Issue 65 – World Liberty Fiasco

Even the most pro-Trump crypto faithful think Trump’s new crypto scheme is a terrible idea.

Leading presidential candidate Donald Trump is partnering with the former head of the pick-up artist advice website “Date Hotter Girls” to launch a “high-yield crypto investments” plat——

You bolt awake in the mountains of Carthage. You are not online. It is 217 BC. You are the general Hannibal, and you have changed your mind. The future cannot come to pass. Rome must burn.

Believe it or not that’s only the tip of the iceberg for this week’s issue, which also features an FTX crypto executive earning some benefit of the doubt, a lawsuit accusing “Pharma Bro” Martin Shkreli of disrespecting the Wu-Tang Clan, and a hamburglary. Strap in.

In the courts

FTX

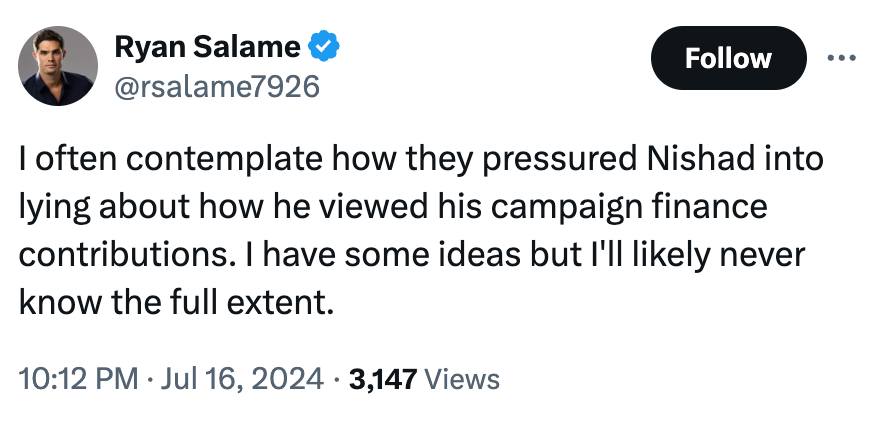

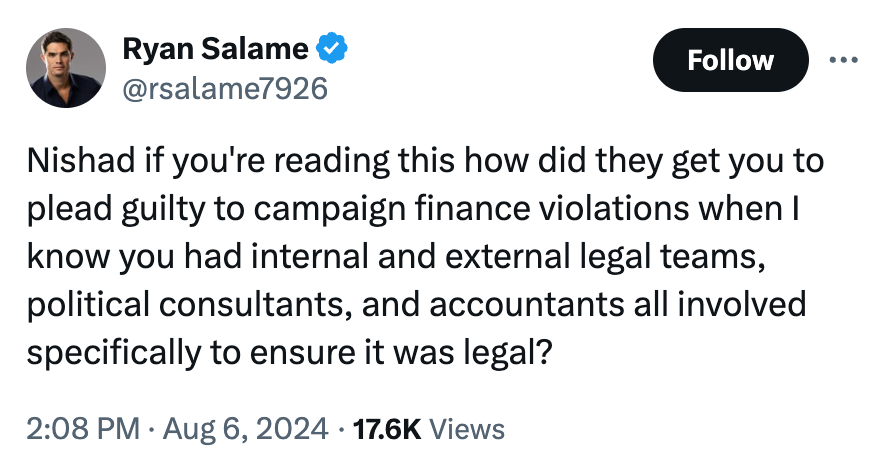

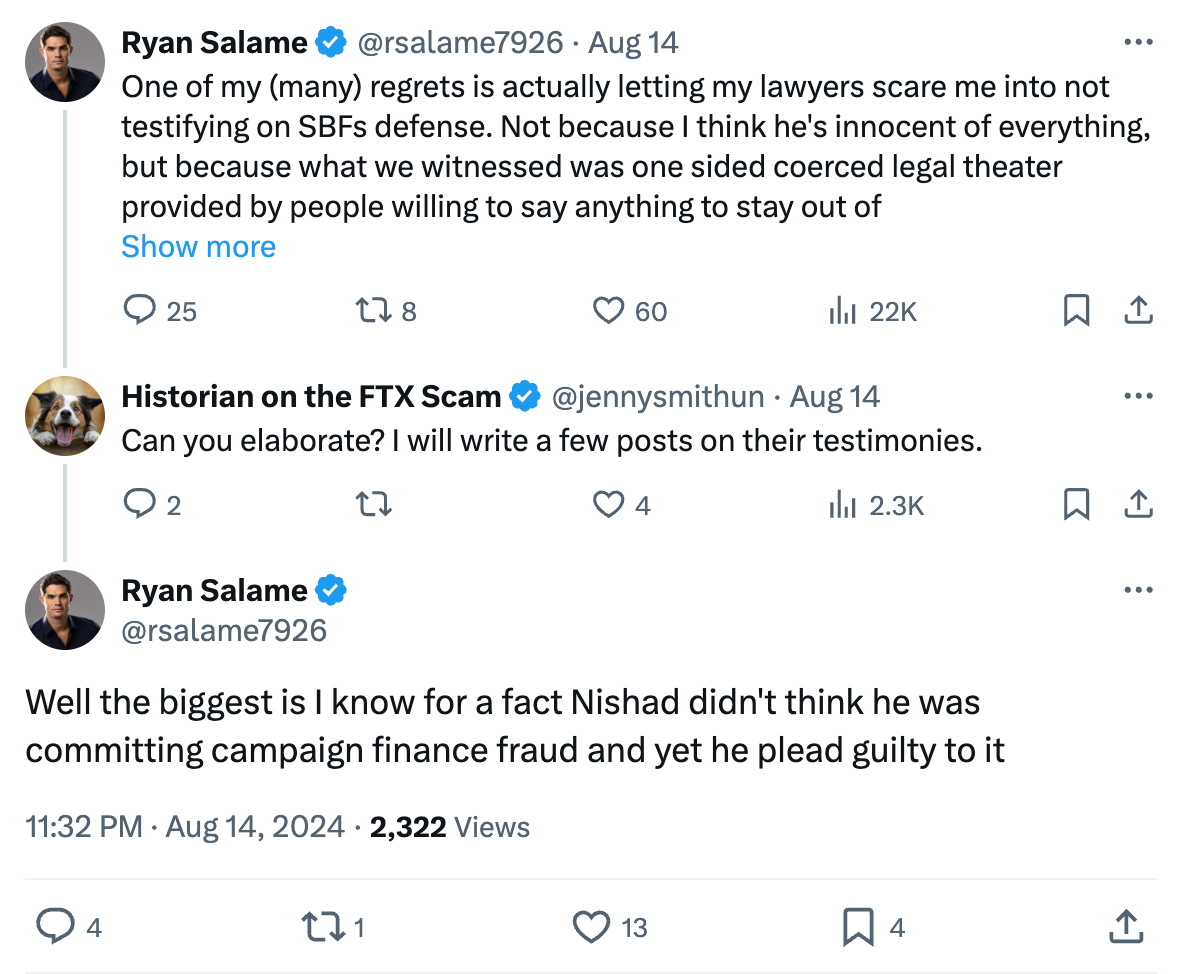

After he was sentenced in May to 7.5 years in prison for his role in the various illicit activities at FTX, former executive Ryan Salame returned to Twitter with a vengeance, where he’s claimed that prosecutors lied throughout the FTX trial and illegally coerced witnesses and defendants. He’s argued repeatedly that the charges to which he pleaded guilty are bogus, and that he was only acting at his lawyers’ and bankers’ advice when he engaged in the activities later charged by the government to be campaign finance violations and operation of an unlicensed money transmitting business.

Then, on August 21, Salame filed a petition in which he and his lawyers claim that prosecutors had made verbal promises to him and his previous legal team that they would end an ongoing investigation into Salame’s partner, Michelle Bond, in exchange for his guilty plea.1 Bond was being investigated for separate, but related, campaign finance violations pertaining to her unsuccessful campaign for a seat in the House of Representatives in New York’s District 1 in 2022. She and Salame, at the time, were being represented by the same legal team. According to his filing, prosecutors said that they could not put the