Issue 69 – Nice

Coinbase threatens me that continuing to report on their activities would be “.... unwise”. Also, election spending hits a fever pitch, with several new crypto PACs coming out of the woodwork.

My previous issue about facing legal threats as an independent writer was apparently well-timed, as Coinbase is the latest entry on the list of entities threatening me with legal action over my factual reporting. In this issue, more on that, and the latest developments in the crypto lobbying efforts as the US election swiftly approaches.

Also, a few have requested merch specific to the Citation Needed newsletter so you can show your support. I have heard your calls, and added a few new items to the store that you can check out.

In the courts

Former FTX head of engineering Nishad Singh has become the fourth of the five FTX defendants to be sentenced. A cooperator generally viewed as less central to the fraud than Sam Bankman-Fried, or Bankman-Fried’s second-in-command Caroline Ellison, Singh is the first of the bunch to receive a non-custodial sentence. He will spend three years on supervised release. To recap:

| Defendant | Charges | Plea | Prison sentence |

|---|---|---|---|

| Sam Bankman-Fried | Wire fraud (×2), conspiracy to commit wire fraud (×2), conspiracy to commit securities fraud, conspiracy to commit commodities fraud, conspiracy to commit money laundering | Not guilty | 25 years |

| Ryan Salame | Conspiracy to make unlawful political contributions and defraud the Federal Election Commission, conspiracy to operate an unlicensed money transmitting business | Guilty (no cooperation) | 7.5 years |

| Caroline Ellison | Wire fraud (×2), conspiracy to commit wire fraud (×2), conspiracy to commit securities fraud, conspiracy to commit money laundering | Guilty (cooperation) | 2 years |

| Nishad Singh | Conspiracy to commit securities fraud, conspiracy to commit money laundering, conspiracy to violate campaign finance laws | Guilty (cooperation) | 0 years |

| Gary Wang | Wire fraud, conspiracy to commit wire fraud, conspiracy to commit securities fraud, conspiracy to commit commodities fraud | Guilty (cooperation) | TBD |

Singh and Ryan Salame were the two defendants with the least severe charges, which heavily underscores the benefits of cooperation when it comes to sentencing. Salame, who pleaded guilty but did not cooperate or agree to testify against his former boss, has just begun his 7 1/2 year prison term; Singh will not see the inside of a prison cell. Salame claims he was not even offered the opportunity to cooperate, although he has also insinuated that he might have been had he agreed to lie — something he also claims the other cooperators chose to do.

The last defendant to be sentenced, Gary Wang, is likely breathing somewhat of a sigh of relief after seeing Singh’s sentence. However, it’s possible Wang may still end up with some prison time as a result of his wire fraud charge, which carries a heftier maximum sentences than Singh’s securities fraud and campaign finance charges. We will find out on November 20.

The government is still working on negotiating the return of some political donations made either by Sam Bankman-Fried, or by Singh on Bankman-Fried’s behalf, to various left-leaning political action committees including the Senate Majority PAC, Emily’s List/Women Vote, the Future Forward PAC, and GMI PAC. Each individual PAC received donations of around $1 million to $2 million.1

Jarett Dunn, the ex-employee who allegedly stole $2 million from the Pump.fun memecoin launchpad and then bragged about it on Twitter [I58, 59], has moved to withdraw his guilty plea in his UK court case. This was against the recommendations of his lawyers, who withdrew their legal representation following his decision.2 Dunn has remained active on Twitter throughout the process, tweeting about other crypto projects he’s been developing and posting screenshots of conversations with ChatGPT in which he seems to be workshopping his own legal defense. (Said defense appears to revolve around the argument that anyone could have hacked Pump.fun, and he just happened to be the one to do it.)3

Eric Council Jr., a 25-year-old allegedly responsible for compromising the SEC’s Twitter account and tweeting that the Bitcoin ETPs had been approved [W3IGG] a day before the decision was actually announced, has pleaded not guilty to conspiracy to commit aggravated identity theft and access device fraud. After perpetrating the SIM swap attack by impersonating the person whose phone number was linked to the SEC’s Twitter account, purchasing a “replacement” SIM card, and then resetting the password to the Twitter account, Council was paid an undisclosed amount in bitcoin. Council then pulled the classic innocent person move: Googling things like “What are the signs that you are under investigation by law enforcement or the FBI even if you have not been contacted by them” and “how can I know for sure if I am being investigated by the FBI” and “what are some signs that the FBI is after you”. This is why when I commit crimes, I immediately go home and Google things like “someone stole my laptop and hacked the government” or “how to prove I am being framed for a crime I didn’t do”.

An interesting new case has been filed by blockchain gaming company FractureLabs against trading firm and market maker Jump Crypto, alleging that Jump defrauded Fracture and manipulated the markets for its DIO token. Fracture has described a pump-and-dump scheme allegedly perpetrated by Jump in concert with the Justin Sun-affiliated cryptocurrency exchange HTX (formerly Huobi).4 Amusingly, much of the complaint seems to come down to allegations that Jump Crypto did not do the market manipulation they had promised to do when they advised Fracture that they would “maintain the pricing parameters” that were required as part of a listing agreement. Instead, Fracture claims, Jump and HTX hired “online influencers” to pump the DIO token price, then profited millions of dollars when they dumped the token and caused its price to crash from almost $1 to less than half a cent. The suit is still very early — it was filed on October 15 and Jump has yet to respond — but it’s an interesting complement to the recent action from US law enforcement and regulators implicating market makers GotBit, MyTrade, ZM Quant, and CLS Global in providing “on-demand market manipulation” [I68]. The practice has long been an open secret in the crypto world — to the point that some in the industry occasionally seem to forget that it’s illegal — but now it seems that some companies may face more scrutiny for this activity.

