Issue 75 – Absolutely preposterous

Trump horrifies even some of his crypto-steeped fans by launching a memecoin before his inauguration, and a flurry of activity from the new administration signals what’s in store for the crypto world in the next four years.

Maybe it’s just because I’ve been trying to keep up with the breakneck pace at which things are happening in the crypto and political worlds right now, but I’m pretty sure this past week was about a month long.

There are not very many people outside of the industry-funded, industry-silenced,a and therefore heavily pro-crypto crypto media world who follow crypto full-time. While there are journalists in traditional media who follow crypto, they often split their time with broader finance, tech, or politics beats and struggle to dive deeply into the topic or even separate the reality from the marketing and political PR. They also often face editorial pressures to give “equal weight”, as though industry spin and reality are two equally valid perspectives. While I knew this was going to be particularly important work going forward into the new United States political administration, the events of the past week have highlighted that even more than I expected.

This is why your support of Citation Needed is so crucial. Your pay-what-you-can contribution enables me to maintain my editorial independence, dedicate the time needed for deep investigation and for helping others in media and government understand this space, and keep all of my work freely accessible to those who need it most. I do not have any institutional or corporate backing, and am entirely supported by readers like you. If you value thorough, uncompromised coverage of the crypto world, the broader technology world, and their increasing impact on the rest of the world, please consider becoming a supporter today.

Before I jump in: the announcement is live that I will be a featured speaker again this year at South by Southwest! I will be doing a featured session about crypto titled “Speaking Truth to Crypto Power” on March 7. This is in addition to the fireside chat on digital sovereignty that I will be having with Flipboard CEO Mike McCue on March 9. If by any chance any of you will be at SXSW, I’d be delighted if you dropped by!

In US politics

The memecoin

As some of Trump’s most devoted supporters from the crypto world were clinking champagne flutes at the industry-funded black-tie “Crypto Ball”, Trump was elsewhere, launching his own $TRUMP memecoin.b There had been no signal that this was coming, and it took the crypto world by surprise. Some, myself included, wondered if Trump’s Twitter was the latest casualty of a years-long slew of incidents in which high-profile Twitter accounts are compromised and used to shill fake crypto projects [W3IGG].

We had reason to be suspicious: the token was launched without any of the usual teasers and other crowdwork typical of Trump’s other crypto ventures. The wallet used to create the token was funded with deposits from Binance and Gate.io, two crypto exchanges that are not supposed to be available to US traders (and a particularly odd choice for a president demanding that crypto be “made in the USA”). His wealthy backers at exchanges like Coinbase and Kraken appeared to be as surprised as everyone else, and it took them several days to list the token — losing them substantial trading volume compared to if they had been in on the plan from the getgo.

Nevertheless, $TRUMP turned out to be the genuine article [W3IGG], and so was the $MELANIA token that followed shortly after. Whoever launched the $MELANIA token perhaps thought they could replicate the successful $TRUMP cash-grab by simply doing the same thing all over again, not realizing that launching a second closely-linked token would directly compete with the first. Indeed, $TRUMP prices tanked 58% upon the $MELANIA launch [W3IGG]. The prices of both tokens have dwindled since, as memecoin prices often do. However, it seems to have succeeded in convincing even more people to get into crypto: an app called “Moonshot” briefly rose to the top of the app store rankings for free finance apps as Trump partnered with the platform to allow people to purchase his $TRUMP tokens using a debit card, Apple Pay, or Venmo.1 Moonshot’s Twitter account is full of celebratory tweets and retweets about onboarding more non-crypto users, with one tweet reading “Boomers have onboarded”,2 and a retweet of a person writing “my entire family including my 80 year old grandma is on” the app.3

While the crypto world has been loudly all in for Trump, his memecoin stunt was a bridge too far for some. Crypto venture capitalist and enthusiastic Trump supporter Nic Carter, who was attending the ball when the token was launched, told Politico, “It’s absolutely preposterous that he would do this ... They’re plumbing new depths of idiocy with the memecoin launch.”4 He later told the AP, “Now, on the cusp of getting some liberalization of crypto regulations in this country, the main thing people are thinking about crypto is, ‘Oh, it’s just a casino for these meme coins’.”5 An influential crypto industry lawyer tweeted: “Trump dropping his own memecoin means he has the wrong people in his ear re crypto policy. I’m now getting very concerned about the Trump presidency.”6 Others expressed concern that the memecoin would make the whole industry look like a grift to outsiders who may be learning about it for the first time, and some joked that they missed former SEC Chairman Gary Gensler’s regulatory approach already.

