Issue 68 – Opportunity agenda

Harris shouts out crypto in her “Opportunity Agenda for Black Men”, one crypto exec leaves prison as another enters, and Stand With Crypto bets on the favorites.

There’s a lot to cover in the crypto world, so I’m going to jump right in... but not before noting that I have some new items in the store themed around the Anti Crypto Cryptid Club, which joins two interests of mine I never thought would overlap.a

Also, if you visited the store and found something you wanted was out of stock or on pre-order, I’m delighted to report that I am now fully restocked and ready to go.

In the courts

Binance’s Changpeng “CZ” Zhao is once again a free man. After serving three months in a minimum security prison in Southern California, and another month in a halfway house in Long Beach, he was released on September 27. As he teased prior to his incarceration, he’s been working on the “Giggle Academy” [I56], a childhood education initiative where he plans to give kids NFTs to “make learning addictive”, explore “learn to earn” models to incentivize parents to put their kids in school, and put kids to work training AI models at “say around 13” years old.1 He also says he’s been working on a book, though he admits it’s “a lot more work than [he] anticipated”.2 One thing he won’t be doing is running Binance again. Although plea agreements initially made it sound like CZ might only be banned from running the company for three years, Binance’s new leadership has clarified that the DOJ settlement involved a lifetime ban.3 That said, CZ is still the majority shareholder, and his life partner He Yi remains an executive at the company.

As one crypto executive leaves prison, another enters. FTX’s Ryan Salame reported to prison on October 11, after one last, unsuccessful attempt to once again use the dog bite excuse to postpone his sentencing. It turns out that’s an excuse that only works once, particularly when, the very same day he filed the request, Salame sat for a video interview with Tucker Carlson in which he showed no evident facial injuries, scars, or impairments despite the reported attack by a 125-pound German Shepherd.b Judge Kaplan noted this, along with Salame’s apparent good health and facial function in recent hearings [I66], when denying the request, writing: “[T]o whatever extent that additional medical treatment is genuinely necessary and cannot await the defendant’s release, it can be provided by or under the auspices of the [Bureau of Prisons].”4

That night, Salame posted an update to his LinkedIn profile, which now also lists “cleaning” and “whittling” as skills he’ll be using in his new full-time position at the Federal Correctional Institution in Cumberland, Maryland.

Luckily for Salame, FCI Cumberland — once described by NBC News as “Club Fed” and “one of the nation’s cushiest prisons”5 — is a massive upgrade compared to his ex-boss’s digs at the notoriously unpleasant MCI Brooklyn. As for Salame’s interview circuit, more on that to come soon in a separate issue. Let’s just say Tucker Carlson wasn’t the only one to snag an interview!

Ilya Lichtenstein and Heather “Razzlekhan” Morgan are due to be sentenced in about a month for their participation in the 2016 theft and later laundering of funds from the Bitfinex cryptocurrency exchange. Prosecutors have just submitted sentencing recommendations for the both of them, and, somewhat surprisingly, recommended downwards departures for both. Morgan was the most substantial beneficiary of this argument, with prosecutors stating that the calculated guidelines offense level of 24 — which would result in a roughly four- to five-year sentence — is too high. Instead, they argue that Morgan’s role as a mere accomplice to Lichtenstein in laundering the funds (as opposed to being the primary launderer, or a participant in the hack itself) as well as her substantial cooperation should earn her a sentence closer to 18 months. While there is a rapper who was notably recently required to pass his lyrics by his probation officer as a condition of his release,6 sadly no such conditions have yet been imposed on Razzlekhan, meaning she might be back to recording her cringeworthy raps unimpeded relatively soon.7

Lichtenstein’s guidelines offense level is 32, which would suggest a sentence of 10–12½ years in prison. Prosecutors, however, have suggested an offense level of 25, and a five year prison term. Despite emphasizing the gravity of the duo’s crimes, prosecutors argue that sentencing enhancements for his role as a leader in the criminal activity and for obstruction of justice are not necessary, and that Lichtenstein should also be granted a reduction for “incomplete conspiracy” because he and his wife had failed to launder all of the funds he had stolen. Prosecutors argue that his eventual choice to plead guilty and cooperate with the investigation helped them recover funds, and warrants such a significantly reduced sentence. While I expected that, I was a little bit surprised at just how much of a reduction they’ve proposed for someone who still ultimately stole 120,000 BTC ($72 million at the time; $8.1 billion at today’s prices).8

The money laundering case against Tornado Cash co-founder Roman Storm has, unsurprisingly, survived a motion to dismiss [I54]. It will go to trial in early December if there are no delays.9

Swan Bitcoin has filed a lawsuit against a group of former employees that started a competing bitcoin mining business called Proton Management. Swan alleges the group stole trade secrets including “highly proprietary code” and mining techniques from 2040 Energy, a joint bitcoin mining venture established by Swan and the Tether stablecoin giant. Amusingly, Swan’s lawyers made a rookie mistake when filing their lawsuit by simply drawing black boxes over the text they intended to redact, meaning that people who downloaded the file could simply move the boxes out of the way to reveal the text that was intended to be hidden from public view. This revealed details around allegations that Tether conspired with the former employees to usurp Swan’s bitcoin mining business, and allegations that they controlled Proton’s board of directors.10

The Justice Department and the Securities and Exchange Commission simultaneously charged eighteen individuals and entities for cryptocurrency wash trading and market manipulation. The sweeping investigation, unusually, involved the FBI working with cooperating witnesses to create their very own cryptocurrency company and token called “NexFundAI”, which they then used in a sort of sting operation. The influence of the cooperators was evident, because the token website hit all the right talking points around deflationary economics, airdrops, and “utility focus”.

The charges were directed at a group of individual crypto promoters who fraudulently pumped tokens like “Robo Inu” and “Saitama Inu”, as well as the market makers ZM Quant, CLS Global, MyTrade, and — most notably — Gotbit. Gotbit is perhaps the only of the four with much name recognition, and it was widely used by memecoin creators including those behind projects like “Neiro”, “beercoin”, and — yes, really — “Buy My Shitcoin”. Many of those memecoin projects are now scrambling to disavow Gotbit, while insisting their projects are legitimate.11 The defendant companies allegedly provided “on-demand market manipulation” intended to inflate token prices and mislead prospective buyers that there was high demand for the tokens. Various defendants promised that they could make the trading appear “organic”, and “pump the price” of various tokens. “The basic goal right now is to create that FOMO by looking as organic volume,” wrote a promoter in a conversation with GotBit. “Yea,” replied a GotBit executive, who then outlined plans to manipulate the token market, but avoided putting a detailed description of their agreement in writing in a contract because some countries are “kinda regulated”.1213

