Issue 59 – Hot damn, this is going to get interesting quickly

Are US legislators warming to crypto? The SEC approves Ethereum ETPs, and a crypto bill gets through the House.

I've got some catching up to do, as I've been so busy with my cryptocurrency industry election influence project and other writing that it's been a minute since I've published a recap post. That project is coming along well, by the way, and I'm hoping to have it out by the end of the month at the latest. Hopefully sooner, but I have a trip to Switzerland(!) for a conference that will pull me away from my computer for a few days, and so I don't want to overpromise.

In a surprise move two weeks ago, the SEC approved Ethereum spot ETP applications. As I mentioned in a previous issue [I56], early optimism around the chances of a speedy approval had dwindled as the SEC delayed decisions and had put off the kind of back-and-forth with issuers that preceded the bitcoin ETP approval. Some analysts still predicted an eventual approval, but the SEC’s rather abrupt decision to engage with applicants and then approve the applications (only days later, on May 23) took many by surprise.

It’s not clear why the SEC approved the ETPs now, rather than continuing to delay the decision — or even deny the applications — as many had predicted. A denial could have provoked legal action similar to that from Grayscale on the bitcoin ETP denial, where the court decision to overturn the SEC's action [I38] seemed largely responsible for forcing the bitcoin ETP approval. There’s been a bit less hunger for an Ethereum ETP than there was for a bitcoin one, so it’s hard to say which of the prospective issuers might have decided to spend millions on a potentially years-long lawsuit against the SEC, but then again the Grayscale court decision and bitcoin ETP precedents might have made the legal battle less grueling.

Some have described the approval as a part of a perceived broader softening towards crypto by US lawmakers and regulators, and there might be something to that — which I will discuss later in this issue.

But first:

In the courts

FTX

FTX executive Ryan Salame was sentenced on May 28 to 90 months (7.5 years) in prison [W3IGG]. The first of the four co-conspirators to be sentenced, he was the only one to plead guilty without a cooperation agreement, and the only one not to testify in Sam Bankman-Fried’s trial.

One of his charges, conspiracy to operate an unlicensed money transmitting business, pertained to his role in transmitting FTX customer funds without a license via FTX, Alameda Research, and the “North Dimension” shell company they set up to obscure to wary banks the cryptocurrency-related nature of the funds. Salame’s second charge was to do with violations of campaign finance laws, through his role as a straw donor to funnel millions of dollars of FTX funds (which we now know were commingled corporate and customer funds) to Republican candidates who were friendly to crypto.1

https://t.co/sGIR5XSEu2 pic.twitter.com/pQuPnQIN7L

— Ryan Salame (@rsalame7926) June 3, 2024

Unlike the other co-conspirators, Salame was not charged with wire fraud or money laundering, and he was not implicated in knowingly misappropriating customer funds. He emphasized this heavily in his sentencing memo, where his lawyers wrote that Salame “was duped, as was everyone else, into believing that the companies were legitimate, solvent and wildly profitable.”2

Salame had requested to be sentenced to no more than 18 months’ imprisonment [I58]. The Probation Office recommended in their presentence report that he receive the maximum penalty of ten years’ imprisonment. Prosecutors asked for a slightly less severe sentence of five to seven years. Judge Kaplan ultimately opted to impose a sentence above what prosecutors had requested, commenting during the hearing that Salame “knew precisely what he was doing … and the whole idea was to hide it from the world. Astonishing!” Kaplan also seemed to factor in the fact that Salame tried to pull his own money off the exchange as it was collapsing, successfully withdrawing $5 million and attempting to withdraw millions more. “It was ‘Me first. I’m getting in the lifeboat first. To heck with all those customers,’” commented Kaplan.3

Unlike his former boss, Salame had seemed to listen to lawyers’ advice to keep quiet about his ongoing criminal case. But his return to social media only hours after he was sentenced suggests this may have been painful for him. Post-sentencing, he eagerly jumped back in to crypto Twitter, even trying to join in on some of the memes that came out of the FTX collapse by replying “H” in response to a person who tweeted “1) What” below one of his tweets — a callback to the string of cryptic tweets by Bankman-Fried shortly after FTX declared bankruptcy.

