Issue 72 – A seat at the table

The SEC is still busy even though it may soon be undermined, crypto industry capture of government continues to worsen, and several media outlets botch their crypto reporting at a time it’s needed most.

Happy holidays everyone! I feel this way year-round, but because it’s a gift-giving time of year, I wanted to say: your support has been the best gift I could dream of. Years ago I would have laughed you out of the room if you told me what I’d be doing these days, partly because I didn’t expect to become a writer, but also because it would have seemed impossible that writing a pay-what-you-want newsletter like this one could be sustainable. It only is because of you, and whether you’re reading this issue for free, sharing my work with others you think might be interested, or signing up for a paid subscription, you are making this possible.

By “this,” I do mean writing this newsletter, but also all the other work I would never have time for if I was still juggling a separate full-time job alongside it:

- Keeping Web3 is Going Great up-to-date so that people can see the ongoing drumbeat of frauds and scams that permeate the crypto industry

- Building and then closely tracking crypto industry election spending at Follow the Crypto, which enabled not only much of my own reporting on crypto industry political influence this election, but quite a lot of other journalists’ reporting in CNN, Wired, The Guardian, and others

- Filing a complaint with the FEC about Coinbase’s apparent violation of campaign finance laws

- Speaking with policymakers and regulators to help them understand cryptocurrency and the surrounding industry, and to advise on proposed legislative and regulatory changes

- Speaking with journalists and doing media appearances, sharing my expertise directly or helping journalists cover the tech industry accurately and critically

- Publishing articles in The New York Times, Heise, and Bloomberg Businessweek (twice) to reach a much broader audience than I can with this newsletter

- and quite a bit more.

Thank you.

While you are perhaps wrapping up last-minute gifts and hopefully enjoying some end-of-year rest, I wanted to get you up to speed on what’s been happening in the crypto world.

In the courts

BitGlobal v. Coinbase

Last issue [I71], I mentioned that Trump’s new business adviser Justin Sun is so shady that even the broader crypto world wants nothing to do with him. As I mentioned then, when Sun and his company BitGlobal recently began helping to manage wrapped bitcoin (wBTC), Coinbase and Kraken rushed to create their own wrapped versions of the token and ditch the now Sun-tainted version. This so infuriated Sun that he has now filed a lawsuit against Coinbase.1 The lawsuit begins with a rather justified screed against Coinbase:

The cryptocurrency revolution began with a warning about the dangers of centralization—the danger that the more power an institution acquires, and the more of the market it concentrates on its own closed, centralized platform, the more it will use that power to crush its competitors and seize the fruits of their innovation for itself. … Like all the centralized tech giants before it, Coinbase gives lip service to the innovation of a decentralized world.

BitGlobal also knocks Coinbase for citing supposed “listing standards” as the reason for removing the wBTC token, fairly pointing out that Coinbase seems to have little in the way of standards at all. BitGlobal points out several tokens as examples, including $MOG, a token which features a “legal disclaimer” on its website that reads: “$MOG is a crypto coin with no intrinsic value or expectation of financial return. Just because some people are getting ridiculously rich buying crypto doesn’t mean you definitely will. MOG is to be used strictly for getting laid and for entertainment purposes only.”

However, that’s about the end of the reasonable portion of the lawsuit, which devolves very quickly — at one point accusing Coinbase of “‘dunking’ on wBTC” and “creat[ing] ‘FUD’”.a BitGlobal accuses Coinbase of violating various federal and state laws prohibiting unfair monopolies, and claims that Coinbase engaged in trade libel by suggesting they were relying on undisclosed information when they asserted that wBTC was too risky to list. Notably, the lawsuit does not mention Justin Sun or his involvement with BitGlobal at all, despite Coinbase’s explicit statement that they were delisting the asset because of his involvement.

BitGlobal tried to convince a judge to issue a temporary restraining order to force Coinbase to continue listing wBTC, but they were unsuccessful in convincing the judge of “imminent irreparable harm”. The lawsuit will still continue, but for now, Coinbase can delist the asset. BitGlobal’s lawyers did make one reasonable point during the hearing, though, referring to Coinbase’s comments about SEC and FBI scrutiny of Justin Sun: “On one hand, Coinbase is publicly stating — their top people are publicly stating — the SEC and FBI aren’t to be trusted … But when it comes to Justin Sun, all of a sudden, they are to be trusted.” Could it be that Coinbase’s beef with US regulators is self-serving rather than principled? No, that can’t possibly be right.2

Trump’s World Liberty Financial project has already taken Justin Sun’s side in a way, swapping a bit over $10 million worth of Coinbase’s wrapped bitcoin product for Sun-managed wBTC.3 Although Coinbase CEO Brian Armstrong had a crypto-focused phone meeting with Trump shortly after the election,4 and Coinbase spokespeople have commented that “we’re gratified by the degree that the new incoming administration team has had an open door with Coinbase and the crypto community”,5 whatever goodwill earned Armstrong this access apparently couldn’t win out over Sun’s cold hard cash.

Everything else

Prosecutors have finally responded to Sam Bankman-Fried’s appeal from September [I66].6 Their 106-page response rebuts his arguments that the judge improperly allowed some of the prosecution’s evidence while improperly excluding the defense’s; that the jury was improperly instructed as to the legal meanings of “intent”, “good faith”, and “willfulness”; that the defense was not allowed to introduce arguments pertaining to Bankman-Fried’s reliance on legal counsel; that the defense was not allowed to order discovery from the FTX bankruptcy team and its lawyers; that the forfeiture money judgment was unlawful; and that the judge was biased and that the case needs to be remanded to a different judge. This is going to be a lengthy and verbose appeal; the judge has already granted the defense team an extension until January 31 to file a reply brief, which she’s also allowed to be 2,500 words longer than the usual 7,000-word limit.7

Dylan Meissner, former VP of Finance at the Delphi Digital blockchain research firm, was sentenced to four years in prison for wire fraud after he borrowed 50 ETH in January 2022 (priced at around $170,000 both at the time and now), telling them he needed the money to shore up his investments against significant losses he was facing.b However, unbeknownst to his employer, he kept helping himself to more of the company’s money as crypto markets continued to decline. He ultimately stole nearly $4.5 million in total. In addition to his prison sentence, he will need to pay back the loan and the money he stole.8