Australian police seized around $9.3 million in cryptocurrency as a part of Operation Kraken, the confusingly-named initiative that has nothing to do with the Kraken cryptocurrency exchange, but rather focuses on the Ghost encrypted messaging application.c This operation has been ongoing for about a month, and at least 46 people have been arrested in connection to the app, which the Australian Federal Police claim was “built solely for the criminal underworld”.d Most of the arrests have targeted people who used Ghost to traffic drugs, order hits, or launder money, although the creator of the application was also charged and arrested in mid-September.14

Horst Jicha, the alleged operator of the $150 million USI Tech cryptocurrency pyramid scheme, seems to have skipped town after disabling his ankle monitor. He was out on house arrest after his partner, children, and several others put up a $5 million bond. I imagine they will be highly upset with him, though perhaps he has assets squirreled away with which he can repay them for their troubles.15

Following an unsuccessful noise violation lawsuit against the plant manager of the Marathon Digital bitcoin mining firm [I62], some residents of Granbury, Texas are applying for a permanent injunction from the Hood County District Court to halt the “intolerably loud noise conditions” and palpable vibrations produced by the operation’s cooling fans and other equipment. Plaintiffs have described the noise as similar to a vacuum cleaner running “only inches away from [their] ears”, and causing noticeable vibrations in the floors and windows of their homes. They complain of ailments including hearing loss, fatigue, and increased stress, and report higher electricity bills amid diminished property values. Several have reported pets, including dogs and horses, exhibiting heightened anxiety and conditions resulting from anxiety, with one dog and one horse both having to be euthanized. The noise is worse at night, and a plaintiff has recorded decibel readings on her property between 3:30 and 5 am of 88 decibels. For context, the American Academy of Audiology warns that “over 85 dB for extended periods can cause permanent hearing loss.”16

Finally, various other people were charged, convicted, or sentenced in connection to cryptocurrency-related crimes:

- A man and his son stole at least $10 million from more than 20 victims by claiming to operate a cryptocurrency brokerage and investing business. They solicited investments, as well as loans from friends and acquaintances who they never repaid. The son pleaded guilty to a money laundering conspiracy charge in April 2023; the father opted to take his chances in court, and was just convicted on three counts.17

- A man who took out $1.1 million in COVID-19 relief loans on behalf of his auto parts and scrap company, then invested almost half into a cryptocurrency business, pleaded guilty to wire fraud.18

- A crypto entrepreneur who went by “The Godfather” was charged on tax evasion and conspiracy charges, and was reportedly paying off members of the LAPD to harass and arrest his various enemies. The Godfather used the roughly $1.7 million he should have paid in taxes on luxury purchases, mansion rent, and a cosmetic leg-lengthening procedure. He also allegedly committed multiple armed robberies to steal cryptocurrency, including one in which he impersonated an FBI agent.19

- A man who hacked into an unnamed “investment holdings company located in Sioux Falls, South Dakota” and stole cryptocurrency priced at more than $37 million from almost 600 victims has pleaded guilty to wire fraud and money laundering charges.20

- The founder of the IcomTech project has been sentenced to ten years in prison, after stealing around $8.4 million by promising “financial freedom” to investors who believed they were investing the money in lucrative cryptocurrency operations, but who had instead been lured into a Ponzi scheme where no crypto trading was actually happening.21

- The founder of the Forcount (and later Weltsys) cryptocurrency Ponzi scheme was hit with the maximum sentence of 20 years in prison for his multimillion dollar scheme targeting primarily Spanish-speaking individuals. He claimed that his crypto trading and mining could guarantee returns on investment and a doubling of investors money within six months, when in reality he — much like the IcomTech founder — was doing no crypto activities at all.22

In bankruptcies

The judge in the FTX bankruptcy case has approved the company’s restructuring plan, after creditors overwhelmingly voted in favor of it. Some former creditors had opposed the plan based on objections to how claims were valued, the legal immunity that will be extended to those who have overseen the bankruptcy, and the possibility of high taxes on the cash (rather than crypto) repayments. While they may still appeal, the approval paves the way for billions of dollars to be repaid to creditors, potentially even by the end of the year.23

Remember Banq, a side character in the Prime Trust saga outlined in issues 38 and 39? Well, the neobank’s June 2023 application for Chapter 11 bankruptcy was rejected after four attempts at coming up with a plan, when the bankruptcy court judge ruled that the filing appeared to be simply a “bad faith” tactic to try to get the upper hand in the ongoing litigation with Scott Purcell rather than a genuine attempt to reorganize the company.24

In governments and regulators

SEC

Lawsuits are flying in both directions over at the SEC.

On the incoming end, the Coinbase lawsuit against the SEC is still ongoing, and the parties appeared in front of a panel of Third Circuit judges in late September to argue over whether the SEC should be forced to write new rules for the cryptocurrency industry. Some of the judges seemed skeptical of the SEC’s position, asking pointed questions about the status of Bitcoin and Ethereum as securities — although Axios opined that, “it could be that judges are critical of the side they lean toward supporting, in order to help it to submit the best possible follow-up filings.” However, they also showed some hesitance to Coinbase lawyer Eugene Scalia’se argument that the court should force the SEC to write new rules for cryptocurrency businesses. “That’s an extraordinary remedy,” one of them commented.25

Joining Coinbase on the ever-growing list of crypto companies who are suing the SEC, crypto exchanges Crypto.com and Bitnomial have both separately filed lawsuits against the agency. Crypto.com is doing the typical post-Wells notice “you can’t sue me, I’m suing you!” move we’ve seen modeled by Consensys, and has been publicizing their lawsuit as an attempt to “protect the future of crypto in the U.S.”26 Bitnomial is suing over the agency’s claim that they share joint jurisdiction with the CFTC over XRP Futures contracts, which Bitnomial argues fall solely under the CFTC’s remit.27

In the outgoing direction, the SEC has earned a few victories. They just won a motion for summary judgment in an ICO-related case against the Rivetz Corp and its CEO Steven Sprague, who offered unregistered securities in 2017 when they sold around $18 million worth of the Rivetz token to investors in the United States and elsewhere. Although Sprague tried to argue that the token was merely software, not a security, the judge opined that “from the first announcement of the ICO through its completion, Rivetz and Sprague made statements to potential purchasers that clearly tied the value of RvT tokens to Rivetz’s goal of creating a security ecosystem for mobile devices.”28

The SEC also reached that settlement I mentioned was in the works a few issues ago with Mango Markets [I65], and — if approved — the various entities involved will all destroy their MNGO tokens and work to halt token trading on outside platforms. They will also collectively pay around $700,000 in penalties.29 Meanwhile, Mango Labs has turned around and sued two “core Mango DAO personnel”, who they allege illegally profited to the tune of around $10 million when they worked on behalf of the DAO to purchase MNGO tokens that were being held by the bankrupt FTX.30

