Issue 61 – Soft war by the enemy

How will recent Supreme Court decisions affect the crypto world? Also, more absurdity from the crypto lobby, and some new regulatory actions.

I’m putting the finishing touches on that cryptocurrency industry election spending project that’s been keeping me so busy lately! Keep an eye out next week for that announcement.

For those who have no idea what I’m talking about, I’ve been working on a website that will give a real-timea view into the money that the cryptocurrency industry has been pouring into US elections. Things like which companies and industry executives are contributing and how much, which races they’re working to influence, and the advertisements they’re running to try to sway voters.

I think this is incredibly important information to have out in the open, and the importance is only underscored by recent primary wins in New York and Utah by candidates who received millions in support from the crypto industry. Not only is the industry actively influencing elections, they have only spent around 16% of the money they’ve raised so far, and they’re continuing to raise millions more. As I mentioned last issue [I60], the largest crypto-focused super PAC raised 50% of its total funds — $85 million — in May alone.b The spending we’re seeing already is only the tip of the iceberg, so I’m really happy to have this project up and running as election season looms ever nearer.

I apologize for just how busy this project has kept me! It was a bigger project than I anticipated, and I know it’s made my writing a little bit less frequent. Thank you for bearing with me!

In the courts

The Wall Street Journal has published an article alleging that Sam Bankman-Fried’s whole family was in on the illicit campaign finance activity that he and at least two of his lieutenants were perpetrating. The Journal describes an email in which Bankman-Fried’s law professor father, Joseph Bankman, appears to have knowledge that Ryan Salame was acting as a conduit for FTX donations to Republican causes, and writes about seeking to “categoriz[e] these [transfers from FTX to Salame] as loans”. The Journal also describes conversations between FTX employees and Bankman-Fried’s mother, Barbara Fried, and brother, Gabriel Bankman-Fried.1 These are much like the conversations that have come out in various court proceedings, in which Bankman-Fried’s mother appears to solicit money for her various charitable organizations, and in which both his mother and brother seem aware of and even to advise the straw donations [Stones, FTX Trial Day 9]. So far, I haven’t seen anything to suggest impending criminal action against anyone else in the Bankman-Fried family, but there sure seem to be plenty of threads the Justice Department could pull on if they felt so inclined.

Two men were sentenced for manipulating the price of a token they had created, which was called HYDRO. They used trading bots to flood the market with manipulative trades intended to inflate the token price and drive consumer interest in the token, and they ultimately profited around $2 million through their scheme. Both co-conspirators were sentenced to three years and nine months in prison.2

In governments and regulators

Big news pertaining to the SEC this week came out of the Supreme Court, who alongside a truly horrifying recent decision, issued another decision that’s downright reasonable.

In SEC v. Jarkesy, the Supreme Court determined that the SEC cannot continue to adjudicate fraud complaints in front of its own administrative law judges and without a jury. Although defenders of that approach have praised it for its efficiency and for drawing on the knowledge of judges who are particularly well versed in securities law, others quite rightfully point out that those facing fraud charges punishable by large fines ought to have the same right to trial by jury like anyone else. This decision certainly will make things more burdensome for the SEC, but appropriately so, in my view. As for the crypto angle, I don’t think it’s terribly likely to affect much. While an increased overall burden on the SEC could reduce the number of crypto cases it’s able to pursue, those cases will likely look much the same, as most crypto-related SEC cases have already played out in federal courts in front of a jury, rather than in the now-verboten administrative proceedings.

Also potentially impacting the crypto world is the decision pertaining to the Chevron deference, where the Supreme Court overruled a 40-year-old principle that gave broad discretion to government agencies in interpreting ambiguous laws and statutes. While some loud voices in the crypto world who believe the SEC is abusing its authority are hopeful that this decision might rein them in,3 it seems fairly unlikely to change much. I’m sure that the decision will be cited widely in the lawsuits against the SEC, or in defenses against complaints brought by the agency, but judges thus far have broadly seemed to view the SEC’s enforcement actions as well within the agency’s remit.

