The FTX subpoenas

The team overseeing FTX's bankruptcy has a lot of questions.

The team overseeing the FTX bankruptcy, led by John J. Ray III, filed a motion requesting the judge grant permission to subpoena Sam Bankman-Fried, several FTX or Alameda executives, and several of SBF's family members, namely:

- Sam Bankman-Fried, founder of both FTX and Alameda Research, CEO of FTX up until bankruptcy, recipient of loans from FTX entities

- Zixiao "Gary" Wang, co-founder and CTO of FTX

- Nishad Singh, co-founder and engineering director at FTX, recipient of loans from FTX entities

- Caroline Ellison, CEO of Alameda Research

- Zhe "Constance" Wang, COO of FTX and co-CEO of FTX Digital Markets Ltd. (a Bahamian entity)

- Barbara Fried, SBF's mother and political advisor

- Joseph Bankman, SBF's father and advisor

- Gabriel Bankman-Fried, SBF's brother and political advisor

Along with the request they submitted copies of the subpoenas they intended to send, which were illuminating. They can be found at Document #579, Attachment 3 on Kroll. (The CourtListener PDF isn't working, or else I'd link it directly).

For those who'd really rather not slog through all 110 pages, read on.

Questions to all

The debtors hope to pose some of the same questions to all recipients of the subpoena, and for the most part these are fairly expected. They inquire about FTX entities, Alameda, and Emergent Fidelity Technologies (a holding company primarily owned by SBF, which held substantial shares in Robinhood): their assets, payments received from them, the companies' operations and financial performance, wallets and bank/brokerage/crypto exchange accounts owned by the companies, transfer of assets among these companies, etc. There are also general inquiries around the subpoena recipients' personal finances, and email, messaging, and social media accounts they used.

Some additional interesting document requests to be posed to all recipients:

All Documents concerning any audit of any of the Debtors or the FTX Entities.

All Documents concerning the Debtors' and FTX Entities' risk management and automated liquidation systems, processes, and policies, including all Documents concerning how those systems, processes, and policies applied or did not apply to Alameda.

FTX advertised its sophisticated risk management and automated liquidation software, but it was later discovered that Alameda's account on FTX had been exempted from these safeguards.

All Documents concerning the minting or transfer of any digital assets (including Tokens) to, or at the direction of, any Bahamian Authority, or any Person affiliated with any Bahamian Authority, including all related Communications.

All Communications with any Bahamian Authority.

A substantial amount of assets were moved to the control of Bahamian authorities, presumably at SBF's direction. The debtor team has expressed some concern that SBF was in cahoots with Bahamian authorities and stashing funds there.

All Documents concerning any investments in or transactions with Moonstone Bank (previously known as Farmington State Bank) by or on behalf of You or any entity within the FTX Group.

For some reason, FTX found a tiny bank in rural Washington State and decided to invest $11.5 million — more than double the bank's net worth. Weird, huh? The bankruptcy team seems to think so too. See Protos' reporting for more.

All Documents concerning any potential purchase of, investment in, or divestiture from any of the FTX Group entities by Binance or any of Binance's directors, officers, or controlling owners, or concerning any potential partnership or other transactions between any of the Debtors and Binance or any of Binance's directors, officers, or controlling owners, including the Letter of Intent signed November 8, 2022.

Did customer funds go towards FTX's buyback of shares from Binance, who once owned a 20% stake in the company? What were the circumstances around Binance's rescue offer to FTX shortly after FTX began to go under, and why did they back out? These are the types of questions I would want to know if I were the bankruptcy team.

All Documents concerning any attempts after January 1, 2022 to procure funding or debt or equity investments for any or all entities in the FTX Group.

SBF was supposedly in talks with all kinds of people to procure rescue financing during the days before FTX declared bankruptcy. He still maintains it all could have worked out. If this was the criminal case against SBF, I would very much want to know if he made intentional misrepresentations when pursuing these deals; I suspect the prosecutors in that case are pursuing similar angles.

All Documents concerning any contemplated, potential, or actual purchases of real estate by or for the permanent or temporary use of any current or former officers, directors, employees, or contractors of any entities within the FTX Group, or for their friends, families, or other Persons.

All Documents concerning any unauthorized accesses to the systems or digital assets of the FTX Group, including any access taking place on November 11, 2022 and November 12, 2022 not authorized by the Debtors.

On November 11 — the same day that FTX declared bankruptcy — more than $370 million was withdrawn from FTX and FTX US in an apparent hack. SBF has suggested he has an idea of who might have done it, saying that he had "narrowed it down to like eight people" in an interview with Tiffany Fong. He suggested it may have been a former FTX employee, or that one of their accounts could have been compromised.

