SEC v. Binance: "A web of deception"

The SEC describes the company's "blatant disregard of the federal securities laws".

Given the March 2023 lawsuit (newsletter, tweet thread) from the U.S. Commodities Futures Trading Commission (CFTC) against Binance, I don't think anyone is genuinely surprised to see something similar come out of the Securities and Exchange Commission (SEC). Some expected the SEC to file something nearly identical to the CFTC's suit, just with references to crypto assets as securities rather than commodities, but that's not exactly what we got. While there are similarities in the lawsuits, the new complaint from the SEC sheds even more light on Binance's alleged activities and on the SEC's harsher approach to the crypto industry in the US.

On June 5, the SEC filed thirteen charges against crypto giant Binance, companies under its control, and its CEO Changpeng "CZ" Zhao. The charges against the companies involve unregistered offers of securities and investment schemes; failing to register with the SEC as an exchange, broker, broker-dealer, or clearing agency; and making materially false and misleading statements to investors. Two of the charges are against CZ specifically, as the control person over Binance and Binance.US.

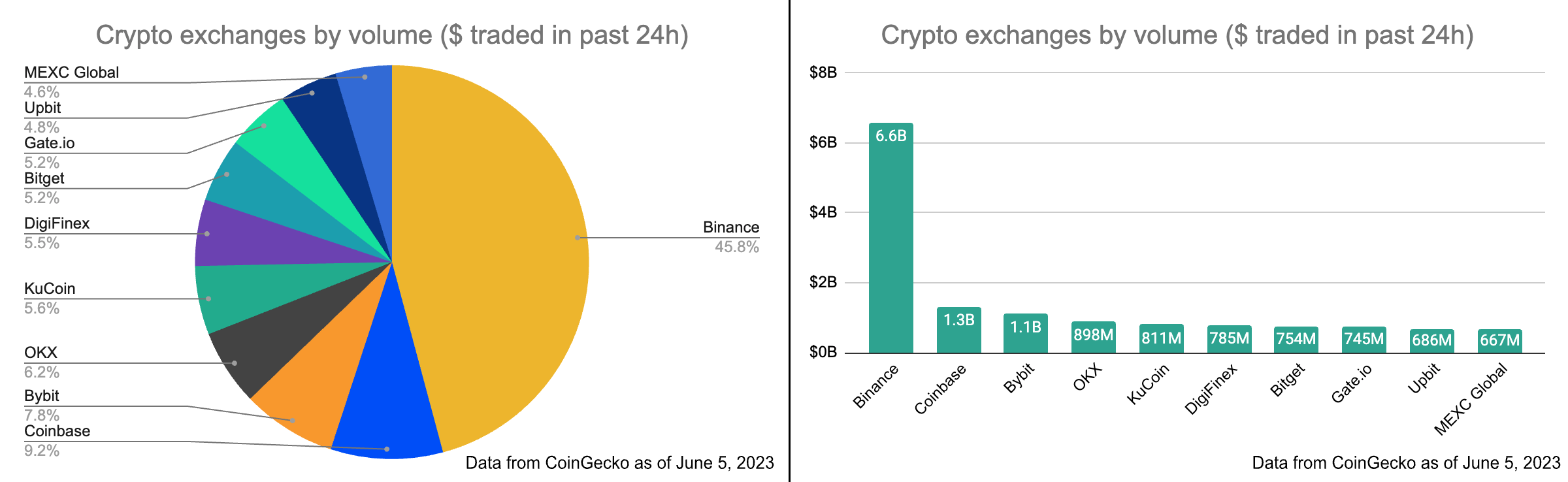

For a little context, Binance is the world's largest cryptocurrency exchange by a considerable margin.

Of course, this data would be skewed if some of the exchanges were full of wash trading, as the SEC has alleged is the case on Binance (more on that later). Even with that, though, Binance undoubtedly enjoys a massive chunk of crypto exchange market share. I say this because it's important to contextualize the possible ramifications of successful enforcement actions against such a giant in the industry.