Speaking of those charges against the market makers: the founder of MyTrade quickly entered a guilty plea. Liu Zhou, who founded and operated MyTrade, reportedly told a client that their service was to locate “other buyers from the community, people you don’t know about or don’t care about” because “we have to make [the other buyers] lose money in order to make profit.” As a part of his plea, Zhou agreed to stop providing a service that used wash trading bots to falsify cryptocurrency trading volume for token creators — bots that were wash trading millions of dollars a day for around 60 different cryptocurrencies. He also faces up to five years in prison and potential fines, and is scheduled to be sentenced in February.5

As for GotBit, the Department of Justice filed a superseding indictment to add charges against the company’s founder and CEO, Aleksei Andriunin. They allege that GotBit earned tens of millions of dollars in proceeds from their wash trading. If convicted on the wire fraud charge, Andriunin faces up to twenty years in prison.6

Chirag Tomar, who created a fake replica of the Coinbase Pro website beginning in June 2021 and used it to drain victims’ Coinbase accounts, has been sentenced to five years in prison after pleading guilty to wire fraud conspiracy earlier this year. He successfully defrauded hundreds of people of more than $20 million in total, which he spent on luxury vehicles and trips. Although he’s an Indian citizen, he was arrested by US authorities in December 2023 after he flew in to Atlanta.7

It’s been a bad few days for creators of knockoff Bored Apes. The creator of the “Undead Apes Society” Solana-based NFT project, who was indicted in January after rug-pulling a spinoff project in April 2022 [W3IGG], was found guilty on wire fraud conspiracy and money laundering charges. A co-defendant had already pleaded guilty to the same charges earlier this year.8 Meanwhile, the creator of “Mutant Ape Planet”, who was charged in January 2023 for the $2.9 million rug pull [W3IGG], has been ordered to forfeit $1.4 million and pay an additional $15,000 fine. The month he spent in jail while awaiting trial was deemed sufficient by the judge, though prosecutors had sought a three year prison term.9

Craig Wright, whose claims of being bitcoin inventor Satoshi Nakamoto were definitively rejected earlier this year when he lost a court case aimed at stopping him from continually trying to sue bitcoin developers [I51, 52, 53, 54, 62], is once again trying to sue bitcoin developers. His latest lawsuit, which he filed without legal representation against Bitcoin Core developers and Jack Dorsey’s fintech company Block, seeks £911 million ($1.18 billion) in damages. He argues that this is the difference in market caps between bitcoin and his fork of the project called “Bitcoin SV”, which he insists is the “real” bitcoin.10 The judge in the earlier COPA v. Wright case had placed an injunction preventing Wright from bringing any new lawsuits based on his claim that he is Satoshi Nakamoto. This newest lawsuit was almost immediately placed on hold pending a hearing in the COPA case to determine if Wright is in contempt of court, though Wright has argued his newest lawsuit is not predicated on claims that he is Satoshi. COPA wants to force the now Singapore-based Wright to attend the contempt hearing in person in the United Kingdom, but Wright has argued that his autism, Christmas plans, and the likelihood of jet lag should prevent such a thing.11

The former CEO of the Australian cryptocurrency exchange Mine Digital has been charged with fraud over allegations that he stole US$1.5 million from a customer who gave him the money to purchase bitcoin. Instead, the money went to paying the company’s debts and other purposes. It might have bought the CEO a little bit of time, but Mine Digital collapsed two months later in September 2022, and creditors are reportedly owed around $16 million.12

In bankruptcies

The FTX estate has been pursuing legal action against various firms still hanging on to crypto assets that FTX says belong to them. They recently settled a lawsuit with the ByBit cryptocurrency exchange, with ByBit agreeing to return $175 million in assets held on the platform and buy back FTX’s BIT tokens for around $53 million. The original lawsuit sought to recover assets priced at around $327 million at the time of FTX’s collapse, but priced at around $1 billion at the time the suit was filed.13

They’ve also filed suit against another crypto exchange, KuCoin, aimed at recovering around $50 million. FTX’s lawyers claim that KuCoin has “without justification refused to turn over the assets”, and seeks the return of the funds as well as potential damages. KuCoin has disputed FTX’s version of events, claiming they had repeatedly tried to contact FTX to discuss the frozen funds.14

In governments and regulators

The SEC has filed yet another Wells notice, this time against the Immutable blockchain gaming infrastructure company. As usual, the news comes from Immutable themselves, and is filled with the industry’s typical accusations: that the SEC is “targeting some of the largest and most reputable actors in the space” instead of providing “clear guidelines for compliance”. Somewhat unusually, Immutable tries to connect the Wells notice to the US election, writing “It does not take an astute observer to connect the timing” without providing any indication as to why they think the timing would be related at all.15

In elections and political influence

With only days until the US election, things have reached a fever pitch. Even with very little time left to spend it, firms and executives in or connected to the cryptocurrency industry have been pouring even more money into races they’ve already spent over a hundred million dollars to influence.