All Documents concerning venture capital or other investments made by You or any entity within the FTX Group including Alameda's investment into Genesis Digital.

Important note: Genesis Digital is a Bitcoin mining firm that is not related to the Genesis crypto brokerage and lender that I've been writing a lot about lately. There are a lot of questions around SBF's and Alameda's decisions to pour an outsized $1 billion into a Cyprus-registered Bitcoin mining firm that primarily operated in Khazakhstan, and now mostly mines in the US post-Kazakh mining crackdown. More from the Wall Street Journal.

All Documents concerning the impact of the collapse of TerraUSD and LUNA on the FTX Group.

The collapse of Terra and Luna in May marked the beginning of many cascading failures throughout the cryptocurrency industry. US prosecutors are reportedly examining whether SBF, FTX, or Alameda Research manipulated the prices of these assets for their own benefit.

All Documents concerning the impact of the collapse of Three Arrows Capital (3AC) on the FTX Group.

Three Arrows Capital was also a major event in the crypto contagion of this year. The firm was borrowing widely from just about anyone who would extend them loans, and suffered major losses in both the Terra/Luna collapse and when the GBTC arbitrage became unprofitable. Three Arrows Capital had positions on FTX, which FTX reportedly liquidated before the fund went under. However, FTX ended up bailing out BlockFi, which itself was exposed to Terra/Luna, Three Arrows Capital, and the bad GBTC bet.

All Documents concerning any minting, trading, lending, or borrowing activities involving FTT Tokens or Serum Tokens by any entities within the FTX Group.

The SEC has alleged that SBF directed Alameda Research to manipulate the price of FTT, FTX's native token. FTT and Serum (SRM) both made up a substantial portion of FTX's and Alameda's balance sheets, despite being very illiquid.

Additional parties of interest

Two document requests for all prospective subpoena targets include a broader list of people in whom the bankruptcy team has apparently taken an interest.

If the motion is granted, the targets will asked for all documents regarding payments by FTX entities "for any goods or services for the use or benefit of You or any of the following individuals", and all communications with the following individuals relating to the FTX entities or Emergent:

- Barbara Fried (subpoena target)

- Brett Harrison, president of FTX US until his abrupt resignation on September 27, 2022

- Can Sun, global general counsel at FTX

- Caroline Ellison (subpoena target)

- Claire Watanabe, chief of brand and people at FTX

- Daniel Friedberg, chief regulatory officer at FTX (also tied to a notorious online poker cheating scandal)

- George Lerner, "company therapist" and "performance coach" at FTX, therapist to Sam Bankman-Fried

- John Samuel Trabucco, co-CEO of Alameda Research until his resignation in August 2022

- Joseph Bankman (subpoena target)

- Luk Wai "Jen" Chan, CFO of FTX and director of FTX's Hong Kong entity

- Nathaniel Parke, CTO of Alameda Research

- Nishad Singh (subpoena target)

- Ramnik Arora, head of product at FTX

- Ryan Salame, co-CEO of FTX Digital Markets, recipient of loans from FTX entities, major political donor

- Ryne Miller, general counsel of FTX US

- Samuel Bankman-Fried (subpoena target)

- Zixiao "Gary" Wang (subpoena target)

Questions to many

Some of the subpoena targets — all except Constance Wang, for some reason — are to be asked for information about SBF's decision to resign from FTX and appoint John J. Ray III, and any involvement they might have had. This is presumably targeted towards allegations SBF has made that he was strong-armed into resigning.

Some of the subpoena targets — all except for Gary Wang and family members of SBF — are to be asked for information about SBF's "control, influence, or role at Alameda". This is presumably relating to SBF's many claims that he had no real oversight of what was happening at Alameda, which has been refuted in a number of places, including in testimony by cooperating parties (namely, Gary Wang and Alameda's own CEO Caroline Ellison) in the criminal case against SBF.

Questions to Sam Bankman-Fried

SBF may begin to regret his choice to speak at length and in great detail to just about anyone who would listen — not only following FTX's collapse, but even after his arrest in a criminal case brought by the Department of Justice.

The bankruptcy team would like to ask him to produce:

All Documents concerning the purported $4 billion of liquidity that came in “eight minutes” after the bankruptcy filing was completed, which you referenced in Your interview with Tiffany Fong published on November 29, 2022.