Hex founder Richard Heart was already wanted by Finnish police for tax evasion and assault [I67], but now he can add Interpol and Europol to the list of police organizations looking for him. According to EU authorities, Heart is wanted for alleged tax evasion amounting to hundreds of millions of euros in unpaid taxes, as well as an alleged brutal physical assault on a sixteen-year-old. The night that the notice was issued, Heart tweeted “It feels great to be wanted”, and wrote of his excitement for the future, including for Trump’s impending inauguration.9

Craig Wright, the man who lied so hard about being bitcoin creator Satoshi Nakamoto that courts had to set the record straight [I51, 52, 53, 54, 62], has rather predictably kept lying, and so now he has a hammer hanging over his head. In July, a London court found that Wright’s claims to be Satoshi were false, and prohibited him from bringing any more lawsuits based on that premise. He of course turned around and did precisely that only a few months later, and so now he’s been found in contempt of court in the original proceedings. He’s been given a one-year prison sentence, which is suspended for two years. This means that if Wright does it again within the next two years, he will have to serve the sentence (plus any additional sentence for the new offense). A court order wasn’t enough to stop him from filing his lawsuits, so we’ll see if this works.

In governments and regulators

US SEC

The SEC has levied a $123 million fine against Jump Crypto subsidiary Tai Mo Shan [W3IGG], which was involved in a secret deal with Terraform Labs to help prop up the floundering Terra stablecoin in May 2021. Jump spent $20 million to help the supposedly “self-healing” stablecoin regain its $1 peg, earning about $1.28 billion in the process, and Terraform Labs CEO Do Kwon would later claim that the restoration to a $1 price was thanks to an automatic feature of the Terra project and not some backroom deal [I54, 60].10 This lie by Terraform Labs and Jump Crypto helped build confidence in the sustainability of the Terra token, which collapsed horrendously a year later.

The SEC has also reached a settlement with Cantor Fitzgerald, which will pay a $6.75 million fine over allegations that two special-purpose acquisition companies (SPACs) had misled investors when they claimed that they had not been in contact with the eventual targets of their acquisitions.11 While the companies were not crypto-related (one is a now-bankrupt “smart glass” manufacturer called View, the other an Earth-observation satellite company called Satellogic), SEC action against a company helmed by Trump’s transition team co-chair and soon-to-be Commerce Secretary Howard Lutnick is noteworthy. Cantor Fitzgerald is also closely linked to the Tether stablecoin [I71].

Crypto.com has abruptly dropped the lawsuit it had only just filed against the SEC in October [I68] — a lawsuit which seemed to be a direct response to a Wells notice issued by the agency against the company in August. This unusual move just so happened to coincide with a meeting between Donald Trump and Crypto.com CEO Kris Marszalek, who posted a photograph with the president-elect on Twitter with the caption “Honored to have a seat at the table.”12 A spokesperson explained, “We withdrew our action against the SEC given our intent to work with the incoming administration on a regulatory framework for the industry.” Trump and Marszalek reportedly discussed crypto-related political appointments and the prospect of a Bitcoin strategic national stockpile.5

Honored to have a seat at the table. pic.twitter.com/KvK0XyEdYZ

— Kris | Crypto.com (@kris) December 17, 2024

Do you think Marszalek asked to take the picture in front of the framed Kim Jong Un photo, or was that just coincidence?

The Unicoin crypto investment company say they have received a Wells notice from the SEC,c warning them of impending legal action involving not only unregistered securities offerings, but also fraud and deceptive business practices. Unicoin’s CEO Alex Konanykhin said the company received subpoenas earlier this year focused on the company’s eponymous token, which they say is backed by real-world assets including real estate. This is not the first SEC investigation into Unicoin, though previous ones did not result in any legal action. Unlike most crypto projects, Unicoin self-identifies its token as a security. While Unicoin had previously agreed with the SEC that they would not to try to go public or undertake ICOs, Konanykhin said they had decided to breach the agreement after Trump won the presidency.13 As a side note, Fortune Crypto has rather amusingly attributed this notice to SEC Chairman Gary Gensler’s “anti-crypto campaign”. Whether the headline writer meant to suggest that going after fraudsters is itself “anti-crypto”, or if this was an accidental peek behind the curtain of the “SEC anti-crypto campaign” narrative coming from the industry, is not quite clear to me.

The SEC has also reportedly delivered a Wells notice to the CyberKongz NFT gaming project. CyberKongz claimed in a statement on Twitter that the SEC communicated to them that they “can not have a token (ERC-20) in tandem with a blockchain game without registering it as a security”. However, this characterization of the SEC’s communications comes from the company and hasn’t been reviewed by outside journalists or others. The SEC doesn’t comment on Wells notices, so the statement should be taken with a grain of salt until a lawsuit is filed.14

It is interesting to observe the SEC sending Wells notices this late into the Biden administration, when it’s unlikely a lawsuit will be filed before Trump takes office. While the SEC may continue to pursue fraud cases like the one they seem to be looking to file against Unicoin, lawsuits based on lack of registration seem like they’re about to become a lot less popular. If CyberKongz is accurately characterizing the SEC’s communications, it seems somewhat strange to me that the SEC would take this action at this stage.

Everything else

Bitcoin and other crypto assets have long earned a reputation as a tool for tax evaders, but it seems that the US authorities have started to pay a bit more attention of late. After proposing a bespoke reporting form for digital assets earlier this year [I60], the IRS has now helped to prosecute its first criminal tax evasion case focused on crypto. A Texas man was sentenced to two years in prison and ordered to pay over $1 million in restitution for filing false tax returns that repeatedly dramatically understated how much he had made in gains on his bitcoin sales. In addition to lying to his accountant and claiming he had bought the bitcoins for a much higher price, he also tried to hide his bitcoin transactions using crypto mixers.15

Australia’s securities regulator, ASIC, has fined Kraken US$5.1 million for offering margin trading to Australian customers without first requiring them to undergo the process that would determine if that degree of risk was suitable for them. The more than 1,100 customers lost more than US$5 million. While some of the customers were likely sophisticated investors, Kraken made no effort to limit the product to such a group, and around 81% of the customers who used Kraken’s margin product lost money [W3IGG].

