Issue 79 – Mundus sine Caesaribus

The crypto industry frees itself from the last remnants of SEC oversight, and Solana tries to appeal to its target demographic by bashing trans people

Citation Needed is entirely subscriber funded. To support my independent writing, sign up for a pay-what-you-want subscription.

I have returned from my quick trip to Austin for a few days at the South by Southwest conference. Last time I was there, Silicon Valley Bank fell apart, which made for a rather entertaining weekend to spend as a fly on the wall around the various tech executives who make their pilgrimages to the conference [I22]. By that point in 2023, the shine had already mostly worn off on the crypto excitement compared to the crypto extravaganzas that characterized SXSW during crypto’s peak hype years.

This time, although crypto prices are back up, crypto excitement didn’t seem to be. Few crypto events made it onto the schedule, which instead featured more somber events with titles like “Are Whistleblowers Going to Save Us From the Harms of Tech?”, “The Fight for Freedom of Speech: From Lawsuits to Spyware”, “Tensions in Creative Labor & Generative AI”, and “Data-Driven Dreams: Is Your Car Your Friend or Big Brother?” My session, titled “Speaking Truth to Crypto Power”, was among the few crypto-related ones. You can watch it here:

As it happens, this rather unfortunate still frame also perfectly captures the face I make when I see someone say they’re going to build “Wikipedia but on the blockchain” for the 2034th time

Although an interview with Solana founder Raj Gokal was supposed to explain how Solana is “fueling the future of web3”a, he spent much of the time reminiscing about how he mostly got into crypto because he was looking for an industry “that’s in a regulatory sort of gray area where you could blitzscale quickly”, and how he ended up opting for crypto over his other idea to create an AI therapist. Somewhere else, a couple of people talked about how blockchains will solve the problem that “for many brands, their relationship with their most loyal consumers has become nothing more than an emotionless exchange of points for purchases”. (Now your emotionless exchange of points will happen on the blockchain!)

Crypto prices may be back up thanks to the defibrillatory shock of the industry’s nine-figure lobbying spree and the subsequent governmental embrace, but I guess excitement from everyday people has turned out to be a little harder to manufacture.

I was delighted to see that there was, however, quite a bit of excitement around the fediverse and other online spaces that exist outside of the grasps of tech giants and venture capital. There was an entire “Fediverse House” dedicated to programming regarding federated social media protocols like ActivityPub (which powers Mastodon) and ATproto (which powers BlueSky), and how bloggers, journalists, and other online publishers are building on these platforms in wonderful and sustainable ways. There was also, as with some years past, a “WikiHaus” hosting conversations about open knowledge and fighting the privatization of the web. Such topics made it to the primary conference programming too — I had a panel conversation with Flipboard’s Mike McCue about digital sovereignty (and the audio was recorded, though not the video). There was a great panel about “Openness Under Pressure”, which touched on similar points as my recent newsletter about open access amid widespread AI scraping. Bluesky CEO Jay Graber took the mainstage for a keynote with the inimitable tech journalist (and Bluesky board member) Mike Masnick. She wore an oversized black t-shirt printed with black text that read mundus sine Caesaribus (“a world without Caesars”). It was immediately recognizable to those who had seen Mark Zuckerberg’s custom black-on-black aut Zuck aut nihil (“Zuck or nothing”) shirt at a Meta event last year, an egomaniacal play on aut Caesar aut nihilb and a nod to the emperor after whom Zuckerberg has long styled himself.1

Her message was clear: we need a world resilient to the outsized power of Zuckerbergian billionaire emperors. And we need platforms that are, as she and Masnick put it, “billionaire-proof”. I couldn’t agree more.

Sadly, for now we remain in a very much not billionaire-proof world, so I will now update you on how that’s all been going.

