Issue 48 – Bitcoin has "no chance" of going to the moon

Bitcoin ETF fakeouts, imaginary CEOs, and a bridge hack make for an eventful start to the new year.

As I begin writing this issue, I am also saying a prayer to the mailsending gods that they shepherd this email through. The transition from Substack to my own setup went remarkably smoothly, with the one notable exception of email. All subscribers seem to have been imported properly, all paid subscriptions seem to be functioning as intended, and my system is at least trying to send the right emails to the right people.

The problem arose with actually successfully getting those emails to land in the intended inboxes, rather than getting trapped up in spam filters and various other traps intended to prevent abuse. As a result, a fair number of people didn't receive the first newsletter from this site in their email as they should've, and some also had trouble receiving the sign-up verification or sign-in magic links. My sincerest apologies for that.

I have made some tweaks to my mail configuration that should hopefully help considerably. I guess we'll see once I hit "send" on this. But full disclosure: this may be a bit of a gradual process also, as Google and Protonmail and O365 and all the other bajillion email providers out there slowly begin to trust that I'm not a spammer and that (hopefully most of) you actually want to be receiving these emails. If you do see an email from this newsletter land in your spam folder, please mark it as "not spam", which really helps train these systems to not flag the newsletter going forward.

In the meantime, thanks for bearing with me. I can't tell you how delighted I am right now to be writing, instead of configuring platforms, and I'm really excited to kick the tires on a new setup that I can gradually perfect to my liking.

Right now, much of the crypto world is turning blue as they continue to hold their breath on a decision from the SEC regarding bitcoin spot ETFs [I41]. A decision on at least one of these applications is due on Wednesday, January 10, and many have speculated that the Commission will announce the whole pile of pending decisions all at once. Despite the occasional rumors that a decision was coming any second now that have all failed to come true over the last few weeks, the SEC seems to have decided to take all the time it's been allotted.

The closest thing was a brief crypto-wide heart attack on Tuesday, January 9, when the SEC's own Twitter account was compromised and posted a false announcement that the ETF had been approved [W3IGG]. Honestly, it's the most crypto thing that could have happened. Bitcoin prices jumped around $1,000 as a result of the tweet, then plummeted almost the same amount again as people learned the tweet was a fake.

Many in the crypto world seem to believe that it's a foregone conclusion that the SEC will approve at least some of these applications, and that bitcoin prices will skyrocket as a result. While I think it's possible — likely, even — that the SEC will approve some or all of the ETFs, I'm not sure I understand the arguments from people like the person who told me I should buy bitcoin this week before it crosses the $100,000 mark as a result of the decision. Many analysts and journalists have been describing an ETF approval as almost certain, so I would think its approval would be more or less priced in by now. The relatively muted price jump after the fake announcement tweet would seem to support this theory.

But even the bitcoin ETFs are approved and it fails to have significant price impact, I think we will still all be able to celebrate bitcoin achieving an important milestone towards its original goals. Finally, people will be able to turn their money into an anonymous peer-to peer asset outside of government control, to which they own their own keys and thus control completely, without having to involve powerful financial institutions like BlackRock.

Meanwhile, the various groups hoping to offer these ETFs have embarked on a race to the bottom when it comes to fees, with Bitwise currently leading the pack with a fee of only 0.20%. Grayscale's Bitcoin Trust's historic 2% fee seems like a whopper in comparison, and they plan to only reduce it to 1.5% if their conversion into an ETF is approved.1 Personally, I think it'll be really interesting to see how these low fees affect regular bitcoin trading if the ETFs are approved, as exchange fees seem quite high in comparison. A bitcoin trade on Coinbase, for example, can often cost more than 1% in fees, all told.2

In the courts

On December 28, a federal judge ruled that Do Kwon and Terraform Labs had violated the law by not registering the Terra (UST) and LUNA tokens with the Securities and Exchange Commission. The judge found that "there is no genuine dispute that UST, LUNA, wLUNA, and MIR are securities because they are investment contracts".3 This could be pretty impactful from a precedent standpoint, in an industry where pretty much every company tries to deny that the tokens they issue are subject to securities laws. Indeed, the SEC has already filed notice of supplemental authority in their other case, against Binance, which also alleges that some of the tokens Binance offered or made available for trading were unregistered securities.4

The IRS filed charges against "Bitcoin Rodney", a flashy crypto influencer who helped to promote the massive HyperVerse scam. [W3IGG]

I wrote about HyperVerse two issues ago [I46]. It was a $1.3 billion investment scam that targeted victims with promises that they would be rewarded by 0.5% to 1% daily. Just a tip: 0.5% or 1% interest rates might be quite reasonable on a much different time scale, but anyone promising you consistent returns of 1% a day is probably trying to scam you.

