No, Bitcoin isn't pumping because it's a "safe haven" from banks

There are more reasonable explanations for the price increase, and more than a few flaws with the "safe haven" narrative.

As Silvergate Bank, Silicon Valley Bank, and Signature Bank all collapsed in short succession, the price of Bitcoin surged.

As one group of insufferable multimillionaires was coming down from the panic that their massive deposits in Silicon Valley Bank might vanish, another began working themselves into their own frenzy, believing that the impending collapse of the American — or even the global — financial system would finally prove to the world the utility of their Bitcoin hoards.

The number of extreme Bitcoin maximalists who truly believe this is small, but they are loud, and the narratives they help to push have seeped in to the rest of the public consciousness. The idea that Bitcoin is a "store of value", often compared to gold, is widespread, as is the belief that Bitcoin's price is decoupled from movements in the traditional financial world and broader economy.

In the past few days, we've been seeing people — including journalists in reputable publications — falling into the trap of looking at a handful of true statements and using them to make causal inferences that don't seem to be well supported.

It is true that:

- Bitcoin prices have increased by anywhere from 20–40% (depending on the starting point you pick) over the tumultuous days and weeks coinciding with the banking crisis

- People widely seem to be feeling less confident about bank stability than they have in years

- New people buying Bitcoin is one reason, among many, that Bitcoin prices can increase

However, the narrative that Bitcoin prices are pumping because people are nervous about bank stability and therefore are putting their cash into Bitcoin because they believe it to be a safe store of value is being repeated despite a lack of evidence.

It's not altogether surprising that it has, because when a journalist goes "huh, Bitcoin prices are pumping, that's weird" and goes to research why that might be, some of the loudest and most eager people to talk to them are Bitcoiners hoping to spread the gospel, using the available data points to back their preferred narrative.

I hope that those journalists thinking about writing those pieces may first come across this one, and consider a few more likely factors contributing to a Bitcoin price pump, and a few reasons why the "people flee banks to buy Bitcoin to preserve their wealth" narrative is not likely accurate.

1. Traders are expecting the Fed to pump the brakes on interest rates

Despite the belief that Bitcoin and other cryptocurrencies are detached from movements in the stock market or changes in monetary policy, the numbers tell a very different story. When the Fed shifted monetary policy and began hiking rates, people backed out of riskier assets, including high-growth stocks, private equity funds, and, of course, cryptocurrencies. Murmurs that the Fed would tighten monetary policy began in late 2021, and in a news conference in mid-December, Fed Chair Jerome Powell announced, "the economy no longer needs increasing amounts of policy support."

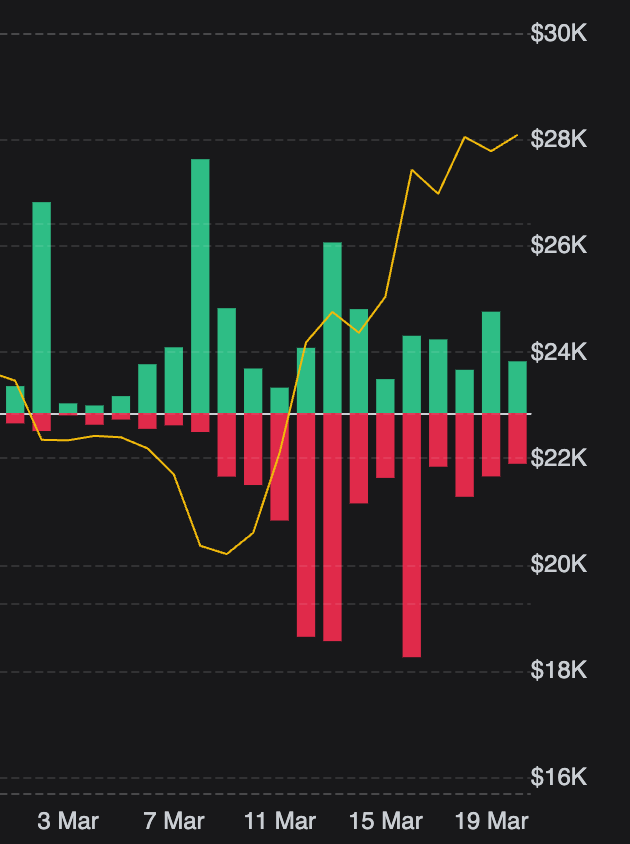

Now, eight rate increases later, and banking collapses that are rightly or wrongly being pinned on the changes to monetary policy, traders seem to think the Fed will back off. This optimism would explain a return to riskier investment choices, and helps to explain not only the boost in Bitcoin prices but an uptick in equities over the same period.