Elsewhere in SEC business: The SEC has filed a new lawsuit, this one against Cumberland DRW, the cryptocurrency trading and market making division of prominent trader Don Wilson’s DRW Trading Group. The agency alleges that Cumberland has operated as an unregistered securities dealer since at least March 2018, listing “crypto assets offered or sold as investment contracts and, therefore, as securities” including Polygon, Solana, Cosmos, Algorand, and Filecoin. Cumberland responded with a statement that they had become “the latest target of the SEC’s enforcement-first approach to stifling innovation and preventing legitimate companies from engaging in digital assets,” and promised that they were “ready to defend ourselves again”.31 “Again” refers to the market manipulation complaint filed by the CFTC against the company in 2011, which was dismissed in 2018 after a judge ruled that the CFTC had not adequately proved its case that Cumberland’s activities were illegal.32

Finally, the SEC has unsurprisingly filed notice of an appeal following the conclusion of their long-running lawsuit against Ripple [I63]. Ripple followed that up with their own notice of a “cross-appeal”.33 The long-running lawsuit becomes longer still.

Everything else

Non-crypto-based prediction market Kalshi has reinstated its betting markets pertaining to US elections after the DC Appeals Court denied the emergency motion by the CFTC to halt trading in those markets. As I mentioned recently [I66], the Court had granted a temporary stay pending their decision, which forced Kalshi to take the markets offline.34 They’re already back up again following the denial. Their market boasts considerably less volume than Polymarket’s — only $14.7 million compared to Polymarket’s $2 billion in US presidential election bets.

A coordinated enforcement action by various US government agencies and Dutch law enforcement has cracked down on the Russian cryptocurrency exchanges PM2BTC and Cryptex, as well as their operators. The agencies allege the firms have been used to process hundreds of millions of dollars in transactions for Russian crime organizations, including ransomware operations. The State Department is also offering rewards of up to $10 million for information on two Russians: money launderer Sergey Ivanov, and Timur Shakhmametov, the operator of a darknet marketplace known for selling stolen credit card information and other personal data. As a part of the action, the US added PM2BTC, Cryptex, and Ivanov to the sanctions list, and seized domains and assets belonging to Cryptex.3536

Not long after the action from US and Dutch authorities, Russia arrested 96 people reportedly connected to the Cryptex exchange and related services. Russian authorities allege that throughout 2023, the network processed around $1.1 billion in transactions and generated around $38.7 million in revenue. Ivanov was reportedly among those arrested by Russian police, who are presumably not eligible for the reward.37

The United Kingdom’s Gambling Commission has charged the creators of the Sorare fantasy sports NFT-based game with providing unlicensed gambling facilities. In the game, players purchase NFTs representing sports players they want to have on their fantasy teams, and then enter various competitions to earn rewards based on their players’ performance. The Gambling Commission maintains that this constitutes gambling, while Sorare insists that the Commission simply “misunderstood [their] business”. This is the Gambling Commission’s first enforcement action against a blockchain-based platform.38

Gemini is joining the ranks of Binance and OKX in choosing to bail out of Canada, which has strong regulations and oversight on cryptocurrency platforms.39 Gemini didn’t provide any details on the decision, but it’s likely related to 2023 rules from the Canadian Securities Administrators dictating that crypto exchanges will need to provide daily financial reports to the regulatory agency, and obtain special permission to sell stablecoins. These rules were implemented following the 2022 collapses of companies including FTX, Celsius, and Voyager, and an announcement by the agency explicitly cited those events as having demonstrated the need for tighter regulations.40

In elections and political influence

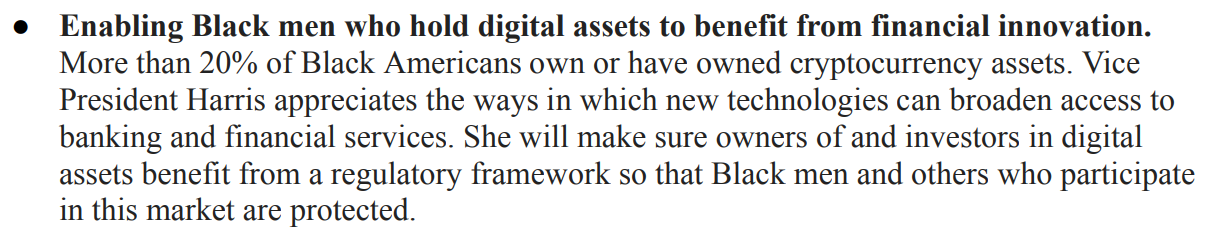

Kamala Harris has included as #3 in a 5-part “Opportunity Agenda for Black Men” that she would “Support a regulatory framework for cryptocurrency and other digital assets so Black men who invest in and own these assets are protected.”41 While three of the promises are focused towards benefiting Black Americans or Black men specifically,f the cryptocurrency tenet and one regarding legalizing recreational marijuana are broader initiatives that seem rather clumsily shoehorned in.

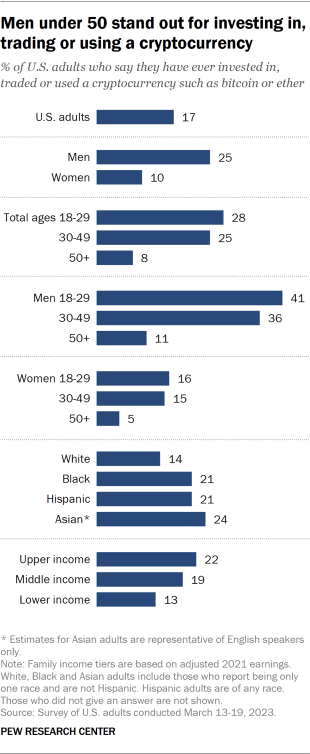

The ostensible reason for including cryptocurrency in a platform aimed at enticing Black voters, particularly men, is data that suggests that men are more likely than women and Black people are more likely than White people to hold crypto. While Harris’s announcement includes no source for its claim that “More than 20% of Black Americans own or have owned cryptocurrency assets,” it wouldn’t surprise me if it came from 2023 Pew Research data that showed 21% of Black American adults had ever invested in, traded, or used cryptocurrency.

