Review: Michael Lewis's Going Infinite

If Sam Bankman-Fried is convicted in the upcoming FTX fraud trial, Lewis’s admiring biography will take an awkward place on the shelves of history.

In Michael Lewis's Going Infinite, he compares FTX's CEO-in-bankruptcy's attempts to sift through the remains of the fallen FTX empire to an ignorant amateur archaeologist trying to fabricate believable explanations for artifacts beyond his understanding.

A writer of Lewis's caliber presumably also knows of many parables about people who get too close to a subject to be able to view it objectively, too, but those don't earn a place in the book. At no point does Lewis seem to reflect on whether the six months he spent shadowing Bankman-Fried prior to the CEO's fall from grace — during which Lewis thought he was writing the story of a nerdy tycoon's rise to unimaginable wealth and influence in a possible new sector of finance — may have influenced his own evaluation of the situation. The time Lewis spent observing Bankman-Fried in the company's ritzy Bahamian offices, joining him on travels abroad, and even accompanying him to parties where they brushed elbows with the likes of Hillary Clinton and Leonardo DiCaprio certainly seems to have endeared the fallen billionaire and now accused fraudster to Lewis, who throughout the book continuously overlooks red flags and omits context that would paint a very different picture.

To this day, Bankman-Fried claims that the collapse of FTX, and the more than $8 billion in missing customer funds, is all the result of mismanagement and sloppy record-keeping, but not intentional fraud. By writing a book that largely backs up Bankman-Fried's claims, Lewis seems to be staking his own substantial reputation on this being the truth — or, at least, on the government being unable to prove beyond a reasonable doubt that it isn't. If Bankman-Fried is convicted in the upcoming trial, Lewis's book will take an awkward place on the shelves of history.

It could be that Lewis genuinely believes Bankman-Fried's side of the story. Or perhaps he got most of the way through writing a glowing, book-length profile of Bankman-Fried and decided he didn't want to throw the whole thing out and start again. Save for a few hasty footnotes referencing the eventual collapse, the first half of the book or so reads as though it was written while Bankman-Fried was still on top of the world, and it doesn't appear to have been substantially revised after that changed.

At one point, while going into gratuitous detail about how Bankman-Fried was unlike other children, Lewis muses: "Every life is defined not just by what happens in it but by what doesn't." Similarly, this book is defined by its serious omissions. For example, Lewis repeatedly refers to FTX's supposed $1 billion in revenue in 2021 without bothering to mention SEC allegations that Bankman-Fried instructed Nishad Singh to falsify that number.1 When Lewis writes that Bankman-Fried was "all in on the sacrifice" that came along with the effective altruist philosophy that supposedly guided him, he fails to include that Bankman-Fried admitted in direct messages with fellow effective altruist and journalist Kelly Piper that all his talk about ethics was mostly a front, a "dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us".2 When Lewis makes brief reference to Alameda Research being named to obscure its involvement in the crypto industry, he doesn't include the context that Bankman-Fried has openly admitted that it was motivated by a desire to convince banks to open accounts for them that they otherwise had repeatedly refused.3

Throughout the book, Lewis appears far too willing to repeat at face value the things he was told by Bankman-Fried and those close to him. When introducing FTX's in-house psychiatrist and "Senior Professional Coach", for example, Lewis regurgitates Bankman-Fried's claims that previous therapists were unhelpful to him "because they could not bring themselves to believe that he was who he was". To Bankman-Fried, he was not the problem; it was the therapists who were wrong. Lewis seems to agree that those former therapists, whom he never interviewed, simply "failed to understand" Bankman-Fried.

At other points, he is quick to overlook the concerns others had with Bankman-Fried, or to take Bankman-Fried's side. "Tara [Mac Auley] had long since decided that [Bankman-Fried] was dishonest and manipulative", Lewis writes, not interrogating any further why one of Bankman-Fried's cofounders had come to feel this way about him years before the eventual collapse. Lewis writes that at one point relationships among Alameda Research employees had deteriorated to the point that engineering director Nishad Singh found himself having to play "human buffer" between Bankman-Fried and others who Bankman-Fried constantly offended or upset, but Lewis concludes that those people "perhaps did not fully understand Sam".