Ripple CEO Chris Larsen, who I mentioned last issue has been supporting the Harris (and previously Biden) campaign and other Democrats for years, dropped a whopping $10 million more on the Harris-supporting Future Forward PAC in the last days of September. Although he is the only individual out of the 31 I follow at Follow the Crypto who has contributed specifically to back Harris, his total contributions of almost $12.6 million outspend the combined $10.6 million from the nine who’ve contributed dedicated support to Trump. However, despite its CEO’s spending, Ripple still seems to be trying to playing both sides: corporate contributions have gone in equal amounts to both the “progressive” Protect Progress and “conservative” Defend American Jobs crypto super PACs, and Ripple Chief Legal Officer Stuart Alderoty has spent $300,000 of his own to back Trump.

Marc Andreessen contributed another $2 million to Trump’s campaign on October 7, bringing his total Trump spending this cycle to $5.35 million. This contribution came on the same day his Andreessen Horowitz co-founder Ben Horowitz sort of followed through on his earlier backpedal, in which he’d promise to make a “significant donation” to Harris [I68]. Horowitz did indeed donate an additional $2.5 million after that promise, but it went to BlackPAC, a left-leaning super PAC that focuses on engaging Black voters. Although BlackPAC does support Harris, it also support a list of candidates down the ballot, and it’s not clear if Horowitz’s money will be earmarked for Harris or used more broadly. Ironically, one of the other candidates supported by BlackPAC is Ohio Senator Sherrod Brown, who has been facing off against Republican opponent Bernie Moreno. Moreno has been backed by $40 million in spending from the cryptocurrency industry super PACs — PACs which Horowitz has personally supported to the tune of $23.5 million. Horowitz and his wife have also both maxed out their individual contributions to Moreno.

Coinbase

The other major recent contribution came from Coinbase, with CEO Brian Armstrong announcing on Twitter that the company had dumped another $25 million into the Fairshake crypto-focused super PAC (on top of the $46.5 million they’d previously provided). Coinbase still holds an active contract with the US Marshals, and, as I reported this summer, federal contractors are prohibited from contributing to political entities including super PACs.

Despite being the subject of our complaint with the FEC pertaining to their $25 million contribution to Fairshake in May, which was also within the prohibited time period, Coinbase has brazenly doubled this amount with a second contribution. While they’ve not (at least that I’ve seen) argued that they were unaware of this campaign finance prohibition, which would already be unlikely given clear warnings on Fairshake’s website that contributions by federal contractors are prohibited, this newest contribution seems to definitively remove that potential line of argument for them.

Instead, Coinbase’s only rebuttal to our complainta has been to claim that, despite that pesky federal contract of theirs, they somehow aren’t a federal contractor due to a detail in how the contract is funded. Because the contract is being paid out of the pool of seized cryptocurrencies and other assets known as the Department of Justice Asset Forfeiture Fund, they’ve argued they do not fall within the definition of “federal contractor”16 used by the FEC because they are not paid with “funds appropriated by the Congress” — an argument that lawyers at Public Citizen have plainly described as “incorrect”, and one that we rebutted on August 5 in our supplemental filing (citations omitted here):

As the Supreme Court has recently explained, “an appropriation is simply a law that authorizes expenditures from a specified source of public money for designated purposes.” Under this definition, Congress’s enactment 28 U.S.C. § 524(c)(1),b creating the Assets Forfeiture Fund and authorizing the Attorney General to make expenditures from that fund for specific purposes, was an appropriation. Indeed, over the past five decades, both courts and the Department of Justice have considered the statutory creation of the fund to be an appropriation. The Congressional Research Service has similarly described the statute as a “permanent appropriation.”

