Issue 63 – RobConf 2024

Coinbase responds to campaign finance violation allegations, Trump panders to bitcoiners, and I chat with Lyn Alden about sexism in bitcoin.

Hello to all of my shadowy backers!

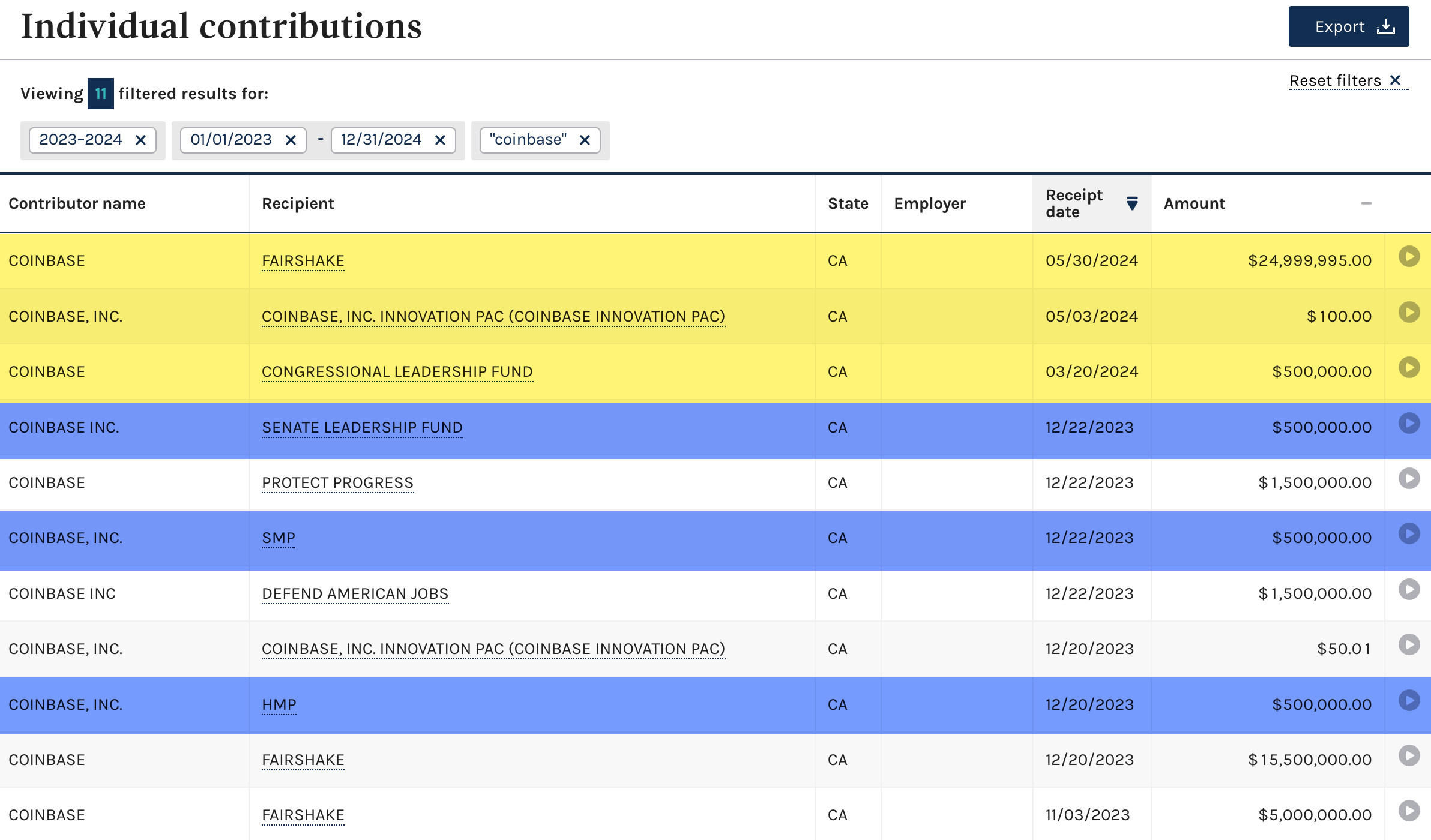

Some of you who follow me on social media may have already seen the news that I filed a complaint with the Federal Election Commission about Coinbase’s apparent campaign finance violations. Advocacy group Public Citizen joined me on the complaint, and I am very grateful to them for all of their assistance in evaluating what I uncovered, as well as their lawyers’ legal analysis. Public Citizen has substantial experience with campaign finance advocacy and other election-related matters, and have been very helpful in navigating what for me are uncharted waters.

I have updated last week’s story with most of the developments, including a response to the allegations on Friday from Coinbase’s Chief Legal Officer Paul Grewal. Scroll down to the “Coinbase’s response” section if you already read it and are just looking for what’s new. For those of you who prefer to listen to my newsletters, the audio version has also been updated.

