Issue 87 – SO ORDERED

Trump’s crypto empire attracts more foreign millions, the FHFA pushes crypto on mortgage lenders, and Mamdani’s mayoral primary win makes billionaires sweat

It feels like every week I write something along the lines of “Trump’s crypto conflicts surge to new heights”, but Trump’s crypto conflicts have again surged to new heights as the Emirati investment fund Aqua 1 pours $100 million into his World Liberty Financial crypto project, leaving former corruption frontrunner Justin Sun in the dust.

Elsewhere, FHFA Director Bill Pulte tries regulating by tweet, directing Fannie Mae and Freddie Mac to consider crypto as mortgage reserve assets — because nothing says economic stability like tying your ability to afford a home to an asset known for its dramatic boom and bust cycles. And crypto PACs are throwing cash into a Virginia special election to try to install a crypto booster in the seat that previously belonged to crypto skeptic Gerry Connolly, while New York’s mayoral primary sent crypto (and other) billionaires into full panic mode.

Welcome to the circus.

In the White House

Trump business interests

Aqua 1 Foundation, a United Arab Emirates-based crypto fund, has spent $100 million to acquire WLFI tokens (tokens issued by the Trump family’s World Liberty Financial Project) and cultivate a close relationship with the Trumps. They have just surpassed shady crypto billionaire Justin Sun and his $75 million investment to become the single largest holder of WLFI tokens.1 World Liberty also profited massively last month from a deal in which Emirati investment firm MGX used the company’s USD1 stablecoin to perform a $2 billion investment into Binance [I83]. In a press release, Aqua 1 claimed that they and World Liberty would work closely to “jointly identify and nurture high-potential blockchain projects”, and said that World Liberty “plans to support the launch of Aqua 1’s Aqua Fund — a UAE-domiciled investment fund ... dedicated to accelerating the Middle East’s digital economy transformation”.2 For all Trump likes to talk about “America First” crypto projects, his businesses are looking very UAE-first.

World Liberty also just announced a partnership with London-based Re7 Capital, a decentralized hedge fund backed by the Hong Kong multi-family office VMS Group. The partnership aims to increase USD1 uptake on BNB Chain, the blockchain run by Binance.3 Connections between Binance and Trump have already been controversial, with Democratic Senators Warren, Durbin, and Blumenthal writing a May letter requesting information on Trump’s connections to Binance and its former executives, and opining that “The convergence of [former Binance CEO] Mr. Zhao’s pardon application and Binance’s financial entanglements with the President’s family presents urgent concerns regarding the integrity of our justice system.”4

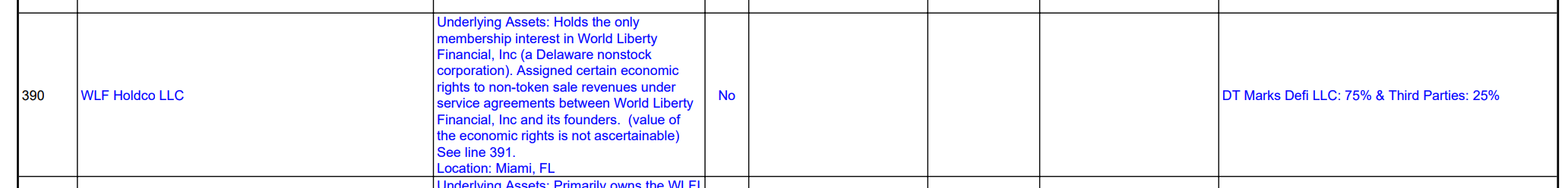

There have been rumblings that Trump has sold some of his stake in World Liberty as Democrats in Congress have tried to hold up crypto legislation over his substantial conflicts of interest. Most of this stems from an update to the fine print on World Liberty’s website which now says that the Trump family-owned DT Marks Defi LLC owns a 40% stake in World Liberty, down from the 60% it displayed previously.5 However, information on the World Liberty Financial site has regularly been wrong, and neither number matches the 75% ownership Trump declared in his most recent financial disclosures that were only just published on June 13, 2025.6

A journalist asked Trump if he was “open to the idea of pulling away from [his] personal crypto ventures, just for the next few years, if that helps get these crypto bills passed?” to which Trump just repeated “I’m president”, in case we were unaware. Technically his incoherent ramble was a bit longer than that, but it didn’t contain much more information.