promise in writing, but that Salame had opted to take the plea because of this unwritten promise. The investigation against Bond continued anyway, and so Salame filed this petition, which asks either that the court enforce the verbal promise and require prosecutors to end the investigation, or that they vacate his conviction.

The day after Salame filed his petition, the Department of Justice unsealed an indictment against Bond, charging her with conspiring to cause and causing unlawful campaign contributions.2 She and Salame had allegedly, and among other things, arranged a sham “consulting” deal in which FTX paid $400,000 to her for her campaign in exchange for no actual work.

The government responded to Salame’s filing, describing it as a “shameless and self-serving attempt to renege on his guilty plea in the aftermath of his sentencing”.3 They claimed that the only promises they made to Salame and/or his then legal team involved the conclusion of the investigation as it pertained to him, not the investigation into his partner, and that they had explicitly restated this to his attorneys in a follow-up meeting. They also pointed to Salame’s plea agreement and plea allocution, where Salame had affirmed that he was not making his plea based on anything outside of the written plea agreement, and answered “no” when asked, “Has anyone made any promises other than whatever is set forth in the plea agreement that induced you to plead guilty?”

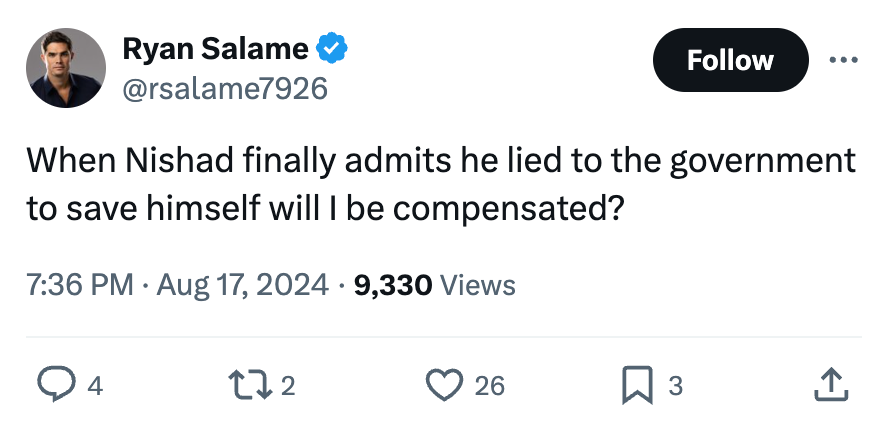

Further, they claimed that Salame and his previous attorneys were aware of the ongoing investigation into Bond at least as early as April 15, but that Salame was only now bringing it up with the court because he is unhappy with the sentence that was ultimately imposed against him (which is five times as long as the maximum of 18 months he’d argued for in his sentencing memorandum).4 Prosecutors continued: “Such behavior is of a piece with Salame’s other post-sentencing conduct, which has demonstrated a complete lack of remorse and utter contempt for the justice system.” They then cited a handful of his tweets:

On August 29, Salame’s new lawyer submitted a letter stating, “we write to inform the Court and the Government that Mr. Salame hereby withdraws without prejudice his Petition”, and explaining that he was doing so so that Bond could argue the issue in her own case.5a Now, I’m not an expert here, but I’m pretty sure the decision on whether an issue is withdrawn, and whether it’s withdrawn with or without prejudice, is ultimately up to the judge, and that lawyers typically request that this happens rather than trying to inform the judge it already has. This seemed to me like a good way to rub the judge the wrong way, and Judge Kaplan’s order issued later that very same day seemed to confirm they’d succeeded. “Notwithstanding defendant’s purported withdrawal without prejudice of his petition,” wrote Judge Kaplan, the parties would need to file the papers as originally ordered, and Salame would need to appear for the originally scheduled argument under threat of remand.6

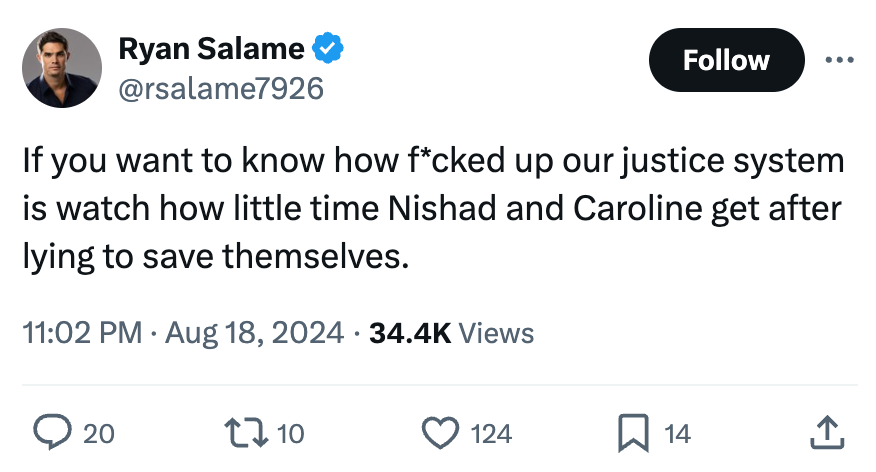

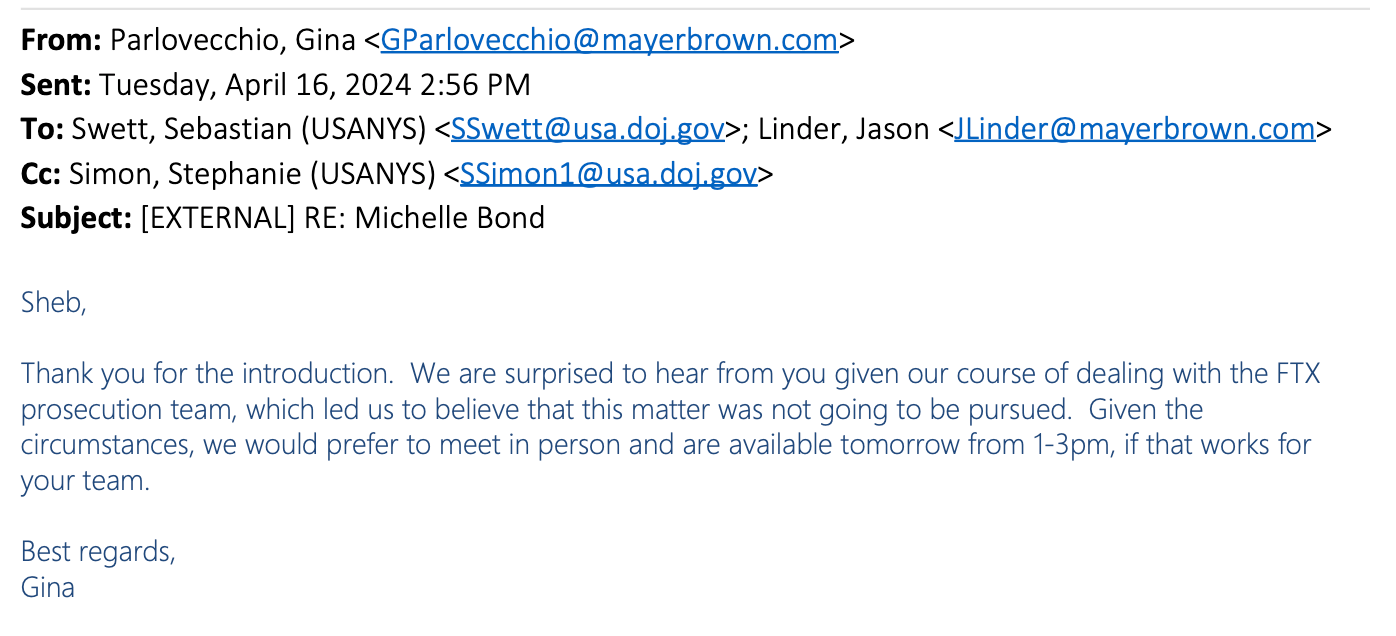

The government then filed their full response, reiterating their earlier descriptions of conversations between the prosecution team and Salame’s then legal team, and also raising some procedural objections to the petition. This time they attached copies of contemporaneous notes that — assuming they are accurate summaries of the conversationsb — seem to support their assertions that they were extremely clear to Salame’s former attorneys that Salame’s plea would not impact the status of Bond’s investigation. However, other notes put some doubt in my mind as to whether Salame’s lawyers actually heard what they were saying, and whether those lawyers properly communicated this to him. One email chain shows his legal team expressing surprise this spring over ongoing investigations into Bond, as though they didn’t recall the earlier conversation.

