Issue 57 - I take deep breath and I get real high

Changpeng Zhao's sentencing, FOIA requests reveal past FBI investigations into Coinbase, and the SEC is on a Wells notice bender.

Before I launch into the writing that I do just for you, my beloved readers of Citation Needed, I wanted to share some writing I did for the slightly broader audience of Bloomberg Businessweek: "The State of Crypto Is Anything But Strong". I hope you enjoy the GIF illustrations of little guys with little ties blowing in the wind as much as I did. Someone asked if I would be republishing the article as a newsletter issue, which is unfortunately not allowed per most standard freelance writing contracts, but I can share a gift link so you can read it even if you don't subscribe to them. Heads up that it will expire in about three days.

That's not the only place where I came up in Bloomberg recently. Yesterday, I discovered that they not only convinced Andreessen Horowitz's Chris Dixon to sit for an interview, but also to do a whole photoshoot, and then started out their article about him and his book with a link to, and quote from, my "skewering" of it:

They at least were kind enough to give him an opportunity to comment, which he chose to use by saying that I am "a professional anti-crypto person". He's... not wrong? I am anti-crypto, and my primary source of income these days is this newsletter, where I certainly write about that a lot. But I suspect he intended a bit more innuendo than that.

After that, Bloomberg goes into how Dixon's early picks at Andreessen Horowitz turned out to be duds, link to my article for them about how the "crypto scene oozes with reasons for the public to distrust it", and finish with a vignette of Dixon signing a couple dozen copies of his book that were purchased by a16z. If I was Dixon in this scenario, I'd probably be pretty steamed, but since I'm not, this is hilarious.

