Issue 73 – Degen volunteer fire brigade

Terra founder Do Kwon is finally extradited, the CFPB proposes crypto consumer protections, and Polymarket reaches new lows.

The new year has kicked off with a major development in one of crypto’s most notorious cases: Do Kwon, founder of the collapsed Terra/Luna project, has finally been extradited to be tried in the United States after a 21-month saga in Montenegro. Meanwhile, one regulator is still pushing for stronger consumer protections in crypto, even as they stare down a hostile administration and threats to their very existence.

Welcome to 2025, friends. It’s going to be a hell of a year.

In the courts

Do Kwon

After almost two years in extradition limbo, Terra founder Do Kwon has been extradited to the United States. To recap: in May 2022, Kwon’s Terra stablecoin and associated Luna crypto token crashed catastrophically, ruining many who had been tempted by supposedly risk-free 19–20% APY they were promised in exchange for depositing their dollar-pegged Terra stablecoins (UST) into a protocol called Anchor. Side note: If someone promises you a risk-free 20% annual yield if you just let them hold on to your dollars for you (or turn your dollars into stablecoins and then let them hold on to your stablecoins for you), the risk that that you never see those dollars again is in fact very high.

Despite tweeting “I am not ‘on the run’ or anything similar” [I4], Kwon was in the wind by the time South Korea (Kwon’s home country, also home to many Terra victims) issued a warrant for his arrest in September 2022 [W3IGG]. The United States SEC followed up with civil fraud charges in February 2023 [W3IGG]. In March 2023, Kwon was nabbed in a Montenegrin airport [I23], where he was using a forged passport to try to travel to Dubai.a That same day, US prosecutors unsealed a criminal indictment against him. Kwon spent the next 21 months in a Montenegrin jail, during which a string of more than twenty court rulings and appeals saw him approved for extradition first to the US, then to South Korea, then the US again in a process that Protos wrote was “single-handedly ripping Montenegro apart”1 amid allegations of corruption [I23, 28, 30, 31, 44, 45, 46, 51, 56, 60, 63, 64]. During that time, he and his company were both found liable for fraud in the US SEC case [W3IGG]. A subsidiary of the US trading firm Jump was also just fined by the SEC for their involvement in a secret deal with Kwon and his company to prop up the faltering stablecoin a year before its collapse [I72].

Montenegro has recently been able to reach its first “final verdict” that was actually final enough to see Kwon actually board a plane, and he arrived in the United States to appear in court on January 2. This was celebrated by Prime Minister Milojko Spajić, who tweeted that he believed the extradition would “put an end to pre-election manipulations and attempts to stage a scandal”.2 Kwon is probably not as happy about the outcome as Spajić. Although he fought both extradition to the United States and South Korea, he seemed particularly opposed to the idea of winding up in the United States, with his lawyers at one point arguing that Montenegrin courts had falsified information so as to suggest that the United States requested Kwon's extradition before South Korea, and stating that the facts “absolutely and one hundred percent give priority to Korea.”3 [I56] He’d tried again to halt this extradition, too, by again claiming that Minister of Justice Bojan Božović had illegally granted it, but to no avail.4

The eight fraud, market manipulation, and money laundering charges carry hefty maximum sentences,56 and Kwon stands accused of causing $40 billion in losses to at least hundreds of thousands, if not more than a million people.7 He’s entered a not guilty plea, as is to be expected this early on, and is likely to do a whole lot more sitting around in a jail cell as prosecutors and defense attorneys sift through discovery. “Sounds like we’re going to be backing up a U-Haul to the Southern District,” District Judge Paul Engelmayer joked about the apparent six terabytes of data, before scheduling the trial start date a whopping year away in January 2026 (while offering Kwon and his defense team the opportunity to request an earlier trial).8

Everything else

The Winklevoss twins’ Gemini cryptocurrency exchange will pay $5 million to settle a lawsuit from the CFTC, which alleged that the company had misled the regulator about how they would prevent Bitcoin price manipulation in the Bitcoin futures contract for which they were seeking approval.9 The case at one time threatened to turn criminal, as prosecutors in late 2017 or early 2018 seized laptops belonging to former executives, but criminal charges were never filed.10 The CFTC case is separate from the lawsuits against Gemini pertaining to its “Earn” product, which the SEC alleges was an unregistered securities offering, and which raised billions from investors before pausing withdrawals in November 2022 amid the broader crypto market upheavals and Genesis’ insolvency. One of those lawsuits, filed by the New York Attorney General, resulted in an agreement by Gemini to return at least $1.1 billion to customers [I60]. Another, from the SEC, is ongoing [I17].

