Issue 50 – Bitcoin busts

Governments seize huge quantities of bitcoin, and a few people seem to be yearning for the days of peak crypto mania.

Not only is this the fiftieth recap issue, but I've also just crossed the 100 post mark! It's been just under a year and a half since I launched this newsletter with Issue 0, and it's been an awesome time. Seriously, I love writing this so much and I'm so happy there are people out there who like reading it.

Some housekeeping

For those of you reading this in your email inbox or RSS reader, I've added sidenotes to the web version that you might like to check out! They should make my compulsive footnoting a little more legible without having to jump around the page. I also published the script I wrote to format my footnotes and references on Ghost, in case any other Ghost-ers out there might find it useful for their own purposes.

I've also moved the newsletter (along with my personal website and Web3 is Going Just Great) off Cloudflare and onto Fastly, made possible thanks to their generous Fast Forward project. Thank you to them!

Emails to @citationneeded.news addresses are currently bouncing back due to an issue with Mailgun, so please use my molly@mollywhite.net email address if you need to get in touch with me for the time being! This should be fixed soon, and I didn't want to delay publishing the newsletter just because of this.

Now, on to the latest:

In the courts

This has been the week of bitcoin seizures, many from people who were not themselves operating crypto schemes, but who instead used the asset to store ill-gotten funds from other activities. For a cryptocurrency meant to be outside of the reach of governments' grubby little hands, governments sure do have an awful lot of it.

In the US, Banmeet Singh forfeited 8,100 BTC (around $340 million today) obtained from selling drugs through the Silk Road and other darkweb marketplaces. The forfeiture was part of a guilty plea to drug and money laundering charges, and he's expected to be sentenced to around eight years in prison [W3IGG].1

Separately, the government has issued a notice that they intend to sell around 2,934 BTC ($123 million today) seized in relation to the Silk Road.2 Some of those tokens were seized in 2021 from Ryan Farace, who used to go by "Xanaxman" on the Silk Road, where he sold what you might expect.3 Others were seized in 2017 from Shaun Bridges, a former US Secret Service agent involved in the Silk Road investigation, who thought it would be a good idea to help himself to some of the bitcoins. Xanaxman has just been sentenced to 4.5 years in prison; Bridges was sentenced to almost six years in 2015 and a concurrent two years in 2017.4

In the UK, the Metropolitan Police disclosed earlier this week that they'd seized four devices containinga 61,000 BTC (around $2.6 billion today) from a safe deposit box in connection with a Chinese investment fraud scheme run by a woman named Zhimin Qian, who went by Yadi Zhang. She allegedly operated the scheme from 2014–2017 and stole money from more than 128,000 people, and is now on the run. The bitcoins were seized in 2018, but the news has only just come out now, during the trial of a woman who allegedly helped launder money for the fraudster.5

In Germany, police just seized almost 50,000 bitcoins (now priced at around $2.1 billion) from operators of Movie2K, a once popular movie piracy website that operated from 2008 until its shutdown in 2013. This haul adds to other Movie2K bitcoins seized by German authorities in 2020, then priced at around €25 million6b. Movie2K made money through advertisements and subscriptions, though not to the tune of billions — most of that is a result of their choice to start converting income into bitcoin in around 2012, when the token price was somewhere between $4 and $14. The two suspects voluntarily moved the BTC to a wallet operated by police, and are apparently cooperating with the investigation.7

Moving past bitcoin seizures, Estonia is preparing to extradite two operators of the HashFlare Ponzi scheme, which solicited investments from people who were told they were running a cryptocurrency mining operation. In reality, they were mining only a tiny fraction of the cryptocurrency they claimed, and when they did make payments to their investors, they were using other investors' money. Altogether, the scheme brought in around $575 million.8 The duo were charged in the US and arrested in Estonia in November 2022,9 but the extradition was a bumpy process.

