The FTX collapse: the latest revelations (part three)

Bankruptcy filings, private messages, and leaked balance sheets reveal some of the chaos at FTX. Here's what we know now.

A week ago, I summarized what was known about the sudden collapse of FTX. To pin it in time a bit, Binance had just backed out of their letter of intent to acquire the exchange.

Needless to say, these things move incredibly quickly. More has happened in the week since, and we also have a lot more insight into what Sam Bankman-Fried likely did to get FTX into this position. That said, a lot of things are still speculative, and we probably won't know the full story for quite some time.

Let's go back in time…

In June 2022, Three Arrows Capital blew up. Three Arrows Capital was a crypto-focused hedge fund based out of Singapore. Until its collapse, its co-founders Su Zhu and Kyle Davies were larger-than-life cryptocurrency personalities. They seemed almost unbelievably good at what they did, buying the bottoms and selling the tops.

But in June, in the wake of the May Terra/Luna collapse, it all fell apart. Three Arrows Capital had been taking on enormous risk, and their loss of $200 million in the Terra collapse, paired with a downturn in crypto prices across the board, left the firm unable to pay off their debts.

Many crypto lending and proprietary trading firms went down with Three Arrows Capital. Their exposure to 3AC, and to one another, triggered cascading failures. Practically everyone who was taking on substantial risk in hopes of high rewards blew up.

Alameda Research, Sam Bankman-Fried's proprietary trading firm, was taking on substantial risk, but didn't blow up.

Or did it?

It's increasingly looking like Alameda Research was in just as much trouble as the other firms, but instead of going under, they were bailed out by Sam Bankman-Fried's other project: FTX.

CoinMetrics researcher Lucas Nuzzi has laid out a compelling hypothesis on precisely what happened, based on the movement of FTT tokens on-chain:

Here's what I think happened:

- Alameda blew up in Q2 along with 3AC+ others.

- It ONLY survived because it was able to secure funding from FTX using as "collateral" the 172M FTT that was guaranteed to vest 4 months later.

Once vested, all tokens were sent back as repayment.

Remember, the FTT ICO contract vests automatically.

Had FTX let Alameda implode in May, their collapse would have ensured the subsequent liquidation of all FTT tokens vested in September.

It would have been terrible for FTX, so they had to find a way to avoid this scenario.

The timing makes sense.

Alameda and FTX essentially put all chips on the table in Q2 and used that cash to bail others out.

This solidified FTXs image as a solvent and responsible institution, which helped FTT's price.

So did SBFs political moves.

The Alameda bailout likely put a dent on FTXs balance sheet to the point where it was no longer solvent.

This would have been fine if the price of FTT didn't collapse and a bank run ensued.

This is why Alameda tried their best to protect FTT's price.

– Lucas Nuzzi, CoinMetrics

Crucially, this bailout was performed by FTX with customer deposits, which they absolutely should not be using in this way.

Nuzzi formed his hypothesis post-FTX collapse, when he looked back and observed some massive transfers of FTT tokens from Alameda Research to FTX in September. At the time, SBF tried to play this off as merely "rotating wallets", perhaps hoping people who observed the massive move wouldn't dig deeper:

A major question at this point is: did CZ, CEO of Binance, reach the same conclusion as Nuzzi shortly before he began tweeting about liquidating Binance's FTT holdings on November 6?

It's possible that CZ realized what FTX had done, and that the firm was insolvent, and decided to push their biggest competitor over the edge (while also doing perhaps unforeseen damage to themselves, as the FTX collapse served a major blow to the industry as a whole). But it's also entirely possible that this gives CZ far too much credit as some sort of Machiavellian mastermind, and he truly had no idea what a house of cards he was poking.

Back to the present…

Now, let's catch up on what happened since I wrote up the FTX collapse on November 9.

