Issue 81 – Crypto crime is legal

Trump continues to dismantle crypto enforcement while expanding his personal crypto empire

A Monday night memo from Deputy Attorney General Todd Blanche, citing Trump’s crypto executive orders, has dismantled the Department of Justice’s National Cryptocurrency Enforcement Team (NCET) and directed the agency’s Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”.1 The memo also directs prosecutors to “not charge regulatory violations in cases involving digital assets including but not limited to unlicensed money transmitting..., violations of the Bank Secrecy Act, unregistered securities offering violations, unregistered broker-dealer violations, and other violations of registration requirements under the Commodity Exchange Act” unless they have specific knowledge that the defendant knowingly and willfully violated a specific requirement — erecting a major barrier to prosecuting such cases.

The National Cryptocurrency Enforcement Team, established in October 2021 and merged with the computer crimes section in July 2023, helped investigate and prosecute cases including the historic Binance case [I44] — which was based on charges that the DOJ is now explicitly discouraged from prosecuting. NCET was also heavily involved in prosecuting Bitzlato for its role in laundering ransomware proceeds and illicit assets tied to the Russian Hydra darkweb marketplace [I46], and in prosecuting Avi Eisenberg, who I will return to in a moment.23

Meanwhile, crypto lobbyists and other industry figures are hard at work4 trying to argue that “Sure, Trump nixed the Crypto Enforcement Team, directed Major Fraud prosecutors to stop prosecuting crypto cases, and is trying to exempt crypto platforms from the BSA, but look! They wrote right here that they care about stopping crypto crime!” Reject the evidence of your eyes and ears.

As Brad Johnson quipped on Bluesky, the “Ending Regulation by Prosecution” memo might as well be named the “Ensuring Lifetime Employment For Molly White” memo.5