In a similar case, ASIC has filed suit against Binance’s Australian derivatives trading platform for allegedly misclassifying more than 500 retail investors as “wholesale investors” (similar to an accredited investor in the US). By designating them as more sophisticated investors, the customers were not given the legal rights and consumer protections granted to retail customers. These investors comprised 83% of Binance’s clients on the Australian platform.16

Nigerian law enforcement have arrested almost 800 people allegedly involved in a cryptocurrency romance scam, also known as a “pig butchering” operation. The operation was based out of a building where more than 500 SIM cards were recovered, used by scammers to impersonate Italian and German women and then romance their victims until they could convince them to put money into the investment scam. Victims were primarily based in North America and Europe, and were targeted via WhatsApp, Instagram, and Telegram. The scam was apparently two levels deep — a group of foreign nationals had engaged the Nigeria-based workers in the scam, but the foreign group was also scamming the scammers in Nigeria, cutting them out of the fraud once the victim had deposited funds.17

Polish police have arrested Dmitry Vasiliev, a man wanted by the United States on fraud and money laundering charges in connection to the Russian BTC-e (later WEX) cryptocurrency exchange.18 BTC-e was the largest exchange in Russia when it collapsed in 2018, and nearly $500 million was lost. Vasiliev faces up to twenty years in prison, and is only the latest person charged in connection to the platform [I50, 57].

El Salvador has tentatively agreed to limit its bitcoin-related activities in exchange for a $1.4 billion loan from the International Monetary Fund, which has long been skeptical of President Bukele’s choice to foist his bitcoin enthusiasm upon Salvadorans. The deal is contingent on the Salvadoran government ending the requirement that Salvadoran businesses accept bitcoin as payment, “confining” the country’s exorbitant bitcoin-related purchases, limiting tax payments to being made in US dollars (El Salvador’s other legal currency aside from bitcoin), and divesting from operations of the troubled government-provided Chivo bitcoin wallet [I56]. Once El Salvador implements the agreed-upon crypto-related changes, as well as some other changes involving fiscal policy, transparency, and reserves, the IMF says they expect to approve the program.19

Taiwanese investigators are looking into the death of a well-known cryptocurrency expert and crypto fraud investigator, Miffy Chen. She had helped bust several major crypto crime cases and had apparently been warned about her safety by authorities when criminal organizations began trying to track her down. Some have expressed concern that the circumstances of her death seem suspicious, although Taiwanese authorities have stated that she was killed in a traffic accident when she was rear-ended by an inattentive driver.2021

In politics

Nominees

A part of the crypto lobby’s dark money arm, the Cedar Innovation Foundation, was hard at work earlier this month alongside the rest of the cryptocurrency industry on a no-holds-barred campaign to block the renomination of SEC Commissioner Caroline Crenshaw, who is broadly perceived by the industry to be as or potentially even more “anti-crypto” than Chairman Gensler. The campaign succeeded when the Senate Banking Committee canceled the renomination vote, meaning that she will almost certainly be replaced with another industry ally. Even Fox acknowledged the crypto industry’s gamesmanship, writing:

The effort to oust Crenshaw was yet another test of the crypto industry's political clout. .... This time, through social media posts, letters to senators and even a mobile advertising campaign, the industry's message to politicians was clear — a vote for Crenshaw would come with political repercussions. The threat was taken seriously and resulted in last week's vote being rescheduled ...

SEC statutes require that a maximum of three of the five people on the Commission can be members of the same party, and traditionally the opposing party is permitted to select the two Commissioners in the minority seats. However, it seems that tradition has gone out the window, and both minority seats will be held by Trump appointees.22

The week before, outgoing Senate Banking Committee chair Sherrod Brown (D-OH) had issued a statement during the committee’s final hearing under his chairmanship, emphasizing the importance of protecting the Consumer Financial Protection Bureau and calling out corporate power:23

[F]rom what we have seen from [Trump’s] nominees thus far, corporate special interests won’t just have a seat at the table this time around – they’ll be given free rein to rip off workers and customers.

He’s opening up our government to the highest corporate bidder. ...

Rising housing costs, private equity infiltrating more and more of our economy, insurance costs going up, risks building up in the private credit market, new technology that’s increasingly being used in our financial system – from algorithmic prices to AI to crypto.

All these risks have one thing in common: they all have the potential [to] take even [more] money away from working Americans…and funnel it to the same corporate elite that always seem to come out ahead.

Avowed crypto critic and CFPB originator Senator Elizabeth Warren (D-MA) will become the ranking Democrat on the committee, but the chair position will go to Senator Tim Scott (R-SC) — who has described crypto as “the next wonder of the world” as he promised to pass industry-supported legislation.24

Over in the House, Scott’s fellow outspoken crypto enthusiast French Hill (R-AR) will take charge of the powerful Financial Services Committee. A crypto advocate in this seat was assured regardless of the outcome, with all four candidates under consideration having “A” (“strongly supportive” of crypto) ratings from Coinbase’s Stand With Crypto advocacy group.25

Trump apparently has more favors to repay than he has political positions to fill, so he’s just creating new ones. In addition to his newly-invented “Crypto & AI Czar”d position, allocated to reactionary PayPal mafioso and venture capitalist David Sacks, Trump has now decided he needs a whole “Crypto Council”. Among its first appointees is Bo Hines, whose qualifications to become the council’s executive director are 1) playing football in college; 2) losing the 2022 midterm general election for a North Carolina House seat; and 3) losing even worse in 2024, when he not only failed to secure the Republican primary nomination, but came in fourth place.26 The crypto world has, like me, mostly reacted with bafflement given that Hines’ crypto qualifications are as absent as all his others. He did receive around $425,000 in backing in 2022 from American Dream Federal Action, a cryptocurrency-focused super PAC run by then-FTX executive and now-federal inmate Ryan Salame, so he was evidently able to convince Salame of his usefulness to the cause.27