Credit where credit is due, I suppose, for not repeating some of the more dubious numbers out of crypto industry surveys — for example, Paradigm, who claimed in 2024 that 33% of Black Americans have ever held crypto,42 or Andreessen Horowitz, who claimed in 2021 that 30% of Black Americans currently owned crypto.43

The statement follows in the same mold as those I’ve covered from her campaign in the past, which seem perfectly crafted to be interpreted as the listener desires [I67]. I, for example, read a statement about making sure investors are protected by a regulatory framework and (perhaps over-optimistically) envision strong consumer protections and a rebuke of cryptocurrency corporations’ attempts to enshrine favorable loopholes into laws and regulations. Others, accustomed to the crypto industry executives’ self-serving definition of “clear, commonsense regulation”, interpret her statement to be supportive of the cryptocurrency companies, and believe it might foretell an administration that would put an end to regulators’ aggressive enforcement of crypto-related matters.

Don’t get me wrong, I do think that Harris is trying to court the crypto industry (and broader tech industry) here, and that’s disappointing to see. But as with her opponent, whether or not campaign statements will translate into a real change in policy approach remains very much to be seen.

As I mentioned in an earlier issue [I64], some in the crypto world seem to fear they prematurely went all in for Trump, back when the choices were between him and Biden and the outcome seemed all but assured. Indeed, since endorsing Trump as “the right choice” alongside co-founder Marc Andreessen on the a16z podcast in July, only days before Biden would withdraw his candidacy, Ben Horowitz has since divulged he will be making an as-yet-undisclosed “significant donation” to the Harris campaign.44 Whether this is a reversal or merely an attempt to play both sides is hard to determine.

But it does show that, while many in the crypto world remain full-fledged MAGA-hatted Trump fans, others seem to be trying to either endear themselves to Harris or at least convince themselves that a potential Harris presidency might not be so bad for crypto after all. Last issue [I67], I mentioned news outlets’ interpretations of her also vague statement that “We will encourage innovative technologies like AI and digital assets while protecting our consumers and investors.” Perhaps the most stark example of the industry’s wishcasting around Harris and that comment came after I published, when Coinbase’s Stand With Crypto lobbying website stamped Harris with a “B” (“supports crypto”) rating based solely on that single “somewhat supportive” comment. This, in contrast to Trump’s “A” (“strongly supports crypto”) rating based on now 23 “very pro-crypto” statements,g, so enraged crypto fans that Stand With Crypto ultimately was forced to retract the rating, returning her to the “NA” (“not enough information”) list.

Ripple co-founder Chris Larsen also put $1 million behind Harris in August, though some news outlets have apparently only just noticed.45 CNBC just ran a disingenuous headline that “Harris PAC’s $1 million contribution from Ripple’s Chris Larsen shows crypto industry warming to VP”, failing to note that the donation happened two months ago — and only three weeks after she took up the candidacy — long before the industry showed any signs of warming to Harris. For his part, Larsen has been one of the few Democratic crypto executives from the getgo, and had already donated $750,000 to the Biden–Harris FF PAC the previous year. He’s put $4.3 million behind various Democrats and Democratic committees this cycle thus far.

Despite all of this, the sometimes decent CoinDesk crypto media outlet has come out with a truly embarrassing endorsement-that-claims-not-to-be-an-endorsement of Donald Trump. (“If CoinDesk were in the business of endorsing political candidates and if crypto were the only issue that mattered, it's pretty clear whom we would back to become the next U.S. president.... [E]ven though we don't endorse candidates, we do endorse Trump's crypto platform, such as is [sic]h.”) Although they claim to be “troubled” by his racism and “increasingly authoritarian rhetoric” — which they describe as “the antithesis of a crypto movement focused on decentralizing authority and empowering individuals” — the opinion piece by CoinDesk’s editor-in-chief, published on behalf of CoinDesk as a whole, is full of “neverthelesses” and “even thoughs” and “howevers” as he recommends Trump anyway. The whole thing boils down to “sure, Trump is a shameless racist who’s been increasingly threatening to do things like round up immigrants and deploy the military against his political enemies, and his statements on crypto kind of seem like empty pandering, but on the other hand, Harris has been... vague.”46

