Issue 71 – (Crypto) banks are not your friends

Celsius’ Alex Mashinsky pleads guilty to fraud, some Tornado Cash sanctions are overturned, and tech billionaires complain about “debanking”.

For those of you in the United States, I hope you had a lovely Thanksgiving. I especially hope you didn’t have to endure any guests who had read the various “how to talk to your family about crypto this Thanksgiving” explainers from crypto media outlets, most of which sounded like some form of multi-level marketing indoctrination manual, with bullet points like “ETFs have made crypto investing simpler and safer” and “Crypto could flourish further under Trump”.1 Could you pass the gravy, grandpa, while I tell you about why Elon Musk’s brilliant scheme to optimize the governmenta is named after a shiba inu-themed memecoin?

Bitcoin has surpassed the $100,000 mark, a highly anticipated milestone among bitcoiners. After surging $90,000 post-election, it was merely a question of how soon the token would hit that elusive number. The purchase of the president-elect and many Congresspeople, while expensive, has already produced returns — crypto billionaires have recouped that spending and then some.

In the courts

Celsius

Alex Mashinsky, co-founder and former CEO of the Celsius cryptocurrency platform,b has pleaded guilty2 in his criminal trial for fraud and market manipulation [I33]. If you need a recap, I wrote an overview of the company’s collapse and an ensuing bankruptcy examiner’s report in February 2023:

The trial was set for late January, and I was curious about how Mashinsky would approach it. Mashinsky is sort of your classic conman, relying on his charisma and ability to talk in circles to pass off his often highly exaggerated pronouncements, if not blatant lies — like claiming to have invented decentralized finance, VoIP, and Uber.3 The combination of mendacity and narcissism reminds me of Sam Bankman-Fried, who remained convinced of his ability to talk his way out of his fraud charges until — and perhaps after — his conviction and sentencing. Their similarities made me wonder if Mashinsky might also take the stand in his own defense.

Mashinsky seems to have proven more willing than Bankman-Fried to listen to the advice of his lawyers, and agreed to this plea deal soon after failing to have two of the charges against him dismissed before trial [I70]. In exchange for a guilty plea to two of the seven charges, commodities fraud and securities fraud, he will forfeit $48 million and face a maximum sentence of 30 years in prison — though he’s likely to get less.

As someone who writes a lot about crypto frauds, I see a wide range of reactions to them. One unfortunately common reaction is to blame the victim: to say they were greedy for chasing sometimes unbelievably high returns, or that they should have known the risk, or that they somehow had it coming for choosing to put money into crypto. People commonly stereotype those who hold crypto as archetypical “crypto bros”: young, braggadocious trolls trying to get rich quick by being early enough to a pump-and-dump scheme that they can later tell everyone else to “have fun staying poor” from their superyachts. Reality, as it so often is, is a lot more complicated.

Shortly after Celsius declared bankruptcy, Celsius customers began writing letters to the bankruptcy judge, telling their stories and explaining how they came to have money in Celsius, and pleading for him to do everything in his power to return their assets. I was struck by the diversity of the writers: young people to retirees; Americans, Europeans, and people in developing countries; some who started with a ton of money to put into crypto and others who scraped together their portfolios a dollar at a time. Some were financially savvy — the types of people you might expect to have “known better” — others had no idea what they were doing, but were convinced to get into crypto by family or other trusted individuals. Many believed what Celsius and Mashinsky were saying, and that the promises had to be true because US regulators wouldn’t allow a company to blatantly lie to customers or run a scam.

The fact that Celsius is regulated by the state of New York and SEC compliant was a significant reason I decided to trust Alex and move my money on to this platform. ... I trusted that my money was safe on Celsius because of the fact that Celsius is regulated in the United States, so it must be safe, since they would never be able to make uncollateralized loans using my USDC coins as collateral, the regulatory body would never allow such a thing, especially after the 2008 financial crisis. This was my thought process, so it would have been better if they were not regulated in New York, because then I would have assumed that my money is not safe.

Mashinsky, who engaged directly with customers via weekly video “ask me anything” sessions and even one-on-one phone calls, was viewed more as a trusted friend or financial adviser by many, who really believed him when he said that he wanted everyone to be able to grow wealthy together using his platform, rather than lose money to banks and other financial institutions that he portrayed as the enemy.