In the courts

Binance

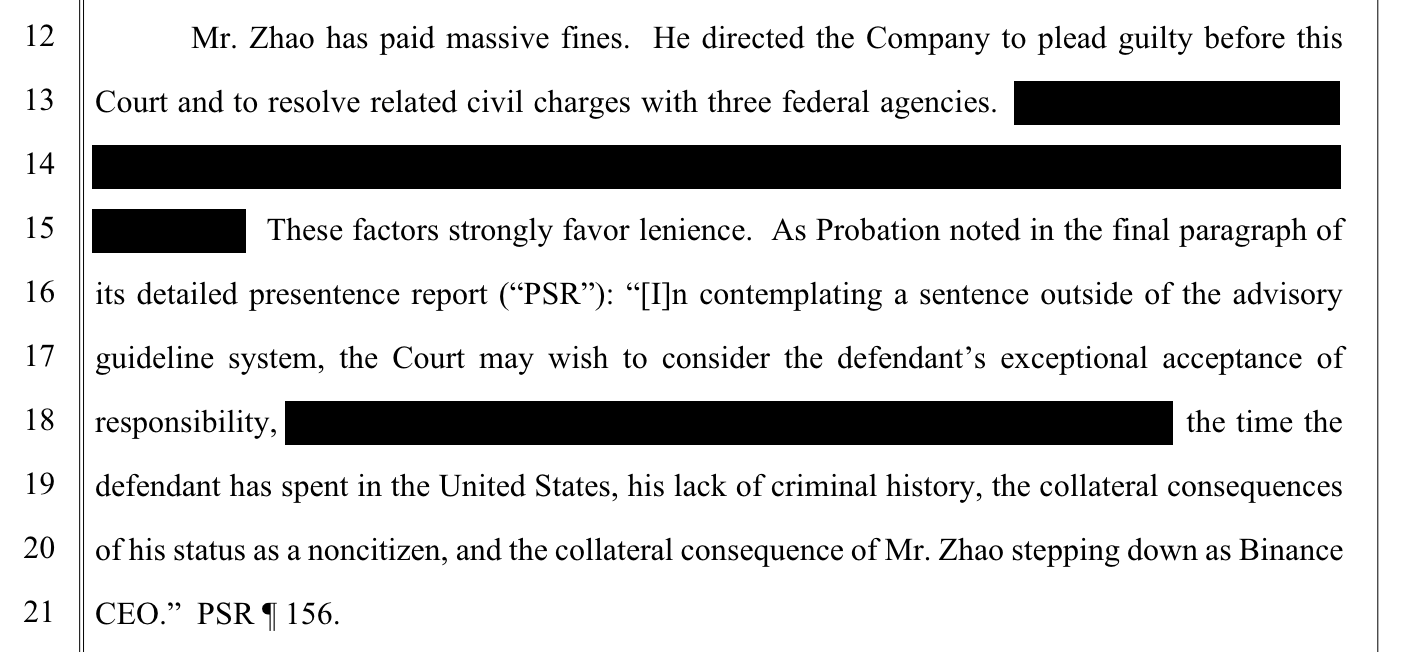

Binance CEO Changpeng Zhao was sentenced to four months in prison [W3IGG]. This was a slight downward departure from the Probation Office's recommended five month sentence. It was substantially lower than the three years requested by prosecutors, who argued that a longer sentence was justified to "send a message to Zhao but also to the world. Zhao reaped vast rewards for his violation of U.S. law, and the price of that violation must be significant to effectively punish Zhao for his criminal acts and to deter others who are tempted to build fortunes and business empires by breaking U.S. law."1 After he completes his sentence, he will not be put on parole. He's already paid the $50 million fine levied against him personally.

Many were horrified by this seemingly light sentence, which looks particularly light when compared to Sam Bankman-Fried's 25-year sentence (75× the length of Zhao's, if you want to do the math). Liz Lopatto speculated in The Verge that the lenience might be because Zhao agreed to share information on terrorist groups, or on states like Iran or North Korea. Others think maybe he ratted on Tether. Maybe. There are some redacted portions of the plea agreement and the sentencing memos that certainly make me very curious, but guesswork over what they contain is just that: guesswork.

Much of Zhao's substantial cooperation is already publicly known. He turned himself in, pled guilty, agreed to step down from Binance, and consented to the incredibly invasive compliance monitors that will be installed at the company. I suspect he mostly has that to thank for the much lighter sentence than Bankman-Fried, who continues to maintain his innocence.a His charges were also substantially fewer: Zhao was charged with a single count of failing to maintain an effective anti-money laundering program – basically, a regulatory violation. Bankman-Fried was hit with seven fraud and money laundering charges. Furthermore, the sentencing for Bankman-Fried's crimes hinged primarily on the monetary losses to his victims, whereas no such sentencing enhancements factored into Zhao's sentence.

I do feel like four months in prison is an incredibly light sentence for the kinds of crimes likely committed at Binance under Zhao, but it's not that light given the crime that was actually charged. If the DOJ wanted to see Zhao serve years in prison, they probably should have considered charging him more aggressively. As for the fine, well... that does seem very light no matter how you slice it. Forbes estimates Zhao's net worth at around $33 billion.2 For comparison's sake, if Zhao had a net worth of only $1 million, this fine would be like penalizing him about $1,500.

Zhao wrote on Twitter: "I will do my time, conclude this phase and focus on the next chapter of my life (education)."3 This presumably refers to his plans to launch the "Giggle Academy" [I56].

Everything else

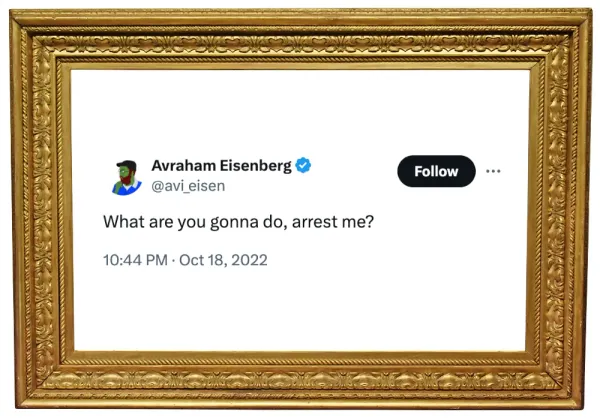

The guy behind the ZKasino scam I wrote about last time [I56] was arrested in record time by Dutch authorities [W3IGG]. Though they haven't released the name of the 26-year-old Dutch suspect, it's almost certainly "@Derivatives_Ape", the creator of the project. They've also seized assets estimated to be worth more than €11.4 million (~US$12.3 million), including crypto, real estate, and a luxury car. A tweet from Derivatives_Ape in 2022 has been added to my wall of shame:

Roger Ver, also known as "Bitcoin Jesus", was indicted on tax fraud charges after allegedly evading paying the IRS $48 million [W3IGG]. He was arrested in Spain, and the US is working on extraditing him. A longtime opponent of taxation, Ver had renounced his US citizenship and become a citizen of the tax haven St. Kitts in 2014. While this is allowed, it has tax implications — ones that Ver tried (and failed) to dodge by lying to his tax advisors. In 2017, Ver spoke at a conference of his dreams to create his own tax-free, law-free libertarian utopia, claiming he'd already raised $100 million for the project and planned to raise hundreds of millions more. Though at the time he predicted that within two years, libertarians would be moving in to the sovereign land he'd not yet bought, nothing seems to have materialized over six years later.4 It's a shame, it could've come in handy.