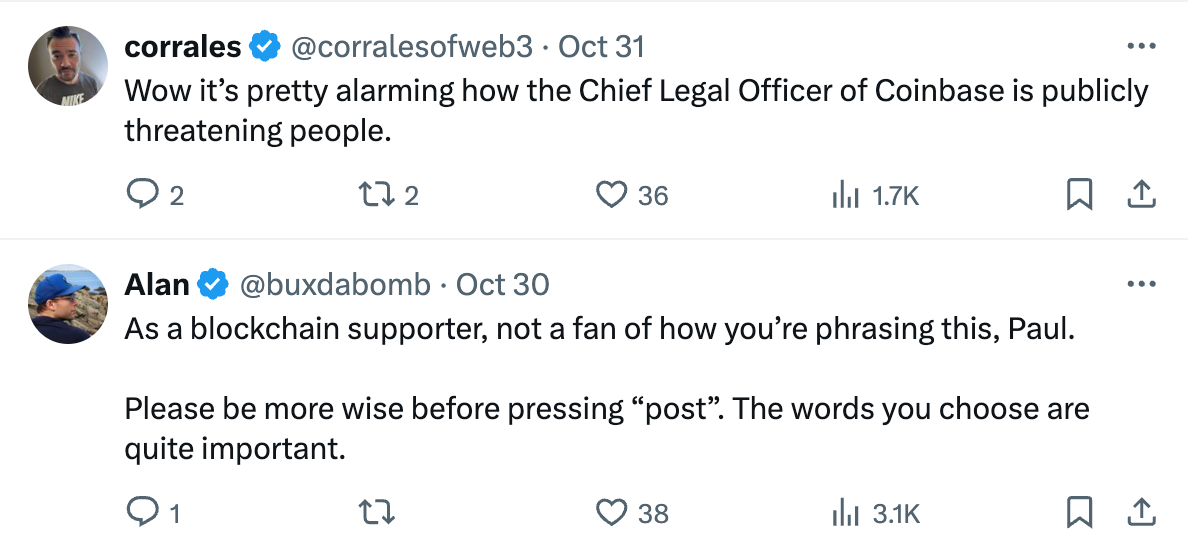

Coinbase’s only communications with me since the FEC complaint have been public, made via a handful of tweets171819 from Chief Legal Officer Paul Grewal. In them, he outlined this argument while also insinuating that I am intentionally spreading “misinformation” on behalf of my shadowy backers. While Grewal has come up with this rather creative legal theory under which he argues Coinbase’s contributions were not prohibited, he has not identified any factual errors in my reporting. As far as I’m aware, neither he nor anyone else from Coinbase have commented on our position since we made the supplemental filing on August 5, except to repeat the claim in a tweet19 (without adding any further support for it) that the funds with which they’re being paid are not Congressionally appropriated.

Despite that, Grewal retweeted my recent post highlighting Coinbase’s newest contribution and its apparent violation of this prohibition with a threat, writing: “Once again, with feeling. Repeating misrepresentations of facts after previously being put on noticec is …. unwise.” And for the record, Grewal is not some total hack with no legal background, but is in fact an ex-magistrate judge who has somehow now found himself reduced to issuing impotent threats on Twitter for Coinbase. (I assume the position pays pretty well, but I can’t imagine any salary at which I would be willing to post with a straight face that it would be “.... unwise” for a writer to continue to report on my company). Lest you think that Grewal is simply a loose cannon, perhaps sent off the rails by knowledge of Coinbase’s poor earnings that would be reported the next day,20 Coinbase communications team member Jaclyn Sales also reshared the threat, adding “Say it louder for the people in the back”.

Some Coinbase supporters have found themselves in the awkward position of trying to defend one of the largest cryptocurrency companies that, on one hand, claims to support individual freedoms and fight back on behalf of the little guy against powerful institutions, but on the other hand threatens independent writers with baseless lawsuits. Ironically, several have accused me (but not Coinbase) of “lawfare”; others have pretended that his tweet somehow isn’t a legal threat. However, many even within the crypto world responded to his tweet to criticize both Grewal and Coinbase for this clear attempt to silence me.

Stand With Crypto

Coinbase’s astroturfed [I59, 61, 62] lobbying group, Stand With Crypto, has been hard at work getting out the vote for their preferred candidates — both the ones they’ve formally endorsed, and the ones they’ve conspicuously left off the list in order to avoid the risk of appearing to back losers [I68].

Despite leaving Bernie Moreno off their endorsements list, Stand With Crypto threw a private benefit concert in Akron, Ohio that was nonetheless free to attend for anyone willing to fork over their contact information and download the Coinbase app. Headlining the show was the formerly popular band The Black Keys, self-described “pretty liberal motherfuckers” who once made fun of “right-clicking” NFTs, who have now found themselves playing a show to benefit a staunchly conservative candidate whose election could turn the Senate over to a Republican majority.21 Likely, they chose to take this gig for the paycheck despite all that after they were forced to cancel every concert on their planned tour this summer due to poor ticket sales. The Black Keys themselves, from the stage, referred to the event as the “weirdest gig we’ve ever played” — perhaps referring to the fact that their staging was set up backwards, with the band facing around 250 attendees standing with them on the stage, but leaving the large orchestra seating area empty and the roughly 250 people in the balcony area left to stare at scaffolding for the lights, and the performers’ backs. This bizarre choice was likely related to the fact that only around 500 people bothered to show up for a free concert in a venue that seats five times as many people. After more than thirty minutes of opening remarks extolling the virtues of crypto, during which one attendee joked they’d been tricked into attending a time-share presentation and another loudly asked the speaker “why should we vote for crypto?” (and was ignored), the Black Keys launched into a set that wasn’t much longer.22 In between songs, irritated concertgoers who had been relegated to the balcony shouted at the band members to turn around, or at least turn off the lights so they could see.23

(via FalconFlower)

Meanwhile, after regularly encouraging crowds to “videotape and tape record anything I say”, Moreno’s campaign has been accused of using audio jammers to try to thwart those trying to ask questions of the Senate hopeful such as “do you have any other opinions on women over fifty you would like to share?”2425 This is a reference to Moreno’s comments earlier this year that suburban women are single-issue voters for candidates who support abortion rights, and that that’s “a little crazy by the way — especially for women that are like past 50 — I’m thinking to myself, ‘I don’t think that’s an issue for you.’”26 Physically bearing children is certainly not an issue for Moreno either, but that somehow didn’t stop him from expressing his own vehement opinion in an interview last year that it’s “insane” that, “as a father of two daughters”, if one of them became pregnant as a result of a rape, they could get an abortion without first obtaining his consent.27 (Moreno’s daughters are around 30 years old.28)

