Issue 70 – The Cryptocurrency States of America

Crypto’s efforts to buy the 2024 elections paid off, and we’re in for a bumpy ride.

As you might have already heard, Donald Trump was recently elected to be the next president of the United States. The cryptocurrency industry is in seventh heaven, happy to ditch their supposedly anti-government, pro-freedom ideology in favor of embracing an authoritarian if it means number go up.

And number has gone up: Bitcoin has recently hit a new all-time high of nearly $93,000 — shattering the pre-election record of around $72,000. Other cryptocurrencies have also rallied to varying degrees, as they tend to do when Bitcoin prices rise.

Hints of the future crypto-stained presidency are already cropping up. Donald Trump has announced he plans to createa a “Department of Government Efficiency” — or D.O.G.E. for short — an idea Elon Musk has been promoting with sophomoric dogecoin memes for months now (though not nearly as long as he has been toying with the price of dogecoin by tweeting various memes and veiled references [I29, 65]). Perhaps not trusting Musk with sole leadership of this new department, Trump says he’ll make Musk and fellow crypto enthusiast Vivek Ramaswamy co-head.

Musk’s first response to the president-elect’s announcement was to tweet “The merch will be 🔥🔥🔥”, which is certainly an odd priority for someone who has promised to slash government excess. Indeed, D.O.G.E. merch giving a nod to the memecoin has already made its way into Trump’s official web store, which now features a t-shirt emblazoned with Trump’s and Musk’s faces, along with a photograph of the shiba inu dog that serves as dogecoin’s mascot.

Various other crypto promoters are joining Trump’s orbit, including his transition team co-lead Howard Lutnick, Attorney General pick Matt Gaetz, and Defense Secretary nominee Pete Hegseth.

All of this to say: I suspect I won’t be running out of things to write about anytime soon. If you haven’t already subscribed to this newsletter, consider signing up for a free or pay-what-you-want subscription to receive each issue in your inbox, and to support my work — which is entirely possible thanks to support from readers like you.

In the courts

The final defendant in the FTX case, co-founder and former Chief Technology Officer Gary Wang, will be sentenced next week. He’s requested a non-custodial sentence,1 and I think he’s extremely likely to get one based on the government’s sentencing submission. The government notes that Wang “decided to cooperate immediately, even though he was not involved in many aspects of the criminal enterprise, and there was little documentary evidence linking Wang to the frauds on FTX’s customers and investors.” The government also notes that Wang has since developed a tool for the government to detect fraud in the stock market — the details of which are redacted from the public record. They write that “Wang is in the process of developing a similar tool for cryptocurrency markets, which – if he is sentenced to a time served sentence – the Government hopes it will be able to take advantage of early next year.” There’s cooperating, and then there’s cooperating.2

Prosecutors in the FTX case have also filed a forfeiture complaint aimed at seizing around $16 million in various crypto assets held in a Binance account. The prosecutors say they believe these funds belong to the recipients of a $150 million bribe to Chinese officials by FTX executives, paid to unfreeze Alameda accounts containing around $1 billion in crypto assets that had been frozen by Chinese authorities.3 Sam Bankman-Fried was originally charged with conspiracy to violate the anti-bribery provisions of the Foreign Corrupt Practices Act, but as with several charges added after Bankman-Fried was extradited from the Bahamas, it was split into a separate trial [I30] which later was dropped by prosecutors after Bankman-Fried earned a 25-year prison sentence on the first set of charges.

Ilya Lichtenstein, the man behind the 2016 theft of nearly 120,000 bitcoin from the Bitfinex cryptocurrency exchange, has been sentenced to five years in prison after both he and his wife, Heather “Razzlekhan” Morgan, pleaded guilty to money laundering conspiracy. Razzlekhan is set to be sentenced on Monday, and is likely to get a lighter sentence due to her lack of involvement in the original theft [I52, 68].