Polymarket

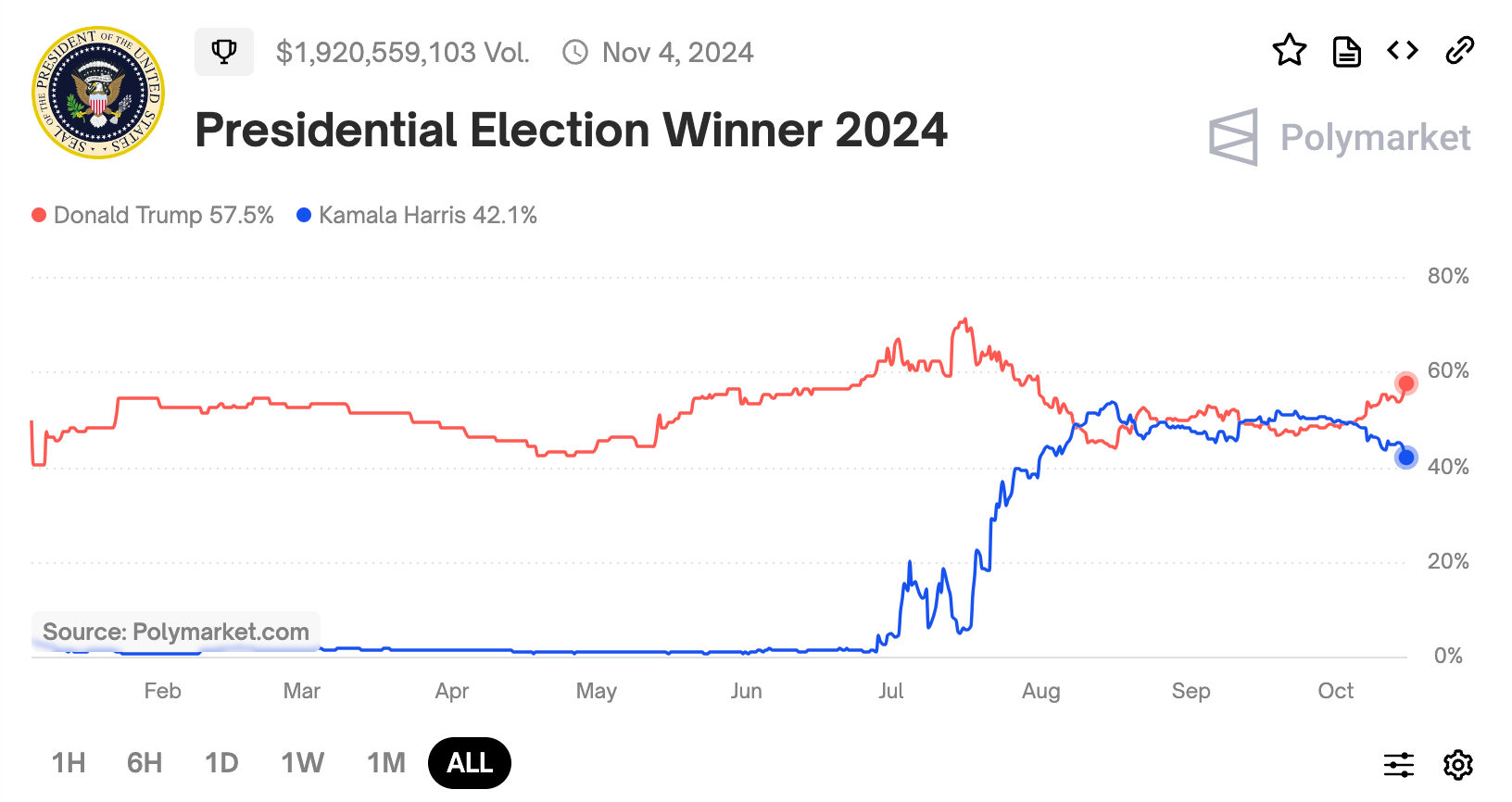

Many Trump fans have been delighted to watch the $2 billion in Polymarket betting on the presidential election winner swing back in favor of Trump, where he currently shows a “58.7% chance” of winning.

Many in the crypto world (and outside of it as well) view prediction markets as potentially even more reliable than polls, despite rather compelling evidence that Polymarket is being manipulated for various reasons, including to try to score payouts from derivative markets.i A recent article by Makena Kelly in Wired has also pointed out that the markets seem to be being used to sway public perception, and are quite likely going to be used as “evidence”, in the event of a Trump loss, that the election was stolen.

But maybe being correct isn’t even the point. Already, Polymarket odds are being used as evidence that Trump is beating Harris, and Musk and other Trump acolytes are using the odds to pump up their base. I’ve seen Democrats celebrating Harris’ odds of winning the popular vote on the site too. All of this has the potential to legitimize these results as viable evidence for conspiracy theorists questioning the outcome of the election.

“Right before the race gets called, Trump and his fans are going to say Polymarket knew the truth and they silenced it. It doesn't matter if it's right. It doesn't matter if it makes any sense in those few hours after the election is called,” says Mike Rothschild, an author who writes about conspiracy theories. “People are going to be looking for any sort of evidence that there was a steal, that there was rigging, that there was the blue ballot dump at three in the morning. And if they can't find it, they're going to make it up.”

Venture capitalist and regular crypto commentator Adam Cochran laid out a similar theory on Twitter that Polymarket is “being used as ad spend”, also noting the potential legitimizing effect on stolen election conspiracy theories after the fact.

-Buy Trump “Yes” votes

-Overtake Harris

-Tweet about it and political sites and shows pick it up

-Repeat any time Harris does well in news cycle.

-Get dirt cheap eyeballs

-Plus point to skewed polls when you lose and claim conspiracy.

And I highly suspect, that come election night (and the days after) it will be these Polymarket polls that Trump starts posting on Truth Social in the event of a loss, especially in a swing state.

His followers will cry “how could he lose when the odds were like this!”

Outside of election prediction markets, there was some controversy when Polymarket began listing betting markets pertaining to ongoing military conflicts, allowing bettors to take sides on whether Israel will take military action against Iran, or whether the US will strike Lebanon. “It feels wrong that Polymarket has an entire Hezbollah betting section that makes a war look like a football game to bet on,” wrote one crypto trader.47 Ethereum co-founder Vitalik Buterin — also one of Polymarket’s backers in a funding round led by Peter Thiel’s Founders Fund earlier this year — jumped in to defend the platform, arguing that the platform is a “news site” that doesn’t “rely on governmental or corporate censors”.48

Polymarket seems to have taken note of the controversy, adding a blurb above all “Middle East Markets” claiming that they have “discussed with those directly affected by the attacks”j and decided “that prediction markets could give them the answers they needed in ways TV news and Twitter could not.” They then emphasize that Polymarket does not (yet)k take any fees on betting markets, presumably to try to dodge criticism that Polymarket is profiting from war.

World Liberty Financial

Trump’s highly publicized “World Liberty Financial” token sale went live on October 15, and the project’s website immediately buckled under the load. After intermittent outages, the team got the website back up, and it was more or less operational by the early afternoon of that same day. It’s now been online for about a full day. While they hope to sell 20 billion tokens in the public sale, only around 807 million (4% of the target) have sold so far, netting around $8 million.49

Some hours after the launch, the project Twitter account tried stirring up interest by promoting a “BIG announcement” from Trump himself, which ended up just being a 14-second-long video belatedly announcing that the token had gone live.

Crypto PACs

With only 20 days remaining until election day, the crypto PACs are hard at work spending the $50 million that remains of the $174 million they’ve raised this cycle.

The top spending over the last few weeks has all gone to incumbent Republicans who had not previously received any crypto PAC money:

- $2.8 million to support Michelle Park Steel, a Republican incumbent running for re-election in California’s District 45. Two September polls both show Steel trailing by two percentage points to her Democratic challenger, Derek Tran.50 Although Tran answered Stand With Crypto’s questionnaire identically to Steel, save for where he indicated he had experience using crypto himself where Steel did not, and where he included a response that “Block Chain technology is essential to economic growth” where Steel opted not to answer, he still somehow only earned only a “B” rating to her “A”.l

- $1.6 million to support Juan Ciscomani, a Republican incumbent running for re-election in Arizona’s District 6 against the same candidate he narrowly beat in 2022, Democratic state Senator Kirsten Engel.

- $1.3 million to support David Valadao, a Republican incumbent running for re-election in California’s District 22 against Democrat Rudy Salas. One September poll showed them tied, while another favored Salas by four points.51

- $1 million to support Mike Garcia, a Republican incumbent running for re-election in California’s District 27 against Democrat George Whitesides. A September poll showed Whitesides with a two point lead.52 As with the race between Steel and Tran, Garcia and Whitesides both had identically positive responses to the Stand With Crypto questionnaire, but Garcia has an “A” rating while Whitesides has a “B”.

Other recent contributions of less than $1 million by the crypto PACs have gone to support Democratic candidates Nikki Budzinski (IL-13), Jimmy Gomez (CA-34), Yadira Caraveo (CO-8, amounting to $2.1 million in total support), and Ritchie Torres (NY-15).

Recent contributions of less than $100,000 have supported Democratic candidates Angie Craig (MN-2, amounting to $973,500 in total support), Eric Sorenson (IL-17, amounting to $817,000 in total support), Pat Ryan (NY-18, amounting to $2 million in total support), and Steven Horsford (NV-4, amounting to $1.8 million in total support).

