Issue 80 – Aimed at benefiting the digital assets industry

As the US government lays a very favorable groundwork for the crypto industry, Trump positions himself for maximum personal profit

Citation Needed is entirely subscriber funded. To support my independent writing, sign up for a pay-what-you-want subscription.

As the US government pushes forward plans to establish the friendliest possible environment for the cryptocurrency industry, Trump builds up his own crypto-related ventures to ensure maximum personal profits. Meanwhile, the SEC invites crypto companies to write their own rules, and the head of the White House crypto advisory council mulls swapping US gold reserves for bitcoin.

In the courts

Gotbit co-founder Aleksei Andriunin, who was recently extradited to the United States after he and his firm were indicted on fraud charges pertaining to alleged market manipulation [I78], has pleaded guilty to wire fraud and conspiracy to commit market manipulation and wire fraud. The company has also agreed to a guilty plea on these charges. As a part of the plea deal, prosecutors will recommend a reduced sentence of two years in prison for Andriunin, and Gotbit will forfeit approximately $23 million in stablecoins [I68, 69].1

The group overseeing the remnants of FTX has dismissed its adversary case against Joseph Bankman and Barbara Fried, the parents of convicted fraudster and former FTX CEO Sam Bankman-Fried.2 The company sued Bankman and Fried in September 2023 [I39], alleging they were unjustly enriched by the FTX fraud in the form of around $30 million in benefits that included a $10 million luxury property in the Bahamas. While the lawsuit alluded to behavior that sounded potentially criminal in nature — including Fried’s close involvement in the political contributions that later amounted to criminal wire fraud charges for FTX executive Ryan Salame, and Bankman’s involvement in the company’s day-to-day financial operations — the parents were never criminally charged. It’s not evident why FTX decided to dismiss the case, or if a settlement was reached.

Crypto influencer Ben Armstrong, perhaps better known as “BitBoy Crypto”, has been sued for defamation by “Mr. Wonderful” Kevin O’Leary only a few days after Armstrong posted on Twitter “Hey @kevinolearytv, what the fuck are you going to do with me? You can't sue me. You can't stop me. You can't shut me up.”3

Armstrong has been recently and repeatedly accusing O’Leary of being a “murderer”, referring to a 2019 boating accident in which O’Leary and his wife collided with another boat, killing its two occupants. O’Leary claims in this defamation suit that it was his wife operating the boat, and notes that she was acquitted of any wrongdoing. It’s not clear whether Armstrong is aware that he’s been sued yet; on March 25 he was arrested for sending threatening emails to the judge in a different defamation case he’s facing from his former business partners after he publicly accused them of various crimes.4 These are only the latest woes for BitBoy, who appears to have been in a protracted downward spiral for the better part of three years [I2, 38]. You may recall him getting arrested in September 2023 after appearing outside the home of a former associate and screaming in the street that he had been “extorted for his lambo” [I40]. Anyway, this is one of those lawsuits that tends to appear in the crypto world where I hope everybody loses.

In the White House

Any sense of relief that may have followed the March executive order’s stipulation that a “strategic bitcoin reserve” would not incur costs to taxpayers has melted away with news that the White House is already looking for creative ways to acquire bitcoin in a “budget neutral” way.

Bo Hines, the baffling choice of executive director for the White House’s “crypto advisory council” [I72, 74], sat for an interview in which he commented that “there’s a lot of high IQ people working on ... countless ideas” to pump bitcoin prices to profit bitcoin holders acquire additional bitcoins for the reserve, including “realizing the gains” on US gold reserves. Asked by the interviewer if he might consider selling some of the country’s gold reserves to swap them for bitcoin, Hines answered, “if it’s budget neutral and doesn’t cost a taxpayer a dime”.5

In the same interview, he commented that bitcoin “is different” from the other crypto assets like Ether, Ripple’s XRP, Solana, or Cardano’s ADA. “It’s unique. It’s a commodity, not a security.” Evidently, Hines has not been briefed that they’re not supposed to admit anymore that these other crypto assets are securities.5

Trump business interests

As the Trump administration continues the process of establishing a regulatory environment maximally beneficial to the cryptocurrency industry, Trump is doing the only thing you might expect of him: increasing his business interests in the crypto sector so that he too can personally profit.