Roman Sterlingov has been sentenced to 12 ½ years in prison for his role in operating the Bitcoin Fog cryptocurrency mixing service [I52, 53, 64]. He has also been ordered to pay a nearly $400 million judgment — roughly the value at time of receipt of the more than 1.2 million bitcoin laundered via Bitcoin Fog throughout its operation.4b According to prosecutors, Bitcoin Fog was a “go-to” service for criminals to launder their cryptocurrency, a process by which “dirty” tokens linked to scams, thefts, or other various criminal activities are made more difficult to trace on the otherwise highly-traceable public ledgers known as blockchains. Throughout the trial, Sterlingov maintained that he did not run Bitcoin Fog, but was merely a user of the service. Prosecutors sought a 30-year sentence, but the judge opted to go lower, stating that he wished to balance deterring other would-be crypto criminals while also matching Sterlingov’s degree of culpability.5

The judge in Celsius founder Alex Mashinsky’s criminal trial has denied his January 2024 motion to dismiss two charges [I49], meaning that (absent future dismissal for other reasons) Mashinsky will face all seven original charges when his trial begins in January 2025.6

South Korean police have arrested 215 people suspected of stealing the equivalent of around $228.4 million in a crypto scam that impacted around 15,000 people. Victims were promised high returns, while the group manipulated the markets for the tokens to artificially inflate the prices.7

Indian police have arrested a man they believe may be linked to the $235 million WazirX hack in July [I62, W3IGG]. It doesn’t seem that the man was himself behind the hack, but instead had opened an account on WazirX under an alias and then sold it to another person. Hackers regularly attempt to fraudulently obtain credentialed accounts on platforms that require know-your-customer verification, and this legal action demonstrates the risk that people selling such accounts may find themselves in hot water for the actions of their customers.8

In bankruptcies

Former Alameda Research co-CEO Sam Trabucco has agreed to forfeit assets to the FTX estate as part of a settlement. As a refresher, thanks to either great timing or the knowledge that things were about to go belly-up, Trabucco resigned from Alameda Research in August 2022, only a few months before the FTX empire collapsed. He has remained a member of my “conspicuously missing” list of FTX-adjacent power players who were rarely mentioned in the criminal trial. For a while, many wondered if he might be hiding out in international waters on his $2.5 million, 52-foot yacht — purchased for him by the company, and christened Soak My Deck. The real story is likely less interesting: he’s just been living in San Francisco, keeping a low profile, and periodically interacting with government and bankruptcy representatives via his lawyers. This is supported by the conversation I had with Ryan Salame last month, who, when I asked about Trabucco, replied: “He's living his life in his apartment in San Francisco. I see him from time to time, maybe once a quarter. You know, I think he’s just waiting until everything shakes out.”

Trabucco has agreed to forfeit two San Francisco apartments that he purchased in June 2021 for a combined $8.7 million, claims on approximately $70 million in assets on FTX, and — sadly for him — his beloved Soak My Deck. According to the filing, “Debtors have determined that during his tenure at Alameda, Trabucco received the benefit of approximately $40 million in potentially avoidable transfers from the Debtors”.9

FTX has also unleashed a flood of 36 adversary cases seeking to recover assets from various entities and individuals. They make for very informative reading as far as the kind of shady business happening not only within FTX, but within the broader orbit of other cryptocurrency companies, customers, investors, and various vendors doing business with them. Because of the quantity, I think they deserve their own standalone issue, so stay tuned for that.

In governments and regulators

The meteoric rise of the crypto betting platform Polymarket, the billions of dollars placed in bets on the outcome of the United States presidential election, and rumors of market manipulation and other malfeasance seem to have culminated in various investigations against the platform.

One, from France’s gambling regulator, seeks to “examin[e] [Polymarket’s] operation and compliance with French gambling legislation”. French law requires gambling platforms to register with and submit to oversight from the country’s gambling authority, as well as pay rather hefty taxes. Polymarket has not done any of these things, and so is likely to be shut down in the country. Although France’s gambling regulator has reportedly been eyeing the platform for a while now, the headline-making bets on a Donald Trump win from a trader who claims to be French [I69] may have hastened things along.10

Over in the US, the FBI raided the apartment of Polymarket CEO Shayne Coplan on November 13. Although Polymarket is based in the United States, it is not meant to be available to US-based bettors following a 2022 wind-down order (and fine) from the CFTC [W3IGG]. However, Polymarket — like many crypto platforms — does the bare minimum to pretend they’re putting in effort to prevent prohibited users from using the platform. If a person tries to place bets while connected from an IP address that geolocates to the United States, the site prevents them from doing so. However, IP-based location spoofing is an incredibly easy task, and many Americans have been using this technique to gain access to betting on the site. As is becoming the norm for crypto-related platforms or people and platforms associated with the American right when scrutinized by law enforcement or regulators, Polymarket was quick to condemn the raid as “obvious political retribution by the outgoing administration against Polymarket for providing a market that correctly called the 2024 presidential election”.11

In elections and political influence

Crypto PACs

While the cryptocurrency industry failed to convincingly prove their claims that there were a flood of single-issue crypto voters waiting to hit the polls, they proved that they didn’t actually need people to care about crypto so long as the billionaire industry executives had enough money to throw around. And they sure did: the cryptocurrency industry spent roughly $190 millionc on this cycle alone.