Meanwhile, Trump has picked Andreessen Horowitz general partner and Musk pal Sriram Krishnan for an advisory role on AI.26

Bitcoin strategic reserve

Federal Reserve Chair Jerome Powell unequivocally stated in a press conference that the Fed is not permitted by the Federal Reserve Act to hold bitcoin, and that he’s not looking for a change to the law.28 Whether he wants one or not is not likely to stop some of the most crypto-enthusiastic Congresspeople for pushing for a change, and longtime crypto fan Senator Cynthia Lummis (R-WY) has already been drafting a bill that would force the Treasury to purchase 1 million bitcoin over the next five years ($100 billion at today’s prices). It’s not clear how Trump himself feels about this proposal, as his promise for a “stockpile” involved no new bitcoin acquisition, but rather holding on to around 210,000 BTC already seized by law enforcement [I63, 70].

While many bitcoiners love the idea of a strategic reserve, mostly because such large purchases would likely pump their bags, even some in the bitcoin world think it’s a profoundly stupid idea. Many of them think it’s stupid for somewhat different reasons than I do, though, with several prominent bitcoiners expressing concern that it would signal lack of faith in the strength of the dollar. Personally, I remain skeptical about the chances that such a thing will pass in Congress.e However, I do worry that several states seem keen on the idea, with various legislators in Florida, Pennsylvania, Ohio, and Texas proposing the establishment of state-level equivalents.29

Banking

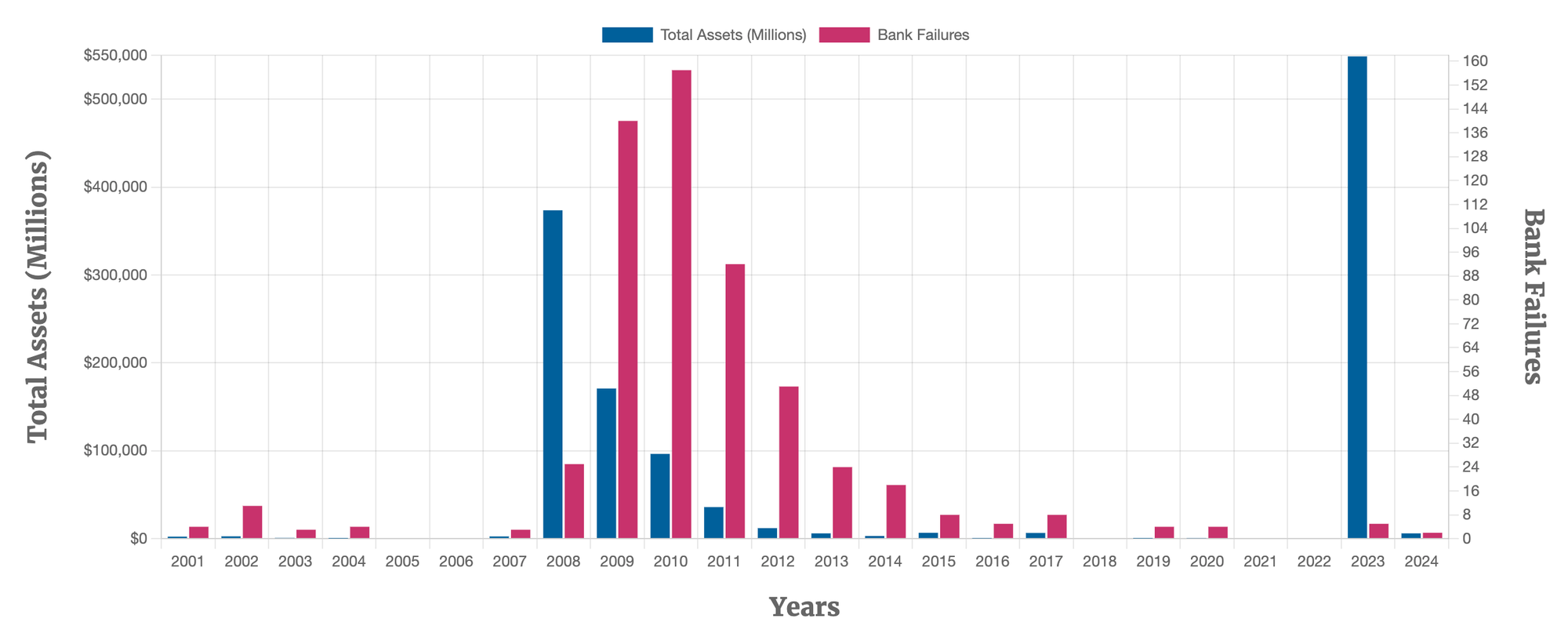

Trump’s nominees have been screening potential bank regulators, and according to the Wall Street Journal, they are very keen on the idea of slashing if not eliminating bank regulators under the guise of “streamlining”.30 Some have apparently asked potential nominees about eliminating the Federal Deposit Insurance Corporation, a Depression-era organization that provides depository insurance against bank collapse, and which has responsible for ensuring that you will not lose up to $250,000 in your bank accounts. This insurance was used heavily throughout the Great Financial Crisis, when more than 300 banks failed from 2007–2010.

It’s not been used nearly as much in the past decade, but it’s notable to reflect on where it’s been used when it has. In 2023, five banks failed, and three of them were closely tied to the crypto industry. In March, a brief banking panic saw the collapse of Silicon Valley Bank and Signature Bank, both of which provided banking services to the then-foundering cryptocurrency industry. SVB was the bank of choice for much of Silicon Valley, and provided some banking to cryptocurrency firms like Circle, which was its largest single depositor, and whose USDC stablecoin lost its $1 peg after news broke that over $3.3 billion in the stablecoin’s backing reserves were held at SVB. However, SVB’s exposure to crypto was not nearly as significant as Signature’s, where more than 90% of total deposits came from crypto clients. (A third crypto bank, Silvergate, also wound down during this time, but because the FDIC did not have to intervene to protect depositors, it isn’t included in the count.)31

The Silicon Valley types now advising Trump were a lot fonder of the FDIC back then, when they were faced with the possibility of losing the millions of dollars they were keeping beyond the FDIC insurance limits.