In the courts

A group of international law enforcement agencies have seized domains and servers belonging to the Russian Garantex crypto exchange, frozen almost $28 million in crypto assets, and criminally charged two of its operators. This is likely related to an investigation I wrote about in April of last year [I54], where US and UK law enforcement were scrutinizing more than $20 billion in Tether that had entered the exchange since it was added to wartime sanctions lists in April 2022. More recent figures suggest that Garantex has processed more than $60 billion in transactions since it was sanctioned. US prosecutors allege that Garantex has been used to launder funds connected to ransomware attacks, crypto hacks, drug operations, and child sexual abuse networks,2 and it has also reportedly been used by Russian oligarchs to evade sanctions of their own.3 Aleksej Besciokov, one of the two alleged operators charged in the indictment, was subsequently arrested in India by US request.4

The very messy $LIBRA memecoin scandal involving Argentina’s president Milei continues to be very messy. One prosecutor has asked a judge to issue an international arrest warrant for Hayden Davis, the crypto businessman who helped launch the token.5 Another has requested the freeze of $110 million in proceeds connected to the launch.6 Meanwhile, Davis has reportedly been involved in the launch of yet another memecoin that also immediately crashed.7 And a parliament hearing in Argentina about the memecoin fiasco turned into a fiasco of its own, with a member of Milei’s party physically attacking a politician who did not join other lawmakers in leaving the session so as to avoid granting quorum.8

Sam Bankman-Fried has continued to attempt to convince everyone that he is a victim of political retribution from the Biden administration [I78] by going on Tucker Carlson. Perhaps when he saw Ryan Salame do it, he thought it might be worth a shot. Salame, however, made a slightly (though only slightly) more convincing claim simply because, unlike Bankman-Fried, he was not among the single largest donors to Biden. So far Bankman-Fried’s Tucker appearance has failed to secure him the Trump pardon he’s angling for — just solitary confinement (the interview was apparently done without authorization from the prison)9 and the resignation of his crisis PR manager (who was evidently not aware of SBF’s ongoing and continually ill-fated attempts to take his reputation management into his own hands).10

The Texas-based Internet celebrity Amouranth was the victim of an armed home invasion in which a group of gun-wielding attackers demanded she turn over her crypto and hit her with a pistol. The intruders fled after Amouranth’s husband fired a gun at them. Law enforcement later arrested four suspects between the ages of 16 and 19 in connection to the attack. In November, Amouranth had posted to Twitter a screenshot of a Coinbase account appearing to hold around $20 million in bitcoin.11

Rowland Marcus Andrade, who in 2017 launched an initial coin offering for a token he called “AML Bitcoin”, has been convicted on wire fraud and money laundering charges in a long-running case involving an early crypto pump-and-dump.12 Jack Abramoff, a lobbyist better known for his role in a federal corruption scandal, also played a bit role in this case, and in 2020 pleaded guilty to fraud for helping to promote the scheme with false claims, including that the NFL had rejected a “controversial” television ad that they claimed they otherwise would have aired at the Super Bowl, and that government agencies had agreed to use the token or related technology.13

Podcaster and crypto influencer “TJ Stone” has been sentenced to 45 months in prison for wire fraud and will forfeit $1.34 million. In addition to running various fraudulent construction schemes, he also ran a crypto scam where he persuaded victims to invest in a “crypto wallet” that he promised would provide 60% returns in three months. Stone had fled to Arizona after learning that New York police were investigating his activities, but law enforcement eventually caught up to him in Vegas when he tried to run out on his bill from the Wynn Casino.14

In bankruptcies

It’s been a while since Three Arrows Capital has come up here, so to refresh your memory: they’re the hedge fund that spectacularly blew up in mid-2022, helping to kick off a string of collapses throughout an industry where everyone had been lending money to everyone. In July 2023, Three Arrows Capital filed a proof of claim against FTX, stating they were owed $120 million by the also-bankrupt exchange. However, 3AC has just received approval from their bankruptcy judge to expand that claim by over 10×, having obtained new evidence supporting a claim that the exchange had improperly liquidated $1.53 billion of the firm’s assets. Although FTX tried to argue that Three Arrows Capital waited too long to make the claim, the judge determined that the delay was caused by FTX debtors being slow to produce necessary records.15

This is a major setback for the FTX bankruptcy proceedings, and potentially for its creditors. The sudden appearance of an additional $1.4 billion in claims could reduce the company’s ability to repay other creditors.16