I have transcribed to the best of my ability:7

Well it’s a very funny thing, crypto, so. I became a fan of crypto, and to me it’s an industry— I view it as an industry. And I’m president. And if we didn’t have it, China would, or somebody else would, but most likely China, China would love to. And we’ve dominated that industry. It’s a big industry, by the way. In fact, when the stock market went down recently, crypto and bitcoin and all of that went down much less than anybody else as a group. Uh, and we’ve created a very powerful industry, and that’s much more important than anything that we invest in. We— we invest in it, but really that was an industry that wasn’t doing particularly well. I got involved with it a couple of years ago and, uh, before this whole— before the second term. I— I got involved before I decided to run. I only decided to run because I saw what was happening and Biden was incompetent and the administration was crooked and incompetent, and I was in bitcoin then. Not— not knowing if I was going to do it a third time. So uh, it’s become amazing. I mean it’s— the jobs that it produces, and I notice more and more you pay in bitcoin, I mean people are say— it takes a lot of, uh, pressure off the dollar and it’s a great thing for our country, so I— I don’t care, I don’t care about investing. You know, I have my— my— I have kids, and they invest in different things, they do believe in it, but I’m president. And what I did do there is build an industry that’s very important. And you know, if we didn’t have it, China would.

Well, that clears things right up.

In government

Ten days after The Lever published leaked messages between Democratic operatives and members of the crypto industry suggesting that pro-crypto Democrats could get air cover for supporting Trump-supported crypto bills by introducing “symbolic anti-corruption amendments to the final bill prohibiting President Donald Trump and elected officials from profiting from cryptocurrencies knowing the effort would be ‘doa,’ or dead on arrival” [I86], Adam Schiff has triumphantly announced his Curbing Officials’ Income and Nondisclosure (COIN) Act to “put a stop to [Trump’s] corruption in plain sight”.8 He announced the bill, which will not pass, less than a week after voting in support of the GENIUS Act. Schiff benefitted substantially from the crypto industry’s $10 million opposition to his fellow Democratic opponent in the primary, Katie Porter, and he received direct support from various executives at companies including Ripple, Coinbase, and Andreessen Horowitz.