And by the way, I learned this week just how brain-poisoned I am from following the cryptocurrency industry. When I first saw reports that HyperVerse's CEO was revealed to have been completely made up, I thought "lol yeah that makes sense" and went on with my day. I was then surprised to see headlines about it in mainstream outlets like The Guardian, only to realize that yeah, companies completely making up their CEOs is actually unusual in most other industries and still raises the eyebrows of normal people.

Anyway, back to Bitcoin Rodney. Actually named Rodney Burton, he took a much more involved role with HyperVerse than mere promotion. According to charging documents, he accepted around $7.8 million in payments from HyperVerse scam victims, for whom he converted money into HyperVerse's $HU token. He swapped $5.8 million of this amount during the period after HyperVerse had made it impossible to convert $HU back into other cryptocurrency, meaning these victims never had any chance to actually get their cash back out. Burton, meanwhile, spent lavishly on designer cars, yacht parties, and... his own "Bitcoin Rodney Anthem".

"He mentored many many millionaires, yeah"

Now he's in custody and facing charges of operating an unlicensed money transmitting business and conspiracy to operate an unlicensed money transmitting business.

In bankruptcies

The bankruptcy judge overseeing the Celsius proceedings has okayed the change to their plan to restart the business, which sees them dramatically narrowing its ambitions and instead only pursuing bitcoin mining. There was some question if this was too far removed from the plan that Celsius creditors had approved, and thus would require a new vote, but Judge Martin Glenn ultimately found that it was not.5

Barry Silbert, CEO of Digital Currency Group (DCG), triumphantly announced on Twitter that the company had "completed a full pay down of the money borrowed from Genesis", their own subsidiary. He quoted a statement from the company, which was more precise: they had paid off their short-term loans, not all loans, and definitely not the $1.1 billion loan due in 2032.6 Some Genesis creditors, however, disagree that the short term loans have been adequately repaid. They claim they're still owed $26 million in interest and late fees, and that DCG also violated the repayment agreement by repaying the loan in part by relinquishing shares of Grayscale Ethereum Classic Trust (ETCG) and Grayscale Ethereum Trust (ETHE). In a court filing, an ad hoc group of Genesis lenders wrote that "nothing in the Partial Repayment Agreement permits the DCG Entities to satisfy their USD and BTC obligations in any asset other than USD and BTC, and certainly not via the transfer of illiquid instruments which cannot be monetized or distributed to creditors in satisfaction of their claims against the Debtors."7

In governments and regulators

India has announced it will block access to the websites of nine cryptocurrency exchanges, including Binance and Kraken. They've accused the exchanges of "operating illegally" and without complying with the country's Prevention of Money Laundering Act. The country's Financial Intelligence Unit stated in a press release that its director had requested the country's technology minister block the domains of these accounts.8

Elsewhere in crypto

BitMEX has been working on a PR stunt in which they would "send bitcoin to the moon" by loading a coin engraved with the private key to a crypto wallet containing 1 bitcoin onboard the Peregrine-1 moon lander, where it would then be placed on the surface of the moon for the some future enterprising moon explorer to collect.9 However, due to a fuel leak, the moon lander and its bitcoin cargo are stuck somewhere in space with "no chance" of making it to the moon.10 Poetic.