Other crypto PACs

A new super PAC called the Bitcoin Voter PAC has cropped up to fund almost $75,000 in ads and text messaging campaigns for Donald Trump and Senate candidates Ted Cruz (R-TX) and Dave McCormick (R-PA). Its sole reported source of funding thus far is $65,000d from the “Bitcoin Voter Project”, which is supposedly a 501(c)4, though I wasn’t able to find a group with that name in the IRS database. The organization was created by three executives from the bitcoin mining companies Marathon Digital, Riot, and CleanSpark.29 They’ve put out a few ads, including one in Pennsylvania urging voters to vote for Trump and McCormick. It features Trump’s comments about “ensur[ing] that the future of bitcoin and crypto will be made in America”, and promises the industry will create jobs for Pennsylvanians (despite bitcoin mines not typically employing very many people30).31 Another ad aired in Texas threatens that “America’s financial freedom is under attack” and shows Cruz arguing that Texas should be “the oasis on planet earth for bitcoin and crypto”.32

Another group, the “Bitcoin Freedom PAC”, has emerged to dump $350,000 into the Texas Senate race to back Cruz against his Democratic opponent, who has also been friendly towards crypto. Recent contributions from these two PACs seem to betray nervousness around the closeness of that race, which has tightened in some polls to even or extremely close odds.3334 The Bitcoin Freedom PAC’s website puts their strategy bluntly: “We believe the only way to protect Bitcoin is to beat Democrats in the House and Senate this November so we can block White House regulations AND remove anti-Bitcoin Senators such as Elizabeth Warren and Sherrod Brown from their powerful positions on the Hill”.35

A joint fundraising committee called “Republicans for A Pro-Crypto Senate Majority” was created and then disbanded almost as quickly, registering with the FEC on August 26 and then filing a termination report on October 30. The group listed as beneficiaries of its fundraising various PACs for the Republican Senatorial candidates Sam Brown (NV), Bernie Moreno (OH), Mike Rogers (MI), Dave McCormick (PA), as well as the National Republican Senatorial Committee. The group raised a total of $208,000 over its short lifespan, bringing in about half of that just from Coinbase executives including CEO Brian Armstrong ($23,300), president Emilie Choi ($20,000), vice president Kara Campbell ($13,200), and chief policy officer Faryar Shirzad ($13,200). Other notable contributions, all in the amount of $13,200, came from Multicoin Capital co-founder Tushar Jain, Paxos CEO Charles Cascarilla, Haun Ventures’ Kathryn Haun (formerly of Coinbase), Anthony Scaramucci, venture capitalist Mike Dudas, and Zachary Witkoff of both the Witkoff Group and Trump’s World Liberty Financial crypto projecte. Another $13,200 contribution came from Toby Scammell,f a man who served prison time and was fined as a result of both criminal and civil insider trading cases in 2014,36 and then who was fined $26 million by the FTC earlier this year for deceiving customers who were trying to obtain PPP loans37 (he lists his profession in the FEC report as “retired”). Another came from Ryan Selkis, best known for his Trumpy meltdown earlier this year that saw him ousted from the Messari blockchain analytics company he’d founded [I62] (he lists his job title as “founder” of “Newco”). Of the money raised by this committee, Bernie Moreno and Mike Rogers both received a bit over $50,000, Dave McCormick received around $43,000, Sam Brown received around $38,000, and the NRSC received less than $1,000. The remaining $16,000 or so went to operating expenses.

World Liberty Financial and Donald Trump

When I published the last recap issue, Trump’s World Liberty Financial token had only been live for about a day, and had only sold about 807 million (4%) of the 20 billion tokens they’d been hoping to offload on (accredited) rubes during the public sale [I68]. Even that 20 billion had been massively reduced from the 63 billion, then 35 billion, that they’d originally planned to offer.38 That early in, I was a little hesitant to confidently describe the project as a flop. Now, two weeks in, I’m happy to.

A full week after the sale began, the number of tokens sold had crept up to only around 936 million (4.7% of the target). Now, two weeks in, we’ve hit 975 million (4.9%). It’s been a hot minute since I’ve had to calculate a logarithmic regression, but if my math is right, at this rate Trump should hit his 20 billion token milestone at some point in around a bazillion years.g

However, rather than wait that long, the project has changed its plans. An October 30 filing with the SEC indicates that the project now “only plans to sell tokens up to $30M in the offering before terminating sale”. Though it’s a major reduction from the $300 million target originally planned, it’s still a far cry from the $2.7 million in sales they’ve reported thus far.39 This is a bummer for Trump, who, according to the project’s “gold paper” only begins to receive payouts after WLFI establishes a “reserve” consisting of the project’s first $30 million in revenue.40

Meanwhile, the project is reportedly considering launching a stablecoin.41 This is highly amusing to me given Trump’s forceful opposition to central bank digital currencies (CBDCs). When asked earlier this year about the possibility of the Federal Reserve creating a digital currency (which, despite conservative talking points, it has never proposed doing), Trump said that a “digital dollar” would be “very dangerous”.42 He’s said that digital dollars would be “dangerous threat to freedom”, potentially allowing the government to “take your money, and you wouldn’t even know it was gone”. Later, at the Bitcoin 2024 conference, Trump pledged “There will never be a CBDC while I’m president of the United States. Forget it.”43 But a digital dollar controlled by and for the financial benefit of him? Just show him where to sign.