While some individual crypto industry executives contributed to the presidential race, crypto-focused super PACs steered clear, instead sticking to Congressional races. Seven executives from the crypto world directly contributed more than $100,000 apiece to back Trump, while only one put funding behind Harris. Trump’s backers were Marc Andreessen ($5.35 million), both Winklevoss twins ($1.3 million apiece), Kraken’s Jesse Powell ($1 million), Sequoia’s Doug Leone ($1 million), Ripple’s Stuart Alderoty ($300,000), and Multicoin Capital’s Kyle Samani ($300,000). They were all outspent, however, by the single donor to Kamala Harris: Ripple co-founder and executive chairman Chris Larsen ($12.6 million).

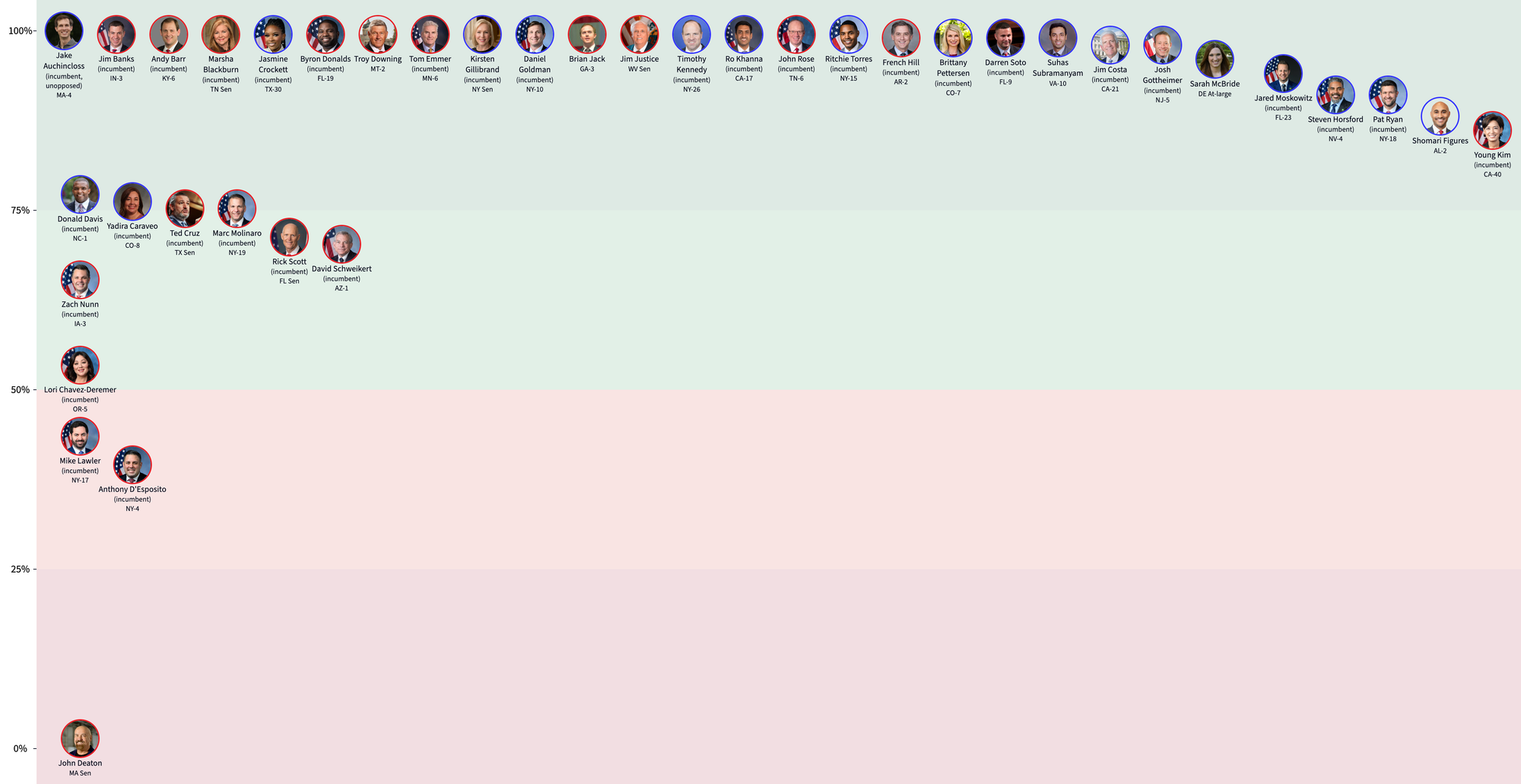

As for the Congressional races, the crypto-focused super PACs spent in 68 races across 35 states. $70.9 million went to support Republicans, and $48.3 million backed Democrats. Only ten races failed to go their way (eight if you exclude two races where candidates they backed in the primaries withdrew — and in both of those two races, the crypto PACs chose new candidates to support who went on to win). 58 races went how they wanted them to go, with either their supported candidate winning the election, or candidates they spent to oppose losing. The remaining two races — California’s House District 45 and Alaska’s House At-Large District — have still not been called, as of writing.

Certainly, some of their success comes down to the PACs’ willingness to shell out massive amounts of money. The crypto PACs put $40 million behind Ohio’s Republican Senatorial candidate, car salesman and one-time blockchain entrepreneur Bernie Moreno, and the tight margins in his race against Democratic incumbent and crypto opponent Sherrod Brown means that it’s possible that it was the crypto spending that made the difference.

However, it’s important to note that cryptocurrency PACs were largely going with a “back the winners” strategy in this cycle — exemplified by their spending on candidates like Jim Justice (R, WV Senate) and John Curtis (R, UT Senate), who were all but assured to win their races, and whose races were called moments after polls closed. Although it took a while for me to realize this — there were times when I wondered why the crypto PACs were supporting some candidate when their opponent seemed roughly equivalent in their crypto-related stances — the strategy later became clear. As I noted in an earlier issue [I68], a whopping 32 of the 39 candidates endorsed by Coinbase’s advocacy group Stand With Crypto had been assigned a 75% or more chance of winning their respective races.

I wrote then that the industry seemed to be “setting themselves up for a guaranteed post-election victory lap” by betting on the winners. Now, a week after election day, they’re still circling the track and hollering about their victory, long after most of the spectators have gone home. They’ve sent out emails, shamelessly boasting about buying the elections with lines like “Crypto’s big bet pays off” and “The crypto army is striking!”.12