Former executives of the Cred cryptocurrency lending service have been indicted on various wire fraud- and money laundering-related charges [W3IGG]. Cred filed for bankruptcy in November 2020, after covering up their insolvency for a number of months. Cred had claimed to its customers that they engaged in only "collateralized or guaranteed lending", hedged their investments, and held "comprehensive insurance", but hid that "virtually all the assets to pay the yield were generated by a single company whose business was to make unsecured micro-loans to Chinese gamers." Furthermore, they did engage in uncollateralized lending, did not hedge their investments, and did not hold insurance as they had claimed to their customers. Around $150 million in customer funds were lost in the collapse based on prices at the time, though those crypto assets would have been worth substantially more at various times since. The three defendants, Cred's CEO, CFO, and CCO, all face up to twenty years in prison.5

The Justice Department has obtained a guilty plea from an operator of the BTC-e cryptocurrency exchange. Alexander Vinnik has been accused of being "responsible for a loss amount of at least $121 million."6 He's the second person to be indicted in connection to BTC-e this year [I50]. Vinnik was first arrested in Greece in July 2017, and has been bounced around since then as the United States, France, and Russia all sought his extradition.7

Maximilien de Hoop Cartier (who claims to be of Cartier jewelry lineage, though the DOJ describes this claim as "purported") and five others were indicted after trying to import 100 kilograms of cocaine into the United States, and trying to launder hundreds of millions of dollars. He and his co-conspirators mostly failed at the latter, only successfully laundering $14.5 million in Tether using over-the-counter trades before getting snapped up by US law enforcement. Perhaps he should have tried laundering the money through jewelry sales...

Federal prosecutors are reportedly investigating Jack Dorsey's Block fintech firm, which creates Cash App and Square. The investigation centers around reports from several whistleblowers of years-long compliance failures that allowed transactions with sanctioned people and groups in both fiat and cryptocurrency. According to the lawyer for an employee whistleblower, "It’s my understanding from the documents that compliance lapses were known to Block leadership and the board in recent years."8

In governments and regulators

US SEC

Consensys, the makers of the MetaMask crypto wallet and Infura Ethereum APIs, filed a lawsuit against the U.S. Securities and Exchange Commission on April 25.9 They allege that the agency has been "attempting to unlawfully regulate ether through ad hoc enforcement actions against Consensys and possibly others," and reveal that Consensys received a Wells notice from the SEC on April 10. The original complaint contained redactions, but an unredacted version filed on April 29 revealed allegations that the SEC's enforcement director Gurbir Grewal had in March 2023 approved a formal order to investigate Ethereum — an order that included language seeming to explicitly describe Ethereum's ether token as a security.

This was a bit of a bombshell for the crypto industry, which has been trying for a long time now to get Gary Gensler and others at the agency to carve out ether — as they have with bitcoin — as an exception to their general stance that crypto assets are securities. Many had in the past clung to unofficial statements from former SEC officials that seemed to provide such a carveout, but found Gensler reluctant to make statements about ethereum in either direction — including during an April 2023 Congressional hearing where he painfully dodged the question for several minutes.

McHenry is demanding Gensler express his view on whether ETH is a security or a commodity.

— Molly White (@molly0xFFF) April 18, 2023

Gensler won't give a specific answer on ETH, wants only to provide his view on the general regime, wanting to avoid to pre-judge. McHenry accuses him of prejudging in the case of Bitcoin.

Many are frustrated that the SEC appeared to have internally reached a decision on ether's status about a year ago, but continued to be publicly coy about it. However, the authorization of an investigation into whether securities laws may have been violated with respect to ether is not necessarily a declaration that ETH is broadly a security, and it's not clear to me that Consensys is correct when they describe this as a formal position by the agency.