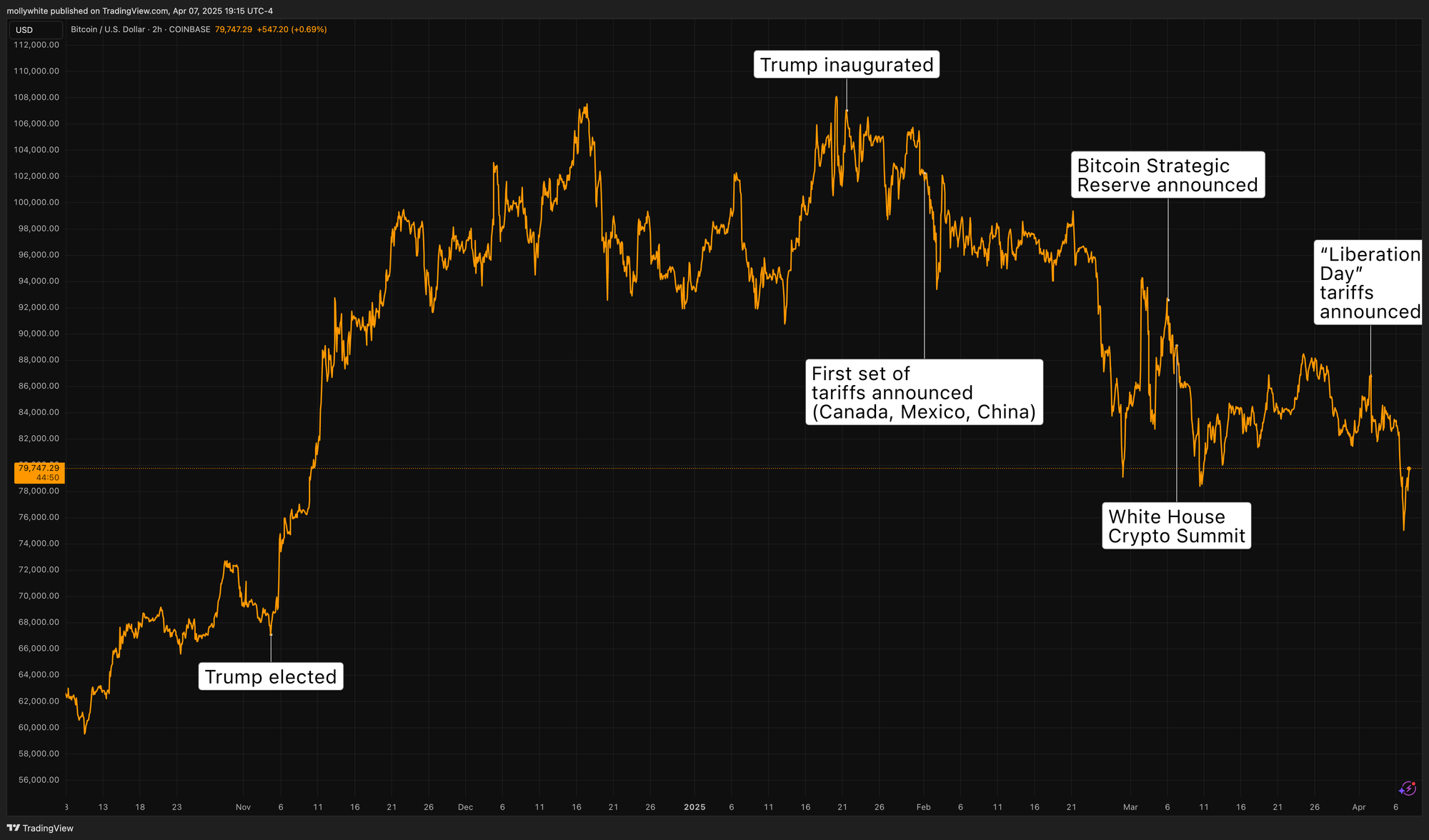

Since his inauguration in January, the self-described “crypto president” has caused the largest drop in bitcoin prices over such a period since its creation. Things had already been pretty much down only since the so-called “Trump pump” shortly before his inauguration, but the recent tariff announcements have worsened things still.

There were some briefly celebratory headlines trying to perpetuate the myth that bitcoin is a safe harbor from disruptions in traditional finance, such as The Block’s premature claim that “Bitcoin holds firm while traditional markets bleed from Trump tariffs”.6 And indeed, this has been a favored narrative among many in the crypto world, including Trump and others close to his administration as they have been trying to perpetuate the claim that bitcoin is like “digital gold” that ought to be kept in a national reserve.

However, crypto markets were — as usual — quick to mirror the bloodbath in equities trading, dropping 9% to around $74,400 as markets prepared to open on Monday.

In the courts

Avi Eisenberg

Mango Markets exploiter Avraham “Avi” Eisenberg has filed his sentencing memo ahead of his April 10 sentencing, where he will face a maximum of twenty years in prison.7 A year ago, Eisenberg was convicted on fraud and market manipulation charges in connection to the $110 million exploit of the Mango Markets cryptocurrency platform [W3IGG, I6, 43, 55, 56, 67]. Shortly before his conviction, the government filed an additional charge of possession of child pornography after finding evidence of such while examining Eisenberg’s devices in connection to the crypto theft. Eisenberg pleaded guilty almost immediately to the additional charge, and the cases were combined for sentencing purposes.

In his sentencing memorandum, Eisenberg continues to argue that he believed his crypto theft was permissible because, essentially, code is law. According to his lawyers, Eisenberg “reviewed several similar crypto trades in the months before, including one rather similar trade on Mango Markets, noting that no litigation or legal action had been pursued against the traders who profited, and concluded that his conduct was entirely permissible under the MNGO smart contract.” His lawyers also claimed that hacking is just so commonplace in the crypto world that it contributed to his belief that what he was doing was acceptable:

A related important circumstance of the offense is the overarching atmosphere of normalcy, if not acceptance, in the cryptocurrency community towards the identification and exploitation of weakness or “bugs” in protocols and smart contracts, as well as what Mango Market’s own terms of service stated. Avi operated in this environment of exploration and pushing the envelope to identify smart contract weaknesses. He does not contend that community attitude toward identifying bugs alone justifies his actions, but he points out that his actions were taken in a place where social norms often accepted such behavior, and the line between acceptable and prohibited conduct could be difficult to delineate. Further, the Mango Markets user interface, which deliberately did not include any terms of use, informed users that the protocol “is unaudited software, use at your own risk” and required users to check a box that they “understand and accept the risks.” These circumstance [sic] make cases like this and others relating to cryptocurrency substantially different from cases dealing with traditional banking and trading markets.