His Trump Media organization, which is the business entity behind the Truth Social platform, has announced a partnership with the Singapore-based Crypto.com to launch various exchange-traded products of the both crypto and non-crypto varieties. The overseas Crypto.com is a bit of an odd choice in partner, given the press release’s emphasis that the project will have a “Made in America focus”.6

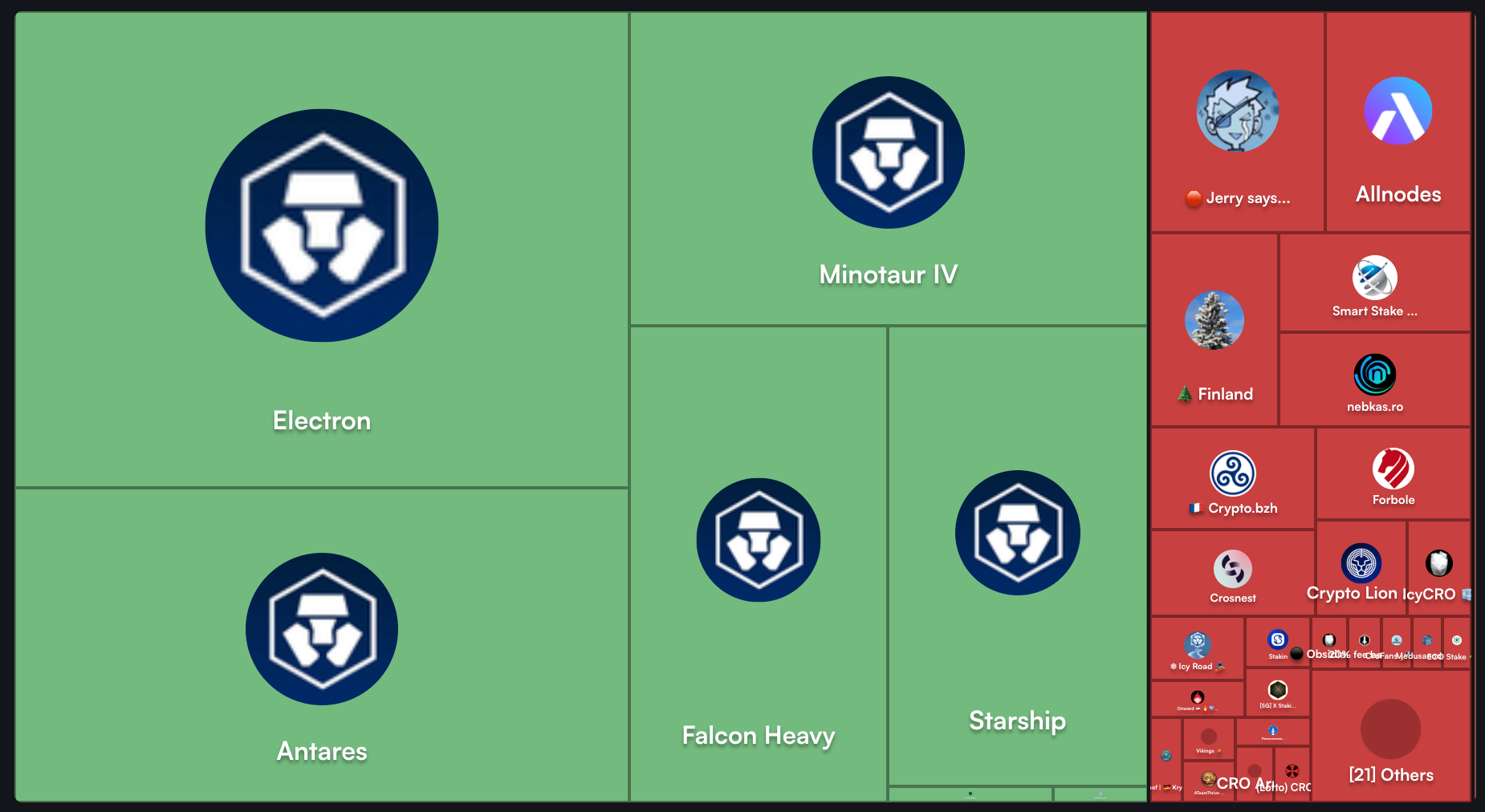

Though the details were scarce, the press release suggested the crypto ETFs would “include a unique ETF basket of cryptocurrencies incorporating Bitcoin, Cronos, and other crypto assets.” (Cronos is the token issued by Crypto.com subsidiary Cronos Labs.) All of this will happen via the “Truth.Fi” brand, a business venture announced by Trump Media in February [I76]. There has been some controversy over this deal in the crypto world, centering around a decision by Crypto.com and Cronos to fund the deal by “reissuing” tokens notionally worth $7 billion that had been burned (ostensibly permanently destroyed) in 2021.7 The proposal was unpopular among many Cronos holders, and comments on the proposal were universally negative. “Veto. Reversing a burn is a violation of trust and integrity of the ecosystem,” commented one community member. “This is a disaster on so many levels—I don’t even know where to begin. This should be a firm NO, with a veto. It feels more like a rug pull from [Crypto.com], where they’re essentially seeking exposure to the US reserve using consumers’ money,” argued another.8 Most Cronos validators voted no on the proposal. However, at the last minute, a sudden surge in yes votes came in from validators operated by Crypto.com, which controls 70–80% of the voting power in Cronos, forcing through the proposal.9

Three Trump Media executives have also filed paperwork for a new special purpose acquisition company (SPAC), which they aim to focus on “the cryptocurrency and blockchain, data security and dual-use technologies markets”. Explaining why the crypto industry was among their targets, they wrote: “The current administration has taken unprecedented steps to integrate digital assets into the national financial strategy.” They also noted the establishment of a strategic bitcoin reserve, and were even blunter than the Trump administration about the reserve’s purpose, explaining that it was “aimed at benefiting the digital assets industry”. They’re looking to raise $179 million.10