Even crypto-friendly Congressman Ro Khanna (D-CA) joined in, writing “Elected officials must be barred from having meme coins by law.”7 Senator Elizabeth Warren (D-MA) and Representative Jake Auchincloss (D-MA) have written an Angry Letter asking multiple government agencies how they intend to address “the unprecedented concerns posed by the launch of the $Trump and $Melania meme coins, including the threats from consumer ripoffs, corruption and foreign influence, and President Trump’s conflicts of interest.”8 They note that “As President, Mr. Trump is responsible for nominating the leaders that will enforce our laws against crypto companies ... This creates an unavoidable conflict of interest, as he will be in a position to both benefit directly from the sale of the tokens while also setting the policy on how these markets are regulated.” While a letter of this sort is no surprise from staunchly anti-crypto Warren, Auchincloss has been a longtime vocal supporter of crypto.

In my view, the memecoin launch only adds to Trump’s long list of already very serious conflicts of interest. The two memecoins are in addition to multiple NFT projects by both Donald and Melania Trump, the World Liberty Financial project from which Trump earns a substantial percentage of the revenue, and Trump’s disclosed ETH holdings. There are also ethical issues around influence buying and the emoluments clause, and the president’s crypto tokens, NFT projects, and publicly disclosed wallet addresses are yet more avenues that those hoping to curry favor with the president could use to funnel money in his direction, as with his hotels and other business ventures during his first term in office.

Ethereum co-founder Vitalik Buterin also joined in expressing concerns about politicians launching tokens, posting: “The risk of politician coins comes from the fact that they are such a perfect bribery vehicle. If a politician issues a coin, you do not even need to send them any coins to give them money. Instead, you just buy and hold the coin, and this increases the value of their holdings passively.”9

Day one

The uproar around the memecoins quieted somewhat as Trump was sworn in, and crypto enthusiasts eagerly anticipated that he would make good on his day one promises. Yet crypto prices reflected the disappointment among those in the crypto industry when neither bitcoin nor crypto earned a mention in his inauguration address. Promises to pardon Libertarian and crypto martyr Ross Ulbricht “on day one” also went unmet. Rumors of an immediate crypto executive order remained only rumors as the day came and went, with Trump instead focusing his priorities on orders seeking to end birthright citizenship, declaring a “national emergency” at the US–Mexico border, eliminating government diversity programs, and pausing the TikTok ban.

The one day-one executive order that pertained somewhat to crypto was one demanding an end to “weaponization of the federal government”. Although it highlighted cases to do with January 6 and the Black Lives Matter protests, the Securities and Exchange Commission earned a shout-out as one of the named agencies whose actions should be “reviewed” to “identify any instances where a department’s or agency’s conduct appears to have been contrary to the purposes and policies of this order” — a likely nod to the crypto industry.10

Ross Ulbricht

The crypto industry and Libertarians alike got their wish on day two, though, as Trump pardoned Ross Ulbricht. Ulbricht, the founder of the notorious Silk Road marketplace, earned a sentence of double life in prison plus forty years after he was convicted on charges including narcotics distribution, money laundering, hacking, and trafficking in fraudulent identity documents. Prosecutors had also alleged that Ulbricht had attempted to commission the murders of at least five people who had reportedly threatened to expose his crimes, but after Ulbricht’s sentencing, those additional charges were no longer pursued.