South Korea has issued a warrant for the arrest of Bang,c a key figure in a messy June 2023 collapse involving the Haru Invest yield platform, the Delio lending platform, and a counterparty to Haru called B&S Holdings [I30, W3IGG, W3IGG]. Bang is the majority shareholder for B&S. Haru claims that B&S falsified management reports, and lost ₩350 billion ($262 million) in the FTX collapse.10

A lawyer for the massive OneCoin fraud has been sentenced to ten years in prison for his role in helping to launder around $400 million for the multi-billion-dollar scheme.11 Although OneCoins's "Cryptoqueen" Ruja Ignatova is still on the lam [W3IGG], her various co-conspirators have been receiving hefty sentences lately. Her co-founder, Karl Sebastian Greenwood, was sentenced to twenty years in prison in September [I39, W3IGG]. Another co-conspirator, the former Chief Compliance Officer, entered a guilty plea in November and will be sentenced this month.12

Indictments are still trickling out in relation to the BTC-e cryptocurrency exchange, a name which may sound familiar if you watched my Binance video. The first legal action against that exchange and its operators was 6½ years ago, in 2017, but one of its operators was only just charged with money laundering conspiracy and operation of an unlicensed money services business.13

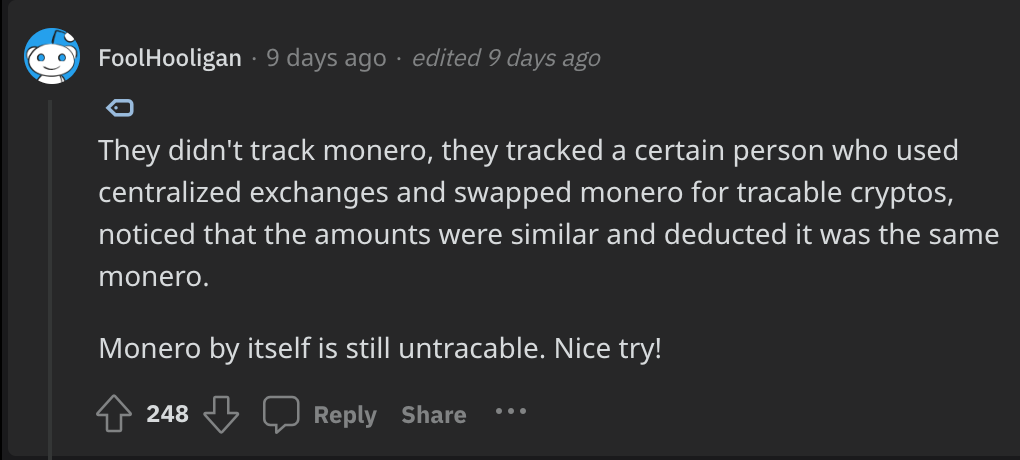

Finland's National Bureau of Investigation claims they've traced Monero transactions related to a ransomware operator who targeted a mental health firm called Vastaamo.14 This is a big claim, because Monero is a privacycoin that promises to be untraceable. Monero fans say it's got to be the criminal's fault. They're probably right to some extent — that it was various swaps on Binance from Monero to Bitcoin that were traced, rather than Monero transactions themselves — but if your privacycoin is only private so long as you never cash out, is it really that private?

Eli Regalado, the crypto-scamming pastor from last issue, apparently jetted off to Zambia to preach about cryptocurrency instead of showing up for his court hearing in Denver. I assume God told him to do that too.15 The judge signed off on continued freezes on the Regalados' assets, and issued an order preventing them from selling cryptocurrency or other investments in the state. This is "a case of just unmitigated greed", said the judge, who also said, "It's one of the more egregious cases I have seen where someone in the name of faith, the name of God, preyed upon his congregants and he did so in the name of the lord."16

Genesis has agreed to settle their portion of the lawsuit from the SEC, which also names Gemini as a defendant. The bankrupt Genesis will pay out a $21 million penalty, if they can afford it after repaying creditors.17 The case against Gemini, which is not bankrupt at least at the moment, will presumably continue.