Authorities haven’t yet tracked down Richard Heart (actually Richard Schueler) [I67], who has likely fled his home country of Finland and who is now the subject of both an Interpol red notice and listed among the EU’s Most Wanted. However, Finnish police did just seize some of his assets: physical, monetary, and crypto. Among them are 22 watches, mostly Rolexes, valued at around $2.6 million, which were a part of Heart’s incredibly gaudy wardrobe that he used “to create an impression of wealth around him ... possibly to convince investors that they too could become wealthy”, according to a lead investigator.11

.jpg/744bb6f5-9e2a-52ca-b229-5834a7c75f61?t=1736257882566)

In bankruptcies

Binance.US has filed suit against the bankrupt Voyager crypto broker, hoping to reclaim a $10 million deposit from a scuppered deal made during the hectic period of mass collapse in late 2022. The already bankrupt Voyager had reached a deal to be acquired by FTX in late September 2022 [I7], only for that to also fall through two months later when FTX fell apart. A month after FTX’s failure, Binance.US agreed to acquire Voyager’s assets and take on their customers [I19]. However, Voyager never completed the deal by the agreed date because they were litigating exculpatory agreements elsewhere in the bankruptcy proceedings. Binance called it off [I26], but Voyager never returned the deposit, and Binance wants its money back.12 Rather than being transferred to some other crypto trading platform, crypto assets were allowed to be withdrawn in-kind, and the rest are being returned by good ol’ check. Voyager creditors should have received about 70% of their allowed claims by now.13

In governments and regulators

Coinbase is being allowed to appeal to the Second Circuit the March 2024 order by New York Judge Katherine Polk Failla that the SEC has plausibly argued that some transactions met the definition of investment contracts, and thus fell under their purview [I54]. Known as an “interlocutory appeal”, this request to appeal was made while the case still remains in its early stages, and such requests are somewhat rarely granted. However, Failla wrote, “Although the Court does not appreciate, and will not co-sign, Coinbase’s efforts to cast aspersions on the SEC’s approach to crypto-assets, the fact remains that these conflicting decisions on an important legal issue necessitate the Second Circuit’s guidance.” She also noted opinions in other cases in the district involving Terraform Labs and Ripple, where judges may have issued conflicting rulings. She continued, “The Court agrees with Coinbase that ‘[t]he conflict between Ripple on the one hand and Terraform and the [March 2024 Coinbase] Order on the other is symptomatic of the more fundamental difficulty of applying Howey to crypto transactions.’” Failla has stayed the rest of the case pending either a decision from the Second Circuit to deny the request for appeal, or a decision on the appeal itself.14 If the Second Circuit takes the case, it could be very meaningful for the crypto world, which has been battling the SEC over the “securities” determination for years now. However, the industry has put significant efforts towards alternate strategies to escape the SEC even beyond the courts, and is very much hoping that the lawmakers they raised hundreds of millions to help to elect will pass legislation definitively removing the SEC from the crypto beat.

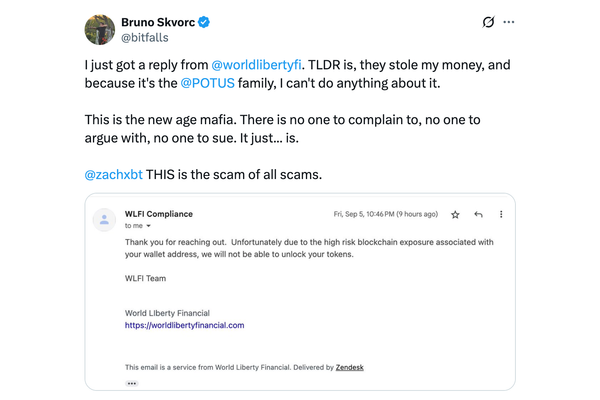

The Consumer Financial Protection Bureau has proposed a new interpretive rule that would require both cryptocurrency platforms and video game companies to reimburse customers for stolen digital assets under the Electronic Fund Transfer Act (EFTA). This is a marked departure from the current sad state of affairs, where crypto platforms that receive complaints from customers whose accounts were emptied typically shrug and say “guess you shouldn’t have fallen for a scam”, then refer them to local law enforcement who in turn shrug and say “we can’t trace stolen crypto”. It’s also a big difference for some video game companies, whose responses to stolen in-game funds vary dramatically based on the game company and, seemingly, the mood of whichever customer support representative you are lucky or unlucky enough to reach on any given day.