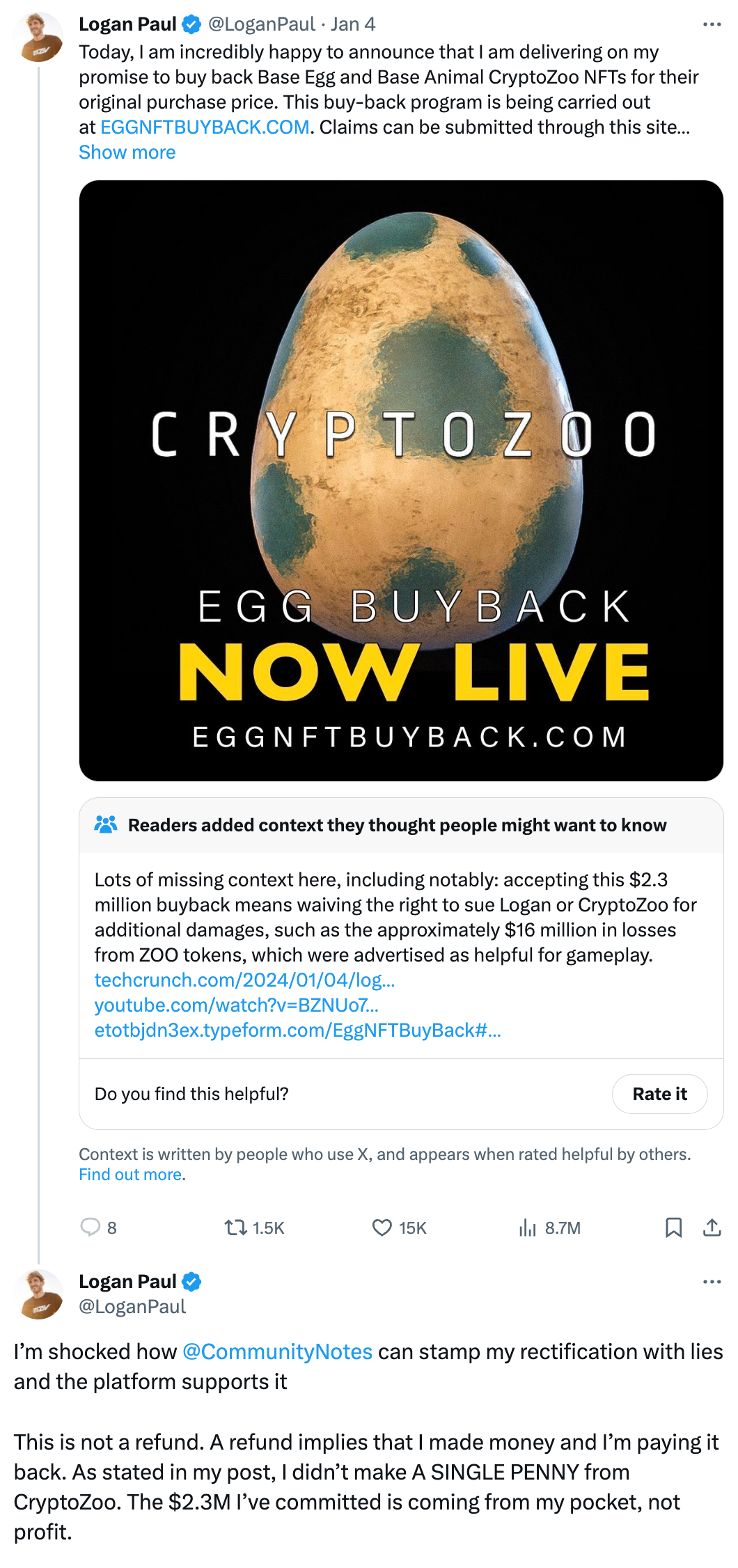

Logan Paul says he will now actually repay the people who lost money in the CryptoZoo scam he helped promote... [W3IGG] if they promise to drop the lawsuit against him. And he's only putting up $2.3 million of the roughly $18.5 million lost. The whole time, he's continued to try to deflect blame from himself onto other developers of the project. He's getting Community Note-d to hell over on Twitter, and he's real mad about it.

The Web3 is Going Just Great recap

There were 13 entries between December 26 and January 9, averaging 0.9 entries per day. $107.33 million was added to the grift counter.

Orbit Bridge hacked

[link]

There's been another bridge hack, a class of theft that tends to be rather exciting due to the sheer amount of assets that can be at stake. Some of the largest thefts in W3IGG history are from blockchain bridges, like the $625 million Axie Infinity bridge hack in March 2022 [W3IGG].

In this case, the Orbit Bridge for the Orbit Chain project was exploited, and a thief successfully drained around $81 million in ETH and the DAI stablecoin. This represented a little over half of the total value locked on the project.