A crypto Twitter regular claims to have identified the bitcoin wallet linked to the novelty “physical bitcoin” presented as a gift to Donald Trump at that same Bitcoin 2024 conference.44 If it is indeed the same one, those who think Trump is a true believer Bitcoin hodler are likely to be disappointed: within a couple months, he sold it off on the Gemini crypto exchange.

The trader who has poured more than $30 million into bets on Polymarket favoring Donald Trump to win the election has done an interview with the Wall Street Journal, using the pseudonym “Théo” and claiming to be a Frenchman with “absolutely no political agenda” whose “intent is just making money”. The Journal was careful to note they could not confirm all of Théo’s claims, including that he is only betting his own money, nor could they rule out links between Théo and political organizations or Trump associates. Rather unbelievably, he claims that he chose to bet tens of millions of dollars simply because he thought pollsters were underestimating support for Trump. He has also placed bets that Trump will win the popular vote — a highly unlikely proposition. If Trump loses, Théo stands to lose the tens of millions he wagered, which he said is the majority of his liquid assets. While some Polymarket bettors favoring Trump have been exiting their positions or at least hedging their bets as the election draws nearer, causing his “odds” on the platform to slump from previous highs of around 67%, this is not an option for “Théo”, who holds around 40% of the contracts on Trump to win and would likely crash the markets if he tried to sell.45

This report of a French whale underscores a point that is, bizarrely, not often prominently mentioned in discussions of Polymarket as a platform that could be akin to or even more reliable than traditional polling data: Americans are not permitted to trade on the platform. While it’s hard to know how many Americans are circumventing Polymarket’s weak enforcement of this restriction, many of the trades on the platform come from people who will not be voting in the election, but instead are watching it from afar. While non-Americans are of course perfectly capable of providing high-quality analysis of the American elections, trades on Polymarket are not akin to polls of American voters.

Furthermore, two separate investigations by blockchain research firms have both found evidence of significant wash trading on Polymarket’s election markets. An investigation by Chaos Labs estimated that one third of trades on the platform’s presidential election market were wash trades, while the investigation by Inca Digital said that wash trading was a “significant portion of the volume” in the presidential election market. Researchers also found that Polymarket had been vastly overstating the volume in their markets by conflating a traded share (which may sell for anywhere from $0.01 to $1) with $1 of volume. At the time of the report on October 30, Polymarket was reporting $2.7 billion in trading on the presidential election market, when in reality only $1.75 billion in transactions had occurred.46 At the time of writing, Polymarket shows $1.99 billion in volume on the presidential market, suggesting they may have updated their figures since the report.

Elsewhere in crypto

A bunch of cryptocurrency companies have just done rounds of major layoffs in very quick succession. MetaMask developer Consensys announced on October 29 that they had laid off 20% of their total team, which is likely somewhere in the ballpark of 150 people. They blamed the move on the SEC, because of course they did.47 Later that same day, decentralized exchange dYdX announced that it had laid off 35% of its “core team”, though it’s not clear how big that team was to begin with.48 The next day, cryptocurrency exchange Kraken announced layoffs,49 with the New York Times reporting the cuts affected around 15% of its employees, or around 400 people.50 Both dYdX and Kraken blamed the layoffs on needing to have more “builders” and fewer “managers”. Kraken’s layoffs included the company’s chief operating and chief technical officers, and venture capitalist Arjun Sethi was appointed as a new co-CEO alongside existing CEO David Ripley. Two years ago, Kraken laid off 1,100 people [I12] — at the time, around 30% of its employees — and around the same time, its founder and then-CEO Jesse Powell stepped down after internal turmoil and an investigation into sanctions evasion [I5]. However, he remained on as chairman.

As YouTube mega-influencer Mr Beast is facing scandal after scandal pertaining to allegations of mistreatment and sexual harassment at his company, deceiving his fans and rigging contests, and other such things, now a group of crypto researchers have alleged that he’s also been involved in massive crypto pump-and-dump schemes. It’s not clear if regulatory or law enforcement investigators have picked up on the allegations, and the crypto sleuths’ website outlining their research ends only with “advice for Mr. Beast” like “Stop using metamask swaps; they charge 0.875% fees”.51 Geez, Mr Beast, if you’re going to insider trade, at least do it somewhere with low fees!

Trends move quickly, but game development doesn’t. Despite the record low popularity of NFTs, Ubisoft’s many clumsy attempts over the past few years to force NFTs on their customers [W3IGG] have finally culminated in a launch trailer for an NFT game called Champions Tactics: Grimoria Chronicles — although the trailer makes no mention of the NFTs. Ubisoft seems almost embarrassed by the launch, putting practically no marketing behind it.52

The Bluesky social network, which I quite like, has raised a $15 million funding round led by... Blockchain Capital. Some other participants in the funding round are also crypto-focused investment companies or have crypto funds. In the announcement, Bluesky goes to great lengths to try to distance themselves from that whole blockchain thing, which I think really highlights just how toxic even a faint whiff of blockchain has become to normal people who just want a normal social network. While I’m not personally rushing to jump ship over this funding announcement, I do think it is concerning. Venture investors are not philanthropists, and Bluesky’s path to profitability is unclear at best. Despite their promises “not [to] hyperfinancialize the social experience (through tokens, crypto trading, NFTs, etc.)”, one wonders if that will hold up once their VCs come knocking at the door looking for returns on their investments — particularly now that their new board member, Blockchain Capital partner Kinjal Shah, will have a say in the future of the platform.53

The Golden State Warriors NBA team have adopted Coinbase as a new sponsor, after their previous sponsorship from FTX didn’t work out so well.54 Is there a team sponsorship curse, or is that just a stadium thing?

