Issue 74 – Stop asking me questions like “where does the yield come from”

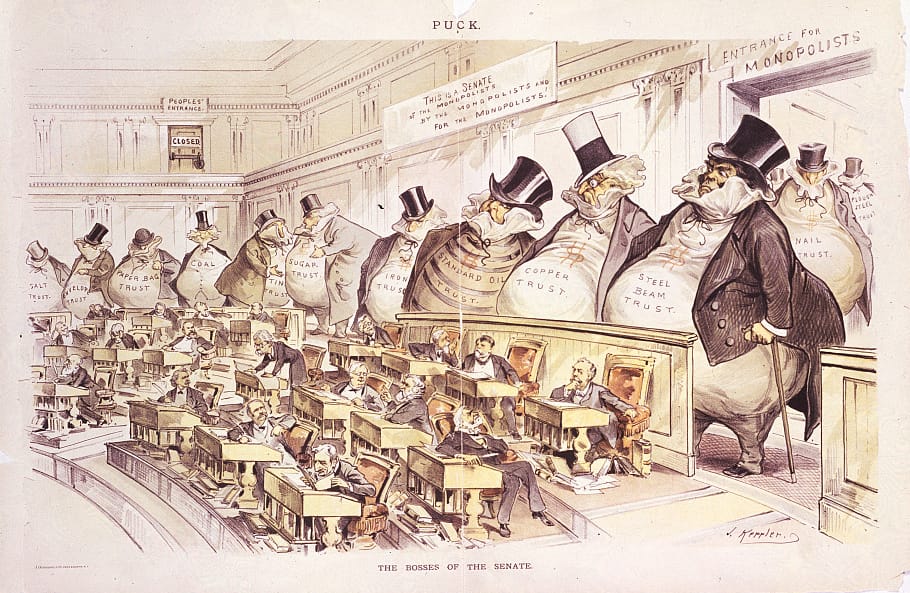

Regulators and lawmakers eagerly prepare to abdicate any last traces of interest in the wellbeing of everyday Americans as they suck up to the powerful billionaires who will soon be publicly calling the shots.

Tech billionaires are eagerly awaiting Trump’s inauguration, hoping that he will quickly follow through with his promises to slash regulations and directly bolster their bottom lines. Many of them have already been named to various advisory positions throughout the White House, ensuring lockstep coordination between the new administration and powerful venture capitalists, crypto executives, and tech CEOs.

As it happens, I’m not the only person rattling on about the tech oligarchy lately. In his outgoing address, President Biden said:

I want to warn the country of some things that give me great concern. And that’s the dangerous concentration of power in the hands of very few ultra-wealthy people, and the dangerous consequences if their abuse of power is left unchecked.

Today, an oligarchy is taking shape in America of extreme wealth, power, and influence that literally threatens our entire democracy, our basic rights and freedoms, and a fair shot for everyone to get ahead.

We see the consequences all across America. And we’ve seen it before, more than a century ago. But the American people stood up to the robber barons back then and busted the trusts. ...

Six decades later, I’m equally concerned about the potential rise of a tech-industrial complex that could pose real dangers for our country as well.

Americans are being buried under an avalanche of misinformation and disinformation enabling the abuse of power. The free press is crumbling. Editors are disappearing. Social media is giving up on fact-checking. The truth is smothered by lies told for power and for profit.

I’ve had more than my share of disagreements with Biden, and wish he’d done a whole lot more and differently to tackle these problems during his tenure,a but I do agree with his words here.

In the courts

After arguing that the $110 million in fines imposed against them in July 2024 [I62, W3IGG] was plenty, thankyouverymuch, bitcoin derivatives exchange BitMEX has been fined another $100 million [W3IGG]. This still pales in comparison to the alleged $1.3 billion in revenues earned by the company during the five-year period it “willfully” ignored US regulations while allowing Americans to trade on the platform. While that revenue did not solely come from American traders, prosecutors alleged that around 11.5% of BitMEX’s customers were based in the US even as the platform claimed not to permit them.

