News flash: 95% of NFTs have ALWAYS been worthless

Be skeptical of catchy headlines and junk data, even when they affirm your prior opinions.

This week, several major news outlets published stories eulogizing NFTs.

The most widely shared article I've seen is from Rolling Stone, titled "Your NFTs Are Actually — Finally — Totally Worthless". It's subtitled: "New report from industry researchers finds that 95 percent of the once-hyped crypto assets have hit rock-bottom valuation". Other outlets including The Guardian, The Register, The Hindu, Insider, and even crypto media outlet CoinDesk have released similar pieces.

The headlines aren't entirely wrong. A lot of NFTs are worthlessa today, including some that once sold for a pretty penny. The NFT market is a ghost town compared to the mania of 2020–2021. Some collections still fetch amounts of money that could just as soon be used to buy a car, but these days we're usually talking Honda Civic, not Lamborghini.

However, for some baffling reason, several major media outlets have decided to support these claims by latching on to an incredibly questionable "study" by an unknown website that usually spends its time reviewing and promoting cryptocurrency casino websites.

Much like with sketches or paintings, pretty much anyone can create an NFT. If you've got a pencil or some paints, you can make art; if you have an Internet connection, you can make an NFT.

Much like with sketches or paintings, most NFTs aren't very good.

Much like with sketches or paintings, most NFTs don't sell.

If I scribble out a lopsided drawing of my dog and try to sell it on Etsy or at a booth in an art convention, I probably won't find any takers. Most people probably won't take that to mean that the fine art market is in freefall.

But that's kind of what happened here.

A website called dappGambl decided to take some portion of a pile of data from a different website called NFTScan, and "analyze" it to produce a blog post titled "Dead NFTs: The Evolving Landscape of the NFT Market".

In it, they take a look at 73,257 NFT collections and proclaim: "an eye-watering 69,795 of them have a market cap of 0 Ether (ETH)." They then do some simple division to proclaim that "95% of people holding NFT collections are currently holding onto worthless investments", even though the percentage of 0ETH-market-cap collections out of their total sample should not be assumed to be representative of NFT holders.

They then baselessly extrapolate that to claim that there must be 23 million people "who's [sic] investments are now worthless" (emphasis in original). They provide no further detail as to how they reached that number, but my best guess is that they've found some estimate of the number of crypto wallets that hold an NFT — a very different figure than the number of individual people — and then took 95% of that number.

At no point does the dappGambl report compare this percentage to the more halcyon days of NFTs, when people were similarly flooding the market with NFT collections that no one would ever buy. Despite that, mainstream outlets like Rolling Stone have assumed that things were different during the NFT boom, and written things like:

In practical terms, that means 95 percent of NFTs wouldn't fetch a penny today — a spectacular crash for assets that reached a trading volume of $17 billion amid a frenzied bull market in 2021.

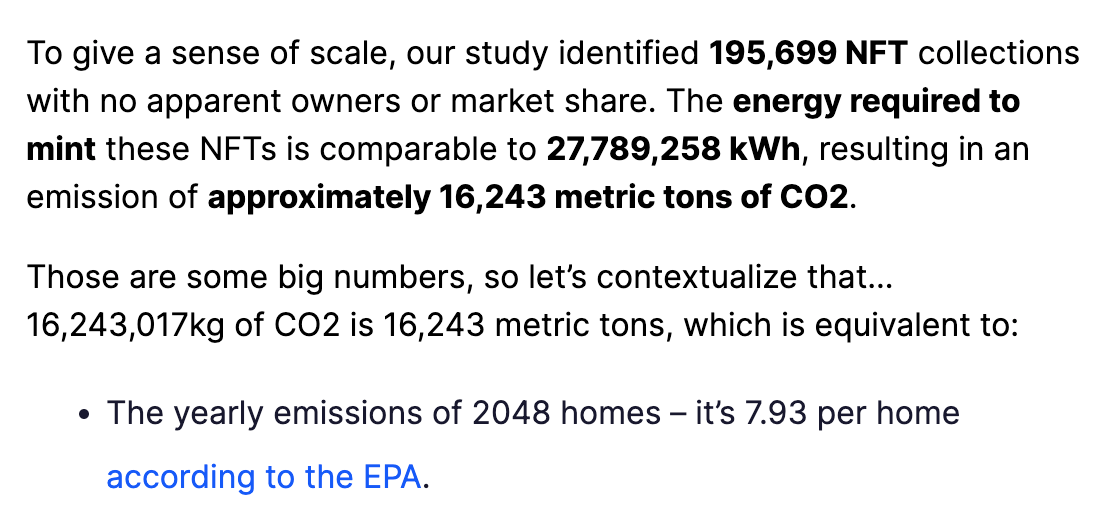

dappGambl continues into some even wonkier math, at one point claiming that:

This is confusing from the outset, because they previously said they were working with a total sample of 73,257 NFT collections, but now say that the number of collections without owners or market share is… 2.7× as big as their total sample size.

Putting that aside, they then conflate collections (which often contain multiple NFTs) with individual NFTs, multiplying the number of collections by the oft-cited 142 kWh-per-NFT1 energy cost:

Because of that conflation, we might expect their result to understate electricity usage and emissions by several orders of magnitude. However, they fail to mention that this kWh estimate predates the September 2022 Ethereum "Merge", which moved the network from its energy intensive, Bitcoin-esque proof-of-work consensus mechanism to a more eco-friendly proof-of-stake approach. I suppose it's possible that they filtered their dataset to only include NFTs minted prior to the Merge, but if so, they make no mention of it in the report, which is generally devoid of that kind of attention to detail. They also make no mention of the variation in minting strategies, including "lazy minting" approaches intended to minimize or completely prevent transactions for NFTs that are never ultimately purchased, that would introduce error into this estimate.

The flaws in dappGambl's post don't end here, but I think I've made my point that this "study" is a pile of garbage.

Now, I am already the kind of person who gets annoyed when media outlets reprint bunk studies, even when they are supporting conclusions that are themselves at least vaguely accurate. Others might tell me to chill out, and to spend my time worrying about all the bad data out there being used to support blatant falsehoods.

However, what annoys me in particular about this report being laundered into the mainstream news cycle is that Rolling Stone and The Guardian — in their evidently neverending quest to both-sides any issue placed in front of them — are also printing the authors' optimistic predictions for the NFT industry. A bunch of crypto casino reviewers promoting the rosy future of NFTs probably wouldn't have made it into multiple mainstream media outlets had it not been for the fact that it was included alongside the eye-catching, but misleading, 95% figure.

When we see headlines that affirm our prior beliefs — for example, that the NFT industry is a huge racket that deserved to go to zero — it can be tempting to reshare them without a second glance. But misinformation benefits no one, and accurate and honest reporting should be far more important than an attention-grabbing headline.

Footnotes

Some will undoubtedly argue that NFTs have always been "worthless", even when they've sold for hundreds of ETH. I get it, but there aren't many other words out there that mean "people won't spend much or any money to buy it". ↩

References

This estimate itself also varies widely, but someone named Memo Akten estimated it at 142 kWh, and that figure was reprinted by Vice and others. ↩