Abra has reached a settlement in principle with the Texas State Securities Board, who issued an emergency cease and desist in June 2023 after finding that the crypto lending firm was "insolvent or nearly insolvent" [I30, W3IGG]. Abra will repay customers and continue to wind down their retail operations in the US.18

In bankruptcies

Celsius

Celsius has exited bankruptcy, and will now start distributing the around $3 billion in cryptocurrency they've got left to creditors.19 Besides this payout, which will only provide creditors with a portion of the funds they once had on the platform, creditors will also get a stake in Ionic, the new bitcoin mining operation that's being created, and which was previously only referred to as "NewCo". Ionic's crypto mining will be managed by Hut 8, which as it happens was the subject of a January 24 short-seller's report that claimed that the company was "hiding stock ownership through [an] undisclosed related party, a stock-promoter cabal, and a host of left-for-dead assets". Promising start!

FTX

Headlines proliferated this week that FTX creditors might be able to be "repaid in full" after a claim to that effect by one of FTX's lawyers in court. You might think said creditors would be overjoyed, but this estimate is based on the bitcoin price at the time of bankruptcy: around $16,800, or 2.5x less than recent prices of around $42,000. Despite a flood of objections from creditors to using this price for estimates [I49], the judge has approved the approach.

Meanwhile, FTX's team has (blessedly) abandoned the idea of trying to restart the FTX exchange. According to one of their lawyers, "The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in the dumpster were simply too high".20

FTX has dropped its lawsuit against Grayscale, presumably because their claim that Grayscale had an "improper redemption ban" on GBTC is now moot.21 GBTC's recent conversion to an ETP [I49] has provided GBTC holders an exit, which holders have been availing themselves of to the tune of billions of dollars. FTX has reportedly been a major participant in that, dumping around 22 million shares (priced at around $1 billion).22

Terraform Labs

Terraform Labs, the company behind the collapsed Terra and Luna tokens, filed for bankruptcy on January 21. Now that they've filed their first day motions, it's a little clearer why: they're anticipating a big fine from the SEC [W3IGG], and don't think they can afford to appeal it without bankruptcy protection.23

In governments and regulators

US

The U.S. Energy Information Administration (EIA) is performing an "emergency" collection of energy usage data from cryptocurrency miners in the country.24 I'm not entirely clear on what the emergency is, exactly. Supporting statements cite strain on electrical grids during weather extremes, but this is not exactly a new phenomenon.25 Some bitcoin miners have already come out to describe the survey as "Orwellian", because of course they have.26

The SEC has really not covered themselves in glory with the DebtBox lawsuit, which may be why they're now filing to dismiss it. SEC lawyers made false statements to the judge, who has been considering sanctions [I45, I47]. It seems to me that the SEC is now hoping the judge will dismiss the case instead of following through with sanctions — although notably they are asking the judge to dismiss it without prejudice, which means they could refile a lawsuit later on.27

FINRA, a self-regulatory agency, performed a review of its member firms that "actively communicate with retail customers concerning crypto assets". They identified "potential substantive violations" of FINRA's rule requiring communications be "fair and balanced" in 70% of communications they reviewed.28

State regulators in Florida and Alaska want Binance US gone. Alaska denied renewal of their license to operate in the state, and Florida issued an emergency suspension of Binance US's money transmitter license there.29

Hong Kong

The Hong Kong Securities and Futures Commission says that staking the dog-themed Floki memecoin is a "suspicious investment product". The announcement seems to have been triggered by claims from Floki that their staking program can provide between 30% and more than 100% annual returns, which the SFC says is "too good to be true". Floki held a Twitter space to address the warning, claiming that the SFC's only complaint was that the program performs too well. I mean yeah, kind of.30