Crypto mortgages

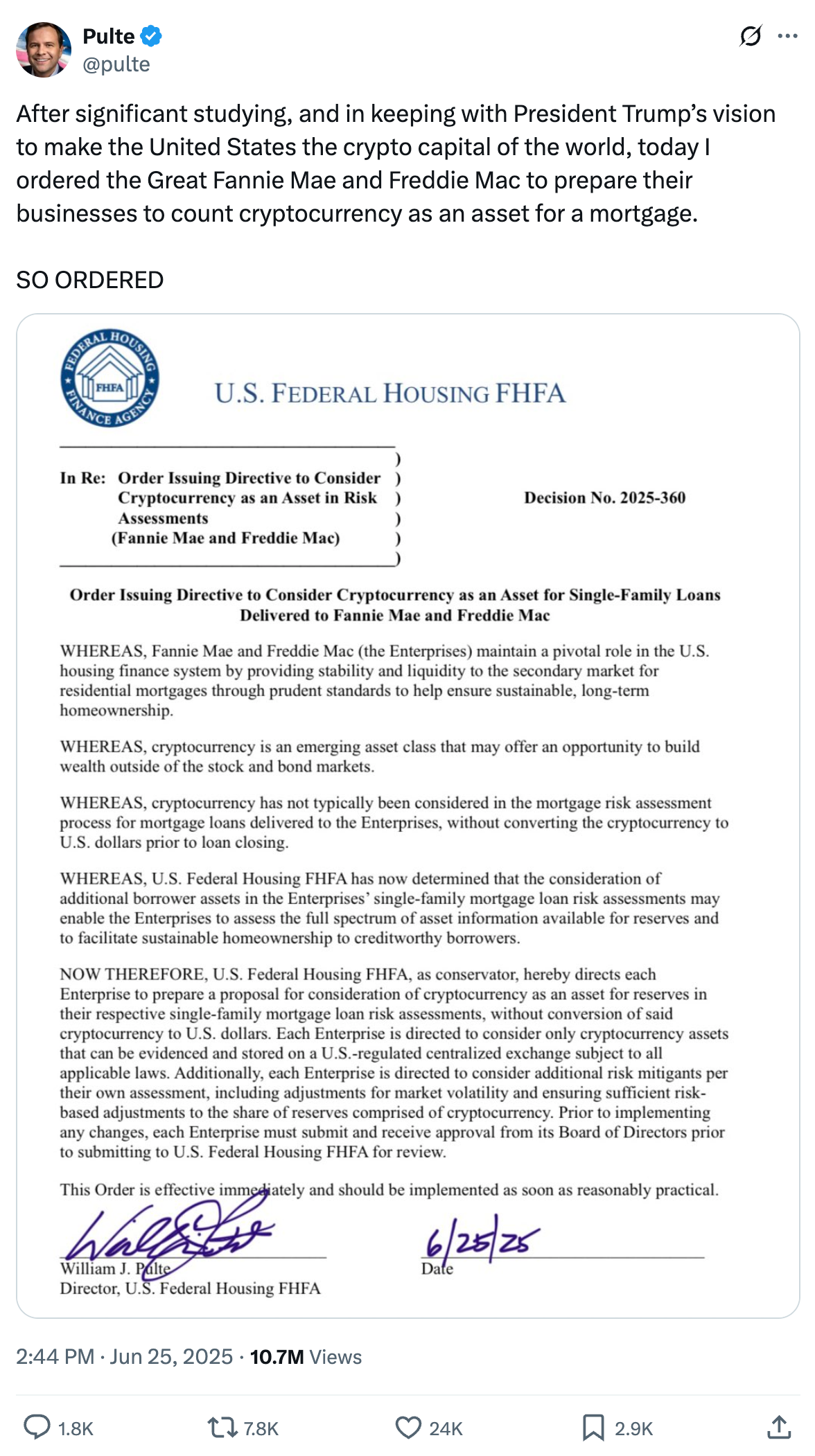

On June 25, Federal Housing Finance Agency Director Bill Pultea published a memo directing Fannie Mae and Freddie Mac to “prepare a proposal for consideration of cryptocurrency as an asset for reserves in their respective single-family mortgage loan risk assessments.” The memo, Pulte said, came after he did some “significant studying”, and was aimed at satisfying Trump’s “vision to make the United States the crypto capital of the world.”9 Despite the official letterhead and Pulte ending his tweet with the Trumpian pseudo-judicial all-caps sign-off of “SO ORDERED”, as of five days after the post, Pulte’s directive does not actually appear on the FHFA’s list of official orders and may have solely been issued via Twitter.10

As the directive currently only orders the two companies to prepare a proposal, details on what this would ultimately look like are somewhat scarce. However, Pulte noted that any proposal should not require the cryptoassets to first be converted to dollars, and that only assets “that can be evidenced and stored on a U.S.-regulated centralized exchange subject to all applicable laws” should be considered. The latter is a somewhat controversial caveat for the “not your keys, not your coins” segment of the crypto populace, who view storing crypto on a centralized exchange as an unacceptable dereliction of control to the types of intermediaries crypto was supposed to make obsolete.