Binance and Binance.US: two puppets controlled by the same puppetmaster

The SEC lawsuit shares similarities to the CFTC one. For example, both allege that the company only pretended that the international Binance platform and its Binance.US arm were operated separately, while in reality they were both fully controlled by Binance CEO Changpeng Zhao. Both lawsuits go into detail about how executives at the company explicitly discussed Binance's plan to create a US arm of the company solely as a regulatory diversion. The SEC lawsuit describes an unnamed "consultant who operated a crypto asset trading firm in the United States", who explicitly stated that the creation of Binance.US might help "[i]nsulate Binance" from regulatory liabilities. The consultant also suggested that Binance engage with the SEC to discuss steps that might bring Binance into compliance, "with no expectation of success and solely to pause potential enforcement actions". Attempts to prevent US customers from trading on Binance's international exchange (Binance.com) were solely for show (or " 'fo sho", as one exec reportedly said), and there were detailed procedures for routing high-value US customers back onto the international exchange via the use of VPNs and shell companies.

This all hearkens back to the "Tai Chi document" first reported upon by Forbes in October 2020, and as a result is no big surprise to anyone who's been paying attention. What is surprising is the degree to which Binance executives spoke candidly in writing about their plans to evade regulations.

The two lawsuits also share similarities in that both feature Binance employees holding the most ironic possible job titles putting their shady activities into writing. I didn't know if the CFTC could be beat with their submission, where they allege that Binance's "Money Laundering Reporting Officer" wrote "I HAZ NO CONFIDENCE IN OUR GEOFENCING" and replied to a colleague discussing Russian customers who are "here for crime" with "we see the bad, but we close 2 eyes". However, the SEC has a strong competitor, submitting in their lawsuit that Binance's "Chief Compliance Officer" wrote: "we are operating as a fking unlicensed securities exchange in the USA bro."

Bro.

The SEC complaint goes into more detail about the level of chaos at the Binance.US platform (controlled by entities called BAM Trading and BAM Management), where employees all the way up to and including the CEO had very little actual control over the company. Some of this information comes directly from sworn testimony by two former Binance.US CEOs who apparently spoke openly with the SEC — a new revelation which seems like bad news for Binance. The CEOs are unnamed in the lawsuit, but can be trivially identified as Catherine Coley ("BAM CEO A") and Brian Brooks ("BAM CEO B"). Coley told the SEC about being "strongarm[ed]" by CZ when he wanted Binance's token, BNB, to be listed on Binance.US against her advice. She also spoke of being unaware of asset transfers within her own company, of amounts totaling millions and even billions of dollars. "haha [I'm] on a wild goose chase to make sure we have knowledge of where $17M is moving around," she wrote in one internal communication. Frustrated by the inability to operate independently from the Binance "mothership", Coley stated that her "entire team feels like [it has] been duped into being a puppet." Coley was eventually fired and replaced by Brooks, who lasted only three months as CEO before resigning. Brooks told the SEC, "[W]hat became clear to me at a certain point was CZ was the CEO of BAM Trading, not me."

The level of disconnection between the two entities wasn't just making things difficult for Binance employees. An auditor conducting a review of Binance's financials observed that this contributed to deficiencies in Binance's reporting, writing that it "was difficult and sometimes not possible to pull wallet balances en masse as of a historical point in time. This makes it very difficult to ensure the Company is fully collateralized at specific points in time."