Trump was very clear in his announcement of the pardon that he had granted it as a thank you to the Libertarians, for whom it has been a top priority over the past decade or so. “I just called the mother of Ross William Ulbricht to let her know that in honor of her and the Libertarian Movement, which supported me so strongly, it was my pleasure to have just signed a full and unconditional pardon of her son, Ross,” he declared.11 This quid pro quo apparently won out over any interest from Trump in remaining consistent with his past, repeated statements that anyone convicted of drug crimes deserves death.12

Ulbricht is a free man now, and he may well also be a rich man soon. The crypto world has raised more than 2.7 BTC (around $287,000) in donations, seeded with an initial deposit of $111,111 from the Kraken cryptocurrency exchange. Besides that, a director at Coinbase identified around 430 BTC likely belonging to Ulbricht.13 “Back then these were probably dust wallets,” said the Coinbase executive, referring to wallets containing very small amounts of bitcoin that get trapped in wallets because they fall below amounts required to pay transaction fees. However, as the bitcoin price increased dramatically over the years, those 430 BTC — which would have combined to a few hundred dollars around the time Ulbricht created the Silk Road — are now priced at around $47 million. Whether Ulbricht still has the keys to access the wallets remains to be seen.13 Some have wondered if Ulbricht might regain access to the billions of dollars in bitcoin he forfeited during his case, now that he’s been pardoned. This seems unlikely, as the pardon does not erase the underlying conviction, and does not overturn civil forfeitures.14

Crypto executive order

On day four, the much awaited cryptocurrency executive order finally appeared, much to the industry’s relief.15 However, the order was not what everyone had hoped. Many had dreamed it might institute the “strategic bitcoin reserve” that has been the topic of much discussion, leaving many bitcoiners with cartoon dollar signs in their eyes.

Instead, the order does a few things:

- Revokes Biden’s Executive Order on cryptocurrencies, the Treasury’s “Framework for International Engagement on Digital Assets”, and any “policies, directives, and guidance” issued as a result that are deemed to conflict with this new executive order

- Establishes a Presidential Working Group on digital assets, to be chaired by Special Advisor for AI and Crypto David Sacks. This is a pretty huge working group, containing high-level officials including the Treasury Secretary, Attorney General, Commerce Secretary, SEC and CFTC Chairs, and six others, with others to be invited to meetings as deemed necessary. However, some are notably missing from the core group — any delegate from the Federal Reserve, for example.

- Directs the working group to, within 30 days, identify all “regulations, guidance documents, orders, or other items that affect the digital asset sector”. Within 60 days, they are to submit recommendations as to whether they ought to be rescinded, modified, or (for items other than regulations) adopted as regulations.

- Directs the working group to, within 180 days, write a report to the president that will propose a federal regulatory framework for digital assets including stablecoins

- As a part of this report, the working group is to “evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts”

- Prohibits actions that would “establish, issue, or promote” central bank digital currencies (CBDCs)

Altogether this seems like... nothing much. The regulatory changes alluded to here were already likely to happen with or without an executive order, this order now dictates that they happen by recommendation of (gigantic) committee. The committee itself also cannot directly make changes, but rather recommendation changes to be submitted for approval.

The Biden executive order also didn’t really do anything, and so rescinding it doesn’t really rescind anything. This is mostly symbolic, as the Biden EO strongly emphasized the need for consumer protections and the risks posed by digital assets. As for the Treasury Framework, that mostly pertained to collaborating with other countries on digital assets (including on law enforcement activities to handle illicit transactions using crypto), so I’ll be curious to see what is downstream of that.

The CBDC prohibition is, again, entirely symbolic. As I mentioned last issue [I74], many Republican crypto enthusiasts enjoy railing against the specter of a CBDC, despite the fact that there has been no effort to actually create one in the United States. However, this may anger some in the Ripple camp, as the company has been developing a platform for CBDCs. Ripple was the second largest donor to the Fairshake crypto super PAC.