Speaking of Wells notices, the SEC has sent yet another one — this time to Robinhood Crypto [W3IGG]. Robinhood has seemed to take a cautious stance towards which tokens they list, and in June 2023 removed their offerings of Solana, Cardano, and Polygon after the tokens were described as securities in SEC lawsuits against Coinbase and Binance [W3IGG]. However, their choice to list one or more of the fourteen non-bitcoin cryptos they offer has apparently not been cautious enough for the SEC's tastes.

The SEC has certainly been busy with their Wells notices, which are formal notices warning of impending litigation. They've sent at least three in the last two months: one to Uniswap [W3IGG], one to Consensys, and one to Robinhood Crypto. Given the massive cases the agency has open against Coinbase, Binance, and Kraken, and various others, it's hard to imagine where they'll find the resources to litigate even more cases against big companies with lots of resources, who are likely willing to shell out for aggressive defense lawyers and are also likely to receive additional support from the same crypto industry groups that have vigorously involved themselves in the ongoing cases. Unlike Uniswap and Consensys, Robinhood could feasibly back off its crypto offerings and return to its other business activities in world of traditional stocks. But that doesn't sound like it's going to be their choice, as they've issued a statement that they "look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be."

Some in the crypto world believe that the SEC is "abusing" Wells notices as a scare tactic without actually intending to follow through on lawsuits. That's a little hard to say, given that the whole point of Wells notices is to give companies the opportunity to argue that the SEC shouldn't pursue legal action. If the SEC sends a Wells notice, the company responds, and the SEC doesn't continue to litigate, isn't that the process working as intended? That said, if the SEC is sending these notices, receiving little beyond the chest-puffery that increasingly has become the default response to such notices in the crypto world, and is still not pursuing litigation, there could be something to that complaint.10

Lastly in SEC news, remember that case by the SEC against Debt Box where some SEC lawyers made false statements [I45, 47]? After earning sanctions for their agency in March, the two lead attorneys in the case took the opportunity to resign from the SEC, rather than be fired. The fate of the case is still uncertain, as the judge has not yet ruled on the SEC's motion to dismiss it without prejudice (which would leave a pathway open to refiling it later on).11