Some recognized and accepted the volatility risk inherent to cryptocurrencies like bitcoin and ethereum, but didn’t think there was a risk that the cryptocurrencies they owned might disappear entirely.

Others avoided volatile tokens, instead opting to keep their money in dollars or dollar-denominated stablecoins like USDC. They believed their Celsius account was essentially a (very) high yield savings account, and some even believed that it had the same types of protection — including FDIC depository insurance — as traditional banks.

I am a retired Dutch citizen. Like many others i never thought of transferring all my pension savings as an investment (as Celsius seems to be calling it suddenly after filing for Chapter 11) but from one savings account to another… Also most of us — elderly; risk avoiding depositers — deposited in stable coins because at our age, one can’t speculate on highly volatile assets such as crypto currencies. Many of us — as we are not able to access our savings — can’t now pay for medium or bigger ‘calamities’ in our households, unless that is why we did set aside our savings for.

Others didn’t make assumptions, but instead relied on Mashinsky’s own promises that the company held a $750 million insurance policy for its deposits, and that it didn’t engage in unsecured lending — both of which turned out to be lies. They believed Mashinsky when he said it was impossible for customers to lose their deposits.

Much of my life’s savings are currently held hostage on the Celsius platform. Alex Mashinsky week after week promised the community that our funds were safe and not being used in any risky lending. Every week during his AMA’s he promised that Celsius had the funds to cover all user assets and that under no circumstances were our funds at risk.

While some say that people just have to be on high alert at all times and in every interaction for possible scams, the reality is that most people just don’t expect companies to lie to their faces — particularly US-domiciled companies that they expect to be under the watchful eye of regulators. Most people don’t think twice about whether the bank they’re signing up with is likely to collapse — and many people who encountered Celsius didn’t understand that Celsius was meaningfully different from a bank.

Even as we reflect on Celsius and the massive failures of not just financial regulators, but regulators like the FTC who are meant to prevent deceptive advertising, politicians are boasting about plans to hobble regulators and make them even less effective in fulfilling their mandates. Should they succeed in these plans, perhaps some will react by putting their shields up, adopting the degree of suspicion nearing paranoia that may be required in an every-person-for-themselves world without adequate regulators. More likely, countless more will continue to rely on regulators even in their absence, and be ruined because of it.

One bit of good news in the Celsius story is that creditors will likely be made substantially whole as a result of the bankruptcy (with the caveat that some repayments take the form of stock in a new bitcoin mining company that has already been encountering some troubles [I43, 50, 66]). This is unequivocally a good thing, and the “but” about to follow is not to suggest otherwise. But, a ton of people lost access to substantially all of their savings when Celsius collapsed more than two years ago. Several letters to the bankruptcy judge referenced urgent medical bills, postponing plans like getting married or buying a home, or needing to change career plans because they could no longer afford education. Even if victims eventually receive full restitution, there is an enormous amount of damage and suffering during the interim period when companies like this go under, particularly amid the stress and uncertainty of not knowing whether they will ever recover any assets at all.

Other criminal sentencing

FTX’s Gary Wang was sentenced to time served for his role in the fraud, an outcome which was largely expected due to his substantial cooperation [I70] with prosecutors.4 Wang was the last defendant left to be sentenced among the five executives who were charged.

Heather “Razzlekhan” Morgan will be taking an 18-month hiatus from her burgeoning rap career to do prison time for her role in laundering the funds her husband stole from the Bitfinex cryptocurrency exchange in 2016. Her husband, Ilya Lichtenstein, earned a five-year sentence last month [I70]. Shortly after her sentencing, Razzlekhan posted a video on Twitter announcing that she was “very excited that I will soon be telling my story, sharing my thoughts, and telling you more about the creative and other endeavors I’ve been working on. Razzle dazzle!” before making hand signs and sticking out her tongue at the camera.5 I’m beginning to think her plea agreement should have included a Son of Sam clause.

