Trump’s newest grift: Building a cryptocurrency empire while destroying its regulators

Inside the Trump family’s sprawling crypto empire — from memecoins to mining — and how Trump is using presidential power to dismantle the regulators who could stop it

In an unprecedented abuse of presidential power, Donald Trump is dismantling federal cryptocurrency oversight while building a sprawling family crypto empire worth billions. Through World Liberty Financial, a planned decentralized finance platform that also recently announced its own stablecoin, the Trump family is positioning to profit from facilitating cryptocurrency lending and trading. Through Truth.Fi, they seek direct exposure to bitcoin and profits from hawking investment products to Trump’s most loyal base. Through a new bitcoin mining venture, they’re gaining control over crypto infrastructure and expanding exposure to assets that Trump himself can influence from the White House. And through a series of memecoins, NFTs, and even a planned crypto game, the Trumps are converting political support directly into cash. This empire is set to profit precisely because Trump is gutting the regulations that would normally constrain it — brazen self-dealing that dwarfs even the unchecked emoluments violations of his first term. This is only one of the many widespread abuses characterizing the most flagrant exploitation of presidential authority in American history.a

Since Trump took office, federal agencies have issued a torrent of announcements stripping away long-established financial regulations and criminal oversight from crypto businesses — dismantling what little oversight existed in the already predatory and poorly regulated industry. As these guardrails fall, the Trump family has aggressively expanded their ventures, which now span nearly every corner of the cryptocurrency world. These projects don’t just generate direct profits — they create new opportunities for outside interests to gain favor through cryptocurrency "investments" that would be illegal as campaign contributions. The timing and scope of these developments clearly demonstrate that federal policy is being weaponized for personal profit.