As for more concrete SEC activities: most of the SEC’s case against Binance will proceed past the motion to dismiss, as Judge Amy Berman Jackson has ruled that the agency made plausible claims on most of the thirteen charges it brought.4 However, one charge, the claim that Binance sold its BUSD stablecoin token as an investment contract, was dismissed entirely. Portions of two others, pertaining to Binance’s secondary sales of BNB tokens, and to its Simple Earn product, were dismissed, with Jackson determining that specific types of sales described by the SEC did not meet the investment contract definition. Binance has naturally claimed this as a massive win, publishing a blog post boasting that “U.S. Federal Judge Rejects Main Claims by SEC Against Binance.”5 This of course is completely false, given that the majority of the very serious claims against the company and its former CEO will proceed. Furthermore, Jackson at points slaps down major arguments by Binance. For example, to Binance’s oft-repeated claim that there must be a “contractual relationship” in order for a sale to be a sale of an investment contract, Jackson wrote: “their argument has been foreclosed by Supreme Court and Circuit precedent, and indignation alone cannot open that door.” While there is certainly room for the case to go in any number of directions, Binance seems to be dancing its victory dance quite prematurely.

Ripple6 and Coinbase7 have both already cited this decision in their own cases involving the agency, though it’s hard not to notice that Coinbase mostly just cites Binance’s arguments against the SEC rather than Judge Jackson’s decision — where she explicitly wrote: “no one should read this case as deciding that crypto assets themselves are or are not ‘securities;’ that is not the question presented.” In the Ripple case, the SEC has already replied, to argue that the decision doesn’t seem relevant to what Ripple’s trying to apply it to: a decision on remedies. They also point out that a portion of the decision, not mentioned by Ripple, seems to actually support the SEC’s case against Ripple: although Ripple has argued at great length that the SEC failed to give them fair notice before taking action against the company, the Binance decision included a note that Binance could not reasonably be surprised when the SEC began enforcing a “decades-old federal securities statute” supported by similarly old Supreme Court precedent, and that they should have taken warning in 2017 from the SEC’s report on The DAO.8

Remember in the last issue when I wrote that “Despite the news about the ETH investigation, it seems likely that the SEC is still planning to bring action against Consensys pertaining to their popular MetaMask wallet software” [I60]? Well, they didn’t make us wait very long. They’ve set their crosshairs on MetaMask’s “swaps” feature, where users swap one token for an equivalent amount of another one, and on their staking service. Back when the threat of a lawsuit first emerged, Consensys’ CEO Joseph Lubin hit back with an argument that only makes sense if you’ve managed to convince yourself that the SEC and the courts are absolutely desperate to keep the cryptocurrency industry afloat: “If we have to register our wallet as a broker-dealer, then virtually every application on Ethereum that does similar things with tokens will have to register themselves as a broker-dealer. And so an entire tech industry would be profoundly killed in the United States.”9 I’m looking forward to Lubin supporting me in my argument that, if these courts require me to get a medical license before operating on patients, an entire industry of human surgical experimentation will be profoundly killed in the United States!

The parent company of the bankrupt Silvergate Bank will pay around $63 million in fines to the Federal Reserve and the California Department of Financial Protection and the Innovation [W3IGG]. The SEC also imposed a $50 million fine, although the terms of the settlement noted this “may be offset” by the other penalties. Silvergate Bank collapsed in March 2023 [W3IGG] after an FTX-induced bank run by its unusually high proportion of cryptocurrency customers, who were largely drawn in by its “SEN” platform that allowed these customers to transfer money among one another even outside of banking hours.

According to the regulators, Silvergate “had serious deficiencies” in its anti-money laundering programs, including in its SEN product. In particular, the SEC highlighted $9 billion in suspicious transfers among FTX entities that should have been detected by compliance programs. The SEC also alleged that Silvergate misrepresented its financial state during the post-FTX collapse bank run. Silvergate, of course, says they too were duped by FTX. But former FTX executive Ryan Salame, who also said he was duped by FTX, and who is still tweeting away [I59], says that FTX was completely transparent with Silvergate about everything they were up to.

If true, and that’s a big “if”, it’s hard not to wonder if there might be criminal charges coming down the line.

