Issue 64 – Pointing its arsenal at our friends

As parts of the crypto industry scramble to court the Harris administration with events like “Crypto4Harris”, others insist it is Harris who must “bend the knee”.

I write to you amid preparation for my upcoming trip to Portland, Oregon, where I will be speaking at the wonderful (and, sadly, final) XOXO festival. I'm really excited for this conference, which is absolutely jam-packed with some of the coolest people on the internet (as both speakers and attendees), many of whom I’ve admired for years. If any of you are lucky enough to also be attending, please try to find me and say hi. I've discovered one great and unexpected benefit of shaving half of my head: it makes me really easy to find at conferences.

While I'm on the topic of conferences, the excellent people at Flipboard have put together a proposal for a conversation between Mike McCue and I at SXSW 2025, where we will talk about digital ownership and online sovereignty for creators. If that sounds interesting to you, consider voting for our panel on SXSW’s panelpicker website! You’ll have to be quick, because voting is only open until this Sunday, August 18. Even if you don’t think you’ll be able to attend SXSW, many of their sessions are recorded and published later (such as my 2023 chat about “Popping the Web3 Bubble”).

Now, let’s go over what’s happened this week in the crypto world, where the industry is still hard at work courting politicians — and some politicians are hard at work courting the industry.

In the courts

Both the government and Roman Sterlingov, the founder of the Bitcoin Fog cryptocurrency tumbler, have submitted sentencing memoranda for his conviction on charges pertaining to money laundering and operating an unlicensed money transmitting business [I52, 53]. The probation department recommended in their pre-sentencing memo that Sterlingov be sentenced to 20 years in prison. Prosecutors have requested 30 years’ imprisonment and a $100,000 fine.1 Sterlingov’s memo argues for a “far lower sentence”, though does not specify precisely what he thinks that sentence should be. However, he argues that 20 or 30 years “vastly exceed” sentences in similar cases.2

The SEC has followed the New York Attorney General in filing their own lawsuit against promoters of the “NovaTech” cryptocurrency pyramid scheme and affinity fraud targeting Haitians, who they promised “financial freedom” and “freedom from the plantation” [I59]. In addition to the two founders named in the lawsuit from the NYAG, the SEC also names another six promoters of the scheme in their lawsuit [W3IGG].