In the White House

The Wall Street Journal reported that the Trump family has been in talks to take a financial stake in Binance US, the US business arm of the Binance crypto exchange.17 Although Binance’s founder Changpeng Zhao was forced to step down as Binance’s CEO as part of a criminal plea relating to his operation of the exchange, he remains a majority owner of the company — and he has reportedly been seeking a pardon from Trump. According to the Journal, the talks began last year when Binance contacted Trump allies in hopes of finding a route back to serving US customers. The Journal noted:

Trump has increasingly blurred the boundaries between the presidency and his business ventures. ... But pursuing a business deal involving a felon seeking a pardon from his administration would be an unprecedented overlap of his business and the government. A stake in Binance.US would also be a striking expansion of the family’s cryptocurrency endeavors as Trump signs a series of executive orders that benefit the industry.

Zhao waved off the reporting, writing rather vaguely that “the WSJ article got the facts wrong”.18 However, it should also be noted that Zhao and Binance routinely deny factual reporting about the company.

ProPublica has reported that new leaders at the U.S. Department of Housing and Urban Development have been pushing for the agency to adopt cryptocurrencies for payments and blockchains for monitoring HUD grants. The proposal smells of the common blockchain pitch where proponents suggest that blockchains are somehow inherently capable of detecting or preventing any kind of fraud. As a HUD official noted after a proof-of-concept meeting, “Without exaggeration, every imaginable implementation of this at HUD appears dangerous and inefficient.” The project sounds like a potentially lucrative contract for a blockchain company, and an enormous headache for everyone else. A HUD spokesperson has stated that they have “no plans for blockchain or stablecoin”, which I hope is true.19

In regulators

I mentioned in the last issue that the few SEC cases against the crypto firms-turned-political-megadonors that hadn’t yet been dropped would likely be dropped shortly. As predicted, the CEO of Ripple has just announced that the SEC will drop the remainder of its long-running case against the company, originally filed in 2020.20 While Ripple’s CEO described this as “a resounding victory for Ripple”, he did not draw attention to the fact that the SEC had already won the portion of the case alleging that the company had violated securities laws with its institutional token sales, which landed the company with a $125 million fine in 2023 — though this was well below the $2 billion fine sought by the enforcement agency. The SEC was in the process of appealing a decision that the company’s sales to retail exchanges did not violate securities laws, but this appeal is what will apparently be dropped shortly. Ripple and its executives contributed $48 million to crypto-focused super PACs, $12.6 million to Harris, $5 million to Trump’s inauguration fund, and several million more to various other political committees. They’ve also pledged another $25 million to the crypto super PACs for the midterms.

Similarly, Kraken has stated that the SEC has agreed in principle to dismiss its lawsuit against the exchange. As with the case against Coinbase, the SEC will ask for the case to be dismissed with prejudice. Kraken was particularly explicit that this outcome had nothing to do with the facts at issue in the case, writing: “We appreciate the new leadership both at the White House and the Commission that led to this change.”21 Kraken and its executives contributed $1 million each to Trump, Trump’s inauguration fund, and crypto-focused super PACs.

Cumberland DRW, the crypto trading portion of DRW, has also announced that the SEC case against them will be dropped.22 The agency had alleged that the firm had sold more than $2 billion in unregistered crypto securities, naming popular crypto assets including Solana and Polygon among them. DRW CEO Don Wilson contributed $100,000 to a crypto-focused super PAC.

Finally, NFT company Yuga Labs — best known as the creators of Bored Apes — have said that the SEC has closed an ongoing investigation into the company.23

Coinbase is hard at work trying to obtain records from the SEC to determine how much money the agency has spent on crypto-related enforcement cases. While they have not gone so far as Gemini’s Winklevoss twins, who suggested they should receive monetary restitution from the agency [I78], they too are apparently unsatisfied with merely having substantially all crypto-related cases dropped and little threat of enforcement action over the next few years. “This is not just about Coinbase or anybody else taking a victory lap,” insisted Coinbase CLO Paul Grewal, mid-victory lap.24