Anybody who thinks that preventing bank runs and panics isn’t a federal responsibility missed a couple hundred years of financial history. It’s called systemic risk, and only federal banking authorities can stop it.

— David Sacks (@DavidSacks) March 10, 2023

Trump’s new “Crypto Czar” was singing a different tune back then

A full half of venture capital firm Andreessen Horowitz’s portfolio companies were among the beneficiaries of the special bailout that was ultimately authorized to protect all depositors, including those above FDIC maximums.32 Now, Andreessen Horowitz co-founder Marc Andreessen is reportedly acting as an adviser to the Musk- and Ramaswamy-led “government efficiency” group trying to kill the FDIC.33

Later in 2023, Heartland Tri-State Bank failed thanks to a very different cryptocurrency-related issue: its CEO had embezzled more than $47 million and sent it to a cryptocurrency scam [I65, W3IGG].

In journalism

The owners of the crypto media outlet CoinDesk cravenly bowed to pressure from Justin Sun to remove an article about his banana stunt [I71] because he didn’t like its tone, and the site deleted the article without a retraction notice. The article by Callan Quinn noted Sun’s open lawsuit from the SEC and his habit of threatening media outlets with legal action when they note that his Tron blockchain has been heavily used by terrorist groups. While it might be asking too much to expect much in the way of journalistic integrity from a lot of crypto media outlets, for all its flaws, journalists at CoinDesk have done some good reporting in the past — such as when they broke the story about the Alameda Research balance sheet that betrayed FTX’s insolvency. That story was part of their downfall, though, as the FTX collapse contributed to financial problems at CoinDesk parent company Digital Currency Group, which ultimately had to sell the media outlet to a cryptocurrency exchange called Bullish. Despite the cowardice by Bullish executives, some employees at the outlet stood up against the retraction, and submitted a letter challenging the move. The letter leaked, and an excerpt was published by The Block:34

In the original press release announcing Bullish’s acquisition of CoinDesk, you expressed your “unwavering support for CoinDesk’s commitment to journalistic independence.” Unbeknownst to most of the public — we no longer function as an “independent subsidiary” of our parent company. Instead, we have been fully absorbed into Bullish, a crypto exchange that directly competes with many of the companies we cover. ... Evidently, this was all for show. Bullish executives now heavily influence editorial and content decisions. ... The decision to retract [the Justin Sun] article was outrageous, crossing every ethical line that we’re taught to observe as journalists. It showed blatant disregard for CoinDesk’s editorial independence and for our profession. If this got out to other media, it would, rightfully, become its own news story, risking the reputation of CoinDesk, Bullish, Block.one and our journalists.

The letter also accuses Bullish management of “plac[ing] limits on our ability to publish opinion articles … to avoid offending industry leaders.” Bullish responded to the letter from their journalists by firing editor-in-chief Kevin Reynolds and deputy editors-in-chief Nick Baker and Marc Hochstein. CoinDesk editorial committee head Matt Murray also resigned.