And to be clear, these were not budget bin, amateur hour lawyers. At the time, he was being represented by two ex-DOJ lawyers working for the white-shoe law firm Mayer Brown: Jason Linder and Gina Parlovecchio.

It seems to me that there are three possibilities here:

- Salame is falsely claiming that prosecutors improperly induced him to plead guilty, and that promises about Bond never happened

- Salame’s former team of bigshot lawyers royally screwed up by leading Salame to believe that Bond’s investigation would be terminated if he pleaded guilty even though the government had expressly told them it would not

- Some of the most powerful prosecutors in the country did, in fact, make these verbal promises to Salame, but simultaneously laid a paper trail reflecting the exact opposite, and are now lying about it under penalty of perjury

The prosecutors’ argument currently lies somewhere between options 1 and 2. They maintain that such a promise was never made, and argue that the petition should be denied outright, suggesting option 1. However, their inclusion of the emails from Parlovecchio, and their request that if Kaplan does hold a hearing, that he also examine Salame’s attorney–client communications, tips things into option 2 territory somewhat.

It’s not clear to me yet which of options 2 or 3 Salame is going to argue. Given the emails from Parlovecchio, it definitely seems like it might be appropriate to dig into those attorney—client communications to get the other side of the story. That the prosecutors suggested doing so perhaps makes option 3 less likely, given that you would think the very same prosecutors involved in such a corrupt and premeditated coverup might not exactly be keen on bringing to light the other side of the story, particularly from such qualified lawyers, but perhaps they’re playing 3D chess. Who really knows what’s happening, at this stage, but that email from his former lawyer definitely makes me more inclined to give him some benefit of the doubt.

Elsewhere in FTX news, Michael Lewis has been on a press tour again as Going Infinite is released as a paperback. In an op-ed for the Washington Post, he continues to argue that Bankman-Fried was “maybe the fastest creator of wealth in recorded history” and that Bankman-Fried doesn’t have “the character of a thief”, and repeat misleading claims that FTX creditors will receive all of their assets back and then some. Lewis even asks questions like, “If he knew he’d orchestrated a giant fraud, why had he devoted so much time and energy to persuading U.S. financial regulators to regulate him?” — a truly bizarre question coming from someone with a long history of writing about financial crime. If you haven’t already, you can read my review of his book:

Everything else

The arrest of Telegram CEO Pavel Durov in France has stirred up the cryptocurrency world. Many crypto projects heavily rely on Telegram for messaging, and Telegram also has an associated blockchain and integrates crypto projects (such as Hamster Kombat [I61]) into its app. Much of the crypto world, and those outside of it, have vociferously denounced the arrest as an attack on private messaging. Putting aside the fact that it’s incredibly erroneous to describe Telegram as a private messaging app in the same vein as Signal or other properly end-to-end encrypted messengers, it’s also not at all clear at this stage why exactly Durov was arrested, and France has remained pretty tight-lipped about the details. I share some of the very serious concerns over the arrest, but with so little information available about what Durov was specifically alleged to have done, I think it’s too early to say conclusively (as so many are doing) that the arrest was just or unjust.

Binance executive Tigran Gambaryan is still in custody in Nigeria [I54, 56, 60], and according to his lawyers and his family, his health is continuing to decline. Gambaryan was diagnosed with malaria and pneumonia after collapsing during a court hearing in June [I60], and a recent video shows him pleading for help from a Nigerian prison guard after reportedly being denied a wheelchair needed for complications from a herniated disc. Binance’s new CEO, Richard Teng, issued a statement on August 27 urging the US government to “exert political pressure to secure Tigran’s release on humanitarian grounds”.7 Meanwhile, a hearing on an application for bail for medical conditions has just been postponed to October 9.8

Shan Hanes, the former CEO of the Kansas Heartland Tri-State Bank, has been sentenced to more than 24 years in prison after sinking $47.1 million of the bank’s funds into a pig butchering scam and ultimately causing the bank to collapse [W3IGG]. While the FDIC stepped in to protect customers’ deposits, equity investors in the bank lost $9 million altogether. And these weren’t necessarily bigwig investors; one community member interviewed by NBC News explained that “There were people who lost 70, 80% of their retirement”, and that he knew of a community member who could no longer retire and one who was having trouble affording her 93-year-old mother’s nursing home as a result of the losses. Hanes also took money from a local church, a local investment club, and his daughter's college savings to buy cryptocurrency after those running the scheme told him they needed more money to “unlock” the returns on his investments — a common tactic with these scams.

