Issue 82 – E-moluments

As Celsius victims detail their devastation even under the weak crypto regulations of the past, the Trump administration continues to dismantle those same rules while he pumps his personal memecoin with promises of private access

Trump is continuing to enrich himself through his various crypto projects, most recently attempting to pump the price of his TRUMP memecoin by enticing the top 220 holders with invitations to a private dinner with him at his Washington, DC golf course. The top 25 of those receive an “Exclusive Reception before Dinner with YOUR FAVORITE PRESIDENT!” and a “Special VIP Tour”.a

I feel like my crypto wallet is being hacked just from looking at this website

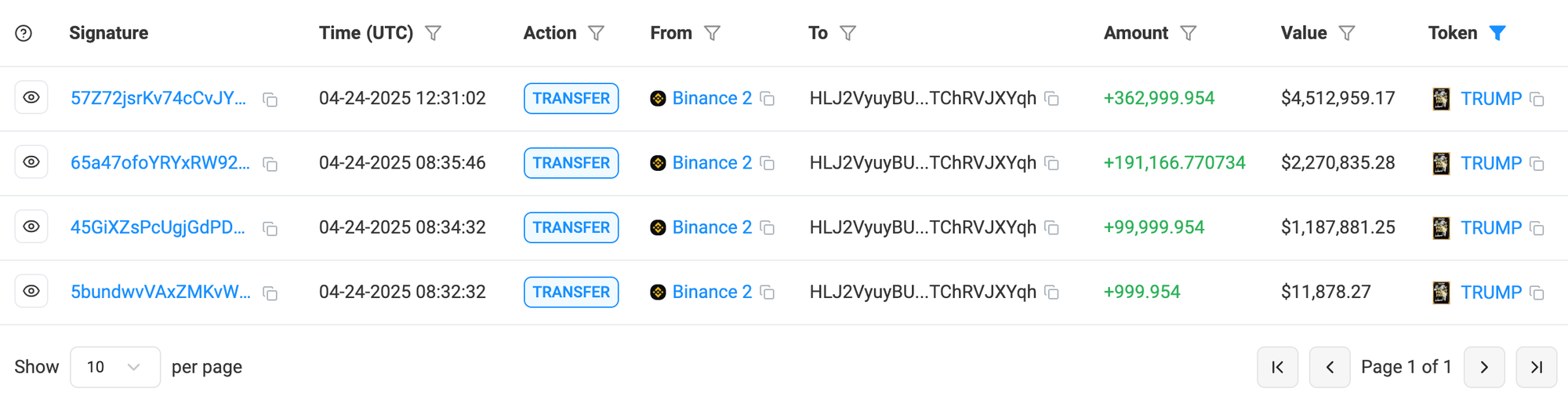

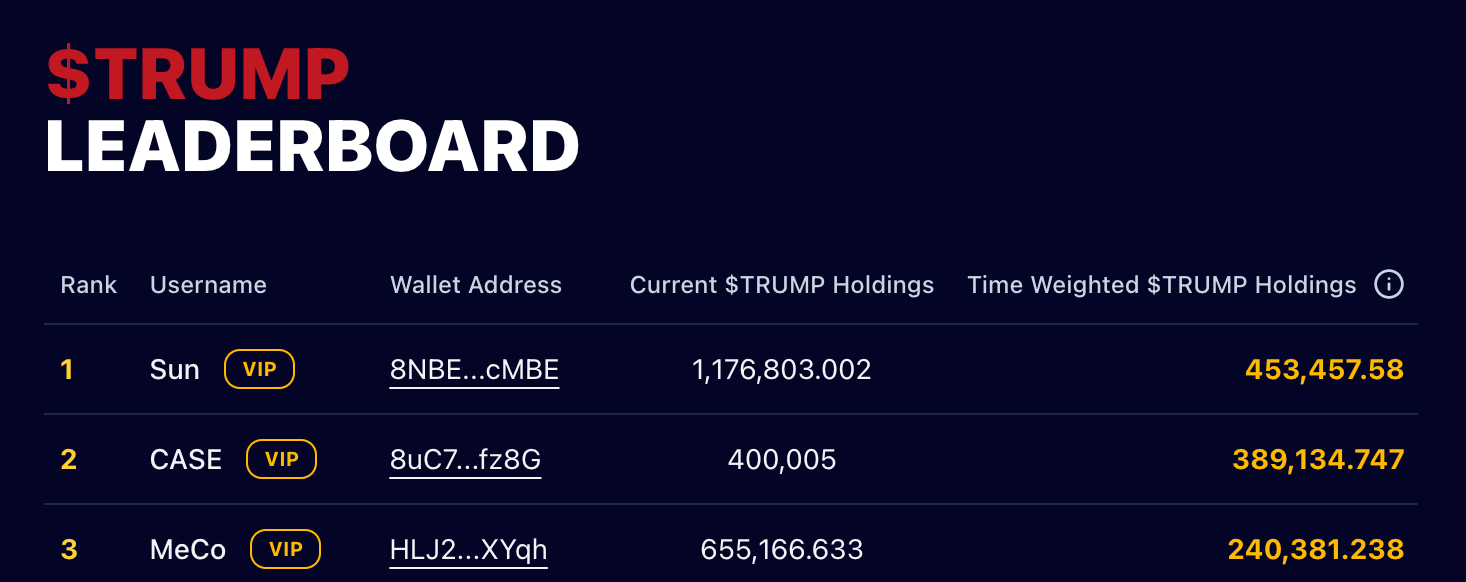

It seems to be working: as of writing, the second entry on the leaderboard is a wallet that purchased 400,000 $TRUMP shortly after the announcement for around $5.3 million.1 Another later purchaser achieved the #3 spot by purchasing over 650,000 $TRUMP for a whopping $8 million — interestingly, funded by a Binance account, suggesting that the wallet holder is not based in the US.2b

The fourth-place spot is also occupied by a wallet that was funded by Binance, which purchased $3 million in $TRUMP. In first place is Justin Sun, who has used the TRUMP holdings belonging to his HTX cryptocurrency exchange, notionally priced at $14.6 million, to secure an invite.

Before we jump in to the rest of the crypto news, I also want to mention that I’m trying to get back into doing more short video content (mostly on Tiktok, but I try to crosspost to YouTube/Bluesky/etc where reasonable). There are a lot of people — especially younger folks — who prefer to stay informed via these platforms rather than going to blogs or email newsletters, and I think it’s important to try to meet them where they are.c If you have a Tiktok account, consider following me there to see what I’ve been working on. If you don’t, don’t worry — anything important I publish there will make it into the newsletter.

You might enjoy my behind-the-scenes video about how I create these newsletters:

@molly0xfff I'm a fulltime independent writer of the technology newsletter Citation Needed. #adayinmylife #spendthedaywithme #independentjournalism #newsletter ♬ original sound - Molly White

or my various others where I talk about cryptocurrency and political news.

In the courts

Alex Mashinsky and Celsius

Celsius CEO Alex Mashinsky has filed his sentencing submission for his upcoming sentencing on May 8.3 After pleading guilty to fraud and market manipulation just ahead of his scheduled trial [I71], Mashinsky is now asking to be sentenced to no more than a year in prison. Sentencing guidelines recommend a sentence of thirty years. Prosecutors have not yet filed their submission, although they have submitted more than 200 victim impact statements.