Another cryptocurrency mixer operator, Larry Harmon of the Helix tumbler, has been sentenced to prison. He had assisted prosecutors in their case against the other recently sentenced mixer operator, Bitcoin Fog’s Roman Sterlingov [I52, 53, 64, 70]. For his cooperation, and for shutting down Helix two years prior to his arrest, Harmon received 3 years in prison: a comparatively light sentence to Sterlingov’s 12 ½ years. He was also ordered to forfeit $311 million in monetary assets, and to forfeit $400 million in seized assets consisting of crypto, real estate, and monetary assets.6

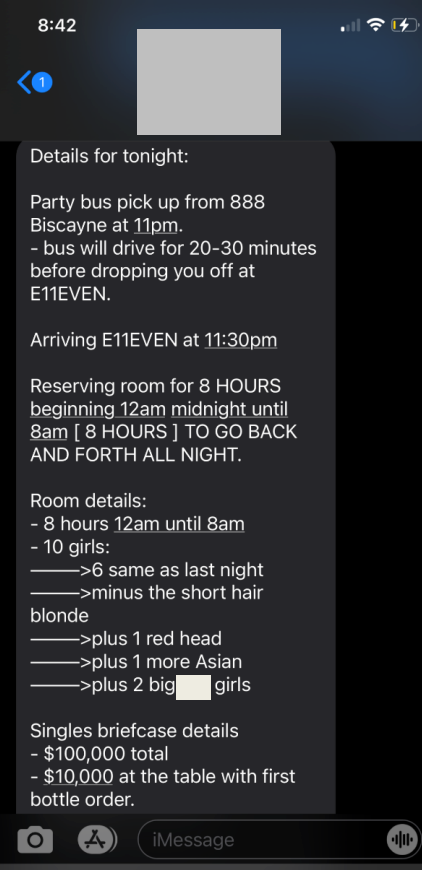

His prison sentence will also be shorter than that of his brother, Gary, who was convicted of wire fraud and obstruction of justice in 2023 after using Larry’s passphrases to help himself to 712 BTC (~$4.8 million at the time) shortly after Larry was arrested in February 2020. After some of the bitcoin seized by Larry went missing, investigators found a photograph of the unemployed Gary sitting in a bathtub full of around $100,000 in dollar bills in a Miami nightclub, which perhaps drew some suspicion.7

As it happens, that Miami nightclub was E11even, a popular bar among cryptocurrency enthusiasts and reportedly “the first major U.S. club to accept bitcoin”. FTX’s Ryan Salame was apparently also a fan, in October 2021 purchasing a $1.175 million condo in an E11even-owned luxury building right next door.8

Also in cryptocurrency mixer prison sentences, Russia sentenced a man to life in prison after courts determined he had operated the notorious Hydra darknet marketplace. Fifteen accomplices received 8 to 23 years for producing and selling drugs and operating a criminal organization. This is somewhat unusual for Russia, which generally doesn’t interfere in cybercrime targeting those in non-allied countries.9

Everything else

A California judge ruled that members of the Lido DAO qualify as partners under the state’s general partnership laws, meaning they cannot avoid liability for the DAO’s actions. DAOs have long purported to be some sort of “one weird trick lawyers hate” for organizations to operate without individual liability, but it seems that reality is exposing them as one weird trick to ensure everyone is liable.10 Among those deemed “general partners” in Lido’s governing body are its investors, including Paradigm, Andreessen Horowitz, and Dragonfly Digital Management. Andreessen Horowitz is really peeved about it, with a lawyer of theirs calling the decision a “huge blow to decentralized governance”.11

Shaquille O’Neal will pay $11 million to settle a class action lawsuit over the defunct Astrals NFT project, which he heavily promoted before abandoning it in 2022.12

YouTube influencer Logan Paul is facing even more allegations of cryptocurrency insider trading, this time from the BBC. After agreeing to an on-camera interview, he sent a rather unconvincing lookalike to do the interview, along with a group of people with megaphones who began accusing the BBC of hiring “pedophiles” after the interviewer asked to speak to the actual Logan Paul. As is his habit [I63], Paul threatened to sue the BBC for publishing their findings.13

Prosecutors charged five hackers who executed phishing and SIM swap attacks that netted $11 million from at least 29 victims, over half coming from a single victim. They also allegedly stole intellectual property, trade secrets, and personal information. The hackers were reportedly part of the Scattered Spider cybercrime group that was likely behind the 2023 hacks of the MGM and Caesars casinos.14

In bankruptcies

The South Korean Delio platform, which suspended withdrawals in June 2023 [W3IGG], has been declared bankrupt and will begin liquidation. They owe customers the equivalent of around $1.75 billion.15

In governments

Tornado Cash

A Fifth Circuit ruling overturned the sanctions against Tornado Cash cryptocurrency mixer smart contracts, imposed by the United States Treasury Department’s Office of Foreign Assets Control (OFAC) in August 2022. The court opined that the smart contracts that comprise the Tornado Cash cryptocurrency tumbler are "not property because they are not capable of being owned", and thus cannot be sanctioned by OFAC.16 The ruling was carefully limited to the specific Tornado Cash smart contracts, which underwent a trusted setup ceremony involving 1,100 participants to make around twenty of the service’s smart contracts permanently immutable.c Unlike many smart contracts, these Tornado Cash contracts truly cannot be modified or controlled in any way (short of, say, changing how Ethereum works), and the court decided that this means they cannot be sanctioned.