World Liberty Financial, the crypto project from which Trump earns 75% of the revenue, has announced plans to issue a stablecoin that they plan to call USD1.11 Trump and other Republicans have been vehemently opposed to any talk of establishing a central bank digital currency, or CBDC,a and Trump’s January 23 executive order on crypto established a prohibition on the creation of such a thing. Trump has described CBDCs as “a dangerous threat to freedom”, adding that “such a currency would give a federal government — our federal government — absolute control over your money. They could take your money and you wouldn’t even know it’s gone.”12 These concerns apparently don’t apply when it is the president himself who has absolute control over your money.

Although the project’s WLFI token ostensibly grants holders “the right to vote and take an active role in the governance of the World Liberty Financial protocol”, including “the overall WLF Protocol direction and plans”, no governance vote was held regarding this decision.13

At the SEC

As the SEC has dropped the majority of its ongoing lawsuits and investigations into cryptocurrency firms, most recently the Immutable web3 gaming company, a few firms seem to be getting a little nervous. Unicoin, a firm that announced shortly after Trump’s election that they would breach the 2024 “standstill” agreement they had reached with the SEC [I72] (and then did so), is now writing letters to the agency asking why their case has yet to be dropped. “We thought the war was over, and we said to the SEC, ‘Hey, we’re resuming our activity,’” explained Unicoin CEO Alex Konanykhin. Like some other industry executives, Konanykhin has gone beyond merely asking for an end to the enforcement case, and in his letter seeks retribution against the SEC employee who led the investigation into his company.14

Ripple has been considerably more successful in their similar efforts thus far, and perhaps can thank their nearly $70 million in political spending for their position at the top of the SEC’s to-do list. The SEC has recently announced that they will return $75 million of the $125 million fine Ripple was ordered to pay in 2023 after a federal judge determined the company had violated securities laws in their institutional sales. At the time, the SEC seemed disappointed that the judge ordered a fine that was much lower than the $2 billion they had sought, but now they’ve just turned around and given most of it back.15