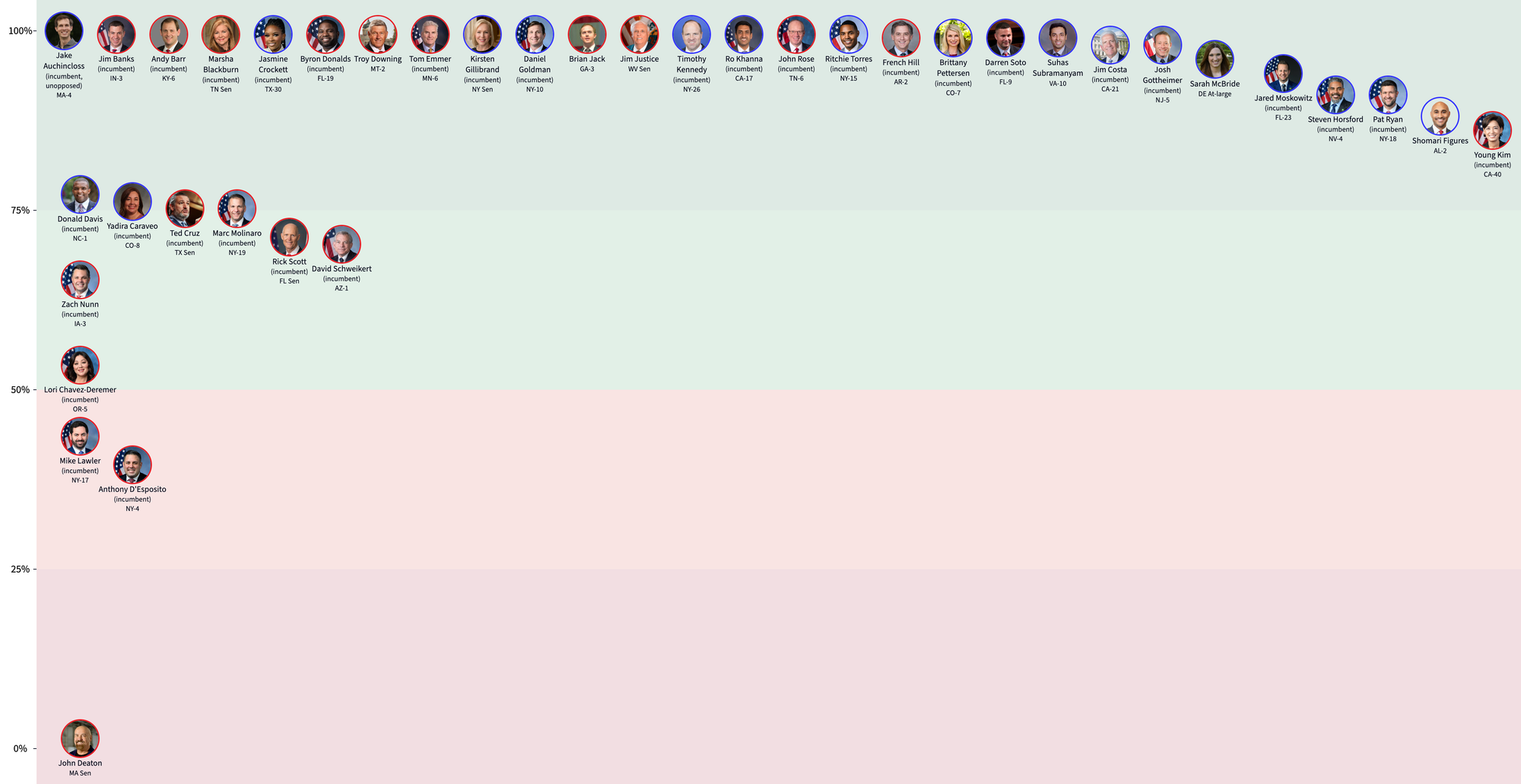

Meanwhile, Stand With Crypto has published a list of endorsements for the upcoming election, with a neatly bipartisan roster of 20 Republicans and 19 Democrats. They have endorsed seven Senate candidates and 32 House candidates, and have not endorsed any presidential candidate.

After noticing that some of the biggest beneficiaries of the industry's political spending were conspicuously missing from Stand With Crypto’s endorsements list, I followed a hunch and looked up their chosen candidates in The Hill’s prediction model, which tries to evaluate the likelihood any given candidate will win their race.

As it turns out, Stand With Crypto is mostly just endorsing candidates who are practically shoo-ins to win their races, with The Hill assigning 27 of the group’s 39 endorsed candidates (69%) a greater than 90% chance of winning their race. 32 of the 39 (82%) were assigned a 75% chance or more. Only three endorsed candidates were estimated have a less than 50% chance of winning, with John Deaton significantly trailing the pack with his “<1%” chance of winning his Massachusetts Senate race against incumbent Elizabeth Warren despite $2.1 million in crypto industry backing.

In addition, 32 of the 39 endorsed candidates are incumbents. Really shaking things up out there.

All of the candidates they’re taking a chance on — that is, the nine candidates with a 75% or less chance of winning — are Republicans.

My guess is that Stand With Crypto is setting themselves up for a guaranteed post-election victory lap, celebrating that the majority of their endorsed candidates won their races. I expect a lot of statements along the lines of “Look at all these crypto voters who made their voices heard!” In fact, I wonder if they’ve started drafting them already.

I have no doubt that Coinbase also is hoping to see wins by the likes of Bernie Moreno, Elissa Slotkin, and Ruben Gallego, who’ve received millions from the same PACs Coinbase has supported to the tune of around $50 million, and who’ve all received “A” ratings from Stand With Crypto. However, it seems they have (probably rightly) calculated that any infinitesimal increase in votes they could muster by having their largely astroturfed lobbying group endorse these riskier, battleground candidates would be less valuable than a later PR campaign trumpeting that “crypto truly is a critical issue to American voters because look at how many of these endorsed candidates won their races!” Anyway, if those candidates also win, they can always retcon support for them by pointing to Coinbase’s campaign contributions.

Elsewhere in crypto

NFT sales have sunk to the lowest they’ve ever been since their initial boom in early 2021.53 Despite this, someone managed to convince the now 85-year-old Christopher Lloyd (Doc Brown in Back to the Future) to partner with DeLorean to promote their new “digital collectibles”.54 As with many of the more contemporary NFT projects, DeLorean seems to be hoping that if they just don’t say the word “NFT”, people won’t cringe at them.

If there’s one thing crypto fans won’t give up on, it’s trying to create their own countries, sovereign communities, seasteads, and other things of that nature. One such community is the rather uncreatively named libertarian paradise that will be “Liberland” — at least if they can convince the Croatian government to stop arresting its supposed “citizens” every time they try to visit the roughly 1700-acrem patch of floodlands next to the Danube that Liberlanders claim is a sovereign state. (Croatia apparently disagrees).