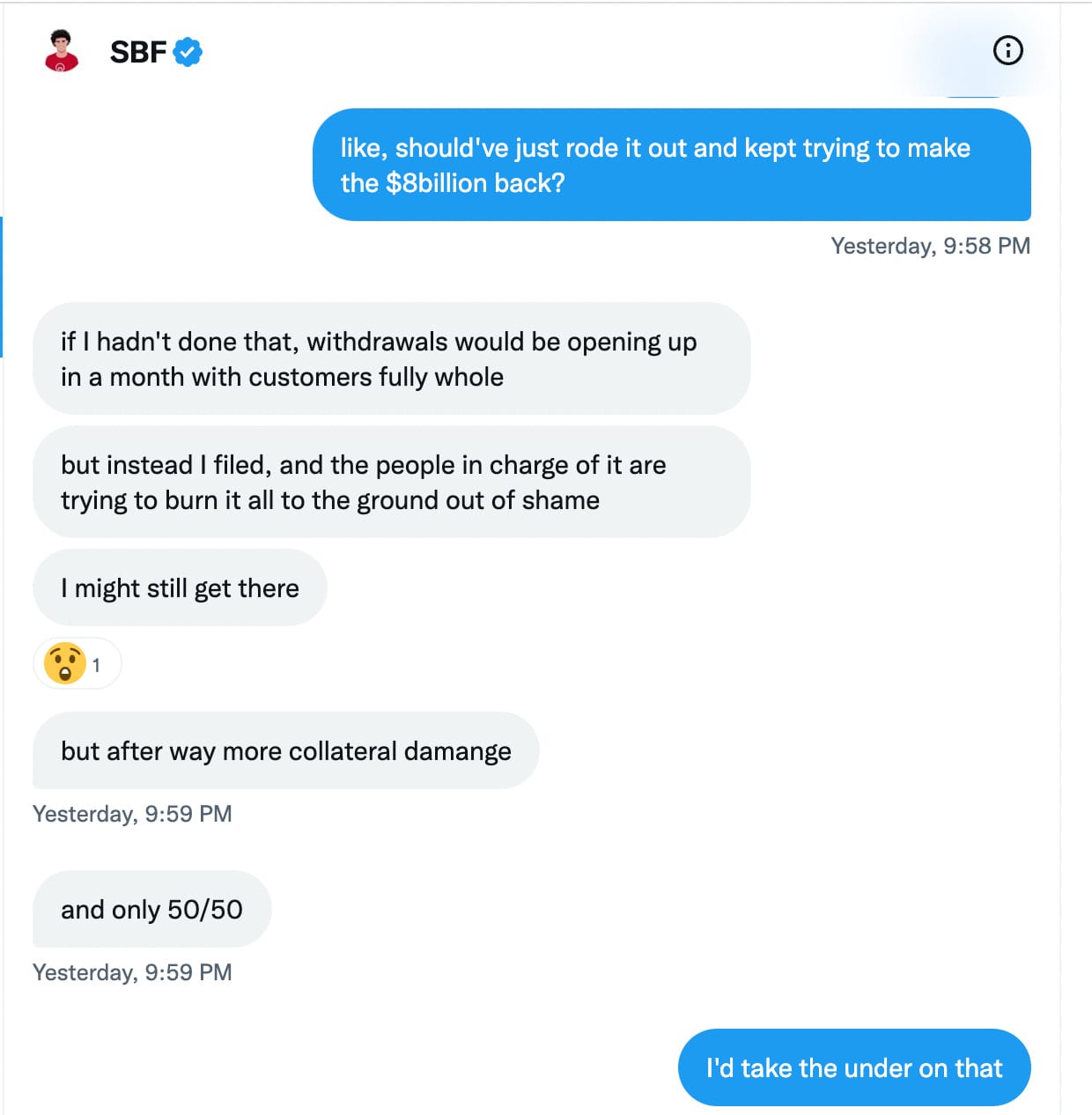

All Documents concerning, substantiating, or refuting the statements You made to Kelsey Piper, as reported in her November 16, 2022 Vox article, including the following:

- “[I]f I hadn’t [filed Chapter 11 petitions], withdrawals would be opening up in a month with customers fully whole.”

- "[B]asically we get there if both a) EITHER Gary OR Nishad comes back[; and] b)we can win a jurisdictional battle vs Delaware."

- ". . . [G]ary is scared, [N]ishad is ashamed and guilty."

All Documents concerning, substantiating, or refuting the following tweets posted to Your twitter account @SBF_FTX:

- Your now-deleted tweet of 12:38 pm on November 7, 2022, which stated: "FTX has enough to cover all client holdings . . . ."

- Your now-deleted tweet of 12:38 pm on November 7, 2022, which stated "A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine."