A judge has granted a preliminary injunction ordering “Pharma Bro” Martin Shkreli to forfeit any digital copies he made of the Wu-Tang Clan’s one-of-a-kind Once Upon a Time in Shaolin.9 In 2018, Shkreli was forced to forfeit the album, along with other assets, to fulfill the forfeiture order resulting from his securities fraud conviction. The art collecting PleasrDAO later purchased it from the federal government at auction for $4.75 million. PleasrDAO sued Shkreli in June of this year, after they found him livestreaming the album on Twitter Spaces and promising to share copies.10 They’ve alleged that although the album was supposed to be one-of-a-kind, Shkreli made digital copies that he has since released, or plans to release, in contravention of the legal agreements attached to the album. This lawsuit is amusing to me when considered in the context of the claims we used to hear a lot out of the crypto world around how blockchains could solve problems around digital uniqueness. If only the Wu-Tang Clan had released it as an NFT... the case would still be right where it is now, in the courts. My favorite part of the lawsuit thus far is that PleasrDAO has now formally argued in front of the court that Shkreli disrespected the Wu-Tang Clan:

Elon Musk and Tesla have won their motion to dismiss with prejudice a class action lawsuit by plaintiffs who allege he is responsible for their losses after they purchased dogecoin after he promoted it on social media and elsewhere [I29]. While it is somewhat satisfying to see Musk dragged to court in the way he is so fond of doing to others, the dismissal was probably the right call, as his statements like this one were pretty clearly not serious claims that reasonable investorsc might rely upon:

Other portions of the case, such as claims that Musk pumped-and-dumped or insider traded the token were also thrown out, not least because plaintiffs couldn’t convincingly establish he actually owns any.

Hyung-soo “Hugo” Lee, the CEO of the South Korean Haru Invest yield platform, was stabbed in the neck while in court for the alleged $826 million fraud.11 Lee survived the attack, and the attacker was arrested.12 This is not the first time a person alleged to have stolen or otherwise lost customer funds has been met with violence in the crypto world: in July 2023, a Canadian alleged crypto fraudster was kidnapped and beaten by angry investors, including an inspector in his bankruptcy proceedings [W3IGG].

A suspect in a different South Korean alleged fraud, this one a $12.1 million crypto mining scheme, was arrested along with 13 others. The reported leader had undergone significant facial restructuring surgery to change his appearance.13

Miami Heat star Jimmy Butler will pay $300,000 to settle allegations in a class-action lawsuit that he illegally promoted the sale of unregistered securities offered through Binance. Ben “BitBoy” Armstrong [I2, 40] will also settle for $40,000, which is the amount he was paid for his promotion. Both maintain that they could win their respective cases, but opted to settle instead.14

Authorities seized the dollar value of bitcoin stolen in March 2020 by home invaders who threatened their victims with a machete, and also stole a car and other valuables. The 23.5 bitcoin were worth around $144,000 at the time of the theft in March 2020, and that amount was seized in cash from a man who received the stolen goods. However, those bitcoins would be worth around $1.3 million at today’s prices. Various news outlets have also reported on how the attackers beat one of the victims with a personalized Toblerone chocolate bar,d which they then used to threaten her with a throat-slitting gesture.15 If I’m ever robbed at machete-point, please do not under any circumstances also report the part where I was clubbed with my novelty chocolate bar.

In bankruptcies

Celsius has reported that they have repaid more than $2.5 billion to creditors, amounting to around 93% of the monetary amount of eligible claims. Around 121,000 creditors have yet to claim their payouts, although around 64,000 of them are owed less than $100, and another 41,000 are owed less than $1,000.16

Indian cryptocurrency exchange WazirX is currently seeking bankruptcy protection after its $230 million hack in July [I62]. They have said it is “extremely unlikely that we can make people whole”, estimating 55–57% recoveries in best case scenarios.17 Fellow Indian cryptocurrency exchange CoinSwitch has threatened to sue them over $9.6 million in assets trapped on the platform. WazirX is also facing the threat of an asset freeze order in a separate lawsuit alleging mismanagement or fraud by the company.13

In governments and regulators

The CEO of the major NFT trading platform OpenSea has claimed that the SEC sent them a Wells notice threatening imminent enforcement action [W3IGG]. OpenSea has helped to rile up the crypto world by insinuating that the SEC is aiming to classify all NFTs as securities, but as with the Telegram case I mentioned earlier, people seem to be jumping to very strong conclusions without a clear indication of what SEC is actually planning to do.18 I would be pretty surprised to see a case against OpenSea claiming every single NFT they offer is an unregistered security, and suspect we will eventually see a much more bog-standard lawsuit against the platform along the lines of their lawsuits against Coinbase and Binance, which instead allege that several specific assets are unregistered securities. Most people even in the crypto world will readily acknowledge that there are undeniably NFTs that are blatantly offered as securities — projects that explicitly promise holders a cut of future proceeds from the NFT creators’ efforts, for example — but despite that, people are still hopping on the outrage bandwagon about this one. Again, as with Telegram, it is certainly possible that the SEC is taking a huge swing here and is actually planning to argue that all NFTs are unregistered securities, but at this stage we just don’t know.

The SEC charged the defunct crypto-focused trading firm Galois Capital with failing to comply with custody requirements, and Galois has settled for $225,000, which will go to its clients [W3IGG]. The firm shut down in February 2023 after disclosing that they had lost half of their funds — about $40 million — on FTX [W3IGG]. Shortly after, they sold their claim on FTX for 16 cents on the dollar, which is significantly less than what they might’ve received had they waited another two years.