Meanwhile, crypto companies are busy writing their own rules for the game now that they’ve successfully lobbied for the previous ruleset to be put through the shredder. SEC Commissioner and “Crypto Task Force” lead Hester Peirce invited input in a request containing 48 questions,16 though some of those questions seem asked merely so they can say they asked them. For example, the questions about the status of various crypto assets as securities have already been undercut by the SEC’s moves to drop crypto-related enforcement cases, given that it’s not likely that the SEC is going to turn around and say “actually, after we thought about it, we’ve determined these assets are probably securities after all” and reopen the cases.b

Andreessen Horowitz has submitted a 49-page response that only gets through the first six questions (with a note that they will shortly produce additional letters responding to the remaining 42).17 Coinbase submitted 41 pages of their own.18 Other submissions have come from Robinhood, Cumberland DRW, and Ripple, as well as a number of lawyers (including crypto skeptic Lee Reiners).19

Reiners wrote:20

As excited as I am to participate and comment, I must admit that whole endeavor seems performative and intended to justify a predetermined outcome. While the stated purpose of the Task Force is to develop a “comprehensive and clear regulatory framework for crypto assets,” the Commission has proceeded to front-run the Task Force by either dismissing, or pausing, nearly every outstanding crypto-related case and investigation, often with prejudice. In several court submissions stipulating that ongoing crypto litigation will be dismissed, as well as in press releases announcing the dismissal, the Commission justifies the action by referencing the work of the Crypto Task Force in “helping the Commission develop the regulatory framework for crypto assets.” Has the Task Force already concluded that every named crypto asset in outstanding enforcement actions is not a security? These actions open the Commission up to allegations of politicization – the very same allegations leveled at the Commission by the crypto industry just months earlier. The crypto industry raised over $238 million this past election cycle in a successful effort to support industry-friendly candidates in Congressional races. And just three days before his inauguration, President Trump and the First Lady issued their own meme coins, netting the Trump Organization significant profits. Is the public expected to think it is just a coincidence then when the Commission’s Division of Corporate Finance issues a staff statement expressing their view that meme coins “do not involve the offer and sale of securities under the federal securities laws”? Perhaps more concerning, the Commission has paused cases involving credible allegations of fraud and misconduct.

To my surprise and to the SEC’s credit, they invited several crypto skeptics and consumer protection advocates to a March 22 roundtable on crypto regulation; Reiners, ex-SEC John Reed Stark, and Better Markets’ Benjamin Schiffrin were mixed in among the various industry lawyers.21 However, I share the concern Reiners voiced in his written submission, which is that this feels like more of an empty gesture than a genuine request for input in the context of the SEC’s actions over the past few months.

The SEC subsequently announced plans for four more of these events between now and June, focused on topics including custody, tokenization of non-crypto assets (often called “real-world assets”), and decentralized finance.22

Paul Atkins, Trump’s nominee for SEC Chair, finally had his confirmation hearing in front of the Senate alongside the nominee to head the Office of the Comptroller of the Currency, Jonathan Gould. Both faced surprisingly few crypto-related questions, though prior to the hearing Atkins received multiple letters from Senator Warren (D-MA) highlighting concerns around his substantial conflicts of interest with financial institutions of both crypto and non-crypto varieties — including a former advisory position with FTX.2324 In 2023, he blamed FTX’s collapse not on the massive fraud at the company, but on “the U.S. [not making] our rules accommodating to this new technology”.25 Atkins serves on the board of the blockchain advocacy and lobbying group Digital Chamber of Commerce and the blockchain company Securitize, and holds up to $6 million in crypto-related assets among his fortune of approximately $328 million (though much of that comes via his wife, an heiress of an evidently lucrative roofing shingles manufacturer).2627

In other regulators

Speaking of the Office of the Comptroller of the Currency, the bureau has issued an interpretive letter stating that banks may participate in crypto custody and stablecoin activities, and may run blockchain nodes.28 They’ve rescinded an interpretive letter published in November 2021 that required banks to notify their supervisory authorities of any intentions to engage in these crypto activities, and to undergo risk management evaluations to obtain a non-objection letter.29

The acting director has also announced that the agency, which oversees national banks, will no longer consider banks’ reputation risk as a factor in examinations. This is a direct result of crypto industry outcry over supposed “debanking”, and several Congressional hearings on the topic featured concerns that this reputation risk evaluation was being used to unfairly target not just banks involved with the crypto industry, but with other “disfavored groups”.