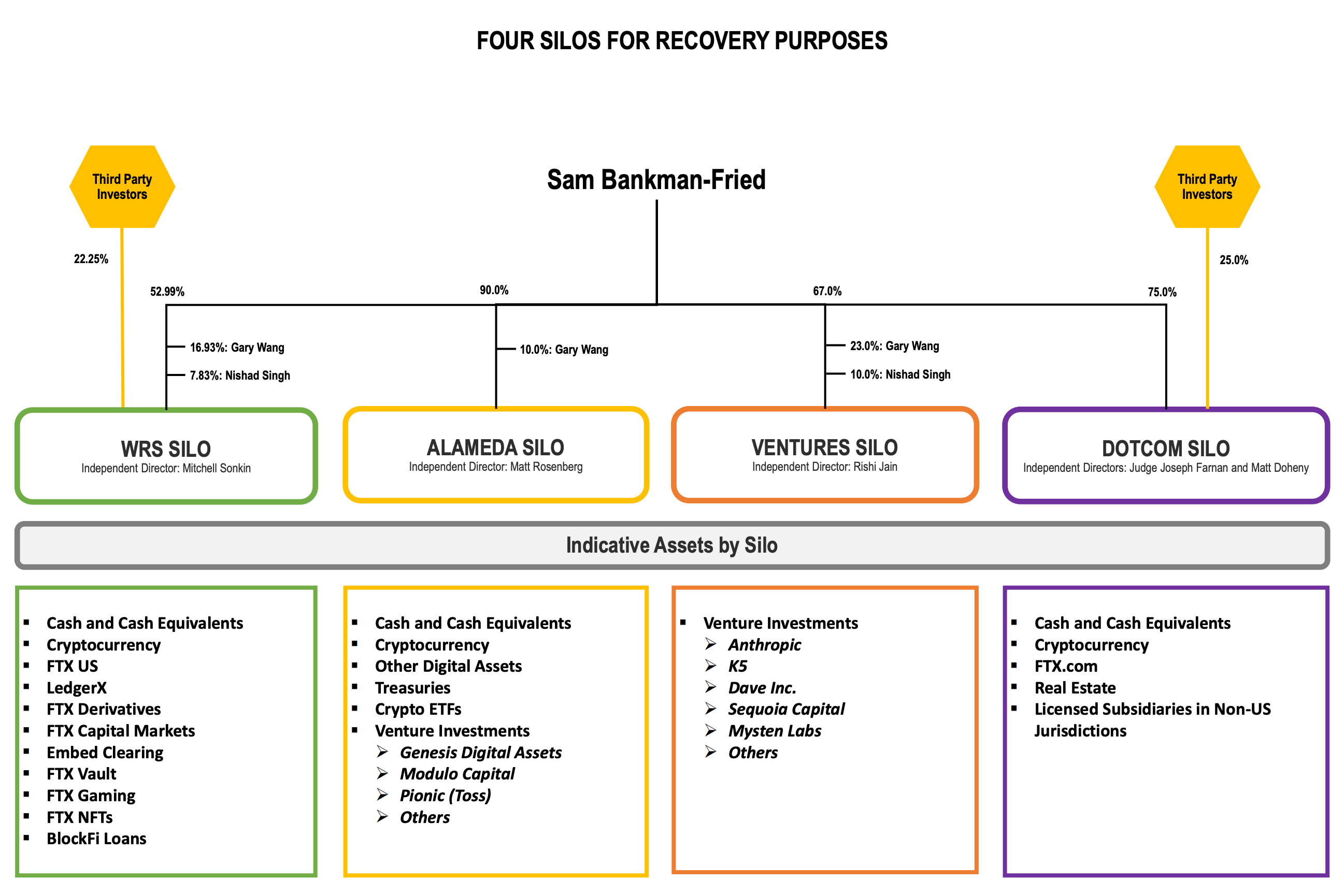

Before we begin, it's useful to know that what I am generally referring to as "FTX" is actually a big hodgepodge of various companies operated by Sam Bankman-Fried, including FTX.com, FTX.US, and Alameda Research.

On November 10, the Securities Commission of the Bahamas froze FTX's assets, and appointed a provisional liquidator. [W3IGG]. That day, FTX announced that they would process withdrawals of Bahamian funds, "per our Bahamian HQ's regulation and regulators".

Predictably, this led to a desperate scramble by non-Bahamians with funds locked in the exchange to try to find any possible way to get a Bahamian FTX user to withdraw their assets for them. [W3IGG]. A Bahamian who had not already submitted documents to prove their identity tried (apparently successfully) to bribe FTX employees to process their identity documents. A non-Bahamian user tried to bribe employees to change their residence to the Bahamas (they later claimed they were joking). Users reportedly used their entire account balances to buy NFTs from Bahamians, in schemes to circumvent blocks on transferring account balances.

There was also, of course, speculation that FTX had enabled Bahamian withdrawals so that its leaders and employees could try to cash out.

Two days later, the Securities Commission of the Bahamas would issue a statement that it had not directed FTX to process withdrawals for Bahamian customers, contradicting FTX's earlier claims. [W3IGG]. More on this in a bit.

On November 11, Bankman-Fried apparently gave up on his remaining hopes that some multi-billion dollar rescue was on the way and resigned as CEO. [W3IGG].