Finally, there’s the “national digital asset stockpile”, which seems to be the most disappointing to the crypto world. Last issue [I74], I mentioned the horrified reaction by bitcoin maximalists to the rumors that Trump was considering cryptocurrencies other than bitcoin for his stockpile. This shift from the “strategic national bitcoin stockpile” wording Trump used at the Bitcoin Conference in July 2024, to “digital asset stockpile”, seems to cement this concern for a lot of bitcoiners, who lamented the likelihood of a “national shitcoin stockpile”. Furthermore, there was disappointment that Trump was not establishing a “strategic reserve” of the kinds promoted by Robert F. Kennedy Jr. during his presidential campaign, or by Senator Cynthia Lummis in her “BITCOIN Act” proposal. Both of those suggest that the US government should go out and buy a substantial quantity of bitcoin (4 million and 1 million BTC, respectively), which would pump the bags of bitcoiners (including Kennedy and Lummis themselves).

Instead, Trump’s executive order echoes his suggestion at the Bitcoin Conference that the US government should establish a stockpile by holding on to cryptocurrencies seized by law enforcement, rather than selling them after the assets are formally forfeited. As I wrote in Issue 70:

[Trump] fails to acknowledge that much of the time when the government seizes crypto assets and then sells them later on, the proceeds are returned to the victims of the crime. Trump’s plan, at least as elucidated on stage in July, is to put a stop to this practice, and instead hold on to those assets that he himself stated had been stolen from people like those in the audience.

There’s also some disappointment that Trump did not create a strategic stockpile (or reserve) directly. His promise at the Bitcoin conference that “if I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the Bitcoin the US government currently holds or acquires into the future” has now become a sub-bullet point in an executive order, instructing that an eleven-person committee led by a venture capitalist fond of non-bitcoin cryptocurrenciesc “shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile”. After they submit their recommendation in their report, it will be passed over along to Congress for further arguing.

As L0la L33tz wrote on Twitter, “ngl Trump being wooed by the crypto industry to the tune of hundreds of millions of dollars only to drop an EO that establishes a working group to maybe build a stock pile by stealing your coins is pretty legendary.”16

Elsewhere in government

Senator Cynthia Lummis (R-WY) faked out the bitcoin markets by tweeting “₿ig things are coming👀” and then “Stay tuned for 10 A.M.” Bitcoin prices jumped on the news as many anticipated that it would for some reason be her announcing the bitcoin strategic reserve. Instead, at 10:44am, she tweeted that she was “honored to chair the Senate Banking Subcommittee on Digital Assets” — something Punchbowl News journalist Brendan Pedersen had reported weeks ago.17 Personally, I think it’s not great that a Senator who personally holds bitcoin can move bitcoin markets by a couple thousand dollars with just a tweet — and it’s not great that someone with a financial stake in crypto is tasked with regulating the sector.d The Subcommittee is stacked with crypto proponents, with pro-crypto Ruben Gallego (D-AZ, recipient of $10 million in crypto PAC funding) serving as the ranking member. Pro-crypto Republicans Bernie Moreno (OH, recipient of $40 million), Dave McCormick (PA, recipient of $35,000), Thom Tillis (NC), and Bill Hagerty (TN) are also taking seats. However, the Democrats besides Gallego on the committee have historically been skeptical of crypto: Mark Warner (VA), Chris Van Hollen (MD), and Tina Smith (MN).18

Over at the SEC, Gensler has stepped down and is being replaced in the interim by the crypto-friendly Mark Uyeda, who has served as a Commissioner at the SEC since 2022. Uyeda will likely be replaced by Trump’s nominee Paul Atkins. Uyeda quickly announced that he would be forming a “crypto task force dedicated to developing a comprehensive and clear regulatory framework for crypto assets”, which will be headed by fellow crypto-friendly Commissioner Hester Peirce. In a press release, the agency signaled its new direction by criticizing its own past actions: “To date, the SEC has relied primarily on enforcement actions to regulate crypto retroactively and reactively, often adopting novel and untested legal interpretations along the way. Clarity regarding who must register, and practical solutions for those seeking to register, have been elusive. The result has been confusion about what is legal, which creates an environment hostile to innovation and conducive to fraud.”19

The SEC was also quick to rescind SAB 121, the controversial rule that Congress nearly overturned last year before Biden issued a veto based on concerns about “jeopardiz[ing] the well-being of consumers and investors” [I58, 59, 74]. “Bye, bye SAB 121! It’s not been fun,” wrote Peirce on Twitter.20 This rescission will make it easier for banks to get into the crypto custody business.