The move mirrors proposed legislation from Senate Banking Committee Chairman Tim Scott (R-SC) aimed at eliminating the consideration of this factor by any federal banking regulator.30 While the bill and the OCC announcement are clearly pandering to crypto industry complaints and broader Republican feelings of political victimhood, the change is likely a good thing overall — and I wonder if Republican-led efforts to target the groups they disfavor in their ongoing campaigns against “DEI” and “ESG” and whatever other Big Bad Acronym they come up with next may later trip up on the changes they themselves have proposed.

The Office of Foreign Assets Control (OFAC) has removed the Tornado Cash cryptocurrency mixer from its list of sanctioned entities after adding it in August 2022 [W3IGG]. In a statement, they said the removal was the result of a “review of the novel legal and policy issues raised by use of financial sanctions against financial and commercial activity occurring within evolving technology and legal environments”. This follows a November 2024 ruling that the crypto mixer’s smart contracts could not be sanctioned [I71]. Sanctions against Tornado Cash co-founder Roman Semenov, however, remain in place.31

In elections and political influence

While crypto-focused super PACs have mostly been hard at work preparing to launch a 2024-esque funding onslaught on the 2026 midterms, they’re not twiddling their thumbs until then. After panic at the White House and among Republican Congresspeople that their favored candidates were being out-raised,32 the Republican-focused arm of the crypto lobby, Defend American Jobs, dumped $1.2 million in ad spending to support Randy Fine in his Florida special election against Democratic opponent Joshua Weil.33 Musk’s America PAC followed shortly after to fund a text message blast. A television ad funded by the Defend American Jobs PAC states:

Florida voters: President Donald J. Trump has an urgent message. President Trump needs Randy Fine in Congress. Fine and Trump will drive prices down and end the border crisis once and for all, and you can count on Randy Fine to tackle our high insurance rates head on. Florida approved, Trump endorsed. Stand with Trump. Vote Randy Fine for Congress.

As usual for ads from these super PACs, cryptocurrency is not mentioned. The two candidates are battling to secure the seat vacated by Michael Waltz, Trump’s new National Security Adviser who has wasted no time in making a name for himself after adding the editor-in-chief of The Atlantic to a top secret war planning group chat. Oopsie. Fine has been a member of Florida’s state legislature since 2016, and prior to that he worked as an executive and then consultant for the casino industry.

Defend American Jobs dropped another $345,000 on ads supporting Republican Jimmy Patronis in his campaign against Democrat Gay Valimont.33 The two are competing in the special election to fill the seat vacated by its also illustrious former occupant, Matt Gaetz, who resigned in confidence that he would be confirmed as Trump’s pick for attorney general before withdrawing his nomination after it became clear that that pesky child sex abuse scandal might prove challenging to overcome. Patronis is a career politician who currently serves as the Chief Financial Officer for the state of Florida. In October, he advocated that Florida state pension funds look into investing in crypto.34

While both districts are heavily red, and both Republican candidates are strongly favored to win, the nervousness around these races reveals Republican fear that Americans concerned about the horrors of the past few months might channel it into elections.

Elsewhere in crypto

A preprint from researchers at University College London suggests that fewer than 500 “masterminds” are responsible for significant pump-and-dump schemes across the decentralized finance world. According to the researchers, “pump-and-dump manipulators swindled $241.6 million in profit” in 2023 in defi, amounting to 10% of the total trading volume.3536

The Coinbase Ventures-backed firm Harpie has shut down, stating “We attempted to create a theft-free crypto ecosystem, but unfortunately could not create a sustainable business model around it.”37

The Web3 is Going Just Great recap

There were six entries between March 20 and March 28, averaging 0.75 entries per day. $33.5 million was added to the grift counter.