Expectation vs. reality

The project — which has been almost ten years in the making — has just announced it has elected none other than Justin Sun [I45, 49] as its prime minister, via an on-chain election. At least they’ve since removed the “laws” section of the website, which in its very earliest days did no favors to libertarians trying to buck the stereotype by announcing that the age of consent would be 13.55

A separate sovereign crypto-nation project called “Praxis” has also just announced that it has received another $525 million in funding, despite still having no disclosed physical location. Much of that funding has come from GEM Digital, a Bahamas-based crypto investment firm.56 Personally, I’m hoping that Praxis will announce that it’s bringing seasteading back. Then we can just cut their mooring line and give them a gentle push out to sea.

Cullen Hoback has published a new documentary on HBO that claims to unmask Bitcoin creator Satoshi Nakamoto as early Bitcoin developer Peter Todd — much to Todd’s dismay. Hoback earned some credibility in the unmasking department with his 2021 HBO documentary series Q: Into the Storm, which more convincingly claimed to have identified “Q”, the mysterious figure behind the QAnon conspiracy theory. This unmasking is considerably less convincing, and my suspicion is that it was it was somewhat shoehorned into the documentary after the fact to try to publicize what is mostly just another bitcoin documentary. This is supported somewhat by my own personal experience having been interviewed for this documentary back in 2022, back when it was being pitched as an inquiry into the origins of crypto compared to where crypto seemed to be going. As you might expect given my focuses, the interview didn’t really touch on bitcoin altogether that much, much less the identity of its creator, and so was ultimately not included in the final product. I respect Hoback and his work, but this missed the mark, I think. And I don’t just say that because he cut my interview — that happens.

The Web3 is Going Just Great recap

It’s been unusually quiet in the world of hacks and scams, with only seven entries between September 23 and October 16, averaging 0.3 entries per day. $47.29 million was added to the grift counter.

Onyx is hacked for a second time with the same tactics

[link]

Onyx, a fork of the popular Compound Finance project, apparently failed to patch vulnerabilities that led to a $2 million theft in November 2023. As a fork of Compound, the project did what so many Compound forks do, and failed to patch known vulnerabilities in the underlying source code.

Even after suffering that 7-figure loss, the project was just hacked for a second time, this time for $3.8 million, apparently using the same techniques. Onyx, however, claims the most recent exploit was due to an unrelated vulnerability.

Everything else

- Permit phisher steals almost $1.4 million in frog tokens [link]

- $3.1 million in EIGEN tokens stolen and sold [link]

- Victim loses over $32 million to wallet drainer [link]

- Bedrock staking platform loses $2 million after bug that allowed users to trade Bitcoin and Ethereum 1:1 [link]

- Truflation hacked for around $5 million [link]

- OpenAI Twitter account once again hacked and used to promote scam token [link]

Worth a read

The New Yorker just published an excellent piece on the explosion of money going into politics from the tech industry, diving heavily into the crypto industry spending against Katie Porter and in support of various crypto-friendly candidates. In particular, they give a lot more background on the people working with Fairshake and Stand With Crypto, and their attempts to sow the narrative that there is this “crypto voter”, despite doubts even from members of Coinbase’s own team. “Then we'll make one,” responded a political adviser. It is gratifying to see what I've been yelling about show up in the pages of a major publication.

While I highly recommend you watch each and every talk from this year's XOXO festival, the talk by Cabel Sasser was equal parts inspiring and entertaining. Appreciate everything endlessly.

In the news

Crypto outlet DL News recently published a profile on me, focusing in particular on my work around crypto influence on this election cycle.

I was more than a little surprised to hear from a social media follower that my name cropped up in a Guardian article about British slang that has entered the American lexicon. Evidently — and this is news to me — “early days” is a Britishism. The author points to my January 2022 essay “It's not still the early days” when noting that "the phrase is common enough to be viewed as a cliche or ... an excuse."

That's all for now, folks. Until next time,

– Molly White

Footnotes

This is a play on the Anti Social Social Club fashion brand, for those who perhaps have not run into that many people fond of wearing $100 t-shirts. Mine are much more reasonably priced, I think. ↩

As someone who regularly finds herself on the other (and losing) side of tug-of-war with my comparatively measly 75-pound German Shepherd mix, this seems nothing short of miraculous to me. Shepherds have among the strongest bites of all dog breeds, and coming out the other side of a bite to the face without serious disfigurement is hard to fathom. ↩

Also confusingly named, and unrelated to the software that runs this newsletter. ↩

If you detect a hint of skepticism in my quotation marks here, it’s because police love to characterize encrypted messaging platforms — which I heavily use and recommend — as “platforms built for criminals”. ↩

Yes, that Scalia. Eugene Scalia is the son of the former Supreme Court Justice Antonin Scalia. ↩

The other three promises include a program to provide forgivable loans to Black entrepreneurs, educational and training programs for Black men (with a particular focus on teacher training), and a health initiative aimed to tackle health problems that disproportionately impact Black men, such as sickle cell disease. ↩

These include Trump’s statement at a crypto fundraiser and campaign event that “maybe we’ll pay off the $35 trillion [national debt] in crypto. I’ll write on a little piece of paper ‘35 trillion crypto’, we have no debt!” ↩

Evidently when the editor-in-chief writes a piece for CoinDesk, they don’t themselves get edited. ↩

In addition to markets betting on the eventual election outcome, there are also derivative markets in which people bet on things like “Favorite to win on Polymarket this Friday”. If a trader successfully temporarily manipulates the election outcome market while also betting on the derivative market, they potentially stand to profit. ↩

It’s hard to imagine being a fly on the wall in these conversations, if Polymarket did indeed try to convince actual war victims to give them a hall pass. ↩

As with many early-stage venture-backed companies, Polymarket is currently subsidized by venture capital. They will likely introduce fees once they have decided they’ve established a large enough user base, or when their backers start clamoring for returns on their investments. ↩

While one could perhaps argue that the reason Steel earned an A while Tran earned only a B is that Steel has a record of voting for pro-crypto legislation, this would suggest it should not be possible for a non-incumbent to earn an A rating with only questionnaire responses and no voting record. However, other candidates who have not previously held office and who have not made outside statements about crypto, such as Bentley Hensel and Curtis Bashaw, managed to earn A ratings despite this. ↩

If Liberland were ever to be recognized as a country, it would be the third-smallest one, behind Monaco and the Vatican. Slightly larger than it is Nauru, which you may remember Sam Bankman-Fried’s little brother once planned to buy to establish a “bunker / shelter” to “ensure that most EAs [effective altruists] survive” “some event where 50%-99.99% of people die”, as well as a human genetic enhancement lab. He did not seem terribly concerned by the inconvenient fact that, you know, Nauru is already a country with its own government and with citizens who already live there. [I34] At this rate, I’m looking forward to crypto-libertarians trying to duke it out with the Pope when they suddenly decide that the Vatican would be the ideal place for their social (and human) experiments. ↩

