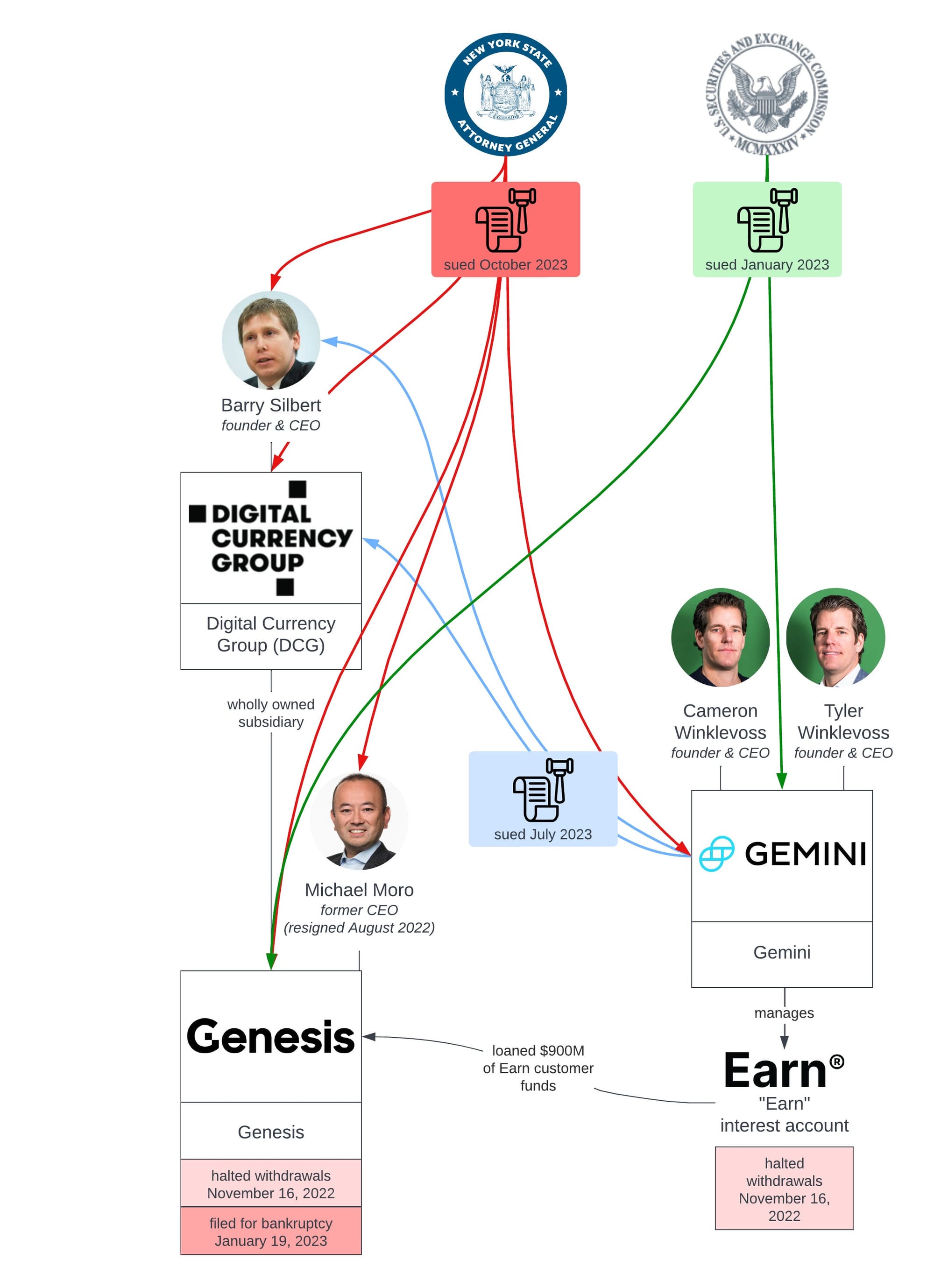

Ever since the Genesis crypto lender halted withdrawals in November 2022 [W3IGG], they've been on the receiving end of a spirited onslaught from Gemini, an exchange that has around $900 million of their customer funds stuck with Genesis. The founders of Gemini, the Winklevoss twins, have written several strongly-worded cartoon supervillain-esque open letters to Genesis, its parent company Digital Currency Group, and DCG's founder Barry Silbert, aggressively accusing them all of fraud. When Silbert's companies wouldn't agree to a repayment plan they proposed, the twins followed the letters with a lawsuit filed on July 7.