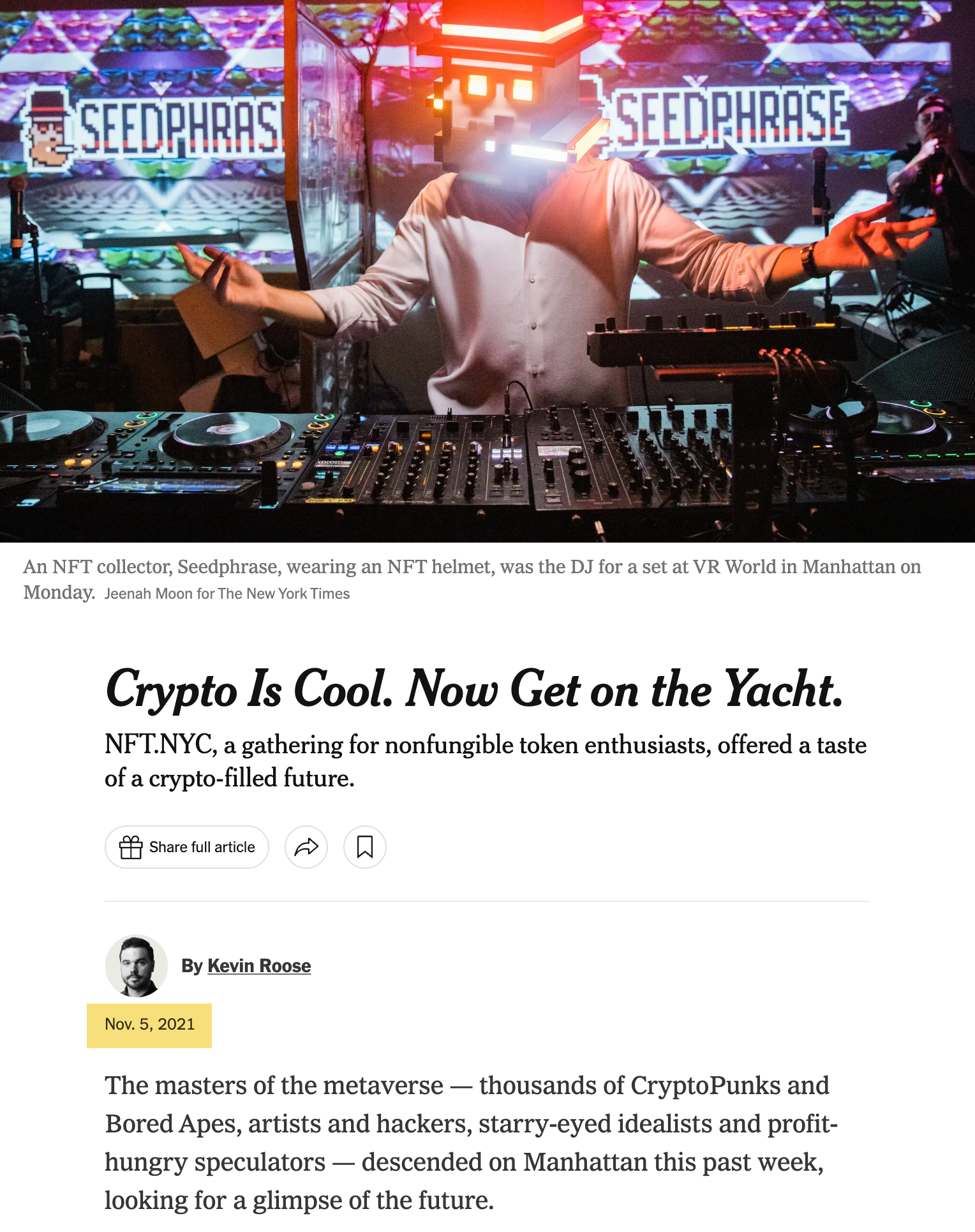

The Wall Street Journal has published a profoundly irresponsible article titled “Young Men Are Making Risky Bets on Crypto and Politics—and Raking It In Right Now”. I still remember, back in late 2021, when there was a spate of articles in mainstream press about how much money some people were making in crypto:

These types of articles were closely timed with peak bitcoin mania and peak bitcoin price, and people who bought in after reading them were immediately plunged into the two years of “crypto winter” that followed.

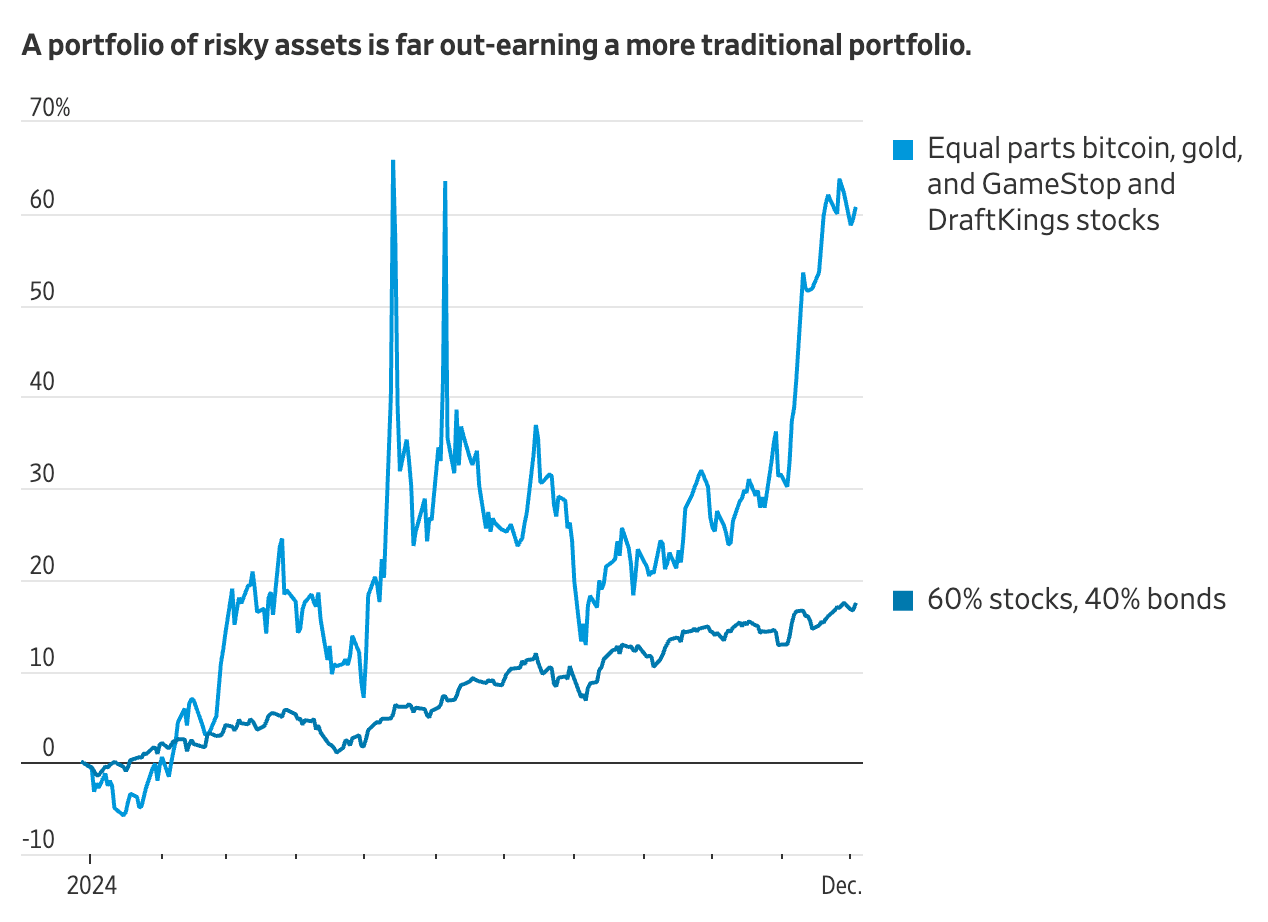

It seems that newspapers have learned nothing from this, and are now publishing puff pieces about how much money people are supposedly making not only from crypto, but from sports betting and meme stocks. The article helpfully includes a chart crime to add to the FOMO, showing that if young investors could just time travel back to January 2024 with the advance knowledge that these four specific assets would outperform an unusually conservative portfolio for young investors, they’d be swimming in it right now.

Practically simultaneously, and without an ounce of self-reflection, the Wall Street Journal also published an article about how Gamblers Anonymous meetings are being frequented by traders who’ve been ruined by memestocks, options, and crypto trading. While the Journal suggests this is “new”, this is a trend I remarked on three years ago [W3IGG], and it certainly predates that as well.