The SEC has also charged the Abra crypto lender with securities violations, and they too have already settled. The civil penalties have not yet been announced. In January 2024, Abra settled claims from the Texas State Securities Board by agreeing to refund customers. As a part of the complaint, the TSSB had alleged that Abra was “insolvent or nearly insolvent”, and had been making misleading statements [W3IGG, I30, 50]. In June 2024, Abra settled with 25 state regulatory agencies, agreeing to refund up to $82.1 million to its US customers. Abra had begun winding down operations in the United States in mid-2023, after facing multiple state regulatory actions.

Mango Markets, the Solana-based decentralized exchange perhaps best known for being the target of a $116 million theft by Avraham Eisenberg [I15, 43, 55, 56], is now looking to settle securities law violations by paying around $225,000, destroying its holdings of the MNGO token, and working to make those tokens unavailable for trading elsewhere. Because Mango Markets is run by a DAO, they had to vote on it. The proposal passed nearly unopposed, though it would’ve been interesting to see what happened if it hadn’t.19

The SEC’s case against Kraken has survived a motion to dismiss. As crypto firms so like to do, Kraken’s Chief Legal Officer tried to paint this as a victory for Kraken, seizing upon a portion of the judge’s ruling to claim that he had “ruled, as a matter of law, that none of the tokens trading on Kraken are securities.”20 This, of course, completely misrepresents the opinion, where the judge notes that the SEC isn’t even arguing that the token are themselves securities, but rather that the tokens were offered as investment contracts. In actual fact, the opinion concludes that “the SEC has plausibly alleged that at least some of the cryptocurrency transactions that Kraken facilitates on its network constitute investment contracts, and therefore securities, and are accordingly subject to securities laws”.21 Kraken was also just found to have violated securities laws in Australia, which it blames on unclear regulations.22

Also in Australia, the Australian Federal Police say that Australians have lost around $122 million to cryptocurrency scams over the last twelve months. That’s almost half of the total losses to investment scams in the country. They also noted that around 60% of victims were under the age of 50, despite the common perception that financial scams mainly affect seniors.23

In the US, the FBI have issued warnings about “aggressive targeting” by North Korea of various companies in the cryptocurrency sector. The scammers often aim to socially engineer employees of cryptocurrency companies into running malicious code on company computers. They try to convince targets to install non-standard “video conferencing” software, or to run code as part of a supposed job interview. The FBI has advised employees of cryptocurrency companies to, among other things, not use company computers to interview for jobs elsewhere, which is probably just good advice regardless of where you work.24

In elections and political influence

What better time to launch a transparently grifty “high-yield” cryptocurrency business than two months before your presidential election? Donald Trump, and especially his sons, have been teasing an upcoming cryptocurrency project that seems to be rapidly shapeshifting. First, they were all teasing something called “The DeFiant Ones” (a play on decentralized finance, or defi), with hashtags #BeDeFiant and tweets warning people to not “get left behind”. Then Eric Trump said something about the project involving “digital real estate”, though its unclear if he was speaking metaphorically or was actually referring to the metaverse “land” fad that more or less came and went. He did immediately follow up this statement by saying “It’s equitable. It’s collateral anyone can get access to and do so instantly,” leaving me to wonder if anyone in the Trump family has ever set foot near an average person trying to buy a house these days. Now the flim-flam family is all talking about “World Liberty Financial”, with a website promising access to “high-yield crypto investments”, a statement that should immediately set off alarm bells in anyone’s head.

The project hasn’t even launched yet, and it’s off to a bumpy start. First, Donald Trump Jr. had to issue a statement to try to stop people from buying up all the fake tokens purporting to be associated with their murky project [I64]. Then, Twitter accounts for Lara and Tiffany Trump were both compromised and used to send tweets announcing a supposed token launch. “This is a scam!!!” tweeted Eric, himself retweeting the tweet from his wife’s account containing the scam token address. Now, CoinDesk has gotten hold of a white paper for this supposed World Liberty Financial, which they note appears to be a clone of Dough Finance, a crypto lending platform that was hacked for around $2 million just a month and a half ago [W3IGG]. The hack was not a sophisticated one, and instead exploited sloppiness on behalf of the development team. The four people who built Dough are all listed as members of the World Liberty Financial team, as are Trump’s sons (including 18-year-old Barron, who they list as a “DeFi visionary”). Zachary Folkman, a Dough Finance creator who is now listed as the head of operations for World Liberty Finance, previously ran a pick-up artist advice platform called “Date Hotter Girls”.25 You should really just read the piece by CoinDesk, they did some great reporting here.

The project is making even the Trumpiest people in crypto nervous. Nic Carter, a crypto venture capitalist and outspoken Trump supporter, tweeted:

Commenting on the hack of the two Trump family Twitter accounts, he added: “can't secure twitter accounts but i'm sure they'll be able to protect an (already hacked) defi protocol from hacks”.26

All I can say is that if he launches this before the election and it gets hacked, it’s a strong contender for biggest clusterfuck in the history of Web3 is Going Just Great.