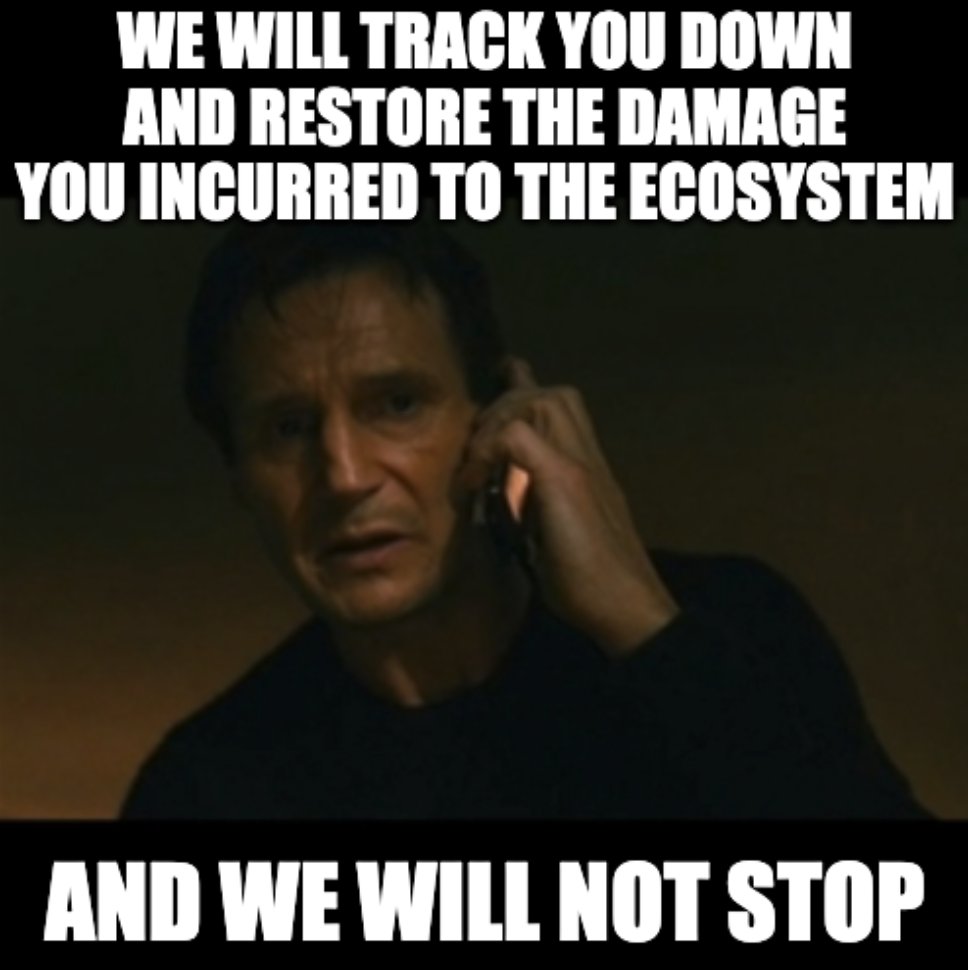

I've noticed that any time a crypto project is hacked and decides to try to communicate with the thief to negotiate a deal, they slip into one of two personas: "uwu 👉👈 you did such a good job hackerman, we're so impressed, please give us our money back though" or Liam Neeson's "I have a very particular set of skills".

Orbit went with the latter. In an on-chain message, they wrote: "We will track you down and restore the damage you incurred to the ecosystem. And we will not stop. But before situation becomes seriously escalated, we want to offer you a way out, a solution for both of us. We urge you to come to the table." Subsequent messages threatened: "As our words get spread, all eyes across global network are following this incident with heightened level of vigilance," and finally, "Every available resource will be used to track you and recover stolen assets. No stone will be left unturned in this pursuit. Our unwavering commitment will ensure the prevention of any attempt to withdraw assets."

The hacker did not appear to respond to any of the messages.