The CFPB is not alone in their interpretation of the EFTA. A federal judge interpreted the law the same way in a decision in the Southern District of New York, stemming from a class action lawsuit that was filed after flawed implementation of multi-factor authentication by the Uphold cryptocurrency exchange contributed to multiple customers losing tens of thousands of dollars in assets. Although Uphold never wound up paying much in damages, the opinion in the case included that “personal asset accounts that are investment accounts like ... the cryptocurrency accounts at issue here, are accounts covered by the EFTA”, and noted that the EFTA does not define the term “funds”, leaving it open to the reasonable interpretation that other money-ish assets — like in-game currencies that are bought and sold for real money, or crypto assets — qualify.15

As Georgetown law professor Adam Levitin observed on the Credit Slips blog around the time of the Uphold decision:

That's a huge consumer protection win. Reg E has important consumer protections regarding unauthorized transactions, error resolution, and provision of receipts and periodic statements. It also creates huge compliance headaches for crypto exchanges, which are not set up for dealing with any of those problems. All of the Zelle scam error resolution issues are now going to become crypto scam error resolution issues. And the ruling also indicates that consumer protection at cryptocurrency exchanges is now squarely within the existing regulatory authority of the Consumer Financial Protection Bureau. This could get interesting.

The cryptocurrency industry will, naturally, vehemently oppose this as they have all other attempts at increasing consumer protection in crypto. Already, lawyer Bill Hughes of ConsenSys (the maker of MetaMask) has blasted the “Warrenites”b for the proposal, showing naked contempt for his own customers when he tweeted, “Hacked because you tweeted you emailed your seed phrase or believed that fashion model in Malaysia needed 5000 bucks to fly to see you? Don't worry your wallet might have to cover it . . . ”16 The CFPB is inviting comment for three months.

The IRS has finalized a crypto tax rule that will require some “defi brokers” to collect information about trading activity and issue 1099 tax forms to their users, though it’s not set to go into effect until 2027. Industry lobbying group The Blockchain Association immediately issued a press release to express their horror that the IRS would dare request public comment and then not immediately abandon their rulemaking upon being informed by the crypto industry that said industry is so very innovative it must not be “crippled” by tax reporting requirements. Unsurprisingly, the press release made no mention of the roughly 100 pages devoted by the IRS to addressing comments received during the comment period.17 And more power to whoever had to write those 100 pages, because they were sure a lot more patient than I might have been in explaining that, no, having to report your taxes is not a violation of the First Amendment’s protection against compelled speech.18 The Blockchain Association also had a lawsuit waiting to go, which they filed on December 27 (along with the Texas Blockchain Council, which helpfully joins on these types of lawsuits so that the cases can be filed in the Fifth Circuit).19

The CFTC has reportedly subpoenaed Coinbase for customer information pertaining to Polymarket, according to screenshots of emails that have been going around to customers potentially impacted by the subpoena.20 Polymarket’s betting markets are supposed to be off-limits to those in the US, though its attempts to actually install any limits were laughable, and many Americans openly spoke of placing bets on election outcomes and various other markets on the site. Perhaps Polymarket should open a betting market as to whether they face a CFTC enforcement action in the near future.