Grewal responded again day before yesterday, after news of the complaint became public, to briefly repeat his claim that Coinbase is not a federal contractor — a claim that we already explained in our filings is not consistent with the law. He then reduced himself to innuendo that I must be being funded by some shadowy secret Coinbase opponent, before making confusing and baseless claims that we are attempting to “report a political bias which does not exist” by highlighting Coinbase's contribution to the House Republicans. I will go into this in more detail later on in this issue, but for now I will leave it with this: it is telling that Grewal is resorting to personal attacks and baseless allegations to try to stir up Coinbase’s supporters, rather than providing a coherent explanation for the legality of Coinbase’s campaign contributions.

Meanwhile, Coinbase’s CEO is boasting to analysts that the next presidential administration, whoever it is, will be “constructive” on crypto thanks to the political pressure. “[Crypto] advocates are making their voices heard as an important voting bloc,” he said, once again exaggerating what he and his company would like to present as a grassroots issue rather than a bunch of mega-wealthy executives and companies spending enormous amounts in hopes of buying friendly regulations.1

Also included in this issue: I had the opportunity to interview Lyn Alden, an investment strategist, analyst, and prominent bitcoiner. We had a conversation on Twitter in which we disagreed on the topic of sexism in the bitcoin and crypto industries, which we took to a recorded face-to-face discussion. It was an interesting conversation, and I encourage you to watch it!

In the courts

Coffeezilla has released a video about the defamation lawsuit filed against him by influencer and (alleged) crypto scammer Logan Paul, which Coffeezilla believes was motivated by upcoming reporting of his on a different shady business venture that Paul was involved with.

This lawsuit is not about Logan Paul getting defamed. Instead, this is about him trying to dodge accountability, victims, and blame anyone but himself for his problems. Especially me. ... I believe this lawsuit was not designed to win, but to shut me up, to threaten me, using Logan’s wealth and a federal court system without anti-SLAPP to send a message: “do not tell that story.”

Legal commentators QuestAuthority (~41 minutes in) and LegalEagle have both covered the lawsuit and agree that it looks like a pretty bogus intimidation suit. Unfortunately for CoffeeZilla, bogus intimidation suits are still expensive as hell (that’s the point).

Not only that, but his errors and omissions insurer has refused to cover this lawsuit because apparently his policy, unbeknownst to him, contained exclusions for defamation suits and for any of his content that describes digital assets. In other words, pretty much everything Coffeezilla might get sued about. If you want to pitch in for his legal defense, he has a Patreon and some cool new merch. Or if you’re feeling really froggy, you could help push for a federal anti-SLAPP law in the United States, which we desperately need.

Terraform Labs’ Do Kwon is now slated for extradition to his native South Korea, not the United States, after endless court battles and flip-flopping in Montenegro, where he has been held in jail since April 2023. Although the Montenegrin High Court’s press release emphasized that this decision is final, after all this back and forth I’m not sure I’ll fully trust it until he actually sets foot in South Korea.2 [I23, 28, 30, 31, 44, 45, 46, 51, 56, 60]

In bankruptcies

The bankrupt crypto lender Genesis has finished up its restructuring, and will begin distributing around $4 billion in assets (in-kind in crypto, and in dollars) to its creditors. Holders of different types of assets will receive different percentages of their assets back, with Solana creditors receiving the least (around 30%), Bitcoiners receiving around 51%, and stablecoin holders receiving the full 100%. Average recoveries will be, for the time being, around 64%. Genesis has also set aside $70 million for legal expenses to go after third parties, including its own parent company, Digital Currency Group (DCG). Creditors may receive more assets later on depending on the results of this litigation and several other factors.3

In governments and regulators

The SEC’s long-running lawsuit against Ripple has finally come to an end... well, at least for now. The judge in the case found that Ripple’s institutional sales of its XRP token were in violation of federal securities laws, and fined the company $125 million. Though this is a big number, it is substantially less than the $1 billion in disgorgement and $900 million in penalties the SEC had sought — and the SEC has indicated they’re likely to appeal the outcome of the case. Ripple, as they are wont to do, has celebrated the outcome as a victory. The judge also banned Ripple from violating securities laws in the future, and seemed skeptical of the company’s willingness to play by the rules going forward. “Ripple’s willingness to push the boundaries of the Order evinces a likelihood that it will eventually (if it has not already) cross the line,” she wrote. “On balance, the Court finds that there is a reasonable probability of future violations, meriting the issuance of an injunction.”