This also explains why the Bitcoin run-up began right around the time the government announced backstops for Silicon Valley Bank, as well as a special facility to provide funding to depository institutions who need it. If the spike was fear-driven, I would have expected it to have started during the SVB bank run and the period of uncertainty after its failure.

2. Bitcoin liquidity is low

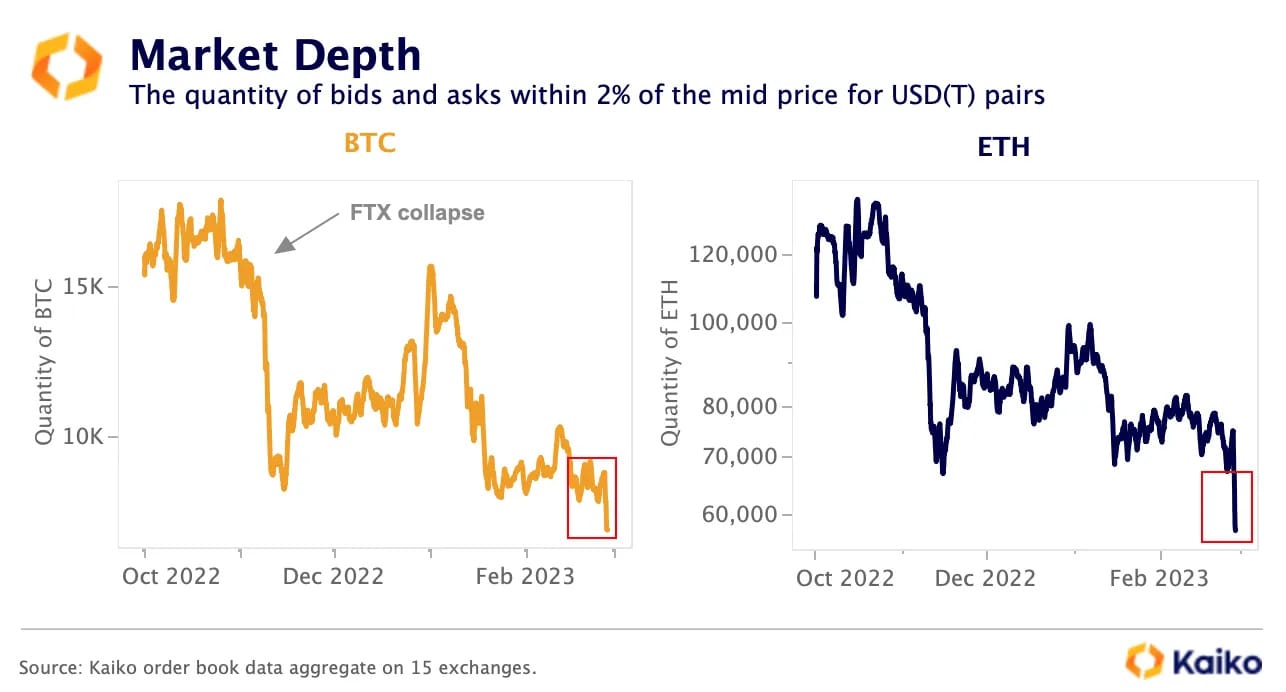

Bitcoin liquidity was never high, but after the collapse of FTX it tanked, and has remained quite low ever since.