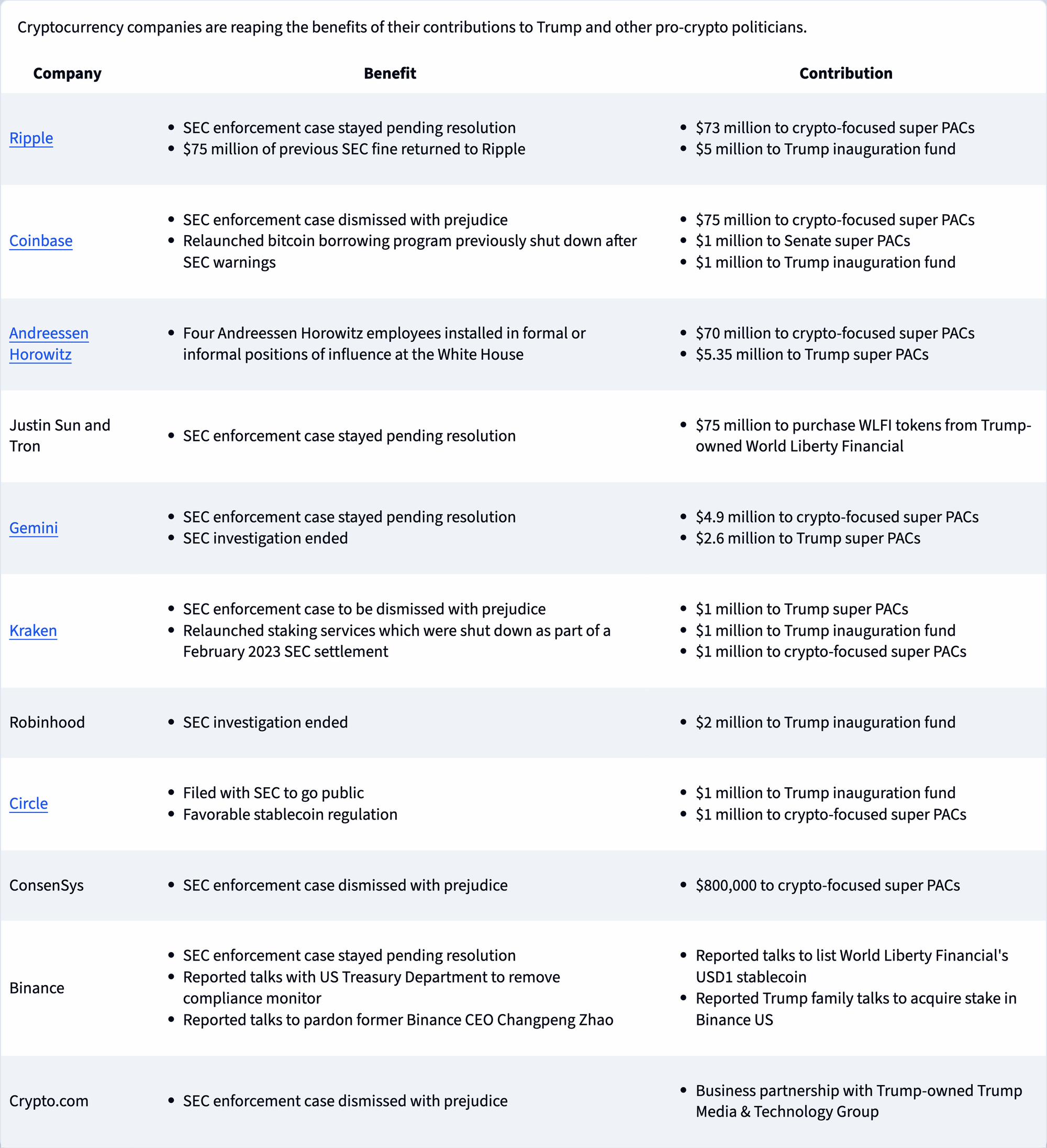

Crypto industry backers

Trump has received at least $20 million in publicly reported political contributions from crypto benefactors, including $5 million from Ripple, $5 million from Andreessen Horowitz, and several million more from Coinbase, Gemini, Kraken, and Circle.

The benefits to these companies have been substantial: at least eight SEC enforcement cases against cryptocurrency firms have been dropped with prejudice or stayed pending resolution. Many have also been invited to shape the new rules for their industry, giving them a priceless opportunity to establish a profitable environment without burdensome financial oversight, legal compliance, and consumer protection requirements.

Far from only benefiting outside companies that bought favors in government, these changes are also paving the way for the Trump family’s business ventures.

World Liberty Financial

World Liberty Financial is a cryptocurrency company created by Trump and several partners in August 2024. The project was co-founded by Zach Witkoff, son of Steven Witkoff: a longtime Trump associate, the newly appointed US Special Envoy to the Middle East, and, more recently, Trump’s personal envoy to Vladimir Putin.1 The elder Witkoff also introduced the Trumps to the project’s other co-founders.

Although the project was entirely branded around Trump, his sons were prominently listed on the website with titles like “defi visionary” and “web3 ambassador”, and Trump was to receive 75% of protocol revenues from the outset, the Trump family nevertheless initially tried to maintain the illusion of an arms-length relationship to the enterprise.

When Trump was inaugurated, he dropped the pretense and took majority control of the company with a 60% stake.2

The project hasn’t launched a trading platform, but the Trumps have discussed a decentralized finance platform for crypto financial services with promises of “democratiz[ing] finance”.2 Recently, World Liberty announced its own stablecoin, USD1 (despite Trump’s past warnings about similar cryptocurrencies, which he described as currencies that “would give a federal government — our federal government — absolute control over your money” [I80]).

And not having any actual platform to speak of has of course not limited World Liberty Financial from raking in money — it raised $550 million in its initial $WLFI token sale, putting Trump’s 75% cut at almost $400 million. $75 million came from Justin Sun, a crypto entrepreneur with a shady past [I71] who, as a foreign national, couldn’t contribute to Trump’s campaign. He was, at the time, facing a lawsuit from the Securities and Exchange Commission alleging fraud. Recent reporting also suggests he was under investigation by the Justice Department, at least as of late 2024.3 With his investment, he earned an advisory position with World Liberty Financial, and shortly after Trump was inaugurated, the SEC case against him and his company was stayed pending potential resolution [I78].