Also in Hong Kong, the Office of the Privacy Commissioner for Personal Data thinks eyeball-scanning WorldCoin may have mishandled biometric data. They've raided six locations linked to the company, and are worried that the company has not properly informed scanees about how their data will be used or obtained proper consent.31

In journalism

Wired has published a profoundly weird story about DAOs. Titled "A Dangerous New Home for Online Extremism", an extremism researcher has written about how "neo-Nazis, jihadists, and conspiracy theorists"... don't actually use DAOs, but could. The whole thing comes off as a weird criti-hype-esque piece about how powerful DAOs might be, and how bad it could be if extremists started using them for organizing, somehow ignoring that DAOs are broadly dysfunctional and extremists aren't generally using them and don't seem terribly interested in starting. Utterly baffling.

Andreessen Horowitz general partner and web3's biggest fan Chris Dixon has published his book, Read Write Own: Building the Next Era of the Internet. It's about two years too late, but he's doing the rounds on tech podcasts anyway, and a16z is splashing out on full-page print ads in the WaPo asking people to "forget what they know about crypto" (like all the scams and disasters, I assume). I'm working on a review.

Something deeply funny to me about a16z resorting to a traditional newspaper advertisement to “set the record straight” on cryptocurrency (also they’re just pushing a book, not actually saying anything meaningful) https://t.co/jcCxiIM21A