Meanwhile, various financial firms are eagerly testing the waters with the new, more permissive regulators by filing applications for exchange-traded funds tracking memecoins including DOGE, BONK, and TRUMP.21 I suppose they made their bed, and now they’re going to lie in it by being forced to review endless applications for the dumbest ETFs possible. If a financial adviser ever recommends I diversify my portfolio by buying shares of a PEPE ETF, I shall take that as my cue to withdraw every penny and place it under my mattress.

Trump has chosen Commissioner Caroline Pham as interim chief over at the CFTC, where former Chair Rostin Benham also stepped down. Trump has yet to nominate a replacement CFTC Chair, although Bloomberg has reported that yet another Andreessen Horowitz employee is in the running: a16z crypto policy head Brian Quintenz.e22 Pham was also quick to fire the CFTC’s entire leadership team, replacing them with interim directors.23

The Department of Government Efficiency now has Elon Musk as its sole leader now that Vivek Ramaswamy is out. While some reports suggest Ramaswamy stepped down of his own volition to pursue an Ohio gubernatorial campaign, other reports suggest Ramaswamy was given the boot after internal rifts.24 Personally, I had not expected to agree so strongly with Musk’s first series of cuts. Meanwhile, the group’s website went online, with little more than placeholder text reading “Department of Government Efficiency: The people voted for major reform.” The text was briefly overshadowed by a large image of the Dogecoin cryptocurrency’s logo, which was quickly removed — I assume after an adult walked into the room, caught Musk hunched over a laptop giggling at his handiwork, and put him in time-out.

In happier news, DOGE is already being sued in separate suits from groups including the National Security Counselors and Public Citizen, both of which aim to bring more transparency into the group’s operations and clarify its status (and whether it and its employees will be subject to ethics laws).25

In the courts

At least eight people have been arrested in connection to the kidnapping of the co-founder of Ledger, a popular cryptocurrency hardware wallet. David Balland and his wife were kidnapped from their home in France early on January 21 by a group who demanded a large cryptocurrency ransom. The group cut off one of Balland’s fingers, sending it to his associates and demanding ransom from them and family members. However, police were able to locate Balland and his wife on the night of January 22.26 “That’s 7 crypto wrench attacks in the first 3 weeks of this year. Unprecedented acceleration,” wrote Jameson Lopp, using slang to refer to physical attacks on people known to hold large sums of crypto.27 Lopp maintains an ongoing list of people who have been attacked in attempted or successful cryptocurrency thefts.