Now, the Attorney General of New York is entering the fray, saying "you know what? It does look like they committed fraud. But so did you, Gemini." That lawsuit, filed October 19, names Gemini, Genesis, and DCG as defendants, as well as the individuals Michael Moro (former CEO of Genesis) and Barry Silbert (CEO and founder of DCG). The Winklevii are not named. According to the NYAG, Gemini knew their exposure to Genesis was high risk, but continued to promote the Gemini Earn lending product to retail customers as a safe way to earn profits on their crypto holdings. According to the NYAG, Gemini at one point revised its internal evaluation of Genesis' creditworthiness to "junk grade", some of their own risk personnel withdrew their own funds from the Gemini lending program, and one exec compared Genesis' condition to the Lehman Brothers shortly before its collapse — but no communication was ever made to customers to inform them that the product had become riskier, nor did Gemini ever really stop working with Genesis (despite gestures at doing so a month or two before Genesis ultimately halted withdrawals). Meanwhile, the NYAG asserts that Genesis failed to adequately vet its borrowers, although they lied to their business partners that they had done so. Furthermore, DCG and Genesis reportedly tried to hide the truth of Genesis' dire financial condition, including by creating a decade-long, 1% interest, $1.1 billion promissory note between DCG and Genesis and by falsifying financial reports or trying to delay sending them.2

The lawsuit highlights some examples of individuals who were hurt by the companies' alleged actions:

One of the Earn investors was Complainant No. 1, a 73-year-old mother, grandmother, and resident of the State of New York. She and her husband, who are both retired, invested their life savings of over $199,000 in Earn because they believed Gemini's marketing statements that Gemini was a safe and secure choice. Complainant No. 1 had hoped to use this money to pay for her grandchild's education. Outside of her Earn investment, she and her husband have little savings.

Another Earn investor, Complainant No. 2, is a 56-year-old resident of the State of New York. Complainant No. 2 invested approximately $20,500 in Earn, virtually all his savings. Complainant No. 2 chose Earn because he researched the product and came to believe, based on Gemini's statements, that Earn was more secure than other interest-bearing cryptocurrency investments.

The web of litigation grows ever more tangled.

In governments and regulators

When an appeals court sided with Grayscale in August, finding that the SEC had not "adequately explain[ed] why it approved the listing of two bitcoin futures ETPsa but not Grayscale's proposed bitcoin ETP" and vacating the Commission's order denying their application, the SEC was given 45 days to appeal. That window expired recently, with no appeal from the SEC, and so on October 23 the court issued a mandate formalizing the ruling.3 All eyes are now back on the SEC, who will take another pass at reviewing the application.

Over in the long-running SEC v. Ripple case, the SEC has dismissed the charges it had originally filed against the company's CEO, Brad Garlinghouse, and Executive Chairman, Chris Larsen. These were set to be tried in front of a jury, but on October 19, the two parties agreed that the SEC would dismiss the charges with prejudice.4 The original charges filed against the company (rather than the individuals) still remain.

Coinbase is once again pounding the table, insisting that the SEC is taking too long to respond to their request that the agency write bespoke rules for the cryptocurrency industry.5

The Financial Crimes Enforcement Network (FinCEN) is considering designating cryptocurrency tumblers (also called "mixers") an area of "primary money laundering concern". They would require these services to collect and report identifying information for transactions, rather defeating the whole purpose. It defines "mixing" extremely broadly, in such a way that seems encompass quite a lot of crypto activity that would not normally be considered mixing:

(Note: CVC is "Convertible Virtual Currency", meaning any virtual currency that is not legal tender).

The term "CVC mixing" means the facilitation of CVC transactions in a manner that obfuscates the source, destination, or amount involved in one or more transactions, regardless of the type of protocol or service used, such as: (1) pooling or aggregating CVC from multiple persons, wallets, addresses, or accounts; (2) using programmatic or algorithmic code to coordinate, manage, or manipulate the structure of a transaction; (3) splitting CVC for transmittal and transmitting the CVC through a series of independent transactions; (4) creating and using single-use wallets, addresses, or accounts, and sending CVC through such wallets, addresses, or accounts through a series of independent transactions; (5) exchanging between types of CVC or other digital assets; or (6) facilitating user-initiated delays in transactional activity.

They are soliciting comment on the proposal through January 22, 2024.

In the news

This has been a rough week for crypto-related journalism.