The Digital Currency Group has agreed to settle with the SEC for $38 million over charges that its Genesis subsidiary misled investors [W3IGG]. When the hedge fund Three Arrows Capital blew up and defaulted on a margin call in June 2022 [W3IGG], DCG publicly downplayed the fact that Genesis’s entire business was at risk and overstated its ability to bail out Genesis by taking on its liabilities and doing some weird accounting maneuvering involving a $1.1 billion promissory note. In November, with further crypto market turmoil, Genesis could no longer meet withdrawal requests and collapsed [W3IGG].

US prosecutors have asked the federal judge in the Bitfinex hacking case to okay the return of the majority of the stolen bitcoins that were recovered by the government. 94,643 BTC, amounting to around 80% of the total number of bitcoins seized in connection to the theft and priced at almost $9.5 billion today, will go back to Bitfinex once the judge signs off. The remaining 25,000ish BTC have to be handled separately, as the laundering by the now-imprisoned Ilya Lichtenstein [I70] and Heather Morgan [I71] has made the tokens’ rightful owners challenging to identify.1

The New York law firm Burwick Law filed a class action lawsuit against the pump.fun memecoin platform.2 I expected they would have a large pool of potential plaintiffs to pull from, given analysis last year suggesting that most people who traded pump.fun tokens had lost money.3 However, the lead plaintiff in the suit seems to be some guy who lost $231 gambling on a $PNUT memecoin, themed after a squirrel-turned-very-brief MAGA cause célèbre. A loss is a loss, I suppose. That said, I’m not sure it helps their case that said lead plaintiff — who is down almost $50,000 across all of his pump.fun trading — is still trading memecoins on the platform even after filing the lawsuit accusing it of being an unlicensed securities exchange that relies on shock value to pump token prices. The whole thing strikes me, not a lawyer, as a bit of a slapdash lawsuit. However, pump.fun is also an absolute shitshow, so perhaps slapdash will do.

Prior to its filing, some crypto enthusiasts scoffed at the prospect of any lawsuit against pump.fun, including blockchain sleuth ZachXBT:

One of Burwick’s founding partners, however, argued (as I have in the past) that the type of crypto activity dismissed as “gambling” is often actually far riskier than gambling, at least when it comes to the regulated variety, and that crypto activity like this is more akin to gambling in a rigged game.4 Burwick, a relatively new firm, focuses on crypto class actions. Late last year, they filed suit against the creators of the failed “Hawk Tuah” crypto token [W3IGG] and against Caitlyn Jenner over her apparently abandonedb $JENNER token [W3IGG]. It remains to be seen how their lawsuits fare when it comes to grabbing legal victories in addition to just headlines.

In governments and regulators

Coinbase has notched another win in litigation with the SEC as the Third Circuit has remanded the agency’s decision to deny Coinbase’s petition for rulemaking [I47, 58]. According to the Third Circuit, “the SEC’s order was conclusory and insufficiently reasoned, and thus arbitrary and capricious”, and so they have sent it back to the SEC for a “more complete explanation”, adding the smackdown that the agency “should not give yet another poor explanation in an already-long line of them”. However, the court declined to go so far as ordering the SEC to begin the rulemaking Coinbase had demanded.5 While the appeals court decision is meaningful, the practical outcome for Coinbase and the rest of the cryptocurrency industry is likely not going to be very different from what we’re already expecting with the new crypto-loving Trump administration’s SEC, as I outline later in this issue.

The United States has teamed up with Japan and South Korea to issue another [I65] warning to the crypto world about North Korean state-sponsored hackers, highlighting the high-value hacks of entities like DMM ($308 million), Upbit ($50 million), Rain Management ($16.13 million), WazirX ($235 million), and Radiant Capital ($50 million).6

South Korea has tentatively suspended the local Upbit exchange, alleging they violated anti-money laundering regulations, particularly when it came to their know-your-customer obligations. Upbit has the chance to respond to the penalty, but if it is finalized, they may be prohibited from onboarding new customers for up to six months. The Korean regulator reportedly found around 700,000 suspected violations of KYC requirements, and each brings with it a fine up of up to ₩100 million (almost $69,000).7