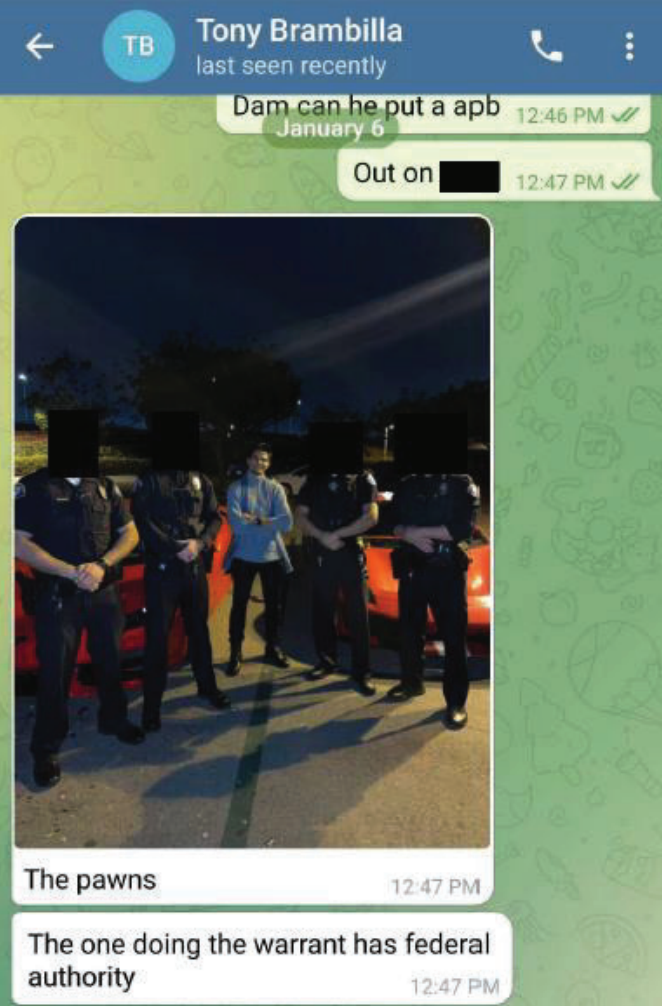

The crypto entrepreneur who called himself “The Godfather” and an LA Sheriff’s deputy have both pleaded guilty to charges including criminal conspiracy against rights and tax charges [I68]. “The Godfather”, actually Adam Iza, hired members of the Sheriff’s department to serve as “his personal enforcers against his enemies”, using them to extort, intimidate, and set people up for arrest. The deputy who pleaded guilty, Eric Saavedra, also abused his access to LASD databases to obtain personal information on Iza’s enemies, and abused his authority to obtain search warrants against those people. In one case, Saavedra obtained an illegal search warrant on a person he believed held more than $100 million in cryptocurrency on a personal laptop. Iza hired three armed robbers to try to steal the laptop, though they were unsuccessful, running away when the victim shot at them. In another instance, two other sheriff’s deputies held a person hostage at gunpoint in Iza’s home until he transferred $25,000; in another case, Iza held a person at gunpoint until they handed over $127,000. Iza faces up to 35 years in prison; Saavedra faces up to 13 years in prison.28

The crypto market maker CLS Global will plead guilty to wash trading on Uniswap and pay around $428,000 in fines and forfeiture. They will also be banned from US crypto markets. The guilty plea was obtained by the FBI through an undercover operation involving a cryptocurrency created by the agency, called NexFundAI [I68]. “I know that it’s wash trading and I know people might not be happy about it,” said a CLS employee in a call. “It’s very hard to track. . . . We’ve been doing that for many clients,” they said.29

Just before the presidential changeover, the SEC filed an enforcement lawsuit against Nova Labs, the creator of the Helium network. The case alleges that the company sold unregistered securities and misled investors.30 Much of the case focuses on Helium’s false claims of partnerships with big-name companies like Salesforce and Lime, which were uncovered by reporter Matt Binder in mid 2022 [W3IGG]. It remains to be seen if this case will survive the likely impending freeze or withdrawal of crypto-focused SEC enforcement actions [I74].

Coinbase has filed its anticipated request to appeal with the Second Circuit after being granted permission and a stay of the lawsuit from the SEC in the lower court [I73]. “[T]his case cries out for the Court’s immediate attention,” they argued. “Whether secondary-market trading of digital assets falls within the federal securities laws is a question of immense importance to the crypto industry, consumers, financial institutions, and lower courts in need of guidance. This case presents an ideal vehicle to address that question and provide clear rules for this multi-trillion-dollar industry.”31

In bankruptcies

WazirX has gotten the okay from a Singapore court to begin returning funds to customers after the court determined the platform was not responsible for the theft. The attack has since been attributed to North Korean state-sponsored hackers. Given that the customer funds are in North Korea somewhere, the platform will be reimbursing victims with “recovery tokens”, which are sort of like an IOU. The company hopes that platform revenues, funds generated by a new decentralized exchange that WazirX is planning to launch, and any recovered stolen assets will eventually be able to repay their customers to the tune of $235 million.32