As for the child sexual abuse material, he argues that his devout Orthodox Jewish upbringing led him to believe that “all depictions of sexual activity [were] so extremely sinful that he made no distinction between child pornography and adult pornography,” and that although he later determined that the former was illegal, he believed it to be “a vice like drug or alcohol addiction, with the primary victim being myself ... I didn’t think of it as having other victims”.

The sentencing memo argues for several downwards variations in Eisenberg’s sentencing, including by performing an analysis of other cryptocurrency fraud cases that is rather carefully crafted to exclude cases like Sam Bankman-Fried’s, which resulted in a 25-year prison sentence. Eisenberg’s sentencing memo resembles Bankman-Fried’s somewhat in that he also argues “no harm, no foul”: because the users of Mango Markets were “swiftly made whole”, in part because Eisenberg returned a portion of the stolen funds, he claims that no victims were harmed.

“I won’t break any more laws. I don’t want to be in this situation again, and I don’t want to hurt anyone,” Eisenberg wrote in a letter to the court.8 “Some of the books I have read, such as Walter Isaacson’s biographies, have made me more ambitious.a I know I have a lot of potential, and the last thing I want is to waste it. When I am released, I intend to use my talents and knowledge for good. I don’t know the exact form that might take — might continue with trading and investments (while making sure to comply with all applicable laws), or I might start a company as I once didb.”

Prosecutors have not yet filed their sentencing memo.

Alex Mashinsky

Prosecutors are seeking further action from the court regarding factual disputes pertaining to the conduct of Alex Mashinsky, the former CEO of Celsius who pleaded guilty to fraud and market manipulation in December [I71]. It’s not entirely clear what the disputes entail, as the government’s letter was filed under seal,9 but it seems that the government feels Mashinsky is trying to deny responsibility for actions stipulated in his plea agreement. An unsealed response letter10 from Mashinsky’s defense quotes a portion of the prosecutors’ letter, where they allege Mashinsky is “distancing himself from the stipulations in the plea agreement”. Mashinsky’s lawyers write that, “The parties certainly dispute the nature and circumstances of Mr. Mashinsky’s offense, and whether, for example, he knowingly misrepresented Celsius’s profitability to customers or engaged in a conspiracy with Roni Cohen Pavon (and others) to manipulate the price of CEL token,” but argue that it is not material to his sentencing.

At least according to Mashinsky’s lawyers, prosecutors are looking for the judge to either resolve factual disputes regarding Mashinsky’s conduct in the government’s favor, or conduct a two-week hearing in which both parties can present evidence for evaluation in his sentencing. Mashinsky’s lawyers don’t want either of these things, and want his sentencing to proceed as scheduled on May 8.

In the White House

Trump has issued the first ever presidential pardon of a business (and some of its executives), and I’m sure you’ll be shocked to hear it was a crypto company. Along with pardons of two other white-collar criminals, Trump pardoned BitMEX and four individuals related to the company.11 BitMEX pleaded guilty to Bank Secrecy Act violations in July 2024 [I62] and was fined a combined $230 million by the DOJ and CFTC. According to prosecutors, the company had willfully flouted anti-money laundering requirements to “serve BITMEX’s bottom line goal of obtaining revenue through the U.S. market without regard to U.S. criminal laws”.12 Evidently, this is now the business model the US government is encouraging crypto companies to pursue, so I guess the pardon shouldn’t be too surprising.