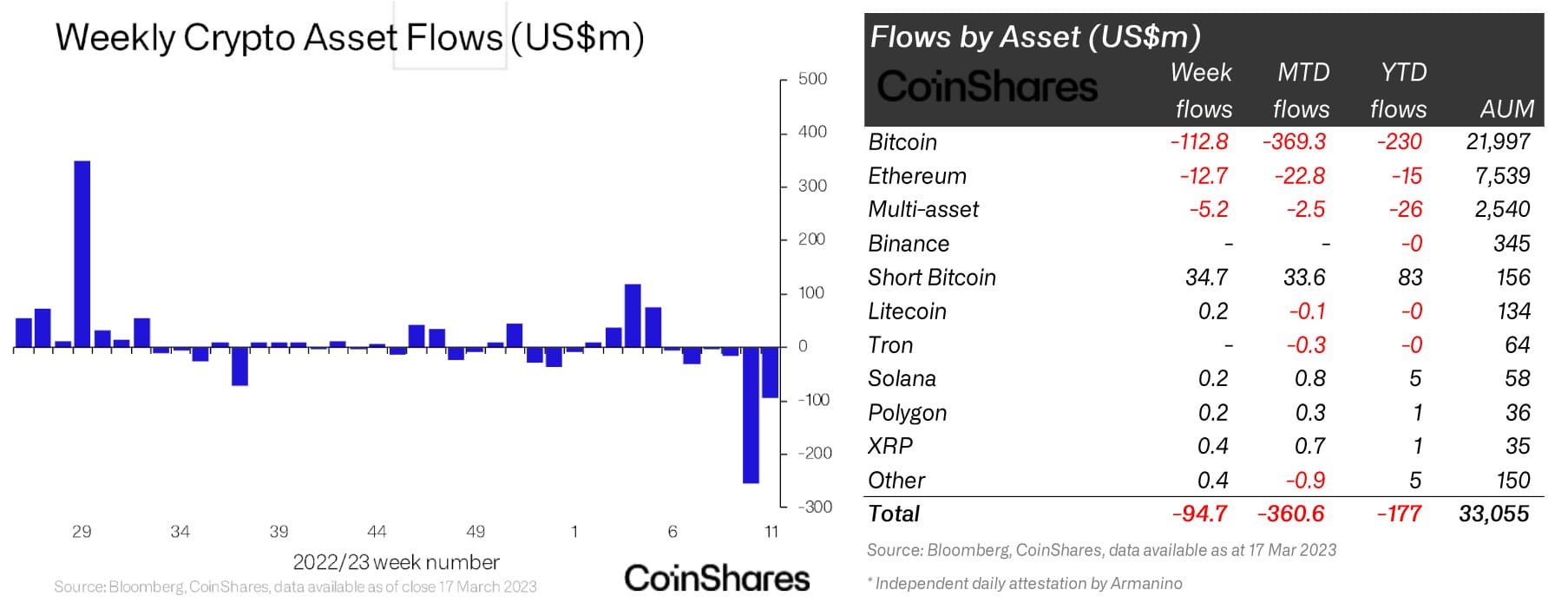

This exacerbates Bitcoin's price volatility, causing trades to have outsized impact on price. This may be supported by data from CoinShares,1 which showed substantial Bitcoin outflows.

They've chosen to interpret that to mean that there was a need for Bitcoin liquidity rather than as negative sentiment around Bitcoin, but they're also a crypto trading firm and so incentivized to present the rosiest picture they can. That's not to say it isn't possible—crypto outflows represent only the movement of crypto, in this case from digital asset investment products, and don't capture where it ends up.

3. There was a Bitcoin short squeeze

When the Bitcoin price unexpectedly began to increase, a lot of people who were short Bitcoin ended up being liquidated. On March 12, March 13, and March 16, between $83 and $91 million in short positions were liquidated.

This resulted in a short squeeze, where traders exiting their positions pushed the prices higher.

4. People got nervous about stablecoins

When Silicon Valley Bank went under, people got really nervous about Circle, who had disclosed in a Q4 filing that SVB held some portion of their $9.7 billion in cash reserves. People got even more nervous when Circle was slow to disclose what that portion was. USDC began wobbling from its peg as the situation at SVB became dire on the afternoon of March 10, and when Coinbase announced that evening that they were suspending UDSC:USD redemptions over the weekend, people really freaked out.

However, when you can't redeem your USDC for USD, your options are limited. You can go into other stablecoins, but some of the large stablecoins such as DAI and FRAX hold USDC as a substantial part of their reserves. That leaves other asset-backed stablecoins like Tether and Binance USD, but a lot of people held USDC because they didn't trust Tether or Binance, some people feared that issues in the US banking system could impact other stablecoins' reserves, and some of these other stablecoin operators limited swaps when USDC lost its peg to prevent price arbitrage or threats to the stability of their own coins. So, there were people who fled USDC for different crypto assets, like Bitcoin.

And when they were able, people fled for USD. Between March 13 and 15, Circle processed $3 billion in net withdrawals.

5. Influential people really want Bitcoin prices to go up

Earlier this week, investor and "anti-woke" torchbearer Balaji Srinivasan made a bet that the US will enter hyperinflation within ninety days, which he also believes means that Bitcoin will hit a price of $1 million (questionable, but we'll go with it for the sake of brevity). He offered to make two bets in which the other side would receive $1 million if that did not come to pass, and in which he would receive one Bitcoin if it did.

Now, it's possible that Balaji has simply lost his mind. Various people attempting to apply normal investment logic have pointed out the obvious, which is that if one truly believes that Bitcoin will reach $1 million in the near future, the smart thing to do would be to put the money into Bitcoin now at the lower price.

More likely, in my opinion, is that Balaji does not actually believe that the US is about to enter some completely irrational and ahistorical hyperinflation scenario, but simply has a ton of money in Bitcoin,2 and is desperate for the price to go up. His bet is more easily explained as a publicity stunt intended to manipulate the market, as are his many doomsday predictions about dollar devaluation and the imminent collapse of the US banking system, all of which end with him encouraging his more than 850,000 followers to buy Bitcoin. The bet is perhaps slightly more veiled pumping than his March 16 promise to pay people $1,000 apiece if they shilled Bitcoin, but not much. If he owns a lot of Bitcoin already, or has OTM long positions, $3 million (counting the two bets plus the $1 million in tweet payments) would be a small price to pay if he can get BTC to tick up a few percentage points.