The Web3 is Going Just Great recap

There were seven entries between October 16 and November 2, averaging 0.4 entries per day. $73.42 million was added to the grift counter.

Hack the USA

[link]

It appears that someone managed to hack a wallet controlled by the US government, which was holding assets seized in connection to the 2016 Bitfinex hack. More than $20 million was emptied from the wallet, then the thief quickly began sending some of the funds to various exchanges — activity that helped to distinguish the transactions as likely theft, rather than the government moving crypto assets around as they sometimes do.

Curiously, within a day of the hack, the attacker returned around $19.3 million to the original wallet. One wonders if perhaps they suddenly realized that the juicy wallet they had targeted was owned by a rather menacing adversary.

There are a lot of open questions around this incident, including who controlled the wallet on behalf of the government. As I mention earlier in this issue, the US Marshals have turned over at least some of their custody and asset management responsibilities to Coinbase. However, some of the stolen funds were withdrawn from the defi borrowing and lending platform Aave, and it’s not clear if Coinbase is responsible for managing assets parked in defi protocols like this. Then there is the question of why the US Marshals have assets on platforms like Aave at all. While many people use these platforms to earn yield on their crypto holdings, it’s a bizarre choice for the US government to do so, particularly given the US regulators’ scrutiny of crypto lending services.

Everything else

- Supply chain attack stemming from JavaScript animation library results in losses for users of 1inch and other platforms [link]

- M2 cryptocurrency exchange hacked for $13.7 million [link]

- Sharpei memecoin rug pulls for $3.4 million [link]

- Blockchain company Forte acquires games studios, demands secrecy, shuts them down [link]

- Tapioca DAO exploited for most of its assets — over $4 million [link]

- Radiant Capital exploited again, this time for at least $50 million [link]

Worth a read

Cory Doctorow provides his perspective on Bluesky, including on their recent funding round. I particularly like his point: “Plenty of people have commented that now that a VC is holding Bluesky's purse-strings, enshittification will surely follow (doubly so because the VC is called ‘Blockchain Capital,’ which, at this point, might as well be ‘Grifty Scam Caveat Emptor Capital’). But I don't agree with this at all. It's not outside capital that leads to enshittification, it's leverage that enshittifies a service.”

Cory is a fellow POSSE-er (and major inspiration to me when I adopted the practice), and has opted not to use Bluesky because he has vowed to “never again devote my energies to building up an audience on a platform whose management can sever my relationship to that audience at will.” Personally, I’ve gone the route of using the platforms that interest me, even the potentially enshittification-prone ones like Bluesky and Threads, but hedging my bets by plugging them into my POSSE system where they can just as trivially be unplugged.

Mike Masnick, who I also deeply admire, and who has recently been a promising addition to Bluesky's board, provided a response to some of Cory's points. In my opinion, telling someone to “just host your own personal data server” is not a terribly feasible proposition at this point in time, but I hope to see it rapidly become so — at which point I’d expect people like Cory to be more amenable to trying the platform.

I loved Jason Koebler's piece about how billionaires buying media outlets won’t, as one such billionaire contends, protect journalism. He also gives a nod to my recent piece on “just go independent”, which is lovely of him.

In the news

Mark Cuban, whose crypto bags are oh so very heavy, says that crypto is waiting for its “Instagram moment”: the moment when a crypto app comes along that's so compelling that even grandma has to make a crypto wallet to use it. I point out the slight issue that compelling apps don’t tend to require crypto wallets. We also talk about election stuff a bit.

TechCrunch wrote about my run-in with the DMCA scammer that I described last issue.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

“US government seeks return of $13 million in political donations from former FTX executives”, The Block. ↩

“Pump.fun Attacker Seeks to Withdraw Guilty Plea as Lawyers Quit Case”, Decrypt. ↩

Complaint filed on October 15. Document #1 in FractureLabs v. Jump Trading. ↩

“Founder of Cryptocurrency Financial Services Firm “MyTrade” Pleads Guilty to Market Manipulation and Fraud Conspiracy”, U.S. Attorney's Office, District of Massachusetts. ↩

“Founder of Cryptocurrency Financial Services Firm "Gotbit" Indicted for Market Manipulation and Fraud Conspiracy”, U.S. Attorney's Office, District of Massachusetts. ↩

“Indian National Is Sentenced To Prison For $20 Million Dollar Fraud Scheme Involving Fake Cryptocurrency Exchange Websites”, U.S. Attorney's Office, Western District of North Carolina. ↩

“Jury Finds Non-Fungible Token Developer Guilty Of Defrauding Investors And Laundering Proceeds Through Solana And Ethereum Blockchains”, U.S. Attorney's Office, Middle District of Florida. ↩

“Mutant Ape Planet Fraudster Avoids Prison for NFT Scam”, Bloomberg. ↩

“Craig Wright Says Bitcoin Devs 'Misled the Public' in New $1 Billion Lawsuit”, Decrypt. ↩

Tweet thread by BitMEX Research. ↩

“Ex-CEO of Mine Digital stole $1.5M from Bitcoiner, regulator alleges”, Cointelegraph. ↩