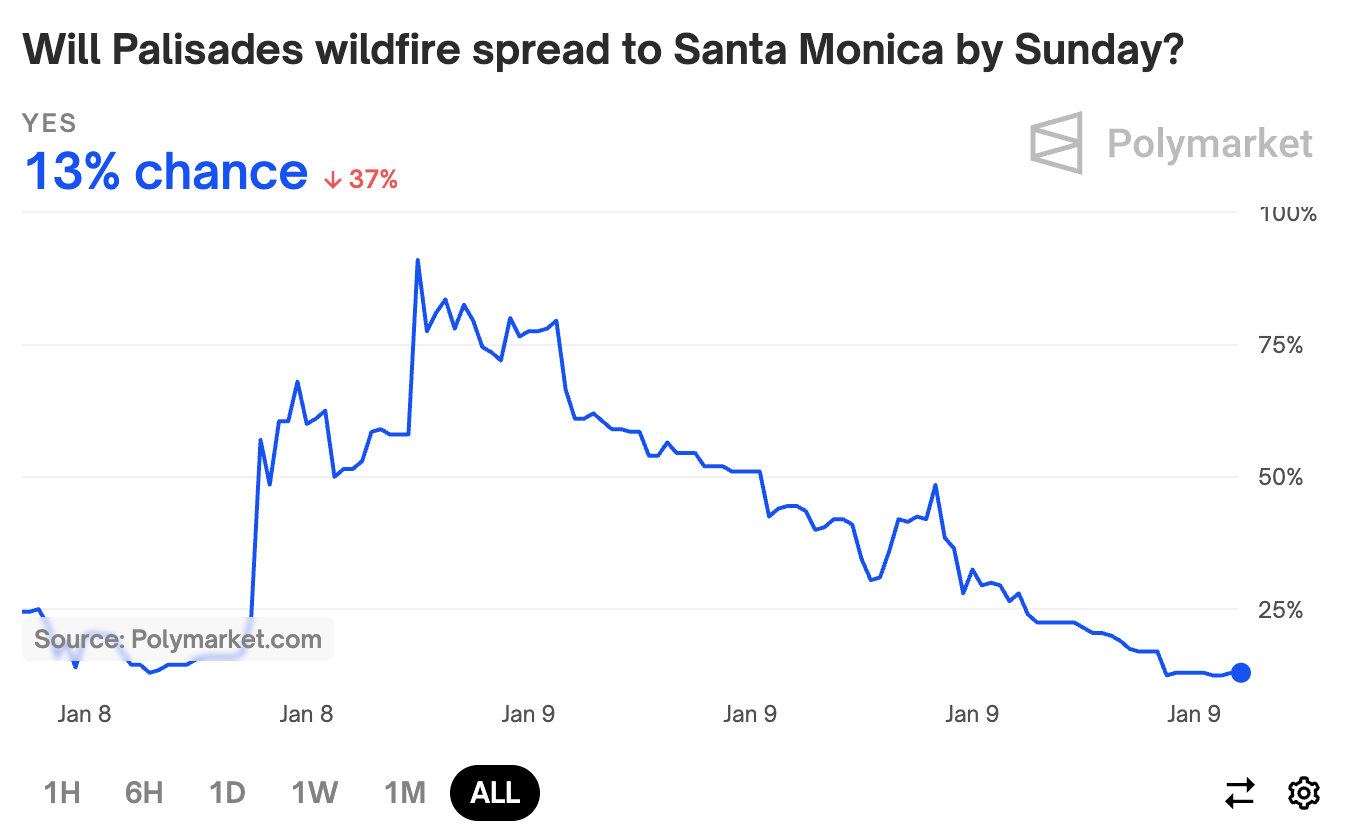

Meanwhile, Polymarket has markets open on questions like “Will Palisades wildfire spread to Santa Monica by Sunday?”, which strikes me as an enormously worrisome thing to have people putting money on.

Then again, if the market swings far enough to “yes”, perhaps we’ll end up with a volunteer fire brigade made up of crypto degens hoping to protect the outcome of their bet.

The crypto industry has continued to doggedly pursue proof of their enormously dubious claims that the FDIC and other financial regulators have been engaging in “Operation Chokepoint 2.0” [I71]. Coinbase has been busy filing Freedom of Information Act requests, hoping to secure documents that would prove that the FDIC was involved in such a nefarious campaign to “de-bank” the crypto industry by ordering banks to deny accounts or other services to anyone involved with the sector. Having failed to obtain such proof, Coinbase is going with the second best option: loudly proclaiming that they have such proof, and hoping no one will bother to dig through the rather dry emails between banks and banking regulators. Fortunately, I have several years of practice in digging through dry documents crypto industry figures hope no one will actually read.