In Congress

The House Oversight Committee Democrats have voiced some opposition to the crypto reserve and stockpile plans, with ranking member Gerry Connolly writing an Angry Letter to Treasury Secretary Scott Bessent: “Such a reserve provides no discernible benefit to the American people but would significantly enrich the President and his donors.”25 Meanwhile, polling from the left-leaning Data for Progress firm has found that the majority of those polled would oppose a crypto reserve that used government funds to purchase crypto assets, with Democrats opposing such an initiative at 59% and Republicans at 40%. (The poll focused on federal spending, and so did not ask any questions to measure approval levels of a reserve that would not involve additional government spending — which was what was ultimately directed by Trump’s executive order.) Only 10% of respondents indicated they believed that there should be more federal spending on “cryptocurrency and blockchain development”, the item with the lowest level of support among other options including social security, medicare, and transportation infrastructure.26

Congress has been continuing to consider stablecoin legislation. In the House, lawmakers tussled over the Republican-led STABLE Act, with Maxine Waters (D-CA) condemning it in its current iteration because she believes it “tears down the wall that was used to separate banking from commerce” — potentially opening the doors to serious financial contagion. She urged other Representatives to reintroduce components of her own proposed legislation, introduced in the last Congress, that would establish more significant oversight and penalties for violations.2728 In the Senate, lawmakers argued over a bipartisan GENIUS Act, with Democrats arguing it doesn’t go far enough to protect consumers or national security. “Anyone who thinks the US taxpayer won’t be called on directly or indirectly to bail out these guys is kidding themselves,” argued Senator Warren (D-MA), also expressing concerns about financial contagion that she likened to the 2008 financial crisis. Several proposals to amend the bill failed along party lines, and the Senate Banking Committee ultimately voted to send the bill to the full Senate.29 Five Democrats voted with the Republicans to advance the bill, including Ruben Gallego from Arizona, who received $10 million in campaign backing from the crypto industry. The other four were Senators Rochester (DE), Alsobrooks (MD), Kim (NJ), and Warner (VA).30

In both the House and the Senate, Democrats expressed concerns that big tech giants, including Elon Musk and Twitter, would further entrench their monopoly positions and abuse consumers by beginning to issue stablecoins. Republicans mostly dismissed any arguments against the bills as fearmongering, with Cynthia Lummis (WY) downplaying concerns about crypto’s role in the drug trade by saying, “I want to assure everybody that Machiavelli is not going to get raised from the dead to issue stablecoins so we can destroy our planet with drugs.”29