- Your tweet of 10:51 am on December 1, 2022, which stated: "When I filed, I'm fairly sure FTX US was solvent, and that all US customers could be made whole . . . ."

(archived just in case)

All Documents concerning, substantiating, or refuting the following statements You made during your November 30, 2022 interview with Andrew Ross Sorkin:

- "FTX U.S., to my knowledge — totally solvent."

- "I don't know the details of the house for my parents. I know it was not intended to be their long-term property. It was intended to be the company's property."

Oh dear.

Questions to Caroline Ellison

SBF isn't the only one the bankruptcy team would like to question about tweets. They would like to ask Alameda CEO Caroline Ellison for:

All Documents concerning, substantiating, or refuting the following tweets posted to Your twitter account @carolinecapital:

- Your tweet of 11:03 am on November 6, 2022, which stated: "@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!"

(archive)

- Your tweet of 9:32 am on November 6, 2022, which stated: "A few notes on the balance sheet info that has been circulating recently: - that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren't reflected there"

(archive)

- Your tweet of 9:32 am on November 6, 2022, which stated: "- the balance sheet breaks out a few of our biggest long positions; we obviously have hedges that aren't listed - given the tightening in the crypto credit space this year we've returned most of our loans by now"

(archive)

Unlike SBF, Ellison wasn't going around giving interviews, but the team would still like to know more about something the NYT published about her (but not sourced to her):

All Documents concerning, substantiating, or refuting the following statement published by the New York Times on November 23, 2022:

- "Ms. Ellison admitted that Alameda had taken customer funds from FTX to make up for shortfalls in its accounts, according to a person familiar with the matter who was granted anonymity to share internal discussions."

Questions to Nishad Singh

The bankruptcy team has some oddly specific questions for Nishad Singh, suggesting to me they have something specific they are trying to verify:

All Communications and Documents involving or concerning You regarding any account (including financial, email or social media accounts) for which You are an accountholder and/or an authorized user, for the period October 20, 2022 to November 20, 2022.

All Communications and Documents concerning the use, control and/or ownership of Your phone with phone number ending -0590 for the period October 20, 2022 through and including November 20, 2022.

Amazon Web Services

The bankruptcy team also has questions for Gary Wang and Nishad Singh about Amazon Web Services:

To Wang:

All Documents concerning the Debtors' or FTX Entities' Amazon Web Services database, and any access You had to it.

To Singh:

All Communications and Documents involving Amazon Web Services, Inc. ("AWS") and/or Amazon.com, Inc., for the period December 1, 2020 through and including December 1, 2022, concerning any cloud computing account or service.

Questions to SBF's family

The team wants to know more from SBF's mother and father, Barbara Fried and Joseph Bankman. They asked both to provide:

All Documents concerning Your work with the FTX Group including any employment contract, consultancy agreement, or volunteer agreement.

All Documents concerning any attempt, successful or otherwise, to return real estate to the Debtors or FTX Entities.

They want to make several additional requests of his mother:

All Documents concerning any advice or input you provided to Mr. Bankman-Fried or any other officer, director, or employee relating to the FTX Group.

All Documents concerning any real property or other assets conveyed, transferred, leased or used by You provided by any member of the FTX Group or any officer, director, employee or agent of any member of the FTX Group.

All Documents concerning Your advice given to Samuel Bankman-Fried with respect to any political campaigns, politicians, political action committees, political parties, or Persons affiliated with the foregoing made directly or indirectly.

The requests intended for his brother, Gabriel Bankman-Fried, are similar to the general questions asked of all intended targets, except they include additional language looping in an additional set of entities:

any non-profit, non-governmental organization, charity or similar entity that You or Samuel Bankman-Fried, or Persons associated with You or Samuel Bankman-Fried, founded, directed, advised or were otherwise involved with, including but not limited to, Guarding Against Pandemics, Building a Stronger Future, Defending America Together, People for Progressive Governance, Planning for Tomorrow, Prosperity Through Enterprise, Protect Our Future, American Dream Institute, and American Dream Federal Action.

They also would like him to provide:

Documents sufficient to identify all employees, officers, directors, or contractors of the Foundations, as well as documents sufficient to show compensation, benefits, and any other remuneration they received directly or indirectly.