As Kimberly Wehle wrote for The Hill:11

The BitMEX pardon sends a different message: Companies involved in financial crimes don’t have to worry about accountability under this president, as least when it comes to crypto, for reasons that he has no incentive to ever make known. BitMEX can continue its prior criminal practices with federal impunity, and maybe even rely on the pardon to thwart future investigations into related conduct by federal lawmakers or state prosecutors.

The biggest losers in this deal are, once again, the American people, including the more than 77 million who might finally be realizing that they voted for lawlessness last November.

Trump business interests

As we watch Trump dismantling cryptocurrency industry regulations and enforcement, it’s worth revisiting the extent to which he and his family personally profit from their cryptocurrency business interests, which they have been rapidly expanding.

Eric Trump has recently announced American Bitcoin, a company he has co-founded with the CEO of bitcoin mining firm Hut8. American Bitcoin will essentially subsume Hut8’s entire bitcoin mining business under suspiciously friendly terms for the Trumps. As VanEck’s Matthew Sigel noted, “I don’t fully understand the rationale of selling 61,000 miners in exchange for an 80% stake in a subsidiary that they previously owned 100% of. No cash changes hands.”13 Hut8 seems to have decided that favor with the Trump family is worth more than cash.

I’ve gotten some flak in the past for describing World Liberty Financial as the Trumps’ crypto platform, as some liked to reiterate the platform’s claims that they had an arms-length relationship with the Trumps (despite the fact that 75% of protocol revenues go to Trump, and the platform prominently listed the three Trump sons as “ambassadors” [I68]). Now that the election is over, all pretense has been dropped, and the Trump family has taken majority control of the company. The company has raised $550 million in token sales, putting Trump’s cut at almost $400 million. The project still has yet to launch anything, but as I noted last issue, their plans now include launching a stablecoin called USD1 [I80].

Then there’s Trump Media, the firm behind the Truth Social platform, which has recently filed documents disclosing plans to explore something called Truth.Fi, which will include a crypto component [I80]. Trump’s stake in Trump Media is estimated at around $2 billion, and the company recently submitted filings that would allow the trust holding his shares in the company (controlled by Donald Trump Jr.) to sell them.14

Then there are the memecoins [I75]. Trump has already extracted around $350 million from crypto buyers via his $TRUMP token.15 On April 18, he’ll be allowed to sell off another 40 million of the tokens in the first token unlock of several scheduled over a three-year period. There’s also his wife’s $MELANIA token, which has been comparatively less lucrative, although the team responsible for it (also responsible for the disastrous $LIBRA token) has been quietly dumping tokens for at least $30 million in recent days.16

Of course we can’t forget the NFTs (multiple projects apiece launched by both Donald and Melania Trump), the bitcoin sneakers, and the other associated crypto-related grifts. And then there’s the political benefit via crypto industry donations — over $10 million contributed directly to supporting Trump, and over $200 million and counting raised to influence Congressional races.

This is the environment we’re living in as we watch Trump call off the SEC from investigating or enforcing cryptocurrency-related cases targeting his crypto benefactors and companies much like the ones he’s running. As Trump establishes a “strategic bitcoin reserve” while directly admitting its purpose is to “elevate this critical industry”. As the SEC and CFTC invite crypto executives to write their own rules. As the SEC declares that memecoins like $TRUMP and $MELANIA don’t fall under their authority, and neither do stablecoins like the one Trump’s World Liberty Financial is planning to launch.17 As the CFTC withdraws guidelines that had established oversight requirements on their portions of the crypto industry.18 As banking regulators nix guidance supervising crypto-related activities. And as the Department of Justice has been unilaterally called off anything crypto-related.

In regulators

SEC

The SEC has declared that “covered” stablecoins do not fall under their purview. (“Covered” seems to be their term for what I usually call asset-backed stablecoins, though the SEC also includes some rules limiting “covered stablecoins” from including those that are intended to generate returns.) Furthermore, they write that those planning to create, mint, or redeem covered stablecoins need not notify the SEC.17 While the SEC has been busy adding limits to its own authority over the crypto world — previously with respect to many digital assets they suggest may not be securities, then with memecoins, and now with stablecoins — there’s been very little movement in filling the vacuum to establish who is responsible for any oversight of such assets. Stablecoins could be addressed by upcoming legislation, such as it is, although of course the crypto industry is hard at work influencing those regulations too, including recently lobbying for changes to proposed laws that would allow for yield-bearing stablecoins.4 Of course those legislations are still very much works-in-progress, and the stated goal is to pass something “this year” — leaving a large period of uncertainty in the meantime.