Elsewhere in crypto

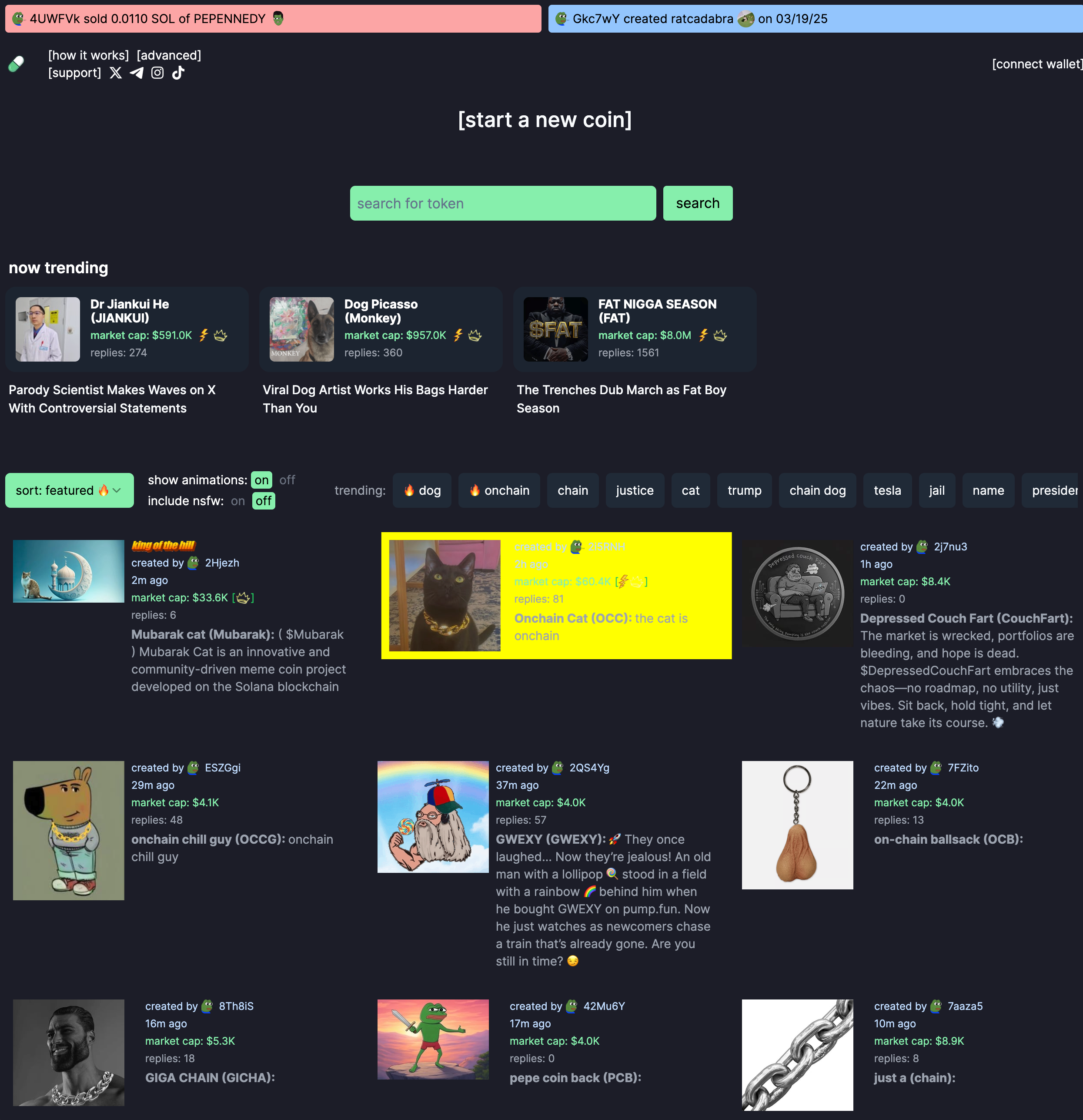

Solana, the blockchain project that has recently enjoyed a resurgence in popularity thanks to the pump.fun-fueled memecoin extravaganza, has completely stepped in it. After the crypto industry’s full-throated MAGA embrace, they apparently thought it would be a good idea to advertise their upcoming conference by going full anti-trans, anti-woke in an ad that is somehow cringeworthy no matter where you fall on the political spectrum.

Content warning for transphobia on this one... it’s gross.

Despite the fact that Solana's primary claim to fame these days is a memecoin launchpad currently offering people the opportunity to invest in such compelling meme tokens as “on-chain ballsack” and “Depressed Couch Fart”, the ad depicts a man named “America”, sitting on a therapist’s couch comparing Solana and crypto more broadly to “multi-planetary travel”, nuclear energy, and the historical innovations that led to the American industrial revolution.

The therapist discourages him, telling him to “take this energy and channel it into something more productive, like coming up with a new gender. ... Why don’t we focus on pronouns?” She urges him to trust the media (producing a newspaper titled The New Yuck Times with the headline “We aren’t biased”) and responds to his argument that he was “canceled for saying two plus two is four” with “have you considered math is a spectrum?” The whole thing ends with him jumping to his feet amid soaring music and monologuing about building the future, leading the world, and “reclaim[ing] my place as the beacon of innovation”. “I want to invent technologies, not genders!” he insists, ending with a Trumpian “you’re fired!” to the therapist before the ad fades to black with the text “America is back”.