The WLFI token is unusual: the project describes it as a governance token, which is a type of token which normally grants holders the right to vote on a project’s direction. However, the project team has made decisions like launching a stablecoin unilaterally and without a vote. The token has unusual restrictions that seemed carefully crafted to dodge the pre-Trump era SEC: it’s only available for purchase by non-US citizens or accredited investors, and it’s not tradeable. However, some hope these restrictions will be lifted after the SEC’s defanging is complete, potentially making for lucrative trading.

Allegations of insider trading and quid pro quo deals [I76] have plagued the project, particularly amid reports of unusual token swaps with other cryptocurrency companies. For example, a World Liberty deal to acquire around $2 million of a Movement Labs token coincided with rumors of Movement’s talks with Elon Musk’s Department of Government Efficiency about integrating blockchain technology into government operations. (Both World Liberty and Movement Labs denied these allegations.)4 But an April 8 memo from Deputy Attorney General Todd Blanche, citing Trump’s executive order on crypto, dismantled the Department of Justice’s cryptocurrency investigations team and directed the Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”. This may well have eliminated any remaining chance of a federal investigation into allegations of malfeasance in a business venture controlled by the president and his family [I81].

As for the stablecoin, the timing is significant: World Liberty Financial announced plans to issue USD1 on March 25, and just ten days later the Securities and Exchange Commission published a statement declaring that "covered" stablecoins fall outside its authority, and that companies issuing stablecoins need not register.5 Meanwhile, a Trump-aligned Congress is working to pass new, friendly stablecoin legislation [I79] with substantial direction from the cryptocurrency industry, which spent over $130 million installing crypto-friendly legislators last election cycle.

World Liberty Financial has also reportedly been in talks with cryptocurrency giant Binance about listing the USD1 stablecoin on their platform — a deal that could be highly profitable for World Liberty by giving them access to traders on the world’s largest crypto exchange. These discussions coincided with separate negotiations between Binance and the Treasury Department, where Binance is seeking to remove the compliance monitor installed as part of the company’s guilty plea agreement, in which they paid over $4 billion after knowingly violating anti-money laundering laws and sanctions.3

Truth Social and Truth.Fi

Trump Media & Technology Group, behind Trump’s Truth Social platform, is also newly exploring the cryptocurrency world. Trump owns about 53% of the shares, estimated to be worth around $2 billion, in the publicly traded company, which recently submitted filings to allow the trust holding his shares (controlled by Donald Trump Jr.) to sell them [I81].

In January, the company announced it would enter the fintech space with a brand called Truth.Fi, focusing on “America First investment vehicles”.6 On March 24, TMTG announced a partnership with Singapore-based crypto exchange Crypto.com — a company under SEC investigation, that had in August 2024 received a Wells notice informing them of an impending enforcement action [I68]. On March 27, only three days after the partnership announcement, Crypto.com revealed that the SEC had dropped its investigation [I81].

Simultaneously with its announcement about entering fintech, TMTG announced it would allocate up to $250 million of its cash reserves into investment vehicles including bitcoin and other cryptocurrencies.7 By investing in crypto, the company (and thus Trump) stands to profit from Trump’s own actions to pump crypto prices, including announcing a bitcoin strategic reserve to “elevate this critical industry”, and exploring avenues to use government money to buy bitcoin [I80].

A crypto game

Fortune recently reported that Trump plans to release a blockchain-based real estate-themed game similar to Monopoly.8 Unlike many traditional games where players use in-game currencies that can’t be transferred outside of the game, crypto games often aim to use cryptocurrencies for game economies, attracting players with promises of earning real money simply by playing a video game. Blockchain games, sometimes dubbed “play-to-earn” games, have a troubled history, struggling to balance in-game economies where wealthier players can simply pay to win, poorer players can’t afford to play at all, and more and more new players must constantly join to sustain token prices.b Games like Axie Infinity, which surged in popularity in late 2021, spawned a form of digital sharecropping where wealthier individuals leased in-game assets to those in the Philippines and other lower-wage areas, who were promised they could earn more playing these video games than from other local jobs.9 Other moral issues arose from children playing games with gambling-like mechanics, where they were encouraged to spend (and often later lose) real money on new characters or items. Then, of course, there was the record-breaking $625 million Axie Infinity exploit by North Korean hackers in March 2022 [W3IGG], which caused players’ tokens to plummet in value and never recover.