This strategy of betting on the winners was partly to ensure loyal advocates in Congress, but it was also because the crypto industry’s spending was as much a show of force as it was about actually achieving their desired outcomes. They revealed this during the primaries, when they dumped $10 million in opposition spending against Katie Porter in California, $2 million against Jamaal Bowman in New York, and $1.4 million against Cori Bush in Missouri. Although none of these candidates were particularly outspoken against crypto, that wasn’t really the point. Instead, the crypto industry used those races to send a message: fall in line, or we might deploy our millions against you, too. It didn’t really matter if the industry spending directly caused their targets to lose their races, so long as there was a plausible argument that it played a role (in both Bowman and Bush’s races, crypto industry money made up only about 20% of the opposition spending).

We can expect the industry to do the same in the future elections: claim responsibility for the outcomes of all the races where they spent money, even if those outcomes were likely not impacted much by crypto industry involvement.

Given various candidates’ willingness to buy the industry-manufactured myth about blocs of single-issue crypto voters, I worry candidates in future elections may also fall for this story and choose to submit to crypto industry pressures rather than risk millions in opposition spending next time they stand for re-election. And the industry is already scrambling to ensure politicians have no doubts about the wealth crypto PACs might muster against them, refilling the super PAC war chests with another $25 million from Coinbase [I69] and $23 million from Andreessen Horowitz.13

As for the losers, the crypto industry’s $2.3 million in spending wasn’t enough to get incumbent Democrat Yadira Caraveo re-elected in Colorado’s District 8’s extremely close race. As Ranking Member of the House’s digital assets subcommittee, Caraveo had been a strong ally to the cryptocurrency industry, and she was one of several sitting Congresspeople to appear during a “Crypto4Harris” event in August [I64]. In Oregon’s District 5, $1.5 million wasn’t sufficient to secure a win for Republican incumbent Lori Chavez-DeRemer, who had written in response to Stand With Crypto that “It's clear that their [sic] is a space for the digital asset ecosystem in the free market of the United States.” Republican incumbent Mike Garcia lost re-election in California’s District 27 despite $1 million in crypto industry backing, which he earned with a promise to “be a champion” for crypto in Congress.