— H.E. Cas Piancey (@CasPiancey) January 31, 2024

Elsewhere in crypto

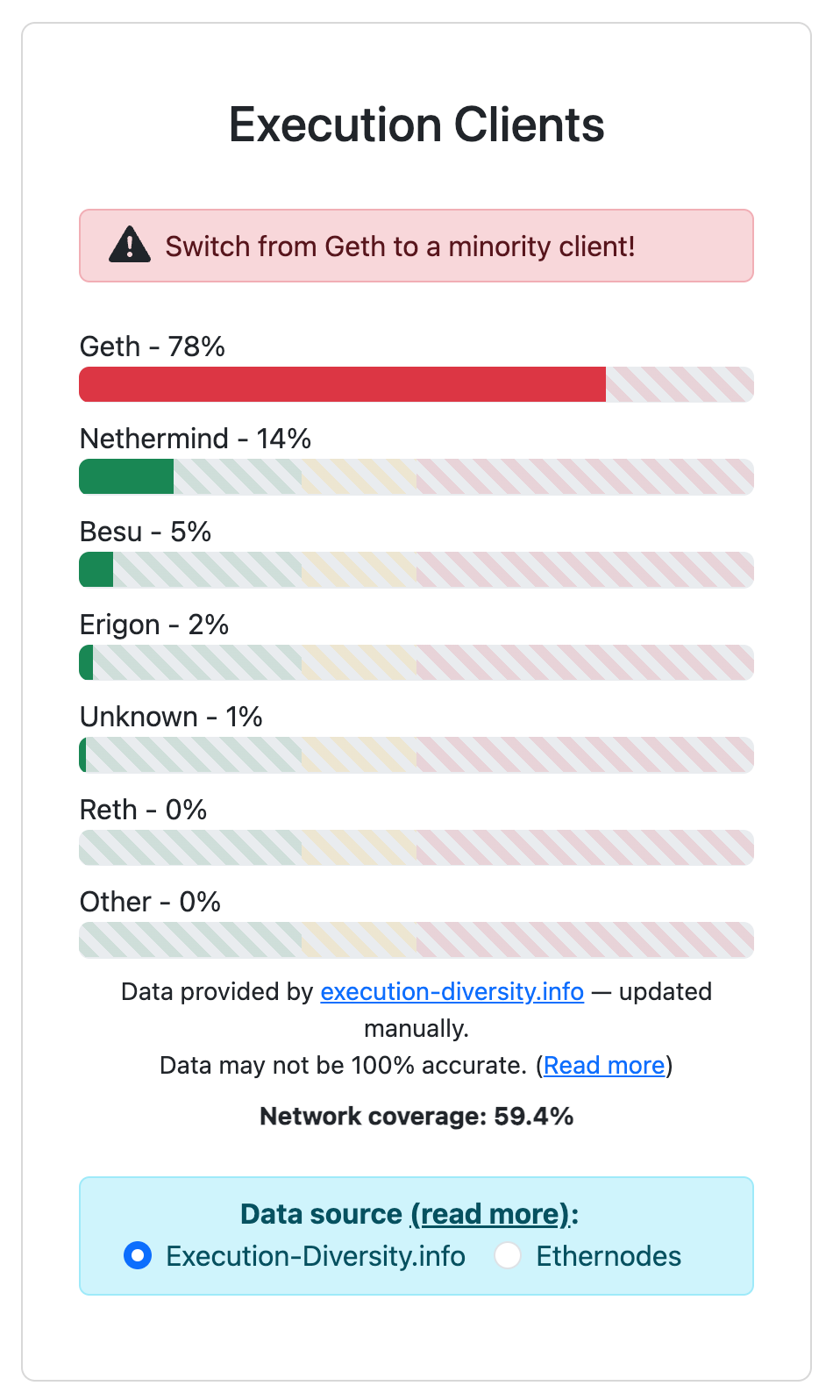

A bug in the Nethermind Ethereum validator software brought a whole bunch of validators offline. Luckily for Ethereum, the bug was in the Nethermind software and not the Geth software — while Nethermind currently powers around 14% of the network's validators, Geth powers more than 75%.d A critical bug in Geth could be devastating to the network, and the Nethermind bug has drawn renewed attention to Ethereum's "diversity problem".32

Polygon laid off 19% of their staff (60 people), and simultaneously gave everyone else raises. Condolences or congratulations.33

Someone published leaked code, infrastructure diagrams, and passwords belonging to Binance on Github. Binance first said "it does not resemble what we currently have in production", but refused to address whether that meant it was old or fake. Finally, after 404 Media published an article about it, they acknowledged that it was real, but provided no additional insight into how someone got access to such sensitive data, outdated or otherwise.34

ChainArgos says 400 million MATIC tokens (priced at ~$320 million today) appear to be "missing" from Polygon's staking allocation.35 On the other hand, "Essentially, every project we’ve ever looked into wasn’t done correctly."36 Ah, well that's reassuring.

Blizzard won't be allowing teams with crypto, NFT, or AI sponsors in its Overwatch esports league.37

Pixelmon, the project that raised $70 million in February 2022 only to launch some of the most hilariously bad NFTs I've ever seen [W3IGG], has just raised $8 million in seed funding.38 They now have the opportunity to do the funniest thing ever. Fingers crossed.

The Web3 is Going Just Great recap

There were 14 entries between January 20 and February 1, averaging 1.1 entries per day. $142.57 million was added to the grift counter.

Dwight Howard rug pulls

[link]

Chris Dixon isn't the only person a few years late to capitalize on a trend. Basketball star Dwight Howard thought he'd get an easy payday by dropping 3,000 low-effort "Ballers" NFTs, but discovered that the days of celebrities rapidly selling out NFT collections based on their celebrity status alone have long since passed.

Howard tried a few desperate moves to gin up interest in the project after initial reception was muted, including by replacing all the artwork, slashing the supply in half, and even just giving out free crypto. In the end, he seemed to give up, because the project's Twitter account has been taken offline, and the OpenSea page for the collection is gone, too. 490 of the original 3,000 NFTs sold.

(via Twitter)

Magic Internet Money loses its peg

[link]

The thing about putting money into a stablecoin called "Magic Internet Money" is that you're really not going to get much sympathy when it falls apart. MIM dropped from its intended $1 peg after the Abracadabra lending protocol (yes, really) was hacked. This is actually the second time MIM has deviated from its peg — the first was in the wake of the Terra collapse.