Elsewhere in crypto

Microstrategy, which is nominally a software company but is really more of a weird bitcoin simulacrum due to its massive bitcoin holdings,f has entered the NASDAQ-100 index. This means that, whether they realize it or not, more than a million people may have some form of exposure to bitcoin via their investments in QQQ, an ETF tracking the NASDAQ-100.g By now, Microstrategy holds a whopping 400,000 BTC (~2% of the entire bitcoin supply). Although the business doesn’t do much, and in fact has been losing money on the software end of things, the stock is trading at around a 2x premium to their bitcoin holdings. What could go wrong?35 Meanwhile, Microstrategy is still taking out every loan they can get to buy even more bitcoin. Chairman and co-founder Michael Saylor, the driver of Microstrategy’s bitcoin plan, has been busy trying to convince companies like Microsoft to dump some of its liquid assets into bitcoin, too, saying they could “add hundreds of dollars to the stock price”. However, his proposal was roundly rejected by Microsoft shareholders, with only 0.55% of votes going his way.36

Despite the bitcoin price rally, it’s still hard out there for bitcoin mining companies. An activist investor that has established a significant position in the Riot Platforms bitcoin mining company is trying to decommission some of its bitcoin mining operations and instead convert them into data centers for companies looking to rent computing power for AI. This has been a popular pivot in the bitcoin mining world, as bitcoin mining operations and AI computing are similarly power-hungry, and bitcoin mines often already have the power infrastructure in place.37

Stablecoin giant Tether has dumped $775 million into the Rumble video sharing platform,38 which is known for its popularity among conservative and far-right users, and which has been described by Columbia Journalism review as “a hub for misinformation and conspiracy theories”.39

The NFT project Pudgy Penguins launched its own crypto token, PENGU. Pudgy Penguins also sells plush toys online and at retailers including Walmart and Target, and each stuffed animal comes with a QR code to join “Pudgy World”. Those who’ve scanned their QR codes will potentially, at some undefined point in the future, be eligible for a PENGU airdrop. As Charlie Munger once said, “show me the incentive and I’ll show you the outcome”. At least one person decided it would be a good idea to bulk purchase 1,000 Pudgy Penguins stuffed toys from Amazon to get the QR codes, use the codes to redeem the airdrop, and then return the toys. Estimating, for some reason, each airdrop would be worth $50, the user believed they’d just stumbled into an easy $50,000. Time will certainly tell if that pans out, but it’s likely the airdrop will be worth considerably less, and I for one am very curious to see whether Amazon accepts 1,000 returned, opened boxes. When pressed on the ethics of this scheme by a Twitter user who wrote, “You don't see an issue in this? You are screwing over the next buyer”, they replied: “ser you're in crypto. Every time you make $1 it means another person loses $1”.40 Elsewhere on Twitter, someone shared photos of Pudgy Penguins boxes in a New York Walmart, damaged after someone opened the boxes to scan the codes.41 Some have joked that crypto is akin to digital beanie babies, and in this case they’re not wrong.

As for the PENGU token, which is already being distributed to holders of the much more expensive Pudgy Penguin NFTs, the token price spiked and then quickly dropped.42 This coincided with a massive selloff of the NFTs, as well, suggesting people were waiting for the airdrop and then dumping their NFTs.43

Radiant Capital is the latest to disclose they were exploited by North Korean hackers impersonating software contractors, a tactic that has become common in recent months, and has been the subject of warnings from the FBI [I65]. Though the protocol’s $50 million hack was disclosed shortly after it happened in mid-October [W3IGG], the company has just attributed the attack to a North Korean threat actor. They say the attackers compromised multiple Apple devices used by Radiant employees with a “sophisticated piece of malware” called INLETDRIFT, which was transmitted within a PDF of a supposed analysis of the September Penpie exploit [W3IGG].44

The Web3 is Going Just Great recap

There were eight entries between December 6 and December 22, averaging 0.5 entries per day. $34.11 million was added to the grift counter.

85-year-old painter loses life savings to NFT art dealer scam

[link]

I’d somehow missed that the “surge in cryptocurrency-related crimes” had forced the Brooklyn District Attorney’s Office to create a “Virtual Currency Unit” in September 2023.45 They just uncovered a group of Nigerian scammers operating a ring of around 40 websites that impersonated various real NFT marketplaces, which they were using to scam artists. Pretending to be art dealers, the scammers contacted artists and asked them to agree to sell their artwork as NFTs on various marketplaces. Then, claiming they had earned large sums of money, the scammers convinced the artists to send them money to pay supposed fees in order to access their windfall.

In one case, an 85-year-old painter was scammed out of his life savings after he was convinced to liquidate his retirement, make credit card payments, and take out loans to pay $135,000 to the scammers, who told him he’d made $300,000 on OpenSea. He was left “emotionally and financially devastated” after realizing he’d been scammed. Unfortunately the police were unable to recover any of his money, although they did seize the 40-odd fake NFT marketplaces, which they redirected to a warning site about crypto scams.

Everything else

- SEC fines Jump Crypto subsidiary $123 million [link]

- Two NFT fraudsters charged for rug pulls amounting to over $22 million [link]

- Kraken fined $5.1 million by Australian securities regulator [link]

- Crypto holder loses assets priced at $2.5 million [link]

- Former pastor charged with crypto scheme in which he stole $5.9 million from his former congregants [link]

- Clober gets clobbered [link]

- Alpaca Finance proposes $50,000 restitution for $2.8 million in losses [link]

Worth a read

Neither of today’s recommendations are short, but they’re both excellent.

Maxwell Neely-Cohen, a fellow at the Harvard Library Innovation Lab, published this amazing long-form article on digital archival techniques, and the challenges that present themselves when trying to use digital media for longterm storage. It’s fascinating to the right type of person, and I am one of those types of people. Maybe you are too.

Patrick McKenzie, sometimes better known as patio11, wrote an extremely long analysis of the recent cryptocurrency industry and venture capitalist claims that crypto firms are being subjected to a systematic capaign of “debanking”. It is very informative.

In the news

I had the great honor of being the first guest on the new System Crash podcast, a collaboration between the excellent Paris Marx (of the Tech Won’t Save Us podcast) and the excellent Brian Merchant (author of the must-read Blood in the Machine). We had a great time talking about crypto influence on the elections, and what it’s likely to mean in the coming years.