And finally, longshot crypto candidate John Deaton failed to oust crypto’s number one enemy on the Hill, incumbent Massachusetts Senator Elizabeth Warren who, as predicted, easily won a third term. This race was one of the clearest indicators that the major industry PACs were more concerned about appearing to back winners rather than risk losses to support those with whom they were strongly ideologically aligned: they didn’t put a cent towards this race despite Warren’s permanent presence in the industry’s crosshairs, and despite Deaton running on an explicitly pro-crypto platform. Instead, Deaton’s $2.1 million in backing came from a completely separate super PAC called the Commonwealth Unity Fund. The vast majority of the funding for this PAC in turn came from the same wealthy donors who backed Fairshake and the bigger industry PACS: the Winklevoss twins, Ripple, and Phil Potter of Potter Ventures. However, by splitting the spending into a separate committee, Fairshake is able to sweep Warren’s landslide victory under the rug.

Not only will Warren return to her seat to continue her push for strict regulations on the cryptocurrency industry, but she will also become the Ranking Member of the Senate Banking Committee following Sherrod Brown’s loss in Ohio and Mark Warner’s choice to remain the top-ranking Democrat on the Senate Intelligence Committee.14 Amusingly, in ousting Brown, the crypto industry may have handed more power to an even more aggressive enemy.

Trump’s political appointments

Trump has been announcing new additions to the Trumposphere at a rapidfire pace, seemingly making ever more horrifying selections each time. While Senate rejections of presidential Cabinet appointments are historically rare, Trump seems to be challenging his newly Republican Congress to defy him with some of the picks. However, he’s also announced that he wishes to be permitted to make recess appointments, which would enable him to bypass the normal Senate hearing and confirmation process.

First to discuss is Trump transition team co-chair Howard Lutnick, who also heads the Cantor Fitzgerald financial services firm. Cantor Fitzgerald has just wrapped up hosting its own “Crypto, Digital Assets & AI Infrastructure Conference” in Miami, and offers crypto services of its own. Lutnick has also personally vouched for the shady stablecoin issuer Tether, which has been proven to have lied about the stablecoin being fully backed by dollars and dollar-like assets [W3IGG], but now insists that we should all just trust them that it is now even if it wasn’t then. Rather than produce legitimate audits, Tether instead leaned on Lutnick to vouch for them. “They have the money they say they have,” he stated earlier this year.15 That’s basically an audit, right? Apropos of nothing, Tether has minted $7 billion in new tokens since Trump’s win.16 Tether is also reportedly (still) under investigation by the Department of Justice,17 though that investigation is only one of many whose futures are uncertain given the new administration. Anyway, Lutnick is in a serious position of power with his role on the transition team, where he helps to staff Trump’s future administration. And the cryptocurrency industry knows it, with Coinbase CEO and political megadonor Brian Armstrong reportedly seeking to secure meetings with Lutnick.18

Lutnick has selflessly put his own name in the running as a potential pick for Treasury Secretary, and is reportedly one of two candidates Trump is considering. The other is Scott Bessent, a fellow Trump megadonor and crypto enthusiast. Bessent has been a proponent of integrating cryptocurrency into the broader economy, and of course of broader deregulation. While perhaps the only blessing in the 2022 cryptocurrency wipeout was that people without crypto investments were pretty much entirely insulated from the carnage — unlike other historical financial collapses, such as the one in 2008 — I fear we may soon wave goodbye to such a firewall as Trump’s crypto-enthusiastic administration and the new Congress allow crypto to enmesh itself within the broader financial and banking system. As far as things to keep an eye out for and mobilize on, this is a big one — although hopefully Elizabeth Warren on the banking committee will provide somewhat of a bulwark.

Trump’s cabinet stands to have a substantial number of pro-crypto members, should his nominees pass Senate approval, although some are destined for roles where they are likely to have little in the way of direct influence over crypto policy. Bitcoin enthusiast Robert F. Kennedy Jr., for example, has been selected to lead the Health and Human Services Department, but his bitcoin beliefs fall well behind his opinions on vaccines, fluoride, and infectious disease studies when it comes to beliefs that are concerning for a public health official — although I personally wouldn’t put it past him to support some of the harebrained schemes I’ve seen to put medical records on a public blockchain.

More consequential might be Trump’s pick for Attorney General, who will advise him on legal matters and oversee the country’s entire legal system. Matt Gaetz, who at least appears to share Trump’s proclivity for breaking laws including but not limited to those prohibiting sexual abuse,19 is also a big bitcoin fan. Among other things, this summer, he proposed a bill that would allow people to pay federal income tax with bitcoin for some reason.20

Trump selected crypto enthusiast Tulsi Gabbard for Director of National Intelligence, likely thanks to her shared desire to root out the “deep state”. She used a 2023 speech at the annual Bitcoin Conference to condemn an “elitist cabal” that she believed was working to undermine Trump, and claimed that lawmakers who oppose bitcoin don’t understand it but “know enough to know that they shouldn't like it because it will undermine their ability to control us.”

