The FTX trial, day nine: Nishad Singh: "I have always been intimidated by Sam"

Singh testified that Bankman-Fried pressured him into trying to dig FTX out of a hole he didn't even know about until the very end.

If I'm being honest, I came away from Monday's testimony feeling a little sorry for Nishad Singh despite everything. Maybe I'm softhearted, or just gullible. But if the jury felt similarly, that's very bad news for Sam Bankman-Fried, who once again came off as the villain. Then again, after the third strong testimony from a co-conspirator who unequivocally implicates Bankman-Fried in orchestrating the fraud at FTX, it may not matter much how the jury feels about Singh.

Singh was FTX's director of engineering, a role he took after first working as a software engineer at Alameda Research, and then at FTX. He and Bankman-Fried went way back: they attended the same high school, and Singh was friends with Bankman-Fried's younger brother, Gabe. Singh met Sam in his sophomore or junior year, and stated that he had always found him intimidating. "Sam is a formidable character, brilliant, so I had a lot of admiration and respect for him. Over time I think a lot of that eroded, and I grew distrustful," he testified. Singh has pleaded guilty to six charges: the same sorts of conspiracy charges as Ellison and Wang, but also a charge of conspiracy to violate campaign finance laws.

Singh, like Bankman-Fried and many others at FTX and Alameda Research, was an adherent to the effective altruism philosophy, but sometimes butted heads with Bankman-Fried over actions he didn't feel were aligned with effective altruist goals. He frequently complained to Bankman-Fried about what he perceived as excessive spending, testifying that he "felt kind of embarrassed and ashamed of how — how much it all reeked of excess and flashiness. It didn't align with what I thought we were building a company for." At one point, Bankman-Fried humiliated Singh by accusing him in front of others of "sowing seeds of doubt in the company decisions", saying that people like Singh were "the real insidious problem here."

To hear Singh tell it, he didn't even really realize what was going on at FTX and Alameda Research until September 2022 — only a month or two before everything came crashing down.

Although Singh was the one who in 2019 implemented the allow_negative flag we saw in code screenshots from Gary Wang's testimony, Singh claimed (and Wang also testified) that its original purpose was legitimate, and only later did Wang add functionality that exempted Alameda from liquidation and gave them unlimited credit.

Several times throughout various testimonies, we've seen a document written by Sam Bankman-Fried, in which he describes his thinking that Alameda Research should be shut down. That document was, ultimately, how Singh learned in September 2022 that Alameda Research had taken billions of dollars of customer funds from FTX. Although Bankman-Fried had not originally shared the document with Alameda Research's CEO, Caroline Ellison, Singh decided to speak with her about the plan's viability in a group chat that also contained Bankman-Fried and Gary Wang.

Assistant US Attorney: So how did Caroline Ellison respond to your message?

Nishad Singh: She said — and I believe verbatim — "That's impossible."

AUSA: How did you respond to that?

Singh: I said: Which part of it? I was pretty alarmed. And I was hoping it wasn't the part about closing out accounts.

AUSA: What did she say?

Singh: That it was the part about closing out accounts.

This was when Gary Wang told Singh that Alameda was borrowing massive amounts of customer money from FTX — at the time, around $13 billion of it. Singh testified that he felt "really afraid", and called an in-person meeting immediately. Bankman-Fried, who was sitting next to Singh at the time, "seemed unsurprised and made up what I understood to be a false excuse for dodging the meeting." Singh, Ellison, and Wang met without him, and Singh confirmed his fears: that he had not misunderstood Wang, and that Alameda had actually taken customer funds to that extent.

At that point, Singh testified that he asked Bankman-Fried to meet one-on-one. The two spoke on the balcony of their shared luxury penthouse, a location Singh chose for privacy.

Singh confronted him about the misappropriated funds, and described a remarkable conversation in which Bankman-Fried said something like, "I'm not sure what there is to worry about." When Singh mentioned the missing billions, Bankman-Fried said, "Right, that. We are a little short on deliverable". At that point, Bankman-Fried outlined plans to repay the funds by raising money from investors, rolling out futures trading in the US, and — at Singh's prodding — reducing their extravagant spending.

In a rather dramatic portion of his testimony, Singh described how he felt: "I was blindsided and horrified. I felt really betrayed, that five years of blood, sweat, and tears from me and so many employees, driving towards something that I thought was a beautiful force for good, had turned out to be so evil."

He thought about leaving the company then, he testified, but worried that his departure could cause everything to fall apart. He felt that if he stayed, maybe he could help the companies make back what they owed.