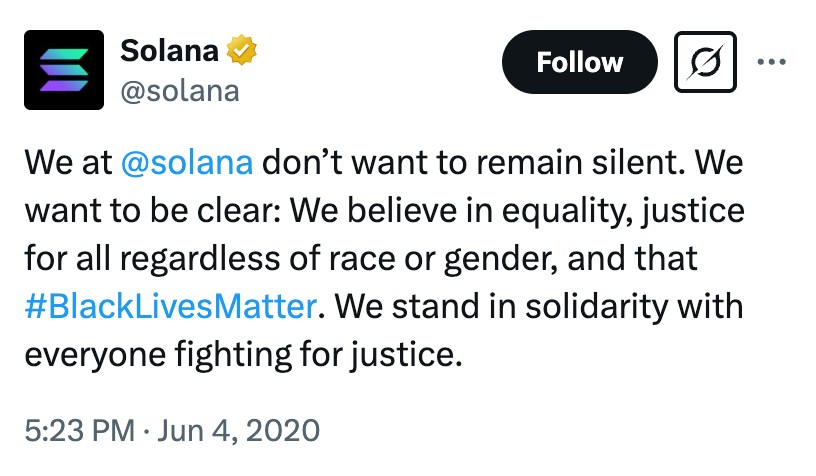

To their credit, the crypto world has totally demolished Solana for the ad. Some have objected to Solana bashing trans people, and have defended the trans people who participate in crypto either as developers or enthusiasts. Several pointed out that just last week Solana tweeted “Solana is for everyone”. Others seem more disgusted by Solana’s willingness to apparently pander using whatever issue is popular at a given moment.

Some seemed more unhappy with the hamfistedness of the ad, which was so over-the-top that came out more as an unflattering caricature of their presumed target audience than a reflection of them. And more still were infuriated when Solana tried to quietly take down the advertisement, seeing it as capitulation. It’s gross as hell that the current political environment, and the atmosphere in crypto such as it is, apparently made Solana feel comfortable producing and publishing such an advertisement.

Frank McCourt and his Project Liberty project will be joined by Reddit co-founder and ex-CEO Alexis Ohanian in their effort to buy Tiktok, with a new addendum by Ohanian: “—and bring it on-chain”. One is forced to wonder if Ohanian has just woken up from a three-year-long nap still believing that “web3” is a buzzword that gets everyone excited these days.31 While Project Liberty has spoken about wanting to “put people in control of their digital identities and data” and suggested “migrat[ing] the [TikTok] platform to a new digital open-source protocol”32 — ideas that sound compelling (if vague) — it’s a shame that Ohanian seems to want to focus their efforts on blockchains.

It’s perhaps not surprising, though, given Ohanian’s past investments in crypto-related projects primarily to do with blockchain-based gaming — including the ill-fated Axie Infinity game which suffered a $625 million hack [W3IGG] and then, separately, a total collapse of its in-game economy from which it has never recovered. In January 2022, Ohanian predicted that within five years, 90% of people would refuse to play a game unless they were being paid to do so in crypto (the premise known as play-to-earn).33 He re-upped the five year prediction in 2023, though I’m not sure you’re allowed to just continuously reset the clock like that.34 Given his past blockchain gaming predictions, McCourt might be wise to be a bit more skeptical about Ohanian’s assertions that blockchains will form the future of video social media platforms, too, though I guess Ohanian still has a year or three left on those prognostications depending on how you count.

The Web3 is Going Just Great recap

There were two entries between March 3 and March 19, averaging 0.1 entries per day. $5.13 million was added to the grift counter.

- Four.Meme suffers second hack in as many months [link]

- 1inch loses $5 million to smart contract bug [link]

Worth a read

Occasionally I get an email or a comment from someone suggesting that I need to stop writing so much about American politics and just focus on crypto. (I also occasionally get comments that I write too much about crypto, so you really can't please everyone). Mike Masnick at Techdirt gets these too, and his response earned a mighty “hear, hear” from me:

When WaPo’s opinion pages are being gutted and tech CEOs are seeking pre-approval from authoritarians, the line between “tech coverage” and “saving democracy” has basically disappeared. It’s all the same thing.

We’re going to keep doing this work because someone has to. Because understanding how technology and power interact isn’t just an academic exercise anymore — it’s about whether we’ll have an innovation economy left when this is all over.

In the news

I recently joined Paul Sullivan on PBS News Hour to try to help explain Trump’s plans for a “strategic cryptocurrency reserve”, and to discuss the substantial conflicts of interest with Trump’s crypto endeavors.