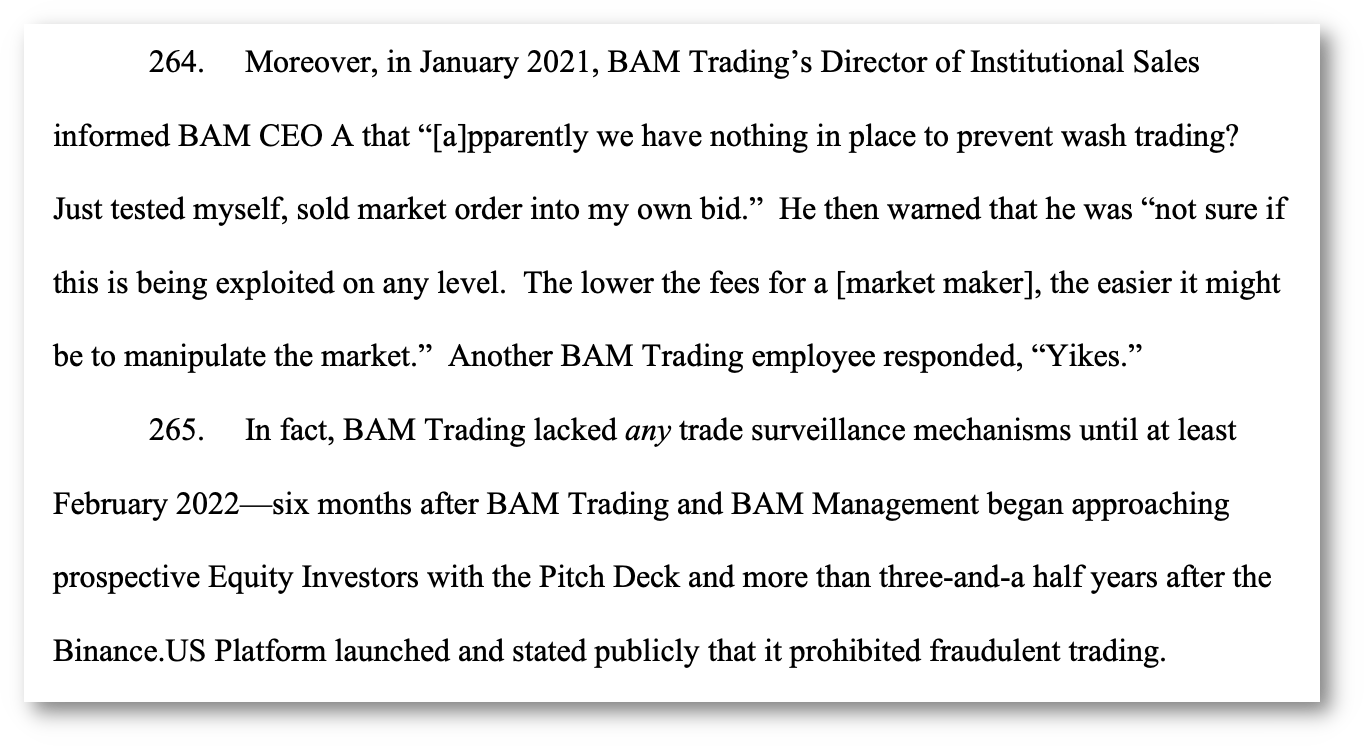

Wash trading

Also new from the SEC complaint are detailed descriptions of wash trading that allegedly occurred on Binance's platforms, and the complete lack of controls to prevent it. Although Binance bragged to investors of its "on-chain analytics, monitoring all the behaviors that are taking place" and its vendors who they claimed used both human and artificial intelligence to identify manipulation, the SEC alleges that Binance had little or at times no monitoring in place.

Not only did Binance allegedly fail to thwart market manipulation and then lie about it, another CZ-owned and -operated company called Sigma Chain was reportedly the source of a substantial amount of it. Sigma Chain was run by several Binance employees who were directed by CZ, and the company described itself as "the main market maker for Binance.com" and a market maker for Binance.US. On Binance.US's first day of operation, wash trading between Sigma Chain accounts and accounts operated by Zhao and/or other Binance senior employees made up more than 99% of the first hour of trading volume for at least one crypto asset, and almost 70% of that asset's volume for the day.

"Between January 1, 2022 and June 23, 2022 alone, Sigma Chain accounts engaged in wash trading in 48 of 51 newly listed crypto assets," claims the SEC. In the three months leading up to Binance.US's equity round, "Sigma Chain accounts repeatedly wash traded 51 crypto assets of the 58 crypto assets available for trading at that time on the Binance.US Platform." The SEC alleges that Binance employees were well aware of the wash trading by Sigma Chain and other Zhao- and Binance-operated accounts, but took no action to either introduce controls to stop the activity, or to ensure they were not making misleading or false statements about Binance's controls (or lack thereof).