The Wall Street Journal and others

The Wall Street Journal published major report on October 10, claiming: "Hamas's lightning strike on Israel last weekend has raised the question how the group financed the surprise operation. One answer: cryptocurrency."

First of all, it's known that Hamas receives funding from state sponsors, making the overdramatic "One answer: cryptocurrency" pretty misleading. But more importantly, the report may have been based on shoddy research, with the WSJ's sources BitOK and Ellliptic reportedly misidentifying substantial funds as being linked to terrorist entities, according to Chainalysis. The numbers printed in the WSJ were then cited by Elizabeth Warren and other senators, who wrote to urge the Treasury to crack down on crypto following attacks by Hamas in Israel.

Cryptocurrency numbers are regularly overstated in news reports (especially crypto media), and generally to the benefit of the industry. Remember, for example, the sentiment that crypto was somehow unilaterally supporting Ukraine in its resistance against the Russian invasion when in reality, it formed only a small sliver of the mostly fiat-denominated aid that flowed to the country. Now, it's a crypto-critical narrative being bolstered by apparently bad numbers, and that's disappointing to see if that's indeed what happened. There's no doubt that cryptocurrency helps to fund terror, but using bad numbers to make it into a larger-than-life bogeyman isn't the way to push policy forward.

The FinCEN proposal I mention above also cites Hamas terror financing as a motivating factor, though it does not cite the WSJ report or its underlying data.

Cointelegraph

Bad reporting also came out of crypto media outlet Cointelegraph this week, when they erroneously announced on Twitter that the SEC had approved one of the long-awaited Bitcoin spot ETFs [W3IGG]. Bitcoin prices soared by almost $2,000 on the news before dropping right back down when it was revealed that Cointelegraph had been hoodwinked by a faked Bloomberg Terminal screenshot. Almost $100 million in positions were liquidated: mostly Bitcoin shorts that were wiped out by the surge, although some long positions were also taken out by the dip back down when the truth became apparent.

Cointelegraph subsequently apologized for their error, blaming a failure in their usual editorial controls. The whole incident is a reminder of just how dramatically misinformation can move crypto markets, and is reminiscent of the April market dips when an influential crypto personality tweeted a false rumor that Binance CEO Changpeng Zhao had been arrested [W3IGG], or two incidents in late 2021 when media outlets fooled by fake press releases inadvertently pumped the prices of Bitcoin Cash [W3IGG] and Litecoin [W3IGG] on supposed news that they would be accepted by major retailers.

In Binance

Binance has lost even more executives. Stéphanie Cabossioras, managing director of Binance's operations in France, jumped ship on October 18.6 The following day, Saulius Galatiltis, the CEO of Binance's payment processing subsidiary Bifinity UAB, resigned.7

Speaking of payment processing, Binance's US arm also suspended withdrawals denominated in US dollars on October 16, something they had warned8 might happen back in June when they suspended dollar deposits. In a terms of use update, Binance also stopped promising that any USD deposits on the platform would be FDIC insured.9 Binance US customers can still withdraw cryptocurrencies, including dollar-denominated stablecoins.

This change has come amidst general difficulties by Binance in finding banking partners willing to work with them, though some good news came for the company on October 19 when they managed to find a new Euro banking partner after being dropped by their last one in September.10

The Web3 is Going Just Great recap

There were 12 entries between October 13 and October 22, averaging 1.2 entries per day. $7.83 million was added to the grift counter.

Reddit scraps its MOONs

[link]

Back in 2020, when people were getting all excited about blockchainifying everything in sight, Reddit decided it should make a version of its famous karma system that was crypto-based. They called it Community Points, and promised people they could finally acquire something that would "represent ownership in the subreddit" (what does that mean???) However, these were limited to only three subreddits: r/CryptoCurrency, whose token was called $MOON; r/FortniteBR, which had a token called $BRICK; and r/EthTrader, which had the $DONUT token.

Crypto advocates were delighted, largely viewing it as an opportunity to onboard the masses to crypto.

Now, however, Reddit has pulled the plug on the program. Citing scaling difficulties, regulatory uncertainty, and the amount of resources the company found itself having to put into the feature, they informed holders that their tokens would no longer have any functionality on Reddit. As tends to happen when companies abandon their tokens, the price plummeted.

Some holders were furious, having sunk surprising amounts of money into the tokens. "You just cost me thousands of dollars with zero warning," wrote one. Others accused Reddit of rug-pulling. Some, however, were delighted, having felt that the tokens only incentivized low-quality engagement farming. "That's awesome! Maybe we'll start getting some quality content that isn't for the purpose of trying to farm MOON."