Coinbase

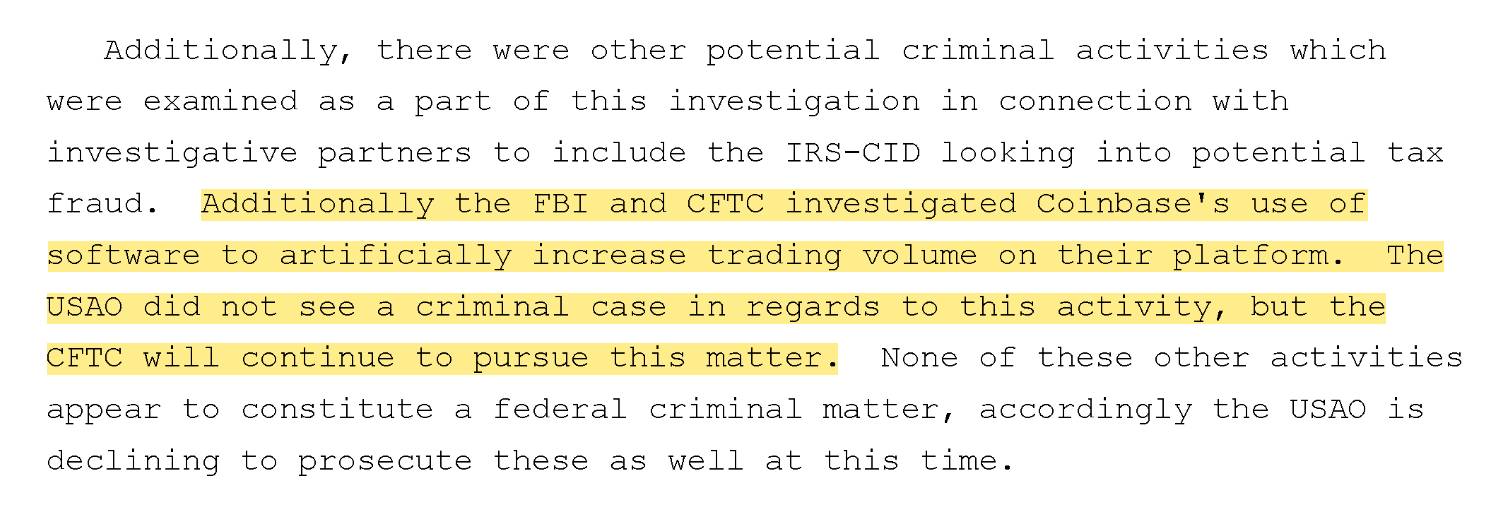

PlainSite founder Aaron Greenspan FOIA'd the FBI for documents pertaining to Coinbase. He received a set of documents reflecting the many complaints received by the FBI's Internet Crime Complaint Center, pertaining to the company's apparent tendency to shut down customer accounts without returning any funds. "Based on a review of victim complaints, open source reporting, and bank reporting, COINBASE, INC (COINBASE) may be involved in an investment fraud scheme," stated a memo drafted in 2018. It reveals the FBI had received around 60 such complaints, but refers to other agencies such as the Consumer Financial Protection Bureau who had received even more. Further documents show that an investigation was opened by the San Francisco branch of the FBI, who had been working with US Attorneys, the Department of Justice's fraud department, and the CFTC. A document from the following month details how the case was expanded to include allegations of investment fraud and corporate fraud.

Other documents describe an investigation by the US Attorney's Office in the Northern District of California into allegations of insider trading that emerged shortly after Coinbase listed Bitcoin Cash for trading on the platform in 2017. Coinbase had themselves acknowledged the allegations and performed an internal investigation, which found no wrongdoing (shocking). Apparently the DOJ also investigated, but decided in 2019 not to pursue the case because there was no precedent regarding cryptocurrency insider trading, and they felt the incident would serve as a bad inaugural case. In their declination, they also included an interesting tidbit:

The DOJ would later successfully prosecute a different Coinbase insider trading case against a Coinbase product manager [W3IGG] who was ultimately sentenced to two years in prison after tipping off his brother and a friend about upcoming Coinbase listings.12

The FBI's portion of any investigations was closed in July 2019.

Elsewhere in crypto

After Bitcoiner and venture capitalist Nic Carter published a chart suggesting that "stable[coin]s are catching up to established settlement networks" like Visa and ACH, Visa's crypto department decided to do some digging (with the help of an outside data firm). Their research suggested that around 90% of stablecoin "volume" is "inorganic" bot activity. "When we apply a simple heuristic that removes inorganic data, we see that transfer volume for the last 30 days can be adjusted from $2.65T to $265B", they write. The "inorganic" activity is mostly arbitrage, market-making, and similar activities — all of which serve a purpose, but which also weaken suggestions that there are real people out there throwing trillions of dollars' worth of stablecoins around each month.13

Shortly after the indictment of Samourai Wallet's founders on charges relating to their operation of a bitcoin mixing service [I56], Wasabi Wallet has announced they will be shutting down their bitcoin Coinjoin privacy service due to fears over regulatory action.14 Days earlier, they had shut off access to customers in the US, citing the legal action against Samourai.15 The Coinjoin service offered by hardware wallet manufacturer Trezor, which was created in partnership with Wasabi Wallet, will also be shutting down.16

Excitement over Bitcoin Runes [I56] is dwindling, and bitcoin transaction fees are coming back down to earth a little bit. This is good news for bitcoin users trying to transact more cheaply, but bad news for miners — who increasingly rely on these transaction fees to keep them afloat as bitcoin block rewards are slashed in half every couple of years. Meanwhile, bitcoin prices have failed to skyrocket in the wake of the halving as some hoped,b which would also help to bolster miners. Now, NASDAQ-listed Stronghold Digital Mining has announced in a press release that they are exploring options to "maximize shareholder value, including, but not limited to, the sale of all or part of the Company, or another strategic transaction involving some, or all of, the assets of the Company." Wuh-oh.17 Elsewhere, Canadian mining company Bitfarms has reported its lowest monthly earnings in more than two years — and that's with around 20 days of mining with the previous level of block rewards.18