Salame’s “H” tweet is a callback to shortly after FTX’s collapse, when Bankman-Fried tweeted “1) What” and then proceeded to spell out “happened” over a period of several days

Salame seems to have woefully misread the room, because he was certainly not embraced upon his return. It seems he may have believed people would receive him more warmly because he wasn’t implicated in the actual theft of funds, but he’s discovered that either people don’t realize that, or more likely, don’t much care that he didn’t steal the funds when he still profited enormously from them and actively funneled them to various causes. He spent much of the subsequent days after his sentencing arguing over this distinction.

getting sentenced to 7.5 years in prison and immediately logging on to argue with @tittyrespecter about your charges is peak poster

— Molly White (@molly0xFFF) May 28, 2024

there's no topping this https://t.co/zqHfSvoZwz

Despite the frosty reception, he kept tweeting away, and seems to be feeling rather sorry for himself. It’s hard to say what I would do if I suddenly found myself staring down the barrel of more than seven years in prison, but I’d like to think it wouldn’t be “tweet through it”.a

It will be interesting to see how Salame’s sentence will compare with the sentences of Ellison, Wang, and Singh. On the one hand, their cooperation against Bankman-Fried should earn them points, but on the other, their charges are both more numerous and more serious.

Everything else

The developer who allegedly stole $2 million from the pump.fun project and then bragged about it on Twitter [I58] was reportedly arrested only a day or so after the whole incident. He tweeted that he had been arrested and kept overnight before being released on bail and placed in a mental hospital.4

The SEC has been ordered to pay $1.8 million in legal fees to the defendants of the Debt Box case, after the judge determined that the SEC had engaged in bad faith conduct when their lawyers lied to obtain a temporary restraining order to freeze the company’s assets [I45, 47, 57].5 The judge did, however, approve the SEC’s motion to dismiss the case without prejudice,6 which means the SEC could potentially take a second swing at the case later on. The whole thing was a really bad look for the SEC, and the sanctions seemed completely warranted to me.

There have been a slew of crypto-related enforcement actions out of the Justice Department. These were once a rare occurrence, but now are becoming so numerous as to be onerous to track on W3IGG. In brief, since I published the last issue:

- Rui-Siang Lin, the owner of Incognito Market, was arrested for his role in operating what was until March 2024 one of the largest darknet narcotics marketplaces. Alongside the marketplace, he ran a cryptocurrency “bank” where vendors and customers held the crypto they used to transact. In March, Incognito Marketplace allegedly stole the funds their users held on the platform, and threatened to release customer data if not paid a ransom [W3IGG]. Lin has been charged with engaging in a continuing criminal enterprise and various other drug crimes, as well as money laundering. He faces life in prison.7

- David Kagel, an 85-year-old former attorney who was disbarred in 2023 for misappropriating client funds, pleaded guilty to conspiring to operate a cryptocurrency Ponzi scheme that defrauded victims of more than $9.5 million. He had served as an attorney for two people who promoted an investment scheme that they said used AI trading bots to generate high returns, and Kagel had backed up the promoter’s false claims that he held around $11 million in Bitcoin in escrow as a sort of insurance fund. He faces up to five years in prison.8

- YunHe Wang was arrested for operating a massive botnet alleged to have enabled a substantial number of computer crimes. Wang was reportedly paid around $99 million in cryptocurrency and fiat. He faces up to 65 years in prison.9

- Rashawn Russell, a former investment banker, was sentenced to around three and a half years in prison for a 2020–2022 cryptocurrency investment scheme. Instead of investing his clients’ funds into cryptocurrency as promised, Russell used the funds for his own purposes, gambling, and repaying other investors.10

- Sergei Potapenko and Ivan Turõgin, the operators of a $575 million crypto Ponzi scheme called “HashFlare”, were extradited from Estonia to face charges. Although their clients invested hundreds of millions of dollars with them from 2015–2019 to rent cryptocurrency mining capacity, their actual mining operations were miniscule — mining only 1% of the Bitcoin they claimed.11

- Widong "Bill" Guan, the Chief Financial Officer of the far-right and Falun Gong-affiliated Epoch Times media company, was indicted on money laundering and bank fraud charges after allegedly operating a more than $67 million fraud. Guan allegedly used cryptocurrency to purchase prepaid debit cards that were loaded with fraudulently obtained unemployment insurance benefits, and laundered the funds through bank accounts they'd fraudulently opened using stolen personal information. [W3IGG]

- Three creators of the October 2021 “Evolved Apes” NFT project [W3IGG] have been charged for their $2.7 million rug-pull.

Meanwhile, the New York Attorney General has sued a couple over an alleged $1 billion set of cryptocurrency pyramid schemes, which were affinity frauds that specifically targeted Haitians. Cynthia and Eddy Petion are learning the hard way that despite moving to Panama and writing “they can’t serve you if they can’t find you lol”, fleeing the country is not a get-out-of-jail-free card. [W3IGG]

Over in the United Kingdom, Jian Wen was sentenced to over six years’ imprisonment after helping to launder billions of dollars in cryptocurrencies for Zhimin Qian, also known as Yadi Zhang [I50].12 The case against Zhang is ongoing.