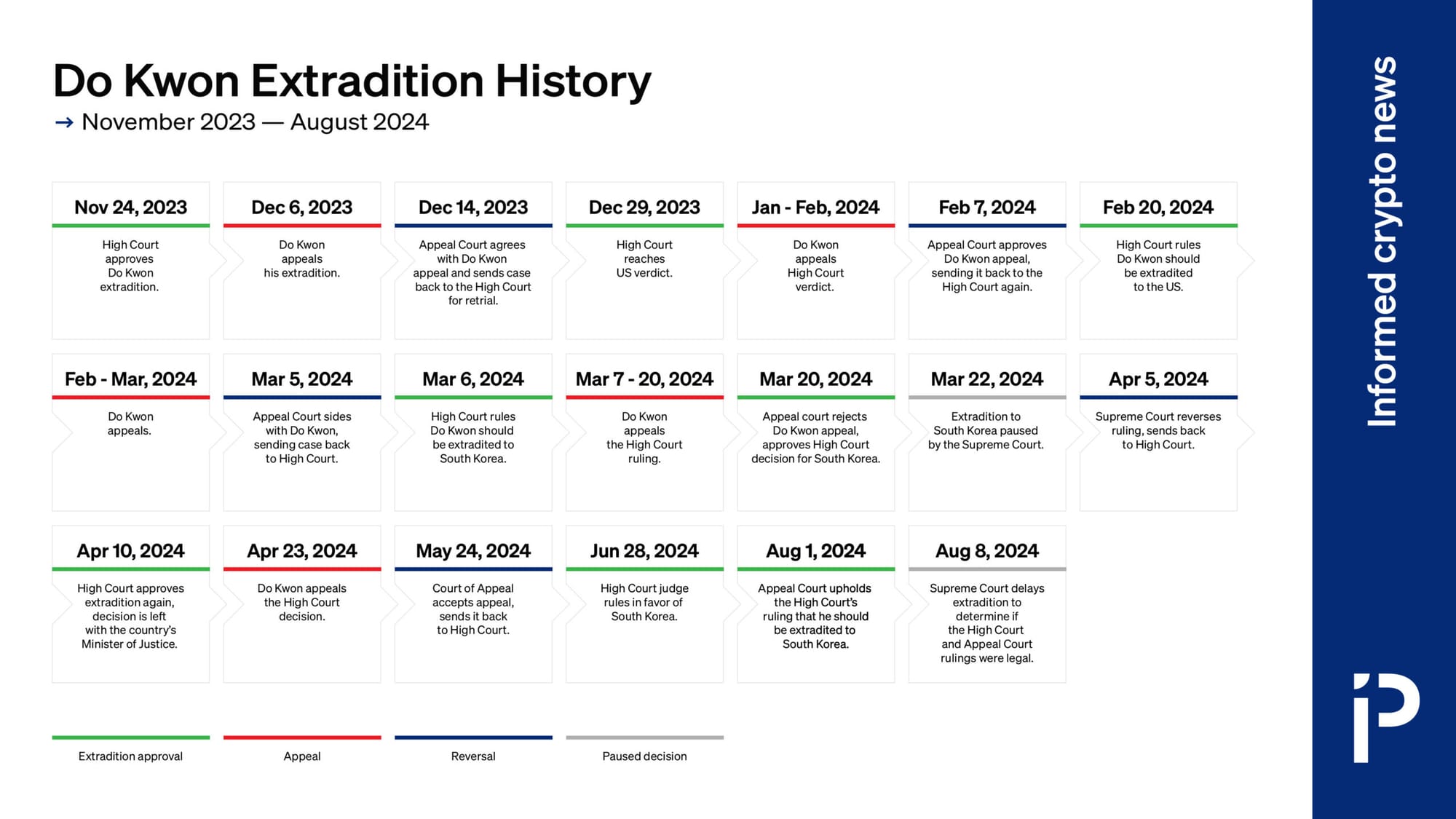

As I mentioned last issue [I63], the high court in Montenegro most recently decided Terra creator Do Kwon will be extradited to South Korea, in a ruling they emphasized was final. Now, of course, that extradition has been postponed as the “final” decision is reviewed. Protos made a chart that really helps to capture the nine months of chaos surrounding Montenegro’s decision.

Protos has also reported that the issue is “single-handedly ripping Montenegro apart”, with various high-ranking officials accusing one another of corruption.3 If he can blow up the entire crypto world, why not a small Balkan country? Dream big, Do. [I23, 28, 30, 31, 44, 45, 46, 51, 56, 60, 63]

A Nigerian court has reportedly ordered $38 million in cryptocurrency be frozen, claiming the funds were a part of roughly $50 million they’d traced in donations to the #EndBadGovernance protests in the country.4 Although cryptocurrency has long been held up as a method to support dissidents and activists, the increasing ability for governments to trace and freeze crypto assets (and the willingness of asset issuers and exchanges to comply with such orders) pose a threat to that narrative — not to mention a threat to those involved in sending and receiving such funds. However, there is some question about the veracity of the Nigerian government’s claims to have frozen such a large quantity of funds, as three of the four crypto addresses listed in the warrant application were non-existent or empty.5

The Holograph project, which suffered a $1.2 million theft in June [W3IGG], claimed on Twitter that multiple people have been arrested in Italy in connection to the theft, and that the suspects would soon be extradited to France. “Significant assets & electronics have been frozen & seized as part of the arrests,” they added.6

In somewhat tangentially crypto-related news, New Zealand-based Internet tycoon Kim Dotcoma will be extradited to the United States to face trial on charges from 2012 related to his operation of the Megaupload file hosting service, which was well known for hosting pirated materials. He has been fighting extradition since the charges were filed more than a decade ago, and has recently stated he will continue to fight extradition despite the court order. Although the Megaupload business had no direct crypto ties, Dotcom has made several attempts to get into the cryptocurrency world with projects including Bitcache and Fileshop. Neither of the two ever went anywhere, with Bitcache entering liquidation proceedings in 2023 due to unpaid legal fees without ever having launched.7