Singapore’s gambling regulators have shut down Polymarket, deeming it an “illegal gambling site operated by an unlicensed gambling services operator”. They join a growing list of jurisdictions, including Taiwan, the United States, and France, which have banned the site from soliciting bets from their citizens. Though Polymarket’s efforts to actually implement any meaningful barriers for Americans have been halfhearted at best [I73], Singapore didn’t leave it up to them. The government ordered Singaporean internet providers to block access to the domain and redirect visitors to a warning that the platform is unlicensed and that individuals who gamble on unlicensed platforms face fines of up to S$10,000 (~US$7,300) and/or up to six months in jail.8 Taiwan has taken a similar stance on individual culpability, in December arresting 17 people who had placed bets on the outcome of the country’s presidential election. They face stiff penalties of up to five years in prison and fines of up to NT$500,000 (~US$15,700).9

The United Kingdom is considering prohibiting public sector entities like schools, railway operators, and the National Health Service from paying crypto ransoms. The apparent hope is that such a ban would discourage ransomware attackers from carrying out the attacks in the first place. The consultation also considers other changes, such as implementing a mandatory reporting requirement for companies that are hit by ransomware attacks, and a review system for any ransom payments made by companies not subject to an outright ban.10

In elections and political influence

After his inauguration, Trump is likely to quickly release an executive order designating crypto as a national priority.11 This would not be the first crypto-related executive order — Biden had his own — but the focus on consumer protection and financial risks in Biden’s order is likely to be completely absent in Trump’s. Instead, Trump’s will most likely formalize the signal — already being received loud and clear in Washington, as I outline in a moment — that the crypto industry is a friend to Trump and needs to be treated accordingly. The order will also likely establish a crypto advisory council, though this is not any big surprise given that Trump has already announced that such a council will exist when he announced it would be led by Bo Hines (for some mystifying reason that I would still quite like to learn more about) [I72].

A “top transition source” told Axios that Trump “is going to be very focused on the price of Bitcoin”, and wants to see it hit $150,000 early into his presidency. This does not give me a ton of hope as far as him not pursuing blatant efforts to juice the price of bitcoin to benefit a minute few at the expense of the vast majority of Americans.12

The New York Post, such as it is, published rumors that Trump has been considering an “America First” strategic reserve that would prioritize tokens founded in the United States, such as Solana, USDC, and Ripple’s XRP token.13 Putting aside Trump’s enchantment with anything remotely nationalist, and his complete ignorance of how cryptoassets actually work, this is actually pretty hilarious to watch. Bitcoin maximalists who are disgusted with the idea of “altcoins” (that is, any crypto that isn’t bitcoin) have suddenly been expressing rather well-founded concerns — ones that happen to also apply to their “strategic reserve” asset of choice. “It’s not the government’s place to be making venture capital bets on altcoins,” complained hedge fund manager Quinn Thompson.14 Hear hear! Anyway, let them fight.

Other predictions of Trump’s early actions in office can be found, of course, on Polymarket, and they paint a grim picture. At the moment, Polymarket bettors are asking whether Trump will issue an executive order relating to transgender rights on day 1 (55% yes), reinstate the global gag rule on day 1 (39% yes), say the words “crypto” or “bitcoin” during his inauguration speech (35% yes), create a Bitcoin reserve within his first 100 days in office (41% yes), ban birthright citizenship within 100 days (66% yes), and so forth.

Further down the list, Polymarket has a 6% chance the Trump administration confirms aliens exist within 100 days. There’s something to look forward to, perhaps. Beam me up.

SEC

Reuters, citing “three people briefed on the matter”, has reported that Republicans at the SEC are raring to go on a plan to remake the agency’s approach to crypto, including by writing guidance around when cryptocurrencies are considered to be securities, and “reviewing” some of the ongoing crypto litigation.15 Reuters reported:

In the first few days of the new administration, the SEC is expected to begin a review of those [crypto-related] court cases and potentially freeze some litigation that does not involve allegations of fraud, said two of the sources. Some of those cases could eventually be withdrawn.

Some of the most prominent of the SEC’s crypto lawsuits fall into that category, including ongoing litigation against Coinbase, Ripple, and Gemini — who also happen to be some of the top donors to the crypto industry’s lobbying efforts. However, some ongoing SEC cases do also allege fraud, such as those against Binance, GotBit and other market makers, and Justin Sun and his various companies.