Before the second Trump administration, play-to-earn games faced new regulatory scrutiny. In its lawsuits against Coinbase and Binance, the Securities and Exchange Commission listed Axie Infinity’s $AXS token and The Sandbox’s $SAND token among the unregistered securities they alleged the exchanges had listed. The lawsuit against Binance also named Decentraland’s $MANA token, which, like $SAND, is used in-game to buy land [I29]. The Consumer Financial Protection Bureau was zeroing in on player exploitation via in-game currencies — crypto and otherwise — that could be converted to real-world money [I73].1011

Since his inauguration, Trump has been hard at work bulldozing regulatory or legal barriers for crypto companies that could require registration with financial regulators, more burdensome oversight, customer support programs and recourse for players whose in-game and/or crypto assets are stolen, and limits on gambling mechanisms in games — all things that would cut into crypto gaming companies’ profits. The Securities and Exchange Commission has practically broken the sound barrier in its race to drop investigations and enforcement actions (including the lawsuits involving Binance and Coinbase naming the gaming tokens as securities). They’ve also declared most cryptocurrency assets exempt from its authority, and invited crypto executives and lobbyists to write their own rules. The Trump administration has been working to shut down the CFPB entirely, with vocal support from crypto industry executives [Debanking]. Meanwhile, Congress is chipping away CFPB regulations where both the House and Senate recently voted to overturn the CFPB’s rule on crypto games, which also would have applied broader protections for crypto holders outside of the gaming sector. These votes fell along party lines, with all Democrats and Independents opposing the removal of the rule and all Republicans except for one token Senator supporting its nullification.1213 All that remains is for Trump to sign the bill eliminating the rule, in a move that will personally profit him.

Bitcoin mining

In late March, Trump’s sons Eric and Donald Jr. announced their investment in a bitcoin mining company called American Bitcoin [I81], where Eric Trump also took the Chief Strategy Officer role. The company was created through a deal with existing American bitcoin mining firm Hut8, which contributed “substantially all” of its bitcoin mining machines. This deal raised eyebrows among observers including VanEck analyst Matthew Sigel, who commented, “I don’t fully understand the rationale of selling 61,000 miners in exchange for an 80% stake in a subsidiary that they previously owned 100% of.”14 It seems to me that Hut8 determined a 20% donation to the Trump family was worth the benefits of getting looped into the Trump crypto empire.

Eric Trump announced plans for the company to go public and hinted at a future partnership with World Liberty Financial. They also intend to stockpile some of the bitcoin they mine, again adding potential upside if Trump successfully boosts bitcoin prices.15

Memecoins

Days before Trump’s inauguration, he dropped the $TRUMP memecoin, horrifying even some of his most devoted crypto industry supporters who described the cash-grab as “absolutely preposterous … plumbing new depths of idiocy” [I75]. Shortly after, the Trump family launched a $MELANIA memecoin, seemingly seeking a second windfall. While memecoin valuations are challenging to calculate accurately, the Financial Times estimated in early March that he and his team had profited at least $350 million from the stunt.16 On April 15, the Trump-controlled wallet appeared to cash out an additional $4.6 million.17

The $MELANIA token team also appeared to cash out around $4.5 million in late March and early April.17 On April 7, Bubblemaps reported insiders had moved more tokens, notionally worth around $30 million, from project’s designated “community” wallets and began selling them.18 This followed reports that the $MELANIA token team is the same group involved in malfeasance around $LIBRA, a token affiliated with Argentina’s president Milei, and a widespread insider trading scandal involving Solana-based memecoins [I77].