Now, I don't know how much Balaji's bonkers tweets actually move markets. But Balaji is wealthy, influential, and well-connected, and it seems likely to me that if he's trying this hard to move markets right out in the open, he's doing it behind closed doors as well.

6. Bitcoin kind of just does this

Bitcoin is volatile and unpredictable. This is why some people make a lot of money trading it, and why most people lose a lot of money doing so. A $5,000 or $8,000 price swing over a week or so is not unusual for Bitcoin, and it's a little strange that journalists outside of crypto media are covering it at all.

Now that we've covered a few more likely reasons why Bitcoin prices have gone up, let's address the theory that people are fleeing banks for the safe haven of Bitcoin.

1. Bitcoin isn't a store of value

"Bitcoin is a safe haven" first requires people to believe that Bitcoin is a good store of value, which is a thoroughly debunked idea for all except those who believe that if you can manage to find two points on a timeline where a Bitcoin is worth roughly the same, then it's a store of value. Checkmate!

The thing with stores of value is that I should be able to, at some point in the future, liquidate that value for somewhere relatively close to what I put into it. With Bitcoin, you have to hope like hell that that future point doesn't happen to be during one of the periods where Bitcoin has lost a third of its value over the past year, or half over the last eighteen months (as it is now, even after the recent pump).

2. Bitcoin isn't a solution to economic collapse

This "flee the banks" narrative also requires people to believe that things are about to get so dire that the entire US banking system will fail, but not so extremely dire that Bitcoin fails to be feasible. This is a bit of a tough needle to thread. As David Gerard points out in his book, the "economic collapse is good for Bitcoin" theory relies on the belief that "continued availability of high powered computing machinery, mining chip foundries, fast Internet and electricity presumably [will be] absolutely assured in the grim meathook Mad Max petrolpunk future."

Now, there's certainly quite a spectrum of possibility between "the US banking crisis worsens" and "put on your goggles and get in the War Rig", but I'm not confident that many of those scenarios involve total collapse of the US banking system and Bitcoin not only being valuable but also practically spendable for the types of things people need dollars for today.

3. Despite what you see on the Internet, most people are pretty reasonable

Most people who have the thought "wow, this bank stuff is scaring me" don't leap right to "so I should withdraw my cash and put it into Bitcoin". If you are brain-poisoned by crypto Twitter like I am, it's sometimes easy to forget that this is a really fringe position. If people are afraid about their money, they usually take actions to try to "flee to safety", and buying Bitcoin is not typically one of those actions.

If people think that regional banks might fail, they might move their money to a "too big to fail" bank. If people believe that uninsured depositors might find themselves without access to their excess deposits, they might distribute their excess cash (assuming they have it in the first place) among multiple banks, or put it into other fairly safe assets. If people believe their employers might lose access to uninsured deposits, and that that might lead to negative effects on them like late paychecks or layoffs, they might take actions that could help them build up emergency savings—again, actions that are typically fairly opposite from going and buying Bitcoin.

In past moments of fear of crisis, such as when it became clear that COVID-19 was highly infectious and spreading rapidly, there were absolutely people who opened black market toilet paper resale businesses, started self-medicating with strange concoctions promoted to them by Internet personalities, or even prepared bug-out plans involving guns and ammunition. But most people were practical: they bought some extra dry beans, loaded up on hand sanitizer and soap and disinfectant, dug bandanas out of the closet to use as makeshift face coverings, and offered to deliver groceries to elderly family members or neighbors who worked in healthcare.

4. People who think Bitcoin is a good solution for bank collapse already hold Bitcoin

Finally, the types of people who are likely to believe that a) banks are broadly in danger of collapse and b) Bitcoin is the answer to that risk… probably already owned Bitcoin. This is a position only really held by Bitcoin maximalists, and the idea that Bitcoin maximalists waited until this very moment to put their money into Bitcoin, thus driving a $5,000–$8,000 price bump, seems unlikely, to say the least.

References

I've fixed an artifact in this PDF that made the row for Bitcoin in the flows by asset chart appear only as "coin", but you can verify this row is referring to Bitcoin from the PDF text content. ↩

This is speculation, and I can't know for sure because he refuses to disclose how much Bitcoin he owns. He replied to a tweet from Jason Calacanis asking "what % in bitcoin are you?" by asking "Have you stopped beating your wife, Jason?" and suggesting it's somehow a loaded question to ask of someone who sure looks like he's trying to stir up panic around the US banking system solely to pump his bags. ↩