Meanwhile, the SEC quotes CZ: "CREDIBILITY is the most important asset for any exchange! If an exchange fakes their volumes, would you trust them with your funds?"

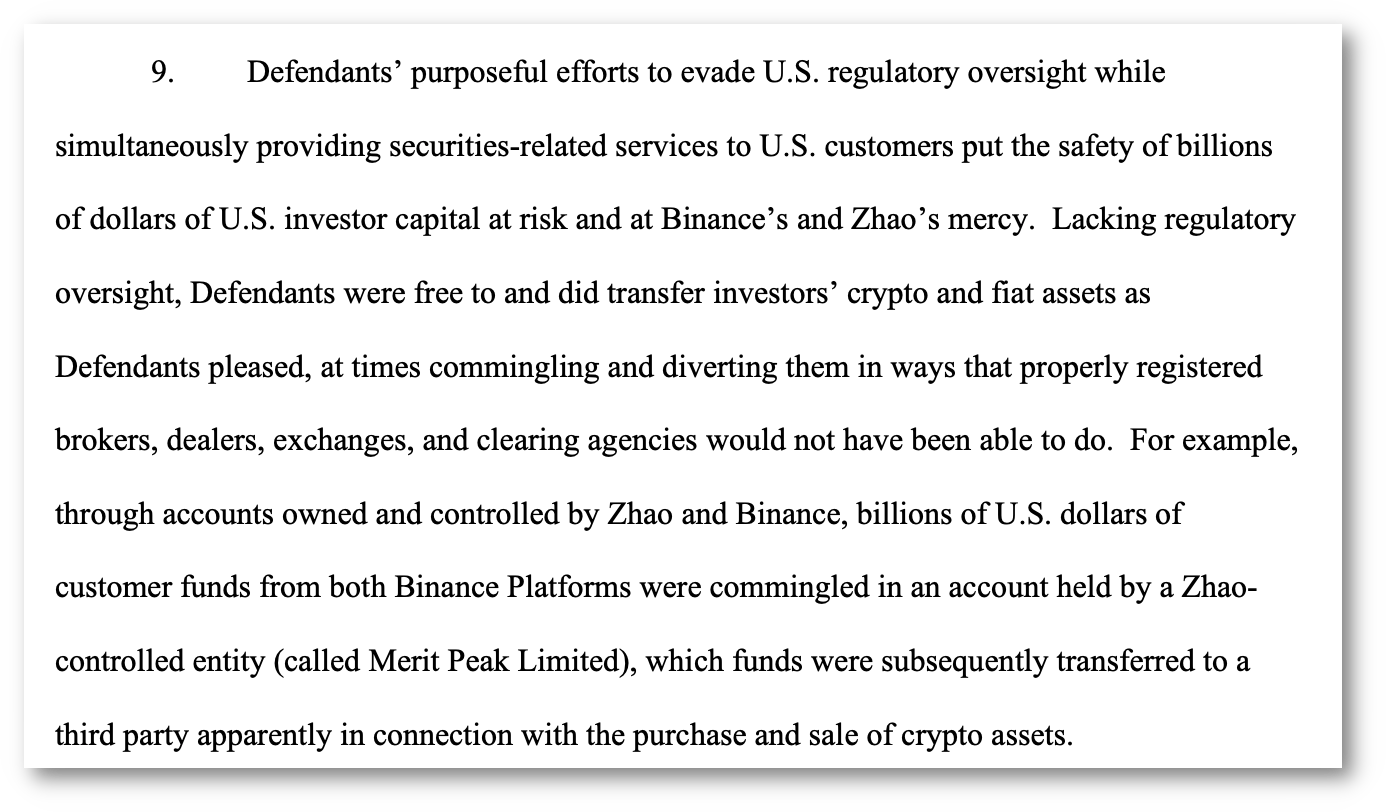

Asset commingling

Sigma Chain comes up elsewhere in the complaint, as well. Tens of billions of dollars in assets allegedly were regularly transferred among Binance companies, Sigma Chain, and another CZ-controlled trading firm and market maker called Merit Peak. In one instance, at least $190 million was transferred from Binance.US accounts to Sigma Chain. $11 million from that account ultimately went towards the purchase of a yacht.