HyperVerse's Sam Lee indicted

[link]

The US Department of Justice has charged Sam Lee, one of the people behind the HyperVerse scam that's stolen somewhere in the range of $1.5 billion from people [I46, W3IGG]. Lee lives in the United Arab Emirates, and given the DOJ didn't announce an arrest as a part of their press release, I assume he's still enjoying his freedom in the non-extradition country. The DOJ also charged a HyperVerse promoter who went by "Bitcoin Beautee". She's the second promoter to be charged in connection to this scam, following in the footsteps of "Bitcoin Rodney" [I48, W3IGG]. I'm starting to think that people who have "Bitcoin" in their monikers maybe shouldn't be trusted.

The SEC has also filed suit against Lee for securities fraud and the sale of unregistered securities.

Everything else

- SIM swappers charged over hacks, reportedly including FTX [link]

- Crypto exchange created by Three Arrows Capital founders to shut down [link]

- $112.5 million in XRP stolen from Ripple CEO Chris Larsen [link]

- Goledo Finance hacked for $1.7 million [link]

- Korean crypto karaoke platform Somesing hacked [link]

- 8,100 Bitcoin forfeited by Silk Road drugs distributor in guilty plea [link]

- WallStreetMemes token price plummets after staking contract exploited [link]

- MailerLite hack enables over $700,000 in crypto phishing thefts [link]

- Animoca Brands-owned Gamee tokens stolen [link]

- Concentric Finance exploited for $1.8 million [link]

- Terraform Labs files for bankruptcy [link]

Worth a read

In the wake of the news that that "AI-generated George Carlin standup routine" was just written by a guy, now's a good a time as any to re-read Jathan Sadowski's excellent article on "Potemkin AI".

Sorry Mrs Jackson, I am for real

— Celestial M Weasel (@celestialweasel) January 29, 2024

Never meant to make your VC cry

I am 4 gig workers

And not an AI https://t.co/X3xrrTrguY

In the news

I'm quoted in a piece by Erika Page on trust in crypto. Betteridge's Law strikes again?

That's all for now, folks. Until next time,

– Molly White

Footnotes

I'll note that news reports (and I) commonly refer to "devices containing cryptocurrency", although this is more of a useful metaphor that works well for brains accustomed to physical wallets with banknotes, and not really how crypto wallets work. A "device containing bitcoin" is really a device containing the private key to a bitcoin address, which then allows a person to make transactions. This is a somewhat important distinction because unlike with physical banknotes, a) multiple devices can store copies of the same private key and thus provide access to the same address, and b) physical access to a device containing a private key does not necessarily guarantee access to the bitcoins belonging to the corresponding wallet if the device is protected by additional layers of security. ↩

Based on euro and bitcoin prices at the time, this was probably around 2,500 BTC, which would be priced at almost $108 million today. ↩

South Korean media privacy laws have prevented the disclosure of his full name. ↩

This is from a sampling of around 60% of Ethereum validators, so the numbers are approximate. ↩

References

"Dark Web Vendor Pleads Guilty to Distributing Narcotics and Forfeits $150M", press release from the Department of Justice. ↩

"US files notice to sell $130M in bitcoin linked to Silk Road agent", Blockworks. ↩

"Father and Son Sentenced for Laundering Drug Trafficking Bitcoin Proceeds Intended for Federal Forfeiture", press release from the U.S. Attorney's Office, District of Maryland. ↩

"Former Secret Service Agent Sentenced in Scheme Related to Silk Road Investigation", press release from the Department of Justice. ↩

"UK police seized £1.4bn of bitcoin from China investment fraud, court told", Financial Times. ↩

"Ermittlungsverfahren gegen die Betreiber von movie2k.to – Sicherstellung von Bitcoins im Gesamtwert von 25 Millionen Euro", press release from Generalstaatsanwaltschaft Dresden (in German). ↩