This verdict has been celebrated by crypto enthusiasts who felt that OFAC’s sanctions were an overreach, but if it is a victory, I’m not sure it’s a decisive one. For one, I’m not really sure it’s a “crypto” vs. “anti-crypto” fight to begin with, though many in the crypto industry have certainly portrayed it as one. It seems to me that the Fifth Circuit is saying that OFAC can’t sanction a program — that is, the lines of code telling a computer how to perform an action — and that you have to sanction a service that runs that program, or perhaps more precisely: an individual or business that runs a service that runs the program. This is a reasonable position, I think, aligned with the point I make in my “Privacy, human rights, and Tornado Cash” piece about computer viruses.

But “you can’t sanction this Tornado Cash smart contract” and “you can’t sanction Tornado Cash” are two very different statements, and the Fifth Circuit has said the former, not the latter. I suspect that OFAC will continue to pursue sanctions against Tornado Cash, and the question then becomes how those sanctions are imposed. I think one very real possibility is that OFAC says, “fine, if we can’t sanction the code, we’ll sanction the operators of the computers that run the code” — that is, the relays and validators that accept transactions involving the Tornado Cash service. Already, more than half of blocks added to the Ethereum blockchain are being created with relays that censor transactions involving sanctioned wallet addresses,17 by validators that have taken a cautious approach when it comes to the rather muddy water around blockchain sanctions and who can be prosecuted for violating them. Further development of these legal theories could stand to make it much more challenging, not to mention legally risky, to run an Ethereum validator.

There’s also, of course, the possibility that the Treasury Department will look to Congress to clarify its authority when it comes to smart contracts. While this is certainly a crypto-friendly Congress, I’m not sure if it’s so crypto friendly that it will effectively greenlight sanctions violations so long as they happen via cryptocurrency rails. (But hey, I’ve been wrong before.)

Finally, there’s some question around the durability of the Fifth Circuit’s decision. An appeal in a separate case challenging OFAC’s authority has been underway in the Eleventh Circuit [I37], leaving the possibility of a circuit split that could encourage Supreme Court review.

In regulators

A California judge rejected Kraken’s request to appeal his finding that the SEC had “adequately alleged” that cryptocurrencies traded on the platform were investment contracts subject to securities laws.18 Basically, the judge didn’t throw it out as a completely implausible argument during the motion to dismiss stage and is allowing it to proceed. Now the judge is saying they need to just move forward with the detailed analysis of whether the assets are securities, rather than continue to argue over whether they should do that analysis at all. Kraken had also previously tried to appeal the judge’s entire rejection of the motion to dismiss, which he also denied.

In a case brought by blockchain industry advocacy groups in Texas, a federal judge rejected an SEC rule change that broadened the definition of “dealers” to include trading firms performing substantial securities and government securities trading. This would potentially include cryptocurrency firms, much to their dismay, and blockchain advocacy groups condemned the change as “an attempt by the SEC to advance the agency’s anti-crypto crusade”.19

The last ripples of the 2017 crypto bubble are still being felt, with an SEC announcement that some investors in the defunct BitClave crypto firm will receive a combined $4.6 million in restitution. BitClave was one of a string of companies that engaged in “initial coin offerings”, or ICOs — offerings similar to initial public stock offerings (IPOs), except that the companies wouldn’t need to submit to all that pesky SEC scrutiny. It didn’t take terribly long before the SEC clarified that you can’t just put your IPO on the blockchain and pretend it’s not a securities offering, but plenty of ICOs happened in the meantime during the 2017 ICO frenzy. BitClave’s raised $25.5 million from almost 10,000 investors in a period of 32 seconds. The SEC brought a number of cases regarding ICOs during that time (under the Trump administration, with Jay Clayton as Chairman), including one against BitClave, settled in 2020 with an agreement that the company would return the $25.5 million, plus a little over $3.8 million in interest and penalties. That return has been proceeding very slowly: it seems that BitClave has only returned about $12 million thus far, and this $4.8 million payout is the first time investors are receiving any portion of the restitution they are owed.20

In political influence

Justin Sun

Pro tip: If you’re one of the shadiest players in the cryptocurrency industry and want to avoid mainstream press attention on your $30 million bribe to the US president-elect via his cryptocurrency grift, just spend another $6 million on a concept art piece involving a real banana, and eat it.d That stunt will land you no fewer than five New York Times articles (plus a letter to the editor) in the span of eight days, with not a single mention of the Trump contribution.