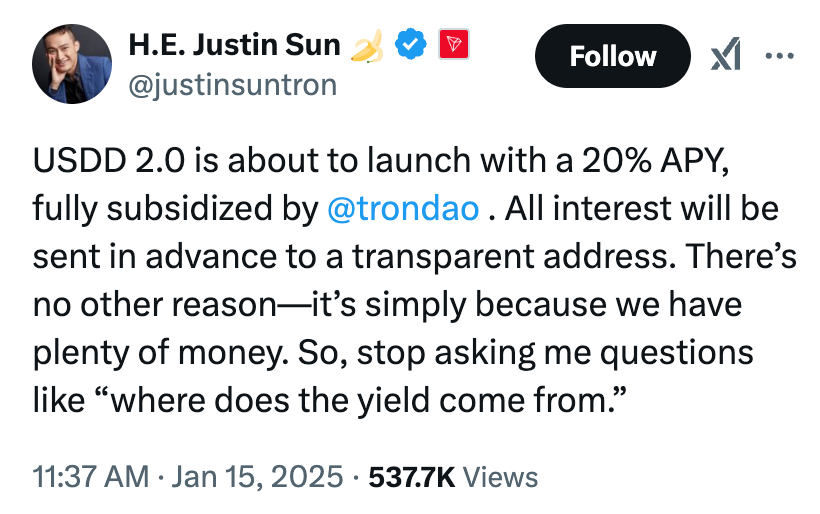

Speaking of Justin Sun, remember last issue when I wrote about the Terra fraud: “Side note: If someone promises you a risk-free 20% annual yield if you just let them hold on to your dollars for you, the risk that you never see those dollars again is in fact very high”? Well, an hour after retweeting with the 👀 emoji a Reuters bulletin about the SEC enforcement “freeze” (a headline which did not make mention of the carve-out for cases, like Sun’s, alleging fraud), Sun fired off one of the most spectacular tweets I’ve seen out of the industry in a while:

Stop asking questions! Why can’t you understand that we just have so much money that we want you to send us your money so that we can give you our money! This fellow is the newest adviser to Trump’s crypto project, a role he bought for $30 million ($18 million of which goes directly into Trump’s pockets) [I71]. More likely he was interested in buying the proximity to Trump and his family members and trusted advisers.

— Molly White (@molly0xFFF) November 10, 2022

It may be time to go frame shopping soon.

The new Trump administration is also likely to quickly overturn the SEC’s Staff Accounting Bulletin 121, which requires banks to report crypto assets as a liability on their balance sheets. The crypto industry has argued that the rule unfairly prevents banks and other financial institutions from getting into crypto by making it extremely expensive, and that the SEC overstepped its authority in issuing such a bulletin without going through its more formal rulemaking process or seeking new legislation from Congress [I58]. A bill to overturn SAB 121 passed in May, but was quickly vetoed by Biden, who wrote: “this Republican-led resolution would inappropriately constrain the SEC’s ability to set forth appropriate guardrails and address future issues. This reversal of the considered judgment of SEC staff in this way risks undercutting the SEC’s broader authorities regarding accounting practices. My Administration will not support measures that jeopardize the well-being of consumers and investors.”16 Biden had far in advance announced his intent to veto the bill if were to pass. Back then, I naively wrote that I thought it was possible that “some Senators viewed this as freebie opportunity to appeal to a promised (though quite likely mostly imaginary) base of single-issue pro-crypto voters without any real ramifications” [I59]. I was very wrong: it was the opportunity to appeal to the crypto industry and its overstuffed PACs’ wallets that they were after. Indeed, very shortly after the voting, Stand With Crypto added Congresspeople’s votes on the bill as a mark in favor or against them on their “crypto report cards”, and allocated funding accordingly.

Meanwhile, rather than waiting for any changes from the SEC, Coinbase is barreling right ahead. They’ve already relaunched a program in which customers can borrow against their bitcoin holdings, even though they’d previously shut it down following SEC warnings.c Coinbase’s website suggests that people take out these loans so they can do things like “making a down payment against your mortgage”.