“In short, the contents are a shameful example of a government agency trying to cut off financial access to law-abiding American companies,” wrote Coinbase Chief Legal Officer Paul Grewal on Twitter.21 In long, the documents actually reflect mostly requests for more information about blockchain-related services provided or used by banks themselves, where the FDIC was seeking to do things like “gain an understanding of how the bank will ensure continued safe and sound operation as this activity is implemented”. Where the FDIC did request banks pause activities, it was again where those banks were looking to themselves provide crypto services or offer crypto assets directly to customers (such as multiple emails addressing one or more banks wanting to sell, or already selling, crypto to their customers via web or mobile banking apps), and the FDIC explained that there was not an approved regulatory process for FDIC-supervised banks to do such a thing. One letter asked for more information from a bank intending to provide an account to a company for the purposes of holding reserve assets backing a stablecoin, and contained a list of very normal questions asking about audits, stress testing, anti-money laundering compliance, and reserves verification, as well as any plans for direct integrations that would allow stablecoin holders to redeem the tokens for dollars directly from the bank.22 It did not instruct that the bank should not open an account for the customer.

In elections and political influence

Representative Bryan Steil (R-WI) has been tapped to lead the House Financial Services Committee’s Subcommittee on Digital Assets, Financial Technology and Artificial Intelligence. Steil enjoyed $764,000 in backing from the Fairshake crypto-focused super PAC, plus smaller direct contributions from the Winklevoss twins and a Coinbase PAC. Steil earned an “A” rating from Stand With Crypto by making statements like “Web 3 is happening and it's transformative” on Twitter in July 2024, long after the “web3” buzzword had been largely abandoned by the industry.23 Despite the occasional out-of-touch tweet, he’s a devout worshipper of the crypto industry who has pledged to “build frameworks that support innovation” while in office, and promoted how “traditional financial institutions like community banks and asset managers can benefit their customers from this technology”.