I will give his backstory as briefly as I can, but I’m afraid it won’t be very brief. In 2017, Chinese citizen and then-resident Justin Sun launched an ICO for his Tron project, raising $70 million days after China banned ICOs, and then fled the country. He bought BitTorrent and tried to turn it into a cryptocurrency company by merging it with Tron, shocking BitTorrent executives who realized that Sun’s “market making” operations were just blatant insider trading. He did another ICO, this time shopping for a lawyer who would agree to write a letter he hoped would shield him from liability if he was later sued by the US SEC (and he was [W3IGG]). He bought the Poloniex cryptocurrency exchange from Circle, after their attempt to turn it from “shitcoin casino numero uno” (as per a former employee) into a legitimate operation failed upon the realization that the lax standards were the whole selling point. Sun promised to return it to its original anything-goes glory, at one point screaming at an employee to “Fake the KYC!” (customer verification documents) to speed things up. He tried to declare as his own a pile of around 300 BTC (almost $30 million at today’s prices) that had been sent by Poloniex customers to the wrong addresses. When employees expressed concern about a potentially illegal activity, Sun reportedly replied “What’s the big deal? The worst thing may be that I will never come to the US anymore.” And indeed, Sun had bought citizenship in Malta, Saint Kitts and Nevis, and maybe Guinea-Bissau.21 He wormed himself into a role as Ambassador for Grenada to the World Trade Organization, thinking it would earn him diplomatic immunity in all of his activities (it doesn’t). It did, however, grant him the title of “His Excellency”, which he used enthusiastically until he finally was forced to admit (after first lying about it) that he lost the position when the party that appointed him lost power.22

Justin Sun has since amassed an even larger collection of companies, many of which he pretends he doesn’t own or control. These include the Huobi exchange (which he rebranded to HTX), BitGlobal, and the TrueUSD stablecoin project. In September 2023, Huobi/HTX was hacked for $8 million [W3IGG]. In October 2023, TrueUSD either lied about having no affiliation with a token called $TEURO, or the TrueUSD deployer was compromised [W3IGG]. In November 2023, Poloniex was hacked for over $120 million [W3IGG]. Less than two weeks later, Huobi/HTX and its Heco Chain project were hacked for $115 million [W3IGG]. In May 2024, Crypto Critics Corner put out an episode presenting a rather convincing argument that Justin Sun is insolvent. They also outlined the incredible shadiness around his companies’ “proofs of reserves”, including the fact that multiple of his companies seem to be counting the same pool of assets as reserves.23

The crypto community distrusts Sun so much that an August announcement that BitGlobal (and thus Sun) would be helping to manage custody for wrapped bitcoin (WBTC) caused a mass exodus from the token. MakerDAO enthusiastically voted to stop accepting WBTC as collateral (before changing their minds after assurance that Sun didn’t have as much influence over WBTC management as they initially thought). Coinbase announced their own wrapped bitcoin product to use instead, and delisted WBTC. Kraken also announced a wrapped bitcoin product.

So all this to say: who better for Donald Trump’s World Liberty Financial to bring on as its newest “adviser”? All it took was Sun’s purchase of $30 million worth of WLFI tokens,e which appears to be about as blatant an attempt to get out of the SEC’s crosshairs as the election spending by Coinbase, Ripple, and others. I’ve mentioned WLFI’s disappointing sales in previous issues [I68, 69, 70], and indeed the project had only sold around $20 million worth of the WLFI tokens in total until Sun came along, so the $30 million purchase certainly caught Trump’s attention. World Liberty Financial announced his advisory position in a tweet that described Sun, as is his preference, as merely “an advisor to HTX” and “a supporter of BitTorrent”. It played up his attendance of the University of Pennsylvania, which would've seemed like a bizarre thing to mention if it wasn’t so clear that it was an attempt by WLFI to downplay that Sun is a Chinese national.24

Now, Sun is telling reporters: “In terms of the friendly level [for] the crypto business, I think we could even say the best [jurisdiction] is the U.S.“25 He’s certainly hoping to make it so, especially for his incredibly sketchy brand of “crypto business”.