According to Singh, over the next few months he ran up against Bankman-Fried multiple times in trying to make progress towards that goal. At one point, during a private conversation in Bankman-Fried's other apartmenta, Singh tried to raise concerns that a planned investment by Saudi prince Mohammed bin Salman1 would not be sufficient to close the hole in the companies' finances. Bankman-Fried first told Singh how he was crucial to making FTX successful, allowing them to repay the funds. However, Singh described the overall tenor of the meeting: "Sam was on edge, and I felt he was very mad at me for talking about this, and it was tense. There were long periods of silence. Sam has a — some physical twitches for when he gets angry. … I ended up apologizing to him at the end for asking for the meeting because I could tell it was so unwelcome."

At other points, Singh tried to hold Bankman-Fried to account on his promises that FTX would curtail the spending that Singh already felt was inappropriate, but now he was concerned was digging only a deeper hole in the company finances. He described that Bankman-Fried either downplayed his concerns, or steamrolled them. "We're going ahead with this," he said in one instance.

Shortly after Singh discovered the misappropriation of customer funds, Bankman-Fried asked him to help cover it up, he testified. Bankman-Fried asked Singh to transfer Serum tokensb belonging to himself, Singh, Wang, and Ellison into Alameda's account, backdating the transfers so that the transactions appeared to have happened much earlier, and updating his collateral calculations to not account for the fact that the Serum tokens were locked and thus couldn't be sold. "I understood the purpose to be to fool the eventual recipient of this — this, like, data that I was collecting, which was the CFTC." Singh stated that he never did the transactions because he wasn't comfortable trying to fool a US regulator.