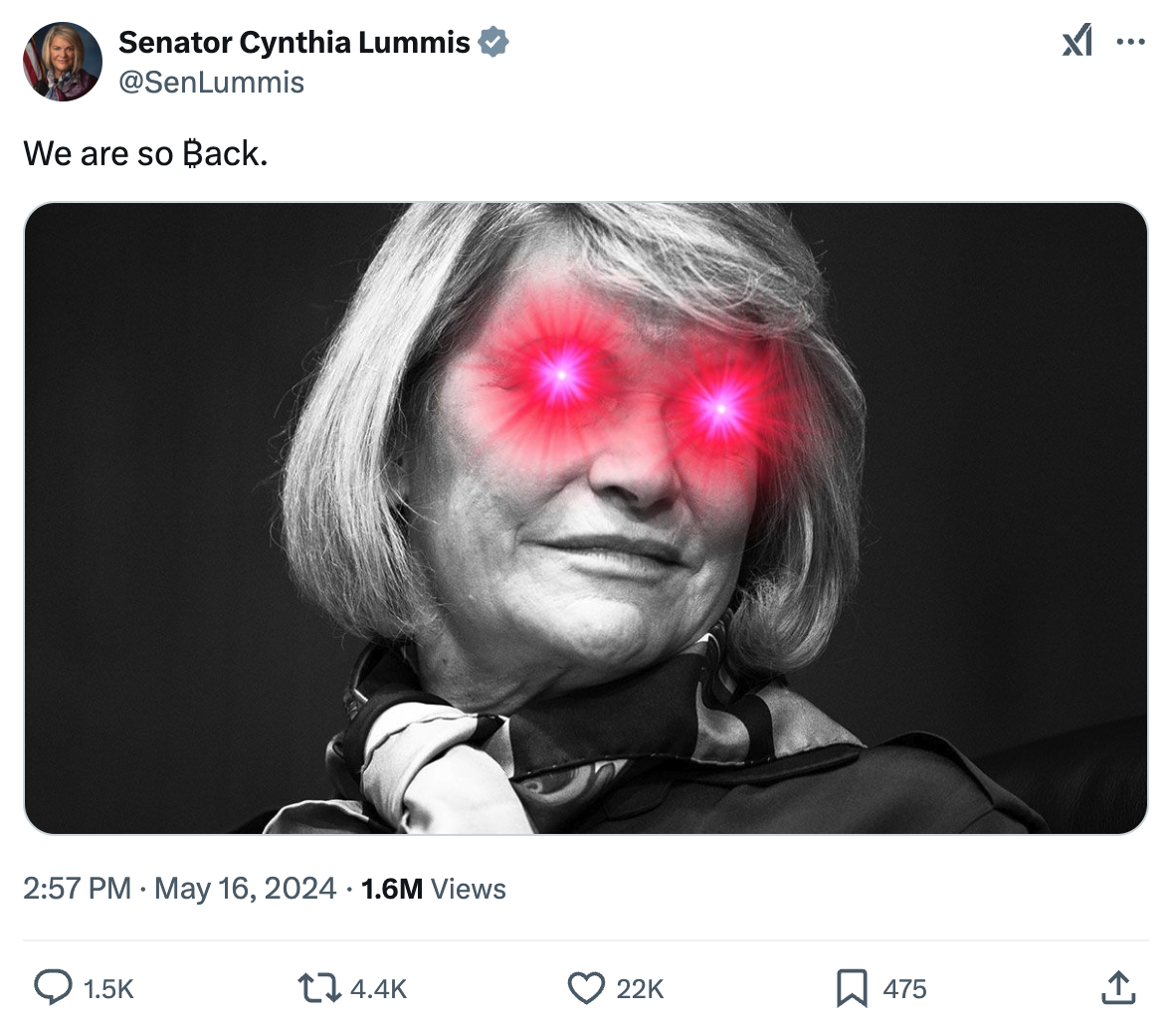

A Senate version of the digital assets subcommittee is also in the works, and has tentatively named laser-eyed Cynthia Lummis as its leader.24

Lummis has been pushing for an absolutely batshit “BITCOIN Act”, which would see the Treasury Department purchasing 1 million BTC over five years (~$100 billion at recent prices). I don’t think she seriously thinks it’ll pass, but it’s useful for signaling loyalty to her bitcoiner fans I suppose.25

Vice Chair of the Federal Reserve for Supervision, Michael Barr, has announced he will step down from the position while retaining his role as a member of the Federal Reserve Board of Governors. While many roles routinely turn over as administrations change, such as the chairs of the SEC and the CFTC, Barr is stepping down not because of norms, but rather because he believes “[t]he risk of a dispute over the position could be a distraction from our mission.” Bad news, Barr: there are going to be a lot of distractions from the Fed’s mission going forward. It’s likely a response to clear signals that Trump plans to replace him with someone considerably friendlier to banks (that is, less interested in the “supervision” activity for which the role is named).26 Barr has also been a notable skeptic of stablecoins, stating that dollar-pegged stablecoins “borrow[] the trust of the central bank” and thus need to be carefully regulated.27

Coinbase CEO Brian Armstrong has cashed out $129 million in personal profit earned from Coinbase stock price increases just since the election, selling off $439 million worth of shares in total. This is more than double the $50 million his company contributed to cryptocurrency super PACs this cycle. Not a bad return on investment.28

Canada

As Justin Trudeau has stepped down as Canada’s Prime Minister, the odds are looking good that the Conservative Party’s Pierre Poilievre will take his spot. Among his other political positions, he’s also a big bitcoin guy, and has made similar arguments as many die-hard bitcoiners about “money printing” and so forth. In 2022 he expressed a desire to make Canada the “blockchain capital of the world” (though he’s now got competition with Trump, who promised similar things with respect to the United States during his campaign).29 Poilievre’s already earned the endorsement of Elon Musk, who has recently taken an unpleasantly active interest in politics outside just the US.30

Elsewhere in crypto

The more than $300 million hack of the Japanese DMM cryptocurrency exchange in May 2024 [W3IGG] has been officially pinned on North Korean state-sponsored hackers, as so many big-ticket crypto heists have been.31 The DMM hack was the largest hack in 2024, followed by the $230 million hack of WazirX [W3IGG] (also likely performed by North Korean hackers).

The Web3 is Going Just Great recap

There were four entries between December 23 and January 9, averaging 0.2 entries per day. $5.1 million was added to the grift counter.

- Feed Every Gorilla hacked again for over $1 million [link]

- Man reports losing $100,000 to website spoofing a crypto exchange [link]

- Hengelo man arrested in alleged crypto pyramid scheme [link]

- Orange Finance hacked [link]

Worth a read

If there’s anything about this most recent crypto boom that I could describe as “refreshing”, it would be the number of crypto-critical articles in mainstream publications. I still clearly remember how I felt in 2021, when crypto was booming and the media was cheerfully complimenting the Emperor’s lovely outfit. Though certainly more clear-eyed, things are a lot less cheery this time around, with Annie Lowrey predicting “[A] bust. A big bust, maybe, with firms collapsing, the government being called in to steady the markets, and plenty of Americans suffering from foreclosures and bankruptcies.”