In governments and regulators

I’ve seen a lot of comments lately that the US government and regulators have been softening towards crypto. Daniel Kuhn at CoinDesk wrote of a “seachange”, saying that “it appears that the U.S. government’s long war on crypto is nearing an end.”13 I’m not sure if I’d go so far as “seachange”, but it does seem that the pain and political fallout from the FTX collapse and related disasters is becoming a more and more distant memory.

One of the first notable recent events in this “seachange” was the Senate’s vote to overturn the SEC’s Staff Accounting Bill 121 [I58]. This received the expected Republican votes, as well as support from the usual crypto-friendly Democrats like Kirsten Gillibrand. However, some other Democratic supporters were more surprising, such as Michigan Senator Gary Peters, who co-sponsored the Digital Asset Anti-Money Laundering Act of 2023 with Elizabeth Warren last July,14 and Montana’s Senator Jon Tester, who had previously said crypto was “all bullshit”.15 Given that President Biden had already publicly promised to veto the bill before the Senate vote, it just may be that some Senators viewed this as freebie opportunity to appeal to a promised (though quite likely mostly imaginary) base of single-issue pro-crypto voters without any real ramifications. However, that interpretation would also mean that these Senators believe the crypto industry’s story that there’s a substantial base of pro-crypto people whose support might be predicated on the Senators’ stances on things like the SAB 121 issue — which in itself would be startling.

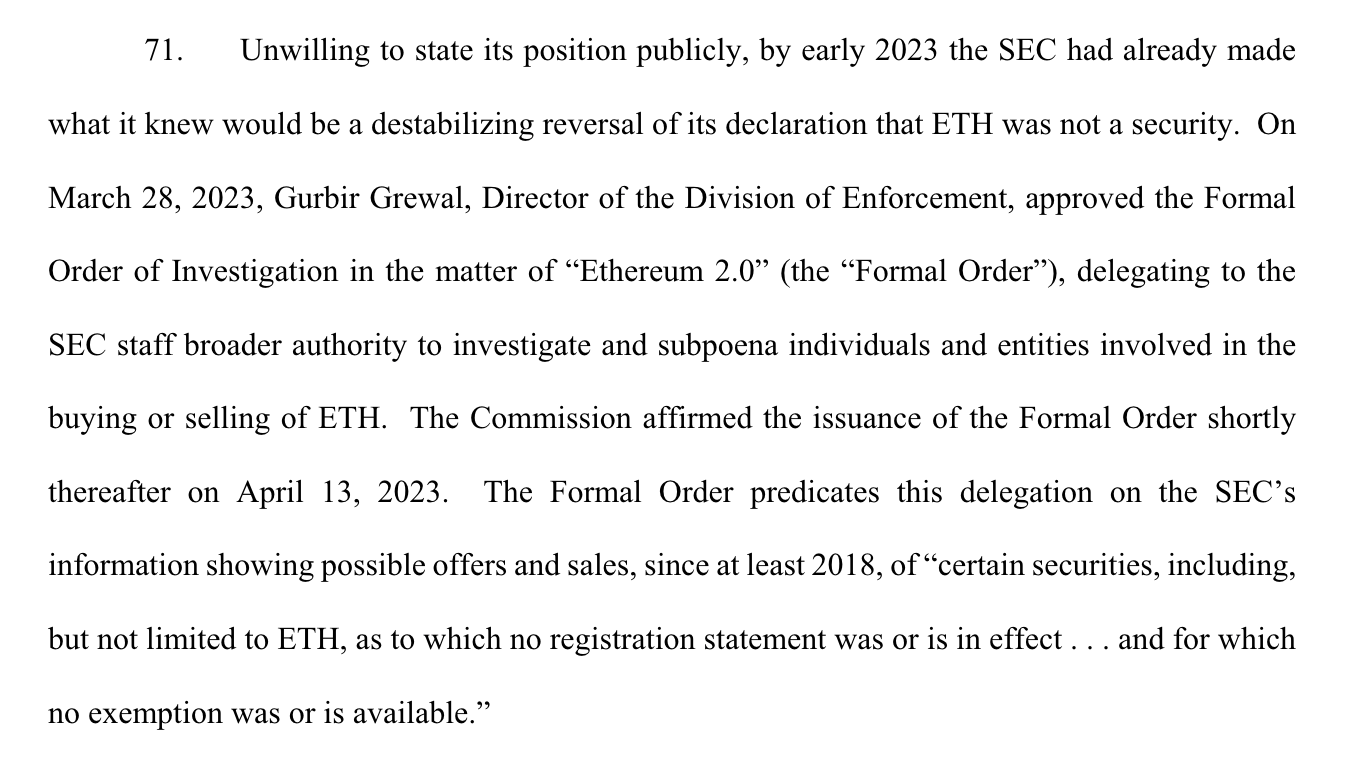

Let’s get back to the topic of the Ethereum ETP. One question on everyone’s mind following the approval is: does this mean the SEC has decided ether is not a security? There were some rumblings in the other direction recently, particularly with the revelation in a lawsuit filed by Consensys on April 25 [I57] of a statement interpreted by Consensys to meanb that the SEC did broadly view ETH to be a security:16