In elections and political influence

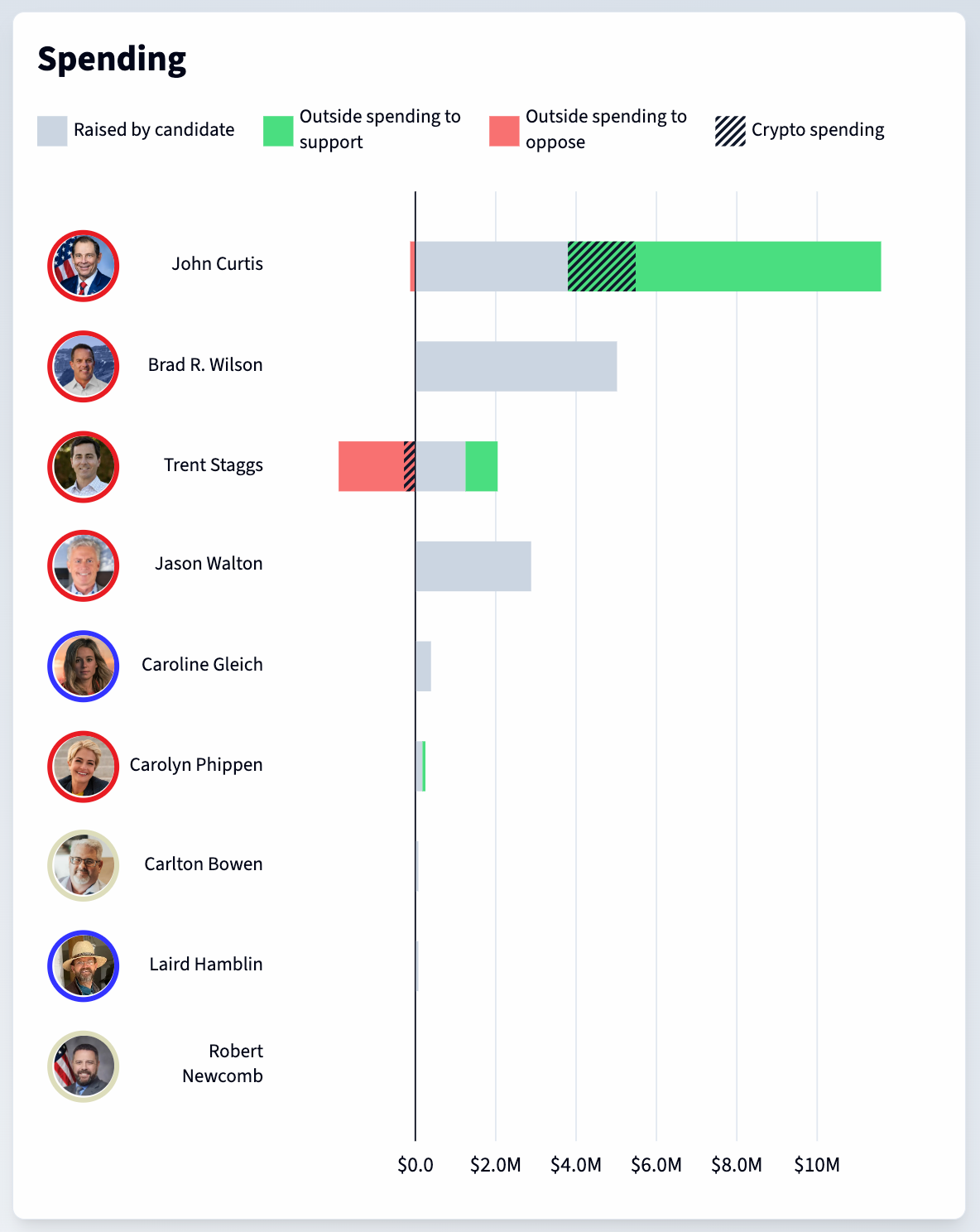

The two primary candidates who enjoyed substantial support from crypto-focused super PACs both won their primary races. In Utah, Republican Senatorial candidate John Curtis defeated Trent Staggs by a hefty margin, earning 51.6% of the vote to Staggs’ 28.1%. The Republican-focused crypto PAC, Defend American Jobs, spent $1.7 million to support him, and another ~$280,000 to oppose Staggs. Curtis, an incumbent, co-sponsored an anti-CBDC bill and FIT21 [I58, 59, 60], and voted in favor of the SAB 121 house resolution [I58, 59].