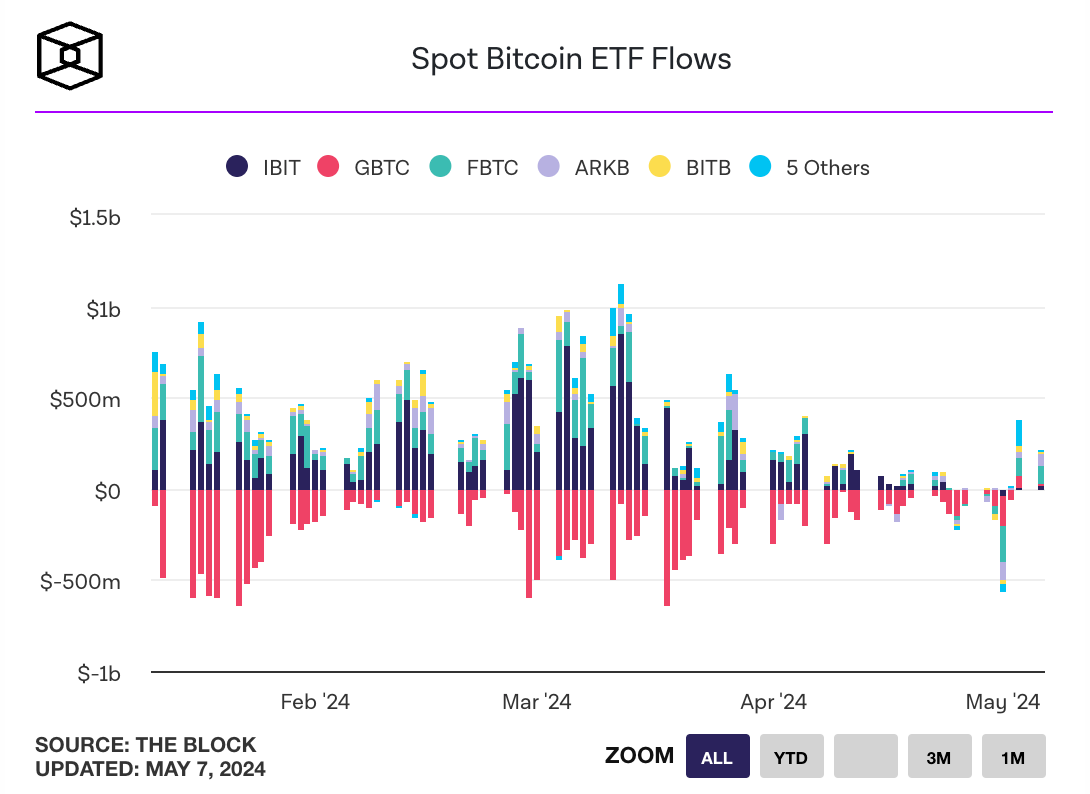

Over in ETP land, the initial excitement for the new instrument has also dwindled, and April was the first month since their release in January that there were higher outflows than inflows to the tune of $343.5 million net outflows. Much of this is thanks to Grayscale's GBTC, which has hemorrhaged roughly $17.4 billion since its conversion to an ETP allowed customers to cash out for the first time.19 To be clear, it's expected for any ETP to have inflows and outflows — I guess, unless you expect everyone to HODL their ETP positions — but there was some panic amid crypto enthusiasts who have pinned a lot of their hopes for another bull run to these ETPs.

On the topic of ETPs, Representatives Mike Flood (R-NE)and Wiley Nickel (D-CA) have been writing letters to Gary Gensler to try to pressure him to approve options trading on spot bitcoin ETPs, because I guess that's an important thing for Congresspeople to be doing right now.20 Axios also points out that they don't seem to have realized their letter might have been more appropriately addressed to the CFTC — but I suspect that doesn't matter to a pair of lawmakers who are more posturing for a crypto base that sees Gensler as the Big Bad than actually trying to effect any change.

Elsewhere in Capitol Hill, Elizabeth Warren (D-MA) has joined up with Angus King (D-ME) on a letter to the Biden administration "to inquire about the Biden administration’s efforts to combat Iran’s rampant evasion of U.S. and international sanctions through cryptocurrency (crypto) mining".21 It is not immediately clear to me what Warren and King are hoping the Biden administration might do about such a thing — though, again, this is more a political move than anything, aimed at highlighting the use of cryptocurrencies by sanctioned groups.

Finally, before I move off of bitcoin in this very bitcoin-heavy issue, let me treat you to a video of Ohio State's commencement speaker getting roundly booed after trying to shill bitcoin to new grads.

via r/Buttcoin

Chris Pan, an OSU alum who worked as a Facebook executive and now runs a company selling bracelets that seem to just be metal washers on strings with inspirational words stamped onto them, decided there was apparently no better opportunity to discuss how bitcoin was a "very misunderstood asset class" that he had just discovered a few months prior with the launch of spot ETPs.