The answer is unfortunately not much clearer than it was before. Some lawyers seem to think the approval means ETH is safe from SEC designation as a security, but others have acknowledged that the SEC could still decide later on that Ethereum is broadly a security.17 Somewhat more likely, in my non-lawyerly view, is that the SEC will continue to focus more on what people do with Ethereum and how they offer it, rather than making a wholesale declaration that the asset is or is not a security. They’ve been quite clear that they view offering Ethereum staking programs to cross the line into unregistered securities offerings, for example, and that stance doesn’t seem to have changed with this approval.

Unlike with the bitcoin ETPs, the Ethereum ETP issuers weren’t locked and loaded to immediately unleash these products on the market, and they still have to go through further approvals, so it’s too early to see how they will be received. Analysts have estimated the first funds won’t launch until the end of June at the very soonest.18

Another important recent event was the House’s passage of the “Financial Innovation and Technology for the 21st Century Act”, or FIT21, which received 279 votes. The bill would place more of the crypto regulatory responsibility under the CFTC — a smaller agency with substantially fewer resources than the SEC — although there would still be a split regulatory regime. It would also allow cryptocurrency companies to simply self-certify that their products are “sufficiently decentralized” and therefore not securities — something many cryptocurrency companies already widely falsely claim in hopes of sidestepping the SEC. Maxine Waters has described the bill as one of the worst she’s ever seen. The crypto industry, of course, loves it.19 Gary Gensler has expressed concerns that the bill would “risk investor protection”, and “not just in the crypto space”.20 Despite its victory in the House, the bill still has a ways to go to get through the Senate. Still, with around 2/3 of the House supporting it, it’s earned considerably more support than most crypto-related bills in the past.