That's all for now, folks. Until next time,

– Molly White

Footnotes

I wonder how many more years they can keep this “future of web3” thing going before people start to wonder where the present of web3 is. ↩

From Wikipedia: “Denotes an absolute aspiration to become the Emperor, or the equivalent supreme magistrate, and nothing else. More generally, ‘all or nothing’. A personal motto of Cesare Borgia. Charlie Chaplin also used the phrase in The Great Dictator to ridicule Hynkel’s (Chaplin’s parody of Hitler) ambition for power, but substituted ‘nullus’ for ‘nihil’.” ↩

References

“Mark Zuckerberg wants to be like Augustus Caesar. How close is he?”, Mashable. ↩

Garantex indictment filed February 27, 2025. ↩

“Sanctioned Russian Crypto Exchange Garantex Seized, Operators Charged With Money Laundering”, CoinDesk. ↩

“India arrests man accused of running $96 billion crypto exchange at request of US”, CNN. ↩

“Argentina seeks arrest of U.S. crypto figure tied to Melania and Milei cryptocurrencies”, Fortune Crypto. ↩

“Argentine prosecutor seeks to freeze $110 million in proceeds tied to Libra memecoin scandal: report”, The Block. ↩

“LIBRA token 'facilitator' Hayden Davis linked to $40 million crash of 'WOLF' memecoin: Bubblemaps”, The Block. ↩

“Lower House session ends in fist fight while police clash with protestors outside”, Buenos Aires Herald. ↩

“Sam Bankman-Fried was reportedly thrown into solitary confinement for his Tucker Carlson interview”, Fortune. ↩

“SBF's crisis manager quit after the crypto scammer's surprise Tucker Carlson interview”, Business Insider. ↩

“Texas teen gang charged in crypto robbery of Twitch streaming star”, DL News. ↩

“Cryptocurrency Founder And CEO Convicted Of Wire Fraud And Money Laundering In Connection With Marketing And Sale Of AML Bitcoin”, press release by the U.S. Attorney's Office, Northern District of California. ↩

“Lobbyist Jack Abramoff And CEO Rowland Marcus Andrade Charged With Fraud In Connection With $5 Million Initial Coin Offering Of Cryptocurrency AML Bitcoin”, press release by the U.S. Attorney's Office, Northern District of California. ↩

“Brooklyn Podcaster and Cryptocurrency Personality Known as “T.J. Stone” Sentenced to 45 Months’ Imprisonment”, press release by the U.S. Attorney's Office, Eastern District of New York. ↩

“US court allows 3AC to expand FTX claim to $1.5 billion; FTX argues reorganization plan at risk”, The Block. ↩

“Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle”, CoinDesk. ↩

“Trump Family Has Held Deal Talks With Binance Following Crypto Exchange’s Guilty Plea”, The Wall Street Journal. ↩

“U.S. Housing Agency Considers Launching Crypto Experiment”, ProPublica. ↩

“XRP Zooms 10% as Garlinghouse Says SEC Is Dropping Case Against Ripple”, CoinDesk. ↩

“A win for fairness”, Kraken. ↩

“SEC Agrees to Drop Enforcement Suit Against Cumberland DRW, Firm Says”, CoinDesk. ↩

“Yuga Labs says SEC has closed its investigation into the company: 'NFTs are not securities'”, The Block. ↩

“Coinbase Chasing Receipts at SEC to Tally Cost of Agency's Crypto Saga”, CoinDesk. ↩

“Oversight Democrats launch review of crypto reserve ‘poised to enrich’ Trump”, The Hill. ↩

“A Majority of Voters Oppose a Crypto Strategic Reserve”, Data for Progress. ↩

“House discusses stablecoins, anti-money laundering”, Axios. ↩

“Democrats slam stablecoin bill as giveaway to Musk, Big Tech, and ‘crypto bros’”, DL News. ↩

“Stablecoin bill advances to full Senate vote with help from Democrats”, DL News. ↩

“GENIUS Act Clears Senate Banking Committee: What It Means For Stablecoins”, Forbes. ↩

“Reddit Co-Founder Alexis Ohanian Joins Bid to Buy TikTok”, Time. ↩

“People’s Bid for TikTok”, Project Liberty. ↩

“Reddit cofounder Alexis Ohanian predicts play-to-earn crypto will be the only type of games people play in 5 years”, Business Insider. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.