FDIC

As you may have observed by now if you are a regular reader of this newsletter, a rather unexpected entity has been at the center of much politicking lately: the FDIC. In addition to Trump transition team members reportedly testing the waters with potential Trump appointees about eliminating the FDIC entirely [I62], the FDIC has also been on the receiving end of a whole slew of accusations from the crypto industry with respect to what the industry has deemed “Operation Choke Point 2.0” [I71, 73]. As I’ve outlined in recent issues, the crypto industry has decided that the government has been involved in a “Choke Point”-style campaign to illegally pressure banks to “debank” crypto companies. The actual specifics of what would constitute such a campaign seem to vary widely based on who in the industry you speak with, and in some cases, based on what moment in time you’re conversing with one of those people. While I agree there would be reason to be concerned if government entities were pressuring banks to baselessly deny services to broad swaths of people without any real risk analysis, much of the conversation seems to have morphed into “crypto company X was denied a bank account and therefore Operation Choke Point 2.0 is real!” without any evidence that there was government pressure involved, or that the bank forewent any risk analysis. (And to be clear, a bank denying a person or company a bank account or other services based on actual risk analysis is a normal part of banking operations, and like other types of companies in the US, banks are not required to offer services to everyone.d)

Nevertheless, the crypto industry’s complaints have found their way to those in (or about to be in) powerful places, who seem very concerned with making sure the crypto industry knows they’re concerned about the issue. There has been a lot of bluster, including a speech from the current Vice Chair of the FDIC (who is likely on the shortlist to become chair, and will be interim chair during any gap) and a Very Angry Letter from Senator Cynthia Lummis (R-WY) to the current (though not for long) FDIC chair. While the crypto industry has celebrated both events as “proof” that an improper Choke Point-esque campaign happened, actual proof remains sparse. Vice Chair Hill spoke only of “various accounts” of such a campaign reaching his ears,17 and Lummis was careful to couch a tweet about “recent allegations” of the same with an “if true”.18 Now Lummis has spoken in her Angry Letter of FDIC whistleblowers who allege that the FDIC has been destroying materials to do with their crypto-related activities.19

I agree with Lummis that, if true, those allegations are concerning. However, I suspect regular readers will not be surprised to hear I’m also hesitant to just take the crypto industry at their word without any firm evidence, particularly in the context of their hopes to break down any firewalls between the banking system and the crypto world. My skepticism somehow has come to a shock to some influential figures in the crypto industry — a group that at one point used to endlessly repeat the phrase “don’t trust, verify”20 — and now some of them seem awfully concerned with my well-being.

I do hope that any such inquiries happen relatively publicly — something I assume the crypto industry and all of its self-described transparency advocates would support as well. With so many crypto advocates now in Congress hoping to signal their support for the industry, I worry about closed-door proceedings where they establish “yep, we promise we found proof that the crypto industry has been wronged by the Big Bads at the FDIC, and for that reason we must make it up to them by eliminating any banking oversight or regulatory hurdles!”

Everything else

Amid confirmation hearings for positions like Treasury Secretary and Attorney General, there have been relatively few questions about crypto despite its prominence throughout the rest of the political conversation. Though mostly using it as an opportunity to soapbox about the non-existent “Biden administration project to create a US CBDC [central bank digital currency]”, Marsha Blackburn (R-TN) lobbed Bessent a softball about whether he’d support the creation of such a thing. He took a meandering route to say that he doesn’t believe the US needs a CBDC, which seemed to more or less suit her, though she seemed to be fishing for a more emphatic “no”.

The crypto industry is throwing its very own black tie “crypto ball,” hosted by Bitcoin Magazine and a very long list of other crypto sponsors. Tickets go for $2,500 on the low end, and dinner will not be served. It does not seem Trump will be in attendance, and reporters are strictly forbidden.