There’s a new lawsuit against the SEC coming out of the crypto world, and from a rather unexpected source. Jonathan Mann, sometimes called “Song a Day Mann”, is a songwriter best known for composing, recording, and publishing a new song every single day for over sixteen years now. For around three years, he’s been selling those songs as NFTs, which is now his primary source of income. He’s concerned about past enforcement actions against NFT projects, particularly the one against the Stoner Cats NFT project [W3IGG], and what he interprets as a stance by the SEC that every NFT project is an unregistered security. He explains, “Because the SEC has been exquisitely random about which projects they go after, it feels like anyone could be next. Are they going to come after me? ... I refuse to sit around and find out.” He and Brian L. Frye, the law professor who once created an NFT called “SEC No-Action Letter Request”, are co-plaintiffs in a lawsuit seeking declaratory action that their planned NFT projects are not violations of securities laws.

Oh, and of course there’s a song:

I joined Mann on his Digitally Rare podcast in May 2022, and as it so happens, featured his episode with Frye in my “Worth a read” section in issue 23 of this newsletter.

A group of Democrats in Congress has written a letter to the CFTC, asking them to ban betting on U.S. elections. While this has to do with prediction markets quite broadly, many in the cryptocurrency industry are taking this as a jab at Polymarket, an increasingly popular crypto betting website that allows people to bet on the outcomes of... well, just about anything. Polymarket has enjoyed a recent surge in popularity, perhaps partly because of the Olympic games, but mostly because of the rapidly heating up U.S. election season. Bettors on the site have been gambling on everything from who will win various Olympic competitions to who will earn the Harris VP spot to who will win the presidential election — all the way to things like “Will JD Vance say ‘Couch’ before August?” (he did) and “Will Kamala say ‘coconut’ before August?” (she did not).

While I find the latter types of bets quite amusing, the lawmakers do not — and especially not when it comes to betting on election outcomes. “Political bets change the motivations behind each vote, replacing political convictions with financial calculations. Allowing billionaires to wager extraordinary bets while simultaneously contributing to a specific candidate or party, and political insiders to bet on elections using non-public information, will further degrade public trust in the electoral process,” they say in the letter.4

These lawmakers are hoping that the CFTC will finalize a proposed rule they published for comment earlier this year, which would clearly define betting on elections, sports outcomes, and some other things as falling within the types of “gaming” event contracts prohibited for trading on CFTC-registered entities.5 While Polymarket is not available to US-based tradersa after a 2022 settlement with the CFTC that also resulted in a $1.4 million fine [W3IGG], that hasn’t stopped more than $500 million in bets being placed on the outcome of the presidential election, not to mention millions more on other politics-related topics.

Fans of Polymarket and similar such projects often argue that prediction markets offer a unique and valuable perspective into upcoming events, with some research suggesting they can be superior to polls in some cases. However, Polymarket predictions often suffer from a clear bias that stems from the fact that its users tend to be crypto enthusiasts, who sometimes vote for things they want to believe will happen even when those things are unlikely. One good example would be a recent bet that Elon Musk would appear as a surprise speaker at Bitcoin 2024, which was at around 25% “yes” votes on the last day of the event as impatient attendees waited for Trump’s late speech and began theorizing that Musk might join — even as public aviation records showed Musk’s jet flying past the conference city of Nashville, Tennessee on his way to an apparently unrelated engagement in Memphis.

Although Russia has historically not been friendly to the idea of its citizens using cryptocurrencies, it has reversed that position somewhat with a new law that will permit businesses to use crypto for cross-border trade. This appears to be motivated, at least in part, by the hope of bypassing sanctions against the country from the U.S. and other nations — although various individuals within the cryptocurrency industry who have been interviewed about the new law say it’s merely evidence of bitcoin’s broad adoption for everyday transactions.6 If you say so.

Binance is facing an $86 million tax bill in India after apparently not paying taxes on the substantial fees they’ve earned from customers based in the country. Binance was facing the possibility of a ban from the country earlier this year, though they were ultimately able to smooth things over.7 This may not help that relationship much.

In elections and political influence

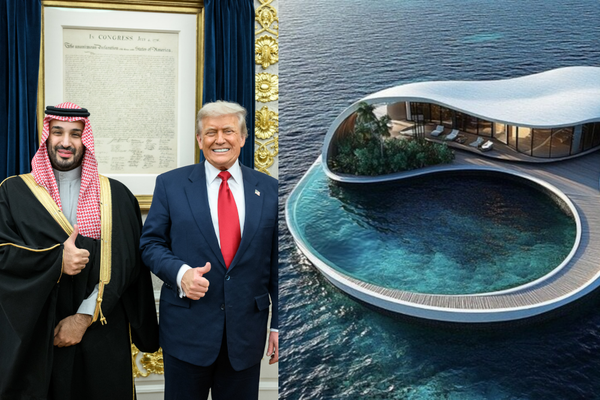

Bitcoin 2024

The Bitcoin 2024 conference — or as I like to call it, RobConf 2024, due to the number amount of speakers named “Rob”b — has wrapped up. It’s the largest Bitcoin event, although this year it looked a bit more like a Trump rally than a crypto conference. Zeke Faux (author of Number Go Up), Hadas Thier, and Gaby Del Valle all both wrote great articles from on the ground.