After the announcement, some observed that some wallets had sold substantial quantities of tokens shortly before the information was made public. It was later determined that some subreddit moderators had sold their holdings when they received slightly advance notice that the feature would be cancelled. These moderators were removed from their positions, and some community members called for further action, including calling for regulatory scrutiny into potential insider trading.

Superdao says the quiet part out loud

[link]

It's not unusual these days for a crypto firm to go under. However, two things were unusual about the demise of Superdao, a project that set out to help groups form DAOs.

For one, they announced that they would be returning funds left over from their seed funding round to investors. They wrote in their announcement that a "substantial" amount remained of the $10.5 million they'd raised in 2021.

The second was that there was no mention of "regulatory uncertainty" or "crypto winter" or "macroeconomic forces" when explaining why they were closing up shop. Instead, they very bluntly addressed the reason: "It became clear that the crypto industry itself becomes much smaller than its initial ambition ("the new internet") and specialized tools for crypto companies are unlikely to produce venture-scale outcomes."

An explanation by TrueUSD raises even more concerns

[link]

Justin Sun project TrueUSD disavowed a new stablecoin that emerged earlier this month, called $TEURO. They claimed to have nothing to do with the project, and chided users to be more skeptical about newly-created tokens.

However, this explanation raised major concerns among observers who saw that the TEURO token had been deployed by the TrueUSD deployer, which left two possible explanations: TrueUSD was lying about not creating the token, or the TrueUSD deployer had been compromised. Earlier in October, TrueUSD had disclosed a hack, which they said had affected a third-party vendor and had exposed customer information. Following the TEURO disavowal, some worried that perhaps that hack had also resulted in private keys being leaked.

Everything else

- AuBit, the company behind Freeway, enters liquidation [link]

- Treasury Department introduces proposal targeting crypto mixers [link]

- Gemini, Genesis, and DCG sued over $1 billion alleged fraud [link]

- Hope Lend emptied in $825,000 hack [link]

- Everscale halts bridge as "large number" of tokens stolen [link]

- Fantom Foundation and employees lose collective $7 million in mass hack [link]

- Almost $100 million liquidated over false news of Bitcoin ETF approval [link]

- South Korean regulators allege Sui Foundation manipulated markets [link]

- Hackers host malicious code on Binance chain to circumvent takedowns [link]

Worth a read

Media upstart 404 Media teamed up with another publication I enjoy, , to do a deep dive into the investigation of a criminal organization that converted crypto into cash for criminals who didn't want to go through the increasingly-surveilled crypto off-ramps like cryptocurrency exchanges. The group delivered plastic grocery bags full of cash in exchange for crypto, often transmitting hundreds of thousands of dollars at a time.

Prisons have begun to restrict who can send books to incarcerated people, citing concerns over narcotics-soaked paper. However, this seems more like a scapegoat than a policy likely to have any real effect on the flow of drugs into prisons, and one with far more negative side effects.

That's all for now, folks. Until next time,

– Molly White

Correction: An earlier version of this post erroneously stated that there were only two subreddits with Community Points enabled, omitting the r/EthTrader subreddit.

Footnotes

An ETP is "exchange-traded product", and is a broader term encompassing exchange-traded funds (ETFs) like the one proposed by Grayscale. ↩

References

"Coinbase Poised to Make Final Pitch in Bid to Kill SEC Accusations Quickly", CoinDesk. ↩

"Attorney General James Sues Cryptocurrency Companies Gemini, Genesis, and DCG for Defrauding Investors", Office of the New York State Attorney General. ↩

Mandate issued to Securities & Exchange Commission on October 23, 2023. Document #1208564168 in Grayscale Investments, LLC v. SEC. ↩

Stipulation of voluntary dismissal on October 19, 2023. Document #918 in SEC v. Ripple. ↩

"Coinbase Decries SEC 'Bureaucratic Pantomime', Again Demands a Decision on Crypto Rules", Decrypt. ↩

"Binance France Director Exits in Latest Senior Departure at Crypto Exchange", Bloomberg. ↩

"Binance's Fiat Payments Processing Affiliate Head Leaves", Bloomberg Law. ↩

"Binance.US Halts Direct Dollar Withdrawals", CoinDesk. ↩

"Binance Says It Has Onboarded New Euro Fiat Partners for Deposits, Withdrawals", CoinDesk. ↩