In bankruptcies

A judge has approved a $12.7 billion settlement to end the ongoing case from the CFTC against FTX and Alameda Research [W3IGG]. The CFTC had been a large creditor in the FTX bankruptcy case, leading some customers to worry that their recoveries might be diminished even further by payouts to the agency. However, terms of the settlement show that the CFTC will forego any payments so long as FTX follows through with its reorganization plans and payouts to creditors.8

Liquidators for the Three Arrows Capital hedge fund have filed a $1.3 billion claim against Terraform Labs, arguing that 3AC — like everyone else — had been misled about the stability of the Terra stablecoin. 3AC had invested heavily into Terra and its surrounding ecosystem, and the stablecoin’s sudden and dramatic collapse in May 2022 pushed 3AC into insolvency.9 Chances are slim that Three Arrows will collect anything close to the $1.3 billion they’ve claimed, even if the claim is determined to be valid. Terraform Labs’ CEO-in-bankruptcy has stated that the company has only around $150 million in assets.10

In governments and regulators

The cryptocurrency industry seems to be having a hard time deciding on a narrative: whether the SEC is tucking its tail and backing off, or tightening its perceived stranglehold on the industry.

A recent, smaller-than-anticipated fine against Ripple [I63], the abandonment of a lawsuit that they had bungled [I59], the decision not to pursue action against two crypto companies they were investigating [I62], and the approval of bitcoin and ethereum ETPs [I49, 59] have had many in the industry declaring victory over the SEC — particularly as Biden’s terrible debate performance in early July at least temporarily convinced many that a Trump presidency (and his promises to fire chairman Gary Gensler and install pro-crypto regulators) was all but assured.

However, we’re simultaneously seeing headlines out of industry publications claiming that the SEC’s “crackdown is gaining pace”. This specific headline accompanies an August 9 report that three unidentified cryptocurrency-focused venture capital firms have received subpoenas from the agency this year, apparently seeking information into “crypto asset offering intermediaries” and token-based investment deals.11 Other such headlines about an aggressive and very much still ongoing campaign by the agency against the industry have accompanied news about a Wells notice to Uniswap [I55] and an enforcement lawsuit against Consensys [I61]. And stories about a bloodthirsty SEC have certainly not been hard to find amid the industry’s embrace of Donald Trump, or in its more recent demands to a Harris administration and friendly Democrats.

While there’s no arguing that the SEC did ramp up its enforcement actions against crypto firms after the Great Crypto Meltdown of 2022, it’s not clear to me that their enthusiasm has substantially waxed or waned since then. In the crypto world, it is common for two contradictory narratives to exist at the same time — for example, “bitcoin is a store of value” existing alongside “bitcoin is an investment that will make you rich”, or “cryptocurrencies offer financial privacy” alongside arguments that those same cryptocurrencies are bad for crime because they can be easily traced. This allows a person to choose whichever talking point benefits them at the time, and I suspect that’s at least part of what we’re seeing here.

In elections and political influence

The cryptocurrency industry had just gone all in on Trump when the Democratic party did a last minute swap-out of its presidential candidate, breathing life back into what appeared to many on all sides to be a doomed campaign.

This is what you call buying in at the peak pic.twitter.com/zs1eYtTjdp

— Hadley (@Hadley) August 13, 2024

Now, some in the industry are backpedaling, seemingly feeling the need to put a Plan B in place should the success of their Plan A indeed turn out to be less than assured.

The thing is, some in the industry seem to have gotten a little too high on their own supply. I’ve noted before that, despite the industry’s attempts to convince incumbent politicians, candidates, campaign managers, and anyone else who will listen that there is a major bloc of single-issue voters who will vote for people with pro-crypto policy stances, the people in charge of actually running strategy don’t seem to truly believe it. Ads run by the Fairshake PAC and related crypto-focused super PACs make no mention of cryptocurrency, for example, suggesting that those behind them understand that it’s not an issue that’s likely to sway voters.

But it does seem that some of the more gullible executives and figureheads within the crypto world have themselves been bamboozled by the questionable numbers and creatively interpreted polls. The feeling among that group is not that they need to pursue a positive relationship with a possible future Harris administration, but rather that this supposed crypto vote will decide the election, and that they are its gatekeepers.