In elections and political influence

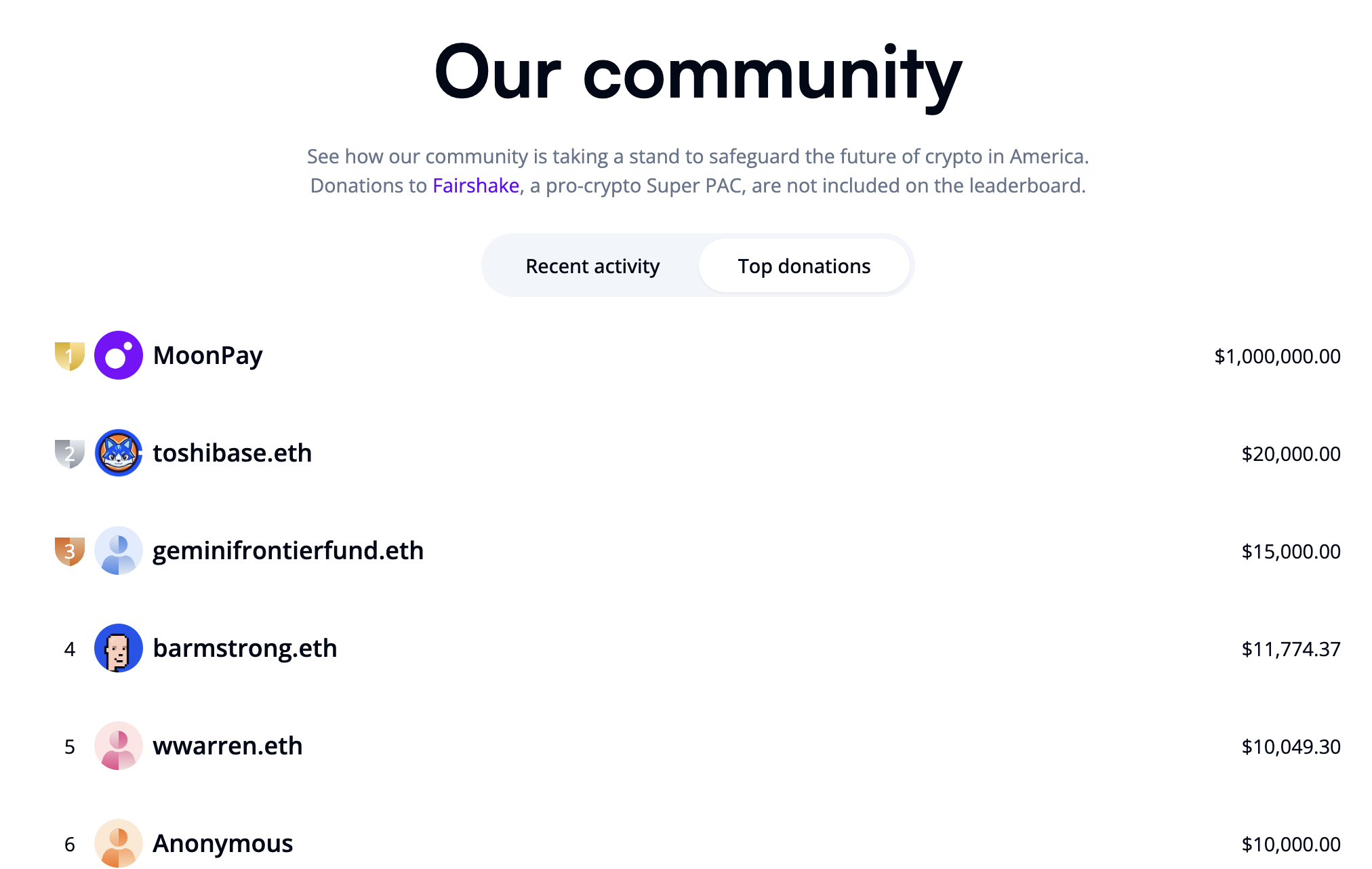

Coinbase claims that more than one million people have signed up as “crypto advocates” for their “Stand With Crypto” advocacy group and political action committee. You should take this with a massive grain of salt, particularly given they also like to claim that “52 million Americans own crypto”, despite a Federal Reserve survey showing that only around 7% of respondents bought or held crypto in 2023 (which would work out to around 18 million people,c or 1/3 of Coinbase’s claim).21 They also claim they’ve raised more than $87 million in donations.d

If we assume they aren’t double-counting donations to super PACs, this would put the total crypto war chest at around $250 million and counting, with around $53 million of that already spent.

Here’s a sneak peek at a part of the project I’ve been working on, showing where all that money’s been going.

However, the list of donations supposedly from this grassroots "community" total up to a paltry $1,176,900.74, suggesting that Stand With Crypto is double-counting donations to PACs like FairShake. Remove the $1 million donated by the MoonPay company, $15,000 from Gemini, and ~$12,000 from Coinbase CEO Brian Armstrong, and that leaves... about $150,000 raised from the “million” people that supposedly signed up.