Elsewhere in crypto

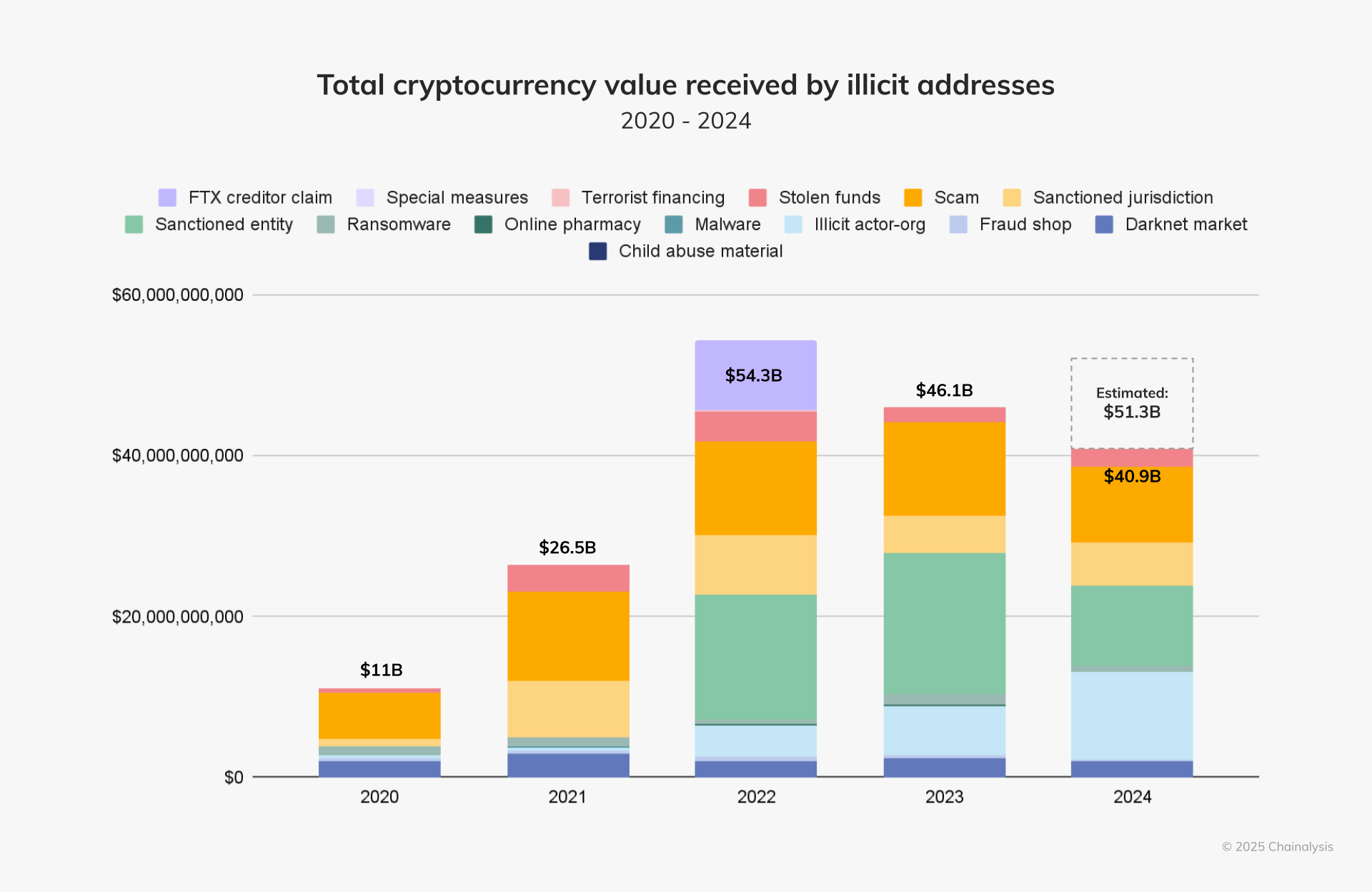

Chainalysis has released its annual crypto crime report, estimating around $51 billion lost to illicit actors last year. However, this likely underestimates things, as Chainalysis omits “funds derived from non-crypto-native crime, except for cases brought to our attention by customers”, “funds associated with crypto platforms accused of fraud, absent convictions in court”, and “transaction volumes associated with potential market manipulation”, probably because they don’t want to risk having to classify a much larger portion of crypto activity as illicit. One interesting trend is that the majority of illicit transactions are now made using stablecoins — a trend that has held roughly steady over the last three years after bitcoin was ousted from this position in 2022.21