Customer funds were also regularly transferred to these supposedly independent entities, which the SEC identified as risk that was taken without notice to or consent from its customers. The SEC also charges that "billions of U.S. dollars of customer funds from both Binance Platforms were commingled":

Crypto asset securities

Throughout the complaint, the SEC identifies several "crypto asset securities" — that is, crypto tokens it has decided meet the definition of a security.

First are Binance's own tokens, the floating BNB token and the USD-pegged stablecoin BUSD.

With regards to BNB, Binance has done just about everything short of coming out and saying "hello SEC! Please come take a look at this unregistered security we created and are selling to people!" The Howey test is a common framework for determining if an asset is a security, and it has four prongs: is the asset (1) an investment of money (2) in a common enterprise with (3) a reasonable expectation of profit (4) derived from the efforts of others?

Binance issued BNB via an "initial coin offering" (ICO) as a way to raise funds for the development of the platform. The company has repeatedly marketed the token as an investment in the future success of the Binance platform. In 2017, CZ replied to a Reddit "ask me anything" question, writing "The value of [BNB] is heavily associated with how well the platform does. Basically, if the platform is successful, the more users use the platform to trade, the more users will buy the coin, hence the price will increase." In a 2021 Forbes interview, former Binance.US CEO Brian Brooks said, "[BNB] gets our customers to act a little bit more like owners—people who want the company to succeed; their interests are aligned with that of the company."

I suspect few reasonable people are truly surprised that the SEC classified BNB as a security in this complaint. But some were certainly surprised to see the SEC's reasoning that led them to declare that BUSD, Binance's USD-pegged stablecoin, is a security. This is not the first time the SEC has taken that stance, to be clear. In February, the agency issued a Wells notice to Paxos, the US-based issuer of the white-labeled token which identified BUSD as a security [W3IGG]. However, the SEC goes into more detail around their reasoning in this lawsuit. Some have balked at the classification of any stablecoins as securities, likening it to a declaration from the SEC that the US dollar is a security. For the SEC, it seems to come down to the fact that BUSD was an integral part of programs where BUSD purchasers were rewarded just for buying the token, or various profit-making schemes such as staking programs and "savings accounts".

Finally, the SEC named ten non-Binance-issued tokens as securities. While it's not been uncommon for the SEC to name in their lawsuits tokens issued by entities who are not defendants in the complaint, they picked some really big-name tokens in this one. They identified SOL (Solana), ADA (Cardano), MATIC (Polygon), FIL (Filecoin),1 ATOM (Cosmos), SAND (The Sandbox), MANA (Decentraland), ALGO (Algorand), AXS (Axie Infinity), and COTI (Coti) all as securities, which has caused some uproar. Looking at CoinMarketCap's list of tokens by market cap,2 these tokens are, respectively, the 9th, 7th, 10th, 32nd, 19th, 44th, 51st, 43rd, 55th, and 302nda largest tokens as of June 5. BNB is #4 and BUSD is #14.

Short of declaring that Bitcoin, Ethereum, or another stablecoin like Tether or USDC was a security, these are some of the biggest they could have announced. Looking at the largest crypto tokens, the SEC has named a lot of them as securities with this action (marked in bold text).

It's not entirely clear from the suit why they chose these specific tokens rather than some others. Some commonalities that jumped out at me, however, were that a lot of these tokens were launched as part of an ICO, and all are tied to very specific centralized organizations that are building out a blockchain ecosystem or project. Many of them also have performed token burns, a mechanism the SEC repeatedly calls out in this lawsuit as a way in which the organizations are leading investors to reasonably believe the tokens have potential for profit, as the strategy decreases the overall token supply and thus increases the individual token price.