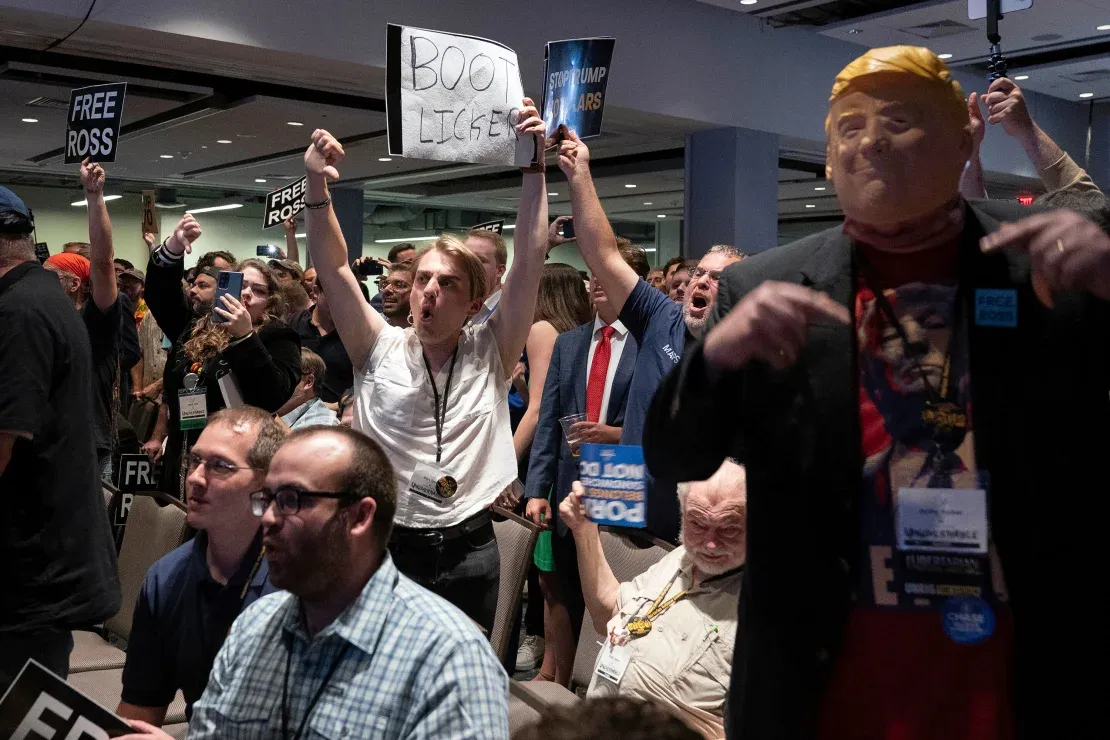

Meanwhile, Donald Trump has continued his attempts to appeal to the crypto crowd and to libertarianse by promising at the Libertarian National Convention to free Silk Road creator Ross Ulbricht if elected. Ulbricht is eleven years in to two life sentences after being convicted of various drug and computer crimes relating to his operation of the Silk Road darknet marketplace, and the judge also heard evidence during sentencing that he had hired hitmen (although no one was ultimately killed). His case has become a cause célèbre among libertarians and cryptocurrency advocates alike, who view his sentence as disproportionate to his crimes, and who argue that he should not have been held accountable for the sale of narcotics when he was not personally involved in the transactions. Trump’s promise of clemency is somewhat surprising for a presidential candidate who’s previously pledged that he would be so tough on drug crime that he would mandate the death penalty for those caught selling drugs, but then again, it’s hardly the first time he’s been inconsistent in his campaign promises. The Libertarians didn’t seem to really buy it, though. Despite a few cheers from the audience when he promised to commute Ulbricht’s sentence, convention-goers later said things like “I would rather eat my own foot out of a bear trap” than vote for Trump, and dismissed the promise as hollow pandering.22

Elsewhere in crypto

Robinhood has announced it will be acquiring the European Bitstamp cryptocurrency exchange, subject to regulatory approval, in a $200 million deal.23

The memecoin mania just keeps getting weirder. People have realized that if they’re just able to raise enough momentary publicity, they stand the chance of getting their hands on potentially life-changing sums of money. That’s playing out about as badly as you might expect.

A new trend has involved people livestreaming while promoting their memecoins, encouraging viewers to buy the tokens as they broadcast live, and promising to do various things on-stream if the token reaches various market cap goals. This has spawned, among others, a token named “LIVEMOM”, where a boy appearing to be in his early to mid teens streamed while sitting next to an adult woman who said she was his mother. The woman flaunted her breasts on the stream and urged viewers to buy more tokens so as to reach market cap goals that would trigger events like “pour milk on my mom’s chest”.24 Another token was “FADELIVE”, in which two teenagers boxed live on stream, wearing boxing gloves, protective headgear, and masks to hide their faces. Despite their attempted safety measures, they were forced to end the livestream early when one of them lost a tooth and asked to be brought to the hospital.25 This was a relatively minor injury compared to those suffered by the creator of the “Truth or Dare” (DARE) token, who doused himself in isopropyl alcohol as friends shot fireworks at him, and quite predictably went up in flames. He later posted videos from the ICU in a Miami hospital, in which he has substantial facial burns, and describes the second- and third-degree burns he suffered over a substantial portion of his body.26