The Acting Chair of the SEC has also announced that, as a result of both executive orders and “recommendations from DOGE”, he has directed staff to “review” past guidance on digital assets, including frameworks for designating digital assets as securities, requirements for disclosures of cryptocurrency-related risk and exposure, and guidance around banks and crypto custody. Under this administration, “review” seems to be largely synonymous with “rescind”.19

The SEC investigation into Crypto.com has been terminated, and the agency will not pursue any enforcement action.20 This is hardly surprising given the flood of dropped SEC lawsuits and closed investigations targeting the industry, but it’s especially unsurprising given that, three days earlier, Trump Media picked Crypto.com as a partner to launch various exchange-traded funds [I80].

I noted in February that, despite the Winklevoss twins’ victory screeches, it wasn’t clear that the ongoing lawsuit regarding the Gemini Earn product had actually been dropped [I78]. The lawsuit was filed against Gemini and Genesis Global Capital in January 2023 after Gemini customers lost access to almost $1 billion in funds as the two companies halted withdrawals [I16], and Genesis settled their portion of the case for $21 million in March 2024 [I50]. The portion against Gemini had been ongoing until an April 1 joint request for a 60-day stay to “allow the parties to explore a potential resolution”.21 This is the same language that’s been used to halt the SEC cases against companies like Coinbase and Tron, and it’s widely understood that these mark the end of SEC scrutiny for these companies.

Even “Hawk Tuah girl” is out of the woods, recently telling TMZ that the SEC had closed its investigation into the memecoin flop [W3IGG] that became emblematic of the memecoin world and — particularly lately — crypto as a whole.22

In governments

Even House Financial Services Committee Chair and longtime crypto booster French Hill (R-AR) has admitted that Trump’s involvement “in the memecoin activity and in considering the formation of a stablecoin have made our work more complicated” in passing crypto legislation.23 Yeah, blatant corruption does complicate things, huh? Maybe you should do something about that.

The Financial Technology Protection Act has been reintroduced after passing through the previous House. The bill claims it would “combat illicit terrorism financing” by creating a working group of cryptocurrency industry executives and law enforcement agencies, and sponsor Representative Nunn (R-IA) announced the bill’s reintroduction with an approving quote from a leading crypto lobbyist.24 Who better to guard the henhouse?

Senator and Ranking Banking Committee Member Warren (D-MA) has written to the U.S. Securities and Exchange Commission’s Office of Inspector General to call for an investigation into Trump and other officials who “may have improperly influenced SEC enforcement and regulatory decisions on cryptocurrency.” She writes in the letter: “In addition to dropping almost all ongoing lawsuits against crypto companies, the SEC has also taken steps to proactively alert crypto companies that they will not be expected to comply with the SEC’s rules. ... President Trump, his closest advisors, and his family members all stand to benefit from boosts in the crypto industry.”25 At least the SEC still has an Inspector General (for now).

Outside the US

A spokesperson for the European Union’s Securities and Markets Authority has noted that the United States’ “crypto-friendly stance has the potential to accelerate crypto adoption, including by institutional investors, [which] would in turn increase interconnectedness and, failing relevant safeguards, risks of negative spillover effects between crypto and traditional markets.”26 At least there’s a voice of reason somewhere, not that I expect it to be heeded by anyone with the ability to shift the US government’s crypto agenda.

The Web3 is Going Just Great recap

There were four entries between March 28 and April 8, averaging 0.3 entries per day. $46 million was added to the grift counter.