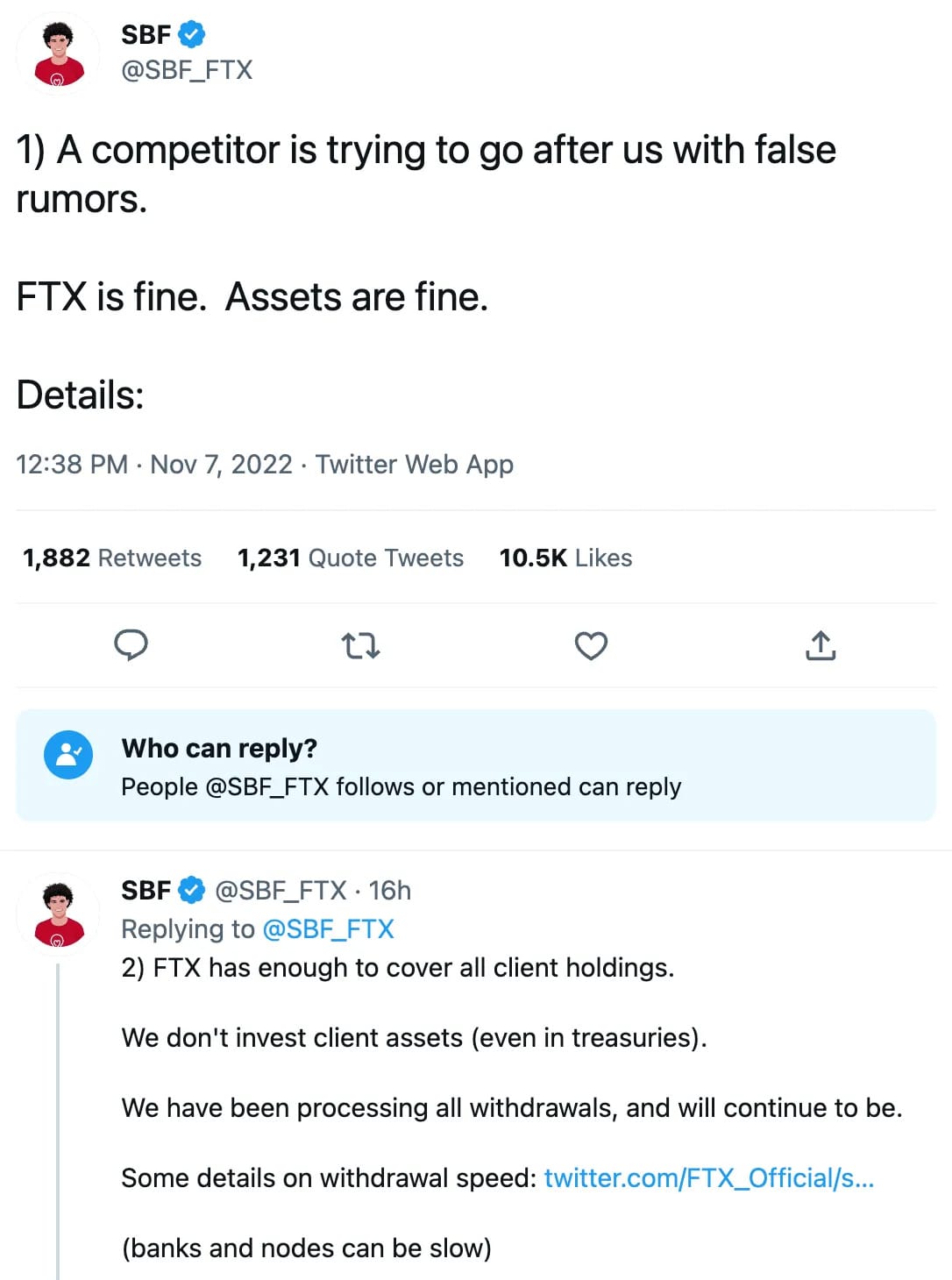

When customers began withdrawing their funds all at once, Singh was a part of the "war room" that tried to handle the crisis. However, he claims that at times he was uncomfortable with what was happening, but felt he had no control to intervene. While Bankman-Fried and others were drafting Bankman-Fried's tweet to try to reassure customers — the one where he wrote that "FTX is fine. Assets are fine." — Singh testified that he announced he was "recusing" himself from the conversation because he was uncomfortable with what was being proposed. "I mostly wanted to express that I didn't approve of this and — but I didn't — I acknowledged I didn't have the power to stop them. I'd already made clear my preferences on what to say and so I just didn't want to be involved. … It was really dishonest."

Later, once things had finally collapsed, Singh testified that the pressure and guilt got to him. He described panicking and asking if he could backdate falsified transactions that would make it appear within company records as though he had paid off all the loans that were in his name. Bankman-Fried approved, writing, "I think that's probably fine". However, Singh never went through with it. He testified, "It felt wrong. I was not — not to make an excuse for my having proposed this, not at all, but I was in different levels of having a right mind throughout these days, and in better moments, I didn't pursue it." He stated that by November 8, he'd "been suicidal for some days."

Despite Singh's testimony that he didn't know about the billions in misappropriated customer funds until September 2022, he wasn't exactly squeaky clean up until that point either. How much of it was due to naïveté and how much was willful criminal activity is, I suppose, a question for the judge to answer in sentencing.