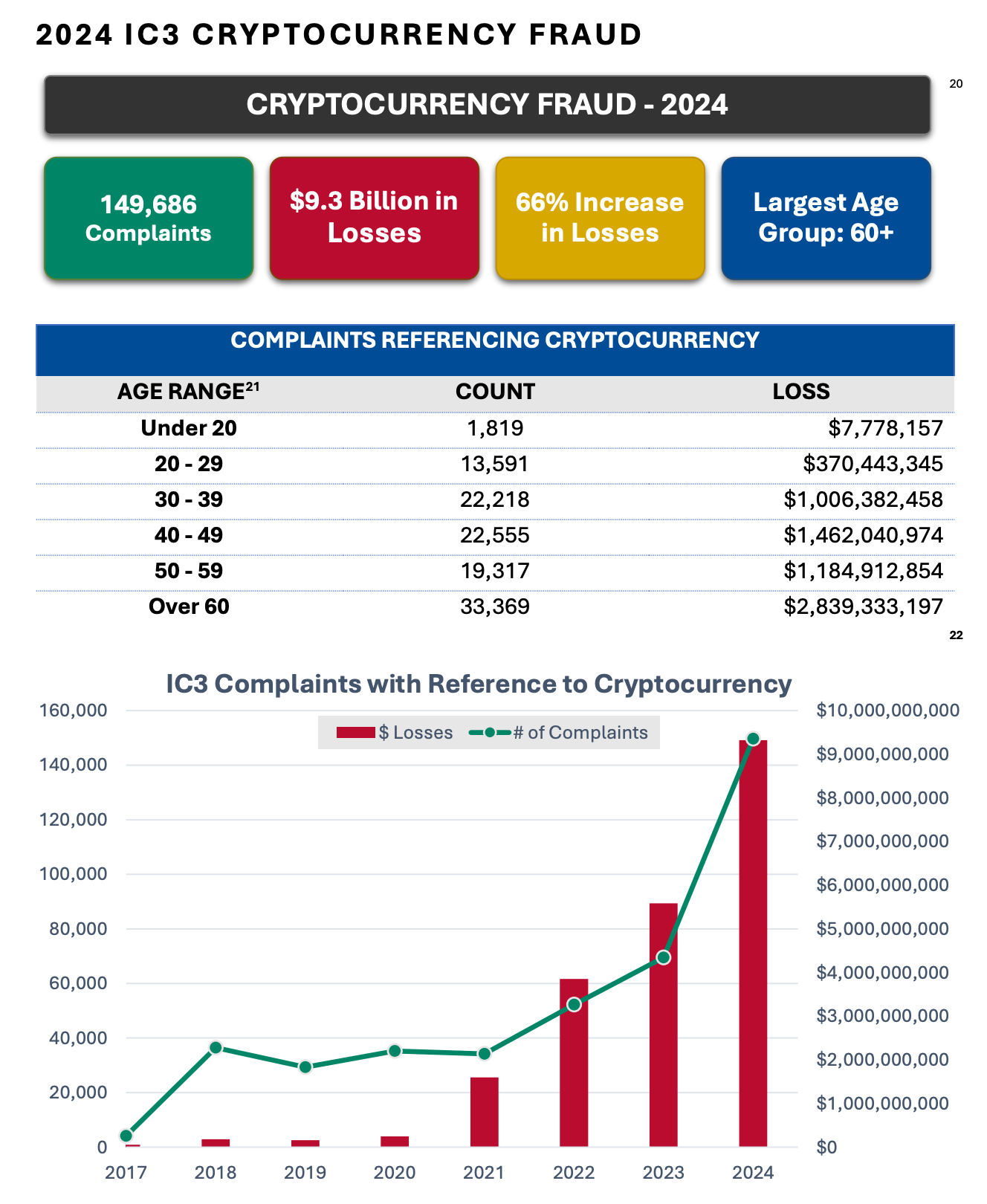

These are heartwrenching, and there are numerous statements from elderly or otherwise vulnerable people who were coaxed to put their life savings into Celsius. The letters really drive home a point I try to make often: some people dismiss the crypto industry’s abuses as though they only harm those who “deserve it” — often picturing a caricature of a young, greedy crypto bro who fully understands the risks he’s taking, gambling away money he can afford to lose. In reality, we frequently see the crypto industry actively targeting the most vulnerable, and these are the people who are worst harmed during crypto’s regular disasters. In fact, the FBI just published its 2024 Internet Crime report, showing that Americans over 60 suffered the most out of reported losses involving crypto, measured by both number of complaints (33,369) and the amount lost ($2.8 billion).4d

In Celsius’s case, Mashinsky repeatedly insisted to his customers that the company was “safer than a bank”, and some customers believed their funds were protected by FDIC insurance. Many expressed the belief that US regulators would never permit such a disaster to happen under their watch.

Mind you, these very same limited regulations and enforcement that failed to prevent the Celsius disaster are the same ones that the cryptocurrency industry has been arguing are “stifling innovation” and making it impossible for them to operate in the United States.

Some excerpts from the submissions:

[I’m] ashamed to admit to you, family and friends how much Alex [Mashinsky] took from me. Decades of hard work that would have created generational wealth for my family is gone. Everyday that I have to keep waking up at 6am to work a physical labor dead end job I’m reminded what you stole from me.

I’m now 59 and lost my entire life savings (nearly 9 Bitcoin) in the Celsius bk case. Needless to say, at my age, it was absolutely devastating. I had retired & had no income and was planning to rely on the bitcoin to live on. I lost my apartment, I could no longer help my very sick mother, I had to liquidate everything else I owned just to scrape by. I literally had to ‘camp’ out of my vehicle for nearly a year until I could begin to get back on my feet.