Replacing him is John J. Ray III, who is apparently the guy to come in and pick up the pieces after a company goes up in flames. He supervised the Enron bankruptcy, as well as the bankruptcies of Fruit of the Loom (1999), Nortel (2010), and others. His job is to try to squeeze as much money out of FTX into the hands of stakeholders as possible, and to investigate what the hell happened here.

This is good news for FTX users. This may not be good news for SBF. More on that in a minute.

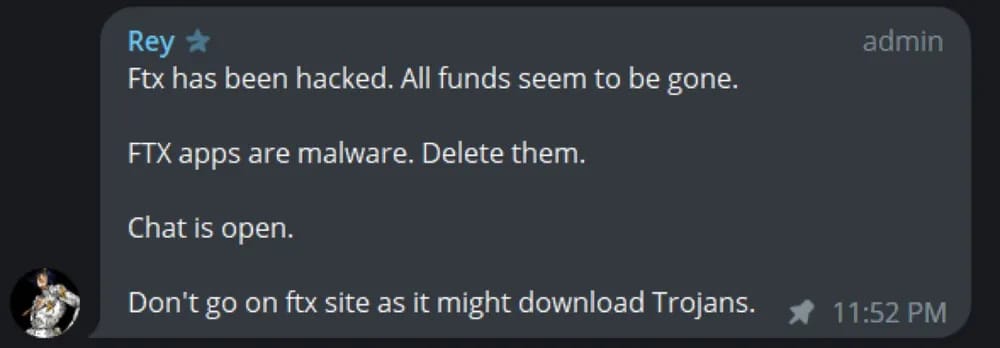

Later that day, a Friday night, funds began moving out of FTX. Assets priced in the hundreds of millions of dollars. Some wondered if this could be liquidators moving to secure FTX's assets, but movement of the assets to decentralized exchanges like 1inch made this theory unlikely.

A message from an FTX employee in the official FTX Telegram chat seemed to confirm the worst had happened. Somewhere between $400 and $600 million had been siphoned off the platform, though the true amount was unclear because FTX had also reported that they had expedited the process of moving funds to cold storage in preparation for bankruptcy proceedings.

It appeared that the perpetrator of the hack may have been an insider, given the scope of access they appeared to have to FTX systems. More on this in a minute.

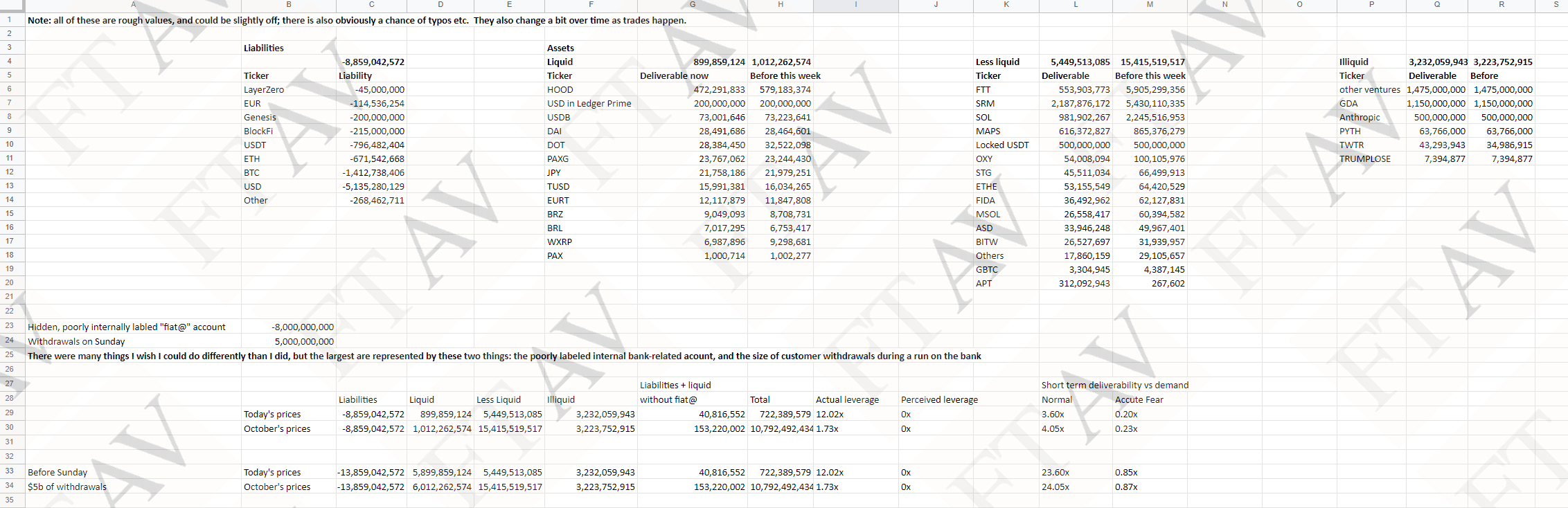

On November 12, the Financial Times published an article titled "FTX held less than $1bn in liquid assets against $9bn in liabilities". It was based on a November 10 "balance sheet" that appeared to have been hastily prepared by SBF:

The spreadsheet included an entry for "Hidden, poorly internally labled [sic] 'fiat@' account: -8 billion". Apparently SBF wishes for us to believe that he somehow just misplaced an account representing eight billion dollars in liabilities. SBF also included an attempt at remorse in the balance sheet (as one does): "There were many things I wish I could do differently than I did…"

On November 15, the liquidator appointed by the Bahamian Securities Commission filed for Chapter 15 bankruptcy in the Southern District of New York. He objected to the Chapter 11 filings, writing that "no person other than me, as Provisional Liquidator, was authorized to take any act including… filing the Delaware Petition… I did not authorize or approve… any of FTX Digital's officers, management or employees to file, or cause to be filed, the Delaware Petition… I reject the validity of any purported attempt to place FTX Affiliates in bankruptcy." Awkward.

On November 16, Vox published an article based on Twitter direct messages between SBF and one of their journalists in the wee hours of the night, Bahamas time. In the messages, SBF reveals that much of his talk about ethics and responsible regulation of the crypto industry was mostly an act.

He later wrote, "Last night I talked to a friend of mine. They published my messages. Those were not intended to be public, but I guess they are now." Apparently at no point did he consider that this "friend of his" was a Vox journalist to whom he'd already given interviews. By the next day, his statements of "fuck regulators they make everything worse" and that he was aiming to "win a jurisdictional battle vs Delaware" had made it into court filings.

On November 17, lawyers for FTX filed an emergency motion to get the Chapter 15 filing moved to the Delaware court and out of SDNY. The motion made some very strong claims:

The filing of the Chapter 15 Case without advance notice and in the SDNY is a blatant attempt to avoid the supervision of this Court and to keep FTX DM isolated from the administration of the rest of the Debtors, which constitute the vast majority of the remainder of the FTX group…

Mr. Bankman-Fried, the co-founder, and controlling owner of all of the Debtors and of FTX DM, appears to be supporting efforts by the JPLs to expand the scope of the FTX DM proceeding in the Bahamas, to undermine these Chapter 11 Cases, and to move assets from the Debtors to accounts in the Bahamas under the control of the Bahamian government.

In addition, in connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and Mr. Wang stated in recorded and verified texts that "Bahamas regulators" instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were "custodied on FireBlocks under control of Bahamian gov't".

The Debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors' systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases. The appointment of the JPLs and recognition of the Chapter 15 Case are thus in serious question. It appears that the automatic stay has been flaunted, by a government actor no less. This is no time to be arguing over venue.

John J. Ray III also filed his declaration in support of the Chapter 11 bankruptcy, which was no less scathing:

I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity.

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Declaration of John J. Ray III in Support of Chapter 11 Petitions and First Day Pleadings

Throughout the document, he cast doubt on Sam Bankman-Fried, writing that he was not confident in the companies' various financial statements prepared under his control.

He disclosed that several of the companies under the SBF umbrella, including Alameda, did not have audited financial statements. Speaking of the audited financial statements that did exist, he described the auditor of the "Dotcom Silo's" financials (FTX.com and various other entities) as "a firm with which I am not familiar and whose website indicates that they are the 'first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland. I have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo."

He went on to describe other massive deficiencies in the SBF companies:

- Accounting

The Debtors do not have an accounting department and outsource this function.

- Human resources

At this time, the Debtors have been unable to prepare a complete list of who worked for the FTX Group as of the Petition Date, or the terms of their employment.

- Disbursement

The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line 'chat' platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors.

- Security and crypto asset custody

Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com's auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).

The Debtors have located and secured only a fraction of the digital assets of the FTX Group that they hope to recover in these Chapter 11 Cases.

- Information retention

Mr. Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same.

As more information comes to light, it is clear that this is not a case of a hapless Sam Bankman-Fried having an oopsie and misplacing $8 billion.

It is becoming more and more apparent that SBF, and various other high-level employees at his group of companies, appear to have been engaged in some serious fraud.

What remains to be seen is whether they will be held responsible for it.

Meanwhile, users wait anxiously to learn more about funds they have locked in the exchange, and the contagion continues to spread.