Speaking of which, Tether CEO Paolo Ardoino has announced that Tether will be relocating to El Salvador. “Many others will follow,” he wrote on Twitter, probably not intending to refer to all of the law enforcement investigators.22

The Financial Times has reported that pension funds are increasingly jumping into crypto, as many of us worried they might with the greenlighting of crypto ETPs in the US. “We generally thought that even though crypto is risky, new and not yet fully proven, that it had become too big, and its potential was too great to continue to ignore,” said a senior portfolio manager at Australia’s AMP financial services company. It’s not often you hear a fiduciary say “well it’s really risky but we had FOMO” not only out loud, but to the press. Another small UK pension fund had put money into bitcoin “in the hope that outsize returns might help plug its funding deficit”. If that doesn’t work, perhaps next they’ll go put it all on black.23

Some crypto enthusiasts have learned the hard way that not all crypto influencers are actually as good at trading as they make themselves out to be. A platform called HyperLiquid created a feature where people can put money into funds that can then be traded by other people, potentially earning returns from their profitable trading strategies. Some people did so with a crypto influencer known as “Rektober” (ominous), who has 83,000 Twitter followers and once boasted of “turn[ing] $3k into $330k in less than 2h” on a Luigi Mangione-themed memecoin (after having promoted said memecoin to his own followers).24 Within two weeks of opening the HyperLiquid fund, he’d blown a million of his and other peoples’ dollars.25

The Web3 is Going Just Great recap

There were nine entries between January 9 and January 17, averaging 1 entry per day. $2.72 million was added to the grift counter.

NFTs are going just great

While cryptocurrency markets have undeniably had a rebound, the same cannot be said for NFTs. Years ago, brands were tripping over themselves to launch NFT projects so as to be seen as cutting edge. Now they’re quietly discontinuing them, often leaving the holders of said NFTs in the lurch. The Australian Open [W3IGG] is only the latest to do so, following in the footsteps of other projects including Nike [W3IGG] and Lacoste [W3IGG] that have jettisoned their short-lived but often lofty and expensive ambitions.

Those involved in selling the NFTs are having a similarly rough time, with MakersPlace admitting that the $30 million in funding they received from the likes of Eminem, Sony Music, and Coinbase Ventures in August 2021 is drying up, and that they have little hope of new cash infusions. They’re shutting their doors and returning whatever venture funding they have left [W3IGG].

Sony accused of “rugging”

[link]

Apparently not deterred by other brands’ (and its own portfolio company’s) failures to launch in the web3 world, Sony has officially launched its own “Soneium” layer-2 blockchain. Almost immediately, they were accused of “rugging” by those who had purchased memecoins that Sony quickly froze for infringing on their IP, including an “Aibo” token based on Sony’s line of toy robot dogs and a “Toro” memecoin themed after Sony’s unofficial Toro Inoue mascot. Sony’s crackdown on these tokens perhaps should not have come as a huge surprise, given that the announcement of Soneium’s launch promised “protecting content rights and creating fair profit-sharing mechanisms” among its goals.

![[person 4] I just wanted a cute robot dog koin? [person 5] Why are you honeypotting coins lol [person 1] this is very bad vibes [person 2] A disastrous beginning [person 1] obviously not end-of-the-world but people bridged to Soneium to ape new memecoins and seeing themselves get locked out and rugged in real time](https://www.citationneeded.news/content/images/2025/01/sony-rug-1.png)

Everything else

- Digital Currency Group settles with the SEC for $38 million over misleading statements surrounding Genesis collapse [link]

- BitMEX fined an additional $100 million for regulatory violations [link]

- The Idols NFT loses $324,000 to exploit [link]

- UniLend exploited for almost $200,000 [link]

- Bankless hosts slammed for dumping tokens [link]

- $2.2 million stolen by fake job scammers [link]

Worth a read

Journalists at The Washington Post have shed some very chilling light on the influence of Marc Andreessen and his cronies in the Trump administration, where they are already working to push the tech agenda, call off any watchdogs that might rein in the industry’s worst abuses, and oppose all things they fear could be tainted by “woke”. “[Andreessen confidants] will be scattered around all over the place and have their marching orders,” said one source familiar with Andreessen’s machinations. I remain fascinated by Andreessen’s ability to convince himself that “Big Tech” is his enemy, and wonder if he’s somehow avoided all mirrors for the last couple decades.