Bitcoin 2024 has more speakers named Rob, Matt, Mike, Chris, Alex, or Brian than they do women speakers

— Molly White (@molly0xFFF) July 25, 2024

Welcome to RobConf 2024 pic.twitter.com/D4xoEULGS3

I greatly angered some devout Bitcoiners by mentioning the number of “Robs” and “Matts” and “Mikes” speaking at a conference with only 56 women speaking. Later, I highlighted some of the horrendously sexist comments I saw about the fact that roughly 87% of the speakers were male, which seemed to help answer other commenters remarking that it was a shame women just weren’t naturally interested in Bitcoin.

This wound up drawing a comment from Lyn Alden, a prominent investment strategist and venture investor into bitcoin companies. She remarked that she hadn’t “had any notable sexist issues directed at [her] personally”.

Hi Molly. A woman checking in.

— Lyn Alden (@LynAldenContact) July 25, 2024

I've been in the bitcoin industry for 4 years directly, and more than that indirectly, and I literally haven't had any notable sexist issues directed at me personally.

While it is male-leaning, it has been a very welcoming ecosystem.

I was happy for her to hear this, although not exactly convinced that her experience was representative or somehow disqualifying of my own — particularly given her status as someone in a position of potentially financing bitcoiners’ endeavors. We ended up having a long back-and-forth on the topic, and she ultimately offered to do a video interview where we could go into more detail. I took her up on that, and have posted the video to my YouTube:

As for the rest of the conference, organizer David Bailey tweeted two days before the event that, “We’re in talks with Kamala Harris campaign for her to speak at the conference. Would be very savvy of her to reset the democrat positioning on the fastest growing voter block in the country. They’re making up their minds today.”8 He tweeted the following day: “Kamala Harris will not be speaking [at the conference]. No surprise. What can she say to us when she’s actively imprisoning developers, forcing our industry overseas, attacking [proof of work]… it would have been a disaster for her. All eyes on Trump now.”9 Although a disappointing number of news outlets reported this claim, none of them seemed to verify it with Harris’s team, nor did they point out there is perhaps an obvious motivation for Bailey to fabricate a story like this to drum up news coverage about the conference he runs, and to use it as an opportunity to bash Harris to the crypto crowd. Around the same time as this rumor, the Financial Times reported that the Harris campaign was “seek[ing a] ‘reset’” with the cryptocurrency industry — also sourced only to “people with knowledge of the matter” without specifying if they were members of the industry or members of Harris’s campaign.10 That story is at least somewhat more likely than her showing up to Bitcoin 2024 in what would have been one of her first appearances after being named the presidential nominee, though.

Trump showed up and gave a rambling speech that occasionally touched on bitcoin topics, though those were clearly the scripted parts in between his stream-of-consciousness commentary on topics ranging from electric vehicles to Hilary Clinton to violence in Chicago. The mask seemed to slip a bit when he signed off with, “Have a good time with your bitcoin and your crypto and everything else you're playing with.” Many in attendance cheered his various promises: firing SEC Chairman Gary Gensler “day one” and ensuring “the rules will be written by people who love your industry, not hate your industry.” Stopping the practice of selling bitcoin seized as part of law enforcement activities, and instead holding it to “serve in effect as the core of the Strategic National Bitcoin Stockpile”.c Preventing the creation of a central bank digital currency or CBDC.d Commuting the sentence of Silk Road creator Ross Ulbricht, somewhat of a martyr among libertarian and bitcoin circles [I59], who has served eleven years of his life sentence.

Robert F. Kennedy Jr. also spoke, and he was widely recognized by attendees as more knowledgeable about the topic. His promises were also much bolder and much more in line with many bitcoiners’ interests, to the point that I found myself wondering how many attendees were sold on Trump at this conference versus how many defected from the Trump camp to vote for RFK Jr.’s supposedly Democratic-spoiler candidacy. His biggest promise by far, announced to thunderous applause, was that he would establish a strategic reserve of 4 million bitcoins — $225 billion at today’s prices, and amounting to around 20% of the total bitcoin supply — which he did not disguise as a promise to pump the audience’s bags. “The cascading impact from these actions will eventually move Bitcoin to a valuation of hundreds of trillions of dollars,” he concluded.