This action is going to put in an awkward position a lot of crypto exchanges and other platforms who serve US customers, who now have to decide whether to delist the popular tokens or risk being slapped with charges that they decided to engage in unregistered trading of assets they knew the SEC believed to be securities.

Staking

Finally, the SEC takes issue with Binance's staking-as-a-service program, in which Binance helps individuals who wish to stake their Ethereum or other proof-of-stake tokens by allowing them to pool assets with other customers, and takes care of the rather technologically complex process of running a validator node.

The SEC has gone after staking before, including via a complaint ending in a $30 million settlement with Kraken in February 2023 [W3IGG], and via a Wells notice to Coinbase in March 2023 [W3IGG]. Some US-based crypto firms have sought to tweak their staking offerings in ways they feel will satisfy the SEC without needing to register, but this lawsuit seems to solidify that that's not possible.

In Kraken's case, the SEC seemed to be taking particular issue with the fact that Kraken was the one setting the reward payout for the staking service, rather than simply passing through staking rewards to customers who staked their tokens. This, and perhaps some signals drawn from the Wells notice, seemed to be a motivating factor in a change Coinbase made to their staking program in late March, in which they sent an email to customers emphasizing that "You earn rewards from the protocol, not Coinbase. Coinbase acts only as a service provider connecting you, the validators, and the protocol. We pass along any rewards earned from staking, minus a transparent Coinbase fee."

However, in this lawsuit, the SEC suggests that they believe even the simplest possible configuration of staking-as-a-service — pooling customer assets, running a validator, and passing any rewards directly back to the customers — still qualifies as a security. This seems like bad news for Coinbase and other staking-as-a-service providers, possibly including even the ostensibly decentralized projects like Lido.

As with the CFTC suit, the lawsuit from the SEC is a civil matter that can't result in jail time or other such criminal penalties. The SEC is seeking disgorgement, civil penalties, and enjoinments to prevent Binance, CZ, or related entities from committing further violations. They also seek to bar CZ from acting as an officer or director of any securities issuer in the US.

The ramifications for Binance could be huge. The "all ill-gotten gains, with prejudgment interest" that the SEC wants Binance to disgorge is a number in the billions. While Binance executives are quoted in the lawsuit discussing SEC penalties as though they are just a cost of doing business, their estimates were considerably lower. In a conversation between the CFO and CCO, for example, they described the risk of listing BNB on Binance.US as merely "$10mm in legal fees and settlements".

Furthermore, a judgment that only allows Binance to continue to operate within the US if they are properly licensed and regulated is essentially the end to Binance operating in the US. When the whole business model is predicated on evading regulations, becoming regulated is a death sentence.

Binance has said they "intend to defend [their] platform vigorously". Although Binance has bowed to regulatory pressure in other jurisdictions, for example when they left the Canadian market just last month [W3IGG], they simply can't afford to lose the substantial revenue from US traders and firms. Binance themselves have said as much in their own internal communications, exposed in these CFTC and SEC lawsuits, where employees describe their need to find work-arounds to keep US traders on the Binance platform. This may be a long legal battle, but it will be an impactful one on the US crypto industry.

Elsewhere in Binance's response to the SEC, they moan about how Binance has been nothing but cooperative with the SEC, and so it is unfair for the SEC to file the complaint. They denigrate the SEC, accusing them of "regulation by enforcement", and prioritizing making headlines over protecting consumers.

Noticeably missing from their response: any mention of the Binance executive's admission that the company is "operating as a fking unlicensed securities exchange in the USA bro."

Footnotes

Coti's a bit of an outlier. If I had to guess, it was probably included because it was used as an example of Sigma Chain's egregious wash trading elsewhere in the complaint. ↩

References

See my disclosures. ↩

Please take your usual grain of salt around cryptocurrency "market cap", but it is a somewhat useful metric of token size here. ↩