This has led to some rather amusing moments, like Tyler Winklevoss tweeting:

Can anyone explain why Kamala Harris didn't attend the crypto roundtable yesterday? I understand that she's on the campaign trail, but the meeting was virtual. All she needed was an Internet connection. Technical difficulties?

— Tyler Winklevoss (@tyler) August 9, 2024

This, naturally, sparked some immediate amusement from those outside of the cryptocurrency world and its reality distortion field:

Can anyone explain why Michael Jordan once again failed to show up and dunk at my birthday party even though I told my entire class he would https://t.co/YXogcZS8Qr

— Daniel Kibblesmith (@kibblesmith) August 9, 2024

The aforementioned roundtable was hosted by Representative Ro Khanna (D-CA), and brought Biden administration officials including Deputy Treasury Secretary Wally Adeyemo and at least one Harris adviser to meet with various crypto industry figures including executives from Coinbase, Ripple, Kraken, Uniswap, and others, as well as various industry figureheads like Mark Cuban and Anthony Scaramucci. It didn’t go so well. “Instead of finding common ground, industry executives lashed out at White House officials largely over the regulatory assault from agencies like the Securities and Exchange Commission and the Federal Reserve,” wrote Fox Business. One attendee told Fox: “Executives didn't hold back on telling the administration reps how much damage they've done to the crypto industry and to the Democrat Party with their actions against digital assets. ... They basically just got yelled at.”12

Crypto podcaster David Hoffman wrote that the industry must “make both parties bend the knee”.13 This sentiment, that crypto’s calling the shots and candidates need to fall in line or else, is bizarre but oddly prominent in recent days.

Polls

Speaking of questionable polls, there’s a new contender on the field. I had missed it, but the crypto venture capital firm Paradigm had released a poll of Republicans in June, which trumpeted that “Republicans who own crypto are more non-white and younger than typical Republicans, exactly the votes Trump needs in this election.” Now they’ve scrambled together a second poll, of Democrats, making the same kinds of arguments in the other direction: “Making inroads with crypto owners could help Vice President Harris win back some wayward Democrats and increase her likelihood of winning.” I have a deep dive into this poll coming out next week.