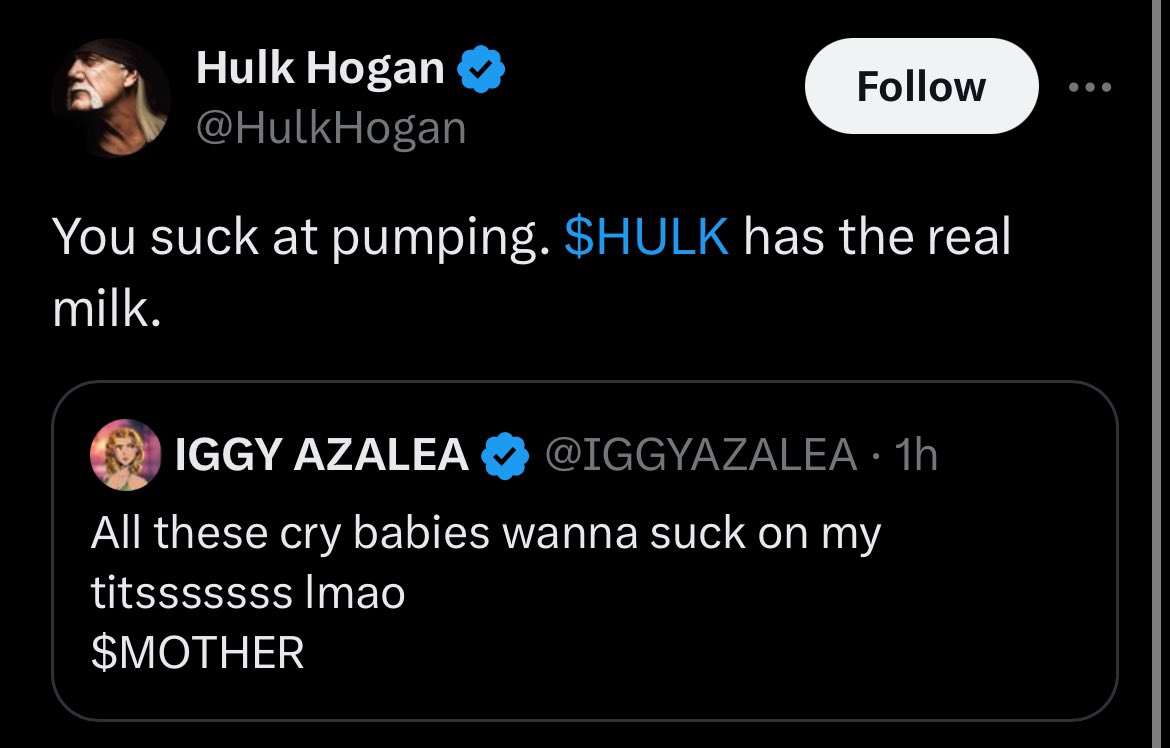

Elsewhere, we’re seeing echoes of the times when various celebrities went all in on crypto. Remember when Reese Witherspoon was tweeting “crypto is here to stay”, and Justin Bieber was posting his NFTs on Instagram? Well, now we have B-list celebrities belatedly getting in on the grift as crypto prices rise again. Olympic athlete-turned-Trumpworld talking head Caitlyn Jenner released a $JENNER token, with such bold shilling that it took people a day or two to be convinced that it was really her and not someone who hacked her Twitter account [W3IGG]. Rapper Iggy Azalea is making frustrated tweets about how she can’t find a market maker for her new token. Hulk Hogan spent a day promoting his $HULK token only for it to turn out to be a pump-and-dump; he’s since claimed that his account was hacked, although it’s not clear if that’s true.

Even Floyd Mayweather couldn’t seem to resist, despite multiple run-ins with securities laws in the past. In 2018, he was forced to pay around $615,000 for unlawfully promoting the Centra Tech ICO the year before, and agreed not to promote securities for three years.27 Once his timeout was over, he got right back in the game, promoting the EthereumMAX token, Bored Bunny NFTs, “the Mayweverse”, and other projects. He was later sued by investors in the EthereumMAX token — which was described as a security in a separate lawsuit by the SEC (that named a bunch of celebrities, but not Mayweather) — although the case against him was ultimately tossed out. Now he’s been posting about a $FLOYD token, although he quickly deleted his tweets after being called out by blockchain sleuth zachxbt for repeatedly scamming his fans.28

The Web3 is Going Just Great recap

There were 10 entries between May 18 and June 7, averaging 0.5 entries per day. $1.316 billion was added to the grift counter.

Linea blockchain halts in response to hack

[link]

The Linea layer-2 blockchain, which is backed by ConsenSys, made the controversial decision to halt block production in response to a $6.8 million hack of Velocore, a decentralized exchange built on top of Linea. Like many layer-2 blockchains, Linea is incredibly centralized, and it's this centralization that gave the project team an easy off-switch they could hit when something went awry.

Although this prevented the thief from cashing out some of the assets they'd stolen from Velocore in a flash loan attack, it was extremely controversial, as this degree of centralization is viewed as dangerous in the cryptocurrency world. As often happens after these types of unilateral actions, Linea has promised that they will soon be trying to decentralize so that they will be prevented from ever doing something like this in the future. We'll see.

DMM crypto exchange hacked for more than $300 million

[link]

The Japanese cryptocurrency exchange DMM announced that they had suffered an "unauthorized leak" of around 4,500 BTC priced at around $308 million. They offered very little in the way of further details about how the hack happened or who might have been responsible, saying that they were still investigating.

The company has promised that it will be able to plug the $300 million hole by raising funds through a capital increase and various loans.

This is one of the largest cryptocurrency heists, rivaling the $320 million Wormhole bridge hack in February 2022 (although some of those funds were later recovered).

