The FTX trial, day five: Sam Bankman-Fried for president

Caroline Ellison testifies about Sam Bankman-Fried's appetite for risk, involvement in Alameda Research, and even his presidential aspirations.

If anyone out there was looking for a silver lining in the FTX collapse, Caroline Ellison delivered it to us today. The failure of Sam Bankman-Fried's cryptocurrency empire, and his likely felony convictions as a result, have almost certainly spared us from having to endure any future Sam Bankman-Fried presidential campaign.

The man who spoke of being "happy to" flip a coin that had a fifty-fifty chance of destroying the worlda was evidently thinking about being president of the United States — something he told Caroline he thought had a five percent chance of happening.

Tuesday kicked off with the defense team completing their cross-examination of former FTX CTO Gary Wang. They repeatedly tried to get him to agree with their insinuation that FTX and Alameda Research were solvent on paper even up through the November 2022 collapse, if you believed their illiquid assets (namely the FTT and Serum tokens) could be sold en masse at mark-to-market values. The defense team probably did not appreciate Wang repeatedly pointing out that those tokens were illiquid and couldn't be sold for the stated values claimed by the defense.

The defense also repeatedly referred to funds stored in "Alameda's bank accounts" — which Wang pointed out were actually funds deposited by FTX customers and belonging to them, not to Alameda.

The defense tried to sow doubt in various parts of Wang's testimony, such as that he had heard Bankman-Fried telling investors and journalists that Alameda was treated like any other trading firm on FTX. They suggested that he hadn't heard the question on the other end of the line, and that it was possible that Bankman-Fried was answering honestly about some of the ways that Alameda was treated equivalently. They also tried to spin a story that Bankman-Fried might not have been aware of Alameda's debt to FTX, suggesting that perhaps the spreadsheet with Alameda's debt that Wang had testified to constantly seeing on Bankman-Fried's screen was perhaps something else. Attempts to get Wang to suggest that Bankman-Fried was concerned that Caroline Ellison wasn't "up to the task" of being CEO of Alameda Research were swatted down by the judge, who balked at their attempts to get Wang to do the testifying when it came to Bankman-Fried's feelings.

Finally, the defense tried to suggest to jurors that perhaps Gary Wang was simply saying what the government wanted to hear because he's hoping they will send what's called a 5K letter to the judge: a letter outlining that he had substantially cooperated with the prosecution, which would then allow the judge to consider a lighter sentence. This was a tough argument to make, I think, largely because it was preempted by the prosecution, who had already brought out the plea agreements (and immunity grants, for the witnesses testifying with immunity) to underscore that the agreements are conditional on them telling the truth, not on that they say things that are helpful to the prosecution. At one point during Adam Yedidia's cross-examination, defense attorney Christian Everdell seemed to hint at the idea that prosecutors might punish witnesses for telling the truth if it was inconvenient to the prosecution, saying "If they thought you were lying, they could prosecute you for perjury, correct? … It was up to the government to decide whether or not you were telling them the truth, correct?" This seems like a challenging defense to bring in front of a jury, given that jurors tend to generally be rather trusting of the criminal justice system and of government officials, and unlikely to entertain what may sound to them like a conspiracy theory.

Caroline Ellison, former Alameda Research CEO and on-and-off girlfriend of Sam Bankman-Fried, was next to take the stand. She outlined how Alameda Research had withdrawn billions in customer assets while she was CEO, at Bankman-Fried's direction and thanks to the systems he had set up to allow those transfers to happen. She also described incorrect balance sheets that Bankman-Fried instructed her to make, which were used to mislead lenders by making Alameda's assets and liabilities look less risky than in reality. She also explained that Bankman-Fried was still the CEO of Alameda Research when it began dipping into customer funds to use for its own trading purposes.

Ellison spoke of a time in 2020 when she raised concerns that auditors might catch Alameda trading with FTX's customers' funds, to which Bankman-Fried replied with something like, "No, don't worry, the auditors aren't going to look at that." She also described the first time Alameda took an amount around a billion dollars from FTX customer funds, which she said was at Bankman-Fried's direct instruction, in order to buy out Binance's stake in FTX.