On the last day of the conference, a group of Democratic Congresspeople and Congressional hopefuls signed on to a letter urging the DNC and “prospective presidential candidates” to “take a forward-looking approach to digital assets and blockchain technology”. The letter repeated Coinbase’s spurious claim that 52 million Americans own crypto, and regurgitated numbers from DCG’s dubious poll that sought to convince these very Congresspeople that crypto is a voter issue. Several of the signatory candidates have received substantial backing from crypto PACs, including Shomari Figures ($2.4 million) and Yassamin Ansari ($1.4 million).11

Coinbase

Coinbase’s Chief Legal Officer, Paul Grewal, on Friday attempted to refute my research into the company’s apparent campaign finance violation by arguing that his company is not a federal contractor (despite having a plainly visible federal contract listed on the official government website that lists such things). He has argued that, based on a definition in the Code of Federal Regulations that specifies that contractors are paid “in whole or in part from funds appropriated by the Congress”, Coinbase is not a federal contractor because this contract will be paid from the Department of Justice’s Asset Forfeiture Fund — that is, out of the pool of crypto and other assets seized by law enforcement.

If Grewal’s explanation were to be accepted, it would be another massive loophole in laws intended to prevent the appearance of, or actual, corrupt “pay-to-play” behavior by federal contractors looking to secure multi-million dollar government contracts such as this one.

However, as Public Citizen and I explained in a supplement we filed on Monday with the FEC, Congress’s enactment of 28 U.S. Code § 524 (called “Availability of appropriations”), which created the Assets Forfeiture Fund and authorized the Attorney General to make expenditures from that fund, was an appropriation, and funds spent from the Fund are appropriated by Congress. This is a widely- and long-held interpretation supported by the courts and by the Department of Justice itself.

Grewal took to Twitter once more after the news of our FEC filing broke, merely repeating his claims that Coinbase is not a federal contractor. He then attempted to insinuate that I have secret backers funding me, and took issue with our suggestion that there is a partisan slant to Coinbase’s campaign contributions.

The first problem here is that I am about as transparent as I can get about exactly who funds me (individuals like you, dear reader, and if you are one of them I thank you! Your dark sunglasses and fedora will be in the mail shortly, and I recommend you get to work growing a mustache you can twirl.)

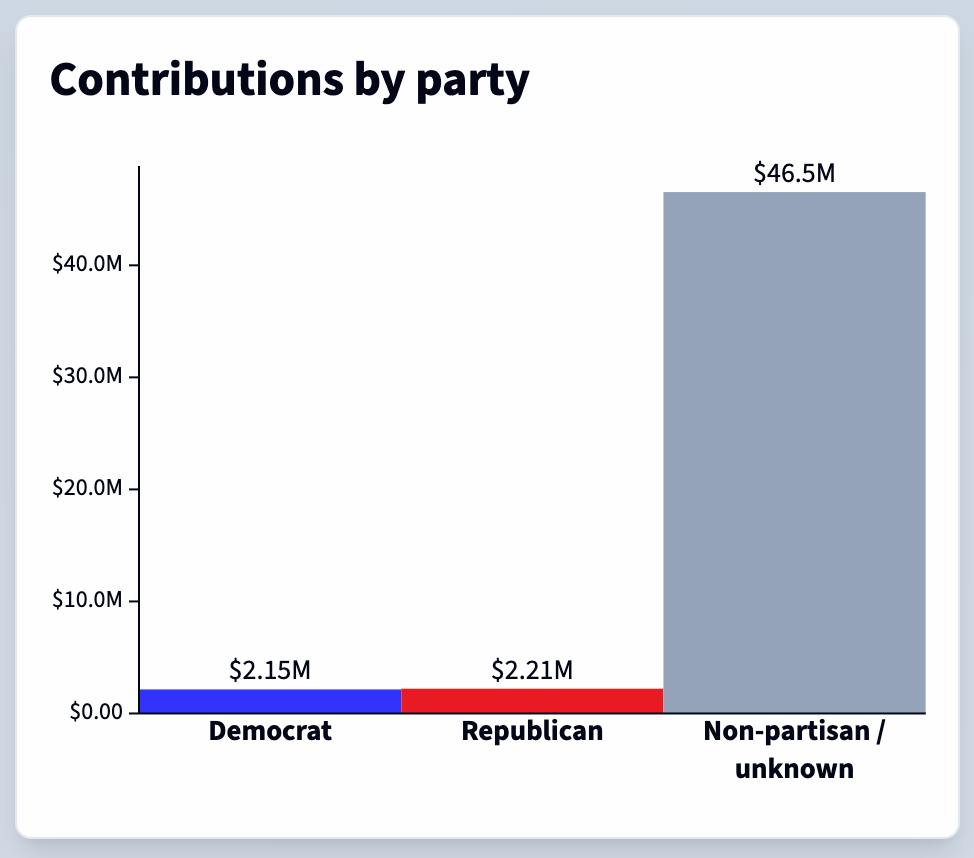

The second problem is that we didn’t make any allegations or even implications that Coinbase is donating along party lines — mostly because they aren’t. My only actual reporting on the partisan breakdown of Coinbase’s spending is to say precisely what he has, which is that Coinbase is funding Republican and Democratic committees and candidates roughly equally:

He was apparently irritated that we only singled out Coinbase’s contributions to Fairshake and to the House Republicans in our complaint, and not the company’s other contributions to the House Democrats, and Senate Republicans and Democrats. This was, of course, Coinbase’s own fault: the contribution to the House Republicans was the only one of the four contributions that fell within the prohibited time period.