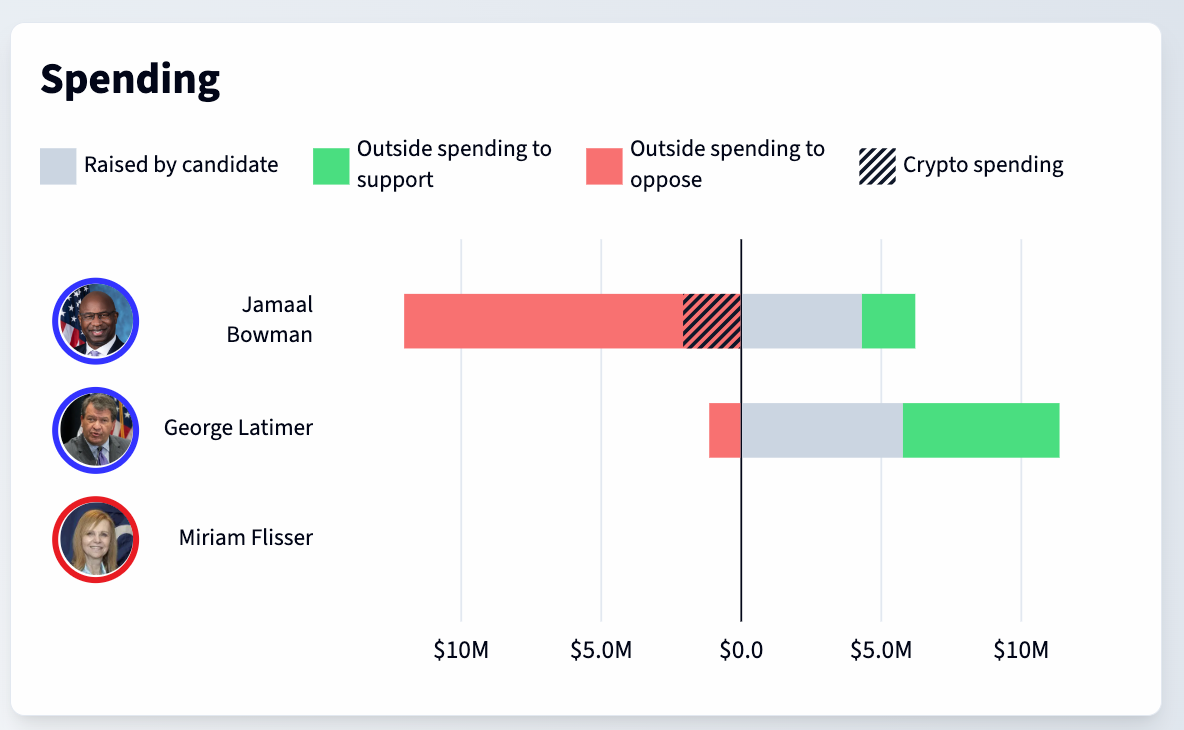

In New York, George Latimer defeated incumbent Jamaal Bowman, earning 54.5% of the vote to Bowman’s 45.5%. Although Latimer himself received no direct support from crypto PACs, Fairshake spent more than $2 million to oppose Bowman. Both Fairshake and AIPAC piled on hard fairly late in the race to oppose Bowman, and Fairshake seemed to largely echo AIPAC’s messaging in the ads they ran, rather than focusing on anything related to the economy or technology, much less cryptocurrency [I60]. Bowman had apparently earned the ire of the crypto lobby for voting against Curtis’s anti-CBDC bill, FIT21, and the SAB 121 house resolution. Latimer, for his part, has had very little to say on the topic of crypto.

A sneak peek at my election spending website, which illustrates the proportion of outside spending that came from the cryptocurrency industry

Coinbase’s Stand With Crypto has finally admitted what I reported earlier [I59]: that less than 1% of the more than $175 million they boast was “donated by crypto advocates” actually came from the sort of grassroots movement they claim Stand With Crypto to be.

That’s a hell of an asterisk...

As I’ve noted previously, that $177.88 million is far from grassroots: most of it was donated in roughly equal amounts by Coinbase, Ripple Labs, and Andreessen Horowitz.

Not ones to let the truth get in the way of juicing the numbers, they simply moved on to the next thing to fudge. Coinbase CEO Brian Armstrong announced during the first presidential debate that “1600+ crypto debate watch parties are in full force right now!” and encouraged people to visit the Stand With Crypto Twitter feed to “see some posts from advocates hosting events”.10 However, an actual glance at these posts revealed that many of these “events” were just individual guys taking advantage of the organization’s offer of $50 in pizza vouchers, eating pizza alone in their apartments and watching the debate.

Wish I’d known, I’d have organized a “crypto watch party” of my own. Maybe next time...

Stand with Crypto had also tried to organize a mass email campaign to get CNN to “add crypto to the debate agenda”,11 and crypto advocates were sorely disappointed when their pet issue made no appearance.12 Given that the 90-minute debate also made no mention of things like public education, the COVID-19 pandemic, or broader technology policy like AI regulation, it was hardly a surprise that cryptocurrency didn’t make the shortlist either.