Elsewhere in Trumpworld, Trump has been diversifying his crypto grifts by also launching a fourth (fourth!!) run of his $99 “Trump Card” NFTs, which have a whole complex scheme where if you buy 5, 9, 15, 50, 75, or 250 NFTs you get various combinations of Trump’s hideous gold sneakers, scraps of the suit he wore during his debate with Joe Biden, and opportunities to have dinner or cocktails with Trump (an event which, according to the fine print, could be canceled and replaced with NFTs for any reason). It’s already been nine days and he’s only sold 28,161 out of the 360,000 cards available, which are distributed among only 1,454 holders.27

On the other side of the aisle, Coinbase’s Chief Financial Officer seemed to spill the beans when Fortune reported that she claimed at a finance conference that Harris “is accepting crypto donations. She’s using Coinbase Commerce now to accept crypto for her own campaign.”28 Later reports clarified that it is actually the Future Forward PAC, a Harris-supporting super PAC that is independent from her campaign, that plans to accept crypto donations, and Fortune updated its headline from “Coinbase CFO says Kamala Harris is using firm to accept crypto donations” to “Coinbase CFO reveals Kamala Harris Super PAC will accept crypto donations”.29

Crypto PACs

The crypto super PACs have broken their previous record for largest expenditure on a single candidate, making their promised $12 million contribution to support Republican Bernie Moreno in his general election in Ohio against incumbent Democratic Senator Sherrod Brown [I64]. Brown chairs the Senate Committee on Banking, Housing and Urban Affairs, and is seen as a powerful opponent of the crypto industry (although he has in the past expressed some tentative support for a stablecoin bill favored by the industry [I55]).

This race really exemplifies the attitude of the crypto industry, which has been “install pro-crypto candidates and damn the ramifications”. Ousting Brown could well flip the Senate to a Republican majority, which would have enormous consequences. But hey, I guess it’s all worth it as long as the crypto industry gets to sell their tokens!

Elsewhere in crypto

Ray Youssef has claimed that “Binance has seized all funds from all Palestinians as per the request of the IDF. They refuse to return the funds. All appeals denied.”30 Binance has denied this, stating that “Only a limited number of user accounts, linked to illicit funds, were blocked from transacting.”7 I normally try to avoid writing about rumors when I don’t know what’s actually going on, but this one has spread more than I expected. I want to emphasize that no one involved here is a trustworthy source. Youssef is a historically volatile character prone to exaggerated claims, and he operates a competing service that he promoted in the very same tweet where he made allegations against Binance. Binance routinely makes statements denying factual allegations. And Israel routinely claims that innocent Palestinians are involved in “terrorism”.

The latest dystopian self-sovereign identity concept has emerged, and instead of eyeball scanning we’re all supposed to get tattoos now.31 Can’t wait! Polkadot founder and “web3” coiner Gavin Wood announced the idea at a web3 conference, and says he hopes the project will launch late this year. I haven’t been able to find any examples of the algorithmically-generated unique designs, which must be tattooed in the same (also as-yet-undisclosed) place on a person’s body, but it seems to me that in order to be a) globally unique, b) resilient to typical age-related tattoo degradation, and c) color-limited enough to be recognizable across skin tones, they would likely need to be quite large. Just ask anyone who got a barcode tattoo in the 90s how those are holding up.

The project team also haven’t explained how they will handle a scenario in which a person already has a tattoo in the designated location. The saving grace is that, at least so far, the project hasn’t announced any Worldcoin-esque plans to foist these upon every member of the global population, so hopefully this is the last time I have to think about it.

A new paper in Geopolitics studied a humanitarian blockchain pilot project called Cash4Work, concluding that it “relied on forms of ignorance: confusion, illusion, disappearance, and misdirection”. The author writes, “The organisation’s experimental adoption of a blockchain database system benefits some stakeholders (innovators, private partners) more than others (local aid workers and refugees). The conjuring of the pilot is what justifies the adoption of blockchain, even though a simple database would have sufficed.”32

The former CEO of the notoriously ill-fated early crypto exchange Mt. Gox is... you guessed it! Launching a new crypto exchange. He plans to lure in former Mt. Gox users by offering them discounts.33

Three executives have jumped ship from the crypto-friendly Evolve Bank and Trust, which is always a good sign.34

The Web3 is Going Just Great recap

There were eleven entries between August 18 and September 5, averaging 0.6 entries per day. $163.47 million was added to the grift counter.

Hamburgled

[link]

Hackers compromised the McDonald’s Instagram account, which bafflingly has more than 5 million followers, as well as a Twitter account belonging to a McDonald’s marketing director. Together, they announced a memecoin called $GRIMACE, which they immediately dumped for $700,000 after people bought in. Then the hackers, who claim to be part of an Indian hacking group, changed the Instagram account’s bio to boast about the haul, writing “thank you for the $700,000 in Solana”.

The stunt was perhaps somewhat more believable because McDonald’s had previously dipped a toe into the crypto world with its McRib-themed NFT project from December 2021 [W3IGG]. The company had also joked about a "Grimacecoin" back in January 2022, in a Twitter reply to Elon Musk.35

Big phish

One crypto wallet was phished for $55 million in the DAI stablecoin after its operator signed a malicious transaction that reassigned ownership of the tokens to another person. They seemed to realize the error several hours later, returning to attempt to withdraw the tokens, only to have the transaction fail because of their previous ownership transfer.

Everything else

- SEC charges Galois Capital, Galois settles [link]

- "Peripheral" Aave smart contract hacked for $56,000 [link]

- Bitcoin mining company Rhodium Enterprises files for bankruptcy [link]

- Brothers charged by SEC for $60 million "crypto bot" Ponzi scheme [link]

- Abra crypto lender charged with securities violations, settles [link]

- Users suffer losses after Polygon Discord hack [link]

- Former CEO of Heartland Tri-State Bank sentenced to more than 24 years in prison after putting bank funds into crypto scheme [link]

- FutureNet founder arrested for alleged crypto fraud [link]

Worth a read

Mike Masnick wrote up a characteristically good summary of the recent Second Circuit ruling, denying the Internet Archive’s appeal of an earlier court ruling that had found the Archive’s book lending program was not fair use. He’s been covering it more or less from the beginning, so you can go back through Techdirt's “Hachette” tag to get the full history.