The financial devastation triggered constant arguments and fights between my wife and me. The economic strain put so much pressure on our relationship that my wife eventually asked for a divorce. Over time, the situation became unbearable, and my wife returned to the Netherlands with my daughter, leaving me behind in Spain. Now, I am not only financially ruined but also alone and separated from my daughter.

I’m a blind father of three that hasn’t worked [redacted] I was desperate and sought yield and ran across Celsius and placed a significant portion of my net worth there and now lets just say we are struggling. I’m now 50k [in] credit card debt just trying to survive with inflation and very small disability checks.

Virgil Griffith

Virgil Griffith, a former Ethereum developer, has been released from prison to a halfway house after serving about 36 months of his sentence for conspiring to aid North Korea in sanctions evasion. He was sentenced to 63 months imprisonment in April 2022,5 though his sentence was later reduced to 56 months as he was a first-time offender. Now he’s joined FTX’s Sam Bankman-Fried [I76] and Binance’s Changpeng Zhao [I79] on the growing list of crypto convicts reportedly seeking a presidential pardon, hoping to join Silk Road founder Ross Ulbricht [I75] and BitMEX executives [I81] in actually receiving one.

Since around 2018, Griffith worked to help North Korea develop its cryptocurrency infrastructure, knowing it could help the country circumvent sanctions.

North Korea has since become one of the largest players in cryptocurrency crime — a $1.5 billion crypto heist by state-sponsored thieves earlier this year [I78] boosted the country’s spoils throughout the last ten years to over $6 billion, much of which has reportedly gone to its nuclear program.6

Changpeng Zhao and Justin Sun

The Wall Street Journal has reported that Changpeng Zhao earned that slap-on-the-wrist four month jail sentence by snitching on Tron founder Justin Sun — yes, the same Justin Sun who’s about to cozy up to Trump at dinner next month.7 The Journal also reported that Binance is working to remove the Treasury Department’s compliance monitor that was installed at the company as part of its plea agreement, originally intended to remain in place for at least three years. These conversations are happening as Binance is reportedly in talks with Trump and his various crypto projects, including talks about the Trumps taking a stake in Binance US [I79] and about Binance listing USD1, a dollar-pegged stablecoin recently issued by Trump’s World Liberty Financial project.