It’s rather telling, I think, that rather than offering any coherent legal explanation for the contributions, he has instead opted to try to seed conspiracy theories about my funding and stir up partisan anger among Coinbase’s supporters.

We should have some news on the status of the Coinbase complaint soon, as there is a relatively short period of time (around twenty days) in which the FEC will verify that it is a valid complaint, notify Coinbase, and invite them to reply. After that, the Commission will vote on whether there is “reason to believe” a violation of campaign finance laws has occurred. If so, they will open an investigation or begin conciliation discussions with Coinbase, at which point the timelines grow much longer.

State primaries

Arizona held its primaries on July 30, and three of those elections involved crypto spending.

The most substantial spending happened in District 3, where Protect Progress contributed more than $1.35 million to support Democrat Yassamin Ansari (one of the signatories of the aforementioned letter to the DNC) in her primary. Her race turned out to be incredibly close, and is headed to a recount because she is leading her opponent Raquel Terán by only 42 of the more than 38,000 votes cast in the district. The one Protect Progress ad I’ve been able to find for her is a Spanish-language ad explaining that “Now, more than ever, we need strong Democrats like Yassamin Ansari” and talking up that she is a daughter of immigrants who will protect reproductive rights and combat inflation.12

This ad is jarring to watch given the crypto PAC support for far-right Republican and Peter Thiel-backed venture capitalist Blake Masters,e running only 30 miles north in the heavily Republican District 8. Masters vocally supports “fetal personhood” laws and other extreme anti-abortion laws, has pledged to slash funding to Planned Parenthood and others he deemed “abortionists”,13 and ran on an anti-immigration platform in which he promoted a conspiracy theory that Democrats were “importing” immigrants to shore up their margins.14 “The Dems are trying to replace you. They’re trying to steal your vote by diluting you with millions of third-world, illegal aliens,” he claimed at a debate in February.15 Although Masters’ $580,000 in crypto funding ostensibly comes via the Defend American Jobs PAC, not the Protect Progress PAC that has donated to Ansari and other Democrats, the two PACs are both mere fronts for Fairshake. They draw from the same pot of money and pool of donors, and are run by the same people. Masters ultimately lost his primary to Abe Hamadeh, 25.8% to 29.9%. Donald Trump made sure he would back a winner by endorsing both of them.

Finally, Democrat Andrei Cherny in District 1 lost his primary race to Amish Shah. Cherny had enjoyed $415,000 in crypto spending. It wasn’t a lot compared when to Ansari in District 3, but the District 1 race also received considerably less outside spending overall than the more heated District 3 race. Cherny’s crypto backing made up 60% of his outside backing, and was a part of total spending on his candidacy that roughly doubled that of Shah. Despite that, Shah won the crowded race with 23.6% of the votes to Cherny’s 21.3%, and will go up against incumbent Republican and crypto advocate David Schweikert in November.

Four other states held their primaries yesterday, and three of them — Michigan, Missouri, and Washington — have races with crypto PAC spending. In two of the four races, we can see the close alignment of the crypto super PACs with AIPAC and other pro-Israel PACs — something that has also been apparent in spending against Jamaal Bowman and, to a lesser extent, to support Yassamin Ansari. The crypto PACs had a lot more success in these races, with three (and likely all four) of the races with spending going their way.

In Michigan’s District 13, Protect Progress spent $1 million to back incumbent Democrat Shri Thanedar against primary challengers. His biggest opponent, Mary Waters, ran on a platform that prominently featured her support for a ceasefire in Gaza,16 whereas Thanedar’s support for Israel has drawn heavy opposition in the district.17 However, Waters faced a massive uphill climb in spending, with only $150,000 raised compared to Thanedar’s $7 million (much of which was self-funded), and $2.3 million in opposition spending against her by a PAC with murky origins, called “Blue Wave Action”.18 Thanedar won the race by a significant margin.19

Fairshake spent $1.4 million to oppose Cori Bush in Missouri’s District 1, contributing to a whopping total of $7.3 million in spending to oust her and another $5 million in support for her opponent that is otherwise coming mostly from pro-Israel groups like AIPAC and the United Democracy Project (UDP). Bush was among the first Congresspeople to call for a ceasefire in Gaza.20 She lost her race against Wesley Bell, by about 45.6% to his 51.2%.21 Bell’s stance on crypto topics is not clear, and the industry’s spending was mostly focused on ousting Bush rather than on installing Bell specifically.