Though any move in this direction is still in its early stages, the tweet is another attempt by the Trump administration to integrate crypto into one of the most central parts of the American economy, and one where instability has particular potential to inflict massive consequences on everyday people. Many interpret Satoshi Nakamoto’s invention of bitcoin as a direct response to the 2008 financial crisis, and his inscription of the headline “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks” into the bitcoin blockchain’s genesis block as a signal of his anger at government intervention and the failures of big banks.

Now, bitcoin and other cryptoassets are increasingly threatening to themselves introduce new instability. Some other companies have also gone beyond just considering crypto holdings as reserve assets when determining mortgage suitability, as is indicated by this memo, with Coinbase recommending people use their crypto borrowing program to borrow money to pay their mortgages,11 and other crypto companies such as Milo offering high-interest mortgages with crypto collateral. Milo has also expressed interest in securitizing their crypto loans in the future, because when have securities backed by high-risk mortgages ever gone wrong in the past?12

House Republicans are working to push forward crypto legislation, possibly by advancing both the Senate’s GENIUS Act and the CLARITY Act market structure bill in a combined vote.13 The GENIUS Act has already passed the Senate, and Trump has urged the House to push it through “LIGHTNING FAST” [I86].

Texas is the third state to enact legislation authorizing the creation of a state bitcoin reserve, following New Hampshire and Arizona [I83, 84].14

In regulators

The Supreme Court has denied a request to take up a case challenging the IRS’ demands for information from companies such as Coinbase. The plaintiff, James Harper, first argued in 2020 that his Fourth Amendment rights had been violated when the IRS “obtained a vast quantity of Coinbase records by means of a dragnet subpoena devoid of individualized suspicion”. The district court dismissed his claims, and the First Circuit upheld the ruling on appeal. Harper’s Supreme Court petition earned support from Coinbase; Elon Musk’s X (formerly Twitter); the DeFi Education Fund advocacy group; the states of West Virginia, Kansas, Nebraska, North Dakota, and Ohio; and several others—but was ultimately denied.15

SEC

Federal Judge Analisa Torres rejected the joint request by Ripple and the SEC to lift the August 2024 permanent injunction ordering Ripple to obey securities laws and reduce the $125 million penalty to only $50 million [I63]. This outcome is no huge surprise given Torres’ previous skepticism towards a malformed request to do the same thing [I84]. Torres elaborated:16

Not that long ago, the SEC made a compelling case that the public interest weighed heavily in favor of a permanent injunction and a substantial civil penalty. ... First, a penalty was necessary because Ripple had violated the law. ... Second, the SEC pressed for a permanent injunction because Ripple’s misconduct was reckless and likely to continue. ... None of this has changed—and the parties hardly pretend that it has. Nevertheless, they now claim that it is in the public interest to cut the Civil Penalty by sixty percent and vacate the permanent injunction entered less than a year ago.

Torres essentially left Ripple with two options: accept the earlier penalties and walk away, or continue fighting to have the judgment overturned on appeal. Ripple chose the former the following day, dropping its cross appeal against the SEC. Ripple CEO Brad Garlinghouse also wrote that they still expected the SEC to drop their appeal as well, which was filed before Trump took office and which sought penalties closer to the nearly $2 billion originally requested by the agency.17

In elections and political influence

Crypto super PACs have just spent $1 million to back Democrat James Walkinshaw in the Virginia special election to replace Representative Gerry Connolly, the former Ranking Member of the House Oversight Committee who died in May.18 Walkinshaw, a longtime chief of staff for Connolly, won the “firehouse primary” with about 60% of the vote.19 Connolly had been a staunch opponent of crypto, recently opposing Trump’s efforts to establish a strategic crypto reserve and blasting Trump’s memecoin as “open corruption”.2021 Walkinshaw, on the other hand, writes on his website that “we must embrace the next generation of technology”, including blockchain.22