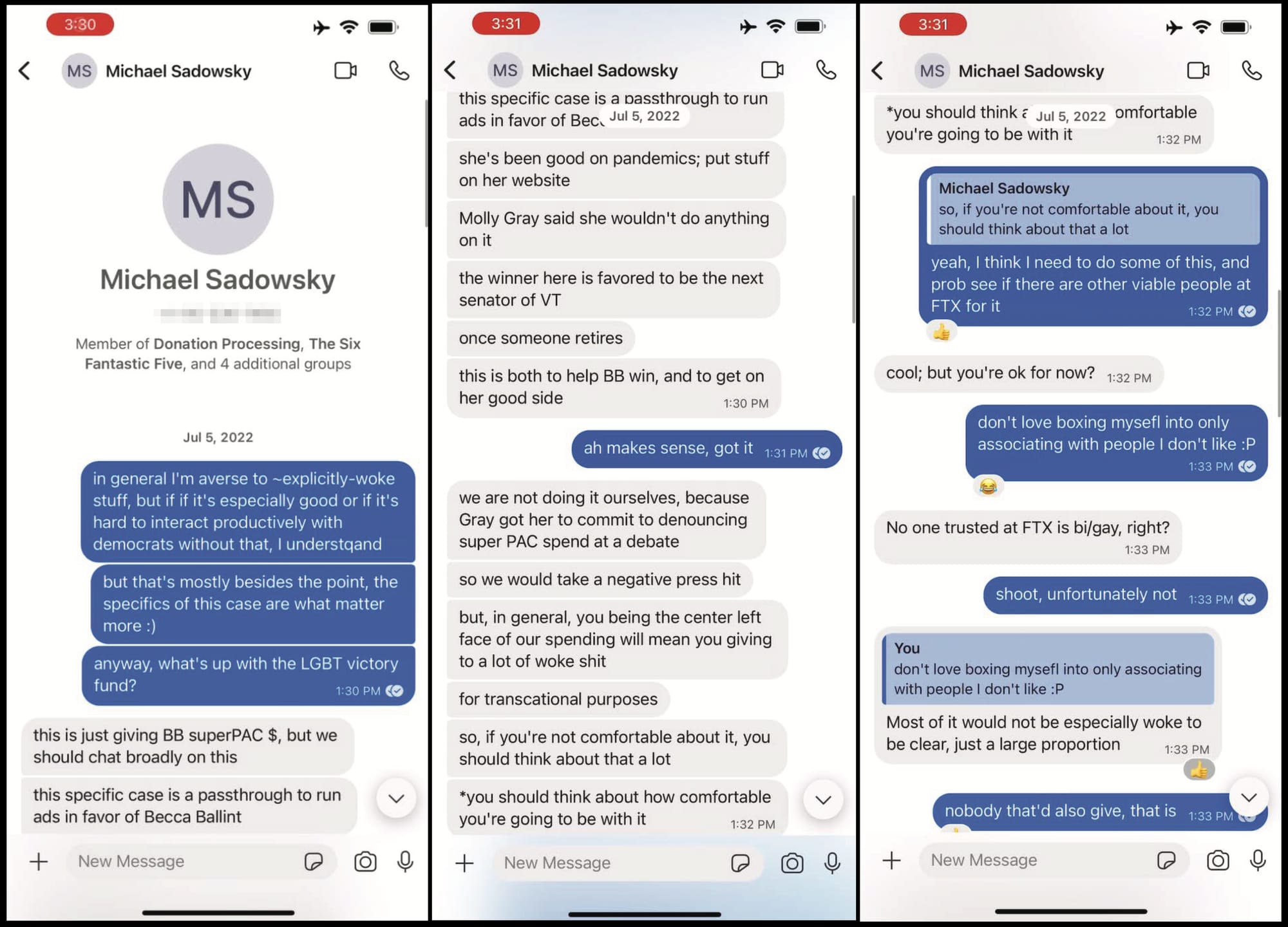

For example, Singh routinely rubber-stamped donations made in his name to causes and political candidates he had never even heard about, "for advantageous optics". As stated by Michael Sadowsky, a partner of Gabe Bankman-Fried's at his Guarding Against Pandemics political action committee, Singh had been designated "the center-left face of our spending" which meant he would be "giving to a lot of woke shit for transactional purposes." Although Singh testified that he felt uncomfortable with the straw donations, and wanted to find another employee willing to take his place, it seems like that never happened.

At various points, and at Bankman-Fried's request, Singh took out massive loans that he understood were not for his personal benefit, but instead would be funneled into FTX US and used for various other purposes. On this, he testified that lawyers would "paper up [the] transaction", so it is possible that at the time he believed this was above board, although he didn't go into detail on that.

The FTX customer

Prior to Singh's testimony, another former FTX customer was called as a witness. Tareq Morad, a Canadian hotel owner, had deposited around US$500,000 into FTX by wire transfer in April 2021. By the time of FTX's collapse, the assets in his account were, if estimated in US dollar value, a little under $260,000. He was never able to withdraw any of them. Placated by Sam Bankman-Fried's "FTX is fine" tweet, he didn't try to withdraw any funds until the next day, by which point it was too late.

Behind the scenes

While lawyers on both sides and the judge had expressed their hopes last week that the plan to provide Bankman-Fried with an extended-release dose of Adderall would solve his ongoing medication access issues (see background from early September and then last week), that never happened.

At the beginning of the day, the judge himself stepped in to try to help Bankman-Fried's defense team get in contact with the proper person at MDC Brooklyn.

By the end of the day, the judge had learned that the soonest the extended-release medication could be available would be Thursday. The defense asked to adjourn until the medication could be provided, which the judge declined. He explained: "I have not observed a problem with the defendant in this period of time. Not that I'm medically competent, but I just make that note. … The bottom line here is that I have no competent medical evidence that is short of months old. … I don't even have a medical opinion that he needs it now, or what the effect of not taking it is, and we're going to proceed." He noted that the defense could have provided that medical evidence, and had not done so.

The government's attorneys noted that physicians at the Bureau of Prisons had evaluated Bankman-Fried and determined that a lower dosage was appropriate for him;c they also noted testimony from various witnesses that Bankman-Fried's original doctor in The Bahamas "was liberally prescribing Adderall to people who told us that they did not need Adderall at all or at that level."

The judge, perhaps a bit exasperated, explained that he was not qualified to make medical decisions, nor was it within his power to authorize Marshals to provide Bankman-Fried's attorneys with medications to dispense to their client at lunchtime, as they had requested. He dismissed the two teams, presumably to try to find some physicians to back up what they each had to say. And with that, the trial will continue on schedule.

Tomorrow will bring the cross-examination of Nishad Singh. After that will be testimony from Richard Busick, the FBI special agent who intends to attest to Bankman-Fried's whereabouts based on cell site analysis. Following that will be Chanel Medrano, about whom I know nothing.d

Footnotes

Bankman-Fried lived for much of the time with roommates in "The Orchid", the luxury penthouse I've mentioned several times. However, he also had another apartment in which he stayed sometimes — possibly because of his strained romantic relationship with Ellison, who was also a tenant at The Orchid. ↩

Serum tokens were created by Bankman-Fried and Gary Wang, and many FTX employees had purchased them at special prices during the token presale. ↩

While Bankman-Fried's company physician may have been overly liberal in issuing ADHD prescriptions, it's worth noting that the BOP physicians likely hold some bias in the opposite direction. ↩

So far, the unknown names have all been FTX customers testifying to their experience, but that's completely speculative on my part. ↩

References

Interesting tidbit: Anthony Scaramucci reportedly accompanied Sam Bankman-Fried and FTX employee Ramnik Arora on this trip. ↩