Kraken co-founder, chairman, and former CEO Jesse Powell has joined the Winklevoss twins [I60] in making a $1 million donation to Trump (and in having part of it refunded, because they are apparently more interested in publicity stunts than campaign contribution limits).13 His tweet announcing his contribution explicitly called out Senator Elizabeth Warren (D-MA), who has yet to see much crypto-related spending in her upcoming Senate race besides some early support from industry figures for her crypto-focused “long-shot” opponent John Deaton [I55].

Elsewhere in crypto

Bitcoin prices have been down for a variety of reasons, including more rumors of Mt. Gox payouts, and the observation that US and German governments have moved around 11,768 BTC (~$664 million) to exchanges, likely in preparation to sell much of it. These are not tokens the governments are holding as some sort of investment, but are rather tokens that have been seized by law enforcement. The tokens moved by the US government were seized from Banmeet Singh, a drug trafficker who sold various controlled substances on dark web marketplaces like the Silk Road [I50]. Singh pleaded guilty to conspiracy to possess with the intent to distribute controlled substances and conspiracy to commit money laundering in January, and was sentenced to five years in prison in April.14

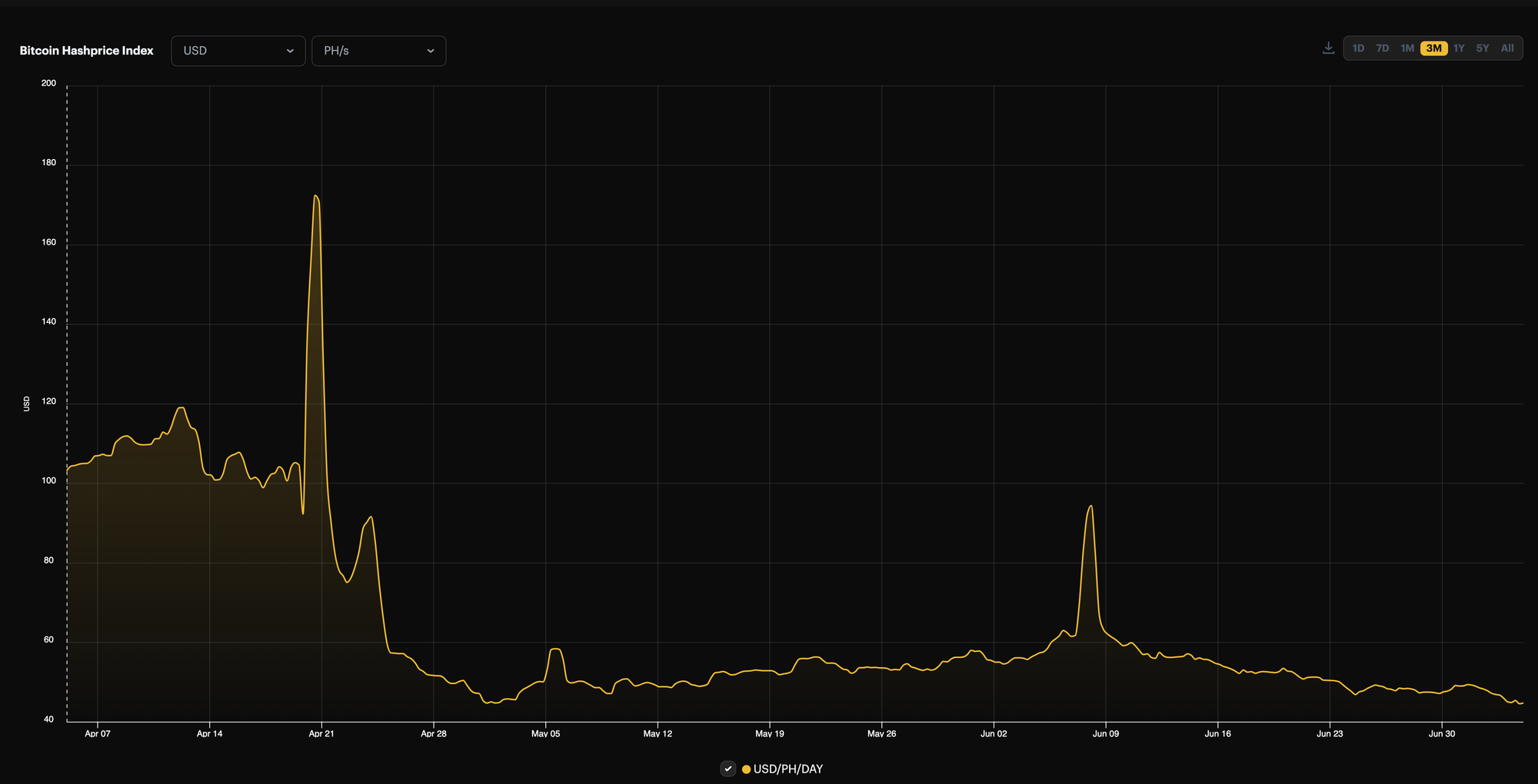

I bring up bitcoin price because I want to revisit something I wrote in April [I55], shortly before the bitcoin halving:

There's also the miner problem. Bitcoin miners have already been operating on incredibly thin margins, and many washed out during the "crypto winter" as the low prices for their bitcoins made mining even less sustainable. Now, with half as many bitcoins issued per block, that's only going to get worse. If bitcoin's price skyrockets as hoped, they might break even and be able to stay in business. If bitcoin's price falters, miners are going to have a really tough time paying off their electricity bills and loan payments, and more companies are likely to collapse.

Any guesses what I’m about to say?

The “hash price” — that is, the approximate dollar value of 1 TH/s of mining power on any given day — plummeted after the halving on April 20, then recovered a tiny bit. However, it’s been on a steady downward trajectory for the last month, and has hit a new all-time low. Combined with data showing a dwindling hash rate, it seems that bitcoin miners are deactivating unprofitable equipment amid challenging business conditions.15 Of course, people in the bitcoin world have observed that these stats resemble the dire conditions around the time of the FTX collapse, and have decided that — as always — this is good news for bitcoin! After all, if that marked a market bottom in 2022, surely this must be all up from here! Sometimes I admire that level of optimism.

Some miners have been trying to rescue their sinking ships by — you guessed it — pivoting to AI. As one computation-hungry tech trend has given way to another, miners are just trying to keep up with the times by adapting their infrastructure to support the similarly power-intensive AI computing.