Zhao was incensed at the Journal’s report (as usual [I79, 33]), writing on Twitter that “People who become gov witnesses don't go to prison. They are protected.🤷♂️”8 (apparently forgetting that only a few months ago, Caroline Ellison started a two-year prison term despite being the star witness against her former FTX boss, Sam Bankman-Fried). Zhao continued by firing back at the Journal, claiming that “I heard someone paid WSJ employees to smear me.” Sun also popped up to refute the claims, writing that “CZ is both my mentor and a close friend”.9

If Zhao did indeed trade intel on Sun prior to his November 2023 sentencing, he did it just in the nick of time. Since the change in administration in the US, Sun has cozied up to Trump, including by buying $75 million in WLFI tokens in exchange for an advisory position at World Liberty Financial [I71]. Despite Sun’s widely known shady past [I71], the likelihood of any Justice Department action against him under the Trump regime now seems very slim.

Despite the rapidly disappearing interest from the Justice Department and the SEC [I78], Justin Sun is facing new legal trouble, this time from a company called First Digital Trust, which has sued him for defamation in a Hong Kong court. Sun alleged that First Digital was insolvent and unable to fulfill stablecoin redemptions, causing the company’s FSUSD stablecoin to lose its dollar peg for a day or so.10 The allegations came after other Hong Kong court documents revealed that Justin Sun had paid over $450 million to bail out his TrueUSD stablecoin, alleging that First Digital, its reserve custodian, had improperly poured that amount of the stablecoin’s reserves into illiquid investments.11 Sun later alleged that First Digital had committed fraud and publicly offered a $50 million reward to “recover the TUSD reserves misappropriated by bad actors including First Digital Trust”.12 In a statement, First Digital described Sun’s claims as “a typical Justin Sun smear campaign to try to attack a competitor to his business”.13

Everything else

Prosecutors have filed their sentencing memo in Avi Eisenberg’s case, requesting a 6½ – 8 year prison term for his crypto fraud and CSAM convictions [I81].14

Richard Kim, the crypto founder accused in bankruptcy court of gambling away the money investors had given him to start a crypto casino [I76], has now also been accused in criminal court. That’s the thing about issuing public apologies for your crimes: while taking responsibility might help redeem your reputation, it also might end up becoming a page and a half of your seven-page indictment. Kim was arrested and released on $250,000 bond.15

A Pennsylvanian crypto trader has pleaded guilty to tax fraud after filing false tax returns that underreported his income by around $13 million in 2021 and 2022. Most of this amount came through flipping CryptoPunks NFTs.16 He probably wouldn’t have the same opportunity for such a crime these days, given that someone just sold a CryptoPunk NFT for a $10 million loss amid the broader collapse in NFT trading.17

Trump business interests

Trump has released a second batch of $TRUMP memecoins onto the market following their scheduled unlock, though the token price had long since dwindled to a mere $8 or so from its previous highs of around $75. On April 23, five days after the new coins were added to circulation, Trump tried to juice the disappointing price by enticing buyers with promises that the top 220 holders would be invited to a private dinner with the president at his Washington, DC golf club on May 22. This was moderately successful, briefly boosting the token price to almost $15 before it fell back to around $12.

The website for the memecoin was updated with a “leaderboard” of “time weighted $TRUMP holdings”, meaning that people will have to buy more and more $TRUMP tokens to rank on the leaderboard as the event draws nearer. Several people have already shelled out multiple millions of dollars following the announcement to secure their positions on the list. And in second place is Justin Sun, who has used the approximately $14.6 million (notional) in $TRUMP holdings belonging to his HTX cryptocurrency exchange to take the lead spot on the invite list.18

The continuously-updated “Leaderboard” invites people to compete to buy as much $TRUMP as possible: “Your $TRUMP coin count puts you in the running. The competition is fierce. Own $TRUMP—or watch from the sidelines.”

It’s worth noting that this weakens Trump’s claim that the memecoin is not a security, as the SEC’s February statement exempting memecoins from its authority describes tokens with “limited or no use or functionality” and “lack of utility, other than for entertainment or other non-functional purposes”.19 By using the TRUMP token to gate access to an event with the president, Trump and his team have essentially morphed the token into a “utility token”.

DWF Labs has purchased $25 million of the WLFI tokens, issued by the Trump family’s World Liberty Financial project. Trump has a direct claim on almost $19 million of this, as he receives 75% of protocol revenues. DWF Labs is a market making firm based in Abu Dhabi, though they announced along with the WLFI token purchase that they would be opening an office in New York.20 Prior to founding DWF, its managing partner Andrei Grachev ran Huobi Russia. A May 2024 Wall Street Journal article implicated DWF Labs in market manipulation to pump token prices.21 Sounds like a great choice of investor!