Come and check out my latest video on how ChatGPT, though not fully human-like, is transforming our work landscape! 🤖

— H.E. Justin Sun 🍌 (@justinsuntron) November 27, 2023

Watch it now here 👇https://t.co/rvlvrybgs2 pic.twitter.com/47MLQnE1YZ

Sun is also a profoundly weird dude, with a habit of posting obviously AI-"enhanced" videos of himself spouting nonsense like this one (which he will vehemently deny were created with AI)

Trump’s political appointments

Trump has named former SEC Commissioner Paul Atkins to replace Gary Gensler as SEC Chairman. Atkins is more of an establishment figure, rather than an outsider tasked with dismantling the agency from within like some of Trump’s other recent selections. That’s not to say he’s likely to maintain the SEC’s trajectory, or anything close to it, though. He strongly advocated for deregulation even before he left the agency to enjoy the revolving door, and will no doubt enthusiastically sign on to the Trump deregulatory agenda. And, of course, he loves crypto, co-chairing the Token Alliance at crypto advocacy group The Digital Chamber since 2017. Dennis Kelleher, president of the financial reform non-profit Better Markets, described Atkins as a “deregulation zealot and industry cheerleader who, as a Commissioner at the SEC from 2002-2008, supported deregulation that contributed to the devastating 2008 crash”.26

Trump is also reportedly considering another member of The Digital Chamber for CFTC chair: founder and CEO Perianne Boring.27 In my recent video on the crypto industry’s election spending, I quoted her statement that “The Crypto Voter Bloc has made its voice heard, and we now have a once-in-a-generation opportunity to make the U.S. the crypto capital of the world.”28 I didn’t realize at the time that she might have meant she would do so by taking over the agency that the industry hopes will be made its primary regulator, and then ensuring its already limited resources to go after crypto malfeasance are spent on nothing of the sort. Her other credentials include executive producer on a movie called God Bless Bitcoin, which “interviewed bitcoin experts and religious leaders to explain how bitcoin is a new money that would allow everyone to use the gifts God gave them”, and as a television anchor on the American branch of the Russian state-controlled RT news network. In other words, she is highly qualified for the role. Other rumored candidates in the running for the position are one of two current CFTC Commissioners, Caroline Pham and Summer Mersinger. Both have been friendly to the cryptocurrency industry, but have more traditional backgrounds in law compared to Boring.

Trump transition team lead and Tether enthusiast Howard Lutnick seems to have been skipped over for the coveted Treasury Secretary role, with Trump instead nominating Scott Bessent for that spot [I70]. Lutnick’s consolation prize is Commerce Secretary, tasked with carrying out Trump’s aggressive tariff agenda. Lutnick says he’ll divest from his trading firm Cantor Fitzgerald, which owns a stake in Tether, custodies a substantial portion of Tether’s reserves, and is currently in talks to have Tether back Cantor Fitzgerald’s planned bitcoin-collateralized lending program.29 However, this “divestment” apparently involves simply passing responsibility for the Tether deal over to his 20-something son.30

Everything else

Tech bigwigs’ favorite word recently has been “debanking”. It all kicked off with Marc Andreessen’s appearance on Joe Rogan’s show, which at some point morphed into a series in which Joe Rogan just makes this face

and says “whoa” for several hours at his disgustingly wealthy and powerful guests as they complain about all the ways they’re being disadvantaged and discriminated against.

“Debanking” refers to when a bank shuts down a person’s (or company’s) account, or denies them when they try to open one. Andreessen also spoke about “Operation Chokepoint”, an Obama-era initiative to scrutinize banks doing business with sectors at high risk for money laundering, including firearms. The initiative formally ended in 2017.

Debanking is a real challenge for those affected by it. In particular, sex workers are regularly debanked — even those who operate in the completely legal zones of sex work like pornography or erotic dance.31 Companies in those areas also face banking access issues, as demonstrated by the events that led up to OnlyFans announcing (and then quickly rescinding) a ban on adult content.32 Similar issues have plagued the cannabis industry, and more recently, pro-Palestine activists who have lost access to financial services on platforms like Venmo and GoFundMe when trying to aid those in Gaza.