Elsewhere in crypto

Binance Labs, the venture capital arm of Binance, is being rebranded to YZi Labs and turned into founder Changpeng Zhao’s family office. Apparently this is somehow permitted, even though CZ was prohibited from “any present or future involvement in operating or managing” Binance as a part of his plea agreement.33

Ethereum

Ethereum is having a bit of a crisis lately, particularly as popularity around memecoins have caused Solana to surge while Ethereum has seemed relatively stagnant. That, combined with the impression that some of the Ethereum Foundation’s development has stalled, disagreements over direction and spending, and a series of conflict of interest scandals several months ago, have resulted in a loss of faith in the foundation. Some have called for the ouster of Ethereum Foundation executive director Aya Miyaguchi, who has held the role since 2018.

Ethereum co-founder Vitalik Buterin announced on Twitter that “We are indeed currently in the process of large changes to EF leadership structure, which has been ongoing for close to a year,” outlining some changes they were pursuing. However, he clarified that they were not looking to begin joining the kinds of aggressive political lobbying efforts that have been happening from elsewhere in the industry, nor were they seeking to “execute some kind of ideological / vibez pivot from feminized wef soyboy mentality to bronze age mindset”.34 Buterin later emphasized that he was in charge of decisionmaking around the Ethereum Foundation’s leadership team, and put his support behind Miyaguchi. He condemned those who were seeking to exert pressure to force Miyaguchi out, and called out a series of tweets that advocated for “bullying” her out or made violent threats against her.35

Amid the shakeup, core Ethereum developer Eric Conner announced he would be leaving after eleven years. “I am no longer a dot eth,” he wrote. “Perhaps some day those in leadership roles will realign with the community but for now, I am out”.36 He continued, “It’s beyond exhausting to hear stuff like ‘stop being mean’ used as an excuse to ignore the mandate coming from the community. We are here to change the world, not create a safe space.”37

The Web3 is Going Just Great recap

There were seven entries between January 17 and January 23, averaging 1 entry per day. $71.25 million was added to the grift counter.

Phemex hacked

[link]

A Singapore-based cryptocurrency exchange called Phemex has suffered a hack of some of their hot wallets, with losses amounting to over $70 million. Early analysis suggests that this attack is one in a long string of attacks perpetrated by North Korean cyberattackers, who have pulled off other high-value crypto heists in recent years.

Trump inauguration pastor launches memecoin that tanks by over 90%

[link]

The pastor who delivered the benediction at Trump’s inauguration was in such a rush to launch his memecoin that he was still wearing his outfit from the inauguration when he recorded a video hours later to announce, “I need you to do me a favor and go and get that coin in order for us to accomplish the vision that God has called us to do in our Earth.”

Apparently God’s vision also involved the coin rapidly losing the vast majority of its value.

Everything else

- ThorChain is insolvent [link]

- Trump crossposting Twitter account advertises fake memecoins that make $1.25 million [link]

- Students for Trump co-founder Ryan Fournier admits to rugpulling memecoin while trying to deny rugpulling memecoin [link]

- Melania Trump launches a memecoin of her own, tanking her husband's in the process [link]

- Trump launches a shitcoin [link]

In the news

I talked to a lot of journalists about crypto this week. I suspect I will be talking to a lot of journalists about crypto a lot going forward. Some of these conversations were with CNN, Vox, The Saturday Paper’s 7am podcast, and Background Briefing. I didn’t directly talk to the New York Times, NBC News, Inc., Futurism, AFP, or the Byline Times (I don’t think, I’m a little delirious) but they cited my work, which I’m always happy to see.