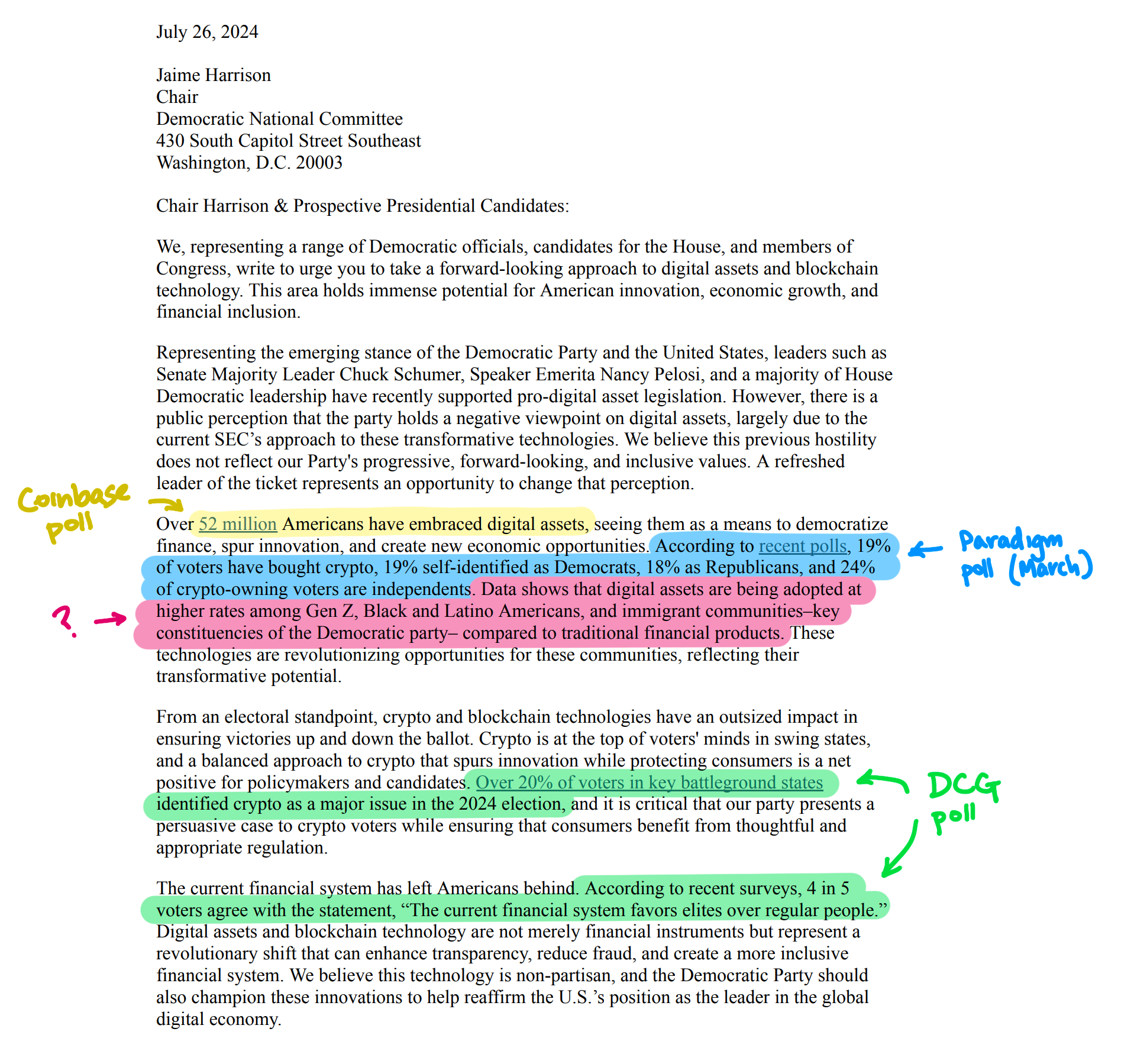

Some of you may wonder why I seem to be so obsessed with the polls that come out of this industry. It’s true that, in general, releasing a bad poll is perhaps the most foolproof way to nerdsnipe me specifically. However, people really love catchy statistics and seemingly hard data, and I’ve noticed that these polls spread like wildfire among people with influence, even if they’re really questionable. You need only look at the letter to the DNC I mentioned last issue, which was signed by 28 Democratic incumbents and candidates [I63], and which pulls from at least three different polls commissioned by the industry: the shoddy Coinbase poll, the shoddy DCG poll, and a poll commissioned by Paradigm back in March that I had missed. One other figure in the letter also seems to come from a poll, although it’s not clear to me which poll they’re citing.

In a “Crypto4Harris” event this week, Representative Wiley Nickel (D-NC) again repeated the DCG-sourced claim that four in five Americans believe the current financial system favors elites. (DCG did not ask in the survey whether people believed crypto favored elites.)

Crypto4Harris

That Crypto4Harris event was one of many events in this template, following ones like “Black Women for Harris”, “White Dudes for Harris”, “Disabled Voters for Harris”, and even “Dead Heads for Kamala”. This event was somewhat different from the others, though, in that it was less focused on fundraising for Harris’ campaign or convincing fence-sitters to vote for her, and instead featured a parade of Democratic politicians mostly speaking about how they were supporting the crypto industry. This may have been because Harris has not released much in the way of policy proposals involving digital assets, instead focusing her economic policy points on perhaps slightly more broadly relevant topics like housing affordability and tax cuts for the middle class.14

Attendees from the crypto side included investor Mark Cuban (who also featured in a “VCs for Harris” event earlier this month), investor and extremely brief Trump appointee Anthony Scaramucci, professor and author Tonya Evans, crypto lobbyist Shiela Warren, Paradigm policy head Justin Slaughter, Circle policy head Dante Disparte, and crypto company founders Carmelle Cadet, Chrissa McFarlane, and Adilah Holivay. From the politics side came Senators Chuck Schumer (NY), Kirsten Gillibrand (NY), and Debbie Stabenow (MI); Representatives Wiley Nickel (NC), Don Davis (NC), Yadira Caraveo (CO), Josh Harder (CA), Elissa Slotkin (MI)b, Dan Goldman (NY), Darren Soto (FL), and Steven Horsford (NV); Colorado Governor Jared Polis; Delaware State Senator Sarah McBride; Senate candidate Adam Schiff (CA); and House candidates George Whitesides (CA) and Shomari Figures (AL).