"Police seize record 50,000 Bitcoin from now-defunct piracy site", Bleeping Computer. ↩

"Estonia to extradite duo accused of $600M crypto fraud to US", Protos. ↩

"Two Estonian citizens arrested in $575 million cryptocurrency fraud and money laundering scheme", press release from the U.S. Attorney's Office, Western District of Washington. ↩

"South Korea issues arrest warrant in Delio-Haru Invest withdrawal-suspension case", The Block. ↩

"Former Law Firm Partner Sentenced To 10 Years In Prison For Laundering $400 Million Of OneCoin Fraud Proceeds", press release from the U.S. Attorney's Office, Southern District of New York. ↩

"'Head Of Legal And Compliance' For Multibillion-Dollar Cryptocurrency Pyramid Scheme 'OneCoin' Pleads Guilty", press release from the U.S. Attorney's Office, Southern District of New York. ↩

"Foreign National Charged for International Money Laundering Conspiracy and Role in Operation of Unlicensed Digital Currency Exchange BTC-e", press release from the Department of Justice. ↩

"Finnish authorities traced Monero transactions tied to Vastaamo hack", Cointelegraph. ↩

"Pastor Charged With Stealing Millions Seen in Zambia After Missing Hearing", Newsweek. ↩

"'Unmitigated greed': Judge orders Colorado crypto pastor's bank accounts frozen", Denver Post. ↩

Debtors’ Motion for Entry of an Order Approving a Settlement Agreement Between Genesis Global Capital, LLC and the U.S. Securities and Exchange Commission filed on January 31, 2024. Document #1220 in In re: Genesis Global Holdco, available on Kroll. ↩

"Texas Securities Board Settles with Abra Over National Sales of Interest‐Bearing Accounts", Texas State Securities Board. ↩

"Celsius Emerges from Chapter 11 and Commences Distributions of Over $3 Billion of Cryptocurrency to Creditors", press release by Celsius. ↩

"FTX Plans to Repay Customers in Full, Drop Exchange Relaunch", Bloomberg. ↩

"Alameda Research Drops Grayscale Lawsuit, Sparking Share Redemption Rush", Decrypt. ↩

"FTX Sold About $1B of Grayscale's Bitcoin ETF, Explaining Much of Outflow: Sources", CoinDesk. ↩

Declaration in support of first day motion filed on January 30, 2024. Document #18 in In re: Terraform Labs. ↩

"EIA to initiate collection of data regarding electricity use by U.S. cryptocurrency miners", U.S. Energy Information Administration. ↩

"Administrator's Memo Requesting Emergency Clearance", available in ICR documents. ↩

"U.S. Drilling Down on Crypto Miners' Energy Use Draws Ire From Community", CoinDesk. ↩

Motion to dismiss filed on January 31, 2024. Document #260 in SEC v. Digital Licensing Inc. ↩

"FINRA Provides Update on Targeted Exam: Crypto Asset Communications", FINRA. ↩

"Florida and Alaska give Binance US the boot, report", Protos. ↩

"Floki restricts Hong Kong staking after Securities Commission’s warning", Cointelegraph. ↩

"Hong Kong eye scan for cryptocurrency scheme probed by city’s privacy watchdog", South China Morning Post. ↩

"Bug That Took Down 8% of Ethereum's Validators Sparks Worries About Even Bigger Outage", CoinDesk. ↩

"Binance Code and Internal Passwords Exposed on GitHub for Months", 404 Media. ↩

"Poly-gone — 400 Million MATIC Missing?", ChainArgos. ↩

"Mystery of Polygon’s missing MATIC: Everyone’s doing it, says ChainArgos", Cointelegraph. ↩

"'Overwatch' Esports League Bans Crypto, NFT, and AI Sponsors", Decrypt. ↩

"Widely mocked NFT project Pixelmon raises $8 million in seed round including Animoca Brands", The Block. ↩