Wallet security startup founder scammed

[link]

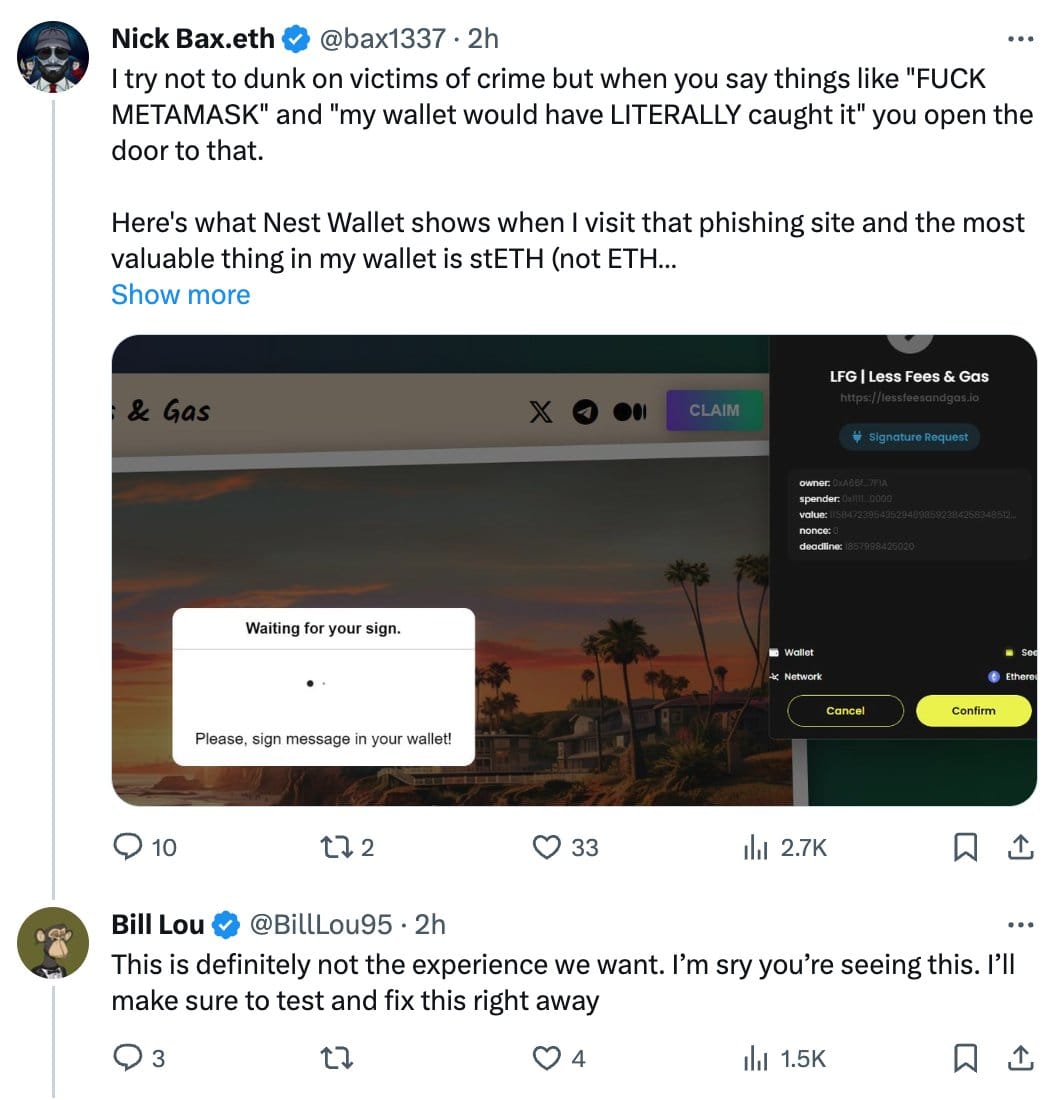

The founder of a wallet security startup was scammed out of around $125,000 when he fell for a phishing link that promised him an airdrop if he just authorized his wallet. He wrote a tweet thread about his "devastat[ion]" that he fell for such a scam. "I'm a fking founder of a wallet startup that's trying to improve wallet security..." he wrote.

He tried to use his misfortune as a marketing opportunity, following up that had he been using the wallet he develops and not MetaMask, it would have warned him of the scam.

However, another person pointed out that his wallet does a worse job of guarding against this specific scam site than MetaMask. Not only that, but in the process of testing the wallet software, he encountered a bug that resulted in $600 of his assets getting stuck. Just incredible stuff all around.

CoinsPaid goes for round two

[link]

After being hacked for $37.3 million in July, CoinsPaid seems to have been hacked for the second time in six months, this time for another $7.5 million. In the last hack, CoinsPaid blamed the North Korean Lazarus Group for the theft. With this one, three days later they've yet to even acknowledge the incident.