However, “Operation Chokepoint” has also become a popular conservative hobbyhorse, and the true history of the program’s scale, purpose, impact, and ongoing existence is heavily exaggerated. Much of the exaggeration was seeded by the gun lobby, which pushed overblown claims to portray a narrative where Democratic lawmakers and bankers extrajudicially discriminated against gun owners and dealers.33 In February 2023, bitcoiner and venture capitalist Nic Carterf published an article in Pirate Wiresg titled “Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs”. Its subtitle, “detailing the Biden Admin’s coordinated, ongoing effort across virtually every US financial regulator to deny crypto firms access to banking services”, laid out the thesis, which he rather grossly decides constitutes “redlining”. Andreessen went even further to blame the Consumer Financial Protection Bureau (CFPB), an agency established post-financial crisis to supervise a broad range of financial firms (including banks, fintechs, lenders, and so on). He even tried to pin the entire 2022 crypto collapse on “debanking”, and not, oh I don’t know, the massive fraud among companies that were leveraged up to their eyeballs.

These debanking gripes — echoed after Andreessen’s Rogan appearance by other cryptocurrency and fintech executives sharing their “debanking stories” — are an egregious attempt by those profiting from predatory financial practices to redefine plain consumer protection as “redlining” and discrimination. It is challenging to sympathize with billionaires like Andreessen Horowitz whining that they, or their portfolio companies, were “discriminated against” for engaging in high-risk, predatory, or unlicensed practices. When Tyler Winklevoss complains that “I was debanked because I’m in crypto, as was Gemini”, for example, he conveniently forgot to mention the unbelievable risk that Gemini was taking on in programs like its Earn program, which would later blow up to the tune of nearly $1 billion [W3IGG]. The so-called “debanking” may even refer to Gemini’s reported loss of bank accounts at JPMorgan in March 2023 [W3IGG], after Gemini Earn’s failure, which seems like a reasonable choice for a bank given their client just lost $1 billion in customer funds and was charged with violating financial laws.

I have written before [I70] about the importance of the firewall between banks and the crypto industry, and the crypto industry’s efforts to attack that firewall. Here is one such example.

Andreessen’s Rogan appearance illustrates just how out of touch these billionaires are with reality, and the whole conversation is just one eyebrow-raising claim after another. The icing on the cake was a tweet from Andreessen in which he condemned “unconstitutional direct administrative pressure applied by unelected bureaucrats and freelancing politicians with no due process, no transparency, and no way to appeal” only six days after the Washington Post reported his involvement with the Elon Musk-led “Department of Government Efficiency”.34h I don’t remember Marc Andreessen on my ballot, do you?

The Web3 is Going Just Great recap

There were seven entries between November 15 and December 5, averaging 0.4 entries per day. $35.48 million was added to the grift counter.

- "Hawk tuah" memecoin immediately crashes [link]

- Clipper DEX suffers $450,000 hack [link]

- Crypto exchange XT.com suffers $1.7 million hack [link]

- 13-year-old rug pulls crypto token, then faces retaliation [link]

- Around $21 million in losses reported by users of DEXX [link]

- Polter Finance exploited for $12 million [link]

- Thala Labs loses, then recovers, $25.5 million [link]

In the news

I spoke to Rolling Stone about the strategy behind the cryptocurrency industry’s spending this election cycle, and what it is they were hoping to buy.

The Register also wanted my thoughts on upcoming changes for the cryptocurrency industry as a result of Trump’s win and crypto’s newfound representation in Congress. We touched on topics including the storied “Bitcoin strategic reserve” and bitcoin industry attempts to green up their image, among other things.