All my Magic Internet Money gone

[link]

For the second time, someone has stolen Magic Internet Money from the Abracadabra project, which was named as though its creators specifically wanted to ensure the Web3 is Going Great entries would be as funny as possible.

An attacker using a flash loan attack to take advantage of a smart contract vulnerability was able to make off with 6,262 ETH, or approximately $13 million. This attack follows a January 2024 attack [W3IGG] in which $6.5 million was stolen from the project.

Polymarket bet outcome manipulated

[link]

Bets on the Polymarket platform where the outcome is not clear are resolved using an oracle system called UMA, or Universal Market Access. Holders of the UMA token participate in a vote to determine the outcome of challenged market resolutions.

Recently, $7 million was spent in a Polymarket market over whether Ukraine would agree to Trump’s proposed mineral deal. Though no mutual agreement was reached, the market resolved to “yes”. When it was challenged, a large holder of the UMA token cast a substantial number of yes votes to sway the outcome of the resolution, leaving the outcome in place.

Although Polymarket acknowledged that “This market resolved against the expectations of our users and our clarification” (referring to a Polymarket clarification that the resolution was too early as no mutual agreement was reached between the countries), they also refused to issue any refunds, writing that “this wasn’t a market failure”. “This is an unprecedented situation, and we have been in war rooms all day internally and with the UMA team to make sure this won’t happen again. This is not a part of the future we want to build,” the team member added.

Everything else

- Galaxy Digital agrees to $200 million settlement over alleged LUNA manipulation [link]

- HyperLiquid loses $13.5 million in alleged JELLYJELLY manipulation incident [link]

- Zoth hacked for nearly $8.3 million, second theft in two weeks [link]

Worth a read

Ed Zitron published another excellent piece on AI, this time focusing on the coverage of the AI boom in the technology media. I particularly enjoyed this one quote, which I think is applicable to tech media far beyond AI: “The result of a lack of true skepticism and criticism is that the tech industry has become captured by people that are able to create their own phony and comfortable realities.”

With the White House flooding the zone with one horrific thing after another, it can be easy to miss important news. One such recent development is the slashing of funding to the Institute for Museum and Library Services (which makes up a whopping 0.005% of the federal budget but provides unquantifiable services to the public) and the subsequent announcement from the acting head of the IMLS that he will “restore focus on patriotism, ensuring we preserve our country’s core values, promote American exceptionalism and cultivate love of country in future generations”. Last I checked, freedom of speech and expression was a core American value, but that seems to be rapidly changing as the Trump administration aims to make libraries into propaganda machines. Now, as ever, is a great time to support your local library.

In the news

I appeared on Columbia Journalism Review’s The Kicker podcast to discuss the cryptocurrency world and the challenges to journalists attempting to cover and decipher it, and the desperate need for quality coverage of the crypto world at this moment. This followed a separate piece in CJR by Lauren Watson titled “The Lessons of Crypto Media”.

I went on The Bunker with Andrew Harrison to discuss the cryptocurrency industry’s entrance into politics and amassing of substantial influence in the White House.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Although it’s worth reiterating that this is mostly an imaginary bogeyman — despite much bluster from Republicans about the need to ban CBDCs in the US, there has been no real talk of establishing one. ↩

In fact in some cases they cannot, given that cases against Coinbase, Kraken, and Consensys were dismissed with prejudice. ↩

References

“Cryptocurrency Financial Services Firm "Gotbit" and Founder Plead Guilty to Market Manipulation and Fraud Conspiracy”, U.S. Attorney's Office, District of Massachusetts. ↩

Stipulation of dismissal filed on February 24, 2025. Document #50 in FTX Recovery Trust v. Allan Joseph Bankman et al. ↩

Complaint filed on March 26, 2025. Document #1 in O’Leary v. Armstrong. ↩

“Crypto influencer Ben ‘BitBoy’ Armstrong arrested in Florida”, CoinTelegraph. ↩

“Trump Media Announces Intention to Partner with Crypto.com to Launch ETFs”, press release by Trump Media. ↩