A game called Hamster Kombat has taken the crypto world and Telegram users by storm, as an application that runs on the messaging platform’s new “mini-apps” infrastructure. As with most blockchain games, it’s more about money than it is about fun, and gameplay mostly involves mashing your hamster avatar, Cookie Clicker style, and spamming your friends with referral codes. The future of gaming that we were promised has finally arrived! Despite the fact that the in-game tokens can’t actually be traded for any other kind of currency — crypto or fiat — we’re beginning to see a similar story emerging around Hamster Kombat as with Axie Infinity in its heyday. Those living under challenging economic conditions in locations like Iran are turning to Hamster Kombat in desperation, hoping that the team behind it will actually follow through on its promises to launch a crypto token that could allow them to cash out actual money based on their in-game performance. The game has not been warmly received by the Iranian government, and an Iranian military chief has gone so far as to accuse the Hamster Kombat developers of harming the country’s elections by distracting its populace. “One of the features of the soft war by the enemy is the ‘Hamster’ game,” he said to local news.16

The Web3 is Going Just Great recap

There were five entries between June 24 and July 5, averaging 0.5 entries per day. $8.15 million was added to the grift counter.

“Five dollar wrench” attackers arrested

[link]

For all the effort that goes into digitally securing cryptocurrency assets, crypto holders (and really, holders of any bearer asset) still face the threat of what’s known as the “$5 wrench attack”, thanks to xkcd.

![Actual actual reality: nobody cares about his secrets. (Also, I would be hard-pressed to find that wrench for $5.) [Cueball is holding a laptop up in two hands, showing it to his Cueball-like friend who is examining it while holding a hand up to his head. Above the top of the panels frame, there is a box with a caption:] A Crypto nerd's imagination: Cueball: His laptop's encrypted. Let's build a million-dollar cluster to crack it. Friend: No good! It's 4096-bit RSA! Cueball: Blast! Our evil plan is foiled! [Cueball is holding a closed laptop down in one hand while giving his Cueball-like friend a wrench with the other. The friend reaches out for it. Above the top of the panels frame, there is a box with a caption:] What would actually happen: Cueball: His laptop's encrypted. Drug him and hit him with this $5 wrench until he tells us the password. Friend : Got it.](https://imgs.xkcd.com/comics/security.png)

Such an attacker was busted recently by the FBI after a string of violent home invasions in which he and his accomplices tried — but mostly failed — to physically rob their victims of their cryptocurrency. They beat, tortured, and kidnapped various victims while demanding passwords to cryptocurrency accounts, but in two cases their captives managed to escape without turning anything over.