That's all for now, folks. Until next time,

– Molly White

References

“Seven Things to Tell Your Crypto-Curious Relatives at Thanksgiving”, Decrypt. ↩

“Celsius Founder And Former CEO Alexander Mashinsky Pleads Guilty To Multi-Billion Dollar Fraud And Market Manipulation Schemes”, U.S. Attorney's Office, Southern District of New York. ↩

“The adventures of the inventive Alex Mashinsky”, Cointelegraph. ↩

“Bankman-Fried's ex-deputy Wang avoids prison time over crypto fraud”, Reuters. ↩

“Operator of Helix Darknet Cryptocurrency ‘Mixer’ Sentenced in Money Laundering Conspiracy Involving Hundreds of Millions of Dollars”, U.S. Attorney's Office, District of Columbia. ↩

Sentencing memorandum filed on April 13, 2023. Document #56 in US v. Harmon. ↩

Adversary case against Ryan Salame, filed November 4, 2024. Document 27543 in In re: FTX. ↩

“Russian court sentences kingpin of Hydra drug marketplace to life in prison”, Ars Technica. ↩

“California Court Rules Lido DAO Members Can Be Held Liable Under Partnership Laws”, Decrypt. ↩

“Logan Paul accused of misleading fans over crypto investments”, BBC. ↩

“US Accuses Five in ‘Scattered Spider’ Hacking Spree”, Bloomberg. ↩

“South Korea’s Delio declared bankrupt with $1.75B in assets lost”, Cointelegraph. ↩

No. 23-50669 filed on November 26, 2024. Van Loon v. Department of the Treasury (5th Cir.). ↩

Order denying motion to certify order for interlocutory appeal filed on November 18, 2024. Document #106 in SEC v. Payward, Inc. ↩

“U.S. SEC Loses Crypto Lawsuit Over 'Dealer' Definition That Pushed Into Crypto”, CoinDesk. ↩

“SEC Distributes $4.6M to BitClave Investors”, CoinDesk. ↩

“The Many Escapes of Justin Sun,” The Verge. ↩

“His Excellency Has No Status: Justin Sun Is No Longer a Diplomat”, Decrypt. ↩

“Justin Sun-advised HTX plays games with its reserves,” Protos. ↩

“Trump crypto project backer Justin Sun lauds 'friendly' U.S. market”, Nikkei Asia. ↩

“Trump’s Nominee for SEC Chair Is a Deregulation Zealot and Industry Cheerleader Who Will Unleash a Deregulation Tsunami that Will Harm Investors, Markets and Financial Stability”, Better Markets. ↩

“Perianne Boring among contenders to lead agency involved with crypto in Trump admin”, Fox Business. ↩

“Trump Considers Pro-Crypto Perianne Boring, Caroline Pham as Possible CFTC Chairs”, CoinDesk. ↩

“Howard Lutnick’s Other Top Client: Crypto Giant Tether”, The Wall Street Journal. ↩

“Tether was an outlaw for years. Now the $132 billion stablecoin has a key ally in Trump’s cabinet”, Fortune. ↩

“Sex Workers Say They Face Hurdles to Banking Access”, Columbia Journalism School. ↩

“OnlyFans’ Now-Reversed Ban Underscores Banking’s Influence on Adult Content”, PaymentsJournal. ↩

“Operation Choke Point: Myths and Reality”, Administrative Law Review. ↩

“Musk and Ramaswamy race to build a ‘DOGE’ team for war with Washington”, The Washington Post. ↩

“Powers of Tau - Round 41”, Socrates1024. ↩

Footnotes

Definitely not just a convenient inroad for Musk as shadow vice president to procure even more lucrative federal contracts, stymy the many ongoing lawsuits against his companies, and pare back those pesky regulations. ↩

Unrelated to the Celsius

bottled cocaineenergy drink manufacturer, which has quite similar branding. ↩If this sounds weirdly ritualistic to you, maybe someday I’ll tell you about the one involving radioactive dust from the Chernobyl reactor core, whose radioactivity was measured from midair within a small aircraft so as to avoid “an adversary … chas[ing] after us to observe the electromagnetic emanation from the laptop”.35 ↩

As a piece of concept art, his purchase was not so much the specific banana that he ultimately ate, but the idea of a banana duct-taped to a wall. ↩

Based on the WLFI gold paper, which states that 75% of “net protocol revenues” will go to Trump after an original reserve of $30 million is established, $18 million of Sun’s contribution went directly to Trump. ↩

Not the Backstreet Boy. ↩

Pirate Wires, for those not familiar, is perhaps best categorized as a relatively recent entrant into the intellectual dark web mediasphere. They also have a hell of a grudge against Wikipedia. It’s run by Mike Solana, one of Peter Thiel’s many protogés. ↩

Kel McClanahan recently pointed out in an interview on the Law and Chaos podcast that, because Trump does not have authority to unilaterally create departments but is allowed to create offices, the better acronym for DOGE at this point is OOGE (pronounced “oogie”). ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.