The initial token allocation for the $TRUMP memecoin granted the president and his affiliates 80% control, but prescribed a schedule for gradual unlocking over three years. The first unlock is nearly here, allowing Trump to unload another 40 million tokens (notionally priced at around $310 million as of writing). Most early purchasers of the $TRUMP token have lost money, with the token plummeting below $5 from its early heights of around $75.19

The Trump family’s memecoin capers are also unlikely to attract any substantial regulatory scrutiny with the regulators firmly under Trump’s thumb. On February 27, the SEC stated that memecoins too fell outside their authority.20 Criminal activity involving memecoins might normally fall to the Justice Department, had they not been directed to spend their fraud department’s resources on “immigration and procurement frauds” instead of crypto.

NFTs

Don’t forget the NFTs. Melania Trump got to them first, issuing her first collection in December 2021 [W3IGG]. After tepid interest, she ultimately appeared to purchase her own NFT for around $170,000 after it failed to attract the ~$250,000 opening bid she’d asked [W3IGG]. A second NFT project in July 2023 attracted a different kind of controversy when she used NASA images in likely violation of NASA’s merchandising policies. It too drew limited interest, selling only 55 tokens within a week for a combined total of less than $5,000 [W3IGG].

Trump was somewhat more successful in finding buyers for his NFT projects, launching the first one in December 2022. Following the post-NFT crash trend of describing them not as NFTs but as “digital trading cards”, the first “Trump Card” NFTs feature uncanny, heavily-muscled, noticeably younger-looking illustrations of the president in various heroic outfits.

Later editions featured Trump’s mugshot, and bulk buyers could earn upgrades including scraps of the suit Trump wore in the mugshot, or dinner with the president during an off day from his New York criminal trial.

Crypto holdings

While the specifics of the Trump family’s crypto holdings remain largely unknown, financial disclosures and blockchain records shed some light. In August 2024, Trump reported holding $1 million to $5 million in ETH,21 which matched with a publicly disclosed Ethereum wallet then holding around $2.28 million worth of the token. Trump later sold sizable portions of those tokens beginning in December 2024.22