In another case, they targeted a woman from whom their more digitally-inclined accomplices had already stolen $3 million. Hoping to steal another $500,000 that she had managed to hang onto, the attackers broke into her house and held her at gunpoint. However, prosecutors say that she was so dismayed by the earlier loss that she told the attackers to just shoot her. (They did not).

In a final instance, after attacking a man and his wife and threatening them with further physical and sexual violence, the attackers were able to get a man to transfer cryptocurrency holdings to them from his Coinbase accounts. However, after moving $156,000 of his holdings, Coinbase’s software determined the transactions seemed suspicious and blocked any further activity.

The leader of the group, a 24-year-old from Florida, was arrested and charged with crimes that, if he is convicted, will carry a sentence of up to life in prison, and a mandatory minimum of seven years. Another thirteen co-conspirators were also arrested, and all pleaded guilty.

Logan Paul actually sues Coffeezilla

[link]

In January 2023, I wrote that influencer-turned-(alleged)-crypto-grifter Logan Paul had threatened YouTuber and crypto sleuth Coffeezilla over the videos he’d made investigating Paul’s failed “CryptoZoo” game. Like many other would-be crypto influencers, Paul had made huge promises of an elaborate NFT-based game, only to completely fail to deliver anything remotely close to what he’d promised. Only after extensive attention — largely thanks to Coffeezilla’s reporting — did Paul cancel the project and promise a “$2.3 million buyback program”, which he of course made conditional on participants not pursuing legal action against him.

I had assumed that the lawsuit was probably the normal rich-guy bluster at being publicly called out for his wrongdoings, which rarely amounts to much, but apparently Paul actually meant to follow through with it. Now, a full year and a half after his initial threat, and after most people who weren’t directly affected have forgotten about his scummy project, he’s decided to bring it back into the public consciousness by filing what looks to be a pretty flimsy lawsuit.

Everything else

- Bittensor wallets drained [link]

Worth a read

I have previously mentioned in this newsletter my excitement that the Ghost blogging platform (which I use for this newsletter) is planning to federate via ActivityPub. Ghost's founder and CEO went on Mike McCue's podcast to talk about why they decided to do it, and it was a really cool conversation. I particularly liked where O'Nolan said: “I think to have journalism with integrity, you have to have technology with integrity. And in my mind, open source is the way to have technology with integrity. And I want the best journalism to win because it's the best journalism, not because they have the best platform.”

With the exception of the rare Wikipedia-versed journalist, the media tends to have a tough time reporting on things that get into the nuts and bolts of how Wikipedia is built. This time, it was a different longtime Wikipedian helping to explain what several media sources got wrong and — more broadly — how Wikipedians evaluate what is and is not a reliable source, particularly when it comes to sources with strong points of view.

That's all for now, folks. Until next time,

– Molly White

Footnotes

References

“Sam Bankman-Fried’s Campaign Spending Spree Was a Family Affair”, The Wall Street Journal. ↩

“Two Men Sentenced for Orchestrating Multimillion-Dollar Cryptocurrency Securities Fraud and Wire Fraud Schemes”, Office of Public Affairs. ↩

Memorandum opinion & order filed on June 28, 2024. Document #248 in SEC v. Binance. ↩

“U.S. Federal Judge Rejects Main Claims by SEC Against Binance”, Binance blog. ↩

Letter filed on July 2, 2024. Document #971 in SEC v. Ripple Labs Inc. ↩

Letter filed on July 2, 2024. Document #43 in Coinbase v. SEC. ↩

Letter filed on July 3, 2024. Document #972 in SEC v. Ripple Labs Inc. ↩

“Cryptofinance: The trade-offs in chasing the decentralised dream”, Financial Times. ↩

“Dark Web Vendor Sentenced for Distributing Narcotics and Ordered to Forfeit $150M”, U.S. Department of Justice. ↩

“Bitcoin Bottom Is Near as Miners Capitulating Near FTX Implosion Level: CryptoQuant”, CoinDesk. ↩

“The Hamster Kombat crypto app that’s spreading through desperate Iran”, The Independent. ↩