In District 3, Defend American Jobs has contributed over $257,000 to Bob Onder’s Republican primary campaign. Earlier this year, Onder and his son wrote an op-ed for the Missouri Times titled “The Future of Cryptocurrency Policy: Jefferson or Xi”, which asked readers “whether we prefer the course taken by the Chinese Communist Party, or the direction dictated by consumers and freedom of choice. ... I would counsel the path of Thomas Jefferson and Adam Smith, not Elizabeth Warren and Chairman Xi.”22 Onder won his primary race against Kurt Schaefer by a solid margin, and will be replacing the also pro-crypto Blaine Luetkemeyer.23

Finally, in Washington, Protect Progress put $1.5 million behind Democrat Emily Randall in her non-partisan primary in District 6. The degree of spending seemed to come as a bit of a surprise in an otherwise relatively low-budget race, although the LGBTQ-focused Equality PAC also swooped in with around $700,000 in last-minute donations to Randall. Her Democratic opponent, Hilary Franz, aggressively incorporated the crypto spending topic into her campaign messaging, issuing a press release about a “MAGA-donor funded cryptocurrency super PAC”,24 condemning them as “out-of-state crypto billionaires attempt[ing] to buy this race at the very last minute.”25 However, Franz herself has a statement on her website about “work[ing] to maintain American technological dominance, including in the blockchain and digital asset industry, by creating a commonsense regulatory framework that protects consumers and jobs while allowing the industry to flourish.”26 Days before the donations were made, her own campaign manager marked her as “very pro-crypto” on the community-curated DoTheySupportIt.com website that feeds data into Coinbase’s Stand With Crypto politician ratings project,27 earning her the same “A” rating on the site as Randall. The Washington primary has not yet been called and only 62% of votes have been counted, but as of writing, Randall is leading the pack with 33.3% of the vote. Republican opponent Drew MacEwen, who hasn’t taken a clear stance on crypto, is behind her with 30.5%. Franz is in third place at 25.7%. The top two vote-getters in that race will advance to the general election.28

Elsewhere in crypto

Bitcoin and other cryptocurrencies had a bad time recently, echoing global stock markets and continuing to pound nails into the coffin of the a theory I once heard a lot more often than I do today: that crypto prices — particularly bitcoin — move independently of the stock market, inflation news, and other such things.

Remember the $235 million hack of the Indian WazirX crypto exchange from last issue? [I62] The one that amounted to almost half of the assets held on the platform? Well, they horrified their customers shortly after by announcing they planned to “socialize” the losses: that is, distribute tokens belonging to those who were not affected by the hack to those that were, essentially ensuring roughly 45% losses across the board.29 They later backtracked somewhat, stating that their plan was not final, and that they were looking for input on how to resolve the situation.30 However, short of recovering the stolen funds — a task that tends to get more challenging as time passes — they may not have many options available to them.

The Web3 is Going Just Great recap

There were ten entries between July 24 and August 6, averaging 0.7 entries per day. $15.51 million was added to the grift counter.

DraftKings pulls the plug

[link]

Participants in the “ReignMakers” game, run by the popular sports betting platform DraftKings, were blindsided by a sudden announcement that DraftKings would be shuttering the project, effective immediately. The company announced that the shutdown was “due to recent legal developments”. Players quickly assumed this referred to a lawsuit from a jilted Reignmakers player, who lost at least $14,000 on the more than $72,000 in NFTs he’d purchased for the game and then sued the company for selling unregistered securities. The lawsuit recently survived the motion to dismiss stage.

Participants in the DraftKings Discord were stunned by the sudden shutdown, and did not seem comforted by the company’s assurance that they would soon announce a buyback program. “What kind of compensation u think we get coming to us? Pennies?” wrote one. “Yeah I'm out like $20k,” someone else replied.

Bad news for BitClout

[link]

The founder of the blockchain social network BitClout has been arrested on wire fraud charges, and simultaneously sued by the SEC for unregistered securities offerings. The wire fraud charges relate to Nader “Diamondhands” Al-Naji’s misuse of investor funds, which he said he had no access to and then used for at least $3 million in personal expenses and gifts to family.