Having gotten over the apparent fleeting distraction that was the inauguration, Elon Musk and other wealthy and influential members of the tech oligarchy have been back to attacking Wikipedia again. I spoke about this rapidly intensifying trend with Katherine Fung at Newsweek.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

For example, the prominent crypto media outlet CoinDesk recently bowed to pressure to take down an article critical of Justin Sun [I72]. ↩

The timing amused me. Many of the crypto heavyweights attending the ball were likely unable to trade the token in its early hours, had they so desired. Nic Carter tweeted, “Trump rugged all of his biggest fans by dropping his memecoin during the crypto ball when we were all sloshed. And rewarded the degens online at 9pm on a Friday smh”. ↩

David Sacks has been a fan of Solana for some time, and his Craft Ventures firm is in turn invested in the heavily Solana-focused Multicoin venture capital firm. ↩

And yes, I feel this way about traditional financial assets like stocks, as well. ↩

Others from Andreessen Horowitz currently orbiting Trump include Marc Andreessen, who has been recruiting and interviewing staff for the Elon Musk-led “DOGE” group, and who said he’d been spending half his time at Mar-a-Lago post-election. a16z general partner Sriram Krishnan was chosen for a senior artificial intelligence policy advisor role in the Office of Science and Technology Policy. Managing partner Scott Kupor was chosen to direct the Office of Personnel Management. ↩

References

“Half of TRUMP and MELANIA memecoin holders never bought a 'Solana altcoin' before: Chainalysis”, The Block. ↩

“‘Horrible look’: Crypto lobby reels from Trump’s ‘memecoin’”, Politico. ↩

“Trump’s embrace of meme coin sours mood in crypto industry”, AP News. ↩

“Warren, Auchincloss Investigate Trump Meme Coins; Raise Concerns about Consumer Ripoffs, Foreign Influence-Peddling, Conflicts of Interest”, United States Senate Committee on Banking, Housing, and Urban Affairs. ↩

“Ending The Weaponization Of The Federal Government”, January 20, 2025 Executive Order. ↩

“Trump wants the death penalty for drug dealers. Here's why that probably won't happen”, NPR. ↩

“Can Ross Ulbricht Get His $18BN in Bitcoin Back From DOJ?”, Newsweek. ↩

“Strengthening American Leadership in Digital Financial Technology”, January 23, 2025 Executive Order. ↩

“Banking Committee Approves Subcommittee Assignments for the 119th Congress”, United States Senate Committee on Banking, Housing, and Urban Affairs. ↩

“SEC Crypto 2.0: Acting Chairman Uyeda Announces Formation of New Crypto Task Force”, Securities and Exchange Commission. ↩

“DOGE and TRUMP ETFs May be Coming But Should Institutional Investor Trade Them?”, CoinDesk. ↩

“Andreessen Crypto Policy Lead Quintenz in Running for CFTC Chair”, Bloomberg. ↩

“Acting Chairman Pham Announces CFTC Leadership Changes”, Commodity Futures Trading Commission. ↩

“Disagreements with Elon Musk prompted Ramaswamy’s ‘DOGE’ exit”, The Washington Post. ↩

“Elon Musk’s DOGE sued minutes after Trump inauguration”, The Washington Post. ↩

“Le cofondateur de l’entreprise de cryptomonnaies Ledger enlevé puis libéré, sa femme retrouvée”, Le Parisien. ↩

“Crypto ‘Godfather’ and LASD Detective Agree to Plead Guilty to Violating Civil Rights of Business Rivals and Tax Crimes”, United States Attorney’s Office, Central District of California. ↩

“Cryptocurrency Financial Services Firm Agrees to Plead Guilty to Charges Related to Cryptocurrency ‘Wash Trading’”, U.S. Attorney's Office, District of Massachusetts. ↩

Complaint filed on January 17, 2025. Document #1 in SEC v. Nova Labs. ↩

Petition for permission to appeal filed on January 17, 2025. SEC v. Coinbase (2nd Cir.) ↩

“WazirX gets Singapore court approval to repay victims of $235M hack”, Cointelegraph. ↩

“Crypto’s Richest Man CZ Turns VC Firm Into Giant Family Office”, Bloomberg. ↩