Trump’s nominee for Secretary of the Interior, Doug Burgum, will have a major role to play in Trump’s plans to ramp up energy production. Burgum is a product of the tech industry, having founded a software company and software-focused venture capital firm. He’s also been a proponent of bitcoin mining in his home state of North Dakota, much to the chagrin of nearby residents whose energy prices spiked by $12 million after the mining operation moved in.21

Fox & Friends co-host Pete Hegseth has been tapped as Secretary of Defense. Hegseth has praised Trump for “making bitcoin great again”, and has boasted of his own bitcoin holdings.

Trump has (once again) nominated former SEC Chairman Jay Clayton as the US Attorney for the Southern District of New York, a district that regularly prosecutes financial crimes as well as other high-profile cases such as the sex crimes cases against Diddy and Ghislaine Maxwell, or corruption cases against former Senator Bob Menendez and current New York Mayor Eric Adams. The current US Attorney for the Southern District, Damian Williams, has prosecuted a number of high-profile cryptocurrency cases including those against Sam Bankman-Fried and other FTX executives, the ongoing case against Celsius CEO Alex Mashinsky, and the ongoing case against Tornado Cash developer Roman Storm. Trump tried to nominate Clayton once before, in 2020, while attempting to oust U.S. Attorney Geoffrey Berman, who was in the process of investigating Trump allies including Rudy Giuliani. Berman initially refused to leave, objecting to Clayton’s complete lack of experience as a prosecutor, but later stepped down when it was determined he would be replaced by a deputy. Instead of obtaining prosecutorial experience in the meantime, Clayton has spent the years since his December 2020 SEC departure enjoying the revolving door, taking typically lucrative advisory positions with crypto- or crypto-adjacent firms including Electric Capital, Fireblocks, One River Asset Management (now owned by Coinbase), and Apollo Global Management.

The biggest excitement for the cryptocurrency world is the prospect of an SEC no longer headed by Gary Gensler, who has over the past few years worked to enforce existing securities regulations against the industry — much to its shock and horror. Many of the heavy spenders in this election cycle are locked in court battles with the SEC, including Coinbase, Ripple, and Kraken, and the millions of dollars they paid to install crypto-friendly politicians may well pay off in legal savings down the line. Traditionally, SEC chairs resign when a new administration is elected, and Gensler will likely not buck tradition. Despite the fact that Trump likely won’t have the opportunity, not to mention the fact that he’s not legally allowed,d Trump has courted the crypto faithful with brash promises of firing Gary Gensler “on day one”.

Trump has not yet indicated who he might install as a replacement, but the crypto industry has been salivating over which crypto-friendly regulators they’d like to see him choose. Coinbase’s Brian Armstrong has proposed SEC Commissioner Hester Peirce,22 who the industry has weirdly dubbed “crypto Mom” for her support of cryptocurrencies and her regular dissents from various proposals and lawsuits targeting the industry. However, some in the crypto world were disappointed with his suggestion, criticizing Peirce for past decisions they felt benefited major institutions at the expense of individual crypto holders. As I wrote in July: “it's interesting to me that even some on the more ideological end of crypto see billionaire executives and VCs spending money on politicians and go ‘yes, good, they're fighting for me’”. Ripple CEO Brad Garlinghouse has proposed three other options: former CFTC head Chris Giancarlo (who now enjoys several advisory roles to prominent crypto firms), former Acting Comptroller of the Currency Brian Brooks (who was later, briefly, the CEO of Binance.US), or former SEC commissioner Daniel Gallagher (who is chief legal officer at stock and crypto trading firm Robinhood).23

So anyway, things are about to get pretty buck wild out there. If nothing else, I will be here to chronicle it.

Bitcoin strategic reserve

Bitcoiners, but also some mainstream media articles, have been making much of the potential for a Trump win to usher in the creation of a “Bitcoin strategic reserve”, to the point that I think the idea has earned some debunking. It hearkens back to the Bitcoin Conference this past July, although it was not Trump who first brought it up — it was his then-opponent Robert F. Kennedy Jr. To quote from issue 63:

[Robert F. Kennedy Jr.’s] biggest promise by far, announced to thunderous applause, was that he would establish a strategic reserve of 4 million bitcoins — $225 billion at today’s prices, and amounting to around 20% of the total bitcoin supply — which he did not disguise as a promise to pump the audience’s bags. “The cascading impact from these actions will eventually move Bitcoin to a valuation of hundreds of trillions of dollars,” he concluded.