The SEC is once again emphasizing that you can’t just slap a “decentralized” label on your centralized project as a sort of magic word to fend off securities regulators. Al-Naji made it particularly easy for them by doing the type of thing that crypto fraudsters seem to love to do: putting their various misdeeds and plotting in writing. “My impression is that even being ‘fake’ decentralized generally confuses regulators and deters them from going after you,” he said to another member of the crypto industry.31

Everything else

- Trump-themed $DJT token rug-pulls, people blame Martin Shkreli or Barron Trump [link]

- $12 million taken by whitehats from Ronin bridge [link]

- CFTC subpoenas former company of Ben "BitBoy" Armstrong over crypto promotion [link]

- Kujira token tanks as team's leveraged bets melt down [link]

- ConvergenceFi hacked for $210,000 [link]

- ZKX decentralized exchange shuts down in what some VCs are describing as a rug pull [link]

- Compound DAO passes $24 million proposal in alleged governance attack [link]

- MonoSwap hacked for at least $1.3 million [link]

Worth a read

Paris Marx just published a great episode with Jacob Silverman, who did an unbelievably comprehensible job of breaking down the weird and tangled ways in which Silicon Valley types and tech billionaires are going all-in on politics, mostly behind Donald Trump.

In case you missed the bombshell, a judge ruled on Monday that Google holds a monopoly on online search and search advertising. This is a huge deal (although likely to be appealed), as one of the first successful anti-trust suits against a major tech firm in a really long time.

In the news

I had a really fun time talking with Zack Guzmán at Coinage about the massive political spending out of the cryptocurrency industry, my broader opinions on crypto and web3, and a few other things. It was a good time, and I enjoy having these types of conversations with folks on the “other side”, so to speak. There’s usually a moment — as there is in this interview — where the person I’m talking to realizes that our views maybe aren’t as radically different as they originally thought.

I also had a great time on the Western Kabuki podcast, recollecting that shared fever dream that was the Bored Apes NFT project. You don’t hear that much about them these days, even when you’re as steeped in the crypto world as I am, but they’re still around.

Follow the Crypto also got some more shout-outs in media outlets including CNN, Zeit Online (in German), DL News, The Lever (syndicated to Jacobin), Truthout, and the Arizona Daily Star.

That's all for now, folks. Until next time,

– Molly White

References

“Coinbase expects US to be crypto-friendly irrespective of election outcome”, Reuters. ↩

“Potvrđeno rješenje Višeg suda u Podgorici u predmetu izručenja Do Kwona”, Apelacioni sud Crne Gore (in Montenegrin). ↩

“Genesis completes restructuring and begins distribution of $4bn to creditors”, DL News. ↩

Letter by Senator Merkley and other legislators to the CFTC. ↩

“Event contracts”, Proposed Rules, Federal Register vol. 89, no. 112. ↩

“Russia approves law allowing use of crypto for global payments as it faces ongoing sanctions”, CNBC. ↩

“Binance Is 'Cooperating' With Indian Authorities on $86 Million Tax Bill”, Decrypt. ↩

“Kamala Harris campaign seeks ‘reset’ with crypto companies”, Financial Times. ↩

Letter to the DNC, posted on Twitter by Pierre Rochard. ↩

Ad for Yassamin Ansari, Protect Progress. ↩

“In Arizona, Blake Masters backtracks on abortion and scrubs his campaign website”, NBC News. ↩

“Pushing an Immigration Conspiracy Theory, While Courting Latinos”, The New York Times. ↩

“Blake Masters revives right-wing abortion, immigration arguments he scrubbed from website”, AZ Central. ↩

“Detroit Councilwoman Waters challenges Thanedar, pushes for ceasefire in Gaza”, Detroit Metro Times. ↩

“Rep. Shri Thanedar community center in Detroit vandalized with ‘ceasefire’ message”, The Detroit News. ↩

“Mary Waters on attack mailers: ‘I support same-sex marriage’”, Detroit Free Press. ↩

“Michigan 13th Congressional District Primary Election Results”, The New York Times. ↩

“Pro-Israel groups spend millions to try to oust ‘Squad’ member Cori Bush”, The Guardian. ↩

“The Future of Cryptocurrency Policy: Jefferson or Xi”, The Missouri Times. ↩

“Missouri 3rd District”, The Washington Post. ↩

“MAGA-Donor Funded Cryptocurrency Super PAC Spends $1.4 Million in Support of Emily Randall”, Hilary Franz. ↩

“On the Issues: Economy and Jobs”, Hilary Franz. ↩

“Hilary Franz”, DoTheySupportIt.com. ↩

“Washington 6th District”, The Washington Post. ↩

“Important Update: Managing Your Funds After the Cyberattack”, WazirX. ↩

“Clarification on Our Recent Community Poll”, WazirX. ↩

Footnotes

Though this is widely circumvented. ↩

And people say nominative determinism isn’t a thing! ↩

This seemed to me like a sort of hasty addition to his speech, after RFK Jr.’s much celebrated promise the previous day to establish a bitcoin reserve. ↩

Trump and other Republicans repeat this promise frequently (including in the official RNC platform) as though there is a looming threat of a CBDC. There have been no serious efforts to implement a CBDC in the United States. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.