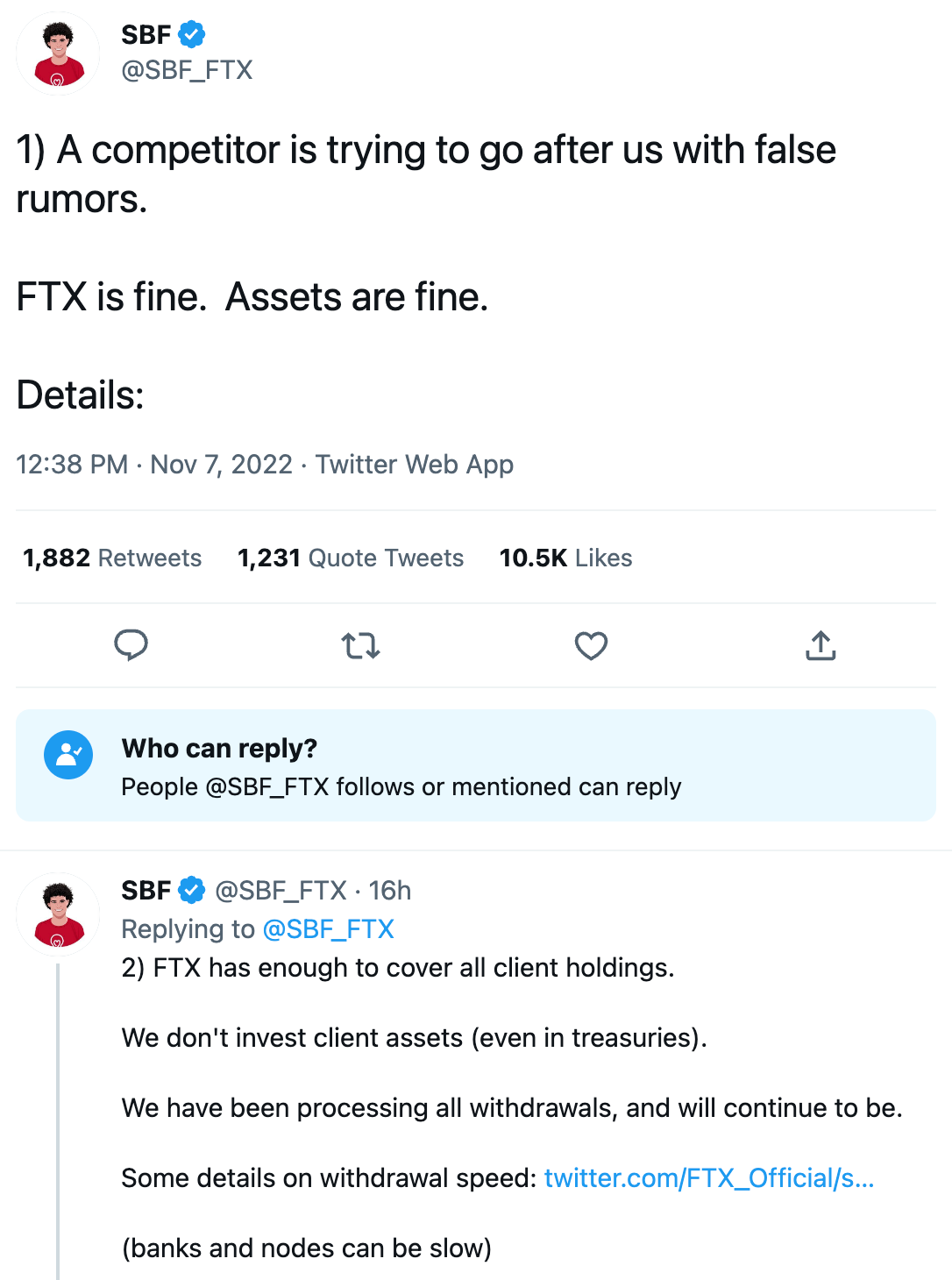

Finally, Lewis occasionally makes points that undermine even the things that he himself has said. Although it is bafflingly relegated to a footnote, Lewis explains that although FTX was a futures exchange, and so it did loan money to its customers, FTX's whole selling point was that its "sophisticated risk engine" didn't expose the company or its customers to potential losses from customers who made bad trades. The ultimate result is that it should never have been possible for there to be a "run on the exchange" as Lewis later describes, and it really undermines the unbelievable statements he's been making lately in interviews: that "They had a great real business. If no one had cast aspersions on the business, if there hadn't been a run on customers deposits, they'd still be making tons of money."4 Similarly, Lewis undermines his own belief in Bankman-Fried's honesty and lack of fraudulent intent when he mentions that Bankman-Fried was aware of the missing customer funds at least as early as October — a detail that might not seem meaningful to those less familiar with the history because he fails to mention that Bankman-Fried continued to lie to the public into November that "FTX is fine. Assets are fine".

Lewis ends the book by using FTX COO Constance Wang's post-collapse attempts to interrogate Bankman-Fried as a preview of how he believes the trial will go. Because neither Wang nor Lewis himself could get Bankman-Fried to admit to any malfeasance in the days following the collapse, Lewis seems to believe the same will be true at trial. He also decides that it is more likely that four separate FTX executives have decided to admit to crimes they did not commit, potentially facing massive consequences of their own, than that Bankman-Fried could be guilty.

Instead of digging deeper into that, though, he spends much of the remaining book excoriating the team in charge of FTX's bankruptcy, who he insinuates are poorly equipped for the job and motivated only by the massive lawyer fees they can draw down. FTX lawyer Dan Friedberg is introduced only as a former Fenwick & West lawyer and "the only important grown-up"5 in Bankman-Fried's companies who was "completely, totally crushed" by their demise — with no mention of Friedberg's own shady history at an online gambling company ultimately brought down by a notorious cheating scandal, or his alleged role in silencing an FTX whistleblower. Lewis endorses Friedberg's story that Sullivan & Cromwell have conflicts of interest that should've precluded them from handling the bankruptcy, and insinuates that the bankruptcy judge's dismissal of Friedberg's attempts to intervene was merely a product of the judge's bias in favor of bankruptcy lawyers as he too was once a bankruptcy lawyer.

Far from providing an incisive inside view into a historic collapse that saw billions of dollars go up in flames at the expense of multitudes of people who were financially ruined, Lewis has still produced the hero story he originally set out to write. By the end of Lewis's first ever conversation with Bankman-Fried, he writes: "I was totally sold". By the end of the book chronicling the same man through his company's dramatic collapse, that doesn't seem to have changed.

Note: I spoke to Michael Lewis on the "On Background" series of his podcast published in May, in which he recorded some of his background research interviews for the book. Though I'm disappointed with the ultimate written product, I do think our conversation holds up.

References

"Sam Bankman-Fried and the spectacular fall of his crypto empire, FTX", NPR. ↩

"FTX founder Sam Bankman-Fried's rise and fall at center of new Michael Lewis book 'Going Infinite'", CBS News. ↩

In the very first portion of my interview with Michael Lewis back in May, I expressed my frustration with the media's habit of referring to Bankman-Fried as though he is a child. Evidently this didn't make much of an impression on Lewis. ↩