I really enjoyed this recent episode on the upcoming administration, which went into a lot of detail about some of the likely cabinet appointments and some of the members of Congress who are all in for crypto.

In the news

My recent piece about the right’s war on Wikipedia was unexpectedly timely, as only a few days later, The Forward obtained a copy of a presentation circulated by the Heritage Foundation about their plans to “identify and target” Wikipedia editors they determine to be contrary to their goals. As I wrote in my piece: As other information sources fall, Wikipedia’s stubborn independence becomes more vital than ever. The attacks from [the right] aren't just about an online encyclopedia — they're part of a broader assault on any information source that refuses to be controlled.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

The United Arab Emirates does not have a formal extradition treaty with the United States, although they do have one with South Korea. ↩

The crypto industry and other tech oligarchs like to portray the CFPB as a shadowy puppet of Elizabeth Warren, as she was the one who proposed the idea (back when she was a law professor, and before she took office). However, Warren doesn’t have any role in the independent agency. ↩

References

“Do Kwon is single-handedly ripping Montenegro apart”, Protos. ↩

“Do Kwon's lawyers filed a complaint: ‘Bare force for the interests of the lucrative minister of justice’”, Vijesti, archived from the original. ↩

“Do Kvonova odbrana traži obustavu izručenja: Žalili se Ustavnom sudu i Strazburu”, Portal Analitika (in Montenegrin). ↩

Superseding indictment filed on January 2, 2024. Document #11 in US v. Kwon. ↩

“Do Kwon Extradited to the United States from Montenegro to Face Charges Relating to Fraud Resulting in $40B in Losses”, press release by the U.S. Department of Justice. ↩

Order filed on January 8, 2024. Document #16 in US v. Kwon. ↩

“Do Kwon Criminal Trial Set for 2026 as Lawyers Deal with ‘Massive’ Trove of Evidence”, CoinDesk. ↩

“Winklevoss Twins’ Gemini to Pay $5 Million to End CFTC Case”, Bloomberg. ↩

“Gemini Faced Criminal Probe Over Claims in CFTC Lawsuit”, Bloomberg. ↩

“Törkeästä veropetoksesta epäilty katosi – Miljoonien arvoiset kellot jäivät Suomeen”, Finland Police (in Finnish). ↩

Complaint filed December 26, 2024. Document #1806 in In re: Voyager Digital Holdings. (Adversary case 24-04049: BAM Trading Services d/b/a Binance.US v. Voyager Digital.) ↩

“Plan Administrator's Eighth Status Report”, Voyager. ↩

Opinion and order filed January 7, 2024. Document #175 in SEC v. Coinbase. ↩

Opinion and order, Nero v. Uphold HQ Inc. ↩

“Industry Groups Sue Over Finalized IRS “Broker” Rulemaking”, press release by The Blockchain Association. ↩

“Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales”, Internal Revenue Service. ↩

Complaint filed on December 27, 2024. Document #1 in Blockchain Association v. Internal Revenue Service. ↩

“US IRS finalizes controversial tax rule requiring 'DeFi brokers' to collect user trading information”, The Block. ↩

History Associates Inc. v. FDIC, No. 1:24-cv-1857-ACR (D.D.C.). FDIC’s Redacted Pause Letters. ↩

Bryan Steil, Stand With Crypto. ↩

“Lummis poised to lead newly created Senate digital assets subcommittee”, The Block. ↩

“Lummis Introduces Strategic Bitcoin Reserve Legislation”, Senator Cynthia Lummis. ↩

“Stablecoin regulation advocate Barr steps down as Fed vice chair for supervision before Trump takes office”, The Block. ↩

“Stablecoins need to be regulated, says Federal Reserve's Barr”, The Block. ↩

“Coinbase CEO, Other Crypto Insiders Billions Richer After Seeking to Steer Elections”, CoinDesk. ↩

“In a pitch to cryptocurrency investors, Poilievre says he wants Canada to be ‘blockchain capital of the world’”, CBC. ↩

“Elon Musk, Michael Saylor endorse pro-bitcoin Pierre Poilievre for Canadian PM”, Protos. ↩

“North Korea Blamed for May's $305M Hack on Japanese Crypto Exchange DMM”, CoinDesk. ↩