Everything else

- Blockchain developer loses over $48,000 after posting private key to Github [link]

- Memecoin team accused of hacking influencer Twitter account to manipulate markets [link]

- "Normie" memecoin plummets 99% after exploit [link]

- Gala Games suffers $21 million hack [link]

Worth a read

Leo Schwarz over at Fortune Crypto just published a scoop on Yida Gao and his Shima Captial blockchain-focused venture capital fund. Gao allegedly took millions of dollars from investors and funneled them into offshore companies under his own name. As for Shima, it seems to have lost money despite the overall cryptocurrency bull run.

In the news

Personally I consider it a career achievement to have made it on the shortlist of people for a journalist to call when they need comments on a tech company telling people to eat glue.

That's all for now, folks. Until next time,

– Molly White

Correction: There was an error in the original version of this newsletter, where the table of cryptocurrency expenditures to support or oppose Congressional candidates double-counted some expenditures and showed erroneously high contributions for some candidates. That table has been corrected.

References

“Former FTX Executive Ryan Salame Sentenced To 90 Months In Prison”, U.S. Attorney’s Office, Southern District of New York. ↩

Defendant’s sentencing memorandum filed on May 14, 2024. Document #433 in US v. Ryan Salame. ↩

“Ryan Salame, part of crypto exchange FTX ‘inner circle,’ sentenced to prison”, ABC News. ↩

“Pump.fun exploiter claims he was arrested in UK and now on bail”, Cointelegraph. ↩

Memorandum decision and order filed on May 28, 2024. Document #312 in SEC v. Digital Licensing. ↩

Memorandum decision and order filed on May 28, 2024. Document #313 in SEC v. Digital Licensing. ↩

“‘Incognito Market’ Owner Arrested for Operating One of the Largest Illegal Narcotics Marketplaces on the Internet”, U.S. Department of Justice. ↩

“Disbarred Attorney Pleads Guilty to Promoting $9.5M Cryptocurrency Ponzi Scheme”, U.S. Department of Justice. ↩

“911 S5 Botnet Dismantled and Its Administrator Arrested in Coordinated International Operation”, U.S. Department of Justice. ↩

“Former Investment Banker and Registered Broker Sentenced for Operating $1.5M Cryptocurrency Investment Fraud Scheme”, U.S. Department of Justice. ↩

“Two Estonian Nationals Extradited from Estonia to the United States for $575M Cryptocurrency Fraud and Money Laundering Scheme”, U.S. Department of Justice ↩

“3 Questions About the SEC’s Abrupt ETH ETF Approval”, CoinDesk. ↩

“‘It’s all bullshit’: Democrats unload on the crypto industry while hearings loom”, Semafor. ↩

Complaint filed April 29, 2024. Document #18 in Consensys v. Gary Gensler. ↩

“SEC's approval of Ethereum ETFs still leaves some questions on whether ETH is a security, lawyers say”, The Block. ↩

“Ethereum ETFs Inch Closer Toward Launch as BlackRock Updates Filing”, Decrypt. ↩

“60 crypto firms pitch support for large market structure bill ahead of next week's vote”, The Block. ↩

“SEC Chair Gary Gensler denounces crypto market bill ahead of House vote”, The Block. ↩

“Survey of Household Economics and Decisionmaking”, Board of Governors of the Federal Reserve System. ↩

“Trump booed and jeered at Libertarian National Convention”, NBC News. ↩

“Robinhood Acquires Crypto Exchange Bitstamp in $200 Million Deal”, Decrypt. ↩

“Mom Sexualizes Herself on Livestream for Son’s Meme Coin—Then Ghosts”, Decrypt. ↩

“Solana Meme Coin Devs Fight on Livestream to Pump Price—Until One Loses a Tooth”, Decrypt. ↩

“Solana Dev Who Got Burned Up in Meme Coin Stunt Is Alive—And Wants Another Dare”, Decrypt. ↩

“Two Celebrities Charged With Unlawfully Touting Coin Offerings”, U.S. Securities and Exchange Commission. ↩

Footnotes

I hope I don’t regret writing this. ↩

I pick my words carefully here, because Consensys’ interpretation for the purposes of the lawsuit is not necessarily reality. As I wrote in Issue 57, “However, the authorization of an investigation into whether securities laws may have been violated with respect to ether is not necessarily a declaration that ETH is broadly a security, and it's not clear to me that Consensys is correct when they describe this as a formal position by the agency.” ↩

Based on an estimated 260.8 million adults in the United States. ↩

This is what they claim on their website. However, the Stand With Crypto PAC has yet to report any fundraising to the FEC. As a PAC they are required to report quarterly, but because they were formally registered with the FEC on April 19 — days after the April quarterly filing deadline — their first filing deadline will be July 15. Stay tuned! ↩

Two groups with substantial overlap. ↩