Zohran Mamdani’s win in the New York mayoral primary is already making crypto billionaires sweat, and it’s making me wonder if the crypto lobby will pile some of their cash into the city’s general election later this year. Trump “Crypto & AI Czar” David Sacks reposted a clip of Mamdani expressing his opinion that “I don’t think we should have billionaires”, tweeting: “Wake up, Silicon Valley. This is the future of the Democrat Party. Communism has defeated liberalism. Even Bill Clinton has bent the knee. You basically have two choices now: Get on board with MAGA or prepare to be on Mamdani’s dinner menu.”23

While Mamdani has not expressed an opinion on crypto, his upcoming opponents sure have. Incumbent mayor Eric Adams, elected as a Democrat but running for re-election as an Independent, recently appeared at the Bitcoin Conference to reinforce his self-anointed title of “bitcoin mayor” and suggest that New York City issue bitcoin-backed municipal bonds (an idea that was quickly swatted down by NYC Comptroller Brad Lander, who was also a candidate in the Democratic primary, coming in third place after cross-endorsing Mamdani) [I85]. Mamdani’s closest opponent in the primary who will now also be running as an Independent candidate in the general election, former New York governor and alleged sex pest Andrew Cuomo, advised crypto exchange OKX after resigning as governor in 2021, when the company faced criminal charges that would ultimately land them more than $500 million in penalties.2425 And the Republican contender, perennial candidate Curtis Sliwa, tweeted during his 2021 campaign that he would “make NYC the most cryptocurrency-friendly city in the nation” by allowing property taxes to be paid in crypto, installing more crypto ATMs, and encouraging businesses to accept crypto.26 (That said, he also later criticized Adams for spending too much time with “crypto profiteers”, “crypto currency pirates”, and “crypto monsters”.2728)

Tyler Winklevoss, one of the twin billionaires behind the Gemini crypto exchange who contributed millions of dollars to political campaigns in 2024, seems to be at least considering bankrolling an opponent, writing that he is “torn and undecided” on the idea before launching into a long screed dismissing the young New Yorkers who turned out in record numbers this election as spoiled and ignorant private school kids living in apartments paid for by their Wall Street parents.29

In the courts

John Woeltz and William Duplessie, charged with kidnapping an Italian cryptocurrency millionaire and torturing him for weeks in a New York City apartment, have pleaded not guilty. They’re currently being held without bail, and are previewing their defense somewhat as they argue that the Italian man wasn’t kidnapped at all. According to the defense, he was in fact “having the time of his life” as he partied with his alleged captors, freely coming and going from the townhouse. Prosecutors have claimed that the alleged captors set up the photos suggesting that the victim wasn’t being held against his will.30

A Pennsylvania man has been sentenced to eight years in prison for his role in a $40 million crypto Ponzi scheme involving scam companies called EmpowerCoin, ECoinPlus, and Jet-Coin.31

Prosecutors in Massachusetts and Georgia have been trying to tackle North Korea’s tactic of having malicious contractors apply for jobs with cryptocurrency firms and then use their access to steal funds. In simultaneous announcements, Massachusetts declared they had charged nine individuals and Georgia charged four.3233

Spanish police have arrested five people on charges connected to their alleged laundering of $540 million in stolen cryptocurrency obtained from investment frauds targeting more than 5,000 victims. The arrests were the result of an international operation supported by Europol.34

Elsewhere in crypto

Polymarket

Crypto betting platform Polymarket is facing renewed allegations of outcome manipulation, again involving Ukraine. When the outcomes of a bet on the Polymarket platform are challenged, the dispute is resolved through a platform called the UMA Protocol, where holders of the UMA token are expected to act as “impartial arbiter[s] of the outcomes of relevant markets”. However, in the past, large holders of the UMA token have swung the outcome of votes, such as in March when one UMA whale manipulated the outcome of a betting market over whether Ukraine would agree to Trump’s mineral deal. At the time, Polymarket stated “This market resolved against the expectations of our users and our clarification ... This is an unprecedented situation, and we have been in war rooms all day internally and with the UMA team to make sure this won’t happen again. This is not a part of the future we want to build.” [I80]