In the White House

Not long after suggesting the White House might try to use US gold reserves to buy bitcoin for the strategic reserve [I80], Crypto Advisory Council Executive Director Bo Hines has floated the idea of using tariff revenue for the same purpose. In an interview with Anthony Pompliano, Hines made it clear that the council is searching for “creative” ways to acquire additional bitcoins to add to the reserve while still technically abiding by the restriction that additional purchases are “budget neutral and do not impose incremental costs on United States taxpayers”. “Everything is on the table, and like we've said, we want as much as we can get, so we’re going to make sure that no stone is unturned,” he said.22

Brandon Lutnick, Commerce Secretary Howard Lutnick’s son who replaced him as chair of Cantor Fitzgerald when he “divested” his interest, is launching a bitcoin investment vehicle called Twenty One Capital.23 The company is backed by the notorious Tether stablecoin issuer and its sister company Bitfinex, with a minority stake held by SoftBank. The venture is launching with 42,000 BTC, putting its value at launch at around $3.6 billion, and it seeks to be a MicroStrategy-esque “public stock, built by Bitcoiners, for Bitcoiners”.24 Howard Lutnick already faced scrutiny during his Senate confirmation about his firm’s close links to Tether, and this move only deepens his and his family’s ties to the business [I76].

Jay Clayton, Trump’s pick for the US Attorney for the Southern District of New York, was sworn in on April 22 [I70]. His interim appointment follows a massive shakeup at the prosecutor’s office, which oversees many of the largest white collar crime prosecutions (including those against Trump), and which has already chewed through three acting US Attorneys since Damian Williams’ resignation in November. Danielle Sassoon, a familiar name to those who followed the FTX trial and observed her as the lead prosecutor in the case against Sam Bankman-Fried, spent only three weeks in the role before she resigned in protest instead of agreeing to drop corruption charges against New York Mayor Eric Adams.25 Trump had tried to install Clayton in the role during his first presidency, but then-US Attorney Geoffrey Berman, who was handling cases involving Trump associates, refused to resign. Eventually Trump fired Berman, who agreed not to fight the firing when he was informed that his deputy would take the role instead of Clayton. Clayton was eventually installed as the SEC Chair under the first Trump administration.26 Trump has named Clayton as an interim appointee, apparently in an effort to exploit a loophole allowing Clayton to serve without going through the normal confirmation process.27 Clayton has no prosecutorial experience.

In regulators

Crypto bank Anchorage Digital is reportedly under investigation by the Department of Homeland Security, according to reporting by Barron’s. It’s not clear precisely why the DHS is interested in the company, although the arm of the agency probing the bank is tasked with “disrupt[ing] and dismantl[ing] transnational money laundering organizations”.28 Anchorage Digital has been a vocal supporter of the Trump administration’s planned cryptocurrency and financial regulatory changes, with CEO Nathan McCauley testifying in a February hearing on crypto industry debanking.

Jack Dorsey’s Block will pay a $40 million penalty to settle charges from the New York Department of Financial Services that it failed to properly implement anti-money laundering controls and cryptocurrency compliance programs in its Cash App product.29 This follows a separate settlement in January, where Block paid $80 million to a group of 48 other state regulators to settle similar allegations.30