If any of you happen to share my affection for space operas — that is, the subgenre of sci-fi novels involving cinematic space battles, futuristic technology, and wars among alien races — I recently had the opportunity to curate a book display at my local library and chose that as the theme. I published on my personal blog the list of books I included (as well as a few more that I wished I could’ve included, two of which I was later able to add after breaking into the library director’s secret stash). I find they make a nice escape from the stresses of current politics and news, though they are sometimes surprisingly relevant (as sci-fi so often is).

In the news

I spoke to Allison Morrow at CNN about Wikipedia, and how it has shifted from the source your high school teacher told you never to trust to one of the increasingly few places on the internet that won’t fabricate absolute nonsense and tell it to you with a straight face. (Glue pizza, anyone?) I also explained why I don’t think Twitter’s community notes will ever make Twitter the “number one news source on earth” as Elon Musk claims to wish it to be.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

“U.S. Prosecutors Ask Court to Green-Light Return of 95,000 Stolen Bitcoin to Bitfinex”, CoinDesk. ↩

Complaint filed on January 16, 2025. Document #1 in Carnahan v. Baton Corporation Ltd. d/b/a Pump.Fun. ↩

Opinion of the court filed on January 13, 2025. Coinbase Inc v. SEC (3rd Cir.) ↩

“Joint Statement on Cryptocurrency Thefts by the Democratic People’s Republic of Korea and Public-Private Collaboration”, U.S. Department of State. ↩

“South Korea’s Upbit exchange hit with business suspension penalty: report”, The Block. ↩

“Polymarket’s shutdown in Singapore increases pressure on leading prediction market”, DL News. ↩

“17 arrested for Taiwan election betting on crypto prediction market”, Taiwan News. ↩

“World-leading proposals to protect businesses from cybercrime”, UK Government. ↩

“Trump Plans to Designate Cryptocurrency as a National Priority”, Bloomberg. ↩

“Behind the Curtain: The Silicon swamp”, Axios. ↩

“Crypto crowd ready for blue skies under Trump administration: Four-year ‘harassment’ is over”, New York Post. ↩

“Solana, XRP Jump as Trump Reportedly Mulls 'America-First' Strategic Crypto Reserve, but Experts Suggest Otherwise”, CoinDesk. ↩

“Trump's new SEC leadership poised to kick start crypto overhaul, sources say”, Reuters. ↩

“A Message to the House of Representatives on the President’s Veto of H.J.Res. 109”, The White House. ↩

“Charting a New Course: Preliminary Thoughts on FDIC Policy Issues”, speech by FDIC Vice Chairman Travis Hill. ↩

Letter from Senator Cynthia Lummis to FDIC Chairman Marty Gruenberg. ↩

“What is Don't Trust, Verify”, Bitbo. ↩

“Illicit Volumes Portend Record Year as On-Chain Crime Becomes Increasingly Diverse and Professionalized”, Chainalysis. ↩

“Pension funds dabble in crypto after massive bitcoin rally”, Financial Times. ↩

“HyperLiquid lets influencers experience blowing up a fund”, Protos. ↩

Footnotes

Read Brian Merchant’s excellent piece on this, which largely aligns with my thoughts on the subject: “The tech oligarchy has been here for years” ↩

As is common with celebrity-backed projects, Jenner repeatedly insisted that her project was different because she was in it for the long term. She hasn’t mentioned the token on Twitter since August 2024, about three months after it launched. ↩

Coinbase claims the shutdown was because of low demand, and certainly had nothing to do with the Wells notice from the SEC shortly before. “You can’t fire me, I quit!” ↩

With the caveat that, like other businesses, banks are not to deny services for discriminatory reasons (though I don’t believe “crypto holder” is a protected class, though you might think so based solely on reading some of the comments out of the crypto industry comparing their claimed plight to that of minority groups). ↩