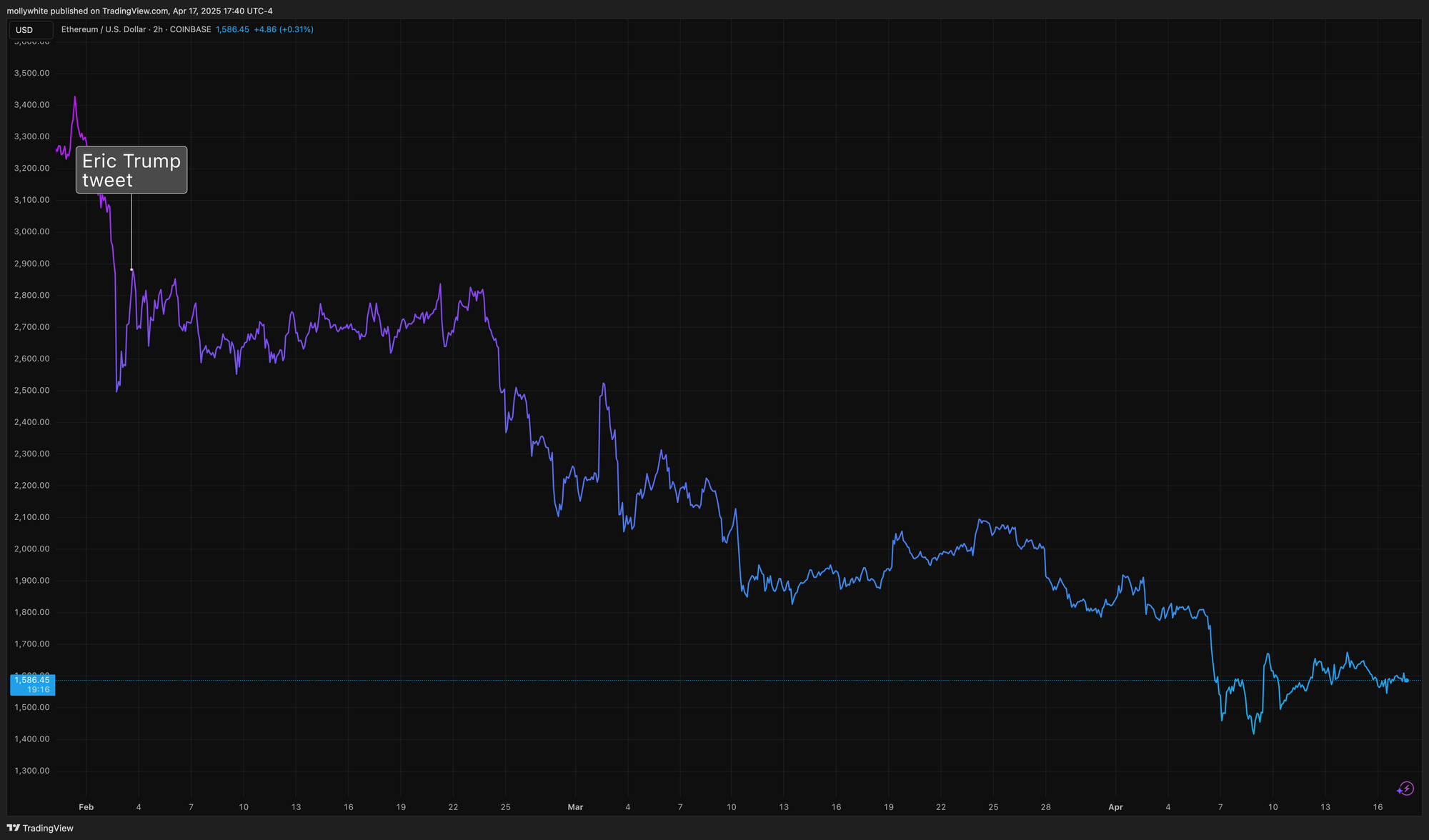

The personal crypto holdings of Trump family members who stand to benefit from market movements under Trump have not been publicly disclosed. Some seem keen to experiment with moving markets themselves, with Eric Trump tweeting “In my opinion, it’s a great time to add $ETH. You can thank me later” in February, right around the time World Liberty Financial was moving a substantial amount of ETH to Coinbase [I76].

That’s not to mention the substantial risk of insider trading by those close to Trump, who may have insight into his unpredictable behaviors that have flung the broader economy into turmoil. Concerns about insider trading have arisen as insiders may have bought the dip in traditional equities markets caused by Trump’s “Liberation Day” tariff announcements, earning them profits as subsequent announcements of tariff pauses kicked off a brief rebound. The same behavior could just as likely be happening in the crypto world, too, as bitcoin and other crypto prices follow broader market movements and could be exploited for personal profit with advance knowledge of Trump’s plans.

The scope of the Trump family’s cryptocurrency conflicts illustrates a degree of corruption that makes the emoluments concerns of Trump’s first term seem quaint by comparison. Through his crypto ventures, Trump has created multiple avenues for personal enrichment: direct profits from cryptocurrency holdings and businesses, regulatory changes that boost his investments, potential insider trading, and opportunities for outside interests to buy favor through crypto “investments” that would be prohibited as campaign contributions. His dismantling of cryptocurrency oversight leaves consumers vulnerable to fraud and manipulation, while ensuring that neither he nor his benefactors will face meaningful scrutiny.

Despite the scale of these conflicts and the clear abuse of power, attempts to check this corruption have been limited and largely ineffective thus far. Democratic Senators have sent letters about both crypto-based and traditional asset-based financial corruption to the SEC Inspector General,23 the SEC,2425 the Deputy Attorney General,26 and state Attorneys General27, pushing for investigations into Trump’s and his administration officials’ conflicts of interest. If there’s been any action on these letters, it hasn’t publicly materialized.