Despite those promises, it sure seems to be happening again, this time in a $14 million betting market over — yes, really — whether Ukrainian President Zelenskyy would wear a suit. When the president, known for almost exclusively wearing military fatigues, appeared at a NATO summit in Germany wearing a jacket and pants that looked at least suit-like, media outlets including the BBC and even one of Polymarket’s own Twitter accounts noted that he’d finally donned a suit. However, the resolution of the market to “yes” was challenged, punting the decision to UMA, where whales have been pushing for a “no” outcome. And despite the flood of reporting on the suit from various news agencies collated by some Polymarket users,35 Polymarket issued a clarification on July 1 that “a consensus of credible reporting has not confirmed that Zelenskyy has worn a suit”.36

zelenskyy wears a suit while visiting germany. this is, technically, a suit, as a suit is just a garment where the jacket and pants have been cut from the same cloth pic.twitter.com/CjLXTzMMaA

— derek guy (@dieworkwear) May 29, 2025

The menswear guy says it’s a suit.

Bitcoin-backed loans

Crypto market maker Wintermute (yes, they’re really called that; no, these guys never actually read the sci-fi they name their companies after) has just secured a bitcoin-backed line of credit from Cantor Fitzgerald, the company once headed by Trump Commerce Secretary Howard Lutnick (who followed the Trump strategy of “divestment” by just putting his sons in charge). CoinDesk says:37

The lending and borrowing of crypto was taking place on an industrial scale several years back, but many of the firms involved either incurred heavy losses or were forced into bankruptcy as contagion spread through the industry. But Cantor’s debut perhaps signals a new and more institution-friendly phase.

Arrested Development’s Tobias and Lindsay Fünke say:

Did it work for those people?

[laughing] No, it never does. I mean, these people somehow delude themselves into thinking it might, but... but it might work for us.

Decentralized in name only

The Solana DEX Jupiter was supposedly a decentralized project because it was governed by a DAO, where community members exercised control over the future of the project by voting on various proposals. That is... until a member of the Jupiter team announced that the company would be suspending DAO voting due to a “breakdown in trust” — ironically, stemming from concerns by DAO members that project team members were exercising too much control over DAO votes by using their massive token allocations to swing vote outcomes. I guess “decentralization” only worked for Jupiter as long as the community voted how the company wanted it to.3839

The Web3 is Going Just Great recap

There were four entries between June 19 and July 1, averaging 0.3 entries per day. $63.85 million was added to the grift counter.

- Resupply stablecoin lender exploited for $9.3 million [link]

- Self Chain fires founder after $50 million scam allegations [link]

- New York scammer "daytwo" steals $4 million from Coinbase users, blows most of it gambling [link]

- Hacken token crashes after private key leak [link]

Worth a read

We’re beginning to see people using technology to fight back against authoritarianism in the US in creative ways. 404 Media wrote about FuckLAPD.com, a tool aiming to help people identify police officers who obscure their faces and cover their badge numbers. Time and CNN have covered Iceblock, an app that’s sort of like Waze except for identifying nearby ICE agents.

These have triggered sharp rebukes from the likes of “Border Czar” Tom Homan and Acting ICE Director Todd Lyons, who both described CNN’s coverage of Iceblock as “disgusting” and suggested the DOJ should get involved. Attorney General Pam Bondi in turn threatened Iceblock creator Joshua Aaron, stating “We’re looking at him and he better watch out.” Homan falsely claimed that the app “puts law enforcement lives at risk” by noting where ICE operations are taking place (which, I should note, is a perfectly legal thing to do). Iceblock told The Daily Beast, “We will not be intimidated ... As long as ICE agents have quotas, and this administration ignores Constitutional rights, we will continue fighting back. No human is illegal.”