Everything else

- SEC Twitter account compromised, used to falsely announce approval of bitcoin spot ETFs [link]

- "Bitcoin Rodney" arrested in relation to HyperVerse scam [link]

- "Undead Apes Society" creator charged over rug pull [link]

- MangoFarmSOL rug pulls for $2 million [link]

- Narwhal likely exit scams for $1.5 million [link]

- Blockchain security firm CertiK suffers compromise of their own [link]

- Gamma Strategies exploited for $6.2 million [link]

- Radiant Capital lending protocol hacked for $4.5 million [link]

- Wallet gets phished for $4.4 million [link]

- UST and LUNA deemed securities in court [link]

- Levana Protocol loses over $1.1 million in slow motion [link]

Elsewhere in tech

This week, billionaire hedge fund manager Bill Ackman tried to feign ignorance about Wikipedia after Business Insider published allegations that his celebrity academic wife, Neri Oxman, had copied from Wikipedia and multiple other sources in her PhD dissertation.

He's been writing some of the longest Twitter screeds I've ever seen, including one (mercifully shorter) one "just asking questions" about how Wikipedia works. I published a YouTube video, unable to resist "just answering questions":a

I've heard some people found it informative as to how Wikipedia works, and how copyright and licensing applies to its content.

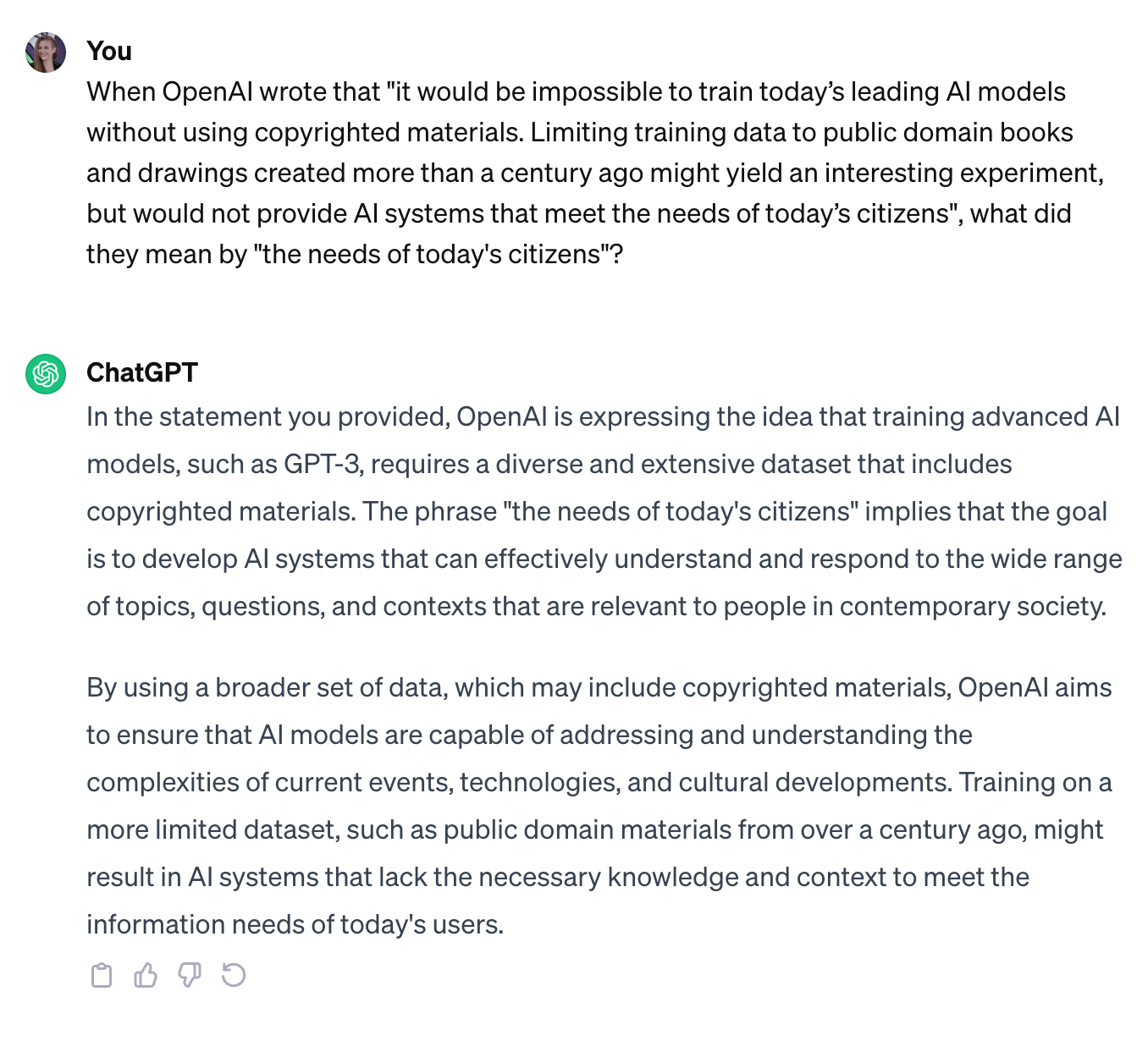

Also in the plagiarism vein, OpenAI made a statement to a UK parliamentary subcommittee that "it would be impossible to train today’s leading AI models without using copyrighted materials. Limiting training data to public domain books and drawings created more than a century ago might yield an interesting experiment, but would not provide AI systems that meet the needs of today’s citizens."

They do not explain what "the needs of today's citizens" are, so I went right to the source:

Well, that clears everything right up.

While I think there are reasonable questions to ask about whether training AI on copyrighted material is in violation of copyright law, some AI advocates have been instead arguing that the solution is to pare back, or even do away with, copyright law. To that, I say:

As you can probably see, I've been having a lot of fun with video this week, after recently dipping my toes into learning how to use video editing software. And yes, I know the audio sync is a little off and rather ironically makes me look a little AI-generated. Like I said, learning. It's also been fun to stick my head out of the crypto rabbit hole for a little bit.