SEC

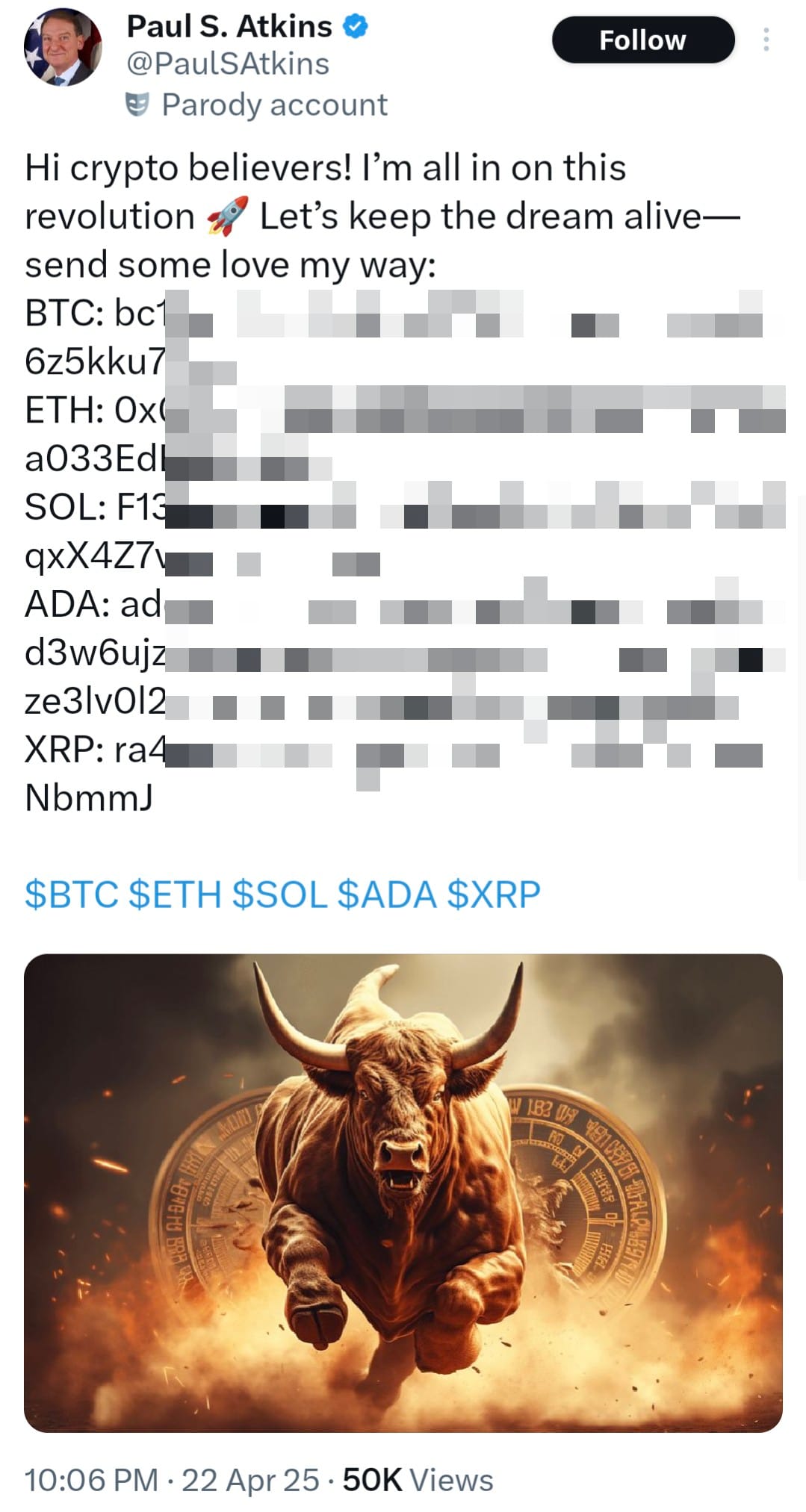

Crypto advocate and Project 2025 architect Paul Atkins has been sworn in as the new chair of the Securities and Exchange Commission. Atkins was previously an SEC commissioner from 2002–2008, and some of his deregulatory moves during that time were later implicated as contributing to the 2008 financial crisis. Since then he’s established a career as a consultant and lobbyist for traditional finance and crypto companies, including FTX — whose collapse he later blamed on the US not being sufficiently “accommodating” to blockchain technology.31

When the official Twitter accounts for both the White House and the House Financial Services Committee Republicans announced his confirmation, they tagged either a fake or hacked account purporting to be his, which quickly posted a list of crypto wallet addresses and encouraged “crypto believers” to “keep the dream alive—send some love my way”. Both of the announcement tweets were belatedly deleted.

The SEC has effectively dropped the case against Hex and its founder Richard Heart, after opting not to amend a complaint in their ongoing case to establish jurisdiction [I78, 35]. Heart was celebratory, though this is hardly the end of his legal troubles. Since December, Heart has been listed on Europe’s Most Wanted List on warrants from Finland alleging hundreds of millions of euros in tax evasion and physical assault on a minor [I72].

The SEC has also settled its recently filed case against Nova Labs, the company behind Helium, which had falsely claimed to have big-name partnerships with companies like Salesforce and Lime [I75]. Nova has paid a meager $200,000 fine, and the SEC has dropped its claim that the company’s tokens were unregistered securities.32

The SEC tried to negotiate a settlement with Unicoin, a crypto company under investigation by the agency. Following in the vein of his March demands for retribution [I80], Unicoin CEO Alex Konanykhin refused to attend the settlement negotiation meeting, claiming the SEC had made “unacceptable” demands and reiterating his charge that the agency had caused “multi-billion-dollar damage” to his company.33

The SEC has charged Ramil Palafox for running a $200 million “Ponzi-like scheme” called PGI Global, in which he used around $57 million of the proceeds to purchase Lamborghinis and other luxury items. The scheme was operational from 2020 to 2021, and promised investors high returns from crypto and forex trading. As one might expect following the SEC’s recnt abandonment of crypto enforcement, the case shies away from anything crypto-specific, although it does seek to prohibit Palafox from participating in the “offer or sale of securities and offerings of crypto assets bought or sold as a security” — a category that the SEC has recently become rather unwilling to use.34

State regulators

While federal regulators are backing off the crypto industry under orders from the Trump administration, some state regulators are stepping up. Oregon Attorney General Dan Rayfield has filed a case against Coinbase, saying that he believes “states must fill [the] enforcement vacuum being left by federal regulators who are abandoning these cases under [the] Trump administration”. The lawsuit makes similar allegations as the original SEC case, but under Oregon state securities laws.35 Coinbase is predictably furious, with Coinbase’s Chief Legal Officer and designated Twitter attack dog Paul Grewal tweeting that “This type of political jockeying is an embarrassing waste of Oregon taxpayer dollars.”36 I can certainly think of some wasteful and embarrassing political jockeying, but it’s not happening in Oregon.