If you enjoyed the piece I recently shared by 404 Media, highlighting testimony from teachers about how AI has impacted their teaching, I suspect you’ll also really like a new series from Brian Merchant of Blood in the Machine titled “AI Killed My Job”. In the first installment, he highlights stories from tech workers whose jobs have been disrupted or have even disappeared as managers use AI to justify making workers’ lives even worse, or firing them outright. Future issues will feature workers from other fields, and there will be a video edition, too.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

“Trump’s Crypto Project Gets $100 Million From UAE-Based Fund”, Bloomberg. ↩

Press release by Aqua 1. ↩

“World Liberty aims for stablecoin adoption growth on Binance chain with new partnership”, The Block. ↩

“Warren, Merkley Seek Records on $2 Billion Trump Stablecoin Deal from UAE Firm and Binance”, US Senate Banking, Housing, and Urban Affairs Committee. ↩

“Trumps May Have Sold Platform Stake as U.S. Stablecoins See Wave of Good News”, CoinDesk. ↩

Executive Branch Personnel Public Financial Disclosure Report, 2025. ↩

“Now get a USDC loan without selling your bitcoin”, Coinbase. ↩

“House Plans Single Vote to Move Genius and Clarity Crypto Bills”, Bloomberg. ↩

“Texas governor greenlights Bitcoin reserve fund, taking bronze in adoption race”, DL News. ↩

Order filed June 26, 2025. Document #989 in SEC v. Ripple. ↩

Protect Progress expenditures supporting James Walkinshaw, FEC. ↩

“Walkinshaw wins Virginia primary to replace Rep. Connolly, his former boss”, The Washington Post. ↩

“Ranking Member Connolly Urges Treasury to Cease Plans to Establish Strategic Cryptocurrency Reserve, Trump’s New Get Rich Quick Scheme”, press release from the House Committee on Oversight and Government Reform Democrats. ↩

“‘Open corruption’: Top US lawmaker decries Trump’s crypto conflicts”, DL News. ↩

Priorities, James Walkinshaw. ↩

“Cuomo Advised Crypto Exchange OKX on Its Response to US Probe”, Bloomberg. ↩

“OKX Pleads Guilty To Violating U.S. Anti-Money Laundering Laws And Agrees To Pay Penalties Totaling More Than $500 Million”, U.S. Attorney's Office, Southern District of New York. ↩

“Crypto Kidnap Suspects Plead Not Guilty, Are Held Without Bail”, Bloomberg. ↩

“Co-Owner of Virtual Currency Companies Sentenced to 97 Months in Prison for Operating Crypto Ponzi Schemes”, U.S. Attorney's Office, Eastern District of New York. ↩

“Nine Charged with Alleged Scheme to Generate Revenue for North Korean Government and Its Weapons of Mass Destruction Program”, U.S. Attorney's Office, District of Massachusetts. ↩

“Four North Koreans Charged in Nearly $1 Million Cryptocurrency Theft Scheme”, U.S. Attorney's Office, Northern District of Georgia. ↩

“Crypto investment fraud ring dismantled in Spain after defrauding 5000 victims worldwide”, Europol. ↩

Google Doc: “Polymarket: Will Zelenskyy wear a suit before July?” ↩

Discussion on UMA voting website. ↩

“Crypto Market Maker Wintermute Snags Bitcoin Credit Line From Cantor Fitzgerald”, CoinDesk. ↩

“DAO behind DEX aggregator Jupiter suspends governance votes until early 2026 amid community concerns”, The Block. ↩

“Solana exchange Jupiter pauses DAO voting amid ‘breakdown in trust’”, DL News. ↩

“Bill Pulte, Trump’s Housing Nominee, Has Quite a History With Meme Stocks”, Rolling Stone. ↩

Footnotes

If the name rings a bell, it’s probably either because he is the grandson of the founder of housing construction giant PulteGroup, or because he became something of a memestock influencer during the early 2020s memestock craze, encouraging novice traders to gamble (and, generally, lose money) on stocks like Bed Bath & Beyond.40 ↩