He also tried to lead a sing-along to the 4 Non Blondes' 1993 hit "What's Up?" (what better pick for a group of people in their early twenties),c and spoke of how he treated his depression with singing, not antidepressants. Believe it or not, this was all somewhat of an improvement on an earlier draft that he had shared on social media, which was going to feature him removing his shirt before poorly explaining the blind men and an elephant metaphor, then abruptly launching into a discussion of the Israel–Hamas war. Pan wrote on LinkedIn that he'd tried to use ChatGPT to write the speech, was disappointed, and then turned to ayahuasca for inspiration. It shows.

![I created a project called VOMO which stands for Voice Movement to make it easier for non-professionals to sing together - by 1) changing the focus to wellness instead of performance, 2) reducing the lyrics, and 3) simplifying the melodies. Our logo is a heart that’s opening through singing. I have this vision of a billion people singing together, so we got rid of lyrics so there was no language barrier. Wanna try? We call it “whoa” music Everyone go “whoa o o o o o…” —--------------------------- [Elephant noise] Did anyone else hear that? Ok I’d like to invite everyone to close your eyes. [remove shirt] Imagine if you were blind and walked up to an elephant for the first time. Let’s say those to my right felt the creature and said “it’s big and rough and round like a tree trunk”. Then the folks in front of me walked up and reply “no no, it’s slick and tubular and hard.” Then the folks to my left respond “no no, it’s big, floppy and soft!” So who’s right? [please open your eyes] Conflict resolution is the ability to hold multiple perspectives. After Oct 7th, I started hosting gatherings to learn. I grew up with many Jewish friends and they were the kindest to me when others were bullying me. I celebrated many Jewish holidays with my best friend’s family. I realized I didn’t have Palestinian friends so I went to a few different Palestinian events to make new connections. I have then hosted many dinners and concerts for both communities to try to humanize each other and build bridges.](https://www.citationneeded.news/content/images/2024/05/GM7pHO_XwAANnGW.png)

Yuga Labs tried to pull a take-backsies with their Moonbirds NFT collection, which they acquired in February. The pixel art owls — which I have to say I actually think are pretty cute — were released under CC0: a Creative Commons designation to release a work into the public domain and relinquish all rights to the extent possible. On April 29, Yuga tried to snatch back the copyright that had been irrevocably waived by posting, "If you’ve made stuff during the CC0 era - cool. But from now on, you’ll need to own a Moonbird to keep doing so."22 After pushback, including from legal experts explaining to Yuga that that's not at all how this works, they adjusted their statements to announce that, oh no, they meant they would be releasing new artwork and 3D avatars that would not be freely licensed.

I think if anything this all just helps to illustrate how much "you own the IP" is an empty marketing promise — though one that seems to work on people who broadly seem to be more interested in the idea that they could develop something with their NFT's artwork than actually doing so. But furthermore, when it comes to developing branded stuffed animals or t-shirts or hamburger restaurants [I55], it's really more of a trademark question than a copyright one, and CC0 deals with copyright. And if Yuga wants to start suing people who don't own a Moonbirds NFT for using those original pixel art images, they can do so — and they could have always done so, even without their hamfisted attempt at revoking its CC0 status. I think any NFT holders who still buy into this "IP ownership" thing, and who actually intend to try to profit from the artwork they "own", would be wise to understand that it's all just a pinky swear. At best, they could try their chances in court, hoping they could convince a judge that often slapdash terms of use granted them the right to use the work in such a way, but that's not something I'd want to build a business on.

The Web3 is Going Just Great recap

There were nine entries between April 24 and May 7, averaging 0.6 entries per day. $75.97 million was added to the grift counter.

Record theft via address poisoning attack

[link]

The operator of an Ethereum wallet lost 1,155 wrapped bitcoin (~$72.7 million) to an address poisoning attack in the largest known attack of this type thus far.

Address poisoning is a scam tactic that takes advantage of crypto traders' tendencies to copy and paste wallet addresses from their transaction histories, since the addresses are long strings of characters that are not practical to type from memory. By creating a new wallet address with identical start and/or ending character strings to addresses used by the victim, and spamming the victim with transactions from that similar address, scammers are sometimes able to get victims to erroneously copy the spoofed address for future transfers.