Instead, the gutting of regulatory oversight has continued, creating a dangerous convergence of the president’s financial interests and his power to shape policy. The ensuing regulatory vacuum will allow cryptocurrency markets to become increasingly susceptible to manipulation and abuse, while providing cover for fraud, money laundering, bribery, and other crimes. The industry under Trump is on course to become even more of a predatory playground where insiders profit from exploitative schemes — high-risk lending programs promising to “democratize wealth”, unchecked bad actors peddling investment scams disguised as business opportunities, and memecoins functioning as thinly-veiled pump-and-dump operations — while ordinary investors are left without protection or recourse. And the degree to which the government has been embracing crypto also poses a risk to those who haven’t gotten involved in crypto trading at all, as regulations limiting things like banks becoming heavily exposed to crypto, or pension and retirement funds incorporating crypto into portfolios, threaten contagion that everyday people could be forced to bear.

I have disclosures for my work and writing pertaining to cryptocurrencies.

Correction: The Follow the Crypto table of benefits to cryptocurrency companies in an earlier version of this issue erroneously reported that an enforcement case against Crypto.com had been dropped. Crypto.com had been subject to an SEC investigation and had received a Wells notice; the investigation was ended with no action.

Footnotes

It feels weird to write this without noting that there are substantially more horrific abuses happening as we speak, such as the kidnapping and disappearance of Kilmar Abrego Garcia and others, without due process or even apparently genuine suspicion of wrongdoing, to a horrific mega-prison in El Salvador. I write about the financial abuses of the Trumps because it is my beat, and it is where I hope I can make something of a difference with my expertise, but I want to direct you to the excellent coverage from experts in that field such as Immigration Impact.↩

References

“To Engage Putin, Trump Turns to an Untested Emissary”, The New York Times. ↩

“Insight: How the Trump family took over a crypto firm as it raised hundreds of millions”, Reuters. ↩

“Binance Seeks to Curb U.S. Oversight While in Deal Talks With Trump’s Crypto Company”, The Wall Street Journal. ↩

“Trump-backed World Liberty Financial disputes allegations of 'selling tokens' to crypto teams”, The Block. ↩

“Statement on Stablecoins”, US Securities and Exchange Commission. ↩

“Trump Media Launches Separately Managed Accounts”, press release by Trump Media & Technology Group. ↩

“Trump Media Announces Expansion into Financial Services”, press release by Trump Media & Technology Group. ↩

“Trump’s latest crypto venture will be a real estate video game”, Fortune Crypto. ↩

“To infinity and back: Inside Axie’s disastrous year”, Rest of World. ↩

“Banking in video games and virtual worlds”, Consumer Financial Protection Bureau. ↩

“Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications”, Consumer Financial Protection Bureau. ↩

Roll Call Vote 119th Congress - 1st Session On the Joint Resolution (S.J. Res. 28). ↩

Roll Call 95, Bill Number: S. J. Res. 28. ↩

“The Trump Family Advances Its All-Out Crypto Blitz, This Time With Bitcoin Mining”, The Wall Street Journal. ↩

“Donald Trump’s crypto project netted $350mn from presidential memecoin”, Financial Times. ↩

“Official Trump memecoin wallet cashes out $4.6m to Coinbase ahead of team unlocks”, DL News. ↩

“Early Crypto Traders Had Speedy Profit on Trump Coin as Others Suffered Losses”, The New York Times. ↩

“Staff Statement on Meme Coins”, US Securities and Exchange Commission. ↩

Letter to SEC Inspector General Deborah Jeffrey, April 2, 2025. ↩

Letter to SEC Chairman Paul Atkins, April 11, 2025. ↩

Letter to SEC Acting Chairman Paul Atkins, April 2, 2025. ↩

Letter to Deputy Attorney General Todd Blanche, April 10, 2025. ↩

Letter to the National Association of Attorneys General, April 11, 2025. ↩