The event mostly consisted of attendees reading prepared statements. Senator Schumer made some waves by promising “get something passed out of the Senate and into law by the end of the year”. Many interpreted this as a nod to FIT21 [I58, 59, 61], which passed the House but has not made it through the Senate, although Schumer did not mention the bill by name. Other politicians mostly repeated talking points about allowing the industry to innovate, maintaining the United States’ technological dominance by embracing crypto, but also “providing guardrails”.

Crypto PACs

Fairshake has managed to piss off some Republicans, who had hoped the industry would be a partisan ally and are enraged to see the PAC spending in support of Democrats — now, in some cases, against Republicans. Throughout the primaries, much (though not all) of their support for Democrats was in primaries where they were challenging other Democrats, which didn’t seem to bother Republicans too much. But now that we’re exiting primary season, promises from the PAC to back Democrats like Ruben Gallego (AZ) and Elissa Slotkin (MI) in their general elections against Republicans have rubbed some the wrong way. Let them fight, I say.

The spending has not yet materialized, but Fairshake has promised to spend $3 million apiece on both Gallego’s and Slotkin’s upcoming races. “People are wondering why our main trade association is pointing its arsenal at our friends,” said one anonymous “crypto industry leader” cited by NBC.15

However, the PAC is continuing to spend on both sides of the aisle. They’ve pledged a whopping $12 million to support Republican Bernie Moreno in the Ohio Senate race, where he is opposing incumbent Democratic Senator Sherrod Brown. Brown chairs the Committee on Banking, Housing and Urban Affairs, and suggested “maybe banning” crypto shortly after the FTX collapse. This would be the largest contribution to any single candidate from the Fairshake PAC so far, outspending the $10 million in opposition directed against Katie Porter in her California Senate primary.

Last issue, results in Washington’s District 6 were still being counted, but it looked like the crypto industry favorite Emily Randall would be heading to the general election. That’s been confirmed, with Randall receiving the most support in the non-partisan primary with 34.6% of the vote. She and the second place winner, Republican Drew MacEwen, will be competing for the seat in the general election. Randall’s Democratic opponent Hilary Franz — who had vocally opposed the crypto industry spending — is out of the race. “I’m especially grateful to the over forty unions, firefighters and first responders and seventeen Tribes that stood with me in this race. Unfortunately, this incredible coalition was not enough to overcome the over $2.4 Million of Super PAC spending that flooded into this race at the last minute,” she said in her concession speech.16

While there were a handful of primary elections this past Tuesday, in Connecticut, Minnesota, Vermont, and Wisconsin, none of them saw substantial crypto spending. The only race with any crypto spending at all was in Minnesota’s House District 6, where Fairshake spent $118,000 all the way back in September 2023 to support incumbent Republican, and longtime friend to crypto, Tom Emmer. His primary was a blowout, and he won 87% of the vote against professional golf caddy Chris Corey.17

There are seven states remaining that have not yet held their primaries.18 The only one that has seen crypto PAC spending in the primary stage is Massachusetts, where Republican Senate candidate John Deaton has received $1.23 million in support from the Commonwealth Unity Fund, which was created solely to support him. Altogether that PAC has raised $2.05 million, though it seems to be saving some of it for what promises to be an extremely tough race against incumbent Democrat and major crypto enemy Elizabeth Warren. The Massachusetts primary is scheduled for September 3.

Trump crypto holdings

Recent financial disclosures by Donald Trump reveal that he owns between $1 million and $5 million in Ethereum-based cryptocurrency assets. This lines up with a wallet tagged by Arkham Intelligence as belonging to him, which holds over $2.2 million in ETH. The disclosure also reveals that Trump has earned more than $7.15 million through his licensing agreement with “NFT INT”, which issues his “Trump Card” NFTs. Interestingly, despite lavishing praise on bitcoin a few weeks ago at Bitcoin 2024, his disclosures don’t show any bitcoin holdings.19

Meanwhile, the junior Trumps have been heavily promoting some kind of “official” upcoming crypto project, but annoyed that various others keep launching tokens that purport to somehow be related to the Trump family. “I have truly fallen in love with Crypto / DeFi,” wrote Eric Trump on August 6.20 “Decentralized finance is the future—don’t get left behind,” wrote Donald Trump Jr. the following day.21 I’m sure this will go well.

please stop buying these fake scam tokens! buy our real scam token, which is coming soon pic.twitter.com/Z4YrR1rcjJ

— Molly White (@molly0xFFF) August 8, 2024

The Web3 is Going Just Great recap

There were four entries between August 7 and August 17, averaging 0.4 entries per day. $1.4 million was added to the grift counter.