“FTX's $228M Settlement With Bybit Brings Conclusion of Epic Liquidation Closer”, CoinDesk. ↩

“FTX estate sues KuCoin to recover over $50M in assets”, Cointelegraph. ↩

“Defending digital ownership in gaming: Immutable’s response to the SEC’s Wells Notice”, Immutable. ↩

Tweet thread by Paul Grewal. ↩

Tweet thread by Paul Grewal. ↩

“Coinbase drops 15% after earnings, posts worst day in more than two years”, CNBC. ↩

“‘America Loves Crypto’? The Black Keys Will Play Ohio Concert Amid Contentious Senate Race”, Decrypt. ↩

“What was up with The Black Keys and their weird private Akron crypto show?”, Cleveland. ↩

“Ohio GOP candidate in key Senate race uses anti-recording tech to combat 'trackers'”, Business Insider. ↩

“Videos show Senate candidate Bernie Moreno using audio jammer at campaign events”, NBC 4 at 5. ↩

“An issue for them? Ohio’s 50+ women emboldened by Moreno comments on abortion”, Ohio Capital Journal. ↩

“GOP congressional candidate Max Miller is engaged to Emily Moreno, daughter of U.S. Senate candidate Bernie Moreno”, Cleveland.com. ↩

“Mining execs establish organization to influence US crypto voters”, Cointelegraph. ↩

“Bitcoin miner’s $640m megadeal stumbles as Texans sour on industry’s promise of jobs and growth”, DL News. ↩

Texas Senate race polls, 538. ↩

“Protecting Ted Cruz’s Senate seat is a ‘top priority‘ — Crypto PAC”, Cointelegraph. ↩

“Bay Area Man Pleads Guilty To Securities Fraud By Insider Trading In The Walt Disney Company’s Acquisition Of Marvel Entertainment In August 2009”, U.S. Attorney's Office, Central District of California. ↩

Order on stipulation filed on April 3, 2024. Document #1 in FTC v. Oto Analytics. ↩

“No one wants Trump’s crypto”, The Context. ↩

Form D filed by World Liberty Financial Inc. on October 30, 2024. ↩

“World Liberty Gold Paper”, World Liberty Financial. ↩

“Trump Crypto Project World Liberty Plans to Issue Stablecoin, Sources Say”, Decrypt. ↩

“Trump Calls Central Bank Digital Currency ‘Very Dangerous’—After Vowing To Prohibit Fed’s ‘Digital Dollar’”, Forbes. ↩

“As Trump Stumps Against CBDC, Fed Chair Says 'Nothing New' With Digital Dollar”, Decrypt. ↩

“The Trump-Betting Whale Speaks Out: ‘I Have Absolutely No Political Agenda’”, The Wall Street Journal. ↩

“Exclusive: Election betting site Polymarket gives Trump a 67% chance of winning but is rife with fake ‘wash’ trading, researchers say”, Fortune. ↩

“Consensys’ Path To Long-Term Sustainability and Decentralization”, Consensys. ↩

“Letting go”, dYdX. ↩

“A new day for Kraken”, Kraken. ↩

“Kraken Lays Off 15% of Workers and Names New Co-Chief Executive”, New York Times. ↩

“MrBeast Investigation”, loock.io. ↩

“Ubisoft Just Quietly Launched a Full-Blown NFT Game”, IGN. ↩

“Bluesky Announces Series A to Grow Network of 13M+ Users”, Bluesky. ↩

“Golden State Warriors Name Coinbase as Crypto Sponsor, Replacing FTX”, Decrypt. ↩

Footnotes

At least publicly, that is. They are presumably in active communication with the FEC, where perhaps they are making other arguments, but Public Citizen and I are not privy to those conversations. ↩

Amusingly, though Coinbase’s claim that they are not subject to this prohibition hinges on their argument that the Department of Justice Assets Forfeiture Fund is not an appropriation by Congress, the AFF was established by Congress in a section of law titled “Availability of appropriations”. ↩

“Put on notice” generally refers to the requirement in many (all?) defamation statutes that, before suing, a plaintiff must first serve notice to the defendant that they have made false statements and identify which statements those are. These are typically accompanied by demands for removal or correction. These notices are not typically made via vague tweet, nor do they normally consist of statements that the plaintiff merely disagrees with an opinion a defendant has formed based on public and uncontested facts. Tweets aside, I have not received any such notice or demand — though I know Coinbase has my (very easy to find) email address, as I have reached out for comment from them several times, and they have replied once. ↩

Expenditures are reported more frequently than receipts, so it’s not unusual for expenditures to appear to be greater than funds raised. ↩

Zachary Witkoff, his brother Alex, and his father Steven are all involved in their family business, the Witkoff Group real estate development firm, but also in Trump’s World Liberty Financial project (where all three are listed as “co-founders”). The elder Witkoff is a major ally and golfing buddy of Trump’s, and was golfing with him in September when a man was discovered in the bushes with a rifle, suspected of plotting to assassinate Trump. Somehow, in the FEC filing for his contribution, Zachary Witkoff managed to misspell his company name, also his own last name, as “Whtikoff”. ↩

[insert obligatory nominative determinism joke here] ↩

I did actually do the math, the number is too large to even have a reasonable comparison but is somewhere in the ballpark of 8.9 × 10129 years from now. ↩