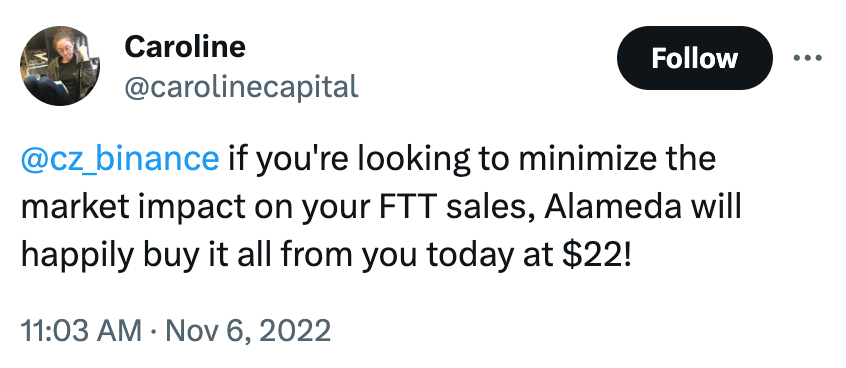

Ellison also offered some interesting new tidbits, such as that Bankman-Fried instructed her to have Alameda prop up the price of the FTT token if it ever fell below a dollar, and got upset if she ever discussed this manipulation around other employees. He later instructed her — even when the price was well above a dollar — to buy the token if a large amount of it was ever sold onto the market, or if the price was falling. He was also the one, she said, who told her to add Alameda's substantial FTT holdings, marked to market, on their balance sheet in order to make the firm more attractive to lenders. And he was the one who instructed her to offer to buy up FTT tokens when Binance threatened to sell them, in an incident that only compounded the panic around FTX's solvency.

Ellison talked about Bankman-Fried's advice to her on borrowing from external lenders, which was generally to borrow as much as she could under any terms she could get. She spoke about being concerned with the risk involved in taking out open-term loans that could be recalled at any moment, and putting the funds into illiquid long-term investments in early stage companies, but said that Bankman-Fried was more willing to take risks than most people if he believed they had "positive EV [expected value]".

Ellison also spoke about her personal and professional relationship with Bankman-Fried, including that she didn't feel prepared to be the CEO of Alameda Research. "I handled a lot of day-to-day decisions and responsibilities in Alameda," she said. "But for any major decisions I would always run them by Sam, and I would always ultimately defer to Sam if he thought that we should do something."

Ellison also outlined a time in 2021 when Bankman-Fried laid out a list of hypothetical scenarios to her — ones that would eventually be part of what ultimately happened to FTX, like FTT dropping in price — and asking her to evaluate the possible risk if Alameda were to do another $3 billion in venture investments. She produced her analysis to Bankman-Fried and discussed it with him , concluding that it would "put Alameda in a significantly riskier position and make it much less likely or almost impossible that we would be able to pay off our loans if all of our loans were called at once." She explained that she believed if loans were recalled, they would need to use customer funds to pay them off. Despite that, Bankman-Fried decided to do the venture investments anyway. Ultimately, her fears would come true.

The prosecution still had more questioning to do when trial wrapped up for the day. They later told the judge they expect that their questioning and the defense's cross-examination will likely take all of tomorrow.

We've yet to hear any cross-examination of Ellison, but given the defense's opening statement, it's safe to say they will attempt to pin FTX's collapse on her, claiming that she was the CEO of Alameda Research and Bankman-Fried had no real idea what was going on, and no control over the company.

This is an argument they've already gestured towards in previous questions to other witnesses, but in my opinion it's been a weird and inconsistent line of argument. They seem to be going for a have-your-cake-and-eat-it-too approach, where they first claim that Bankman-Fried had no knowledge of what was going on at Alameda or control over the company after Ellison was installed as CEO, but also that he instructed her to hedge and was angry when she failed to do so.

We also may learn how much Bankman-Fried's "Ellison was my spurned lover" media strategy was endorsed by his defense team, versus something he and he alone thought might be useful. It's possible that the defense will try to delve deeply into Ellison's personal life — including by asking questions about her romantic relationship with Bankman-Fried but also potentially about things like her illicit drug use [see Preview] — a strategy that could help to discredit her but could also bear the substantial risk of alienating the jury and making the defense team (and by extension, Bankman-Fried) even less likable to jurors.

Social image created from U.S. Government image, image of Bankman-Fried via the AP.

Footnotes

Bankman-Fried has said he would be eager to flip a coin that would destroy the world on a tails result, so long as the result if it came up heads was that the world would be more than twice as good. ↩