North Korean developers bilk crypto project of $1.3 million

[link]

North Korean developers using fake identities have reportedly been trying to obtain jobs with various cryptocurrency projects, with blockchain sleuth zachxbt identifying at least 25 projects who had hired a group of developers he linked to the country.

His investigation started when a project reported that malicious code inserted by contract developers had resulted in a $1.3 million loss to the project. The funds were later laundered through Tornado Cash.

Google ad phishing fools customers looking for Coinbase support

[link]

Crypto scammers continue to successfully impersonate support representatives for various prominent cryptocurrency companies, stealing assets from customers who are looking for help. Most recently, Fortune ran a story on a man in his 60s, who they only call “Fred”, who lost $100,000 after Googling to find a contact number for Coinbase’s support team, only to encounter a promoted Google result that directed him to a group of scammers who were able to empty his account.

Worth a read

Andreessen Horowitz co-founder and managing partner Ben Horowitz has been fuming over this article about him and his wife, who pivoted from supporting Obama’s presidential candidacy and various progressive causes to publicly supporting and pledging money to Donald Trump. He says it’s a racist “hit piece” ordered by fellow billionaire venture capitalist and business rival Mike Moritz (who owns the Standard). “Always the bitch asses that throw rocks at the real ones,” Horowitz wrote on Twitter.

The Washington Post just published a brutal piece about bitcoin’s performance during the recent market jitters. In it, she picks apart the oft-repeated claim that bitcoin is a stable store of value or a safeguard against inflation. “It seems less like digital gold than a digital slot machine,” writes McArdle.

In the news

I'm quoted in a recent piece about the scourge of Elon Musk deepfakes that convince people to hand over their crypto assets or put money into scammy “investment opportunities”.

Joanna Wright wrote about the FEC complaint Public Citizen and I filed against Coinbase, as well as Coinbase's response to it.

That's all for now, folks. Until next time,

– Molly White

Footnotes

References

Government’s memorandum in aid of sentencing filed on August 1, 2024. Document #314 in US v. Sterlingov. ↩

Sentencing memorandum on behalf of Roman Sterlingov filed on August 15, 2024. Document #321 in US v. Sterlingov. ↩

“Do Kwon is single-handedly ripping Montenegro apart”, Protos. ↩

“Nigeria Court Freezes $38M of Crypto Allegedly Sent to Support Protests in the Country: Reports”, CoinDesk. ↩

“EXCLUSIVE: Nigerian govt. freezes $37m worth of cryptocurrency traced to suspected protest organisers”, Premium Times. ↩

“Bitcache founder Kim Dotcom ordered to be extradited to the US”, Protos. ↩

“Judge approves $12.7 billion settlement between FTX and CFTC, bringing 20-month-long lawsuit to an end”, The Block. ↩

“Three Arrows Liquidators Seek $1.3 Billion Over 2022 Luna Crash”, Bloomberg. ↩

“Terraform Labs, Do Kwon Agree to Pay SEC a Combined $4.5B in Civil Fraud Case”, CoinDesk. ↩

“SEC subpoenas three crypto VCs in sign crackdown is gaining pace”, DL News. ↩

“Crypto executives clash with Democratic leaders in heated Zoom meeting”, Fox Business. ↩

“Vice President Harris Lays Out Agenda to Lower Costs for American Families”, Harris campaign press release. ↩

“Republicans claim betrayal as cryptocurrency PAC backs Democrats”, NBC News. ↩

“Hilary Franz concedes to Emily Randall in WA-06 race”, The Cascadia Advocate. ↩

“Minnesota 6th District”, The Washington Post. ↩

“2024 Presidential and Congressional Primary Dates in Chronological Order”, FEC. ↩

OGE Form 278e for Donald J. Trump. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.