I’m genuinely heartbroken about this. Wired also had a shorter and less in-the-weeds piece about it, if that’s more your thing.

The Bloomberg editorial board wrote an op-ed urging Kamala Harris, if elected, to "work with Congress and regulators to ensure that the rules applied to cryptocurrencies are consistent with existing laws on fraud, money laundering and sanctions enforcement. If the technology is as innovative and useful as its advocates assert, then playing by the rules shouldn’t be a problem. No amount of campaign cash should lead candidates to think otherwise." This entirely reasonable statement of course horrified the crypto press to the point that CoinDesk decided they had to publish not one, but two rebuttals (1, 2).

In the news

I chatted with Paris Marx about the crypto industry’s election spending, and why it’s been so substantial even though, to many, it feels like crypto is a thing of the past.

Wired mentioned the FEC complaint against Coinbase in their article about the industry’s political spending. Still no updates on that, by the way.

That's all for now, folks. Until next time,

– Molly White

Footnotes

In doing so, Salame was also seemingly abandoning his hopes of the judge vacating his conviction, given that no argument Bond could make in her case would result in her judge overturning the conviction and sentencing of a person in a totally separate case. However, I suppose his attempt to declare the petition withdrawn without prejudice, if successful, could’ve left the door open for him to refile on the issue later on. ↩

There is of course a hypothetical argument that the prosecutors were laying some sort of deliberately fabricated paper trail so they could later claim they’d made no promises to Salame about Bond, but Salame has not made that argument, at least not so explicitly. ↩

I suspect these “reasonable investors” so frequently described in securities laws all ran away screaming at the first mention of “dogecoin”. ↩

The outlets, sadly, do not specify what the Toblerone was personalized to say. ↩

References

Motion for writ of of error coram nobis, or alternatively for a writ of audita querela filed on August 21, 2024. Document #470 in US v. Bankman-Fried. ↩

Indictment unsealed on August 22, 2024. US v. Michelle Bond. ↩

Letter by USA as to Ryan Salame filed on August 26, 2024. Document #478 in US v. Bankman-Fried. ↩

Defendant's sentencing memorandum filed on May 14, 2024. Document #433 in US v. Bankman-Fried. ↩

Letter by Ryan Salame filed on August 29, 2024. Document #484 in US v. Bankman-Fried. ↩

Order as to Ryan Salame filed on August 29, 2024. Document #485 in US v. Bankman-Fried. ↩

“Nigerian Court Postpones Decision on Gambaryan Bail Application”, CoinDesk. ↩

Order on motion for preliminary injunction filed on August 26, 2024. Document #30 in PleasrDAO v. Shkreli. ↩

Memorandum in support filed on June 10, 2024. Document #4 in PleasrDAO v. Shkreli. ↩

“South Korean crypto firm Haru Invest CEO stabbed during fraud trial, police say”, Reuters. ↩

“Former Haru Invest investor stabs CEO in Korean courtroom”, DL News. ↩

“$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express”, Cointelegraph Magazine. ↩

“NBA Star Jimmy Butler and Ben ‘Bitboy’ Armstrong Settle in Binance Lawsuit”, Decrypt. ↩

“UK Authorities Seize, Convert $144,000 of Bitcoin Stolen in Machete Home Invasion”, Decrypt. ↩

“Bankrupt Crypto Lender Celsius Has Repaid $2.5 Billion to Creditors”, Decrypt. ↩

“Extremely Unlikely WazirX Customers Will Be Made Whole in Crypto Terms: Legal Advisers”, CoinDesk. ↩

“Taking a stand for a better internet,” Opensea. ↩

“Solana's Former Top Decentralized Crypto Exchange Faces SEC Securities Violations”, CoinDesk. ↩

Order denying motion to dismiss filed on August 23, 2024. Document #90 in SEC v. Payward, Inc. ↩

“Australia's Securities Regulator Wins Case Against Kraken's Local Operator”, CoinDesk. ↩

“AFP alerts Australians to common cryptocurrency investment scam tactics for Scams Awareness Week”, AFP. ↩

“North Korea Aggressively Targeting Crypto Industry with Well-Disguised Social Engineering Attacks”, FBI. ↩

“Inside the Trump Crypto Project Linked to a $2M DeFi Hack and Former Pick-Up Artist”, CoinDesk. ↩

Trump Digital Trading Cards America First Edition on Polygonscan. ↩

“Coinbase CFO says Kamala Harris is using firm to accept crypto donations”, Fortune (original version). ↩

“Top super PAC backing Kamala Harris to accept cryptocurrency donations”, Reuters. ↩

“Proof-of-Ink by Gavin Wood: The tattoo that secures your Web3 privacy”, Cointelegraph. ↩

“Conjuring a Blockchain Pilot: Ignorance and Innovation in Humanitarian Aid”, Geopolitics. ↩

“Former Mt. Gox CEO’s new crypto exchange set to launch this month with 'transparency' focus”, The Block. ↩

“Execs at crypto-friendly Evolve Bank leave amid regulatory crackdown: Report”, Cointelegraph. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.