(Note that the $225 billion estimate was July prices — with recent price movements, 4 million bitcoins would be priced at around $350 billion today.)

RFK Jr. so thoroughly upstaged Trump the day before Trump was scheduled to speak that Trump seemed to shoehorn in his own promise of a “Strategic National Bitcoin Stockpile” in order to try to keep up. However, I think many who are picturing a “strategic reserve” now are picturing not what Trump described, but rather RFK Jr.’s fever dream.

Trump’s version was a far cry from RFK Jr.’s plan to spend 5% of the national budget pumping bitcoin, but it was still weird: he proposed that the “Stockpile” would consist of the crypto assets seized as a result of various law enforcement activities, which they normally sell in batches once the assets have been formally forfeited — a practice Trump says he would stop.

I am announcing that if I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the Bitcoin the US government currently holds or acquires into the future. We'll keep 100%. I hope you do well, please. This will will serve in effect as the core of the Strategic National Bitcoin Stockpile. As you know... as you know, most of the bitcoin currently held by the United States government was obtained through law enforcement action. You know that. They took it from you. “Let's take that guy's life, let's take his family, his house, his Bitcoin, we'll turn it into Bitcoin.” It's been taken away from you. Because that's where we're going now, that's where this country is going. It’s a fascist regime. And so as I take steps to transform that vast wealth into a permanent national asset to benefit all Americans.

It’s not entirely clear to me whether Trump was merely acknowledging that many of these seized crypto assets are seized from crypto thieves who themselves wrongly stole crypto from the types of people likely to be in the audience at Bitcoin 2024, or if he was stating that law enforcement had no right to, say, seize assets from the perpetrators of the 2016 Bitfinex hack.

Either way, he fails to acknowledge that much of the time when the government seizes crypto assets and then sells them later on, the proceeds are returned to the victims of the crime. Trump’s plan, at least as elucidated on stage in July, is to put a stop to this practice, and instead hold on to those assets that he himself stated had been stolen from people like those in the audience.

It’s a weird plan, but I also hold a lot more skepticism that he will follow through with it than many in the crypto industry (who are in turn being heavily quoted by media with little scrutiny of their claims). To me, it seems like a hastily tacked-on promise likely to fall by the wayside with many others made by presidential candidates as they seek to court voters and donors on the campaign trail.

Everything else

Hilariously, despite Trump’s win and the crypto markets’ enthusiastic response, Trump’s own crypto project continues to limp along [I68, 69]. World Liberty Financial has sold only 1.33 billion of the 20 billion (reduced) total token supply, or around 6.7%. Much of the lackluster response can probably be blamed on the strict limitations around token resale and remuneration to token holders, and availability only to accredited investors — limitations which were rather obviously crafted to try to dodge securities enforcement. If Trump succeeds with his plans to defang the SEC, I expect these limitations to swiftly change — likely significantly financially benefiting Trump and his family, who receive 75% of net protocol revenues in addition to their initial allocation of 22.5 billion $WLFI tokens.24

Elsewhere in crypto

There’s been more violence in the cryptosphere, in what seems to be a worsening trend in recent months [W3IGG, I65, 61]. The CEO of a Canadian cryptocurrency company called WonderFi was kidnapped off a street in Toronto and held until he agreed to transfer CA$1 million (~US$720,000).25 Over in Montreal, a missing cryptocurrency influencer and suspected pump-and-dump scammer named Kevin Mirshahi was found dead in a park, after disappearing in June. Mirshahi had been under investigation by Quebec’s financial authorities, and had been ordered by the regulator to cease some financial and social media activities.26 In Thailand, a Ukrainian tourist was kidnapped and threatened with violence until he agreed to transfer $250,000 in the Tether stablecoin.27 A list of violent attacks against cryptocurrency holders maintained by prominent bitcoiner Jameson Lopp shows 17 incidents this year, with 11 of them occurring in the second half of the year alone.28

The Web3 is Going Just Great recap

There were three entries between November 3 and 14, averaging 0.3 entries per day. $36.93 million was added to the grift counter.

- DeltaPrime loses $4.8 million in second hack [link]

- Trader reveals he lost $28 million to bad copy-paste [link]

- MetaWin casino hacked for $4 million [link]

Worth a read

Ed Zitron wrote a really kickass piece on the election, the tech industry, and the media’s broad approach to covering tech developments. He ends it on a hopeful but pragmatic note that I really needed. If you're looking for other hopeful but pragmatic election-related reading, you should also read Ken White’s “And Yet It Moves” and Rusty Foster’s “Election Day”.