I spoke to Charlie Warzel about what the cryptocurrency world has become, and its shift away from its original stated anti-government, anti-establishment ideology.

I tried to help shed some light on what’s going on with crypto prices right now, as well as some of the changes that are likely to come at the Securities and Exchange Commission under the Trump administration.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

Complaint filed on December 13, 2024. Document #1 in BiT Global Digital Limited v. Coinbase Global Inc. ↩

“Judge won’t block Coinbase from delisting wBTC over Justin Sun claims”, CoinTelegraph. ↩

“Trump and Coinbase CEO speak by phone—a sign of crypto’s new political clout”, Fortune Crypto. ↩

“Crypto.com CEO Met Trump at Mar-a-Lago as Industry Seeks Influence in New Administration”, Bloomberg. ↩

Brief for the United States of America filed on December 13, 2024. Document #50 in US v. Bankman-Fried (2nd Cir.) ↩

Motion order filed on December 16, 2024. Document #51 in US v. Bankman-Fried (2nd Cir.) ↩

“Cryptocurrency Firm Executive Sentenced to 4 Years in Federal Prison for Stealing $4.46 Million from Employer”, U.S. Attorney's Office, District of Connecticut. ↩

“Tai Mo Shan to Pay $123 Million for Negligently Misleading Investors About Stability of Terra USD”, U.S. Securities and Exchange Commission. ↩

“SEC Charges Cantor Fitzgerald Over Misleading SPAC Disclosures”, U.S. Securities and Exchange Commission. ↩

“Crypto.com Dropped Its SEC Lawsuit Just as CEO Met With Donald Trump”, Decrypt. ↩

“SEC plans to sue Unicoin—a sign outgoing Chair Gensler’s anti-crypto campaign is not over”, Fortune Crypto. ↩

“SEC Serves NFT Project CyberKongz With Wells Notice Citing Securities Violations”, Decrypt. ↩

“Early Bitcoin Investor Sentenced for Filing Tax Returns that Falsely Reported His Cryptocurrency Gains,” U.S. Department of Justice. ↩

“ASIC sues crypto company Binance Australia Derivatives for consumer protection failures”, Australian Securities and Investments Commission. ↩

“EFCC Bursts Syndicate of 792 Cryptocurrency Investment, Romance Fraud Suspects in Lagos … Arrests 193 Chinese, Arabs, Filipinos, Others”, Nigerian Economic and Financial Crimes Commission. ↩

“Polish police arrest former Russian crypto exchange boss wanted by US”, Reuters. ↩

“IMF Reaches Staff-Level Agreement with El Salvador on an Extended Fund Facility Arrangement”, International Monetary Fund. ↩

“Crypto expert’s death to be investigated”, Taipei Times. ↩

“Negligent driving caused crypto expert’s death: prosecutors”, Taipei Times. ↩

“Letter to Senators: Support Commissioner Crenshaw”, Public Citizen. ↩

“Chair Brown in Final Committee Hearing: Our Charge is to Put Workers at the Center of Everything We Do”, U.S. Senate Committee on Banking, Housing & Urban Affairs. ↩

“Next U.S. Senate Banking Chair Calls Crypto 'Next Wonder' of World”, CoinDesk. ↩

“Hill to chair House Financial Services Committee, Walberg to lead Education and Workforce panel”, The Hill. ↩

“Trump appoints former college football player, GOP House nominee Bo Hines to head crypto council”, The Block. ↩

FEC Form Schedule E filed by American Dream Federal Action on June 20, 2022. Page 34. ↩

“‘We’re not allowed to own bitcoin,’ Fed Chair Powell says in light of Trump's strategic bitcoin reserve promise”, The Block. ↩

“Even Bitcoiners say a US strategic reserve is a bad idea”, DL News. ↩

“Trump Advisers Seek to Shrink or Eliminate Bank Regulators”, The Wall Street Journal. ↩

“The Role of Cryptocurrency in the Failures of Silvergate, Silicon Valley, and Signature Banks”, Congressional Research Service. ↩

“Mortgages, Wine and Renovations: Silicon Valley Bank’s Deep Tech Ties”, The New York Times. ↩

“Musk and Ramaswamy race to build a ‘DOGE’ team for war with Washington”, The Washington Post. ↩

“CoinDesk staffers wrote letter to Bullish calling Justin Sun retraction 'outrageous' ahead of leadership firings”, The Block. ↩

“MicroStrategy to Enter Nasdaq 100, Exposing Bitcoin-Linked Stock to Billions in Passive Investment Flows”, CoinDesk. ↩

“Michael Saylor’s case for Microsoft buying bitcoin gets rejected by shareholders”, CNBC. ↩

“Activist Starboard Value Takes Stake in Bitcoin-Mining Company Riot”, The Wall Street Journal. ↩

“Tether Takes $775M Stake in Video-Sharing Platform Rumble; RUM Shares Soar 41%”, CoinDesk. ↩

“Rumble wants your attention”, Columbia Journalism Review. ↩

“You’re not gonna make $50K in PENGU by buying and returning Pudgy toys”, Protos. ↩

“Radiant Capital Incident Update”, Medium. ↩

“Brooklyn DA Launches Virtual Currency Unit to Combat Crypto Fraud”, New York Law Journal. ↩

Footnotes

These are direct quotes from a lawsuit that BitGlobal presumably wanted a judge to take seriously. ↩

I wonder how many crypto firms extend six-figure loans to employees who’ve gotten out over their skis on their personal, risky trades. ↩

Unicoin is not to be confused with Uniswap, a decentralized crypto exchange that also received a Wells notice from the SEC this April [I55]. ↩

Do we really have to call them czars? ↩

While I do think Trump’s promise is a possibility, I don’t know if Congress can find the support for such substantial purchases of additional bitcoin. ↩

Prior to the bitcoin ETFs, it was more challenging to get exposure to bitcoin via traditional brokerages. Buying Microstrategy stock became sort of a way to approximate it. ↩

The good news is that holding a basket of 100 stocks softens the blow if one of those stocks implodes (which is part of the point). ↩