No individual or company has publicly identified themselves as the owner of the victim wallet, which still holds around $1.6 million in the DAI stablecoin.

Pike Finance screws up twice

[link]

Pike Finance, a cross-chain lending protocol backed by the likes of Circle and Wormhole, fumbled massively. First, they were attacked on April 26 by an exploiter who took advantage of a bug that Pike knew about, but had failed to address. The total theft amounted to around $300,000 in the USDC stablecoin.

Then, in an attempt to patch the vulnerability that enabled the first theft, Pike introduced new, worse vulnerabilities that allowed an attacker on April 30 to replace the project's smart contracts with malicious ones, then withdraw around $1.68 million in various tokens.

I guess that $50,000 grant they received weeks earlier from Circle and Wormhole didn't go towards any security efforts.

Everything else

- Instagram influencer Jay Mazini sentenced to seven years in prison for crypto fraud [link]

- GNUS.ai exploited for $1.27 million [link]

Worth a read

I thought about trying to write up the saga in which Jesse Lyu, founder of the much-hyped and then widely panned Rabbit R1 AI-powered gadget, has been exposed as the creator of an NFT project he later rug-pulled and then hoped people wouldn't discover. Then I decided I would just link to Ed Zitron's much more in-depth reporting on the subject.

The fabulous Ethan Zuckerman, with support from the Knight Institute, is suing Facebook over the right to develop tools that grant users more control over their newsfeeds on the platform. There's been some good coverage of the lawsuit in Techdirt, Wired, and from Zuckerman himself in the New York Times.

That's all for now, folks. Until next time,

– Molly White

professional anti-crypto person

Footnotes

Bankman-Fried did offer to cooperate with the FTX bankruptcy team, who seem to have declined that offer wholesale with skepticism that any information he could provide would be reliable. He's also agreed to cooperate with some class action litigants, as I mentioned last issue [I56]. It's not clear if, or to what extent, he's cooperated with the Justice Department. ↩

As I write this, Bitcoin is hovering at around $63,130. Price at the halving was $63,971. It's bounced around between around $58,000 and $67,000 in the roughly two weeks since then, but hasn't made any massive moves. ↩

Younger folks may recognize the song from the "HEYYEYAAEYAAAEYAEYAA" He-Man meme, though that too is from the mid to late 2000s, when most people graduating college would have been like eight years old. ↩

References

United States' sentencing memorandum filed April 23, 2024. Document #78 in US v. Changpeng Zhao. ↩

"Changpeng Zhao". Forbes. ↩

"Interview with Roger Ver: His Plans to Start a New Libertarian Country", Bitcoin Magazine. ↩

"Former CEO, CFO, And CCO Of Cred LLC Charged With Alleged Multi-Million-Dollar Cryptocurrency-Related Wire Fraud Conspiracy", U.S. Department of Justice. ↩

"BTC-e Operator Pleads Guilty to Money Laundering Conspiracy", U.S. Department of Justice. ↩

"BTC-e Operator Alexander Vinnik Pleads Guilty to Money Laundering Conspiracy Charge", CoinDesk. ↩

"Federal prosecutors are examining financial transactions at Block, owner of Cash App and Square", NBC News. ↩

Complaint filed April 29, 2024. Document #18 in Consensys v. Gary Gensler. ↩

"Crypto lawyers say SEC is 'abusing' the Wells process as part of 'carpet bombing campaign' against crypto", The Block. ↩

"2 SEC lawyers quit after agency censured for abuse of power in crypto case", The Seattle Times. ↩

"Former Coinbase Insider Sentenced In First Ever Cryptocurrency Insider Trading Case", U.S. Attorney's Office, Southern District of New York. ↩

"Making sense of stablecoins", Visa. ↩

"Wasabi Wallet-Developer Blocks U.S. Citizens and Residents After Samourai Wallet Arrests", CoinDesk. ↩

"Bitcoin Miner Stronghold Looking at Options, Including Sale of Company", CoinDesk. ↩

"Bitcoin halving sees Bitfarms’ BTC mining earnings plummet", Cointelegraph. ↩

"Spot bitcoin ETFs saw $344 million net withdrawals in April as flow reversal continued", The Block. ↩

"Scoop: SEC's Gensler pressed to approve options on spot bitcoin ETFs", Axios. ↩