Trump is continuing to issue legal threats against newsrooms that dared to criticize him. Perhaps the CJR editors decided it went without saying, but it feels worth mentioning that — if his appointments go as planned — he will have the entire judicial branch to bring to bear on journalists, not just his wacky lawyer neighbor. This is really something to keep an eye out for.

In the news

Michael Hiltzik wrote a really lovely profile, focused on my recent sparring match with Coinbase and my “I am my own legal department” article. I was rather amused to discover from this article that Coinbase’s Paul Grewal actually claimed that no legal threat was implied by his tweet that continuing my reporting would be “.... unwise”.

CNN quoted me in an article about how the crypto world’s embrace of Donald Trump is completely incongruous with the original ideology many of them still claim to espouse.

Store update

I’ve added a few new items to the store, for those wanting to show their support for reading, libraries, and access to information more broadly. These stickers and shirts are based on a linocut print I created earlier this year.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

Sentencing submission by Zixao (Gary) Wang filed on November 6, 2024. Document #535 in US v. Bankman-Fried. ↩

Sentencing submission by USA as to Zixao (Gary) Wang filed on November 13, 2024. Document #538 in US v. Bankman-Fried.

↩Complaint for Forfeiture filed on November 13, 2024. Document #3 in US v. All Assets and Funds Formerly Contained in Binance Account ID 804093810. ↩

Memorandum opinion filed on November 4, 2024. Document #337 in US v. Sterlingov. ↩

“Crypto ‘Mixer’ Gets 12 1/2 Years for Money Laundering”, Bloomberg. ↩

Memorandum opinion and order filed on November 8, 2024. Document #92 in US v. Mashinsky. ↩

“South Korea police arrest 215 in suspected $228 mln crypto scam”, Reuters. ↩

“Bengal Man Arrested in Connection With $235 Million WazirX Hack”, Decrypt. ↩

Redacted Motion of the Debtors filed on November 11, 2024. Document #27858 in In re: FTX. ↩

“French regulator probes Peter Thiel-backed betting platform”, Politico. ↩

“FBI raids apartment of election betting site Polymarket's CEO and seizes cellphone, source says”, NBC News. ↩

“The Crypto Industry Spent Over $130 Million on the Election. It Paid Off.”, The New York Times. ↩

“Andreessen Horowitz Donates $23M to Crypto Super Pac Fairshake for 2026 Elections”, CoinDesk. ↩

“Warren will lead Democrats on the Senate Banking Committee”, American Banker. ↩

“Tether’s Reserves Do Exist, Cantor Fitzgerald CEO Says”, Bloomberg. ↩

“Federal Investigators Probe Cryptocurrency Firm Tether”, The Wall Street Journal. ↩

“Crypto Industry Lobbies Trump and His Allies to Capitalize on Election Wins”, The New York Times. ↩

“Matt Gaetz once faced a sex trafficking investigation by the Justice Department he could now lead”, AP News. ↩

H.R.8822 - To amend the Internal Revenue Code of 1986 to allow the payment of certain Federal taxes with bitcoin, Congress.gov. ↩

“MDU customers seeing big costs related to crypto mine near Williston, utility says”, The Bismark Tribune. ↩

“WonderFi CEO Safe After Paying $720,000 Ransom to Kidnappers”, Decrypt. ↩

“Body of abducted cryptocurrency influencer Kevin Mirshahi found in Montreal park”, The Montreal Gazette. ↩

“Ukrainian robbed of B8m in digital money in Phuket”, Bangkok Post. ↩

“Known Physical Bitcoin Attacks”, Jameson Lopp. ↩

Footnotes

Trump cannot unilaterally create a new official government agency without Congressional approval, although he’s been pretty scant on details as to whether this would be an official government agency or just some sort of gesture to try to placate the increasingly annoying barnacle he has developed. ↩

It’s not likely that Sterlingov will pay this amount. The government states that they believe he “will someday be able to access” the Bitcoin Fog cluster that contains, or once contained, 1,354 BTC (~$117 million today). However, Sterlingov claims to have a net worth of approximately $2 million. ↩

$133 million raised and spent by crypto-focused super PACs, plus another $55 million in individual donations by crypto-affiliated individuals. ↩

Although Trump could likely demote Gensler from chairman. “You’re demoted!” has a bit less of a ring to it, though. ↩