A judge has denied most of DCG’s arguments in the company’s motion to dismiss a lawsuit from the New York Attorney General over the losses of its now bankrupt Genesis subsidiary, related to its partnership with Gemini. Two claims were dismissed as duplicative, but the majority of the case will be allowed to proceed as the judge has found that the NYAG had adequately argued at this stage that the Gemini Earn lending program was a security.37 At the federal level, the portion of an SEC case against Gemini has been paused pending “potential resolution” [I81]. The portion targeting Genesis had already been settled in March 2024 with a $21 million penalty [I50].

In Congress

Congress is still working on stablecoin regulation, though it’s not been without snags. I noted last issue that even Republican House Financial Services Committee Chair French Hill (AR) had noted that Trump’s crypto endeavors were “complicat[ing]” Congress’s work in passing stablecoin legislation.

Now there’s infighting among the crypto lobbyists pushing to get these new rules through Congress, with reports that Coinbase is trying to convince Congress to pump the brakes on standalone stablecoin bills in favor of passing one giant bill that would combine stablecoin and crypto market regulation changes. It seems that they’re concerned that goodwill for crypto is drying up somewhat in Congress, and their priority is a market structure bill that might definitively safeguard their company from the bigger threat of crypto assets being designated as securities. An anonymous source quoted by Decrypt explained their reasoning: “If we only do stablecoin, they think there might not be enough interest or appetite or time left to also do market structure.” According to the outlet, this is “causing friction in the tight-knit world of crypto policy” as the GENIUS Act approaches a floor vote [I79, 76].38 This is a sentiment shared by some outside of politics, with analysts from the major investment bank TD Cowen commenting that “political threats could intensify to the point where they become a threat to legislative and regulatory reforms for crypto”, citing controversy around the Trump family’s crypto involvement. “We increasingly worry about escalating political risk as actions by the Trump family business and his administration could spark a backlash that derails positive government action,” commented analysts from the firm’s Washington Research Group.39

Congress has passed several resolutions under the Congressional Review Act that impact the cryptocurrency world. One overturns an IRS rule known as the “defi broker rule”, which would treat crypto platforms — including defi platforms — as brokers and require them to collect taxpayer information. The rescission of the rule was signed into law by the president on April 10.40 Another resolution is seeking to overturn the CFPB interpretive rule that would have required more robust consumer protections by tech firms that offer fintech products like Cash App or Apple Pay, cryptocurrency platforms, and video game companies [I73]. This has passed both the House and Senate, and the Senate has indicated that Trump will sign it into law, though he has not yet.41

Outside the US

Russia’s central bank and finance ministry have announced that they will be launching a crypto exchange for “highly qualified investors”, which they say “will legalize crypto assets and bring crypto operations out of the shadows.”42 Although Russians are allowed to buy and hold crypto, there has not been a centralized Russian exchange, meaning Russians have had to use foreign platforms to purchase crypto. Russians are also not permitted to use crypto for payments within the country, although the 2024 “experimental” law under which this exchange is being created also legalized international crypto payments.43 These moves are part of a softening towards crypto by Russia, largely spurred by major sanctions on the country as a result of the invasion of Ukraine.

Argentina’s Congress has voted to form a commission to investigate the collapse of the $LIBRA memecoin and its ties to the country’s President Milei. They also approved summonses for various government officials and formal requests for information from the executive branch.44

The Web3 is Going Just Great recap

There were three entries between April 9 and April 24, averaging 0.2 entries per day. $1.25 million was added to the grift counter.

- $5 million in tokens stolen from ZKsync, later recovered [link]

- KiloEx exploited for $7.5 million, later recovered [link]

- Mantra token price suddenly collapses by 90% [link]

Worth a read

Just after I published my recent piece on Trump’s cryptocurrency empire, former SEC official John Reed Stark and Duke policy fellow Lee Reiners published an op-ed in the New York Times on the same topic. While the warnings are grim, it’s good to see them making it into the newspapers of record. “This state of affairs brings to mind a similar moment in our history — the 1920s, when insider trading, market manipulation and lack of transparency destroyed public confidence in the system and helped set off the stock market crash that in turn played a part in the Great Depression.”

Public Citizen is tracking the quid pro quo deals between Trump donors and the Trump administration. Their tracker is similar to the Follow the Crypto quid pro quo tracker I recently launched to follow the benefits crypto donors have received in exchange for their support, but Public Citizen’s version goes much wider than just cryptocurrency industry.

In the news

I joined Tim Miller to discuss my recent article on the Trump family’s crypto self-enrichment, as well as the regulatory changes rolling back consumer and market protections in the crypto world.

I had a wide-ranging discussion with Rachel Donald on her Planet: Critical podcast, where we discussed the tech industry and the billionaires who shape it, the current US political environment (and the billionaires who shape that too), and the cryptocurrency world.