References

”Concept brainstorm”, Giggle Academy. ↩

“Sorting out CZ’s Binance influence”, Axios. ↩

Order denying 518 motion to continue as to Ryan Salame filed on October 10, 2024. Document #522 in US v. Bankman-Fried. ↩

“Jesse Jackson Jr. could end up in one of the nation's cushiest prisons”, NBC News. ↩

“‘Bling Bling’ Rapper B.G. Just Finished An 11-Year Prison Term — Now a Probation Officer Reviews His Lyrics Before He Records Them”, Digital Music News. ↩

Sentencing memorandum by USA as to Heather Rhiannon Morgan filed on October 9, 2024. Document #143 in US v. Lichtenstein. ↩

Sentencing memorandum by USA as to Ilya Lichtenstein filed on October 15, 2024. Document #146 in US v. Lichtenstein. ↩

“Tornado Cash Dev Roman Storm’s Criminal Case Will Proceed to Trial, NY Judge Orders”, CoinDesk. ↩

Complaint filed on September 25, 2024. Document #1 in Electric Solidus v. Proton Management. ↩

“Gotbit? Never Heard of It! Meme Coins Try to Distance Themselves”, Decrypt. ↩

“Eighteen Individuals and Entities Charged in International Operation Targeting Widespread Fraud and Manipulation in the Cryptocurrency Markets”, U.S. Attorney's Office, District of Massachusetts. ↩

“SEC Charges Three So-Called Market Makers and Nine Individuals in Crackdown on Manipulation of Crypto Assets Offered and Sold as Securities”, US Securities and Exchange Commission. ↩

“Operation Kraken: AFP restrains $9.3 million in crypto linked to alleged head of global organised crime app”, Australian Federal Police. ↩

“Accused $150M Crypto Fraudster Turns Fugitive After Disabling Ankle Monitor”, Decrypt. ↩

Levels of Noise. American Academy of Audiology. ↩

“Father And Son Charged In Manhattan Federal Court With Multimillion-Dollar Cryptocurrency-Related Crimes”, U.S. Attorney's Office, Southern District of New York. ↩

“Smithtown Man Pleads Guilty to $1 Million Covid-19 Fraud”, U.S. Attorney's Office, Eastern District of New York. ↩

“Witness Says LA 'Godfather' Impersonated FBI to Steal Crypto at Gunpoint”, Decrypt. ↩

“Indiana Man Pleads Guilty to Conspiracies Involving Cyber Intrusion and $37 Million Cryptocurrency Theft”, U.S. Attorney's Office, District of South Dakota. ↩

“Founder Of Cryptocurrency Ponzi Scheme IcomTech Sentenced To 121 Months In Prison”, U.S. Attorney's Office, Southern District of New York. ↩

“Senior Promoter In Cryptocurrency Ponzi Scheme Sentenced To 240 Months In Prison”, U.S. Attorney's Office, Southern District of New York. ↩

“FTX Customers Will Get Back Billions After Judge OKs Bankruptcy Plan”, Wired. ↩

Findings of fact and conclusions of law filed on October 8, 2024. Document #274 in In re: Banq. ↩

“Coinbase lawsuit leads to SEC grilling in appellate court”, Axios. ↩

Complaint for declaratory and injunctive relief filed on October 8, 2024. Document #1 in Foris DAX v. US Securities and Exchange Commission. ↩

Complaint for declaratory and injunctive relief filed on October 10, 2024. Document #1 in Bitnomial Exchange v. US Securities and Exchange Commission. ↩

Memorandum and order on cross motions for summary judgment filed on September 30, 2024. Document #62 in SEC v. Rivetz Corp. ↩

“SEC Charges Entities Operating Crypto Asset Trading Platform Mango Markets for Unregistered Offers and Sales of the Platform’s ‘MNGO’ Governance Tokens”, US Securities and Exchange Commission. ↩

Complaint filed on October 7, 2024. Document #1 in Mango Labs v. Kramer. ↩

Complaint filed October 10, 2024. Document #1 in SEC v. Cumberland DRW. ↩

“U.S. CFTC loses case against prominent trader Donald Wilson, DRW”, Reuters. ↩

“Ripple Plans ‘Cross-Appeal’ in SEC Case”, CoinDesk. ↩

“U.S. Election Betting: Kalshi Preps Presidential Prediction Markets After Re-Launching Congressional Contracts”, CoinDesk. ↩

“US sanctions crypto exchanges used by Russian ransomware gangs”, BleepingComputer. ↩

“Two Russian nationals charged in connection with operating billion-dollar money laundering services; Justice Department seizes web domains for multiple illicit crypto exchanges”, U.S. Attorney's Office, Eastern District of Virginia. ↩

“Russia arrests US-sanctioned Cryptex founder, 95 other linked suspects”, BleepingComputer. ↩

“Fantasy Sports Company Sorare Charged With Providing Unlicensed Gambling Facilities in U.K.”, CoinDesk. ↩

“Gemini Is the Latest Exchange to Leave Canada, Following Binance and OKX”, Decrypt. ↩

“Canadian Securities Administrators Staff Notice 21-332: Crypto Asset Trading Platforms: Pre-Registration Undertakings Changes to Enhance Canadian Investor Protection”, Canadian Securities Administrators. ↩

“Vice President Harris Will Deliver for Black Men”, Kamala Harris. ↩

“March 2024 Public Opinion Poll”, Paradigm. ↩

“Prediction for the New Year: A Web3 Midterm”, Andreessen Horowitz. ↩

“Scoop: VC titan Ben Horowitz plans ‘significant’ donation to Kamala Harris”, Axios. ↩

“Harris PAC’s $1 million contribution from Ripple’s Chris Larsen shows crypto industry warming to VP”, CNBC. ↩

“Editorial: We Applaud Trump’s Crypto Efforts Though His Record, Rhetoric Raise Red Flags”, CoinDesk. ↩

World Liberty Financial token on Etherscan. ↩

Polls for California District 45 on 538. ↩

Polls for California District 22 on 538. ↩

Polls for California District 27 on 538. ↩

“CryptoSlam NFT Global Sales Volume”, CryptoSlam. ↩

“DeLorean, Christopher Lloyd Reunite for Time Capsule Digital Collectibles”, Decrypt. ↩

“Justin Sun Is Now Prime Minister of Liberland—What Does That Even Mean?”, Decrypt. ↩

“Praxis gets $525M for utopic crypto, AI-friendly city”, Cointelegraph. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.