- FDUSD depegs [link]

- zkLend thief gets robbed [link]

- ICERAID crypto project claims to pay people to report immigrants and "terrorist" judges to law enforcement [link]

- Coinbase customer loses $35 million in bitcoin theft [link]

Worth a read

Laura Hazard Owen has published a great guide for government employees or others who might wish to leak to journalists, including how to best protect themselves in doing so. She also provides resources for whistleblower protection.

One thing that really frustrates me about attempts to slash library funding, and the discussions surrounding it, is how little people involved in these attempts and discussions seem to understand what libraries actually do. I particularly liked that this article was intentional in highlighting that library services extend far beyond booklending.

In the news

I joined Fred Wellman on his On Democracy show to discuss crypto industry influence on the US government, Trump’s crypto conflicts of interest, and the bitcoin strategic reserve.

If you can read French or don’t mind a machine translation, I spoke to a journalist at Radio Canada about the American far right’s attacks on Wikipedia. The piece also goes into some similar issues that have been facing French Wikipedia.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Walter Isaacson’s most recent book is the authorized biography, Elon Musk. ↩

Eisenberg previously ran a company reselling items on Amazon, which was shut down by Amazon after less than two years over allegations that he was selling counterfeit products. Eisenberg claimed that he was booted from Amazon because of “greed disguised as ‘brand protection’” by Chinese network equipment manufacturer TP-Link, who he unsuccessfully sued for tortious interference and libel in 2019.27 ↩

References

“Ending Regulation by Prosecution” (archive), April 7, 2025 memo by Deputy Attorney General Todd Blanche. ↩

“Justice Department Revamps Crypto Enforcement Team”, Wall Street Journal. ↩

“Justice Department scraps crypto unit as Trump further loosens oversight of digital assets”, Fortune Crypto. ↩

“Crypto execs ask Congress to let stablecoins pay interest as bill set to advance”, Reuters. ↩

“Bitcoin holds firm while traditional markets bleed from Trump tariffs”, The Block. ↩

Avraham Eisenberg’s Sentencing Memorandum, filed on March 27, 2025. Document #14 in US v. Eisenberg. ↩

Letter by Avraham Eisenberg, filed on March 27, 2025. Document #14-1 in US v. Eisenberg. ↩

Order filed on April 4, 2025. Document #128 in US v. Mashinsky. ↩

Letter filed on April 7, 2025. Document #130 in US v. Mashinsky. ↩

“Trump makes history by pardoning a corporation”, The Hill. ↩

“Global Cryptocurrency Exchange BitMEX Pleads Guilty To Bank Secrecy Act Offense”, U.S. Attorney's Office, Southern District of New York. ↩

“Trump Media Refiles to Register the President’s Shares, Worth $2 Billion, for Sale”, New York Times. ↩

“Donald Trump’s crypto project netted $350mn from presidential memecoin”, Financial Times. ↩

Tweet thread by Bubblemaps. ↩

“Statement on Stablecoins”, U.S. Securities and Exchange Commission. ↩

“U.S CFTC Withdraws 2 Crypto Staff Advisories Citing ‘Market Growth and Maturity,’ Need for Fair Treatment”, CoinDesk. ↩

Tweet thread by U.S. Securities and Exchange Commission. ↩

“SEC Closes Crypto.com Investigation with No Action”, Crypto.com. ↩

Joint letter filed on April 1, 2025. Document #75 in SEC v. Genesis. ↩

“'Hawk Tuah' Girl Off the Hook for Hawking Meme Coin!!!”, TMZ. ↩

“President Trump's crypto moves complicate efforts to pass stablecoin legislation as lawmakers forge ahead to get bills to the finish line”, The Block. ↩

“Nunn Introduces Bill to Combat Illicit Terrorism Financing”, Zach Nunn. ↩

“Warren Calls for SEC Watchdog Investigation into Whether Agency Actions Were Influenced by Trump Administration’s Crypto Conflicts of Interest”, United States Senate Committee On Banking, Housing, and Urban Affairs. ↩

“U.S. Openness to Crypto Could Raise Risk Levels in TradFi, European Regulators Say”, CoinDesk. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.