If you like the videos, you can subscribe to my YouTube and/or TikTok to see them a little sooner.

Worth a read

Mike Masnick wrote about what I alluded to just above: how does copyright law apply to the training of large language models like ChatGPT? This question is certainly not a settled one, but it is an interesting and important one. There are also a lot more legal and ethical questions around the training of ChatGPT on various data — copyrighted and otherwise — that go far beyond the fairly narrow realm of copyright.

Amid all my griping about email, a few people linked me to this excellent — and prescient — 2021 piece by Cory Doctorow about the hell that sending email has become.

404 Media has once again teamed up with Seamus Hughes over at the Court Watch newsletter, writing about a Coinbase phishing group that's raked in $20 million by posing as Coinbase customer support.

In the news

I was delighted to join Gita Jackson, Aaron Thorpe, and Paris Marx on Tech Won't Save Us for the annual year-end episode! It was such a great conversation about the tech industry, science fiction, and hauntologies. Here's a picture of my holiday overalls for those of you who are not TWSU premium subscribers. As you can see, Atlas was very concerned with my style choices.

After Van Lathan, Jr. saw my video about Wikipedia and Bill Ackman, I went on his Higher Learning podcast to discuss the Bill Ackman/Neri Oxman/Claudine Gay saga in a little more detail.

That's all for now, folks. Until next time,

– Molly White

Footnotes

And unable to resist an excuse to do literally anything that wasn't fiddle with mail services. ↩

References

-

"Amid Bitcoin ETF Fee War, Grayscale Stands Its Ground With Priciest Product", CoinDesk.

-

"The Bitcoin ETF Fee Wars Are Heating Up. It May Hit Coinbase." Barron's.

-

Memorandum & opinion filed on December 28, 2023. Document #149 in SEC v. Terraform Labs.

-

Notice of supplemental authority filed on January 3, 2024. Document #202 in SEC v. Binance Holdings Limited.

-

"Celsius Network wins court approval for shift to bitcoin mining", Reuters.

-

Tweet by Barry Silbert.

-

Notice of disputed payments in connection with amended partial repayment agreement between debtors and Digital Currency Group, filed on January 8, 2024 (available on Kroll). Document #1133 in In re: Genesis Global Holdco.

-

"India to block crypto exchanges Binance, Kraken websites", TechCrunch.

-

BitMEX promotional website about the moon project.

-

"Peregrine 1 has ‘no chance’ of landing on moon due to fuel leak", The Guardian.