You can also catch me in (another) PBS Segment on memecoins, and in a radio interview with Radio New Zealand.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

Solscan transfers for wallet 8uC71. ↩

Solscan transfers for wallet HLJ2V. ↩

Sentencing memorandum of Alex Mashinsky. Document #136 in US v. Mashinsky. ↩

“Internet Crime Report 2024”, Federal Bureau of Investigation. ↩

“U.S. Citizen Who Conspired to Assist North Korea in Evading Sanctions Sentenced to Over Five Years and Fined $100,000”, U.S. Department of Justice. ↩

“How Hackers Stole Billions in Crypto to Keep North Korea’s Regime Afloat”, The Wall Street Journal. ↩

“Binance Seeks to Curb U.S. Oversight While in Deal Talks With Trump’s Crypto Company”, The Wall Street Journal. ↩

“First Digital Trust Files Defamation Claim Against Justin Sun”, CoinDesk. ↩

“Tron's Justin Sun Bailed Out TUSD as Stablecoin's $456M Reserves Were Stuck in Limbo, Filings Show”, CoinDesk. ↩

“First Digital to 'Pursue Legal Action' Over Justin Sun Allegations as FDUSD Drops”, CoinDesk. ↩

Sentencing submission filed on April 22, 2025. Document #217 in US v. Eisenberg. ↩

Complaint filed on April 13, 2025. Document #1 in US v. Kim. ↩

“York County Man Pleads Guilty To Filing False Income Tax Returns That Omitted More Than $13 Million In Income From Digital Artwork Sales”, U.S. Attorney's Office, Middle District of Pennsylvania. ↩

“Someone just lost $10 million selling their CryptoPunk NFT”, The Block. ↩

“Staff Statement on Meme Coins”, U.S. Securities and Exchange Commission. ↩

“DWF Labs Announces U.S. Expansion with New Office as Part of Growth Strategy, Unveils $25M Strategic World Liberty Financial (WLFI) Token Purchase”, DWF Labs press release. ↩

“Binance Pledged to Thwart Suspicious Trading—Until It Involved a Lamborghini-Loving High Roller”, The Wall Street Journal. ↩

Bo Hines interview by Anthony Pompliano. ↩

“Strike CEO Mallers to Lead Bitcoin Investment Company Backed by Tether, Softbank, Brandon Lutnick”, CoinDesk. ↩

“Cantor teams up with Tether, Softbank for $3.6 billion crypto venture”, Reuters. ↩

“Who is Danielle Sassoon, prosecutor who quit in protest from Trump justice department?”, BBC. ↩

“Trump Chooses Former S.E.C. Chief as Manhattan’s Top Federal Prosecutor”, New York Times. ↩

“Schumer wants to block Trump’s nominee for a top federal prosecutor. Trump may have a workaround.”, Politico. ↩

“Crypto Bank Anchorage Probed by U.S. Homeland Security”, Barron’s. ↩

“Jack Dorsey’s Block to Pay New York $40 Million in Cash App Settlement”, Bloomberg. ↩

“State Regulators Issue $80 Million Penalty to Block, Inc., Cash App for BSA/AML Violations”, press release by the Conference of State Bank Supervisors. ↩

“Incoming SEC chair Paul Atkins owns up to $6 million in crypto-related assets”, Fortune Crypto ↩

“Helium Issuer Nova Labs Agrees to Pay SEC $200K to Settle Allegations It Lied to Investors”, CoinDesk. ↩

“Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe”, CoinDesk. ↩

“SEC Charges PGI Global Founder with $198 Million Crypto Asset and Foreign Exchange Fraud Scheme”, U.S. Securities and Exchange Commission. ↩

“Oregon Attorney General Rayfield Sues Coinbase for Promoting and Selling High-Risk Investments”, Oregon Department of Justice. ↩

“Judge Rules Against Most of DCG’s Motion to Dismiss NYAG’s Civil Securities Fraud Suit”, CoinDesk. ↩

“Why America’s Biggest Crypto Company Is Trying to Stop a Pro-Crypto Bill From Passing”, Decrypt. ↩

“Political risk for crypto is rising, says TD Cowen as it warns Trump's crypto ventures could derail US legislative efforts”, The Block. ↩

H.J.Res.25 - Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales". ↩

S.J.Res.28 - A joint resolution disapproving the rule submitted by the Bureau of Consumer Financial Protection relating to "Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications". ↩

“Russian Finance Ministry, Central Bank to launch crypto exchange for highly qualified investors”, press release. ↩

“Russia to allow crypto payments in international trade to counter sanctions”, Reuters. ↩

“Diputados. Otra derrota del gobierno: por la Criptoestafa habrá investigación y serán citados Caputo, Francos y Cúneo”, La Izquierda Diario (in Spanish). ↩

Footnotes

Evidently of the White House and not the golf club, according to an early version of the Trump memecoin website, although that detail was later removed to leave it unclear. ↩

Binance.com is not available to US-based traders. While the company’s Binance.US arm does allow Americans on the platform, it uses different hot wallets from the one used by this purchaser. ↩

Also it’s a fun place to yap about the books I read. ↩

When I share statistics like this, I often am met with surprise from people who don’t expect that the 60+ demographic had this much crypto to lose. While some of these losses are due to crypto-related investment fraud or stolen crypto assets, a fair bit of it is also fraud of the “someone claiming to be from my bank called me and told me I needed to pay them in bitcoin to secure my account” variety. ↩