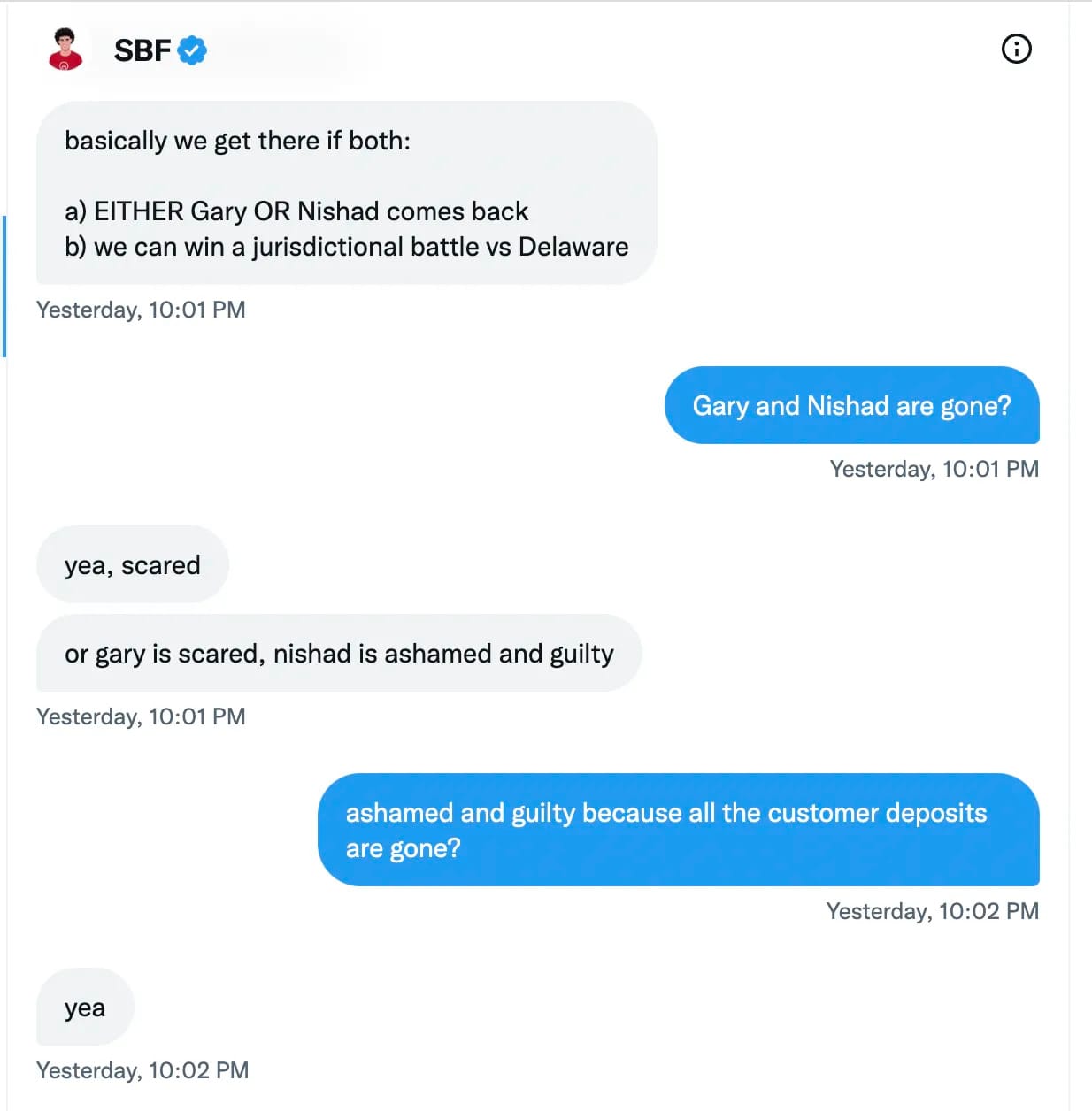

Super secret questions

Not included in this filing, but following shortly after it in Document 588, were partially-redacted requests for subpoenas to do with the debtors' attempts to recover the more than $300 million that was stolen from FTX and FTX US the same day as the bankruptcy was declared. The targets of the subpoena are redacted, as are all the requested documents.

The motion is extremely frustrating to read, because I'm sure it's got some really juicy details, but sadly my curiosity does not trump the need to not impede the debtors' investigation.

![PRELIMINARY STATEMF],NT The Debtors have been engaged in a time-sensitive investigation to attempt to recover, [redacted], over $300 million of the Debtors' cryptocurrency assets at the outset of the bankruptcy by accessing the Debtors' computer environment without authorization. Through their investigation, the Debtors have identified [redacted] In addition, the Debtors' investigation has also revealed [redacted] The matter is urgent given that [redacted]](https://www.citationneeded.news/content/images/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https-3a-2f-2fsubstack-post-media.s3.amazonaws.com-2fpublic-2fimages-2fabc18083-d424-4ae5-8be1-67368c09a0f3_1236x786.png)