“Trump Media’s ETF deal with Crypto.com sparks controversy over $7bn in tokens”, DL News. ↩

“INITIAL PROPOSAL: Cronos New Golden Age to Onboard Billions and Invest in the U.S. - Cronos POS V5 upgrade”, Github. ↩

“Crypto.com Forces Through Controversial Vote to Re-Mint 70 Billion CRO”, Unchained. ↩

Renatus Tactical Acquisition Corp I S-1 filed with the SEC. ↩

“Trump-Backed World Liberty Financial Confirms Dollar Stablecoin Plans With BitGo”, CoinDesk. ↩

“Trump Tells New Hampshire Voters He’d ‘Never Allow’ a Federal Reserve Digital Dollar”, Bloomberg. ↩

“Unicoin CEO: Why Are We Still Under the SEC's Gun?”, CoinDesk. ↩

“Ripple to Get $75M of Court-Ordered Fine Back From SEC, Drops Cross-Appeal”, CoinDesk. ↩

“There Must Be Some Way Out of Here”, U.S. Securities and Exchange Commission. ↩

“Re: There Must Be Some Way Out of Here: Recommendations on the Regulation of Digital Securities Markets”, U.S. Securities and Exchange Commission. ↩

“Re: Recommendations Regarding a Safe Harbor for Certain Airdrops and Incentive-Based Rewards of Network Tokens”, U.S. Securities and Exchange Commission. ↩

“Crypto Task Force Written Input”, U.S. Securities and Exchange Commission. ↩

“Prepared Statement for SEC’s Crypto Task Force March 21, 2025 Roundtable titled ‘How We Got Here and How We Get Out – Defining Security Status’ and Responses to ‘Security Status’ Questions in SEC Commissioner Hester Peirce’s February 21, 2025 Statement Titled ‘There Must Be Some Way Out of Here.’”, U.S. Securities and Exchange Commission. ↩

“How We Got Here and How We Get Out – Defining Security Status”, U.S. Securities and Exchange Commission. ↩

“SEC Crypto Task Force to Host Four More Roundtables”, U.S. Securities and Exchange Commission. ↩

March 23, 2025 letter on SEC Nomination from Senator Warren to Paul Atkins. ↩

March 23, 2025 letter on Ethics Commitment from Senator Warren to Paul Atkins. ↩

“Incoming SEC chair Paul Atkins owns up to $6 million in crypto-related assets”, Fortune Crypto. ↩

“Trump SEC Pick Paul Atkins’ Crypto Ties Draw Sen. Warren’s Ire Ahead of Confirmation Hearing”, CoinDesk. ↩

“Trump SEC pick discloses family fortune of more than $328 million”, Reuters. ↩

“OCC Letter Addressing Certain Crypto-Asset Activities”, Interpretive Letter #1183 issued by the Office of the Comptroller of the Currency in March 2025. ↩

“Chief Counsel’s Interpretation Clarifying: (1) Authority of a Bank to Engage in Certain Cryptocurrency Activities; and (2) Authority of the OCC to Charter a National Trust Bank”, Interpretive Letter #1179 issued by the Office of the Comptroller of the Currency in November 2021. ↩

“Tornado Cash Delisting”, U.S. Department of the Treasury. ↩

“GOP leaders raise alarm bells over a Florida special election in a deep-red district”, NBC News. ↩

“Pro-crypto PAC spends $1.5 million on two Florida special elections”, Axios. ↩

“Inspired by Trump, Florida Official Eyes State Bitcoin Stockpile for Retirees”, CoinDesk. ↩

“PERSEUS: Tracing the Masterminds Behind Cryptocurrency Pump-and-Dump Schemes”, Computers and Society preprint. ↩

“Fewer than 500 people are responsible for $3.2 trillion of artificial crypto trading”, Fast Company. ↩

“Coinbase-backed web3 security shop Harpie announces immediate shutdown due to financial difficulties”, The Block. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.